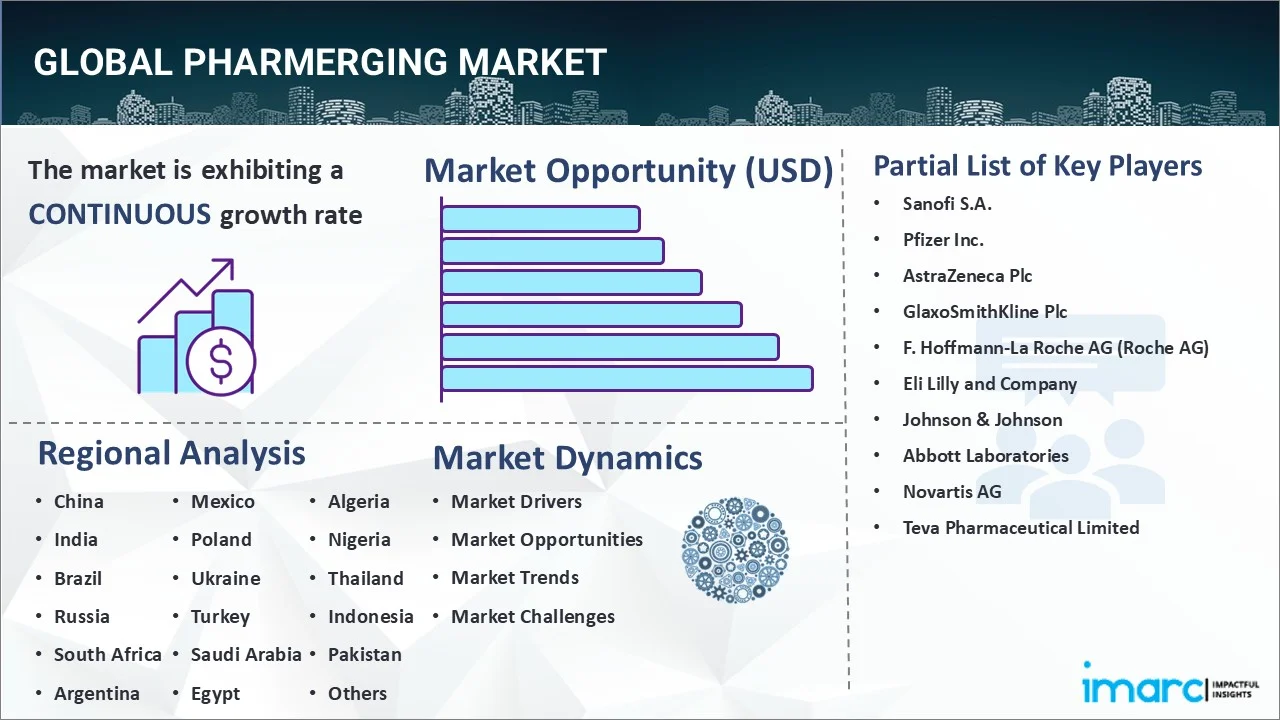

Pharmerging Market Report by Product (Pharmaceuticals, Healthcare), Indication (Lifestyle Diseases, Cancer and Autoimmune Diseases, Infectious Diseases, and Others), Distribution Channel (Hospitals, Retail Pharmacies, Online Stores, and Others), and Country 2026-2034

Pharmerging Market Size:

