Personalized Nutrition and Supplements Market Size, Share, Trends and Forecast by Ingredient, Dosage Form, Distribution Channel, Aged Group, and Region, 2025-2033

Personalized Nutrition and Supplements Market Size and Share:

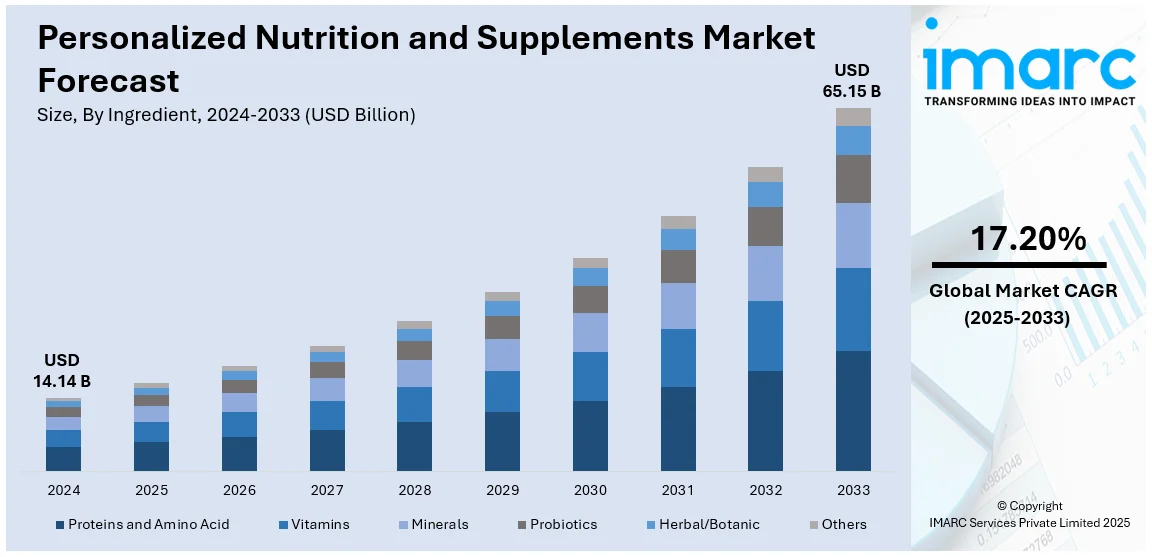

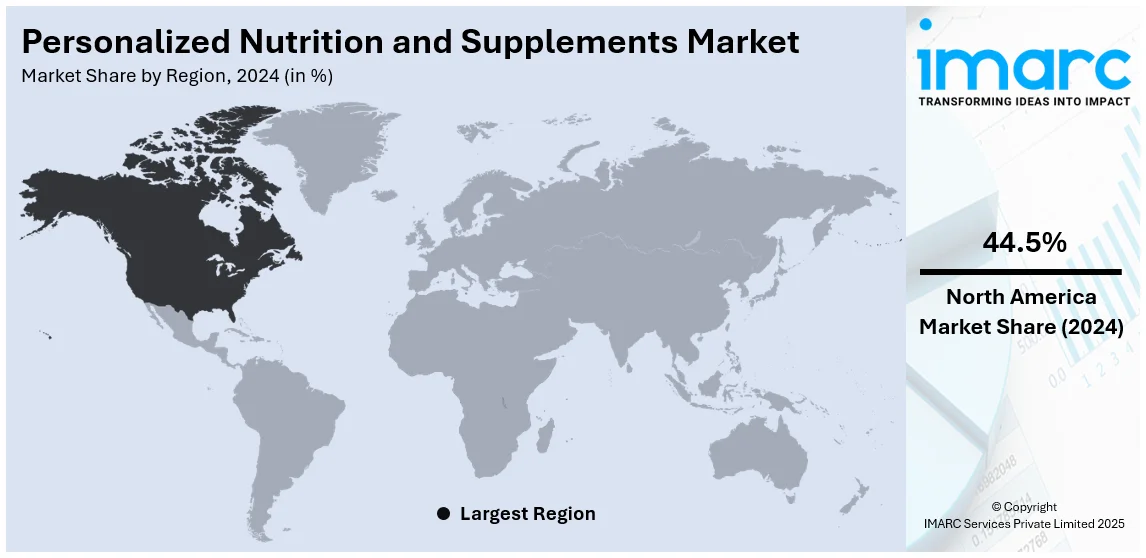

The global personalized nutrition and supplements market size was valued at USD 14.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 65.15 Billion by 2033, exhibiting a CAGR of 17.20% from 2025-2033. North America currently dominates the market, holding a market share of over 44.5% in 2024. The increasing consumer demand for tailored health solutions, growing awareness of the benefits of personalized diets, advancements in biotechnology, and the rise of digital platforms offering customized products based on individual health data are bolstering the market growth in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.14 Billion |

