Pet Wearable Market Size, Share, Trends and Forecast by Product, Technology, Application, End-User, Distribution Channel, and Region, 2026-2034

Pet Wearable Market 2025, Size, Share and Trends:

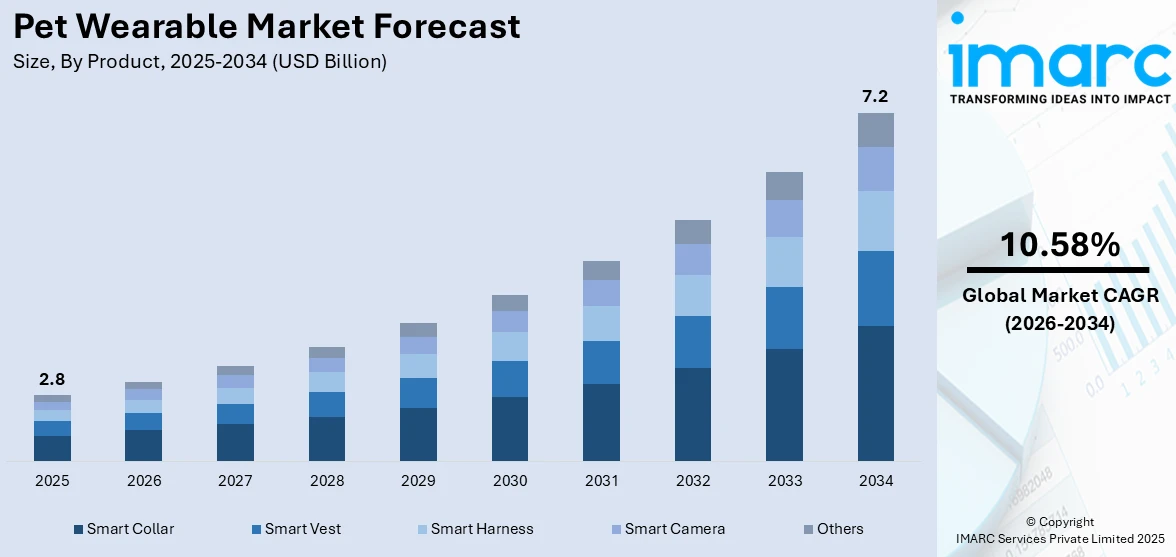

The global pet wearable market size was valued at USD 2.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7.2 Billion by 2034, exhibiting a CAGR of 10.58% during 2026-2034. North America currently dominates the market, holding a market share of over 37.8% in 2025. The increasing pet ownership, growing awareness about pet health and safety, advancements in IoT and GPS technologies, and rising disposable income of pet owners are some of the factors driving the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2034 | USD 7.2 Billion |

| Market Growth Rate (2026-2034) | 10.58% |

The global pet wearable market is primarily growing due to increasing pet ownership and the rising focus on pet health and safety. Devices, such as GPS trackers, health sensors and activity monitors, are gaining popularity among pet owners seeking advanced tools to monitor the wellbeing of their pet. Technological advancements, including IoT integration and mobile app connectivity, are enhancing functionality and user convenience. According to the IMARC Group, the global IoT market size reached USD 1,022.6 Billion in 2024 and is projected to reach USD 3,486.8 Billion by 2033, exhibiting a CAGR of 14.6% during 2025-2033. Moreover, the expanding adoption of wearable technology by veterinary clinics for diagnostics and treatment is further propelling industry expansion. Increasing disposable income and awareness about pet care are also contributing to market growth globally.

To get more information on this market Request Sample

The United States has emerged as a key regional market for pet wearable, primarily driven by rising pet ownership and increasing spending on pet health and wellness. As per the American Veterinary Medical Association (AVMA), 45.5% of households in the United States owned dogs and 32.1% owned cats as pets in 2024. Growing awareness among pet owners about advanced technologies, such as GPS trackers, activity monitors, and health sensors, is driving demand for innovative products. Integration of IoT and mobile apps further enhances the usability of these devices, allowing real-time monitoring and improved pet safety. In addition, veterinary clinics are also adopting wearable technology for diagnostic and therapeutic purposes, further augmenting industry growth. Increasing disposable income and robust technological infrastructure are also supporting sustained market expansion.