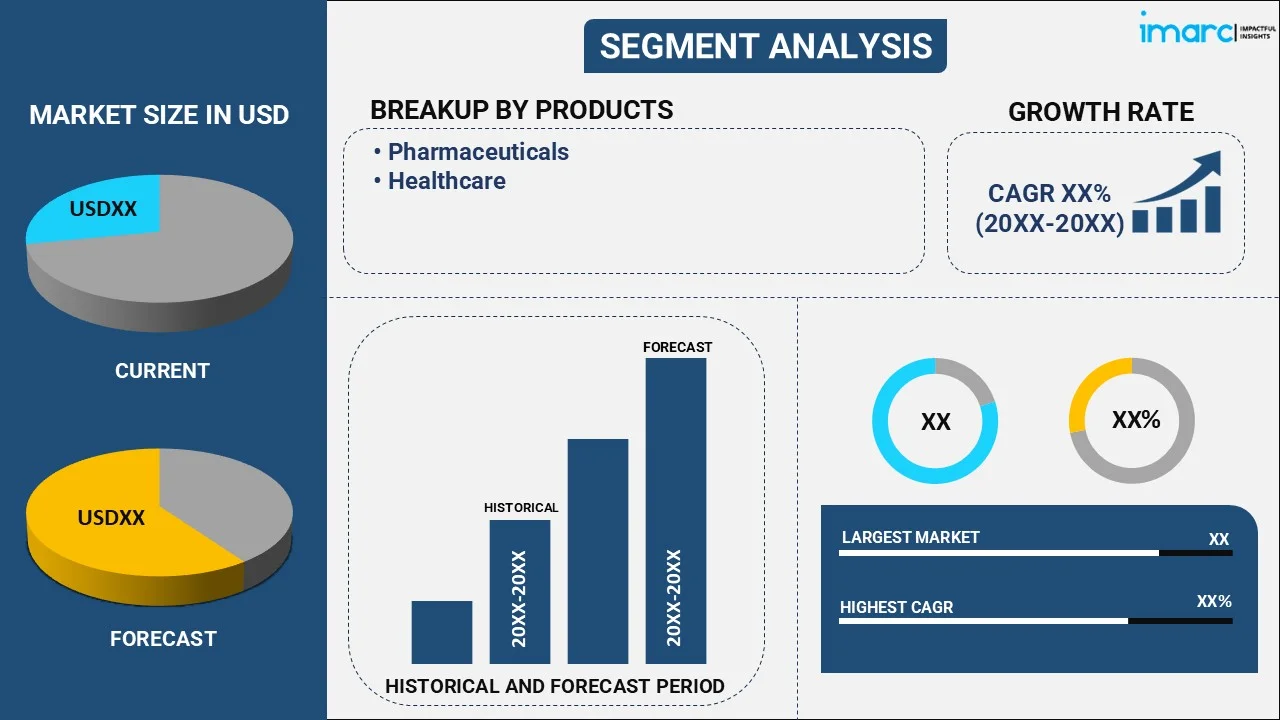

The global pharmerging market size reached USD 2.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.8 Billion by 2034, exhibiting a growth rate (CAGR) of 11.84% during 2026-2034. The increasing demand for pharmaceuticals, the rising aging population, the growing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer in pharmerging markets, the improved access to healthcare, and the escalating government initiatives are some of the factors driving market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.0 Billion |

|

Market Forecast in 2034

|

USD 5.8 Billion |

| Market Growth Rate 2026-2034 | 11.84% |

Pharmerging Market Analysis:

- Major Market Drivers: The increasing research and development investments by the pharmaceutical companies, the rising demand for generic therapies, the growing aging population, the escalating healthcare expenditure, and the improved access to healthcare are some of the other major market drivers.

- Key Market Trends: Technological advancements and rising demand for generics are some key market trends. Furthermore, the increasing demand for over-the-counter medications for colds, pain, and digestive issues is emerging as another trend.

