Petroleum Coke Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Petroleum Coke Market Size and Share:

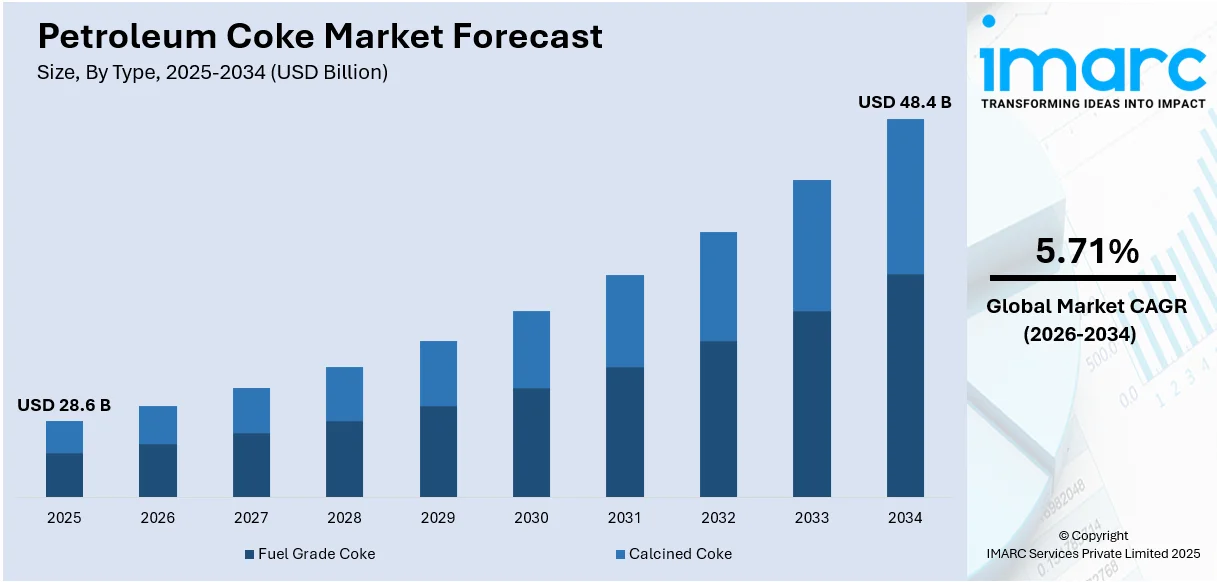

The global petroleum coke market size was valued at USD 28.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 48.4 Billion by 2034, exhibiting a CAGR of 5.71% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 45.1% in 2025. The market growth is driven by the increasing demand from the aluminum industry, the expanding power generation sectors, and the rising use of petroleum coke as a cost-effective fuel alternative in various industries. Collectively, these factors are increasing the petroleum coke market share across the globe.

Petroleum Coke Market Insights:

- Increasing aluminum manufacturing is largely fueling demand for calcined petroleum coke.

- Fuel-grade coke is still leading with its effectiveness in electricity generation.

- The Asia-Pacific region continues to lead with accelerated industrial growth.

- Cement and steel industries highly turn to petcoke for its economic advantage.

- Stringent environmental policies are motivating cleaner technologies of petcoke combustion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 28.6 Billion |

| Market Forecast in 2034 | USD 48.4 Billion |

| Market Growth Rate (2026-2034) | 5.71% |

The petroleum coke (petcoke) market is driven by an increasing demand from industries such as power generation, cement, and aluminum smelting. Its high carbon content and calorific value make it a cost-effective fuel alternative, especially in regions with strict energy cost constraints. In line with this, the rising global energy needs and industrialization, particularly in emerging economies, have fueled its consumption. Additionally, petcoke's use as a raw material in producing electrodes for steel and aluminum industries further boosts demand. The availability of low-cost petcoke due to growing crude oil refining capacities also contributes to the petroleum coke market growth.

