Pharmacy Benefit Management Market Size, Share, Trends and Forecast by Service, Business Model, End Use, and Region, 2025-2033

Pharmacy Benefit Management Market Size and Share:

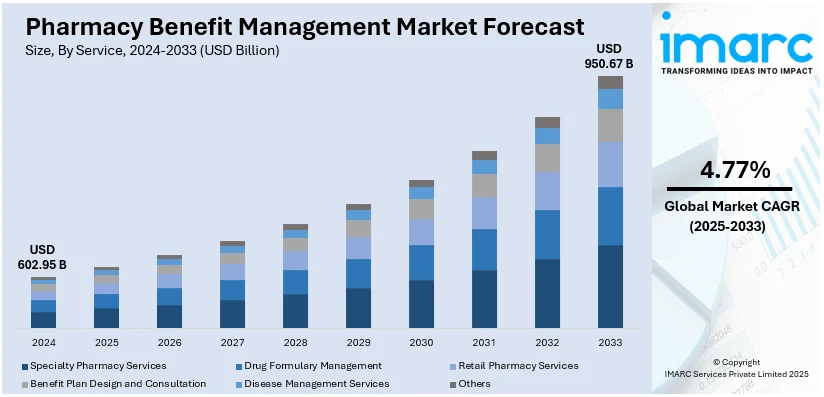

The global pharmacy benefit management market size was valued at USD 602.95 Billion in 2024. The market is projected to reach USD 950.67 Billion by 2033, exhibiting a CAGR of 4.77% from 2025-2033. North America currently dominates, with 37.8% pharmacy benefit management market share, driven by the increasing demand for cost-containment solutions, the growing prevalence of chronic conditions, the rising adoption of value-based care models, and the expansion of employer-sponsored health plans, all of which necessitate more efficient drug management and access to medications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 602.95 Billion |

|

Market Forecast in 2033

|

USD 950.67 Billion |

| Market Growth Rate 2025-2033 | 4.77% |

The pharmacy benefit management (PBM) market demand is driven by the increasing demand for cost management solutions, as organizations seek to control the rising expenses of prescription drugs. In addition, the rise of chronic diseases like diabetes and heart disease is leading to greater medication use, aiding the market growth. For example, PBM ensures that 72% of people get a commercial or Medicare Part D PDP, given the importance of PBMs in facilitating necessary treatments for many people. Besides this, ongoing advancements in data analytics are enhancing PBMs’ ability to optimize drug formularies and improve patient outcomes, providing an impetus to the market. Also, the shift toward value-based care models emphasizes cost-effective medication management, which is driving the market demand. Furthermore, regulatory changes are influencing market dynamics, while technological innovations such as digital health tools streamline PBM processes, thus catalyzing the pharmacy benefit management market growth.

The United States PBM market growth is driven by the growing number of employer-sponsored health plans with a share of 90.00%. In line with this, the need for medication therapy management to reduce adverse drug events is gaining attention, contributing to the market expansion. Moreover, the rise in specialty drugs is increasing the demand for cost-containment strategies as they are more expensive, thus strengthening the market share. Around 70% of the national PBM market is dominated by four major players: CVS Health, OptumRx, Express Scripts, and Prime Therapeutics. Additionally, the growing preference for home healthcare services is contributing to the expansion of the market. Concurrently, the shift towards personalized medicine is encouraging PBMs to tailor prescription drug plans, providing an impetus to the market. Apart from this, the emergence of e-commerce and telemedicine is making digital PBM solutions more essential for consumers and providers, which is propelling the market forward.

Pharmacy Benefit Management Market Trends:

Increasing Value-Based Care Models

The shift towards value-based care models, which focus on patient outcomes rather than the volume of drugs dispensed, is favoring the PBM market trends. Moreover, this trend emphasizes collaboration between healthcare providers, PBMs, and insurers to ensure that patients receive the most effective treatments at the best possible cost. In the last decade, the CMS Innovation Center has piloted over 50 payment and care delivery models, significantly transforming the US healthcare system. These models have more emphasis on quality, clinical outcomes, and patient experience, rather than focusing on the volume of services offered. Consequently, efforts toward adopting value-based care models have risen steeply and undoubtedly affect PBM configurations. Because PBMs link reimbursement rates to health outcomes, the latter aspires to improve medication compliance and eventually contain the costs of such services as readmissions to hospitals, etc. For example, in April 2024, AMGA called upon Congress to open the all-important provider payment stability panel to prevent further Medicare payment reductions, promote value-based care, and preserve Medicare Advantage. This, in turn, has boosted the pharmacy benefit management market statistics.

