Pharmaceutical Regulatory Affairs Market Size, Share, Trends and Forecast by Service Provider, Service, Category, Indication, Deployment Stage, Company Size and Region, 2026-2034

Pharmaceutical Regulatory Affairs Market Size and Share:

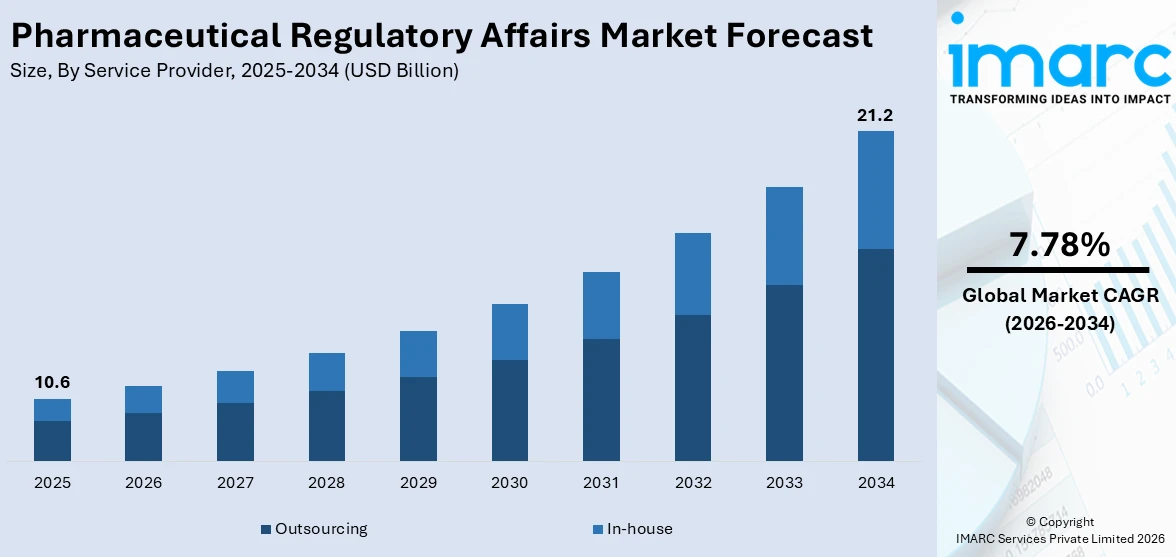

The global pharmaceutical regulatory affairs market size was valued at USD 10.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 21.2 Billion by 2034, exhibiting a CAGR of 7.78% from 2026-2034. The pharmaceutical industry faces growing regulatory demands, driven by stringent safety and efficacy standards. Regional variations, evolving guidelines for biologics and advanced therapies, and frequent updates require robust regulatory strategies. This complexity fuels the demand for skilled professionals to ensure compliance, streamline approvals, and manage global market entry challenges effectively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.6 Billion |

| Market Forecast in 2034 | USD 21.2 Billion |

| Market Growth Rate (2026-2034) | 7.78% |

The pharmaceutical regulatory affairs market is driven by the increasing complexity of global regulatory frameworks. Regulatory bodies, such as the Food and Drug Administration (FDA), exponential moving average (EMA), and the World Health Organization (WHO), continue to tighten compliance standards to ensure the safety, efficacy, and quality of pharmaceutical products. This creates a growing demand for regulatory expertise to navigate diverse approval processes and address regional variations in requirements. The focus on patient safety, coupled with the rising volume of new drug applications and biologics, amplifies the need for meticulous documentation and compliance strategies. Additionally, frequent updates to regulations, including guidelines for advanced therapies and digital health technologies, compel pharmaceutical companies to invest in robust regulatory affairs teams and consulting services, further propelling market growth.

To get more information on this market Request Sample

The U.S. plays a pivotal role in the pharmaceutical regulatory affairs market, driven by the rigorous standards set by the FDA with 83.60% market share. In 2023, the FDA approved 55 novel drugs, marking the second-highest number in recent years. As a global leader in pharmaceutical innovation, the U.S. regulatory landscape is characterized by stringent requirements for drug approvals, clinical trials, and post-market surveillance. The rise of biologics, advanced therapies, and digital health solutions has further complicated compliance processes, increasing reliance on regulatory affairs professionals. The market is also influenced by evolving policies, such as the FDA's initiatives to streamline drug approval timelines and foster innovation through programs like Breakthrough Therapy Designation. Additionally, the U.S. market is shaped by a high volume of applications for generics and biosimilars, necessitating precise regulatory strategies.