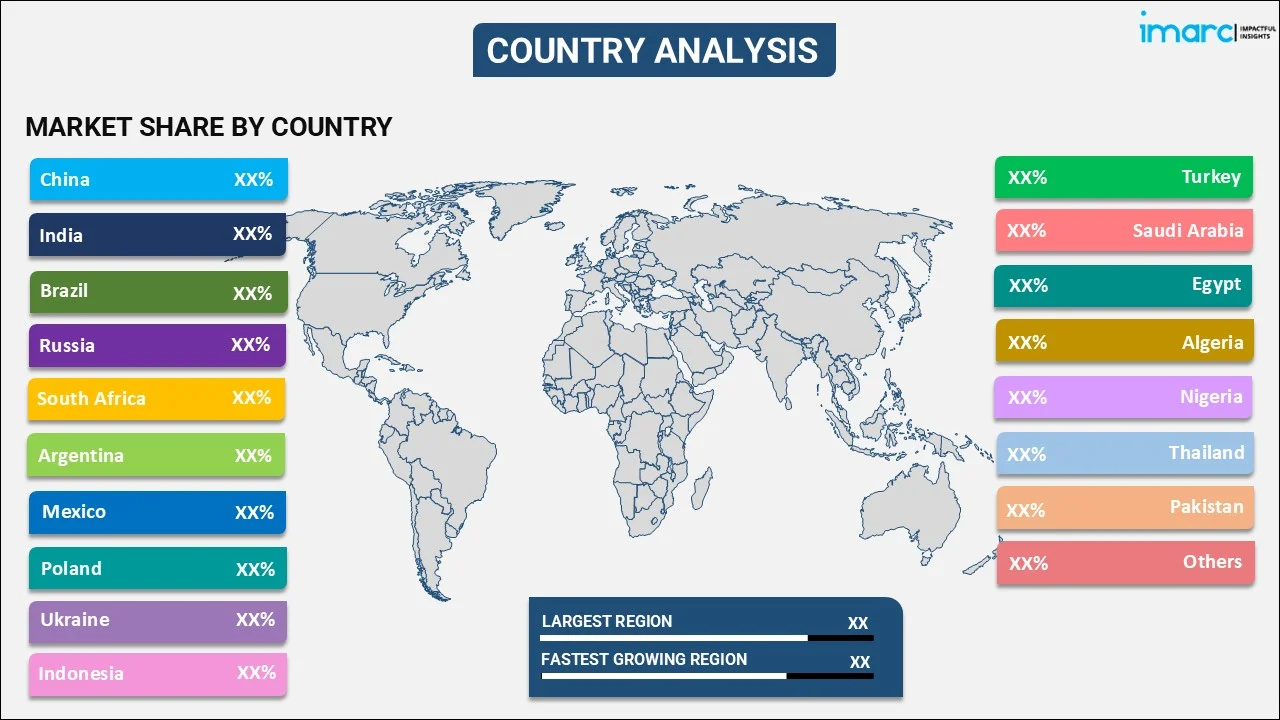

- Geographical Trends: China dominates the majority of pharmerging market share due to growing healthcare infrastructure and rising disposable incomes. Moreover, the increasing healthcare demand, government policies and reforms, and local manufacturing and innovation are also augmenting the market growth across the country.

- Competitive Landscape: Some of the key companies operating in the market include Sanofi S.A., Pfizer Inc., AstraZeneca Plc, and GlaxoSmithKline Plc.

- Challenges and Opportunities: Challenges include regulatory hurdles and inadequate healthcare infrastructure while opportunities lie in expanding market reach, increasing healthcare awareness, expanding healthcare access, rising demand for affordable medication, and innovative healthcare solutions.

To get more information on this market Request Sample

Pharmerging Market Trends:

Increasing generic population

The increasing generic population across the globe is contributing to the market growth. The growing elderly population is having varying effects on the pharmerging sector around the world. It is anticipated that by 2030, one out of every six individuals will be above the age of sixty. China's geriatric population is predicted to reach 330 million by 2050, while India's geriatric population will surpass 277 million by 2050. The most frequent diseases in the geriatric population are dementia, hypertension, and cardiac failure. These disorders necessitate continuous and sustained treatment. This, in turn, is providing a boost to the pharmerging market outlook.

