Pharmacovigilance Market Size, Share, Trends and Forecast by Service Provider, Product Life Cycle, Type, Process Flow, Therapeutic Area, End Use, and Region, 2026-2034

Pharmacovigilance Market Size and Share:

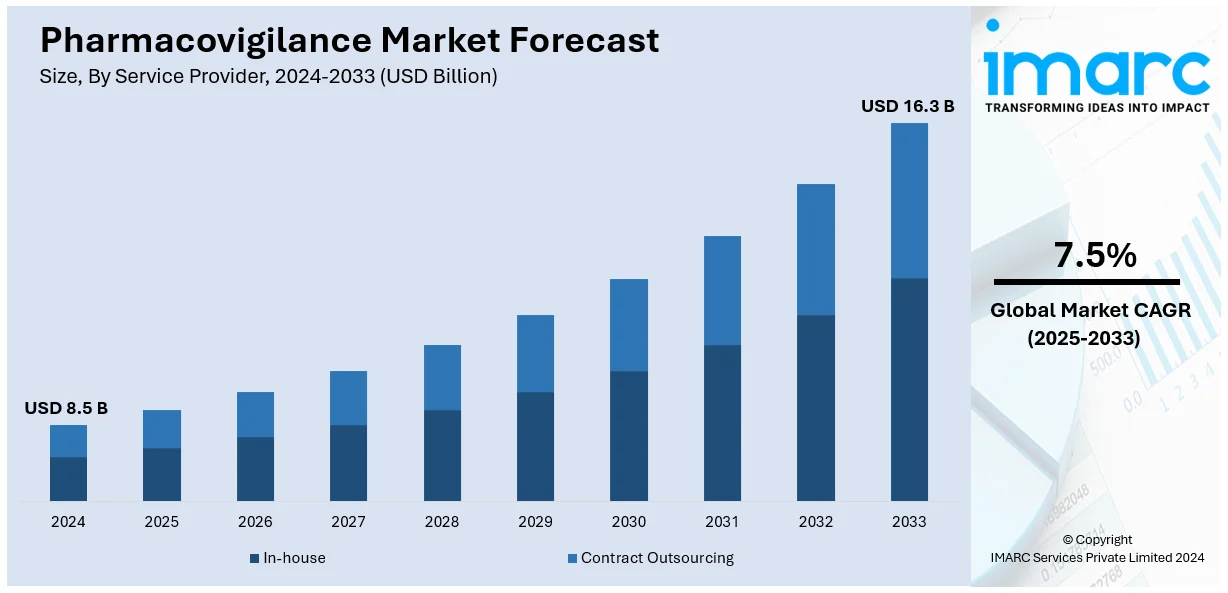

The global pharmacovigilance market size was valued at USD 8.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 16.3 Billion by 2034, exhibiting a CAGR of 7.5% from 2026-2034. North America currently dominates the market, holding a share of 33.7%. The market is expanding due to rising drug complexity, strict global regulations, growing use of AI and big data, increased adverse drug reactions from polypharmacy and substance abuse, and greater outsourcing by pharmaceutical firms to manage clinical and post-marketing safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.5 Billion |

| Market Forecast in 2034 | USD 16.3 Billion |

| Market Growth Rate (2026-2034) | 7.5% |

The pharmacovigilance market is driven by the growing prevalence of adverse drug reactions (ADRs), increasing demand for post-market drug monitoring, and stricter regulatory requirements worldwide. In addition, the rising adoption of artificial intelligence (AI) and big data analytics enhances signal detection and drug safety evaluation, improving efficiency and aiding the market growth. For instance, in 2024 European Medicines Agency (EMA) released tools and guidelines for using AI in pharmacovigilance, hereby showing a willingness to use technology to improve drug safety monitoring. Additionally, the growth of the pharmaceutical and biotechnology industries drives the demand for thorough safety monitoring during drug development, further contributing to the market's expansion. Besides this, the surge in chronic diseases and new drug launches boosts the demand for robust pharmacovigilance systems, providing an impetus to the market. Furthermore, outsourcing pharmacovigilance activities to specialized firms reduces operational costs while maintaining compliance, thus catalyzing the market growth.