| Market Forecast in 2033 | USD 65.15 Billion |

| Market Growth Rate (2025-2033) | 17.20% |

A major driver in the global personalized nutrition and supplements market is the growing consumer awareness of health and wellness. As more people focus on maintaining a healthy lifestyle, there is a rising demand for products tailored to individual needs. Personalized nutrition allows consumers to address specific health concerns, such as weight management, digestive health, and immune support. Technological advancements are associated with genetic testing and data analysis. Because companies can offer custom products through the help of such advances that increase the efficacy of the supplements, personalized solutions form the trend of new changes in the nutritional area among consumers.

The U.S. holds a significant share in the global personalized nutrition and supplements market, driven by a high level of consumer awareness about health and wellness along with 84.50% market share. Also, the U.S. wellness market has grown to $480 billion and continues growing at 5 to 10 percent annually; 82 percent of U.S. consumers identify wellness as an important or one of the most important things that matter to them in their lives. Americans increasingly seek personalized solutions for weight management, immunity, and overall well-being, fueling demand for tailored products. Advancements in technology, such as deoxyribonucleic acid (DNA) testing and health tracking devices, enable precise formulations based on individual needs. The rise of digital platforms and e-commerce has further expanded access to customized nutrition solutions. Additionally, the U.S. benefits from a large base of health-conscious consumers and established companies investing in innovative, personalized nutrition products.

Personalized Nutrition and Supplements Market Trends:

Technological Advancements in Personalization

Technological innovations are revolutionizing the personalized nutrition and supplements market. Tools like DNA testing, microbiome analysis, and wearable health devices enable more accurate personalization of products based on individual genetics, health conditions, and lifestyle factors. In line with this, the U.S. millennial population surveyed, 49% showed a strong preference for products, services, or apps that use personal data to customize the consumer experience. In addition, 37% of Gen Z also preferred such customized products. Supplements are now available for every need of the consumer to increase efficacy. Companies use AI and data analytics to provide more accurate formulations and recommendations. This is one of the reasons for growth as it offers a science-based approach to nutrition that enables consumers to make decisions about their health. This further incorporates it with digital health platforms and enhances consumer engagement. Thus, personalized nutrition becomes more accessible and widespread.

Growing Consumer Demand for Preventive Health

Consumers are focusing increasingly on preventive health measures; this means that demand for customised nutrition and supplements targeted towards wellness rather than fixing a problem is growing. The general cultural trend today is proactive health management in which consumers are looking at supplements that prevent diseases, boost immunity, and augment energy. As people are getting healthier and more educated, they are turning to products that are tailored specifically to their needs. Personalized nutrition provides solutions tailored to specific issues like gut health, stress, and aging, which is the growing market as consumers are seeking products to enhance long-term vitality. Along with this, Preventive care in India gained importance post-COVID-19, addressing NCDs responsible for 66% of deaths in 2019. Overweight and obesity cost India over $35 billion annually, highlighting urgent health priorities.

Rise of E-commerce and Subscription Models

The growth of e-commerce and subscription-based models is transforming the personalized nutrition and supplements market. Online platforms enable consumers to access a wide range of personalized products, often with home delivery, enhancing convenience. Subscription services, where customers receive customized supplements regularly, have gained popularity, providing a steady revenue stream for companies and improving customer retention. These models are particularly attractive because they offer personalized convenience and ongoing health support. Additionally, e-commerce allows brands to collect valuable customer data, enabling further personalization. This trend has expanded the market’s reach, making personalized nutrition more accessible to a global audience.

Personalized Nutrition and Supplements Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global personalized nutrition and supplements market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on ingredient, dosage form, distribution channel, and age group.

