Pharmaceutical Filtration Market Size, Share, Trends and Forecast by Product, Technique, Application, Scale of Operation, and Region, 2025-2033

Pharmaceutical Filtration Market Size and Share:

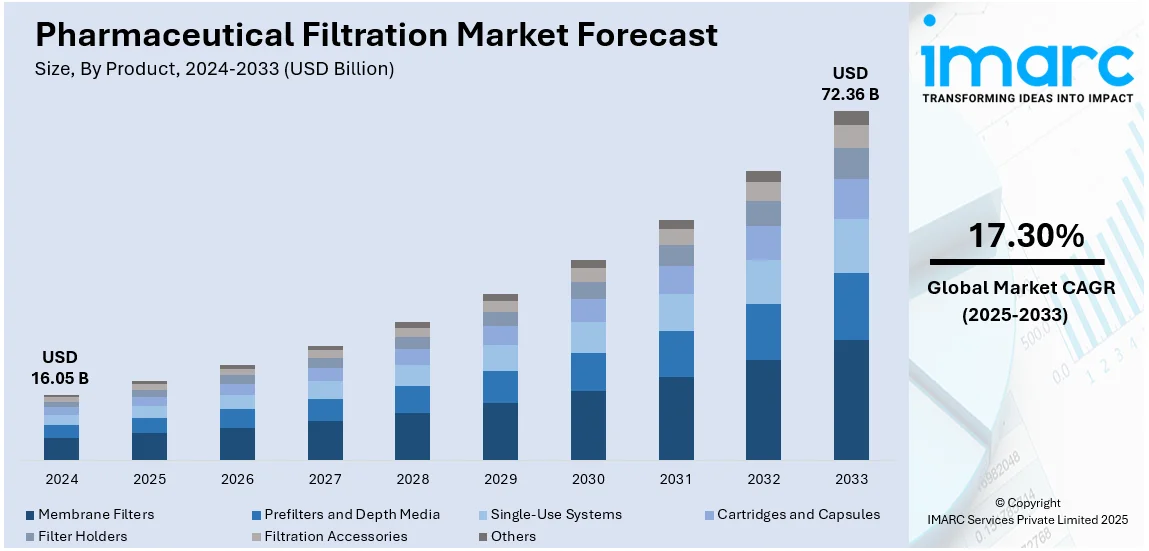

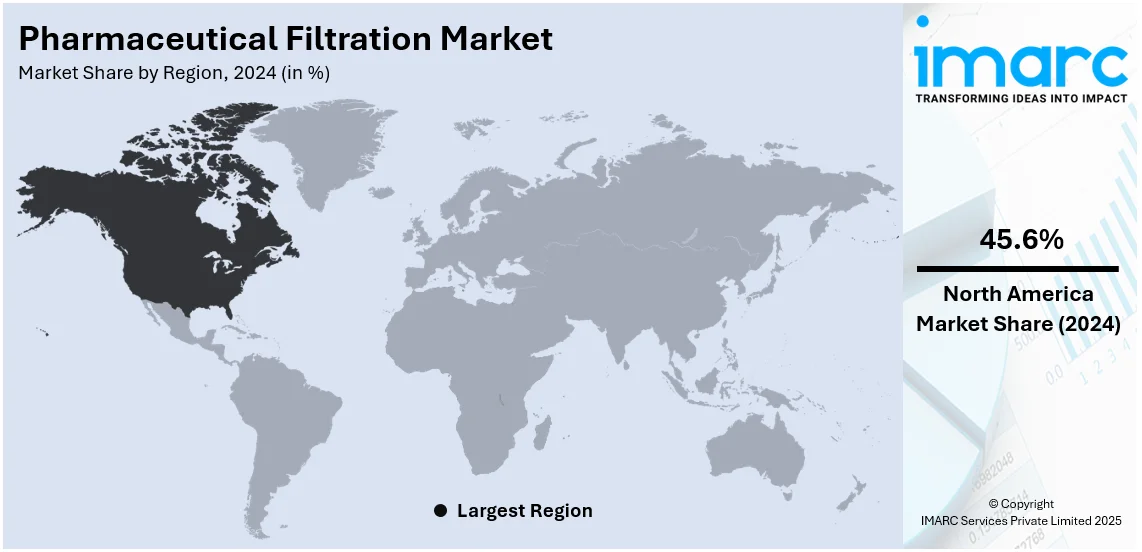

The global pharmaceutical filtration market size was valued at USD 16.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 72.36 Billion by 2033, exhibiting a CAGR of 17.30% from 2025-2033. North America currently dominates the market, holding a market share of over 45.6% in 2024, due to the escalating demand for biopharmaceuticals, stringent regulatory standards, ongoing technological advancements, and growing focus on drug safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 16.05 Billion |

|

Market Forecast in 2033

|

USD 72.36 Billion |

| Market Growth Rate (2025-2033) | 17.30% |

The pharmaceutical filtration market shows expansion because of escalating requirements for medicines, biologics, and vaccine quality. As pharmaceutical manufacturers aim to achieve strict quality and safety standards, the requirement for advanced filtration systems for product purity has grown. Drug formulations achieve their safety standards along with effective performance through filtration which efficiently eliminates contaminants, microorganisms, and particulates. In line with this, modern filtration technologies such as membrane filtration, depth filtration, and sterile filtration have advanced filtration performance to match the changing industry requirements. Furthermore, the growing demand for specialized filtration systems that can execute complex production processes of personalized medicine and biologics continues to rise.

In the United States, the pharmaceutical filtration market is experiencing significant growth driven by increasing government investments in healthcare infrastructure and the expanding pharmaceutical and biotech sectors. For instance, in September 2024, U.S. government announced a USD 3.9 million EDA investment in North Carolina for infrastructure improvements supporting biotechnology and healthcare sectors. The country maintains strong regulatory oversight especially through FDA standards which drives drug manufacturers to embrace high-quality filtration systems. Furthermore, the growing trend of outsourcing pharmaceutical manufacturing to contract manufacturing organizations (CMOs) enhances demand for filtration technologies that meet global standards for drug safety and compliance.