The United States pharmacovigilance market is strongly driven by the country's extensive pharmaceutical industry, which conducts numerous clinical trials requiring thorough safety monitoring. In line with this, the rise of biosimilars and personalized medicine increases the complexity of drug safety assessments, boosting the market demand. Concurrently, government initiatives promoting drug safety surveillance, such as the Food and Drug Administration’s (FDA) Sentinel Initiative, are fostering the market growth. In confluence with this, the growing integration of patient-centric approaches emphasizes real-world data collection for safety evaluations, strengthening the pharmacovigilance market share. Also, collaborations between regulatory bodies and pharmaceutical companies enhance compliance and monitoring systems, supporting the market growth. Apart from this, the rapid adoption of telemedicine and digital health tools fosters remote reporting and monitoring of ADRs, propelling the market forward.

Pharmacovigilance Market Trends:

Technological Advancements Transforming Pharmacovigilance Operations

The pharmacovigilance market outlook highlights the role of automation and intelligence-driven workflows in redefining the landscape. Technologies such as AI, machine learning (ML), natural language processing (NLP), and big data analytics are transforming traditional pharmacovigilance models into agile, data-rich ecosystems. These tools are enhancing core functions—especially ADR monitoring, signal detection, and regulatory reporting—by processing massive datasets at speed and scale. According to recent market research, the global ML industry reached USD 31 billion in 2024, with pharmacovigilance emerging as one of its fastest-growing applications. High-impact collaborations are setting new benchmarks: Sanofi and Deloitte’s ConvergeHEALTH Safety platform uses AI to streamline case intake, while ArisGlobal’s integration with the USFDA's FAERS II system has enhanced electronic safety submissions. Saama Technologies’ ASAP solution further advances real-time risk detection, drawing on the FDA’s Sentinel Common Data Model and TreeScan methodology.

Government Regulation and Real-World Evidence Reinforce Market Expansion

A clear takeaway from the current pharmacovigilance market overview is the intensification of global regulatory scrutiny. Agencies like the USFDA, EMA, CDSCO, and TGA are increasing their vigilance, issuing strict mandates around safety reporting, especially in light of the rising production of novel drugs and complex therapies. Aurobindo Pharma USA’s recall of Quinapril and Hydrochlorothiazide tablets—due to nitrosamine contaminants—highlights how stricter testing standards are becoming non-negotiable. These episodes are driving pharmaceutical firms to reinforce internal systems and seek external pharmacovigilance partners. The growing reliance on post-marketing surveillance has also spotlighted the critical role of ADR monitoring, particularly in an environment of increased drug abuse and polypharmacy. Regulatory expectations are now focused on both trial phases and real-world usage data that captures patient outcomes over time. A study in Frontiers in Drug Safety and Regulation emphasized the value of real-world evidence (RWE) in updating drug risk profiles beyond the clinical setting.

Rising Pharma Demand for Pharmacovigilance Services Amid Drug Complexity

The latest pharmacovigilance market trends point to a surge in demand from pharmaceutical companies for specialized safety monitoring services. One of the core drivers behind this shift is the growing complexity of novel drug production, especially in biologics, gene therapies, and personalized medicine. With disease burdens rising—particularly chronic and comorbid conditions—patients are often prescribed multiple drugs simultaneously, increasing the chances of interactions and unexpected adverse reactions. To manage this complexity, pharma companies are outsourcing pharmacovigilance tasks to expert service providers. These firms offer scalable infrastructure, experienced analysts, and access to regional regulatory intelligence. IQVIA’s strategic partnership with NRx Pharmaceuticals for medical information and pharmacovigilance illustrates how outsourcing has evolved from cost-cutting to performance enhancement. This trend also reflects another key insight from the pharmacovigilance market report: internal resources are often overstretched. Outsourcing enables organizations to focus on core innovation while ensuring end-to-end drug safety monitoring is maintained across global markets.