Pet Wearable Market Trends:

Increasing Pet Ownership and Humanization of Pets

The pet wearable market is primarily driven by the increasing pet ownership rates globally, particularly in areas such as North America and Europe, where pets are often treated as family members. According to the APPA National Pet Owners 2024 report, 82 million households in the United States have a pet. A June 2024 report from FEDIAF European Pet Food Industry also reports a total of 166 million households in Europe or 50% of homes own at least one pet. Moreover, the trend of pet humanization is increasing the demand for products aimed at their health, safety, and wellness. More than anything else, pet owners have become keener on improving the quality of life for their pets, resulting in more reliance on wearable such as GPS trackers, activity monitors, and health tracking devices. These devices allow pet owners to ensure that their pets' comfort, security, and overall health are intact. This is, therefore, propelling the adoption of wearable that offer real-time data on the activities and well-being of pets. The ever-increasing concern for pet health and safety, as well as the interest in tracking and improving the lifestyles of pets, is driving market growth.

Significant Technological Advancements

Technological innovations in sensors, GPS tracking, and health monitoring have significantly improved the functionality of pet wearable. Devices such as smart collars that track the activity, location, and health metrics of pets are becoming more accessible and user-friendly. For instance, in March 2024, PetPace 2.0 introduced a revolutionary vet-grade AI-driven collar that offers remote health monitoring, providing peace of mind to owners. Similarly, in November 2022, Whistle Labs launched the Whistle Health Limited Edition, a sleek, stylish version of its wearable device that tracks activity, behavior, and offers custom-made nutrition recommendations, all while helping monitor emotional well-being. These advancements enable pet owners to track the health and behavior of their pets more effectively, giving them peace of mind and helping with proactive care. The integration of technologies such as IoT, Bluetooth, and mobile apps further enhances the user experience and drives market growth.

Growing Awareness about Pet Health and Safety

With a greater concern for the health and well-being of pets, numerous pet owners are making preventive care a priority. As such, pet owners are now considering monitoring vital signs, physical activity, and behavior through pet wearable. These devices allow for early detection of potential health issues, enabling timely interventions that prevent diseases and enhance longevity. Tracking devices have also gained importance, particularly for outdoor pets prone to wandering, as they provide peace of mind through real-time location monitoring. This rising concern about the health and safety of pets reflects a deeper emotional bond between humans and animals, with significant spending highlighting the priority placed on pet care. As a result, pet wearable are becoming increasingly integrated into the routines of modern pet owners, driven by the desire for convenience, safety, and improved health outcomes. The expanding awareness about pet health and safety is thereby a primary factor propelling the growing demand for wearable technologies in the pet care market.

Pet Wearable Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pet wearable market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on product, technology, application, end-user and distribution channel.

Analysis by Product:

- Smart Collar

- Smart Vest

- Smart Harness

- Smart Camera

- Others

Smart collar leads the market, with around 60.9% of market share in 2025. Smart collars dominate the pet wearable market due to their multifunctionality and advanced features, catering to a wide range of needs. These devices combine GPS tracking, activity monitoring, health tracking, and behavior analysis in a single, convenient product. Their ability to provide real-time data through connected mobile apps enhances pet safety and health management. Moreover, smart collars are particularly popular among pet owners for locating lost pets and monitoring fitness levels. The integration of advanced technologies such as artificial intelligence (AI), Internet of Things (IoT) and sensors, along with customizable options, makes them a versatile and essential tool, driving their widespread adoption in the pet wearable market.

Analysis by Technology:

- GPS

- RFID

- Sensors

- Others

RFID holds the majority of the market share, with 40.0% of shares in 2025. This segment is driven by its reliability, cost-effectiveness, and widespread use for identification and tracking. RFID tags are commonly implanted or attached to pets, providing a permanent and tamper-proof means of identifying animals, which is essential for pet recovery and management. These tags require no batteries and offer a long lifespan, making them a low-maintenance option for pet owners and shelters. In addition, RFID technology integrates seamlessly with veterinary databases, allowing quick access to vital pet information. Its simplicity, durability, and efficiency in managing large pet populations make RFID a leading choice in the growing pet wearable market.