Rising demand for generic therapies

The rising demand for generic therapies is another major market driver. Healthcare systems in developing nations heavily promote generic pharmaceuticals to minimize expenses. Generic medications and therapies are offered at 20% to 35% lower prices than their branded counterparts. This them accessible to a larger segment of the population in pharmerging markets where budget constraints are common. Furthermore, the rising prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions creates an ongoing demand for affordable medications, which generics can meet effectively. This, in turn, is favorably impacting the pharmerging market growth. According to the India Brand Equity Foundation's Indian Pharmaceutical Industry report, which was published in November 2021, the country's pharmaceutical industry accounts for more than 25% of the demand for pharmaceuticals in established European nations. Generic medications have the same ingredients as their non-generic versions. Generic pharmaceutical manufacturers make little investments in marketing and advertising. This is one of the main reasons for their affordability. The Government of India created the 'Pradhan Mantri Bhartiya Janaushadhi Pariyojana' (PMBJP) to raise public awareness about generic drugs. It strives to deliver generic pharmaceuticals that cover the broadest range of therapeutic areas. This, in turn, is creating a positive outlook for the pharmerging market overview.

Growing awareness about early detection of chronic diseases

The growing awareness regarding early detection of chronic diseases is favoring market growth. Chronic diseases have been a source of concern in recent years. According to the OECD, cardiovascular diseases account for about 9 million fatalities in the Asia Pacific. One of the important pharmerging market trends is an increase in public awareness of early diagnosis of chronic diseases to facilitate timely treatment, which is directly related to the amount of time spent researching cost-effective remedies for these conditions. The need to introduce inexpensive pharmaceuticals to address chronic diseases at an early stage is driving up the pharmerging market revenue.

Pharmerging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and country levels for 2026-2034. Our report has categorized the market based on product, indication, and distribution channel.

Breakup by Product:

To get detailed segment analysis of this market Request Sample

- Pharmaceuticals

- Patented Prescription Drugs

- Generic Prescription Drugs

- OTC Drugs

- Healthcare

- Medical Devices

- Clinical Diagnosis

- Others

Pharmaceuticals dominate the market

The report has provided a detailed breakup and analysis of the market based on the product. This includes pharmaceuticals (patented prescription drugs, generic prescription drugs, and OTC drugs) and healthcare (medical devices, clinical diagnosis, and others). According to the report, pharmaceuticals represented the largest segment.

By product type, the pharmaceuticals segment dominated the market and led to the increasing pharmerging demand. The rising demand for counter-drugs, generic prescription, and patented prescription drugs worldwide is the major factor bolstering the segment growth during the forecast period. The pharmaceutical segment dominates the healthcare industry in developing countries. The generic prescription drug category is expected to foster growth in the pharmaceutical industry. The generic prescription pharmaceutical sector is expected to expand due to price sensitivity in these countries and increased healthcare spending.

Breakup by Indication:

- Lifestyle Diseases

- Cancer and Autoimmune Diseases

- Infectious Diseases

- Others

Lifestyle diseases hold the largest share in the market

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes lifestyle diseases, cancer and autoimmune diseases, infectious diseases, and others. According to the report, lifestyle diseases accounted for the largest market share.

According to the pharmerging market forecast, the lifestyle diseases segment dominates the market. These non-communicable diseases are caused by a lack of physical exercise, unhealthy eating, alcohol, substance use disorders, and tobacco use, all of which can lead to heart disease, stroke, obesity, type II diabetes, and lung cancer. The demand for pharmaceuticals to manage these diseases is increasing. The market players are also developing low-cost generics and other treatments to manage and treat these diseases, thereby augmenting the market growth.

Breakup by Distribution Channel:

- Hospitals

- Retail Pharmacies

- Online Stores

- Others

Hospitals hold the maximum share in the market

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospitals, retail pharmacies, online stores, and others. According to the report, hospitals accounted for the largest market share.

The pharmerging market report shows that hospitals are dominating the market. In emerging countries, hospitals frequently serve as primary centers of treatment for a considerable proportion of the population, particularly in metropolitan areas where access to healthcare services is limited. The rising prevalence of chronic and infectious diseases in these regions is a major driver of pharmaceutical sales in hospitals. Hospitals require a consistent supply of medications to treat patients, thereby fueling the market growth.