Complex Clinical Trials and Polypharmacy Fuel Market Momentum

The increasing number and complexity of clinical trials are major growth engines for the pharmacovigilance market forecast. According to recent market data, over 22,000 new trials were launched in 2023, with many featuring adaptive protocols, decentralized elements, and patient-centric designs. These trends underscore the need for agile and proactive safety systems that can function in real-time across multiple geographies. Moreover, the rise of chronic diseases—like cardiovascular conditions, diabetes, and cancer—means that patients often undergo polypharmacy, i.e., simultaneous use of multiple therapeutic agents. This adds significant layers of safety risk, making ADR monitoring more vital than ever. Tech-driven partnerships are at the heart of this evolution. Cognizant’s collaboration with Medable—a leader in decentralized clinical trial (DCT) platforms—has introduced streamlined safety monitoring at every trial touchpoint. Likewise, Viedoc and LINK Medical’s partnership was built to support collaborative feature testing and improve trial productivity through integrated pharmacovigilance tools.

Pharmacovigilance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pharmacovigilance market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on service provider, product life cycle, type, process flow, therapeutic area, and end use.

Analysis by Service Provider:

- In-house

- Contract Outsourcing

Contract outsourcing is the most popular segment and holds 61.2% market share since it is more affordable and productive in terms of compliance with regulatory requirements and risk monitoring. The pharmacovigilance outsourcing trend has become common with more pharmaceutical and biotechnology companies opting to outsource the processes as a way of avoiding operational costs and focusing on business strengths such as product research and marketing. The increasing stringency of the safety requirements for drugs across the world also increases the need for contract service organizations that have niche competence in the regulation’s affairs and other safety assessment techniques. These providers use advanced technologies such as AI and big data analytics to enhance the outcomes of adverse event identification and notification. Also, the increase in the number of clinical trials, new drug launches, and growth in the biosimilars segment supports the growth of this segment. Both contract service providers and pharmaceutical firms are continuously building up their capabilities through more strategic collaborations, making this segment more dominant in the pharmacovigilance market.

Analysis by Product Life Cycle:

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

Phase IV or the post-marketing surveillance phase has the biggest market share of 76.5% in the pharmacovigilance market as the monitoring of drug safety after approval is crucial. The dominance of the segment is due to the regulatory requirements for constant safety assessments and risk management procedures. Higher numbers of ADRs observed after approval add to the need for Phase IV to ascertain long-term safety. The pharmaceutical business and increasing number of drugs launches again broaden this segment as firms have to follow safety surveillance standards. Furthermore, new Phase IV activities that combine RWE and big data analytics enable efficient and compliant safety assessments. The ability to outsource Phase IV pharmacovigilance services to specialized service providers that offer cost-effective and compliant post-market surveillance is another factor driving segment growth.

Analysis by Type:

- Spontaneous Reporting

- Intensified ADR Reporting

- Targeted Spontaneous Reporting

- Cohort Event Monitoring

- EHR Mining

The global pharmacovigilance market is led by the spontaneous reporting method with a share of 31.9% due to its high usage in identifying ADRs at a relatively low cost and time. The growth of this segment is due to the compliance standards on healthcare professionals and pharma companies, to report ADRs to central repositories such as the FAERS. This approach to data collection is quicker and means that safety issues can be identified very quickly. Greater public awareness and patient promotion to report ADRs directly also expand the size of this segment. The use of sophisticated technologies like ML and NLP advanced data analysis from spontaneous reports, signals, and risks. With the steady rise in the consumption of drugs all over the world, the need for monitoring the safety of these drugs through spontaneous reporting systems enhances the growth of this segment.

Analysis by Process Flow:

- Case Data Management

- Case Logging

- Case Data Analysis

- Medical Reviewing and Reporting

- Signal Detection

- Adverse Event Logging

- Adverse Event Analysis

- Adverse Event Review and Reporting

- Risk Management System

- Risk Evaluation System

- Risk Mitigation System

Signal detection constitutes the largest segment of the pharmacovigilance market with a market share of 38.2% because it plays a central role in detecting and managing safety concerns that may exist about a drug during its development and after launch. The foundation of this process lies in the collection of real-time data from clinical trials, electronic health records (EHRs), and patient records, gathered through adverse event logging. Modern technologies particularly ML algorithms increase the efficiency of adverse event analysis thus enhancing the improvement of drug safety. The increased compliance with regulatory frameworks enhances adverse event review and reporting to meet the required time and quality standards of reporting to the regulatory authorities. Signal detection is anticipated to record strong growth due to the rising uptake of big data analytics as well as the integration of RWE alongside growth in drug development projects and public awareness of drug safety.

