PET Bottle Recycling Market Size, Share, Trends and Forecast by Recycling Process, Application, and Region, 2025-2033

PET Bottle Recycling Market Size and Share:

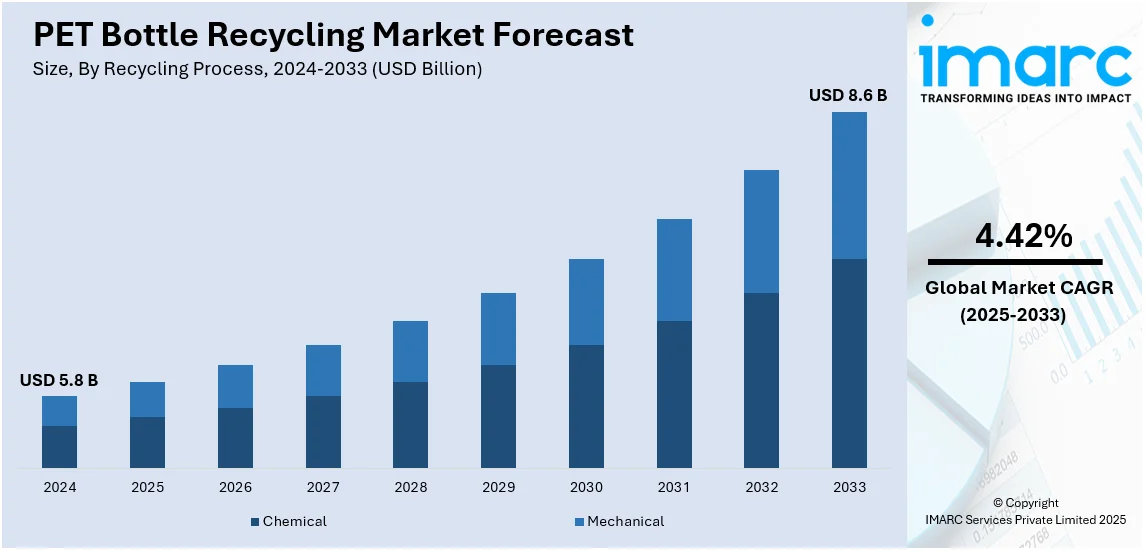

The global PET bottle recycling market size was valued at USD 5.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.6 Billion by 2033, exhibiting a CAGR of 4.42% from 2025-2033. North America currently dominates the market, holding a significant PET bottle recycling market share of over 34.7% in 2024. The rising consumer awareness regarding the recycling and reuse of PET bottles, increasing demand for recycled PET in the food and beverage (F&B) industry, and introduction of artificial intelligence (AI)-enabled robotics in recycling process represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Market Growth Rate (2025-2033) | 4.42% |

The "Accelerating a Circular Economy for Plastics and Recycling Innovation Act" aims to mandate 30% recycled content in plastic packaging by 2030, reinforcing the growing demand for recycled PET (rPET). Beverage and consumer goods companies are integrating rPET into packaging to align with sustainability targets and comply with evolving regulations. Governments worldwide are strengthening plastic recycling mandates, driving businesses toward circular economy practices. Consumer preferences for eco-friendly products further push brands to adopt rPET, increasing its use across industries. The textile sector also plays a crucial role, utilizing recycled PET fibers in clothing, carpets, and upholstery. This rising demand is accelerating investments in collection and processing infrastructure, expanding the PET bottle recycling market through regulatory support and corporate sustainability commitments.

The U.S. PET bottle recycling market is expanding due to sustainability initiatives, corporate commitments, and government regulations. The U.S market currently holds a total share of 92.50%. Beverage companies are increasing recycled PET (rPET) content, with the average post-consumer rPET in U.S. bottles and jars rising to 16.2% in 2023 from 13.2% in 2022. State policies like California’s minimum recycled content law are driving higher recycling rates, encouraging manufacturers to adopt circular economy practices. Advances in collection and sorting technologies are improving recycling efficiency, strengthening domestic rPET supply. However, challenges such as contamination and inadequate infrastructure persist. Despite this, rising investments in mechanical and chemical recycling are positioning the U.S. as a key player in PET recycling, with growing applications in packaging, textiles, and industrial sectors.

