Pharmaceutical Logistics Market Size, Share, Trends and Forecast by Type, Component, Application, and Region, 2025-2033

Pharmaceutical Logistics Market 2024, Size and Trends:

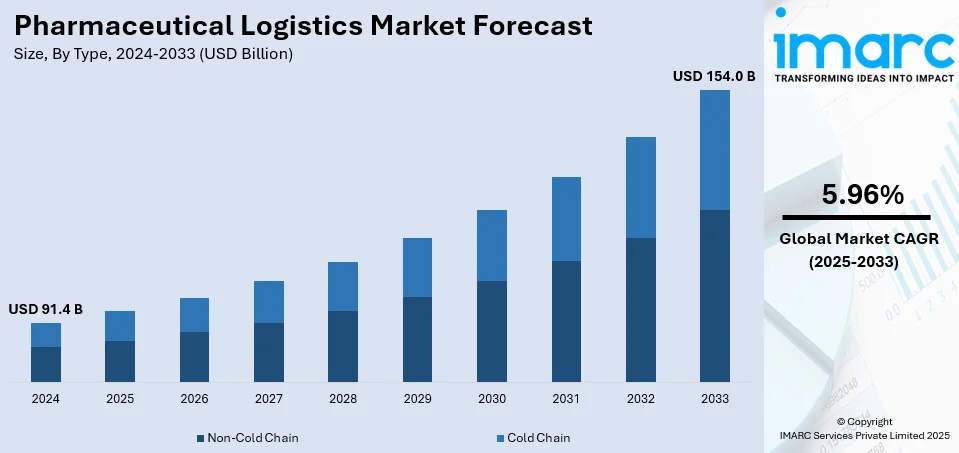

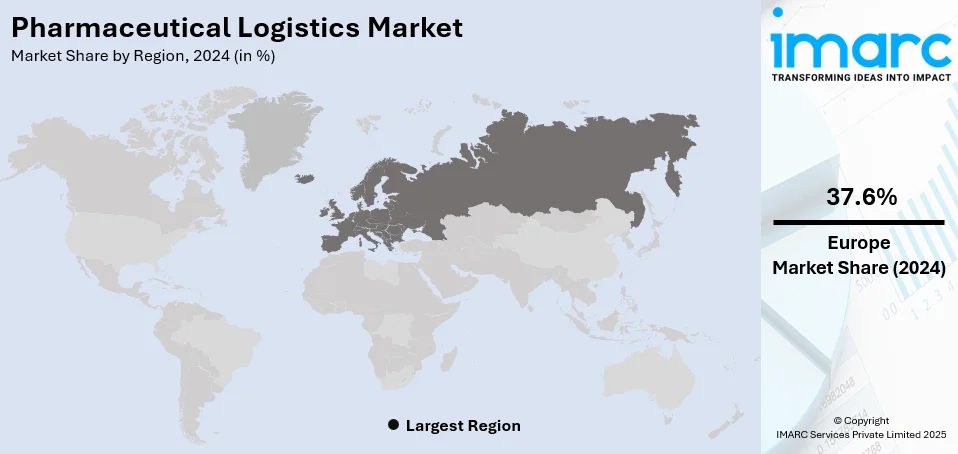

The global pharmaceutical logistics market size was valued at USD 91.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 154.0 Billion by 2033, exhibiting a CAGR of 5.96% during 2025-2033. Europe currently dominates the market, holding a market share of over 37.6% in 2024. The rising need for efficient and reliable logistics networks, the development of medical facilities across rural and geographically extended locations, and significant growth in the pharmaceutical industry represent some of the key factors driving the pharmaceutical logistics market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 91.4 Billion |

|

Market Forecast in 2033

|

USD 154.0 Billion |

| Market Growth Rate 2025-2033 | 5.96% |

The increasing globalization of the pharmaceutical industry has caused a major impact on the pharmaceutical logistics market. As companies extend their market reach into developing regions, especially in Asia Pacific, Latin America, and Africa, the need for efficient cross-border logistics has intensified. In September 2024 United States' pharmaceutical products exports accounted up to $7.71B and between September 2023 and September 2024 the exports of United States' pharmaceutical products increased by $451M (6.22%) from $7.26B to $7.71. Pharmaceutical manufacturers are no longer limited to their domestic markets but are now required to transport drugs internationally, often across vast distances and through complex customs and regulatory environments. The growth of e-commerce in pharmaceuticals has further boosted this trend, allowing patients and healthcare providers to access medications from any part of the world. To meet these needs, logistics companies are developing specialized services tailored to the pharmaceutical sector, including international transportation, customs clearance, and last-mile delivery solutions.