Analysis by Therapeutic Area:

- Oncology

- Neurology

- Cardiology

- Respiratory Systems

- Others

The pharmacovigilance market is led by oncology as it has the largest market share of 27.8%. Oncology has the highest number of clinical trials and approved drugs as a therapeutic area. The increasing occurrence of cancer all over the world, estimated to be 29,564,943 cases in 2040, fosters the development of oncology drugs and the comprehensiveness of safety measures. Personalized medicine and immunotherapies increase the complexity of adverse event reporting by targeted therapies, and for this reason, necessitate the use of pharmacovigilance processes. The US FDA pressure on the highly secure oncology treatment adds to the market intensity. Also, expensive, and long oncology trials stress the need to have optimum risk management approaches and post-market vigilance to safeguard the patient from any harm while meeting legal compliance requirements. Due to this directed focus on oncology pharmacovigilance, the development of data analytics and AI signal detection innovation is further fueled and market expansion is sustained.

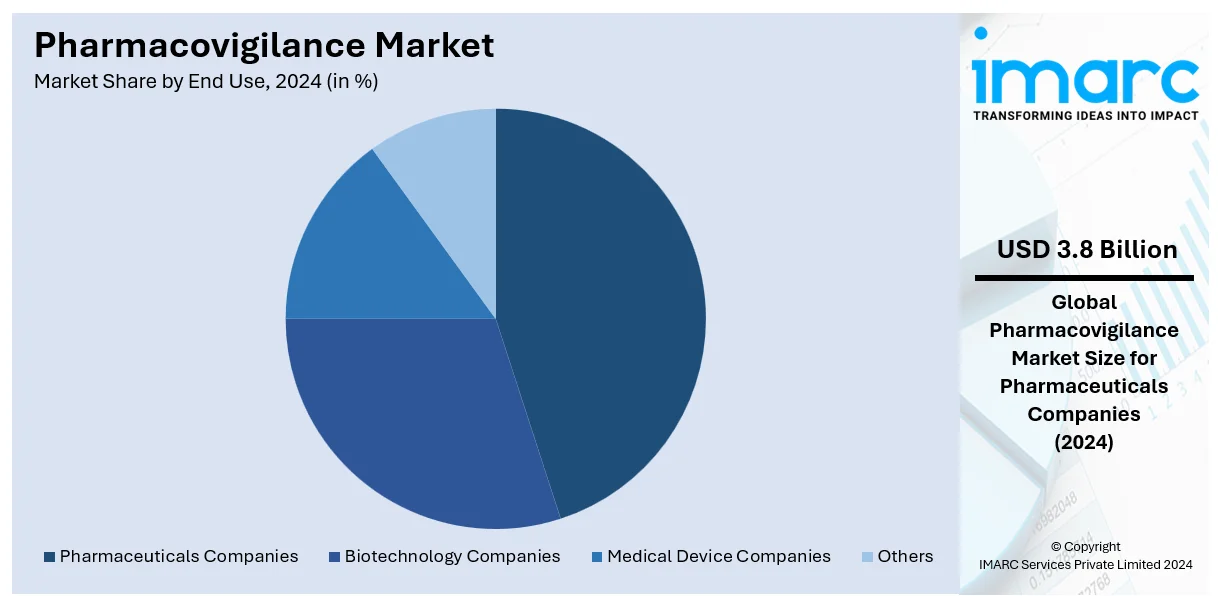

Analysis by End Use:

- Pharmaceuticals Companies

- Biotechnology Companies

- Medical Device Companies

- Others

The largest segment in the pharmacovigilance market is occupied by pharmaceutical companies with a share of 44.2% because of their significant responsibilities within drug development and safety. They spend a lot of money on pharmacovigilance to meet set regulatory requirements and reduce the potential consequences of ADRs. The increasing numbers of new chemical entities and clinical trials contribute to the escalating demand for sound pharmacovigilance practices. In personal medicine and other biologic products, tracking and risk assessment become difficult; hence, pharmaceutical companies use robust instruments like AI for signal detection. Further, the global engagements between pharmaceutical firms and other regulatory authority organizations improve compliance and data sharing. The continuously rising public concern over drug safety and the shift towards RWE continue to cause pharmaceutical companies to be the most significant drivers of the pharmacovigilance market growth.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the largest share of the pharmacovigilance market at 33.7%, driven by advanced healthcare infrastructure, including the 6,120 hospitals and 916,752 staffed beds in the U.S. along with stringent regulatory frameworks established by the FDA. The region benefits from significant investments in drug safety programs and the widespread adoption of technology for adverse event reporting and data analysis. The rising prevalence of chronic diseases and an aging population are driving the increase in drug consumption, which in turn heightens the demand for effective pharmacovigilance practices. Moreover, the region leads in the integration of AI and big data for signal detection and real-time monitoring, improving efficiency and compliance. Robust collaboration between pharmaceutical companies and research institutions also plays a key role in supporting drug safety initiatives, driving ongoing market growth. The growing focus on patient safety and rising awareness about ADRs solidify North America’s leadership in the pharmacovigilance market.

Key Regional Takeaways:

United States Pharmacovigilance Market Analysis

The United States accounted for a share of 83.40% in the North America pharmacovigilance market in 2024. The US pharmacovigilance market is driven by a combination of stringent regulatory frameworks, technological advancements, and increasing healthcare awareness. The FDA enforces robust pharmacovigilance requirements, fostering the demand for comprehensive adverse event reporting and monitoring systems. With rising concerns over medication safety and side effects, there is a growing need for post-market surveillance, further propelling market growth. According to the US Department of Health and Human Services, an estimated 129 million people in the US suffer from at least one major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension, which drives the demand for continuous drug safety monitoring. Technological advancements like AI, ML, and automation are improving drug safety monitoring by increasing both efficiency and accuracy in the detection of adverse events. The integration of EHRs and wearable devices also contributes to real-time safety data collection, enabling faster response to potential risks. Additionally, increasing collaborations between pharmaceutical companies and third-party service providers for pharmacovigilance outsourcing optimize operational costs and ensure compliance with global safety standards. The focus on personalized medicine and the growth of biologics further intensifies the need for robust pharmacovigilance practices in the US market.

Europe Pharmacovigilance Market Analysis

The pharmacovigilance market in Europe is highly driven by an effective regulatory framework set down by the EMA and individual country agencies. The uptake of the EU Pharmacovigilance Directive (2010/84/EU) has provided more impetus to the expected safety monitoring and reporting by the pharmaceutical industries. With concern for patient safety, estimations of pharmacovigilance services have gained importance as adverse event reporting and risk management plans are a substantial part of drug development and post-marketing surveillance. The threat level of diseases including cancer, diabetes, and respiratory illnesses amongst others, along with the growing elderly population creates the need for constant safety evaluation of drugs. According to reports, on January 1, 2023, the EU population of 448.8 million, and more than one-fifth of the people are 65 years and above, thus requiring better pharmacovigilance to address the aging population. Furthermore, the application of modern technologies, including big data, AI, and EHRs, as a consequence, contributes to the pharmacovigilance improvement and early identification of ADRs. The European market is also following the overall trend towards outsourcing pharmacovigilance services to specialized contract research organizations (CROs), thus supporting the market growth.

Asia Pacific Pharmacovigilance Market Analysis

The pharmacovigilance market in the Asia-Pacific (APAC) region is expanding rapidly, driven by the region’s growing pharmaceutical industry and increasing drug consumption. The prevalence of chronic diseases and the rising need for effective post-market surveillance are key factors fueling this growth. The demand for pharmacovigilance services is particularly prominent due to the increasing focus on drug safety and the need for risk management. As reported by PubMed Central, the prevalence of knee pain among older Asian populations varies significantly, with rates ranging from 11% to 56% in China, 33% in Japan, 38% in Korea, and 61% in Vietnam, underscoring the importance of monitoring treatments in aging populations. Emerging markets like China and India are witnessing significant investments in healthcare infrastructure, improving the collection and analysis of pharmacovigilance data. Moreover, the rising trend of clinical trials in the region further necessitates robust pharmacovigilance systems. Technological advancements, such as EHRs, are enhancing the monitoring of ADRs, further boosting market growth in the region.