PET Bottle Recycling Market Trends:

Growth of Chemical Recycling Technologies

Chemical recycling is emerging as a crucial trend in PET bottle recycling, offering a solution to the limitations of mechanical recycling. While PET is 100% recyclable, only 28% of PET bottles are currently recycled in residential systems, highlighting inefficiencies in traditional methods. Unlike mechanical recycling, which degrades PET quality over multiple cycles, chemical recycling breaks PET down into its original monomers, enabling infinite reuse without loss of integrity. Leading corporations are investing in depolymerization technologies to enhance recycled PET (rPET) supply and improve recycling rates. This method also tackles contamination issues, allowing the processing of colored and lower-quality PET. With growing regulatory support and corporate sustainability commitments, chemical recycling is set to play a key role in advancing circular economy goals.

Expansion of Deposit Return Schemes (DRS)

Another major PET bottle recycling market trends is the Deposit Return Schemes (DRS) are becoming a widespread trend in PET bottle recycling, driven by government policies and industry initiatives to increase collection rates. Under these programs, consumers pay a refundable deposit when purchasing PET bottles, which incentivizes returns for recycling. Countries and U.S. states implementing or expanding DRS have seen significantly higher recycling rates and reduced landfill waste. Retailers and beverage companies are also supporting these schemes as part of sustainability commitments. Additionally, advancements in reverse vending machines and digital tracking systems are improving efficiency in bottle returns. As more regions adopt DRS, the PET recycling ecosystem strengthens, ensuring a steady supply of high-quality post-consumer PET for manufacturing industries.

Increasing Corporate Commitments to rPET Usage

Leading beverage, food, and personal care brands are setting ambitious targets for incorporating recycled PET (rPET) into their packaging, driving demand in the recycling market. PepsiCo aims to achieve 50% recycled content in its plastic packaging, while Coca-Cola and Nestlé are also increasing rPET usage to meet sustainability goals and comply with regulations. These commitments align with growing consumer demand for eco-friendly packaging and circular economy principles. As a result, the PET recycling industry is expanding to supply high-quality, food-grade rPET. Collaborations between brands, recyclers, and policymakers are accelerating infrastructure investments and technological advancements. These efforts are strengthening global PET recycling capabilities, enhancing sustainability, and reducing plastic waste across various industries.

PET Bottle Recycling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global PET bottle recycling market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on recycling process and application.

Analysis by Recycling Process:

- Chemical

- Mechanical

According to the PET bottle recycling market forecast, the mechanical recycling dominates the PET bottle recycling market due to its cost-effectiveness, established infrastructure, and lower environmental impact compared to chemical recycling. This process involves collecting, sorting, cleaning, and reprocessing PET bottles into recycled PET (rPET) without altering their chemical structure. The simplicity and efficiency of mechanical recycling make it the preferred choice for beverage, packaging, and textile industries seeking sustainable materials. Additionally, stringent regulations mandating higher recycled content in packaging and growing corporate sustainability commitments drive demand for mechanically recycled PET. Despite challenges such as contamination and quality degradation over multiple cycles, continuous technological advancements in sorting and processing improve efficiency. As global demand for rPET rises, mechanical recycling remains the leading method for sustainable PET bottle reuse.