Pharmaceutical Filtration Market Trends:

Rising Spending in Pharmaceutical and Biotechnological Industries

Pharmaceutical companies are investing heavily in research and development, particularly in biotechnology, which requires advanced filtration technologies for processes such as protein purification and cell culture. For instance, according to reports, large pharmaceutical businesses typically dedicate 20% of their earnings to research and development. Also, AstraZeneca, a pharmaceutical company, spent more than 23% of its prescription drug earnings in 2023 on research and development. Moreover, the rise in biopharmaceuticals, including monoclonal antibodies and recombinant proteins, requires specialized filtration methods to ensure product quality and yield. These factors are further driving the pharmaceutical filtration market growth.

Increasing Demand for Generic Drugs

The increasing demand for generic drugs is one of the prominent factors driving the growth in the pharmaceutical filtration market. For instance, according to IMARC, the global generic drugs market size reached USD 367.1 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 628.0 Billion by 2032, exhibiting a growth rate (CAGR) of 5.96% during 2024-2032. Generic drugs are manufactured in large volumes to meet global demand, necessitating efficient and scalable filtration processes to ensure quality and regulatory compliance. These factors are further positively influencing the pharmaceutical filtration industry forecast.

Growing Prevalence of Chronic Diseases

The increased prevalence of chronic diseases increases the demand for a variety of medications. It is estimated that the four major noncommunicable diseases will be responsible for 75% of worldwide deaths by 2030. New medications are introduced to address chronic conditions, such as cancer, diabetes, asthma, COPD, and arthritis. For instance, in December 2023, AstraZeneca Pharma India launched Trastuzumab Deruxtecan, also known as Enhertu, which is used to treat HER2-positive breast cancer. Each new drug launch typically requires scaled-up production to meet the market demand. This increased manufacturing volume directly correlates with higher demand for filtration technologies to ensure product quality and regulatory compliance. These factors are further contributing to the pharmaceutical filtration market share.

