Pharmaceutical Quality Management Software Market Size, Share, Trends and Forecast by Solution Type, Deployment Model, Enterprise Size, End User, and Region, 2025-2033

Pharmaceutical Quality Management Software Market Size and Share:

The global pharmaceutical quality management software market size was valued at USD 1.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.91 Billion by 2033, exhibiting a CAGR of 8.9% from 2025-2033. North America currently dominates the market, holding a market share of 42.5% in 2024. The market includes the increasing regulatory compliance needs, increased drug manufacturing complexity, and operational efficiency demands. Organizations are implementing digital solutions to simplify quality processes, minimize human intervention, and ensure global operations consistency. The demand for quicker time-to-market along with greater attention on product safety and risk management further fuel pharmaceutical quality management software market share. Integration with new technologies such as artificial intelligence (AI) also increases data analysis and decision-making, enhancing overall quality assurance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.35 Billion |

|

Market Forecast in 2033

|

USD 2.91 Billion |

| Market Growth Rate 2025-2033 | 8.9% |

A key force propelling the pharmaceutical quality management software industry is growing compliance with strict regulatory requirements. With growing complexity of pharmaceutical processes, companies are under increased pressure to maintain product quality and safety consistency. Regulatory agencies require rigorous adherence to protocols and paperwork, compelling companies to implement sophisticated digital tools. Quality management software facilitates streamlined audits, document control, and procedure standardization across operations. This not only minimizes the risk of non-compliance but also improves the efficiency of operations. Pharmaceutical companies are, therefore, investing more in such solutions to remain competitive and manage regulatory threats.

The United States is a global leader with a share of 89.80% in the pharmaceutical quality management software market owing to its sophisticated pharmaceutical industry and stringent regulatory setup. Firms are increasingly going digital to stay in compliance with FDA mandates and industry best practices. Quality management software assists in streamlining operations, standardizing documentation, and facilitating quicker decision-making. The availability of major pharmaceutical firms and technology innovators in the U.S. also plays a role in their speedy development and usage. With the increasing demand for productivity, safety, and regulatory compliance, the U.S. market still leads in innovation and standards in pharmaceutical quality management.

Pharmaceutical Quality Management Software Market Trends:

Increase in Usage of Cloud-Based Solutions

Cloud-based quality management solutions are gaining popularity due to their flexibility, allowing pharmaceutical businesses to scale efficiently, offer remote access, and improve real-time collaboration without incurring significant upfront costs. In July 2024, Antares Vision Group released DIAMIND Sentry, a solution that will enable pharma businesses to effectively deal with the significant increase in exceptions by facilitating collaboration and managing regulatory compliance seamlessly. The cloud-based software enables manufacturers, wholesalers, and dispensers to detect and correct product data exchange faults. An industry report found that 41% of companies identified manual rework as a key issue, highlighting inefficiencies in current systems, while 31% expressed concerns over data exchange errors, underscoring challenges with product traceability under DSCSA regulations. This trend is largely adding to the pharmaceutical quality management software market share.

Implementation of Regulatory Compliance Automation

Automation of regulatory compliance within the quality management system is becoming more crucial as firms seek to eliminate manual effort and human mistake. According to an industry study, nearly 74% of compliance failures are attributed to human errors. Pharmaceutical companies can ensure compliance with the FDA and other global standards by automating document control, audit trails, and reporting. In April 2024, Clarivate Plc, a global leader in transformative intelligence, revealed that it had acquired Global QMS, Inc., or Global Q, a life sciences solutions provider of cloud-based offerings that allow clients to automate regulatory reporting and compliance management. This trend is contributing to the pharmaceutical quality management software market outlook.

Widespread Integration with AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) enhance quality management systems through automated quality operations, enhanced data analysis, and predictive maintenance. It was found through an industry survey that 80% of pharmaceutical and life sciences professionals utilize AI for drug discovery, and 95% of pharmaceutical firms are proactively investing in AI capabilities. The technologies aid early trend and anomaly detection, enabling prompt corrective action. Veeva Systems Veeva AI Partner Program announced in April 2024 aims to equip partners with the cutting-edge technology and support required to integrate Veeva Vault applications with generative AI (GenAI) solutions seamlessly. The trend plays a major role in enhancing the demand of the pharmaceutical quality management software market.

