Personal Protective Equipment Market Size, Share, Trends and Forecast by Equipment Type, End Use Industry, and Region, 2026-2034

Personal Protective Equipment Market Size and Share:

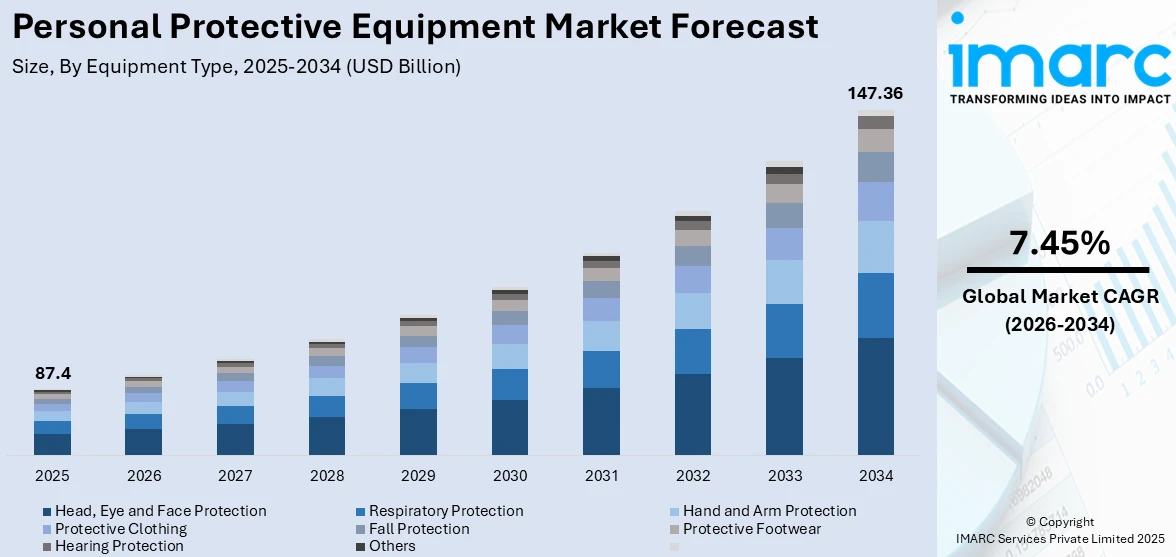

The global personal protective equipment market size was valued at USD 87.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 170.0 Billion by 2034, exhibiting a CAGR of 7.45% from 2026-2034. Europe currently dominates the personal protective equipment market share by holding over 30.2% in 2025. The market in the region is primarily driven by stringent occupational safety regulations, strong industrial and healthcare sectors, and increasing awareness of workplace safety standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 87.4 Billion |

| Market Forecast in 2034 | USD 147.36 Billion |

| Market Growth Rate 2026-2034 |

7.45%

|

The global personal protective equipment (PPE) market growth is fueled by the increasing awareness of long-term health risks from hazardous workplace exposure, which is encouraging proactive safety measures. In addition, strict regulatory frameworks across sectors such as mining, chemicals, and construction mandate PPE usage, driving the market demand. Moreover, the expansion of heavy-duty manufacturing industries worldwide is supporting the market growth. Besides this, growing female participation in industrial jobs drives demand for more inclusive and size-diverse PPE, which is providing an impetus to the market. Also, the rising emphasis on sustainability has led to innovations in eco-friendly PPE materials, contributing to the market expansion. Consumer behavior indicates that 63% of people show increased interest in buying products from companies that focus on sustainability. Furthermore, multinational companies are standardizing global safety protocols, boosting PPE adoption across all regions, thus impelling the market growth.