Pharmaceutical Regulatory Affairs Market Trends:

Digital Transformation in Regulatory Processes

The adoption of digital tools is revolutionizing pharmaceutical regulatory affairs, which now offers more efficient management of complex data. Electronic submissions through FDA's eCTD, and AI-driven analytics enable streamlined document processing and monitoring of compliance. Routine dossier preparation and tracking regulatory updates are automated to minimize human error and improve speed. The use of blockchain technology is now coming in for better security and transparency in clinical trials and supply chain documentation. Such advances ensure the optimization of the operational workflows along with real-time collaboration with global regulatory agencies to be agile in the compliance shift. The industry is generally shifting towards a digital transformation, which helps to be in regulatory compliance but accelerates the time-to-market of new products.

Growing Emphasis on Global Regulatory Harmonization

There are some efforts that are emerging with regard to harmonizing regional regulatory frameworks in the Pharmaceutical Regulatory Affairs market. ICH is an international body that tries to develop and establish uniform guidelines and make less duplication of effort to approve drugs. It allows cross-border clinical trials to be less complicated, leading to product launches. With this harmonization, entry into a global market can be easy for pharmaceuticals. However, there is still much variation in implementation timelines and local requirements, which demands the expertise to navigate through both standardized and region-specific regulations. The trend underscores the importance of maintaining compliance while leveraging global opportunities, driving the development of specialized roles and consulting services within the regulatory affairs domain.

Focus on Advanced Therapies and Biologics

The growing market of biologics, gene therapies, and personalized medicine is transforming the Pharmaceutical Regulatory Affairs landscape. Such advanced therapies often demand new pathways of regulation, where traditional frameworks cannot satisfactorily address these novel characteristics. Agencies like the FDA and EMA are introducing specialized guidelines for cellular and gene therapy products, including adaptive approval processes to accommodate evolving scientific data. This trend necessitates a deeper understanding of emerging regulations and close coordination with regulatory bodies. The increasing pipeline of biologics and advanced therapies highlights the growing complexity of compliance, driving innovation in regulatory strategies and expanding the demand for professionals equipped to handle these transformative therapeutic categories.

Pharmaceutical Regulatory Affairs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Pharmaceutical Regulatory Affairs market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on service provider, service, category, indication, deployment stage, and company size.

Analysis by Service Provider

- In-house

- Outsourcing

Outsourcing stands as the largest component in 2025, holding around 61.3% of the market due to its affordable and enables access to certain expertise. Companies increasingly have a preference for outsourcing activities to minimize overhead costs associated with streamlined operations and optimize core competencies. Outsourcing becomes important because large regulatory processes consume significant resources that require extensive expertise to complete compliance work, document information, and make submissions. Outsourcing also enables faster navigation of diverse global regulatory landscapes, offering flexibility and scalability. This trend is further driven by the rising complexity of drug approval processes and the need for continuous updates to meet evolving regulations. Consequently, outsourcing has emerged as a preferred solution, capturing a substantial market share.

Analysis by Service

- Regulatory Consulting

- Legal Representation

- Regulatory Writing and Publishing

- Writing

- Publishing

- Product Registration and Clinical Trial Applications

- Others

Regulatory writing & publishing leads the market with around 37.6% of market share in 2025 due to increasing demand for precise and compliant documentation required for regulatory submissions. The segment covers critical functions like preparing clinical trial protocols, investigator brochures, and regulatory dossiers, ensuring adherence to stringent global standards. With rising drug development activities and the growing complexity of approval processes, pharmaceutical companies rely heavily on specialized services for accurate reporting. Additionally, the adoption of electronic submissions and evolving guidelines further heightens the need for expert writing and publishing solutions. These factors collectively establish regulatory writing and publishing as a pivotal component of the market.