Analysis by Ingredient

- Proteins and Amino Acid

- Vitamins

- Minerals

- Probiotics

- Herbal/Botanic

- Others

Vitamins leads the market with around 28.1% of market share in 2024 due to their essential role in maintaining overall health and addressing specific deficiencies. Growing consumer awareness about the importance of personalized health and wellness solutions has significantly boosted the demand for vitamins in tailored formulations. The increasing adoption of technologies like DNA testing and microbiome analysis has further enabled precise identification of individual vitamin requirements, enhancing the efficacy of these supplements. Additionally, the rise of e-commerce platforms and digital health solutions has made personalized vitamin products more accessible to a broader audience, cementing their position as the leading ingredient category.

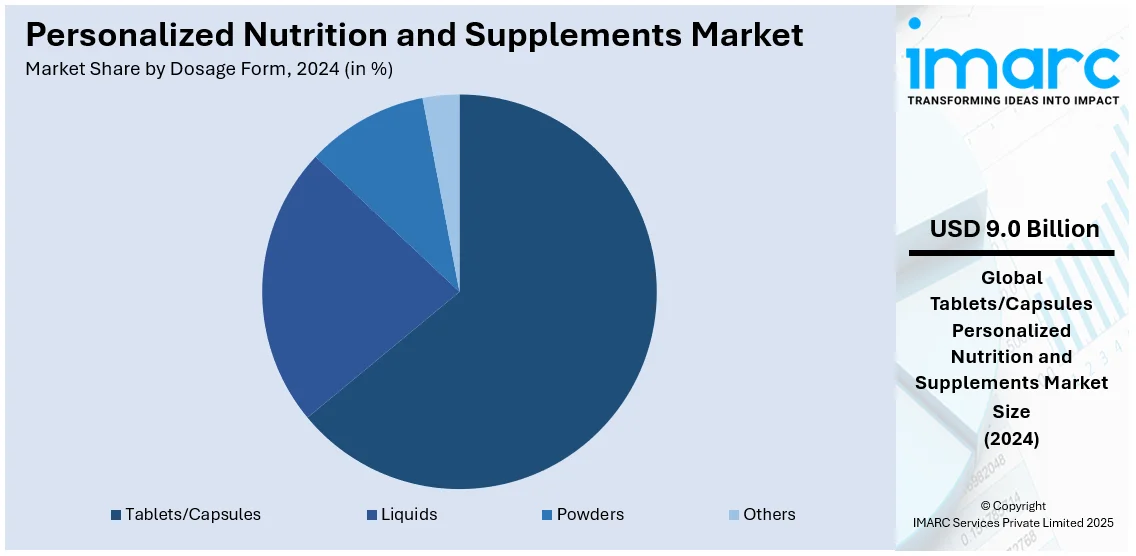

Analysis by Dosage Form

- Tablets/Capsules

- Liquids

- Powders

- Others

In 2024, tablets/capsules accounts for the majority of the market at around 63.5% driven by their convenience, ease of storage, and accurate dosage delivery. These forms are highly favored by consumers for their portability and extended shelf life compared to liquid or gummy alternatives. Their popularity has been further amplified through technology advancement, whereby specific formulations can be provided based on individual health requirements. Also, tablets and capsules offer a wider scope in terms of ingredients and formulations that can be utilized. Moreover, their widespread distribution both online and offline boosts their popularity, hence topping the market.

Analysis by Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Retail Pharmacies

- Online Pharmacies and E-Commerce Site

Supermarkets/hypermarkets represented the leading market segment, holding 42.7% of the total share owing to the convenience they offer, providing a wide variety of products under one roof, including leading brands and private-label options. These stores attract customers using the competitive price, discounting, and on-shelf inspection of products sold for building trust and assurance in the purchase. A strategic location in cities and suburbs increases accessibility for wide varieties of consumers. Also, partnerships with manufacturers to supply exclusive products allow tailor-made in-store experiences that cater to the tastes and preferences of customers. Online stores have also gained in recent years by integrating offline experience using click-and-collect facilities.

