Pet Grooming Market Size, Share, Trends and Forecast by Product Type, Pet Type, Distribution Channel, and Region, 2025-2033

Pet Grooming Market Size and Trends:

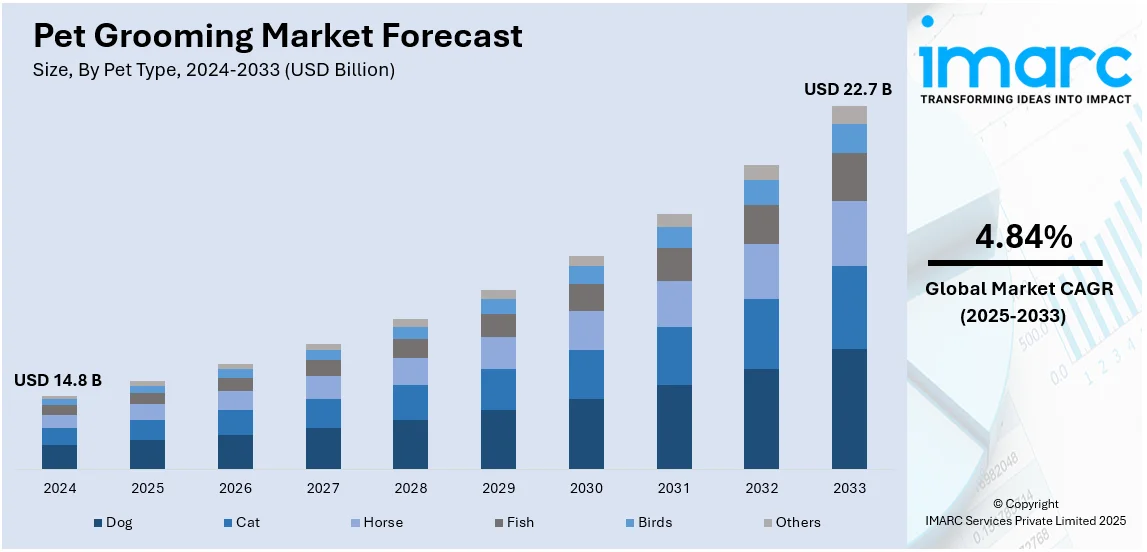

The global pet grooming market size was valued at USD 14.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.7 Billion by 2033, exhibiting a CAGR of 4.84% during 2025-2033. North America currently dominates the pet grooming market share by holding over 43.7% in 2024. The growing awareness among individuals toward pet health, the elevating consumer preference for premium-quality hygiene products, and the easy availability of pet grooming products via online and e-commerce retail platforms are some of the primary factors augmenting the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.8 Billion |

|

Market Forecast in 2033

|

USD 22.7 Billion |

| Market Growth Rate (2025-2033) | 4.84% |

The increasing adoption rates of pets and increased awareness among pet owners about the health and cleanliness benefits of grooming boost the global pet grooming market demand. The rise of cities and increased disposable income make pet owners spend more on quality grooming products and services. The growing humanization of pets has raised a wide variety of grooming products that have emerged on the market including shampoos, conditioners, brushes, and clipping instruments. In addition, technological innovations in this sector; self-cleaning brushes, and clever grooming instruments propel further developments in the pet grooming markets. Increased development in online market platforms especially within the emerging regions increases pet grooming products reach. As per the India Brand Equity Foundation (IBEF), the e-commerce industry in India is expected to reach USD 163 Billion by 2026.

The United States is a critical market disruptor, with the rising pet ownership levels and the trend of 'pet humanization', where pets are treated as family members, stimulating the United States pet grooming market growth. Rising awareness about animal health and hygiene among pet owners is driving demand for regular pet grooming services and premium products. The pet salon chain and mobile grooming services cater to the convenience needs of a busy pet parent. The availability of the latest grooming tools and technologies is also responsible for market growth, which includes self-cleaning brushes and pet-friendly grooming kits. Social media effects, as it depicts well-groomed pets, and the need for premium services has been further enhanced due to such media influence.

Pet Grooming Market Trends:

Emergence of pet grooming services

The rising popularity of mobile pet grooming services is one of the primary factors propelling the pet grooming market trends. According to the Press Information Bureau (PIB), smartphone users increased from 150 Million to 750 Million in India. Key providers are developing customized and specialized stations and vehicles to offer doorstep services to pet owners, thereby enhancing convenience. For instance, Aussie Pet Mobile offered various services, such as pickup and drop, effective care and grooming of pets, location-specific services, etc. In line with this, in 2023, Village Pet Care introduced enhanced pet care services with the help of investments made by General Atlantic. Besides this, the rising number of luxury pet resorts is also providing a positive outlook to the overall global pet grooming market growth. For instance, Wag Hotels, which provides various pet grooming-related services, opened a luxury pet resort in March 2023.