Analysis by Category

- Drugs

- Innovator

- Generics

- Biologics

- Biotech

- ATMP

- Biosimilars

In 2025, drugs account for the majority of the market driven by their critical role in healthcare innovation. This is largely driven by the sheer number of new drug applications, tight regulatory requirements, and a complex process of approval. Drug products are a sizeable chunk of the overall portfolio for pharmaceutical companies. Hence, they spend huge amounts on compliance with continuously evolving global standards. More so, the requirement for elaborate documentation, clinical trial data, and post-approval monitoring raises the demand for regulatory affairs services. Specialty drugs, biologics, and personalized medicine are also factors that contribute to this segment's prominence, making it the largest category in the market. These factors underscore the importance of regulatory support for drugs.

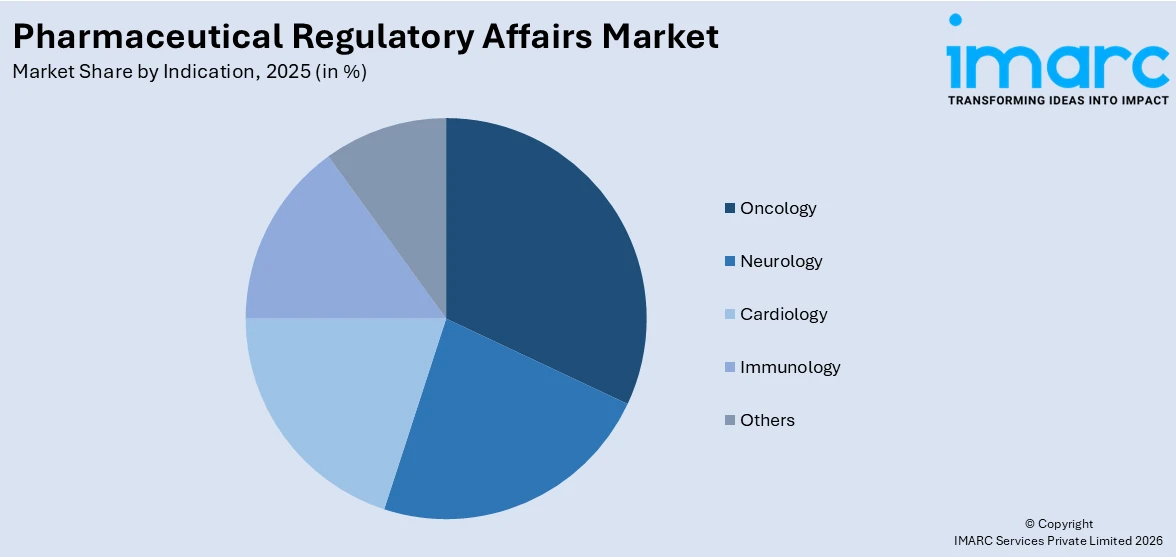

Analysis by Indication

Access the comprehensive market breakdown Request Sample

- Oncology

- Neurology

- Cardiology

- Immunology

- Others

Oncology represented the leading market segment, holding 32.5% of the total share driven by the growing prevalence of cancer and the corresponding surge in research and development of innovative therapies. Regulatory processes for oncology drugs are particularly rigorous due to the complexity of cancer treatments and the need for comprehensive safety and efficacy data. Companies prioritize regulatory compliance to expedite approvals and meet the demand for life-saving therapies. Additionally, advancements in immunotherapy, targeted treatments, and biologics contribute to increased submissions in this segment. The focus on addressing unmet medical needs and navigating evolving global guidelines further solidifies oncology's position as the leading market segment in regulatory affairs.

Analysis by Development Stage

- Preclinical

- Clinical

- Post Market Approval (PMA)

Clinical leads the market with around 48.2% of market share in 2025 owing to its leadership stems from the critical importance of clinical trials in the drug development process, where compliance with stringent regulatory standards is essential. Regulatory oversight during this phase ensures the safety, efficacy, and ethical conduct of trials, requiring meticulous documentation and adherence to international guidelines. The increasing complexity of clinical studies, coupled with the growing number of global collaborations, heightens the need for specialized regulatory support. Furthermore, advancements in clinical trial designs and the rise of personalized medicine contribute to the segment's growth. These factors position the clinical stage as a pivotal component in regulatory affairs, driving its substantial market share.