Pharmaceutical Filtration Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pharmaceutical filtration market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, technique, application, and scale of operation.

Analysis by Product:

- Membrane Filters

- MCE Membrane Filters

- Coated Cellulose Acetate Membrane Filters

- PTFE Membrane Filters

- Nylon Membrane Filters

- PVDF Membrane Filters

- Others

- Prefilters and Depth Media

- Glass Fiber Filters

- PTFE Fiber Filters

- Single-Use Systems

- Cartridges and Capsules

- Filter Holders

- Filtration Accessories

- Others

Membrane filters stand as the largest product in 2024, holding around 27.8% of the market. Membrane filters are essential in pharmaceutical manufacturing for processes, such as sterile filtration, virus filtration, and protein purification. They are used in bioprocessing applications for cell culture clarification, concentration, and separation of biomolecules. In research laboratories, they are applied for sample preparation, microbiological analysis, and removing particles among a variety of scientific experiments. For instance, in December 2023, TeraPore Technologies, a nanofiltration membranes company, launched IsoBlock VF product line and IsoBlock PF Syringe Prefilter Device for parvovirus elimination from biopharmaceuticals. The IsoBlock PF Syringe Prefilter Device is an adsorptive membrane-based prefilter that removes undesired high-molecular-weight species from the feed prior to size-based virus removal.

Analysis by Technique:

- Microfiltration

- Ultrafiltration

- Crossflow Filtration

- Nanofiltration

- Others

Microfiltration leads the market with around 37.6% of market share in 2024. As per the pharmaceutical filtration market outlook, microfiltration is commonly used for sterile filtration to remove microorganisms and particles from pharmaceutical solutions and suspensions. This process is critical in preparing sterile drug products, such as injectables, ophthalmic solutions, and parenteral nutrition solutions. Moreover, it is used for clarification and particle removal in pharmaceutical manufacturing processes. The increasing demand for biologics and biosimilars further drives its adoption, as these products require stringent contamination control. The rising need for biologics together with biosimilars promotes the growth of microfiltration due to their strict requirements for contamination control.

Analysis by Application:

- Final Product Processing

- Active Pharmaceutical Ingredient Filtration

- Sterile Filtration

- Protein Purification

- Vaccines and Antibody Processing

- Formulation and Filling Solutions

- Viral Clearance

- Raw Material Filtration

- Media Buffer

- Pre-Filtration

- Bioburden Testing

- Cell Separation

- Water Purification

- Air Purification

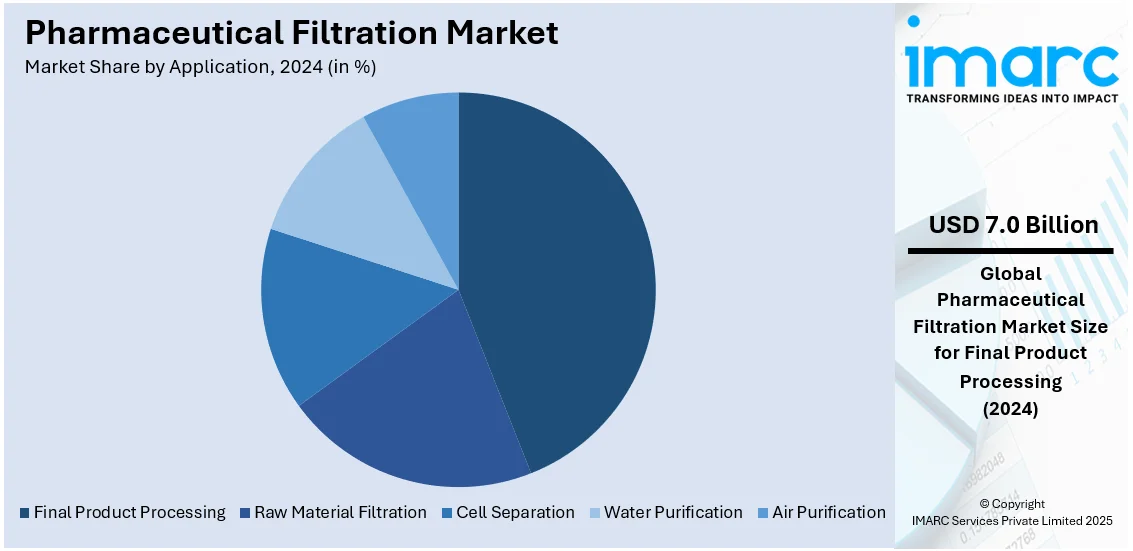

Final product processing leads the market with around 43.7% of market share in 2024. Pharmaceutical filtration during final product processing remains essential for product safety, efficacy, and quality outcomes in the market. Additionally, pharmaceutical solutions and suspensions require sterile filtration to take out microorganisms and particles for achieving stringent sterility requirements. The procedure of sterile filtration eliminates microbiological contaminants present in end-stage drug products, including vaccines and antibiotics along with ophthalmic solutions and other sterile formulations.

Analysis by Scale of Operation:

- Manufacturing Scale

- Pilot-Scale

- Research and Development Scale

Manufacturing scale leads the market with around 67.8% of market share in 2024. The pharmaceutical industry produces medications at industrial levels to fulfill worldwide medicine needs. This high product volume demands powerful filtration methods that guarantee safe and dependable product quality. In addition, the implementation of safety standards and efficacy requirements by regulatory bodies remains enforced upon pharmaceutical manufacturers for ensuring product safety and purity. The manufacturing volumes of biologics, biosimilars, and complex drug formulations demand innovative filtration technologies as an essential necessity. Besides this, technological improvements in filtration systems boost operational productivity by minimizing contamination hazards and bettering output volumes as well as maintaining adherence to strict industry standards.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 45.6%. The region has a strong presence of biopharmaceutical companies engaged in the production of biologics, vaccines, and biosimilars. For instance, in April 2024, Bavarian Nordic A/S, a fully integrated vaccine company, launched Jynneos, the only FDA-approved mpox vaccine in the United States. This sector requires advanced filtration technologies for processes like sterile filtration, virus filtration, and ultrafiltration/diafiltration (UF/DF). Moreover, continued investments in research and development by pharmaceutical companies and academic institutions fuel innovation in filtration technologies, supporting the market growth.

Key Regional Takeaways:

United States Pharmaceutical Filtration Market Analysis

In 2024, United States accounted for 80.50% of the market share in North America. Pharmaceutical filtration is gaining widespread adoption due to increasing investments in healthcare. For instance, U.S. healthcare companies securing venture capital deals of USD 15 Million plus are driving robust investment growth, focusing on innovation in medical technology to meet rising market demands. As governments and private entities inject substantial funding into the healthcare sector, there is a notable shift towards modernizing medical infrastructure and improving treatment options. This surge in investment has led to an expansion of pharmaceutical production facilities, which in turn demands high-quality filtration solutions for drug production and purification processes. The need for sterile and safe drug formulations requires the use of advanced filtration technologies that can meet stringent quality standards. As healthcare systems grow and evolve, pharmaceutical filtration systems are increasingly seen as essential in maintaining the efficiency, safety, and effectiveness of the drug development process, contributing to the overall improvement of public health.