Rising trend of pet humanization

The pet grooming market size is significantly driven by the growing trend of pet humanization, where pets are treated as family members. According to the National Pet Owner's Survey conducted in 2024 by the American Pet Products Association (APPA) in the United States reported that almost 82 Million households have a pet. As a result, the inflating expenditure capacities of individuals on pet care have increased the demand for pet grooming products and services.

Introduction of premium pet grooming products

Individuals across the globe are becoming informed regarding the health and well-being of their pets. In line with this, they recognize that the quality of grooming products can directly impact the skin health, hygiene, and overall comfort of their pets. Consequently, the widespread adoption of premium pet grooming products that offer enhanced efficacy and safety is providing a positive outlook to the market. For instance, Wahl Animal developed a line of premium dog grooming tools. These tools were specifically designed to offer high-quality grooming results and make the grooming process more efficient. Moreover, Wahl's dog grooming products include trimmers, clippers, and combo sets. Furthermore, Ryan's Pet Supplies introduced the Low-Low Grooming Table, which aimed to elevate the grooming experience and offer convenience for both groomers and pets. In line with this, they also improved their cage banks, which offered a better solution for pet containment during grooming sessions. This, in turn, is expected to catalyze the future of the pet grooming market outlook over the forecasted period.

Pet Grooming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pet grooming market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, pet type, and distribution channel.

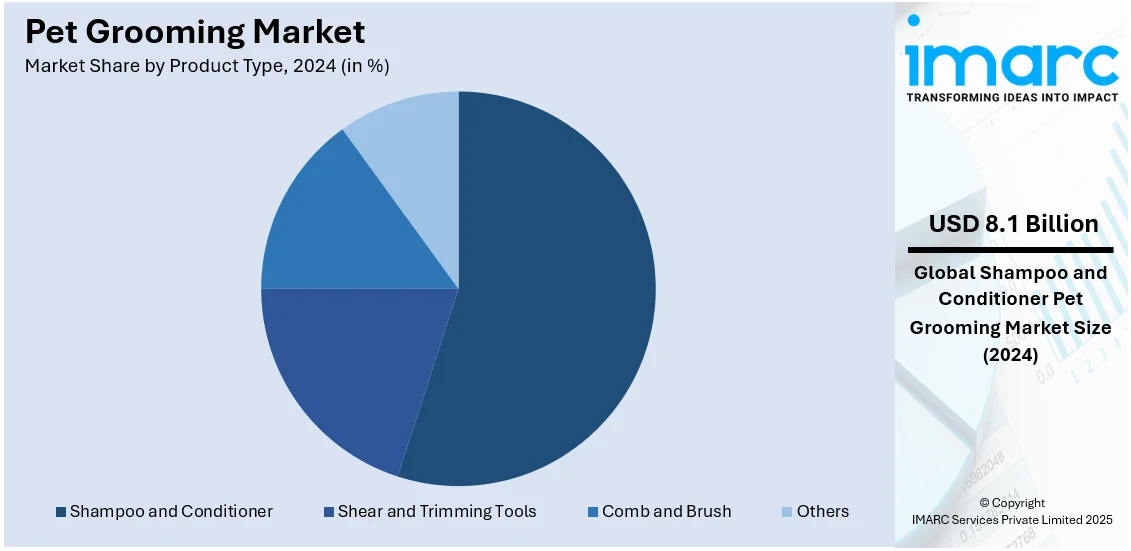

Analysis by Product Type:

- Shampoo and Conditioner

- Shear and Trimming Tools

- Comb and Brush

- Others

Shampoo and conditioner stand as the largest component in 2024, holding around 54.8% of the market. Shampoo and conditioner are important for routine pet maintenance. Shampoo aids in removing dirt, odors, and excess oils, while conditioners enhance the texture and manageability of the coat. Apart from this, shampoo and conditioner products are commonly available in a wide range of formulations, catering to the specific needs of various coat types. Leading players are introducing organic shampoo and conditioners for pets, which will continue to drive the segment in the coming years. For instance, in August 2021, Pure and Natural Pet launched a latest product at SuperZoo. The new product was the United States Department of Agriculture (USDA) Certified Organic 2-in-1 Fragrance-Free Hypoallergenic Shampoo and Conditioner.