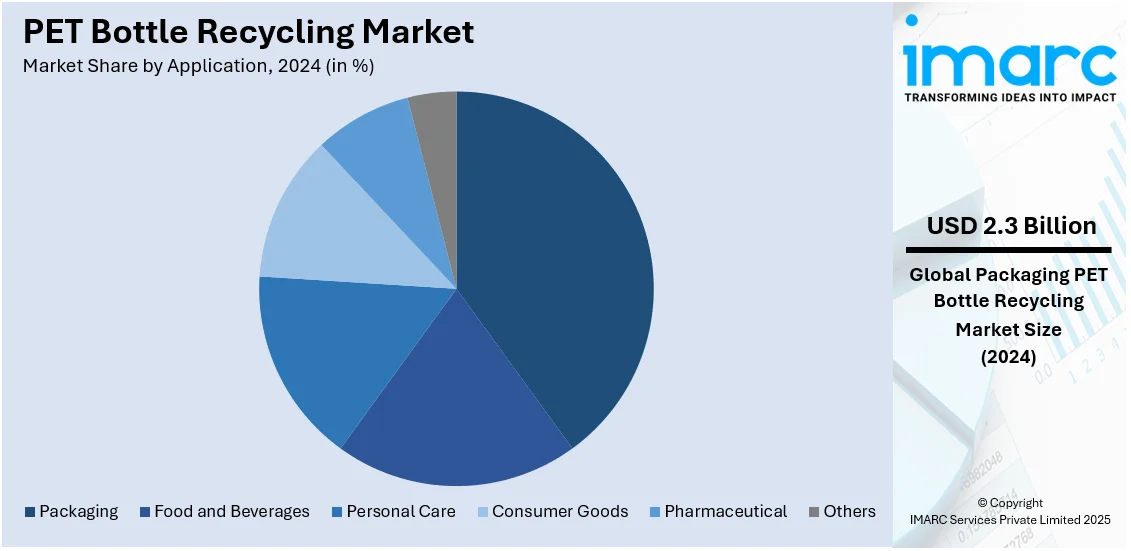

Analysis by Application:

- Food and Beverages

- Packaging

- Personal Care

- Consumer Goods

- Pharmaceutical

- Others

The packaging sector holds the largest share of the PET bottle recycling market at 40.2% due to increasing demand for recycled PET (rPET) in food, beverage, and personal care packaging. Stringent government regulations mandating higher recycled content in plastic packaging drive adoption, while leading brands commit to sustainability goals by incorporating rPET into their products. Consumer preferences for eco-friendly packaging further bolstering the PET bottle recycling market growth, encouraging companies to replace virgin PET with recycled alternatives. Additionally, advancements in recycling technology enhance rPET quality, making it suitable for food-grade applications. The expansion of circular economy initiatives and deposit return schemes ensures a steady supply of post-consumer PET, reinforcing packaging as the dominant application in the PET bottle recycling market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the largest share of the PET bottle recycling market at 34.7% due to well-established recycling infrastructure, strict government regulations, and strong corporate sustainability commitments. State-level policies, such as minimum recycled content mandates and deposit return schemes, encourage high collection and recycling rates. Leading consumer brands actively incorporate recycled PET (rPET) into packaging to meet environmental targets and consumer demand for sustainable products. Additionally, investments in advanced recycling technologies, including chemical recycling, enhance efficiency and improve rPET quality. Growing public awareness and participation in recycling programs further aiding the PET bottle recycling market demand. As demand for high-quality rPET rises across packaging, textiles, and industrial applications, North America continues to dominate the PET bottle recycling sector.

Key Regional Takeaways:

United States PET Bottle Recycling Market Analysis

The PET bottle recycling market in the US is driven by growing environmental awareness and government regulations. According to US EPA, in 2018, plastics generation in the United States amounted to 35.7 Million Tons, representing 12.2% of municipal solid waste (MSW) generation, highlighting the need for effective recycling solutions. Policies such as extended producer responsibility (EPR) and bottle deposit schemes have significantly impacted recycling rates. Additionally, there is a strong push from both the private sector and consumers to reduce plastic waste, with increasing demand for sustainable packaging solutions. Companies are investing in advanced recycling technologies, such as chemical recycling and enhanced sorting systems, to improve PET recovery rates and product quality. Moreover, the rising emphasis on the circular economy model has accelerated the demand for recycled PET (rPET) in manufacturing processes. Consumer preference for eco-friendly products, coupled with the increasing adoption of sustainability initiatives by major corporations, supports the growth of the recycling market. Increasing awareness of the harmful effects of plastic waste on ecosystems and wildlife further drives recycling activities, with many states implementing stricter recycling mandates to reduce landfill waste. The expansion of recycling infrastructure and collection systems across various regions in the US also facilitates PET bottle recycling market outlook.