Rising Integration of Digital Health Technologies

Novel advancements in technologies, such as the introduction of mobile health apps, telehealth, and electronic health records (EHRs) to facilitate better communication between pharmacists, patients, and healthcare providers, are catalyzing the market. SOTI’s 2024 global survey revealed that 85% of healthcare personnel globally think organizations require new or higher technology to enhance client health status. Furthermore, PBMs are employing mobile applications to monitor treatment compliance and to prescribe medication alarms and teleconsultations so that patients can better manage their medications. Apart from this, these solutions provide an opportunity to share data in real time and take into consideration individual needs. For instance, in May 2024 a PBM firm EmpiRx Health in New Jersey created an artificial intelligence (AI) tool used by pharmacists for claims processing.

Growing Focus on Transparency

There is a growing demand for increased transparency and regulatory compliance in the market, driven by both consumer advocacy groups and regulatory bodies. Patients and payers are demanding better information on the rebate arrangements, drug prices, and bottles for formulary entry. Furthermore, PBMs are now practicing increased transparency including providing rebates to pharmaceutical firms as well as revealing other aspects of pricing arrangements. For instance, in May 2024, Optum Rx which is the independent business of UnitedHealth Group unveiled a new drug pricing model called Clear Trend Guarantee to make drug spending more predictable for payers if it operates as pharmacy benefit manager PBM.

Growing Focus on Quality and Affordability

The market is experiencing sustained growth, mainly due to the growth in demand for prescription medication. The drivers of this growth include the widening insurance coverage, rising incidence of chronic conditions, and transition toward personalized medicine. In addition, a growing population coupled with increasing healthcare costs puts pressure on stakeholders to find more effective models of drug distribution and reimbursement. According to industry reports, the average cost of medicine on a global scale is expected to increase by 10% in 2025. Rising costs of specialty medications and the expanding complexity of treatment regimens accelerate this pressure, prompting both public and private payers to reconsider how benefits are administered. Such an environment has heightened the emphasis on cost control and quality monitoring. Employers, insurers, and government programs are increasingly depending on PBMs to negotiate lower drug prices, execute formulary management tactics, and discourage fraud. Additionally, utilization review procedures and tiered formularies have become more prominent as part of these efforts.

Pharmacy Benefit Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pharmacy benefit management market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service, business model, and end use.

Analysis by Service:

- Specialty Pharmacy Services

- Drug Formulary Management

- Retail Pharmacy Services

- Benefit Plan Design and Consultation

- Disease Management Services

- Others

Specialty pharmacy services lead the market with a 25.0% market share as it caters to patients with complex, chronic, or rare conditions requiring specialized medications and comprehensive management. These pharmacies handle drugs that often need special handling, storage, and administration, such as biologics and injectables. Services include patient education, adherence support, and coordination of care with healthcare providers to optimize treatment outcomes. For instance, in April 2024, Walgreens expanded its specialty pharmacy services to improve patient outcomes and provide greater value to payers and partners. This, in turn, is bolstering the pharmacy enhancing the PBM market outlook.

Analysis by Business Model:

- Health Insurance Management

- Standalone PBMs

- Retail Pharmacy

Standalone PBMs accounts for the majority of the market share with 38.9% market share. The escalating prevalence of chronic diseases such as diabetes, hypertension, and asthma necessitates ongoing medication management, thereby increasing the volume of prescriptions filled. PBMs play a crucial role in negotiating drug prices and formulating benefit plans to manage these costs effectively. Additionally, the shift towards value-based care models, which emphasize improving patient outcomes while controlling costs, has led healthcare providers and payers to seek innovative solutions from PBMs. These organizations are adopting strategies that focus on medication adherence, patient education, and the management of specialty drugs, which often carry higher price tags. Furthermore, the growing emphasis on transparency in drug pricing has prompted PBMs to develop tools and resources that facilitate clarity regarding medication costs, thereby building trust with consumers and enhancing their competitive position in the market.