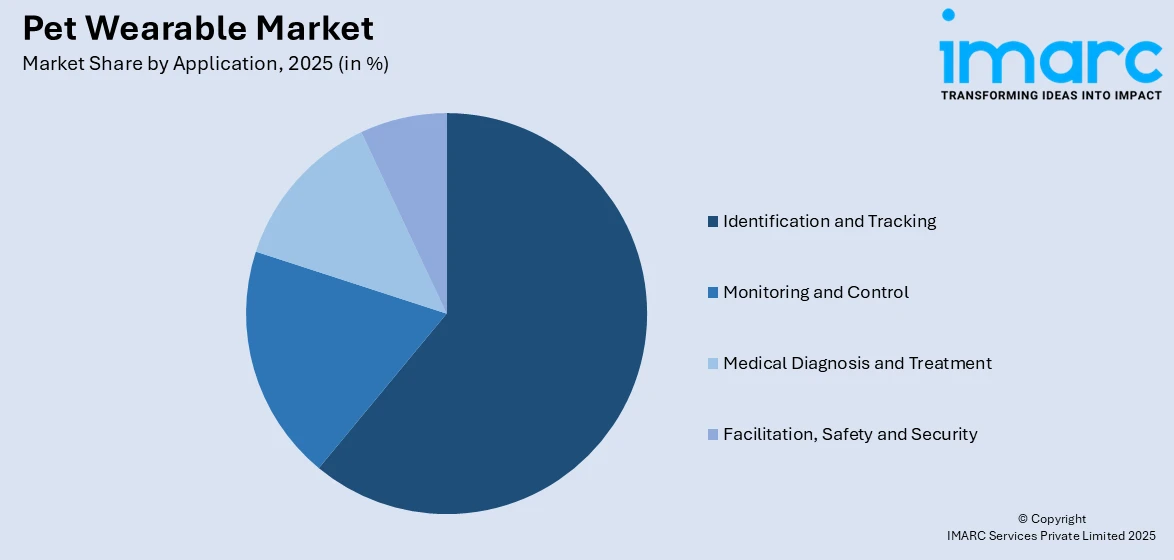

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Identification and Tracking

- Monitoring and Control

- Medical Diagnosis and Treatment

- Facilitation, Safety and Security

Identification and tracking exhibit a clear dominance in the market, with 61.2% market share in 2025. These devices address critical concerns of pet safety and recovery, driving their prominence in the industry. Devices equipped with technologies such as GPS and RFID enable pet owners to locate lost pets in real time, ensuring their safety, particularly for outdoor or highly active pets. These features provide peace of mind to owners, particularly in urban areas where pets are more likely to stray. Identification capabilities, often integrated with tracking, allow quick access to the medical and ownership information of pets, streamlining veterinary care and shelter operations. The growing awareness about pet safety and advancements in tracking technology are driving demand for these solutions.

Analysis by End-User:

- Households

- Commercial

Households represent the leading market segment in 2025. This is largely due to the rising rates of pet ownership, driven by the growing trend of treating pets as family members. Pet owners are increasingly adopting wearable devices such as smart collars and activity trackers to monitor the health, behavior, and location of their pets, ensuring safety and well-being. These devices cater to household pets by providing real-time insights into physical activity and health, enabling preventive care and early detection of potential issues. Additionally, the convenience of integrating wearable devices with mobile apps aligns with the tech-savvy preferences of modern households, further driving the adoption of pet wearable in domestic settings.

Analysis by Distribution Channel:

- Modern Trade

- Franchised Outlets

- Specialty Stores

- E-Commerce

- Others

Specialty stores lead the market, with 42.0% of the market share in 2025. This dominance is driven by their ability to offer a curated selection of high-quality, innovative products tailored to the needs of pet owners. These stores provide a personalized shopping experience, often staffed with knowledgeable professionals who can guide customers in selecting the right wearable device for their pets. Moreover, specialty stores frequently stock premium brands and advanced technologies, including GPS trackers, activity monitors, and health sensors, appealing to tech-savvy and health-conscious pet owners. Their focus on niche markets and exclusive offerings helps build customer loyalty, positioning them as a trusted source for cutting-edge pet wearable in the growing market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 37.8%. In this region, the pet wearable market is driven by high pet ownership rates and advanced technological infrastructure. Pet owners in North America prioritize health and safety, driving demand for devices such as smart collars, GPS trackers, and activity monitors. Strong disposable income levels enable widespread adoption of premium pet care products, including wearable. Additionally, North America is home to leading tech companies and manufacturers that foster innovation and market growth. Supportive government regulations for pet safety and the availability of robust distribution networks further augment industry growth. The strong emphasis on personalized pet care in the region and its advanced technological infrastructure further solidify its market leadership.