The United States stands out as a key market disruptor with a market share of 87.80% in North America. It is driven by the increased regulatory compliance. The pharmaceutical industry in the country is highly regulated, and there are strict guidelines around the storage, handling, and transportation of pharmaceutical products. These regulations ensure that drugs are safe for consumption and maintain their efficacy throughout the supply chain. Regulatory bodies like the Food and Drug Administration (FDA) and other global authorities require pharmaceutical companies to adhere to specific standards for packaging, storage, and transportation. For instance, the Drug Supply Chain Security Act (DSCSA) that was established as Title II of the Drug Quality and Security Act (DQSA) has been functioning as an important regulatory structure to protect the integrity of the pharmaceutical supply chain in the country. Its main aim is to prevent the diversion and counterfeiting of drug products. Additionally, serialization and traceability requirements are becoming more stringent. These regulations ensure the authenticity of drugs, help combat counterfeiting, and enable tracking in case of recalls.

Pharmaceutical Logistics Market Trends:

Increasing Prevalence of Infectious Diseases

The rising cases of various chronic ailments across the world are augmenting the demand for medicines and drugs. As per the World Health Organization (WHO), chronic diseases are said to be the leading cause of death globally. Ischemic heart disease alone was responsible for about 8.89 million deaths in 2019. Additionally, all cardiovascular diseases (CVDs) together are known to cause about 17.9 million deaths per year. Such rising incidences of diseases are bolstering the demand for pharmaceutical vaccines, drugs, and medicines, which in turn is catalyzing the market for efficient pharmaceutical logistics. Furthermore, various key market players are increasingly investing in developing robust, fast-paced, and cost-effective logistics systems via sea routes to cater to the escalating demand. The transportation of pharma products by sea reduces the transportation cost by up to 80% and reduces staffing requirements. Additionally, it is known to conserve the packaging and storage needs while diminishing the carbon footprint of logistics activities. Moreover, the rising geriatric population across the globe, which is more prone to developing age-related diseases, is also contributing to the growth of the pharmaceutical logistics market. As per the United Nations Population Division, the number of individuals aged 65 and older is anticipated to double over the next three decades, reaching a 1.6 billion mark in the year 2050. Such a massive increase in the geriatric population is projected to propel the pharmaceutical logistics market share in the coming years.

Increasing Demand for Cold Chain Logistics in the Sector

The increasing demand for specialty, personalized, and temperature-sensitive vaccines is catalyzing the market for cold chain logistics. In addition to this, the imposition of stringent government regulations to maintain accurate temperatures for highly temperature-sensitive pharmaceutical products is also contributing to the market growth. As a result, various key market players are significantly investing in cold chain logistics to cater to this demand. For instance, in November 2022, Celcius Logistics, India's fastest-growing cold-chain marketplace startup, launched Hyper-Local temperature-controlled delivery services for pharma orders across 9 cities in the country. In addition to this, various pharmaceutical logistic providers are also integrating advanced technologies with logistics to maintain real-time pharma cold chain visibility and logistics management. For instance, in February 2024, Sensitech, a leading provider of supply chain visibility solutions, launched TempTale GEO X, a state-of-the-art IoT temperature monitoring solution. It is said to deliver a validated, GxP-compliant solution to monitor temperature-sensitive vaccines and medicines that are transported worldwide across different modes, including road, air, ocean and rail. Such initiatives are projected to bolster the pharmaceutical logistics market revenue over the forecasted period.