Analysis by Pet Type:

- Dog

- Cat

- Horse

- Fish

- Birds

- Others

Dogs lead the market with around 45.0% of global pet grooming market share in 2024. Individuals are adopting dogs as their pets as they feel more secure with them and form unconditional friendships. Moreover, dogs' ability to adapt to their owners' routines is elevating their adoption across the globe. For example, from 2017 to 2018, 85% of pet owners in the United States viewed dogs as family members. In line with this, according to a report, in 2020, pet parents in China treated their dogs as family members, accounting for 82.8% of the total pet population.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Retail Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 45.4% of market share in 2024. Supermarkets and hypermarkets are the dominant distribution channels in the pet grooming market. In recent times, specialty stores are also gaining prominence across the world. For instance, PetSmart was the largest pet specialty retail chain in North America in terms of store count, with a total of 1,669 stores.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 43.7%. According to the pet grooming market statistics, the rising number of pet parents who are spending pet grooming products for the well-being, appeal, and safety of their pets is primarily augmenting the regional market. For instance, as per the American Pet Productions Association (APPA), in 2021, the US pet care industry expenditures crossed USD 123.6 Billion, which was a 19.3% increase from the previous year. Moreover, favorable initiatives by associations, such as the National Groomer Association Canada, are contributing to the growth of the pet grooming market in North America.

Key Regional Takeaways:

United States Pet Grooming Market Analysis

In 2024, the United States accounts for over 79.85% of the pet grooming market in North America. Rising pet ownership across the United States is driving the pet grooming market. The American Veterinary Medical Association has indicated that between 1996 and 2024, the number of dogs has consistently grown from 52.9 Million to a record high of 89.7 Million. In this regards, the cat population went relatively stable over the past years, and increased by 59.8 Million in 1996 to 73.8 Million in 2024. Also, in 2006, there was a peak in population by 81.7 Million cats. Also, as pet grooming services are widely expanding, growth is induced through the increasing adoption of mobile grooming vans that allow pet owners to receive convenient and personal services. For example, in 2021, Alpha Grooming Pet Salon, one of the most prominent mobile dog and cat grooming companies, opened up operations in the Sacramento, California area, which it plans to take the company to cover the whole state. Besides that, the company has also been ranked as one of the "Top 3 Mobile Pet Grooming Companies in the US," the company used over 50 state-of-the-art grooming vans and professional groomers, successfully servicing over 200 cities in California.

Asia Pacific Pet Grooming Market Analysis

Growing urban lifestyles in Asia Pacific are supporting this increasing increase in pets. This subsequently is motivating the pet grooming market. As per National Bureau of Statistics of China, by 2023 year-end national population was recorded as 1,409 Million wherein urban permanent residents were estimated to have been 932 Million. Economic development in this region is, therefore, contributing towards increased spends on pet care and products for grooming. The India Brand Equity Foundation reports that Indian rich households earn over ₹2 crore per annum, which translates to USD 242,709 per year. This figure increased from USD 1.06 Million in 2016 to 1.8 Million in 2021. Therefore, growing involvement in pet competitions across the region is increasing demand for professional grooming services.

Europe Pet Grooming Market Analysis

This drives up the demand for grooming products of good quality by Europeans, who consider pets to be family. Currently, reports indicate that Europe is experiencing growth in the ownership of companion animals such that 90 Million households own one (46%) thus causing market values related to the services and products offered to be above 20 Billion EUR or 21 Billion USD. Further impetus to this growth is provided by online sales of pet grooming products in Europe. According to the European Commission, as of 2022, 45.9% of large enterprises conducted e-sales, contributing 22.9% of their overall turnover within the size category. Medium-sized enterprises saw 30.2% participating in e-sales that accounted for 15.1% of their total turnover. On the other hand, 20.8% of small enterprises were engaged in e-sales, which accounted for 8.1% of their total turnover. In addition, the growth of mobile and at-home pet grooming services is also contributing to the growth of the pet grooming industry in Europe as pet owners increasingly seek convenient and personalized grooming solutions for their pets.

Latin America Pet Grooming Market Analysis

Pet ownership across the Latin American region is driving the pet grooming market. The United States Department of Agriculture has reported that in 2022, Brazil saw a 3.6% increase in its population of pets, with a total of 167.6 Million pets. This means there were nearly four pets for every five people in the country. Additionally, dogs proved to be the most popular pet, making up 40% of the total population of pets. Apart from that, growing disposable incomes throughout the region is driving the pet grooming market.

Middle East and Africa Pet Grooming Market Analysis

Increasing urbanization and rising western influence across this region are fueling pet grooming market. According to the Central Intelligence Agency (CIA), 68.8% of the total population in the year 2023 in South Africa resided in urban areas. In line with this, 87.8% of the total population in the year 2023 in the United Arab Emirates (UAE) resided in urban areas. In addition, the growing preference for cats and dogs as pets across this region are contributing to the pet grooming market.