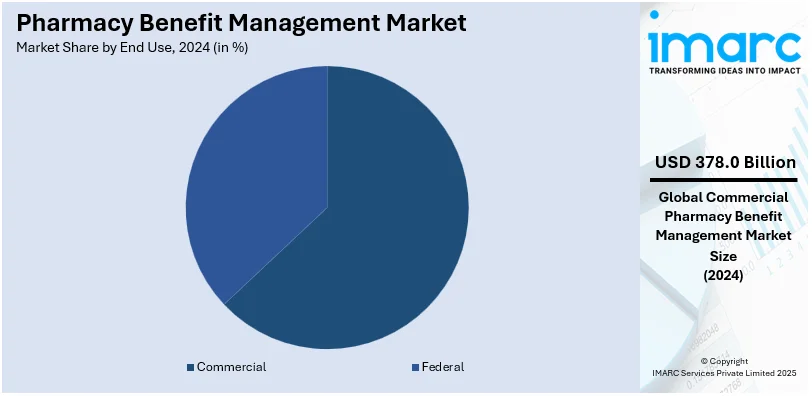

Analysis by End Use:

- Federal

- Commercial

Commercial leads the market, with 62.7% share as it is typically offered by employers as part of employee benefits packages, encompassing a large segment of the insured population. As businesses seek to manage healthcare costs and ensure their employees have access to necessary medications, commercial PBMs play a crucial role in negotiating drug prices, managing formularies, and implementing cost-saving strategies such as mail-order pharmacies and generic substitution. This extensive usage and the need for efficient drug benefit management in the commercial sector drive its dominance in the pharmacy benefit management market revenue.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Others

In North America leads the market in 2024 with 37.8% PBM market share, propelled by innovative product launches aimed at enhancing efficiency and reducing healthcare costs. Recent product launches have focused on integrating advanced technologies such as artificial intelligence and data analytics to optimize drug utilization and patient outcomes. For example, CVS Health's launch of the Transform Diabetes Care program uses connected devices and data analytics to provide personalized care for diabetes patients, aiming to improve adherence and health outcomes while reducing overall costs. Another notable example is Express Scripts' SafeGuardRx, a suite of solutions designed to manage the cost and utilization of high-priced specialty medications through advanced clinical programs and patient support services.

Key Regional Takeaways:

United States Pharmacy Benefit Management Market Analysis

The US PBM market continues to boom with increasing healthcare spend and emerging value-based cost-containment. According to CMS, the total health spending in the United States came in at USD 4.5 trillion for 2022, with PBMs playing an important role in managing prescription drug benefits. The significant drivers include high demand for specialty drugs, which command well over 50 percent of total drug spend, and increasing adoption of value-based contracts. The two market leaders, CVS Health, and Express Scripts are using economies of scale to bargain for better prices. Regulatory pressure is increasing, which has made pricing models and fee structures transparent. According to the Kaiser Family Foundation (KFF), out-of-pocket prescription drug costs in the United States averaged more than USD 633 billion in 2022, and PBM-driven cost-saving measures are a significant need. Focusing on digital tools, like AI-driven analytics in formulary management, speaks volumes of innovation as the pathway toward improved patient outcomes and cost-effectiveness.

Europe Pharmacy Benefit Management Market Analysis

The European PBM market is growing with pharmaceutical expenditure increasing along with an ever-increasing need for cost control. According to industrial reports, total pharmaceutical spending in Europe reached an estimated amount of EUR 300 billion, or USD 309 billion in 2023, and the PBMs were gaining momentum as intermediaries between the parties dealing with prescription benefits. Countries leading the adoption curve are Germany, the UK, and France due to government-sponsored healthcare systems with strict measures toward cost control. Specialty drug prices are increasing, and the market is being driven toward biosimilars and generics to maintain budgets. Regulations in the European Union that focus on drug pricing transparency open the door for PBMs to bargain better terms with public and private payers. Technology-enabled platforms such as e-prescriptions and automated reimbursement systems improve efficiency. In the face of high regulatory pressure, the partnerships between local payers and global PBM firms like OptumRx and MedImpact are encouraging innovation and ensuring market growth.