Analysis by Company Size

- Small

- Medium

- Large

Medium leads the market with around 46.1% of market share in 2025 due to its leadership qualities as it is attributed to their unique ability to balance agility and resourcefulness, enabling them to navigate complex regulatory landscapes effectively. Unlike larger corporations, medium-sized companies benefit from streamlined decision-making processes, which enhance adaptability to evolving global regulations. Additionally, they increasingly leverage outsourcing to access specialized expertise, ensuring compliance without incurring excessive costs. These companies often focus on niche markets or innovative drug segments, driving demand for tailored regulatory solutions. Their strategic investments in expanding global footprints and maintaining high operational efficiency further contribute to their significant market presence, solidifying their position as market leaders in 2024.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Pharmaceutical Regulatory Affairs Market Analysis

The United States dominates the Pharmaceutical Regulatory Affairs market due to its highly structured and stringent regulatory framework. Governed primarily by the FDA, the market is characterized by rigorous standards for drug approvals, clinical trials, and post-market surveillance. Innovations in biologics, personalized medicine, and digital therapeutics add complexity to compliance processes, creating significant demand for skilled regulatory professionals. Initiatives such as the Breakthrough Therapy Designation and Accelerated Approval programs streamline the development of novel therapies but require precise navigation of complex regulatory pathways. Additionally, the U.S. market sees a high volume of applications for generics and biosimilars, further driving the need for expertise. Evolving regulatory policies and the integration of digital tools like eCTD have bolstered efficiency, though challenges in managing regional variations persist.

Europe Pharmaceutical Regulatory Affairs Market Analysis

Europe holds a substantial position in the Pharmaceutical Regulatory Affairs market, guided by the European Medicines Agency (EMA). The region emphasizes regulatory harmonization through mechanisms like the Mutual Recognition Procedure and centralized approval processes, simplifying cross-border drug approvals. Advanced therapies and biosimilars drive market growth, necessitating adherence to specialized guidelines such as those for Advanced Therapy Medicinal Products (ATMP). Additionally, the adoption of digital tools, including eCTD for electronic submissions and AI for compliance monitoring, is enhancing efficiency and accuracy in regulatory processes. However, Brexit has added complexity, requiring companies to manage dual compliance frameworks for the EU and the UK. Despite these challenges, Europe's regulatory environment continues to evolve, supporting innovation while ensuring stringent standards for pharmaceutical safety and quality.

Asia Pacific Pharmaceutical Regulatory Affairs Market Analysis

Asia Pacific’s Pharmaceutical Regulatory Affairs market is experiencing significant growth due to the rising prominence of clinical trials and the establishment of pharmaceutical manufacturing hubs in countries such as China and India. The region's diverse regulatory systems pose challenges, requiring companies to adapt to varying standards and approval processes. However, ongoing efforts toward harmonization, such as the ASEAN Common Technical Dossier and international alignment initiatives, are easing compliance burdens and fostering regional integration. Rapidly expanding markets, coupled with increasing investments in biosimilars and innovative drugs, further underscore the importance of regulatory expertise. Companies are increasingly focusing on navigating the dynamic landscape to capitalize on growth opportunities while ensuring compliance with evolving regulations and market-specific requirements.

Latin America Pharmaceutical Regulatory Affairs Market Analysis

The Pharmaceutical Regulatory Affairs market in Latin America is growing, driven by evolving regulatory frameworks led by key agencies like ANVISA in Brazil and COFEPRIS in Mexico. These organizations are advancing standards to support the development and approval of biosimilars and generics, which are becoming increasingly significant in the region’s healthcare landscape. The rise of local pharmaceutical manufacturing adds to the demand for regulatory compliance expertise. Efforts toward regulatory modernization and alignment with global standards, such as incorporating international best practices, are improving market accessibility and operational efficiency, enabling streamlined drug approvals and fostering industry growth across Latin America.

Middle East and Africa Pharmaceutical Regulatory Affairs Market Analysis

The Middle East and Africa Pharmaceutical Regulatory Affairs market is influenced by varied regulatory frameworks across nations, presenting both challenges and opportunities. Governments in the region are actively modernizing their regulations to attract foreign investments and enhance accessibility to essential medicines. This modernization supports the growing pharmaceutical manufacturing sector and a rising focus on generics, which are pivotal to meeting healthcare demands. Consequently, the need for skilled regulatory professionals has surged to navigate complex compliance processes and facilitate efficient market entry in this rapidly evolving and strategically significant region.