Analysis by Age Group

- Pediatric

- Adults

- Geriatric

Adults leads the market with around 43.5% of market share in 2024 driven by the growing emphasis on health and wellness among working-age individuals who face lifestyle-related health challenges, such as stress, fatigue, and nutrient deficiencies. Adults increasingly seek personalized solutions tailored to their specific needs, including weight management, immunity support, and energy enhancement. The segment benefits from advancements in health technologies like DNA testing and wearable devices, enabling precise recommendations for dietary supplements. Additionally, increased disposable incomes and health-conscious behaviors among adults contribute to higher spending on tailored nutritional products, fueling their leadership in this rapidly evolving market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 44.5% owing to the high consumer awareness of health and wellness, alongside a strong inclination toward preventive care solutions. The region's advanced healthcare infrastructure supports the integration of personalized technologies such as DNA testing and microbiome analysis, enabling tailored dietary recommendations. Additionally, the widespread adoption of digital health platforms and wearable devices further empowers consumers to make informed decisions regarding their nutrition. The prevalence of lifestyle-related health issues, such as obesity and diabetes, also drives demand for customized supplements. With a robust network of established companies and innovations in product offerings, North America maintains its leadership in this growing market.

Key Regional Takeaways:

United States Personalized Nutrition and Supplements Market Analysis

The United States personalized nutrition and supplements market is a significant player in the global industry, valued at approximately USD 9.5 billion in 2023. The market is projected to grow at a robust CAGR of 9.5% from 2024 to 2030. This growth is driven by increasing consumer demand for tailored health solutions and a growing focus on preventive health. Advances in technology, such as DNA testing, microbiome analysis, and wearable health devices, are enabling highly personalized supplements that cater to individual needs. These innovations help target concerns regarding weight management, immunity, and energy levels, giving nutrition a more directed and result-oriented approach. E-commerce platforms and subscription-based services have also made significant contributions to market growth by opening up easy avenues for people to access products that match their individual profiles. In the quest for convenience, reliability, and data-driven recommendations, the consumer demands are becoming ever more exacting. There is further the U.S. benefit of a large base of health-conscious individuals supported by biotechnology and personalized wellness well invested in by leading firms. This puts the United States as the industry leader in the market.

Europe Personalized Nutrition and Supplements Market Analysis

Europe’s personalized nutrition and supplements market is witnessing significant growth, valued at approximately USD 4.8 billion in 2023. The market is projected to expand at a CAGR of 8.7% from 2024 to 2030. A key driver of this growth is the increasing consumer awareness of the benefits of personalized health solutions. Countries like Germany, the UK, and France are leading the charge, with consumers actively seeking customized supplements for health optimization. This trend is fueled by advancements in genetic testing, which allow for more precise, individualized product offerings. Additionally, a shift towards natural, organic, and clean-label ingredients is influencing purchasing decisions, with consumers becoming more conscious of the quality and source of their supplements. Digital platforms offering personalized nutrition plans, along with the rise of wellness apps, are also contributing to the market’s expansion. Europe’s health-conscious demographic, combined with technological innovations, positions the region as a key market for personalized nutrition and supplements.

Asia Pacific Personalized Nutrition and Supplements Market Analysis

The Asia Pacific (APAC) personalized nutrition and supplements market is experiencing rapid growth, valued at approximately USD 2.5 billion by 2026. This expansion is driven by rising disposable incomes, urbanization, and increased awareness of preventive healthcare. Consumers in key markets such as China, India, and Japan are increasingly seeking customized solutions to meet their specific health needs, such as weight management, energy enhancement, and immunity support. Technological advancements, including the use of wearable devices, health apps, and genetic testing, are making personalized nutrition more accessible. Furthermore, there is growing demand for natural and organic products, reflecting a broader trend towards healthier lifestyles. The market is projected to continue growing as health-conscious consumers embrace personalized nutrition to optimize well-being.

Latin America Personalized Nutrition and Supplements Market Analysis

Latin America's personalized nutrition and supplements market, valued at approximately USD 1.2 billion in 2023, is experiencing steady growth. This expansion is driven by increasing consumer awareness of health and wellness, along with a rising demand for tailored nutrition solutions. Key countries such as Brazil, Mexico, and Argentina are central to this growth, fueled by better access to digital health platforms and a growing preference for natural and organic products. As consumers become more health-conscious and technology-driven, the market is projected to grow at a CAGR of 7.2% from 2024 to 2030.

Middle East and Africa Personalized Nutrition and Supplements Market Analysis

The Middle East and Africa personalized nutrition and supplements market is valued at approximately USD 450 million in 2023 and is projected to grow at a CAGR of 6.5% through 2030. Growing awareness of health and wellness, coupled with increasing disposable incomes in countries like the UAE and Saudi Arabia, is driving demand for customized nutritional solutions. Additionally, rising interest in preventive healthcare and the adoption of digital health technologies are contributing to market expansion.