To get more information on this market Request Sample

The petroleum coke market in the United States is driven by an increasing industrial demand, particularly in sectors like cement, power generation, and steel production. The U.S., being a major producer of petcoke due to extensive refining capacity, benefits from its cost-effectiveness as a fuel alternative. Petcoke's high energy content supports its use in energy-intensive industries, while its application in manufacturing electrodes for the aluminum and steel sectors further boosts demand. Exports to countries with growing industrial needs also play a significant role in market growth. For instance, in November 2024, based on data from the U.S. Census Bureau, the U.S. Energy Information Administration (EIA) recently stated that the average annual production of petroleum coke (petcoke) in the United States stayed largely similar from 2014 to 2023, at 46 million tons. Because of its high heat content and low cost, petcoke—a product that is derived from petroleum during the refining process, is popular abroad but not in the United States because of its high carbon content. In fact, in 2023, about 90% of the petcoke produced in the United States was exported.

Petroleum Coke Market Trends:

Expanding industrial sector

The burgeoning industrial sector in emerging economies is a significant driver of the market. For instance, the expanding industrial sector in the United States drives demand for petroleum coke, with manufacturers contributing 10.70% of the nation's total output. This growth highlights significant opportunities for increased production and utilization. As nations like China, India, and Brazil are making investments in manufacturing and infrastructure, there is a growing need for affordable fuels like petroleum coke. Pet coke, a byproduct of the oil refining process, is increasingly used in cement kilns and power plants due to its high energy content and relative affordability. The rapid industrialization in these regions, coupled with the growing need for energy-efficient fuel alternatives, makes the product a desirable option, thus propelling the petroleum coke market demand.

Increasing aluminum production

Petroleum coke is used extensively in the manufacturing of aluminum, particularly in the anode-grade coke that is necessary for the smelting of aluminum. According to Ministry of Mines, India, primary aluminium production in FY 2024-25 (April-June) posted a growth of 1.2% over the corresponding period last years. The global surge in aluminum demand, driven by its applications in various industries like automotive, construction, and packaging, directly impacts the petroleum coke market. As aluminum becomes more integral in lightweight and energy-efficient designs, especially in the automotive sector for reducing vehicle weight and improving fuel efficiency, the demand for petroleum coke correspondingly increases, thereby positively influencing the market.

Expanding cement industry

Another significant factor driving the market is the rising cement industry which is a major consumer of petcoke. According to India Brand Equity Foundation, cement production increased by 1.9% in June 2024 over June 2023. Cement consumption is rising due to the significant expansion of the worldwide construction sector, especially in developing nations. Petroleum coke is a great substitute for conventional fuels like coal because of its high calorific value and consistency when used as fuel in cement kilns. This increased demand in the cement industry is significantly impacting the petroleum coke market price, as manufacturers are seeking more efficient and cost-effective fuel options to enhance production efficiency.

Implementation of environmental regulations

Clean energy projects and environmental concerns may seem like odd motivators, although they have a complicated impact on the petroleum coke market. Stricter environmental regulations in many countries are leading to advancements in technology to make petroleum coke burning cleaner and more efficient. Petroleum coke also acts as a transitional fuel in regions where renewable energy sources are not yet practical or economical. Therefore, the market for petroleum coke is growing in a nuanced way due to efforts to reduce its environmental impact and the need to balance cost with cleaner energy methods.

Petroleum Coke Market Challenges:

The petroleum coke industry, with its enhanced growth prospects, faces several issues that need close attention. Of prime concern is related to environmental laws, as petroleum coke involves a high carbon content, and its production creates emissions of greenhouse gases and air pollution. With tightening environmental regulations by global and regional governments, industries that rely on petroleum coke have a possibility of having to shift to superior emission control systems or switch to cleaner fuels. Furthermore, the market is also responsive to crude oil price volatility and refineries' capacities, influencing both the supply and pricing stability of petroleum coke. Geopolitical considerations and changing global trade circumstances also further condition the global distribution and export suitability of the material, especially among countries that are greatly dependent on foreign markets. In addition, the increasing focus on renewable energy sources and cleaner fuels creates a long-term challenge, slowly altering market inclinations. Overcoming the problems with innovation and adherence to regulations will become imperative for long-term market progress.

Petroleum Coke Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global petroleum coke market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type and application.

Analysis by Type:

- Fuel Grade Coke

- Calcined Coke

Fuel grade coke stand as the largest component in 2025, holding around 50.9% of the market. Fuel-grade coke is largely suitable for the power and energy generation industries. Based on its average high calorific value and economically efficient characteristics, fuel-grade coke is a preferred fuel source in several applications. Fuel-grade coke is very important in power plants, especially in regions where energy is in huge demand. In line with this, applications include cement manufacturing and various industrial processes that require a reliable and efficient energy source. The steady growth of the energy sector, especially in emerging economies, drives demand for fuel-grade coke, which dominates and is a key segment in petroleum coke markets.