Pharmaceutical Quality Management Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pharmaceutical quality management software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on solution type, deployment model, enterprise size, and end user.

Analysis by Solution Type:

- Corrective Action Preventive Action (CAPA) Management

- Audit Management

- Document Management

- Change Management

- Training Management

- Risk Management

- Complaints Management

- Regulatory and Compliance Management

- Non-Conformances Handling

- Supplier Quality Management

- Inspection Management

- Equipment Management

- Others

Regulatory and compliance management holds a dominant 18.7% share due to the industry's highly regulated nature. Pharmaceutical companies must adhere to strict guidelines from bodies like the FDA, EMA, and WHO to ensure product safety, efficacy, and quality. Non-compliance can lead to costly recalls, legal penalties, and reputational damage. As a result, there is a growing demand for software that can streamline compliance processes, manage documentation, track audits, and ensure traceability. These tools help companies stay updated with evolving regulations and maintain accurate records for inspections. The increasing complexity of global regulatory frameworks drives the need for automated, centralized solutions, making regulatory and compliance management a key driver of market growth.

Analysis by Deployment Model:

- On-Cloud

- Web-Based

- On-Premises

On Cloud solutions account for the majority share of 47.3% in the pharmaceutical quality management software market due to their flexibility, scalability, and cost-efficiency. These platforms allow organizations to access real-time data from any location, streamlining collaboration across global teams. Unlike traditional on-premise systems, cloud-based solutions require minimal upfront investment and reduce IT infrastructure costs. They also offer faster deployment, automatic updates, and better integration with other enterprise systems. Additionally, cloud platforms enhance data security and compliance through advanced encryption and regular backups, critical for meeting stringent pharmaceutical regulations. With the industry's increasing focus on digital transformation and remote operations, especially post-pandemic, cloud and web-based solutions have become the preferred choice for ensuring efficient, compliant quality management.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises dominate the pharmaceutical quality management software market, holding a 64.6% share due to their extensive operational scale, stringent compliance requirements, and higher investment capacity. These organizations often operate across multiple regions, requiring robust, standardized quality management systems to ensure regulatory adherence, risk mitigation, and process efficiency. Their substantial budgets also enable them to adopt advanced software solutions with features like audit management, CAPA, document control, and real-time analytics. Additionally, large enterprises are more likely to pursue digital transformation strategies, prioritizing automation and integration across departments. As regulatory frameworks become more complex, these companies rely heavily on comprehensive software solutions to maintain quality standards and product safety, driving their dominant market share.