Asia Pacific Pharmacy Benefit Management Market Analysis

The PBM market in Asia Pacific is growing at a rapid pace with rising healthcare spending and the prevalence of chronic diseases. The OECD indicates that health spending in the Asia Pacific region is growing at an annual rate of 6%, reaching USD 2 trillion in 2023. The growth in the Asia Pacific region is being driven by countries such as China, Japan, and India, fueled by rising populations and an increasing demand for costly medical treatments. Specialty drugs now account for 30% of prescription drug costs, the industrial reports show, making the need for PBM services necessary to optimize cost. Government-backed programs like Japan's "National Health Insurance Drug Pricing System" should lead to increased efforts toward generic drugs, opening a door for PBMs to become increasingly important. Digital healthcare platforms, complemented by telemedicine integration, have strong support for growth. Local insurers are collaborating with global PBM firms so that the application of efficient drug management systems is widespread.

Latin America Pharmacy Benefit Management Market Analysis

The PBM market in Latin America is on a growth trajectory based on the trend of increasing healthcare expenditure as well as increased focus on the affordability of medication access. According to the International Trade Administration, Brazil allocates 9.47% of its GDP to healthcare, amounting to USD 161 billion. The increase in spending on specialty drugs is primarily driven by the growing prevalence of cancers and autoimmune diseases. Local providers, such as Amil in Brazil and Banmedica in Chile, through partnerships with PBMs, enable better drug pricing and access. Regulatory reforms, such as Mexico's, have increased the use of generic drugs as part of its cost-control measure. Technology has also been implemented, such as mobile health applications, which will change prescription management, improve transparency, and make access easier. With increasing insurance penetration throughout the region, PBMs are particularly well-positioned to address inefficiencies and drive cost savings for payers and patients alike.

Middle East and Africa Pharmacy Benefit Management Market Analysis

With improved healthcare awareness and increased insurance coverage, the Middle East and African PBM market is changing. According to data from industrial reports, in 2022, healthcare expenditure of the Gulf Cooperation Council countries had crossed the USD 50 billion mark, with drug benefits also becoming a salient feature in the insurance policies. In Saudi Arabia, for instance, the National Unified Procurement Company (NUPCO) is unifying pharmaceutical purchases to realize savings. South Africa is taking the strategy of PBM in the private sector, where about 50% of healthcare spending is recorded. Digital health initiatives, for example, in the UAE's e-prescription systems, will make drug management more streamlined. With chronic diseases and specialty drug costs on the rise, PBMs will play a crucial role in ensuring sustainable healthcare solutions.

Competitive Landscape:

Companies in the pharmacy benefit management (PBM) market are engaged in various services to effectively manage prescription drug benefits for their clients. Several leading players are developing and managing formularies, which are lists of covered medications for specific health insurance plans or employer groups. They decide on the efficacy and cost of drugs within a district and their risk-benefit balance when deployed in clinical practices. PBMs engage in negotiation with manufacturers of drugs for formulary to ensure that drugs needed by consumers are well priced for access by the same consumers. Furthermore, PBMs provide different services to patients to ensure that they are more compliant with medication therapy management. Such services might include daily or after-hours pharmacist call center access, medication delivery notifications, materials to learn about specific diseases or drugs, and individual patient consulting to discuss issues or further questions arising regarding medications. Apart from this, PBMs use some of the data analytical tools in collecting information, analyzing, tracking, and making decisions.

The report provides a comprehensive analysis of the competitive landscape in the pharmacy benefit management market with detailed profiles of all major companies, including:

- Aetna, Inc.

- Centene Corporation

- Cigna Corporation

- CVS Health Corporation

- Express Scripts Holding Company

- Magellan Health, Inc.

- Medimpact Healthcare Systems, Inc.

- Optumrx, Inc.

- Prime Therapeutics LLC

- ProCare Rx

- SS&C Technologies, Inc.