Competitive Landscape:

Major participants in the pet grooming industry are proactively fostering expansion by implementing creative strategies and developing new products. They are putting money into research and development to produce sophisticated grooming tools and environmentally friendly products that meet changing consumer demands for sustainability and safety. Businesses are broadening their product ranges with natural and organic grooming options to attract health-aware pet owners. Partnerships with veterinary specialists and dermatologists assist brands in guaranteeing the effectiveness and safety of their products. Digital transformation is also a priority, as major companies utilize e-commerce platforms and direct-to-consumer methods to improve product availability and connect with a wider audience. Marketing initiatives, frequently employing social media influencers and pet-focused content, enhance awareness regarding grooming advantages and foster brand loyalty.

The report provides a comprehensive analysis of the competitive landscape in the pet grooming market with detailed profiles of all major companies, including:

- Ancol Pet Products Limited

- Beaphar

- Ferplast S.p.A.

- Groomer's Choice

- Johnson’s Veterinary Products Ltd.

- Petco Animal Supplies Inc.

- Rolf C. Hagen Inc.

- Rosewood Pet Products

- Ryan's Pet Supplies

- The Hartz Mountain Corporation (Unicharm Corporation)

- Wahl Clipper Corporation

Latest News and Developments:

- March 2024: Pet Valu, a leading Canadian specialty retailer of pet food and pet-related supplies, launched Exceed, a premium health and wellness brand aimed at dedicated pet owners seeking products that promote their pets' health, beauty, and comfort. Initially, Exceed introduced a 14-item grooming portfolio, featuring essential oils, vitamins, and superfood extracts, offering targeted solutions designed to enhance the overall well-being of dogs.

- March 2024: Nutravet announced the successful launch of their new range of grooming products under the brand name Pet’s Choice. The Pet’s Choice products were developed with a focus on pets' well-being, extending beyond basic grooming to offer dermatology-focused solutions specifically formulated to soothe and support the health of a pet’s skin and coat.

- November 2024: Paris Hilton, in collaboration with her next-generation media and lifestyle company, 11:11 Media, successfully launched her debut pet grooming collection, developed by Kira Labs. Moreover, it is crafted in the USA with premium ingredients and the collection provides gentle and effective grooming solutions, enabling pet owners to pamper their pets at home.

Pet Grooming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shampoo and Conditioner, Shear and Trimming Tools, Comb and Brush, Others |

| Pet Types Covered | Dog, Cat, Horse, Fish, Birds, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Retail Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ancol Pet Products Limited, Beaphar, Ferplast S.p.A., Groomer's Choice, Johnson’s Veterinary Products Ltd., Petco Animal Supplies Inc., Rolf C. Hagen Inc., Rosewood Pet Products, Ryan's Pet Supplies, The Hartz Mountain Corporation (Unicharm Corporation), Wahl Clipper Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pet grooming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pet grooming market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pet grooming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pet grooming refers to the hygienic care and cleaning of a pet, including activities such as bathing, brushing, nail trimming, ear cleaning, and fur styling, to maintain their health and appearance.

The pet grooming market was valued at USD 14.8 Billion in 2024.

IMARC estimates the global pet grooming market is expected to reach USD 22.7 Billion by 2033, exhibiting a CAGR of 4.84% during 2025-2033.

The pet grooming market is driven by rising pet ownership, rising awareness about pet hygiene, increasing humanization of pets, and growing demand for eco-friendly and premium grooming products and services.

According to the report, shampoo and conditioner represented the largest segment by product type, driven by their essential role in maintaining pet hygiene, preventing skin issues, and catering to the high demand for breed-specific and natural formulations.

Dogs lead the market by pet type due to their higher grooming needs, such as regular bathing, fur maintenance, and nail trimming, coupled with their widespread popularity as pets and owners’ willingness to invest in their care.

Supermarkets and hypermarkets hold the maximum number of shares due to their wide product selection, competitive pricing, and convenience, making them a one-stop destination for pet grooming products.

North America currently dominates the pet grooming market, accounting for a share exceeding 43.7% in 2024. This dominance is fueled by the rising demand for increasing pet ownership, rising awareness about pet hygiene, and growing disposable incomes.

Some of the major players in the global pet grooming market include Ancol Pet Products Limited, Beaphar, Ferplast S.p.A., Groomer's Choice, Johnson’s Veterinary Products Ltd., Petco Animal Supplies Inc., Rolf C. Hagen Inc., Rosewood Pet Products, Ryan's Pet Supplies, The Hartz Mountain Corporation (Unicharm Corporation), Wahl Clipper Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)