The increasing demand for specialty, personalized, and temperature-sensitive vaccines is catalyzing the market for cold chain logistics. In addition to this, the imposition of stringent government regulations to maintain accurate temperatures for highly temperature-sensitive pharmaceutical products is also contributing to the market growth. As a result, various key market players are significantly investing in cold chain logistics to cater to this demand. For instance, in November 2022, Celcius Logistics, India's fastest-growing cold-chain marketplace startup, launched Hyper-Local temperature-controlled delivery services for pharma orders across 9 cities in the country. In addition to this, various pharmaceutical logistic providers are also integrating advanced technologies with logistics to maintain real-time pharma cold chain visibility and logistics management. For instance, in February 2024, Sensitech, a leading provider of supply chain visibility solutions, launched TempTale GEO X, a state-of-the-art IoT temperature monitoring solution. It is said to deliver a validated, GxP-compliant solution to monitor temperature-sensitive vaccines and medicines that are transported worldwide across different modes, including road, air, ocean and rail. Such initiatives are projected to bolster the pharmaceutical logistics market share over the forecasted period.

Emerging Trend of On-Demand Delivery

The on-demand healthcare industry is rapidly expanding in response to the advancement of technology. Additionally, with the improved accessibility and practical treatment options, the practice of receiving healthcare services at home has become more common throughout the pandemic and is currently growing. Various key market players have introduced on-demand medicine delivery apps, which have made it possible for patients to receive their medications promptly without leaving the comfort of their houses. This innovation not only offers convenience but also ensures that healthcare services are accessible to everyone, irrespective of their geographical location. For instance, Hyperlocal Cloud delivery solution is a specialized marketplace that creates tailored solutions for local delivery needs, including medicine delivery. Their platform makes use of cutting-edge cloud technology to ensure swift, secure, and scalable service. They also focus on offering seamless integration with local pharmacies to enable real-time tracking, efficient inventory management, and personalized customer experiences. In line with this, Amazon Pharmacy announced the expansion of its services by offering same-day delivery for prescriptions in New York and Los Angeles. Its small-format facility in Brooklyn is said to offer a selection of about 12,000 medications from Amazon.com, hence focusing on urgent-care needs. Customers who require medication to treat "common conditions" like the flu, high blood pressure, and diabetes can access the service to have these medications delivered within hours. Such innovations in the delivery of pharma products are further bolstering the pharmaceutical logistics market outlook.

Pharmaceutical Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pharmaceutical logistics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, and application.

Analysis by Type:

- Non-Cold Chain

- Cold Chain

Non-cold chain stands as the largest component in 2024. Non-cold chain pharmaceutical logistics refer to the transportation, storage, and distribution of pharmaceutical products that do not require strict temperature control throughout their supply chain. Examples include many oral medications, tablets, and capsules that can be stored and transported at room temperature without significant risk of degradation. The rising preference for over-the-counter (OTC) medications, such as vitamins, minerals, and supplement (VMS) medicines, for the common cold and cough, gastrointestinal drugs, and various other common flus is contributing to the segment's expansion.

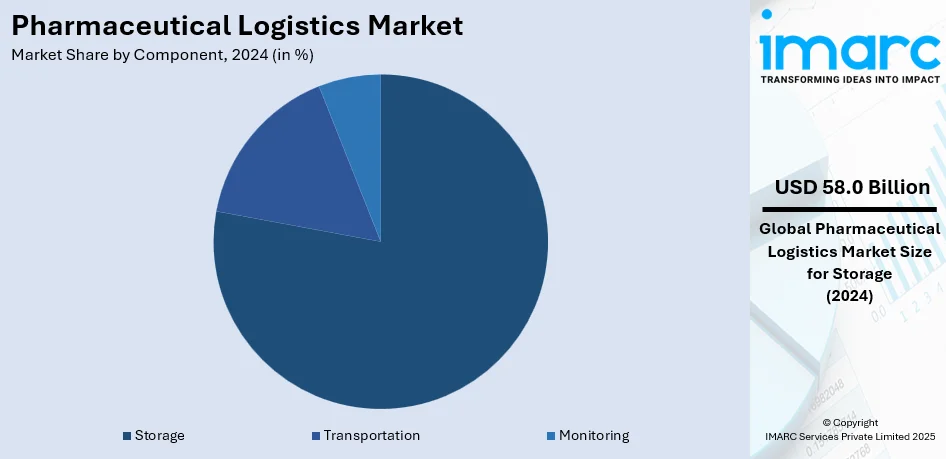

Analysis by Component:

- Storage

- Warehouse

- Refrigerated Container

- Transportation

- Sea Freight Logistics

- Airfreight Logistics

- Overland Logistics

- Monitoring

- Hardware

- Software

Storage leads the market with around 63.4% of market share in 2024. In pharmaceutical logistics, warehouses play a crucial role in storing and managing pharmaceutical products. These facilities are designed to meet stringent regulatory requirements, to ensure product safety and integrity. Refrigerated containers are used to transport temperature-sensitive pharmaceutical products. These containers are equipped with refrigeration units to maintain the required temperature throughout transit. Various key market players are significantly investing in refrigerated contains to cater to the escalating demand for temperature sensitive drugs and vaccines. For instance, in April 2022, Tower Cold Chain launched KT Evolution container, including reliable thermal protection and reusable durability for pharmaceutical transport.

Analysis by Application:

- Bio Pharma

- Chemical Pharma

- Specialty Pharma

Chemical pharma leads the market in 2024. Chemical pharmaceuticals, refers to pharmaceutical products that are synthesized chemically rather than being derived from natural sources. Chemical pharma includes a wide range of medications, such as antibiotics, antivirals, analgesics, and many others. These products play an important role in modern medicine and are used to treat various chronic medical conditions and improve health outcomes.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 37.6%. Some of the factors driving the Europe pharmaceutical logistics market included the continuous developments in the healthcare infrastructure, the advent of modern technologies, rapid urbanization, etc. Furthermore, various pharmaceutical companies are entering the European markets to expand their consumer base and increase sales. For instance, in October 2023, UPS Healthcare announced the launch of UPS Pickup Point locations, a new reverse logistics service for health laboratory customers, across the UK, Spain, Germany, Italy, and France. Such investments in the region are anticipated to cater to the growth of Europe in the coming years.

Key Regional Takeaways:

North America Pharmaceutical Logistics Market Analysis

The rising need for medications that are sensitive to temperature, the rise of the healthcare industry, and developments in supply chain technology are all contributing to the notable growth of the pharmaceutical logistics market across North America. The demand for effective logistics solutions is being further increased by the growth of e-commerce and direct-to-patient services. The solid infrastructure of North America, which includes excellent transportation networks and cold chain capabilities, ensures that pharmaceutical items are delivered on time and securely. The market is also majorly shaped by regulatory compliance, such as following Good Distribution Practices (GDP), which guarantees that medications keep their integrity while in transit. Integration of automation, AI-powered logistics, and real-time tracking technologies is anticipated to further streamline operations and boost delivery efficiency as the industry develops.

United States Pharmaceutical Logistics Market Analysis

The United States is leading market in North America with a share of 87.80%. The market framed as a pharmaceutical logistics market has been growing for several reasons. One of the major factors is the growth of temperature sensitive products especially the biological and vaccines which need a hi-tech cold chain management for effective delivery. In addition, the current increased population in the U.S., with Census data indicating that the population of older people reached 55.8 Million, 16.8% of the total population in 2020, hence, the need for medications. RFID and IoT in tracking and tracing of products have improved on the flow of logistics for compliance to regulations for instance DSCSA. The initiatives aiming at enhancing supply chain protection in course of which the COVID-19 pandemic occurred stimulated investments in performing logistics. Also, in the case of pharmaceuticals there is the added element of e-commerce with the consequent pressures for faster and more flexible means of distribution. Moreover, global compliance with regulatory policies such as GDP is also putting pressure on sourcing timely and secured logistics services from professional players within the industry. Such influences are changing the nature of the U.S. pharmaceutical logistics market, putting more pressure on increasing the speed and applying high technologies into the process.