Latest News and Developments:

- May 2025: HealthEZ, a national third-party benefits administrator, introduced EZrx, a next-generation pharmacy solution that can reduce pharmacy costs by up to 50% compared to traditional PBM plans by employing six integrated cost-reduction strategies. The solution strategically shifts clinical reviews for medications priced over USD 1,000 outside the PBM, ensuring employers benefit from the lowest net costs and enabling members to digitally compare prices and switch pharmacies easily. HealthEZ positions EZrx as a transformative tool for employers managing self-funded plans, combining cost containment with an enhanced member experience driven by digital platforms and concierge advocacy.

- May 2025: Waltz Health and pharmacy benefit manager WellDyne announced a strategic partnership to introduce a transparent specialty pharmacy solution powered by Waltz Connect to health plans and self-funded employers. The integration leverages AI-enabled prescription routing to optimize medication placement based on cost, clinical appropriateness, and service quality—empowering members to access lower‑cost specialty drugs while enhancing outcomes. The program combines WellDyne’s “Clear” PBM model with Waltz’s dynamic marketplace, aiming to streamline member experience, drive cost savings, and uphold transparency in specialty drug management.

- February 2025: The Pharmaceutical Care Management Association (PCMA) unveiled its PBM Innovation Project, an interactive web portal and accompanying white paper showcasing patient‑centric programs developed by PBMs of all sizes. The initiative highlights five key areas—including reducing out-of-pocket costs, enhancing benefit transparency, improving biosimilar access, supporting retail pharmacies, and broadening specialty drug coverage. PCMA emphasized that PBMs are innovating independently of government mandates, urging policymakers to recognize this evolving marketplace and avoid regulations that may inhibit progress.

- July 2024: CVS Caremark announced that the company will focus on increased transparency, decreased costs for prescription drugs, and enhanced clinical care. Being the leader in pharmacy benefit management, CVS Caremark promises better services to businesses, unions, and health plans while simplifying and increasing transparency both for payers and patients.

- May 2024: UnitedHealth-owned Optum Rx, one of the biggest pharmacy benefit managers in the U.S., launched a new drug pricing model called Clear Trend Guarantee to make payers’ drug spending more predictable.

- May 2024: EmpiRx Health, a PBM company headquartered in New Jersey, developed an AI-powered platform to help pharmacists with claims adjudication.

- March 2024: Transparency-Rx introduced the organization of transparent pharmacy benefit managers working towards addressing the ongoing challenges with pharmacy benefit managers (PBMs).

- February 2024: Mindera Health partnered with Liviniti™ to improve the management of moderate-to-severe psoriasis patients.

Pharmacy Benefit Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Services Covered | Specialty Pharmacy Services, Drug Formulary Management, Retail Pharmacy Services, Benefit Plan Design and Consultation, Disease Management Services, Others |

| Business Models Covered | Health Insurance Management, Standalone PBMS, Retail Pharmacy |

| End Uses Covered | Federal, Commercial |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, Australia, Brazil, Mexico, Saudi Arabia, South Africa, United Arab Emirates |

| Companies Covered | Aetna, Inc., Centene Corporation, Cigna Corporation, CVS Health Corporation, Express Scripts Holding Company, Magellan Health, Inc., Medimpact Healthcare Systems, Inc., Optumrx, Inc., Prime Therapeutics LLC, ProCare Rx, SS&c Technologies, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmacy benefit management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pharmacy benefit management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmacy benefit management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pharmacy benefit management market was valued at USD 602.95 Billion in 2024.

IMARC estimates the pharmacy benefit management market to reach USD 950.67 Billion, exhibiting a CAGR of 4.77% during 2025-2033.

Key factors driving the pharmacy benefit management (PBM) market include the increasing demand for cost-effective drug management, the rise of chronic diseases requiring long-term medication, advancements in data analytics for optimized drug formularies, the shift toward value-based care, regulatory changes, and the growing adoption of digital health solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market with 37.8% pharmacy benefit management market share.

Some of the major players in the pharmacy benefit management market include Aetna, Inc., Centene Corporation, Cigna Corporation, CVS Health Corporation, Express Scripts Holding Company, Magellan Health, Inc., Medimpact Healthcare Systems, Inc., Optumrx, Inc., Prime Therapeutics LLC, ProCare Rx, SS&c Technologies, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)