Competitive Landscape:

The global personalized nutrition and supplements market is highly competitive, with numerous players offering a range of customized products. Key strategies driving competition include leveraging advanced technologies such as DNA testing, microbiome analysis, and artificial intelligence to create highly tailored solutions. Companies are increasingly focusing on enhancing consumer engagement through digital platforms, mobile apps, and e-commerce channels, providing personalized recommendations based on individual health data. The demand for natural, organic, and clean-label products is intensifying, prompting brands to innovate in product formulations. Additionally, subscription models and direct-to-consumer (D2C) services are becoming more common, offering convenience, and fostering customer loyalty. The market is characterized by a strong emphasis on research and development to create more effective, scientifically backed personalized nutrition solutions.

The report provides a comprehensive analysis of the competitive landscape in the personalized nutrition and supplements market with detailed profiles of all major companies, including:

- Abbott

- ADM

- Amway India Enterprises Pvt. Ltd.

- Herbalife International of America, Inc.

- Metagenics

- Viome Life Sciences, Inc

Latest News and Developments:

- In December 2024, Bioniq launched "Bioniq Build Your Own," a hyper-personalized supplement solution catering to individuals with special health needs, such as allergies and vitamin intolerances. This innovation allows consumers to create tailored formulas to meet their unique health requirements. With the supplement market projected to reach $44.24 billion by 2029, Bioniq’s AI-driven platform and granular delivery system aim to reshape the industry, following the success of its 2023 launch, Bioniq GO.

- In November 2024, Persona™ Nutrition launched a white-labeling service to help businesses and influencers enter the personalized nutrition market. With over 20 years of expertise, Persona offers a turnkey solution, including customized vitamin assessments, a proprietary algorithm, supplements, nutritionists, and full subscription management. This flexible program allows partners to scale efficiently, enhance customer loyalty, and offer science-backed health solutions without upfront costs, long timelines, or new operational teams.

- In September 2024, InsideTracker launched Nutrition DeepDive, an app-based tracker that connects food, beverage, and supplement intake to overall health goals. Unlike traditional trackers, it integrates blood, DNA, and fitness data, revealing how nutrition affects biomarkers and aligns with genetics. After just seven days of logging, users receive a comprehensive health report with color-coded graphs and personalized recommendations for food and supplements, enhancing health insights and decision-making.

- In March 2024, SIRIO Pharma launched a women’s health platform at Vitafoods Europe, featuring a portfolio of 25 personalized formulations addressing women's health needs across various life stages. This includes the innovative “MenoBalance” Gummy, incorporating Novasoy®, a soy isoflavone proven to reduce hot flashes and support bone health post-menopause. The launch highlights SIRIO’s R&D capabilities, providing nutraceutical brands with scientifically backed, first-in-class products for quicker market entry.

Personalized Nutrition and Supplements Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredients Covered | Proteins and Amino Acid, Vitamins, Minerals, Probiotics, Herbal/Botanic |

| Dosage Forms Covered | Tablets/Capsules, Liquids, Powders, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty Stores, Retail Pharmacies, Online Pharmacies and E-Commerce Site |

| Age Groups Covered | Pediatric, Adults, Geriatric |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott, ADM, Amway India Enterprises Pvt. Ltd., Herbalife International of America, Inc., Metagenics, Viome Life Sciences, Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the personalized nutrition and supplements market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global personalized nutrition and supplements market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the personalized nutrition and supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global personalized nutrition and supplements market was valued at USD 14.14 Billion in 2024.

The global personalized nutrition and supplements market is estimated to reach USD 65.15 Billion by 2033, exhibiting a CAGR of 17.20% from 2025-2033.

Key factors driving the global personalized nutrition and supplements market include increasing consumer awareness of health and wellness, advancements in technology like DNA testing and AI-driven solutions, growing demand for customized products, rising interest in preventive healthcare, and the shift towards natural, organic, and science-backed nutritional solutions.

North America currently dominates the global personalized nutrition and supplements market. The increasing consumer demand for tailored health solutions, growing awareness of the benefits of personalized diets, advancements in biotechnology, and the rise of digital platforms offering customized products based on individual health data are bolstering the market growth in this region.

Some of the major players in the global personalized nutrition and supplements market include Abbott, ADM, Amway India Enterprises Pvt. Ltd., Herbalife International of America, Inc., Metagenics, Viome Life Sciences, Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)