Asia Pacific PET Bottle Recycling Market Analysis

In APAC, the PET bottle recycling market is driven by rapid urbanization, increasing plastic waste concerns, and government policies promoting recycling. According to The Energy and Resources Institute (TERI), India generates over 62 Million Tons (MT) of waste annually, with only 43 MT being collected and 12 MT treated before disposal, while the remaining 31 MT is discarded in wasteyards, underscoring the need for improved recycling infrastructure. Countries like Japan and South Korea have implemented strict recycling regulations and advanced waste management systems. Growing consumer preference for sustainable products has also contributed to the expansion of recycling practices. Additionally, significant investments in recycling infrastructure, particularly in emerging economies, are boosting the market’s growth potential. Public awareness campaigns further accelerate the adoption of PET recycling technologies, driving market development across the region.

Europe PET Bottle Recycling Market Analysis

The European PET bottle recycling market is significantly influenced by stringent environmental regulations and EU directives aimed at reducing plastic waste. According to the European Union, more than three-quarters of Europeans (78%) agree that environmental issues directly impact their daily lives and health, underscoring the rising demand for sustainable solutions. Policies such as the European Plastics Strategy and the Single-Use Plastics Directive have established clear recycling targets, compelling companies to invest in sustainable practices. Additionally, 84% of EU respondents believe that EU environmental legislation is essential for protecting the environment in their country, reinforcing the commitment to recycling initiatives. The push for a circular economy has encouraged widespread adoption of recycled PET (rPET) in packaging and manufacturing. Consumer demand for eco-friendly products is a driving force, as consumers become more conscious of the environmental impacts of plastic waste. Companies are increasingly implementing closed-loop systems, improving collection infrastructure, and investing in innovative technologies to increase recycling efficiency. Furthermore, collaboration between governments, industries, and NGOs plays a crucial role in establishing effective recycling programs, while the high level of environmental awareness in countries like Germany, the UK, and France strengthens the market further. The growing commitment to using recycled content in packaging and production processes further contributes to the market's PET bottle recycling market share.

Latin America PET Bottle Recycling Market Analysis

In Latin America, the PET bottle recycling market is driven by regulatory changes and increased environmental awareness. Also, companies are expanding their bases in the region owing to increased PET recycling. For instance, in 2023, Indorama Ventures anticipates 16,000 Tons increase in PET recycling capacity as the Brazil facility completes expansion · Several countries have begun implementing stricter recycling laws, creating incentives for recycling practices. As public concern over plastic waste grows, there is rising demand for recycled PET in packaging and other industries, driving market expansion.

Middle East and Africa PET Bottle Recycling Market Analysis

In the Middle East and Africa, the PET bottle recycling market is fueled by growing environmental concerns and urbanization. The Middle East beverage packaging market is projected to exhibit a growth rate (CAGR) of 4.27% during 2024-2032, driving increased demand for sustainable packaging solutions. Countries like South Africa are implementing stricter waste management laws, promoting recycling. Additionally, the demand for eco-friendly products from both consumers and industries is accelerating market growth. The International Trade Administration (ITA) also highlights the region's increasing focus on recycling, further enhancing the market's potential. Collaborative efforts across industries and governments are strengthening recycling initiatives.

Competitive Landscape:

The PET bottle recycling market features a highly competitive landscape driven by technological advancements, regulatory policies, and increasing demand for recycled PET (rPET). Industry players focus on expanding recycling capacities through mechanical and chemical processes to meet the rising sustainability targets of consumer brands. Strategic collaborations between recyclers, packaging firms, and government agencies are shaping market dynamics. Companies are also investing in advanced sorting and processing technologies to improve efficiency and reduce contamination in rPET production. Market competition is further intensified by regulatory pressures requiring higher recycled content in packaging. Additionally, innovation in collection systems, such as deposit return schemes and AI-driven sorting, is fostering growth. The competitive environment is expected to strengthen as demand for high-quality rPET rises globally.

The report provides a comprehensive analysis of the competitive landscape in the PET bottle recycling market with detailed profiles of all major companies, including:

- 9 Evergreen (Greenbridge)

- Indorama Ventures Public Company Limited

- Krones AG

- PFR Nord GmbH

- Phoenix Technologies International LLC (Far Eastern New Century Corporation)

- Plastipak Holdings, Inc.