Latin America Pharmacovigilance Market Analysis

The Latin American pharmacovigilance market is driven by an increasing demand for regulatory compliance and drug safety monitoring, primarily due to the region's expanding pharmaceutical sector and rising healthcare awareness. According to PubMed Central, in Brazil, an estimated 928,000 deaths annually are attributed to chronic diseases, highlighting the need for effective pharmacovigilance systems to manage medication risks in such populations. Key factors contributing to market growth include the implementation of stricter regulatory guidelines by national agencies such as ANVISA in Brazil and COFEPRIS in Mexico. Moreover, the growing adoption of advanced technologies for drug monitoring and the outsourcing of pharmacovigilance services are major factors driving the market.

Middle East and Africa Pharmacovigilance Market Analysis

The pharmacovigilance market in the Middle East and Africa (MEA) is influenced by regulatory improvements, increasing healthcare infrastructure, and rising awareness of drug safety. According to PubMed Central, in the UAE, the prevalence of self-reported chronic diseases is 23.0%, with obesity, diabetes, and asthma/allergies being the most common (12.5%, 4.2%, and 3.2%, respectively). This high prevalence of chronic conditions drives the demand for robust pharmacovigilance systems to ensure patient safety. The region’s pharmaceutical market is expanding, and with rising healthcare infrastructure and the growth of clinical trials, the need for comprehensive drug safety monitoring continues to rise across MEA.

Competitive Landscape:

The pharmacovigilance market is experiencing heightened competition, with leading players concentrating on technological innovations and strategic partnerships to improve their service offerings. There is a growing trend toward leveraging AI and ML for automated adverse event detection and predictive analytics. Companies are expanding their global presence by outsourcing pharmacovigilance services to emerging markets, aiming to reduce operational costs while maintaining high standards. Strategic partnerships with clinical research organizations and healthcare providers are becoming common to streamline data collection and analysis. Additionally, the integration of RWE and patient-reported outcomes into safety assessments is gaining momentum, reflecting the industry's commitment to improving drug safety and regulatory compliance. These activities underline the dynamic evolution of the market landscape.

The pharmacovigilance market research report provides a comprehensive analysis of the competitive landscape with detailed profiles of all major companies, including:

- Accenture plc

- ArisGlobal LLC

- BioClinica Inc. (Cinven Partners LLP)

- Capgemini

- Cognizant

- International Business Machines Corporation

- ICON plc.

- IQVIA Inc.

- ITClinical

- Parexel International Corporation

- Wipro Limited

Latest News and Developments:

- April 2025: ELIQUENT Life Sciences acquired Truliant Consulting, a leading pharmacovigilance, risk management, and regulatory compliance firm, enhancing its end-to-end product lifecycle support. This acquisition strengthens ELIQUENT’s global platform by integrating Truliant’s technology-driven, scalable solutions. The expanded capabilities include risk management, operational efficiency, compliance readiness, safety oversight, technology integration, and scalable support models.

- March 2025: Tech Mahindra and NVIDIA collaborated to develop an agentic AI-powered pharmacovigilance solution that enhances drug safety management by automating and optimizing workflows. Built on Tech Mahindra’s TENO framework and NVIDIA AI Enterprise software, it uses AI agents to streamline case intake, data transformation, quality control, and compliance, reducing human error. The solution improves turnaround times by 40%, data accuracy by 30%, and cuts operational costs by 25%, transforming pharmacovigilance from reactive to predictive and ensuring timely, efficient ADR management.

- March 2025: ArisGlobal launched three new AI-driven products at Breakthrough 2025: LifeSphere Unify, NavaX Insights, and Advanced Compliance Docs. These innovations highlight ArisGlobal’s commitment to responsible, industry-leading AI adoption, advancing regulatory operations and pharmacovigilance.