Europe Pharmaceutical Filtration Market Analysis

In Europe, the growing adoption of pharmaceutical filtration is driven by the rising incidence of chronic diseases and the aging population. For instance, Europe's ageing population is on the rise, with one in five Europeans now aged 65 or older, projected to approach 30% by 2050. As the elderly population continues to increase, so does the prevalence of chronic conditions such as diabetes, hypertension, and cardiovascular diseases. The need for continuous treatment and management of these conditions has boosted the demand for pharmaceutical products. This, in turn, has led pharmaceutical companies to invest in advanced filtration technologies to ensure the quality and safety of their products. The aging population requires long-term care, driving the need for innovative filtration solutions to support the production of high-quality medicines. With healthcare providers striving to meet the needs of an aging demographic, pharmaceutical filtration has become a critical element in ensuring the efficacy and safety of treatments, improving patient outcomes.

Asia Pacific Pharmaceutical Filtration Market Analysis

The adoption of pharmaceutical filtration has seen a significant rise in response to the growing demand for generic medicines. According to National Informatics Centre (NIC), India is the largest provider of generic medicines globally, occupying a 20% share in global supply by volume. The industry manufactures about 60,000 different generic brands across 60 therapeutic categories. With a rapidly increasing population, more individuals are seeking access to medications, and generic drugs have become a popular alternative to branded drugs due to their affordability. The demand for these medicines has led to a rise in pharmaceutical production, which necessitates the implementation of filtration processes to ensure that the final products are free from contaminants. As the need for high-quality, affordable drugs grows, pharmaceutical companies are investing more in filtration technologies to maintain the safety, purity, and compliance of the medications they produce, meeting the growing healthcare needs of the population.

Latin America Pharmaceutical Filtration Market Analysis

The growing adoption of pharmaceutical filtration in Latin America is attributed to the expanding private healthcare sector. According to International Trade Administration, Brazil is the largest healthcare market in Latin America with 7,191 hospitals, 62% are private. With increasing investments in private healthcare infrastructure, more facilities are being established to cater to the growing demand for quality medical services. The shift towards privatization has led to improvements in healthcare services, with a focus on adopting advanced technologies such as filtration systems. These innovations play a crucial role in enhancing the quality of medicines and ensuring that pharmaceutical products meet international standards. As the private sector grows, pharmaceutical manufacturers are adopting filtration systems to meet stricter regulatory standards and improve product safety, driving the increased use of these technologies in the region.

Middle East and Africa Pharmaceutical Filtration Market Analysis

In the Middle East and Africa, the growing adoption of pharmaceutical filtration is driven by the expansion of healthcare facilities. According to Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022, projected to expand further by 3-6% in facilities and 10-15% in professionals in 2023. With governments and private sector entities investing heavily in healthcare infrastructure, the need for advanced pharmaceutical filtration technologies has risen. These investments are aimed at improving the quality of healthcare services, which includes the production of medicines that adhere to international safety and quality standards. As healthcare facilities expand, pharmaceutical companies are incorporating filtration solutions to meet these standards and improve product safety. The development of healthcare infrastructure in the region is expected to continue driving the demand for pharmaceutical filtration systems, ensuring the availability of safe and effective treatments for the population.

Competitive Landscape:

The pharmaceutical filtration market remains competitive because companies focus on enhancing their technological capabilities while ensuring high product quality and following strict regulatory requirements. Moreover, businesses dedicate research investments for developing cutting-edge filtration systems that include membrane filters, sterile filtration, and depth filtration to serve the expanding requirements of drug producing companies alongside biologics producers and vaccine developers. For instance, in October 2024, Asahi Kasei Medical launched the Planova™ FG1, a high-flux virus removal filter. It enables time-saving filtration operations while achieving superior virus removal rates and harmonizing with common cleaning procedures which enhances the productivity of pharmaceutical manufacturing. The market demand for high-quality biologic and pharmaceutical products drives competitor focus on offering reliable filtration technologies at cost-effective prices and efficient solutions. In addition, the pharmaceutical sector shows market consolidation due to partnerships and acquisitions which help companies enhance their global pharmaceutical operations through expanded product offerings.