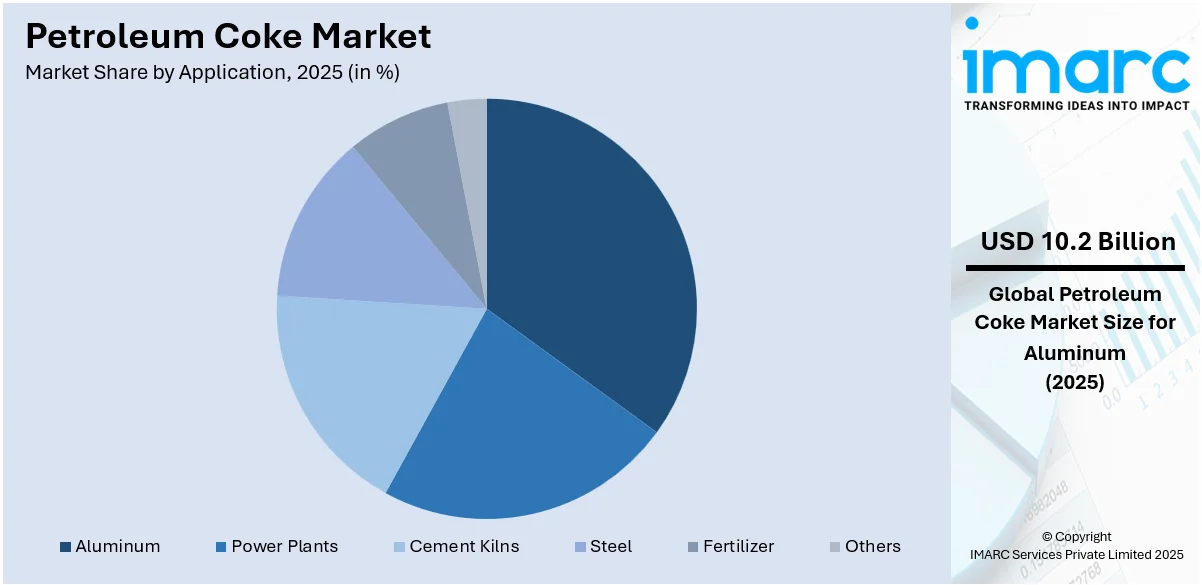

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Power Plants

- Cement Kilns

- Steel

- Aluminum

- Fertilizer

- Others

Aluminum leads the market with around 37.81% of the market share in 2025. The aluminum is utilized in the production of anodes used in aluminum smelting. Calcined petroleum coke (CPC) is particularly vital in this application, as it serves as a primary raw material in the production of carbon anodes. CPC's high carbon content and low impurities are essential for maintaining the efficiency and cost-effectiveness of aluminum production. Aluminum is lightweight and highly recyclable, which meets sustainability approaches in stimulating the production and consumption of petroleum coke in this industry.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 45.1%. The growing need for fertilizers has boosted the demand for petroleum coke in agriculture. According to the India Brand Equity Foundation, India's organic food market is projected to grow at a CAGR of 10% from 2015 to 2025, reaching approximately USD 9.1 Billion by 2025, up from USD 386.32 Million in 2015. The surge in sustainable agriculture drives demand for petroleum coke-based fertilizers, enhancing crop productivity while supporting eco-friendly farming practices. This growth underscores the synergy between organic farming and innovative fertilizer solutions. This material serves as a critical ingredient in fertilizer production, providing essential carbon content that enhances the nutrient composition of these products. Agricultural growth and the expansion of arable land cultivation are driving this trend. The increasing focus on improving crop yields to support population growth intensifies the use of fertilizers, indirectly elevating petroleum coke demand. Additionally, the ability of this material to complement cost-effective production processes in the fertilizer industry strengthens its position as a preferred input material. Farmers and fertilizer manufacturers alike recognize its utility in achieving enhanced agricultural productivity, ensuring its continued relevance in this sector.