- March 2025: LSK Global Pharma Services, a leading Korean CRO with extensive clinical trial experience, has selected Oracle Argus to enhance its global pharmacovigilance and safety case management. This collaboration aims to accelerate drug safety analysis, reduce costs, and meet evolving regulatory demands, ultimately supporting faster, safer therapeutic development and improved patient outcomes.

- January 2025: Clinigen formed a strategic partnership with Tepsivo, acquiring a minority stake in the global digital pharmacovigilance services provider. This collaboration combines Clinigen’s expertise in PV, regulatory affairs, and medical information with Tepsivo’s innovative technology, aiming to modernize PV services, accelerate drug development, and navigate complex regulatory landscapes worldwide.

- August 2024: The Pharmacovigilance Programme of India (PvPI) launched ADRMS software as part of the ‘Digital India’ initiative. Launched by Health Minister Shri J.P. Nadda, it is India’s first safety database for proper reporting of adverse events by patients, doctors, nurses, and pharmaceutical industries.

Pharmacovigilance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | In-house, Contract Outsourcing |

| Product Life Cycles Covered | Pre-clinical, Phase I, Phase II, Phase III, Phase IV |

| Types Covered | Spontaneous Reporting, Intensified ADR Reporting, Targeted Spontaneous Reporting, Cohort Event Monitoring, EHR Mining |

| Process Flows Covered |

|

| Therapeutic Areas Covered | Oncology, Neurology, Cardiology, Respiratory Systems, Others |

| End Uses Covered | Pharmaceuticals Companies, Biotechnology Companies, Medical Device Companies, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, ArisGlobal LLC, BioClinica Inc. (Cinven Partners LLP), Capgemini, Cognizant, International Business Machines Corporation, ICON plc., IQVIA Inc., ITClinical, Parexel International Corporation, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmacovigilance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pharmacovigilance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmacovigilance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pharmacovigilance is the science and activities related to the detection, assessment, understanding, and prevention of adverse effects or other drug-related problems. It ensures the safety of medicines, monitors their efficacy, and minimizes risks to patients. This discipline plays a critical role in public health and regulatory decision-making.

The pharmacovigilance market was valued at USD 8.5 Billion in 2024.

IMARC estimates the global pharmacovigilance market to exhibit a CAGR of 7.5% during 2025-2033.

Key factors driving the global pharmacovigilance market include increasing drug development activities, rising adverse drug reactions (ADRs), stringent regulatory requirements for drug safety, growing outsourcing of pharmacovigilance services, advancements in data analytics and AI enhance signal detection are improving adverse event monitoring efficiency.

In 2024, contract outsourcing represented the largest segment by service provider, driven by its cost efficiency and access to specialized expertise. Pharmaceutical companies increasingly partnered with contract organizations to streamline operations, reduce overhead costs, and ensure compliance with evolving regulatory requirements.

Phase IV leads the market by product life cycle owing to its focus on post-marketing surveillance and long-term drug safety evaluation. This phase ensures ongoing monitoring of adverse effects, compliance with regulatory standards, and risk mitigation for approved drugs in real-world settings.

The spontaneous reporting is the leading segment by type, due to its simplicity, cost-effectiveness, and widespread adoption. It serves as a primary method for identifying adverse drug reactions, enabling rapid signal detection, and contributing to regulatory compliance and patient safety.

In 2024, signal detection represented the largest segment by process flow, fueled by advancements in data analytics and artificial intelligence. The growing emphasis on early identification of safety signals and proactive risk management further drove its widespread adoption across the industry.

Oncology leads the market by therapeutic area owing to the rising global cancer prevalence and the use of complex, high-risk therapies. The need for rigorous safety monitoring of targeted treatments, immunotherapies, and chemotherapy regimens further drives the demand for pharmacovigilance in this area.

The pharmaceutical companies are the leading segment by end use, due to their responsibility for ensuring drug safety, regulatory compliance, and risk management. These companies invest in robust pharmacovigilance processes to monitor adverse effects, maintain product quality, and meet global regulatory standards across the entire product lifecycle.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global pharmacovigilance market include Accenture plc, ArisGlobal LLC, BioClinica Inc. (Cinven Partners LLP), Capgemini, Cognizant, International Business Machines Corporation, ICON plc., IQVIA Inc., ITClinical, Parexel International Corporation, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)