Asia Pacific Pharmaceutical Logistics Market Analysis

The pharmaceutical logistics market in the Asia and Pacific (APAC) region is in the growth stage due to the development of the health and pharma businesses. One of them is demography: the elderly population as part of the population of the region is expected to continue growing and by 2050 is likely to exceed 1.3 Billion people, according to ESCAP data from the year 2020. Technology is improving as this demographic trend develops and pushes for high usage of medication, thereby calling for better delivery solutions. Also, today’s biologics and vaccines present new challenges for temperature-sensitive logistics and are indicative of the rising challenges in the sphere. In addition, regulatory shifts across the region are encouraging the use of innovative solutions to meet the requirements. Another supply side driver for logistics demand is the rise of e-commerce, particularly in the pharmaceutical industry where these platforms are becoming a popular means of getting products to the customer. Due to smart technologies like GPS tracking and real-time shipment tracking, companies all over the region are improving supply chain effectiveness and security.

Europe Pharmaceutical Logistics Market Analysis

The prime factors influencing the market in Europe are the increasing healthcare expenditure, specific focus on the need for cold chain logistics and expansion in the catalog of temperature-sensitive drugs. Logistics also poses a challenge for products such as biopharmaceuticals, vaccines, and others, which are required to be shipped under a certain temperature. The growing incidence of chronic diseases is one major contributing factor to the burgeoning demand for pharmaceutical products. Chronic illnesses such as cancer, cardiovascular diseases, chronic respiratory diseases, diabetes, and mental illnesses accounted for 8.5% of the death toll among EU nations, as per PubMed Central, increasing the demand for medicinal products. Also, there are rigorous measures in place such as the GDP standards that is prevalent in the European Union whose purpose is to ensure that pharmaceutical products are distributed under the best environmental conditions as possible. The region is also experiencing the transition to sustainable logistics wherein transport providers select environment-friendly supply chain solutions and minimize routes that would require lots of fuel consumption. The development of online portals to market and sell pharmaceutical products is opening new prospects for logistics, but these markets are putting pressure for increasing speed and flexibility. Additionally, the increasing demand for better visibility and track and traceability, an effort made by EU Falsified Medicines Directive makes it possible to implement new technologies like RFID and block chain for tracking of all the products. These are the factors that are defining European pharma logistics environment, requiring effective and regulatory compliance solutions.

Latin America Pharmaceutical Logistics Market Analysis

The pharmaceutical logistics market in Latin America has a major impact on the growing healthcare needs and increased demand for medicines. In Brazil, for example, PubMed Central estimated that long-term health problems such as heart disease, diabetes, and cancer lead to about 928,000 deaths, which boosts the need for pharmaceuticals. As these conditions become more common, it's crucial to have effective logistics systems to make sure people can get their medications when required. Also, as healthcare facilities improve and more biologics and vaccines are produced, there's a greater need for specialized cold storage and transport. Changes in laws and the growth of online shopping are also helping to improve how pharmaceuticals are distributed across the region.

Middle East and Africa Pharmaceutical Logistics Market Analysis

The Middle East's pharmaceutical logistics market is expanding due to increased healthcare needs and better infrastructure. A crucial aspect is the higher demand for products that need specific temperatures, like vaccines and biological medicines. Just like other parts of the world, the Middle East is seeing more long-term illnesses, which leads to more use of medicines. Also, a statement from Africa CDC points out that under 1% of vaccines are made on the continent right now, and work to boost local production has an impact on logistics requirements in the area. The Middle East is also investing in cold chain solutions, regulatory enhancements, and e-commerce platforms to meet these growing demands.

Competitive Landscape:

To remain competitive, major market participants are actively concentrating on innovation and diversifying their product lines. Businesses are spending money on research and development (R&D) to improve the functionality and efficiency of their products, especially in fields like automation and artificial intelligence (AI). Collaborations and partnerships are also growing in popularity, enabling participants to take use of one another's technological and market access advantages. For instance, a few enterprises are collaborating with digital companies to include sophisticated data analytics into their goods, which will help customers make better decisions. In response to the increased demand from consumers for environmentally sensitive products, businesses are also making sustainability a priority by implementing eco-friendly materials and production techniques. Players are looking into new geographic areas to increase their market reach, particularly in emerging nations where there is a need for these solutions.