Key Regional Takeaways:

United States Pet Wearable Market Analysis

In 2025, the United States accounts for over 80.50% of the pet wearable market in North America. The United States pet wearable market is growing exponentially, due to increased pet ownership and rising expenditures by households for the care of pets. As per APPA, total U.S. expenditure for the pet industry in 2023 stood at USD 147.0 Billion, up from USD 136.8 Billion in 2022. This growth represents an expansive market for wearable products for pets and other pet-related products and services. The millennial generation is the largest owner group currently, with 32% of owners, while Gen X follows with 27%, and Baby Boomers at 24%. This is leading to a greater need for pet wearable, particularly as younger generations embrace new technology related to monitoring their pets' health and safety. There is also a growing demand for pet wearable that have GPS trackers, activity monitors, and health monitoring devices. More emphasis on health, safety, and convenience from pet owners is increasing the demand for pet wearable, propelling market growth. Preventive health for pets, combined with advancements in technology, is also driving the development of wearable that can track real-time health data, analyze activities, and send alerts in case of emergencies. This is encouraging continued innovation and growth in the United States pet wearable market as more pet owners aim for more personally tailored and proactive care solutions.

Europe Pet Wearable Market Analysis

The European pet wearable market has been witnessing increasing demand due to the rising numbers of pet owners along with a growing interest in pet personal care. As per FEDIAF European Pet Food, 90 million households in the EU own a pet, constituting 46% of the population, with a diverse range of pets including 110 million cats, 90 million dogs, and millions more. Now with pet owners more concerned over their pets' health and welfare, the demand is greater for bespoke, innovative solutions relating to pet care, including wearable. Personalization is also prominent in the pet care industry, in which owners are willing to invest in products specifically tailored according to the needs of their pet. An example is Sure Petcare launching SureFeed Connect, a line of smart feeders with RFID technology to feed each pet according to its needs. This is one of the reasons that the European market for pet wearable is growing at such a rapid rate, driven by the increasing trend of personalized pet care and technological innovation in pet wearable.

Asia Pacific Pet Wearable Market Analysis

As per industrial reports, in the well-developed countries of Asia Pacific, average annual expenditure per pet is estimated to be above USD 100 in the year 2024, particularly for cats and dogs. Singapore and Japan account for an expenditure of USD 195 and USD 101, respectively, with a higher spending in South Korea at USD 360 per pet. This increased expenditure reflects a growing commitment to pet health and well-being in the region. The Asia Pacific pet wearable market benefits greatly by this trend, where pet owners increasingly seek innovative products that can monitor their pets' health, activity, and safety. Drivers for the market include increased pet ownership, primarily in urban locations, improved awareness about pet health, and increased demand for higher technologies such as GPS tracking, health monitoring, and fitness tracking devices. In addition to this, increased disposable incomes and the rising humanization of pets are helping create a growing market for premium products, including wearable for pets. Since the trend of adopting technology is growing and innovative personalized pet care solutions are being introduced, Asia Pacific will continue to emerge as a favorable market for pet wearable.

Latin America Pet Wearable Market Analysis

Several factors are contributing to the growth of the Latin American pet wearable market, with Brazil leading the industry. The country has a very large population of pets numbering almost 168 million and currently ranks third globally in pet ownerships according to a research study. Since the onset of the COVID-19 pandemic in 2020, Brazil has reported a consistent rise in its pets, mainly dogs, exceeding the count of children in individual homes. Such an increase is driving demand for innovative pet products. wearable top the chart as owners want to improve their pets' health, safety, and overall lifestyles. The growth in disposable incomes and an increasing interest in pet care technology are also promoting the adoption of pet wearable. As more Brazilian and Latin American pet owners consider the health of their pets as of prime importance and prioritize real-time monitoring solutions, the pet wearable market is expected to witness continued growth in the region.

Middle East and Africa Pet Wearable Market Analysis

In the Middle East and Africa, the pet wearable market is growing rapidly as pet ownership in these regions increases. For instance, in Saudi Arabia, cat ownership has significantly increased lately as people become aware of the impact their pets have on mental health and well-being. The country reportedly has about 100,000 to 150,000 stray cats as estimated from the records compiled by International Cat Care. Moreover, with favorable climate in most parts, the breeding season persists throughout the year and contributes much to pet growth. As for the UAE, "Kitten Season" is throughout the year in the country as the climatic conditions are moderate here, encouraging constant reproduction. An increasing number of people are raising pets, which is generating the demand for new pet products, including health, location, and activity monitoring wearable. As pet owners in the region become more invested in their animals' well-being, the pet wearable market is continually growing, driven by an increased need for advanced solutions for pet care.