- UltrePET, LLC (wTe Corporation)

Latest News and Developments:

- November 2024: Revalyu Resources has commissioned its second PET recycling plant in Nashik, India, increasing daily recycling capacity to over 20 Million PET bottles and production to 160 Tonnes. A third plant, part of a USD 100 Million investment, will add 120 Tonnes per day by Q3 2025. The site uses advanced glycolysis-based recycling technology, reducing water use by 75% and energy consumption by 91% compared to conventional PET production.

- November 2024: Indorama Ventures, Suntory, Neste, ENEOS, Mitsubishi Corporation, and Iwatani have launched the first commercial-scale bio-PET bottle made from used cooking oil. Suntory will distribute 45 Million bottles in Japan, with expansion planned. The ISCC+-certified process significantly reduces CO2 emissions. Mitsubishi oversees the supply chain, while Iwatani manages production and delivery. Indorama Ventures also collaborates with Dhunseri Ventures and Varun Beverages to establish PET recycling facilities in India, set for completion in 2025.

- September 2024: Race Eco Chain has announced a joint venture with Ganesha Ecosphere to establish PET washing plants in India. The partnership aims to convert PET bottles into reusable flakes, addressing the growing demand for recycled PET (rPET) driven by regulatory requirements, including a 30% recycled plastic mandate by 2025-2026. The joint venture, Ganesha Recycling Chain Pvt Ltd, will focus on meeting India's recycling needs as part of Environmental, Social, and Governance (ESG) efforts. The agreement is pending finalization.

- September 2024: Indorama Ventures, through its Indian subsidiaries, has partnered with Varun Beverages to develop PET recycling facilities in India. The joint venture is constructing two plants in Jammu and Kashmir and Odisha, aiming for a combined annual capacity of 100,000 metric tons of recycled PET. This initiative aligns with India's increasing demand for rPET, driven by regulatory requirements and sustainability commitments.

- October 2023: Coca-Cola India has expanded its use of 100% recycled PET (rPET) by launching Coca-Cola® in rPET bottles in 250 ml and 750 ml sizes. Manufactured by bottling partners Moon Beverages Ltd. and SLMG Beverages Ltd., these bottles are crafted from food-grade recycled PET and include a “Recycle Me Again” message to promote consumer awareness. This initiative is part of Coca-Cola's broader sustainability efforts under its World Without Waste program, which aims to make 50% of its bottles from recycled content by 2030.

PET Bottle Recycling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Recycling Processes Covered | Chemical, Mechanical |

| Applications Covered | Food and Beverages, Packaging, Personal Care, Consumer Goods, Pharmaceutical, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 9 Evergreen (Greenbridge), Indorama Ventures Public Company Limited, Krones AG, PFR Nord GmbH, Phoenix Technologies International LLC (Far Eastern New Century Corporation), Plastipak Holdings, Inc., UltrePET, LLC (wTe Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the PET Bottle Recycling market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global PET Bottle Recycling market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the PET Bottle Recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The PET bottle recycling market was valued at USD 5.8 Billion in 2024.

The PET bottle recycling market was valued at USD 8.6 Billion in 2033 exhibiting a CAGR of 4.42% during 2025-2033.

The PET bottle recycling market is driven by rising demand for recycled PET (rPET) in packaging and textiles, stringent government regulations promoting plastic recycling, and growing corporate sustainability commitments. Advancements in recycling technologies, increasing consumer awareness of environmental impact, and expanding deposit return schemes further accelerate market growth and infrastructure investments.

North America dominates the PET bottle recycling market with 34.7% share due to stringent recycling regulations, high consumer awareness, and strong corporate sustainability commitments. Advanced recycling infrastructure, widespread deposit return schemes, and increasing demand for recycled PET (rPET) in packaging and textiles further drive market growth in the region.

Some of the major players in the PET Bottle Recycling market include 9 Evergreen (Greenbridge), Indorama Ventures Public Company Limited, Krones AG, PFR Nord GmbH, Phoenix Technologies International LLC (Far Eastern New Century Corporation), Plastipak Holdings, Inc., UltrePET, LLC (wTe Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)