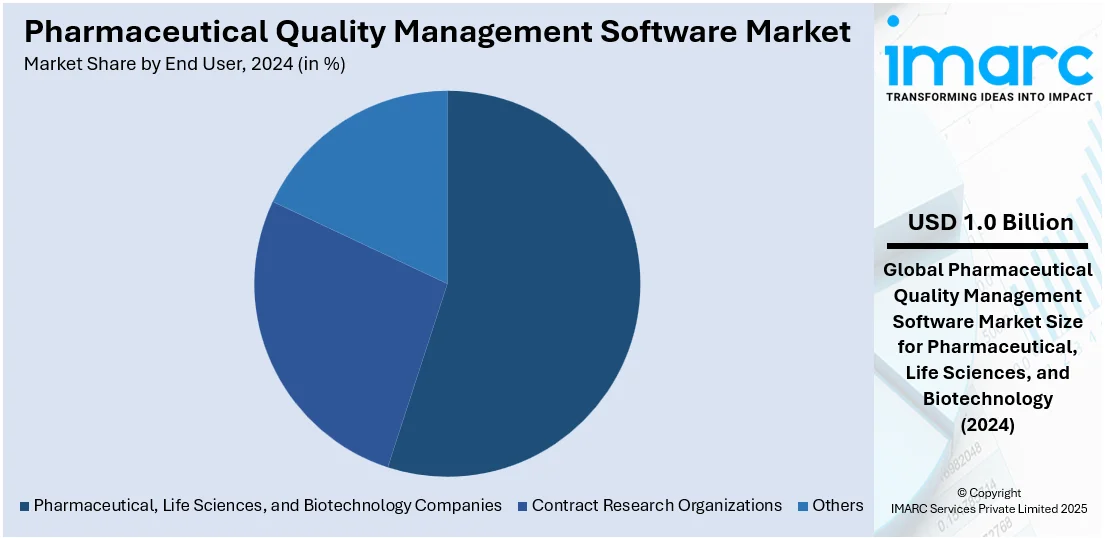

Analysis by End User:

- Pharmaceutical, Life Sciences, and Biotechnology Companies

- Contract Research Organizations

- Others

Based on the pharmaceutical quality management software market forecast, the pharmaceutical, life science, and biotechnology firms are the largest shareholders with 55.0% in the pharmaceutical quality management software market, as their demand for regulatory requirements, accuracy, and product safety is high. These sectors follow stringent regulations that call for strict documentation, quality control, and process standardization. With drug development, manufacturing, and clinical trials becoming increasingly sophisticated, these organizations increasingly turn to digital quality systems to oversee risk, validate data integrity, and ensure consistency of operations. Their requirement to adhere to changing global regulatory guidelines, enhance operational effectiveness, and speed up time-to-market fuels considerable investment in cutting-edge quality management solutions. Such consistent demand makes them leaders in adopting and market-leaders in the broader marketplace.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the pharmaceutical quality management software market with 42.5%, mainly because of its stringent regulation and well-developed technological base. The U.S. Food and Drug Administration (FDA) imposes stringent compliance norms, leading pharmaceutical manufacturers to implement advanced quality management systems to meet compliance and retain product purity. The region's high focus on research and development, along with high investments in healthcare, fuel demand for effective quality management solutions. In addition, the existence of leading pharma companies and a strong healthcare ecosystem also supports the expedited adoption of advanced software tools. The incorporation of complex technologies like artificial intelligence and cloud computing also further increases operational effectiveness as these allow better management of data, further cementing North America's leadership position in the market.

Key Regional Takeaways:

United States Pharmaceutical Quality Management Software Market Analysis

The United States pharmaceutical quality management software market is primarily driven by increased FDA oversight and stricter enforcement of current Good Manufacturing Practices (cGMP). In line with this, the rising volume of decentralized and multi-site clinical trials necessitating centralized quality oversight tools is impelling the market. Similarly, the growing reliance on Contract Development and Manufacturing Organizations (CDMOs) is encouraging the use of standardized, cloud-based QMS to manage outsourced quality functions. The expanding role of real-world evidence in drug development, driving demand for data-integrity-compliant quality systems, is fostering market expansion. Furthermore, the rapid integration of AI into quality monitoring for predictive analytics and error detection is enhancing operational efficiency. Additionally, the ongoing digitization of supply chains, promoting interoperability among quality platforms across stakeholders, is propelling market growth. Moreover, increasing cybersecurity risks tied to protected health information (PHI) are pushing the adoption of secure, validated QMS solutions. According to an industry report, ransomware attacks targeting the U.S. healthcare sector increased by 128% in 2023 compared to 2022. In 2024, 389 healthcare institutions across the country were forced to shut down or experienced delays in medical procedures as a result of these attacks.