Breakup by Country:

To get more information on the regional analysis of this market Request Sample

- Tier I

- China

- Tier II

- India

- Brazil

- Russia

- South Africa

- Tier III

- Argentina

- Mexico

- Poland

- Ukraine

- Turkey

- Saudi Arabia

- Egypt

- Algeria

- Nigeria

- Thailand

- Indonesia

- Pakistan

- Others

Tier I (China) leads the market, accounting for the largest pharmerging market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Tier I (China), Tier II (India, Brazil, Russia, South Africa), Tier III (Argentina, Mexico, Poland, Ukraine, Turkey, Saudi Arabia, Egypt, Algeria, Nigeria, Thailand, Indonesia, Pakistan, and others). According to the report, Tier I (China) represents the largest regional market for pharmerging.

China dominates the market and offers numerous pharmerging market recent opportunities. This dominance is due to the increasing patent expiration, rapid urbanization, and rising investments by the government. China holds the prospect of growing during the forecast period. The entry of key companies into the market with a wide variety of portfolios is expected to fuel the market growth. Furthermore, the increasing demand for generic therapy is also bolstering the market. Healthcare systems in China are promoting generic medications to reduce costs. They are transitioning from a policy of balancing quality, access, and cost in healthcare to raising awareness about generic therapies through private-public partnerships. This, in turn, will lead to pharmerging recent market developments.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Sanofi S.A.

- Pfizer Inc.

- AstraZeneca Plc

- GlaxoSmithKline Plc

- F. Hoffmann-La Roche AG (Roche AG)

- Eli Lilly and Company

- Johnson & Johnson

- Abbott Laboratories

- Novartis AG

- Teva Pharmaceutical Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

In the pharmerging industry, many market players already own strong research and drug manufacturing resources, offering collaborations with reliable pharmaceutical companies. India and China have long been participants in pharmaceutical manufacturing, presenting numerous opportunities for collaboration among the market players. Global pharmaceutical companies are organizing manufacturing skills in emerging needs to fulfill rising demand, thereby bolstering market growth. These regional investments by the key market players decrease production expenses, facilitate partnerships with regional providers, and help expand in-country diffusion networks for their outcomes. The pharmerging companies are also entering into various strategic alliances to expand their global network.

Pharmerging Market News:

- May 21, 2024: Sanofi S.A. announced its collaboration with Formation Bio and OpenAI to build AI-powered software to accelerate drug development and bring new medicines to patients more efficiently.

- April 29, 2024: Pfizer Inc. announced that it has received the U.S. Food and Drug Administration (FDA) approval for the supplemental Biologics License Application (sBLA), granting full approval for TIVDAK® (tisotumab vedotin-tftv) for the treatment of patients with recurrent or metastatic cervical cancer with disease progression on or after chemotherapy.

- May 20, 2024: AstraZeneca Plc announced to build a $1.5 billion manufacturing facility in Singapore for antibody drug conjugates (ADCs), improving the global supply of its ADC portfolio. ADCs are next-generation treatments that deliver highly potent cancer-killing agents directly to cancer cells through a targeted antibody.

Pharmerging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Indications Covered | Lifestyle Diseases, Cancer and Autoimmune Diseases, Infectious Diseases, Others |

| Distribution Channels Covered | Hospitals, Retail Pharmacies, Online Stores, Others |

| Countries Covered |

|

| Companies Covered | Sanofi S.A., Pfizer Inc., AstraZeneca Plc, GlaxoSmithKline Plc, F. Hoffmann-La Roche AG (Roche AG), Eli Lilly and Company, Johnson & Johnson, Abbott Laboratories, Novartis AG, Teva Pharmaceutical Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global pharmerging market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global pharmerging market?

- What is the impact of each driver, restraint, and opportunity on the global pharmerging market?

- What are the key regional markets?

- Which countries represent the most attractive pharmerging market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the pharmerging market?

- What is the breakup of the market based on the indication?

- Which is the most attractive indication in the pharmerging market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the pharmerging market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global pharmerging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmerging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pharmerging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmerging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)