The report provides a comprehensive analysis of the competitive landscape in the pharmaceutical filtration market with detailed profiles of all major companies, including:

- 3M Company

- Amazon Filters Ltd

- Danaher Corporation

- Eaton Corporation plc

- General Electric Company

- Graver Technologies LLC

- Meissner Filtration Products Inc

- Merck KGaA

- Parker Hannifin Corporation

- Sartorius AG

Latest News and Developments:

- September 2024, Sartorius AG introduced the Vivaflow SU, a cutting-edge tangential flow filtration (TFF) system tailored for laboratory applications. It offers efficient ultrafiltration and diafiltration for feed volumes of 100–1,000 mL, enhancing productivity in scientific workflows. The innovation emphasizes sustainability by reducing material waste and optimizing process efficiency. Vivaflow SU sets a new benchmark for precision and ease in laboratory filtration processes.

- June 2024, Danaher Corporation unveiled its Supor Prime sterilizing grade filters, addressing challenges in high-concentration biologic drug manufacturing. The filters enable higher yields, reduce premature blockages, and cut costs related to filtration inefficiencies. This product supports drug developers in achieving consistent production outcomes while enhancing operational efficiency. Supor Prime filters reflect Danaher’s commitment to advancing bioprocessing solutions.

- August 2024, Donaldson Company acquired Medica S.p.A., a leader in hollow fiber membrane filtration technology for medical and water purification devices. Through this strategic acquisition Donaldson expands its operations in leading-edge filtration solutions designed for healthcare facilities and environmental needs. The move strengthens its market position in medical device innovation and sustainable water purification technologies. Donaldson aims to leverage Medica's expertise to broaden its global impact.

- June 2024: Cytiva introduced Supor Prime sterilizing-grade filters designed for biologic medicines with high concentrations. These filters aim to improve yields, reduce blockages, and minimize cost losses during production. The technology enhances efficiency in medication development processes. The launch addresses the growing demand for advanced filtration solutions in biopharma.

- April 2024: Asahi Kasei unveiled a cutting-edge membrane system for producing water for injection (WFI), critical for sterile injection preparations. It leverages the Microza™ hollow-fiber membrane technology for enhanced filtration and water treatment. The system reflects Asahi Kasei's innovation in liquid product filtration. This launch supports pharmaceutical manufacturing with improved sterile water production.

Pharmaceutical Filtration Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Techniques Covered | Microfiltration, Ultrafiltration, Crossflow Filtration, Nanofiltration, Others |

| Applications Covered |

|

| Scale of Operations Covered | Manufacturing Scale, Pilot-Scale, Research and Development Scale |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Amazon Filters Ltd, Danaher Corporation, Eaton Corporation plc, General Electric Company, Graver Technologies LLC, Meissner Filtration Products Inc, Merck KGaA, Parker Hannifin Corporation, Sartorius AG, etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmaceutical filtration market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pharmaceutical filtration market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmaceutical filtration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pharmaceutical filtration market was valued at USD 16.05 Billion in 2024.

IMARC estimates the global pharmaceutical filtration market to reach USD 72.36 Billion in 2033, exhibiting a CAGR of 17.30% during 2025-2033.

The market is driven by rising drug production, increasing demand for biologics, stringent regulatory requirements, and advancements in filtration technology. Growing concerns over drug safety, contamination control, and compliance with quality standards further boost the adoption of advanced filtration solutions in pharmaceutical manufacturing.

North America currently dominates the market, holding a market share of over 45.6% in 2024. This leadership is driven by its strong biopharmaceutical industry, advanced manufacturing capabilities, and stringent regulatory standards. High investments in drug development, rising demand for biologics, and the presence of key industry players further drive market growth, ensuring innovation and compliance with strict quality and safety regulations.

Some of the major players in the pharmaceutical filtration market include 3M Company, Amazon Filters Ltd, Danaher Corporation, Eaton Corporation plc, General Electric Company, Graver Technologies LLC, Meissner Filtration Products Inc, Merck KGaA, Parker Hannifin Corporation, Sartorius AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)