Key Regional Takeaways:

North America Petroleum Coke Market Analysis

In North America, the petroleum coke market is characterized by steady demand primarily driven by the energy sector and industrial applications. A steady need for petroleum coke as an affordable carbon source is a result of the area's established industrial base, which includes the steel, cement, and aluminum sectors. Furthermore, environmental rules are receiving more attention, which has prompted improvements in refining techniques to create petroleum coke with less sulfur, which complies with more stringent emission criteria. With a steady petroleum coke market prognosis for the near future, North America continues to be a major player in the sector.

United States Petroleum Coke Market Analysis

In 2025, the United States accounted for the largest market share of over 69%. The increasing reliance on petroleum coke as an energy source is supported by the expanding energy sector's need for efficient, high-calorific-value fuels. According to U.S. Energy Information Administration, U.S. electricity consumption hit a record 4.07 Trillion kWh in 2022, a 14-fold rise since 1950, reflecting surging energy demand. This growing consumption boosts the utility of petroleum coke as an efficient, high-energy fuel in power generation. Increasing reliance on such alternatives supports energy-intensive industries and grid stability. As electricity requirements continue to rise, particularly in areas witnessing rapid industrial and residential expansion, petroleum coke serves as a cost-effective and high-energy-density fuel alternative. Its adaptability in power generation and industrial boilers makes it a preferred choice for fulfilling the growing demand for reliable energy sources. The ability of petroleum coke to ensure steady power generation capacity without frequent supply chain interruptions further accelerates its adoption, particularly as energy infrastructures expand. Additionally, its cost advantages compared to other fuels contribute to its widespread utilization, offering industries a dependable solution to meet increasing energy consumption levels.

Europe Petroleum Coke Market Analysis

Petroleum coke is gaining traction as a reliable fuel due to its high energy efficiency and economic advantages. Its adoption in manufacturing processes that require raw petroleum derivatives, such as metallurgy and specialized industrial fuels, has increased steadily. According to reports, the EU's industrial production surged by 8.5% in 2021 compared to 2020, signalling robust recovery and growth in key manufacturing sectors. This upturn benefits the petroleum coke market, with expanding industries like steel and cement driving demand for its efficient energy and cost advantages. As production accelerates, petroleum coke remains pivotal in supporting industrial energy needs. This growth stems from its versatility in acting as a substitute for more expensive raw materials. Industries utilizing heavy machinery and high-temperature processes benefit significantly from petroleum coke's consistent performance, low ash production, and cost savings. Additionally, this material supports reduced environmental compliance costs by offering a cleaner alternative to certain traditional fuels.

Latin America Petroleum Coke Market Analysis

The cement sector is experiencing heightened demand due to the rapid expansion of construction activities. For instance, in 2022, 87.4% of Brazil's 203.1 Million population lived in urban areas, driving demand for construction activities. This surge is boosting the cement industry, which increasingly relies on petroleum coke as a cost-efficient fuel. The trend highlights the role of urbanization in fuelling industrial growth. With its high calorific value and cost-effectiveness, Petroleum coke has emerged as a favored fuel for cement kilns. Its role in achieving energy-intensive clinker production processes ensures its widespread use. Construction projects, including commercial infrastructure and housing developments, are fueling this trend. The consistency in petroleum coke’s energy output also contributes to lower operational disruptions, aligning well with the production schedules of cement manufacturers.

Middle East and Africa Petroleum Coke Market Analysis

The real estate sector's growing need for building materials such as steel and aluminium is indirectly driving petroleum coke usage. According to reports, over 5,200 construction projects worth USD 819 Billion are ongoing in Saudi Arabia, comprising 35% of the GCC's total active project value. This surge in construction activities is driving demand for petroleum coke, benefiting its application in the cement industry. The booming construction sector highlights significant growth opportunities for related industries. As an essential material in the smelting and refining processes, it offers significant advantages in reducing production costs while maintaining output quality. Expanding urbanization and infrastructure projects have led to a rise in the demand for these materials, further pushing petroleum coke adoption. Its high efficiency and reliability in industrial applications ensure its continued role in supporting the evolving construction landscape.

Competitive Landscape:

The petroleum coke market is highly competitive, with key players focusing on expanding production capacities, enhancing product quality, and exploring cleaner technologies to address environmental concerns. The market is dominated by major enterprises with major refining activities. The dynamics of global trade are important, with China and the United States being major exporters and buyers. Regional suppliers and smaller firms compete by meeting specialized needs, such low-sulfur petcoke. Companies use technical developments, strategic alliances, and investments in emission reduction initiatives as vital tactics to preserve market share and adhere to legal requirements.