The report provides a comprehensive analysis of the competitive landscape in the pharmaceutical logistics market with detailed profiles of all major companies, including:

- C.H. Robinson Worldwide Inc.

- CEVA Logistics

- DB Schenker.

- Deutsche Post AG

- DSV A/S

- FedEx Corporation

- Kuehne + Nagel

- Nippon Express Co. Ltd.

- SF Express Co. Ltd.

- United Parcel Service

Latest News and Developments:

- June 2024: DHL Supply Chain has entered into partnership with Sanofi for the implementation of logistics for life sciences in France. In this new partnership, DHL will be responsible for warehousing, inventory, and order fulfillment at three locations: Amilly, Croissy-Beaubourg, and Saint- Loubès. The companies aim at the enhancement of supply chains to be more efficient and robust in order to benefit the customers of Sanofi across the globe.

- April 2024: Cardinal Health has started building a 350,000-square-foot logistics center in Columbus, Ohio, to support the distribution of over-the-counter health products. The facility, located in the Rickenbacker Global Logistics Park, will be Cardinal Health's fourth in Central Ohio. Scheduled to open by Summer 2025, it will create about 100 jobs and address rising demand for consumer health products.

- March 2024: KEZAD Group has entered into a partnership with Pharmatrade and has opened a new logistics center in Abu Dhabi aimed at accelerating the storage and distribution of pharmaceutical and medical products. In its 5th phase of development, the hub is located in KEZAD's Phase 5 Logistics Park, powered with temperature-controlled Grade-A warehouses, which will continue aiding Pharmatrade even after the opening of its Dubai Logistics Centre.

- March 2024: The announcement of Noramco Group, a pharmaceutical logistics company based in North America, has been made, bringing together Halo Pharma and Purisys as branches. The endeavor aims to relieve U.S. drug shortages and quality issues through improved supply chain efficiency and increased domestic production capabilities.

- November 2023: Kuehne+Nagel has earned its third consecutive IATA CEIV Pharma certification, becoming the first logistics company with over 100 certified stations. This achievement highlights the company’s commitment to safe, compliant, and efficient pharmaceutical air cargo handling. The network spans 66 countries, ensuring high regulatory standards in pharmaceutical logistics.

Global Pharmaceutical Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Non-Cold Chain, Cold Chain |

| Components Covered |

|

| Applications Covered | Bio Pharma, Chemical Pharma, Specialty Pharma |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | C.H. Robinson Worldwide Inc., CEVA Logistics, DB Schenker., Deutsche Post AG, DSV A/S, FedEx Corporation, Kuehne + Nagel, Nippon Express Co. Ltd., SF Express Co. Ltd., United Parcel Service, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmaceutical logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pharmaceutical logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmaceutical logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pharmaceutical logistics involves the transportation, storage, and distribution of pharmaceutical products, ensuring their safety, efficacy, and compliance with regulatory standards. It includes temperature-controlled shipping, inventory management, and timely delivery to maintain product integrity, especially for sensitive items like vaccines, biologics, and clinical trial supplies.

The pharmaceutical logistics market was valued at USD 91.4 Billion in 2024.

IMARC estimates the global pharmaceutical logistics market to exhibit a CAGR of 5.96% during 2025-2033.

The market is experiencing steady growth driven by the rising number of cyber threats, increasing adoption of cloud-based solutions, and technological advancements in security.

Th three primary segments are type, component, and application.

According to the report, non-cold chain represented the largest segment by type, driven by the increasing demand for generic and over-the-counter (OTC) drugs, which do not require stringent temperature controls, allowing for more flexible storage and transportation options.

Storage leads the market by component due to the growing need for sophisticated facilities that ensure the efficacy of pharmaceutical products post-production.

Chemical pharma leads the market by application, owing to its extensive supply chains that require efficient logistics solutions for various chemical-based products.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global pharmaceutical logistics market include C.H. Robinson Worldwide Inc., CEVA Logistics, DB Schenker., Deutsche Post AG, DSV A/S, FedEx Corporation, Kuehne + Nagel, Nippon Express Co. Ltd., SF Express Co. Ltd., United Parcel Service, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)