Europe Pharmaceutical Quality Management Software Market Analysis

The market in Europe is experiencing growth due to increasing regulatory alignment under the European Medicines Agency and stricter compliance with Annex 11 for computerized systems. In accordance with this, enforcement of the Falsified Medicines Directive, accelerating the adoption of digital quality platforms to enhance serialization and traceability, is impelling the market. Similarly, pharmaceutical manufacturing expansion in Eastern Europe is driving investment in standardized and scalable QMS infrastructure. The rise in biotech firms and ATMP developers, augmenting demand for cloud-enabled, configurable quality management tools, is propelling market growth. According to industry analysis, in 2023, European biotech firms raised about USD 11.5 Billion in venture capital, representing 7% of global biotech investment. Public funding also increased, supported by initiatives such as France’s EUR 7 Billion innovation fund, Germany’s Zukunftsfonds, and the European Investment Bank (EIB). Furthermore, compliance with shifting ISO standards and pharmacovigilance protocols, prompting system upgrades across manufacturing sites, is strengthening market demand. The rapid integration of digital twins and simulation tools in pharmaceutical production, supporting predictive quality control measures, is stimulating pharmaceutical quality management software market growth. Besides this, an increase in Horizon Europe funding for public-private research and development (R&D) partnerships is encouraging innovation in compliance technology.

Asia Pacific Pharmaceutical Quality Management Software Market Analysis

The Asia Pacific pharmaceutical quality management software market is majorly propelled by the rapid growth of pharmaceutical manufacturing hubs in India, China, and South Korea. India is the third-largest producer of pharmaceuticals by volume globally, exporting to nearly 200 countries and territories. With a strong domestic manufacturing base and an annual growth rate of 10–12%, the industry is projected to reach USD 100 Billion by 2025. In addition to this, the increasing adoption of electronic batch records and digital documentation is enhancing traceability and compliance. Similarly, government-led initiatives like India’s Production Linked Incentive (PLI) scheme incentivize quality infrastructure investments across pharma operations, impelling the market. Furthermore, the rising presence of global CROs and CMOs in the region, promoting scalable quality systems capable of multi-site integration, is fostering market expansion. Moreover, the rise in biosimilar and generic drug development is amplifying the complexity of regulatory oversight, driving heightened software adoption. Apart from this, continual advancements in mobile-accessible QMS interfaces are enabling seamless real-time collaboration among geographically dispersed teams, contributing to operational agility and market expansion.

Latin America Pharmaceutical Quality Management Software Market Analysis

The Latin America pharmaceutical quality management software market is gaining momentum due to increasing regulatory harmonization efforts driven by regional agencies such as ANVISA and COFEPRIS. Similarly, the expansion of domestic pharmaceutical production capabilities, particularly in Brazil and Mexico, is encouraging the implementation of structured digital quality systems. The growing participation in global clinical trials necessitates compliance with international GxP standards through integrated quality platforms, which is fostering market expansion. Additionally, rising investment in healthtech and digital infrastructure is fostering the adoption of cloud-based QMS solutions tailored for multilingual and region-specific compliance requirements. As such, Brazilian healthtech Carecode raised a USD 4.3 Million pre-seed round led by Andreessen Horowitz and QED. Its AI WhatsApp agent helps hospitals and clinics manage patient journeys, cutting operational costs by handling scheduling, follow-ups, and payment reminders via audio and text.

Middle East and Africa Pharmaceutical Quality Management Software Market Analysis

The Middle East and Africa market is progressing due to increased government investment in pharmaceutical manufacturing under national health strategies, particularly in Saudi Arabia, Egypt, and South Africa. Accordingly, Saudi Arabia currently has around 206 pharmaceutical and medical device factories with SR 10 Billion (USD 2.6 Billion) in investments. The pharmaceutical market grew 25% from 2019–2023, with localization efforts reducing import reliance and boosting domestic production, including advanced medical devices and vaccines. Furthermore, the heightened adoption of international quality certifications, such as WHO GMP and ISO 9001, is driving demand for digital QMS tools. Additionally, the region's expanding clinical research landscape, promoting the need for standardized quality documentation systems, is strengthening market demand. Moreover, growing interest in pharmaceutical exports is also pushing companies to adopt compliant, audit-ready platforms to meet stringent global regulatory expectations.

Competitive Landscape:

The competitive scene is dominated by a mix of mature technology companies and niche life sciences vendors. Dominant companies are Veeva Systems, MasterControl, Dassault Systèmes, IQVIA, and Sparta Systems (part of Honeywell), all of which provide customized solutions to meet regulatory compliance, process automation, and data integrity requirements. The companies compete on cloud-based platforms, integration, and domain-specific features. It is also influenced by mergers and acquisitions, strategic alliances, and ongoing innovation to improve product quality and global presence. With increasing regulatory needs and an escalating need for effective management of quality, competition increases, and firms are compelled to provide more advanced and easy-to-use software applications.