Competitive Landscape:

Key players in the pet wearable market are driving growth through innovation, strategic collaborations, and expanded product portfolios. Companies are integrating advanced technologies such as Internet of Things (IoT), GPS, and artificial intelligence (AI) into their products, offering features such as real-time tracking, health monitoring, and behavioral analysis. Partnerships with veterinary clinics and pet care providers are also enhancing product accessibility and credibility. Moreover, numerous industry players are focusing on developing user-friendly mobile apps that provide insights and recommendations for pet owners. Furthermore, investments in research and development (R&D) are fostering the creation of lightweight, durable, and multi-functional wearable. Besides this, targeted marketing campaigns and expansion into emerging markets are helping these companies reach a broader consumer base, thus influencing the market.

The report provides a comprehensive analysis of the competitive landscape in the pet wearable market with detailed profiles of all major companies, including:

- Cybortra Technology Co. Ltd.

- Dogtra

- FitBark Inc.

- Garmin Ltd.

- High Tech Pet Products Inc.

- Invisible Fence Inc. (Radio Systems Corporation)

- Loc8tor Ltd.

- Motorola (Lenovo)

- Petcube

- PetPace Ltd.

- Tractive

- Whistle Labs Inc. (Mars Inc.)

Latest News and Developments:

- March 2024: PetPace announced the availability of PetPace 2.0, a vet-endorsed AI-powered Canine Pet Collar providing real-time, life-saving medical insights for researchers, vets, and pet owners. The PetPace collar gathers various data points and uses varied analytics to identify health concerns and report them in real-time.

- January 2024: PETREK has unveiled the Petrek GPS-4, a successor to the Petrek 3G. The new model offers numerous advantages, such as support for 4G and 4G LTE, besides 3G as a backup network. It also offers lower batter consumption, reduced working heat temperature, and better accuracy.

Pet Wearable Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Smart Collar, Smart Vest, Smart Harness, Smart Camera, Others |

| Technologies Covered | GPS, RFID, Sensors, Others |

|

Applications Covered |

Identification and Tracking, Monitoring and Control, Medical Diagnosis and Treatment, Facilitation, Safety and Security |

| End-Users Covered | Households, Commercial |

| Distribution Channels Covered | Modern Trade, Franchised Outlets, Specialty Stores, E-Commerce, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cybortra Technology Co. Ltd., Dogtra, FitBark Inc., Garmin Ltd., High Tech Pet Products Inc., Invisible Fence Inc. (Radio Systems Corporation), Loc8tor Ltd., Motorola (Lenovo), Petcube, PetPace Ltd., Tractive and Whistle Labs Inc. (Mars Inc.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pet wearable market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pet wearable market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the pet wearable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

A pet wearable is a device designed to monitor and enhance the well-being of pets through advanced technology. These devices include collars, tags, or harnesses and feature capabilities such as GPS tracking, activity monitoring, and health diagnostics. Integrated with mobile apps or cloud platforms, pet Wearable provide real-time data, helping owners ensure the safety, health, and overall quality of life of their pets.

The pet wearable market was valued at USD 2.8 Billion in 2025.

IMARC estimates the global pet wearable market to exhibit a CAGR of 10.58% during 2026-2034.

The increasing pet ownership and humanization of pets worldwide, advancements in wearable technologies, including IoT and AI integration, growing awareness about pet health, safety, and preventive care, rising demand for GPS tracking and activity monitoring devices, and expansion of e-commerce facilitating easy product access are the primary factors driving the global pet wearable market.

According to the report, smart collar represented the largest segment by component due to its multifunctionality, offering GPS tracking, activity monitoring, and health diagnostics in a single device.

RFID leads the market by technology due to its cost-effectiveness and reliability in providing permanent identification for pets.

Identification and tracking is the leading segment by application as it ensures pet safety through real-time location monitoring and secure identification.

Households exhibit a clear dominance by end user due to rising pet ownership and the growing focus on pet health and safety.

Specialty stores lead the market by distribution channel as they offer curated, high-quality products tailored to the specific needs of various pet owners.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global pet wearable market include Cybortra Technology Co. Ltd., Dogtra, FitBark Inc., Garmin Ltd., High Tech Pet Products Inc., Invisible Fence Inc. (Radio Systems Corporation), Loc8tor Ltd., Motorola (Lenovo), Petcube, PetPace Ltd., Tractive and Whistle Labs Inc. (Mars Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)