The report provides a comprehensive analysis of the competitive landscape in the global petroleum coke market with detailed profiles of all major companies, including:

- Aminco Resources

- BP p.l.c

- Chevron Corporation

- DYM Resources

- Indian Oil Corporation Ltd.

- Marathon Petroleum LP

- Petroleum Coke Industries Company

- Phillips 66 Company

- Reliance Industries Limited

- Renelux Commodities PC

- Valero

Latest News and Developments:

- November 2024: The Indian Oil Corporation (IOC) intends to finish refinery expansions in Panipat, Gujarat, and Barauni by December 2025 after being delayed by the COVID-19 pandemic and Ukraine crisis. The Barauni refinery's capacity will rise from 6 to 9 Million tonnes annually, with a 10% cost overrun, reaching approximately USD 1.90 Billion. The project aligns with India's energy demand growth and includes upgrades for processing petroleum coke. Sources highlight the simultaneous completion of all three projects. IOC remains committed to enhancing refining capacity despite challenges.

- October 2024: Oil and Natural Gas Corporation (ONGC) and Bharat Petroleum Corporation Limited (BPCL) are exploring international partnerships for greenfield refinery developments. These projects aim to bolster India’s refining capacity and include the production of value-added petroleum coke. The collaboration will support advanced technologies and environmental compliance. ONGC and BPCL's initiatives align with the nation’s energy security goals. Discussions with potential partners are underway to finalize investment plans.

- September 2024: Indian government eased import norms for raw (RPC) and calcined petroleum coke (CPC), allowing shipments to cater to the domestic needs of the aluminium industry and other sectors. Previously restricted to the aluminium industry, these imports will now support broader industrial demand. The Directorate General of Foreign Trade (DGFT) issued the notification to enhance domestic availability. Pet coke, primarily used as a fuel, plays a critical role in various industries.

- March 2023: ExxonMobil has recently celebrated the successful commencement of its Beaumont refinery expansion initiative. This project has bolstered the refinery's capacity by an impressive 250,000 barrels per day, further solidifying its position as one of the most significant refining and petrochemical complexes along the U.S. Gulf Coast. This expansion contributes to the United States' overall energy infrastructure and demonstrates ExxonMobil's dedication to fulfilling the region's increasing energy demands and improving its production capacities.

Petroleum Coke Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fuel Grade Coke, Calcined Coke |

| Applications Covered | Power Plants, Cement Kilns, Steel, Aluminum, Fertilizer, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aminco Resources, BP p.l.c, Chevron Corporation, DYM Resources, Indian Oil Corporation Ltd., Marathon Petroleum LP, Petroleum Coke Industries Company, Phillips 66 Company, Reliance Industries Limited, Renelux Commodities PC, Valero, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the petroleum coke market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global petroleum coke market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the petroleum coke industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The petroleum coke market was valued at USD 28.6 Billion in 2025.

The petroleum coke market is projected to exhibit a CAGR of 5.71% during 2026-2034, reaching a value of USD 48.4 Billion by 2034.

The key factors driving the global petroleum coke market include rising energy demand, industrial growth in emerging economies, and its cost-effectiveness as a fuel alternative. Increasing use in aluminum and steel production, expanding refining capacities, and growing demand for construction materials like cement also contribute, alongside technological advancements to address environmental concerns.

Asia Pacific leads the petroleum coke market, accounting for a significant share of 45.1%. This dominance can be attributed to its rapid industrialization, strong demand for energy, and extensive refining capabilities. The region has a large base of cement, power, and steel industries, which rely heavily on petroleum coke as a cost-effective fuel source. Additionally, Asia Pacific's growing urbanization and infrastructure development drive demand, while the region's significant refineries and availability of feedstock further bolster its dominance in the market, while creating a positive petroleum coke market outlook.

Some of the major players in the petroleum coke market include Aminco Resources, BP p.l.c, Chevron Corporation, DYM Resources, Indian Oil Corporation Ltd., Marathon Petroleum LP, Petroleum Coke Industries Company, Phillips 66 Company, Reliance Industries Limited, Renelux Commodities PC, Valero, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)