The report provides a comprehensive analysis of the competitive landscape in the pharmaceutical quality management software market with detailed profiles of all major companies, including:

- AssurX Inc.

- ComplianceQuest

- Dassault Systèmes SE (Dassault Group)

- ETQ LLC (Hexagon AB)

- Ideagen

- IQVIA Inc.

- Mastercontrol Inc.

- Qualio

- Veeva Systems Inc

Latest News and Developments:

- March 2025: Qualified Digital acquired Xpediant Digital to enhance content automation in pharma and life sciences. Xpediant’s integration with Adobe Experience Manager and Veeva enables regulatory efficiency, delivering major time and cost savings. The move strengthens QD’s digital transformation capabilities across healthcare and regulated industries.

- February 2025: Yokogawa launched the OpreX Quality Management System, a cloud-based platform to digitize and streamline quality assurance in pharmaceutical and food and beverage manufacturing. Built on the ServiceNow platform, it enables no-code workflow customization, system integration, regulatory compliance, and continuous process improvement across QA operations.

- January 2025: Honeywell launched the TrackWise Life Sciences Platform to digitize and automate quality and manufacturing in the life sciences sector. With modular architecture, AI-driven quality tools, low-code deployment, and integrated applications, it enables rapid, compliant production of pharmaceuticals, medical devices, and combination products across the full lifecycle.

- December 2024: QbD Group announced the acquisition of SciencePharma to expand its regulatory, product development, and pharmaceutical quality assurance capabilities. The deal enhances QbD’s presence in Poland and China, integrating 120 SciencePharma specialists into its global network of 750+ consultants.

- August 2024: Valsoft Corporation acquired Anju Software, marking its entry into the life sciences sector. Anju’s flagship products, TrialMaster, IRMS MAX, and TA Scan, streamline clinical research and data management. The acquisition aims to expand Anju’s global reach while maintaining its customer-centric, value-driven approach in life sciences solutions.

Pharmaceutical Quality Management Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Solution Types Covered | Corrective Action Preventive Action (CAPA) Management, Audit Management, Document Management, Change Management, Training Management, Risk Management, Complaints Management, Regulatory and Compliance Management, Non-Conformances Handling, Supplier Quality Management, Inspection Management, Equipment Management, Others |

| Deployment Models Covered | On-Cloud, Web-Based, On-Premises |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | Pharmaceutical, Life Sciences, and Biotechnology Companies, Contract Research Organizations, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AssurX Inc., ComplianceQuest, Dassault Systèmes SE (Dassault Group), ETQ LLC (Hexagon AB), Ideagen, IQVIA Inc., Mastercontrol Inc., Qualio, Veeva Systems Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmaceutical quality management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pharmaceutical quality management software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmaceutical quality management software industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pharmaceutical quality management software market was valued at USD 1.35 Billion in 2024.

The pharmaceutical quality management software market is projected to exhibit a CAGR of 8.9% during 2025-2033, reaching a value of USD 2.91 Billion by 2033.

Key factors driving the pharmaceutical quality management software market include stringent regulatory compliance requirements, increasing complexity in drug manufacturing, and the need for operational efficiency. Additionally, growing emphasis on product safety, risk management, and the adoption of advanced technologies like AI and cloud computing accelerate market growth.

North America currently dominates the pharmaceutical quality management software market, accounting for a share of 42.5% due to its advanced pharmaceutical industry, stringent regulatory standards like FDA guidelines, and high adoption of digital technologies. Strong healthcare infrastructure and presence of leading pharmaceutical companies further drive demand for efficient quality management solutions in the region.

Some of the major players in the pharmaceutical quality management software market include AssurX Inc., ComplianceQuest, Dassault Systèmes SE (Dassault Group), ETQ LLC (Hexagon AB), Ideagen, IQVIA Inc., Mastercontrol Inc., Qualio, Veeva Systems Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)