Competitive Landscape:

The competitive landscape of the pharmaceutical regulatory affairs market is marked by the presence of a diverse range of players, including global consulting firms, specialized regulatory affairs companies, and in-house regulatory teams within pharmaceutical companies. Key players include Contract Research Organizations (CROs) and regulatory consulting firms which provide comprehensive regulatory services across various regions. These companies offer expertise in navigating complex regulatory frameworks, ensuring compliance, and facilitating market entry. With increasing demand for regulatory expertise due to expanding drug portfolios, biologics, and advanced therapies, firms differentiate themselves by offering specialized services, including digital tools like AI-driven compliance solutions. Additionally, partnerships with regulatory bodies and expertise in global market entry strategies are essential for staying competitive in this rapidly evolving sector.

The report provides a comprehensive analysis of the competitive landscape in the pharmaceutical regulatory affairs market with detailed profiles of all major companies, including:

- Charles River Laboratories International, Inc

- Freyr

- ICON plc

- IQVIA Inc

- Parexel International (MA) Corporation

- Pharmalex GmbH

- Pharmexon

- WuXi AppTec

Latest News and Developments:

- In October 2024, The ISPE Regulatory Quality Harmonization Committee highlighted recent updates in pharmaceutical regulations. The EU Commission released revisions to Clinical Trials Regulation (EU) No 536/2014, focusing on transparency and pediatric trial results. The EMA updated its guidelines on environmental risk assessment for medicinal products, effective from September 2024. Additionally, EMA published new Q&As on co-processed excipients (CoPEs), categorizing them into risk levels and providing regulatory and quality control guidance.

- In May 2024, BIRAC launched a dedicated Regulatory Affairs & Policy Advocacy division at the BioNest Conclave on May 17, 2024, to support innovation in India's biotech sector. The division aims to navigate regulatory challenges, harmonize global regulations, and advocate for policies benefiting startups and SMEs. It will collaborate with CDSCO, FSSAI, NITI Aayog, and other stakeholders to foster a supportive ecosystem, driving biotech growth and facilitating the transition of lab research into market-ready products.

- In May 2024, The School of Pharmacy launched an MSc in Pharmaceutical Regulatory Sciences, available to graduates of the HCI Postgraduate Diploma who achieve a Second-Class Honours Grade 1 or above. The 30-credit dissertation module offers practical research experience through industry placements or academic settings. Course Director Dr. Patrick O’Dwyer highlighted that the program addresses emerging sector needs, including ATMPs and Big Data, aligning with the “Skills for Biopharma” report’s findings on regulatory and quality roles.

Pharmaceutical Regulatory Affairs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Provider Covered | In-house, Outsourcing |

| Services Covered |

|

| Categories Covered |

|

| Indications Covered | Oncology, Neurology, Cardiology, Immunology, Others |

|

Development Stages Covered |

Preclinical, Clinical, Post Market Approval (PMA) |

| Company Sizes Covered |

Small, Medium, Large |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered |

Charles River Laboratories International, Inc Freyr, ICON plc, IQVIA Inc, Parexel International (MA) Corporation, Pharmalex GmbH, Pharmexon, WuXi AppTec, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmaceutical regulatory affairs market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pharmaceutical regulatory affairs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmaceutical regulatory affairs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global pharmaceutical regulatory affairs market was valued at USD 10.6 Billion in 2025.

The global pharmaceutical regulatory affairs market is estimated to reach USD 21.2 Billion by 2034, exhibiting a CAGR of 7.78% from 2026-2034.

Key factors driving the global pharmaceutical regulatory affairs market include increasing drug development activities, stringent regulatory requirements, and growing demand for biosimilars and advanced therapies. Additionally, globalization of clinical trials, rising complexity of compliance, and advancements in digital tools like AI for regulatory management further fuel market growth.

Some of the major players in the global pharmaceutical regulatory affairs market include Charles River Laboratories International, Inc, Freyr, ICON plc, IQVIA Inc, Parexel International (MA) Corporation, Pharmalex GmbH, Pharmexon, WuXi AppTec, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)