To get more information on this market Request Sample

In the United States, the PPE market demand is primarily driven by the expansion of the oil and gas industry, which necessitates specialized protection due to high-risk operations. In line with this, increased defense and homeland security investments support demand for tactical and ballistic PPE, strengthening the market share. Concurrently, a rise in climate-related disasters like wildfires drives demand for fire-resistant and respiratory gear, impelling the market growth. Reflecting this trend, Massachusetts and Connecticut became the first U.S. states to ban the use of toxic PFAS chemicals in firefighters' protective gear, aiming to reduce health risks associated with these substances. In confluence with this, the aging industrial workforce calls for ergonomically enhanced protective equipment, which is contributing to the market expansion. Furthermore, the U.S. focus on infrastructure renewal creates higher demand for construction safety gear, providing an impetus to the market. Apart from this, the growth of biotech and pharmaceutical research strengthens the need for contamination control and lab-specific PPE, thereby propelling the market forward.

Personal Protective Equipment Market Trends:

Supportive Regulatory Frameworks

The imposition of high standards and regulations regarding workplace safety by the government agencies, which are compelling the industries to use specific types of PPE in different industries, is impacting the market trends for PPE. Further, adhering to the safety standards in the manufacturing, healthcare, construction, and oil and gas industries is also driving the market. For example, OSHA mandates that various types of PPE comply with or be equivalent to American National Standards Institute (ANSI)-developed standards. In addition, respiratory protection company Optrel released the P Air Clear, the NIOSH-certified N95 respirator with transparent window. The P Air Clear is a breakthrough for teachers, medical professionals, geriatricians, and hard-of-hearing and deaf individuals. It gives the highest level of protection with the added advantage of a clear window, eliminating the communication barrier that comes with traditional masks.

Continual Technological Advancements

The relentless progress in the field of material sciences and engineering is supporting the growth of niche personal protective equipment that is functional and comfortable, which is fueling the market share of PPE. Apart from this, the integration of new and sophisticated technologies like nanotechnology and intelligent textiles into novel designs to provide enhanced protection, increase durability, and improve comfort for users is serving as another key growth-driving factor. For example, Health Professional Resources introduced a High-Performance Personal Protective Equipment (PPE) Line in Strategic Partnership with MAS Holdings. On top of that, LG Electronics introduced an electronic face mask to the citizens of South Korea. The mask was named the PuriCare Wearable Air Purifier and it had two H13 HEPA filters and a respiratory sensor to automatically adjust fan speed according to the breathing pattern of the wearer.

Rising Emphasis on Sustainability and Eco-Friendly PPE

A growing trend in the PPE market is the increasing emphasis on sustainability and the development of environmentally friendly products. Manufacturers are actively exploring biodegradable materials, recyclable components, and energy-efficient production processes to reduce the environmental footprint of PPE. This shift is driven by both regulatory pressures and rising consumer awareness around sustainability. According to reports, 73% of consumers believe companies have a duty to act responsibly toward the environment. Organizations are also incorporating life cycle assessments and eco-label certifications to validate the environmental impact of their products. Additionally, businesses across sectors are prioritizing sustainable procurement practices, which has further encouraged innovation in reusable and low-waste PPE. This trend aligns with broader environmental, social, and governance (ESG) goals, influencing purchasing decisions and brand preferences in the PPE industry, thereby enhancing the PPE market outlook.

Personal Protective Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global personal protective equipment market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on equipment type and end use industry.

Analysis by Equipment Type:

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Market Breakup by Protective Clothing Type

- Market Breakup of Suits by End-Use Industry

- Market Breakup by Gown Type

- Fall Protection

- Protective Footwear

- Hearing Protection

- Others

Head, eye and face protection hold the largest market share of 22.7% in 2025. This includes equipment items such as protective eyewear, goggles, face shields, and safety helmets, which are important to protect workers from harmful conditions in the workplace. In addition, the increasing importance placed on workplace safety across all industries, particularly in manufacturing, construction, and mining, is boosting the market demand. Furthermore, the growing consciousness about the prevention of injuries, stricter regulations, and advances in technology are providing an impetus to the market. For instance, Uvex and 3M have brought out next-generation face and eye protection equipment with anti-fog, anti-scratch coatings, and ergonomic design to improve comfort and durability for prolonged use.

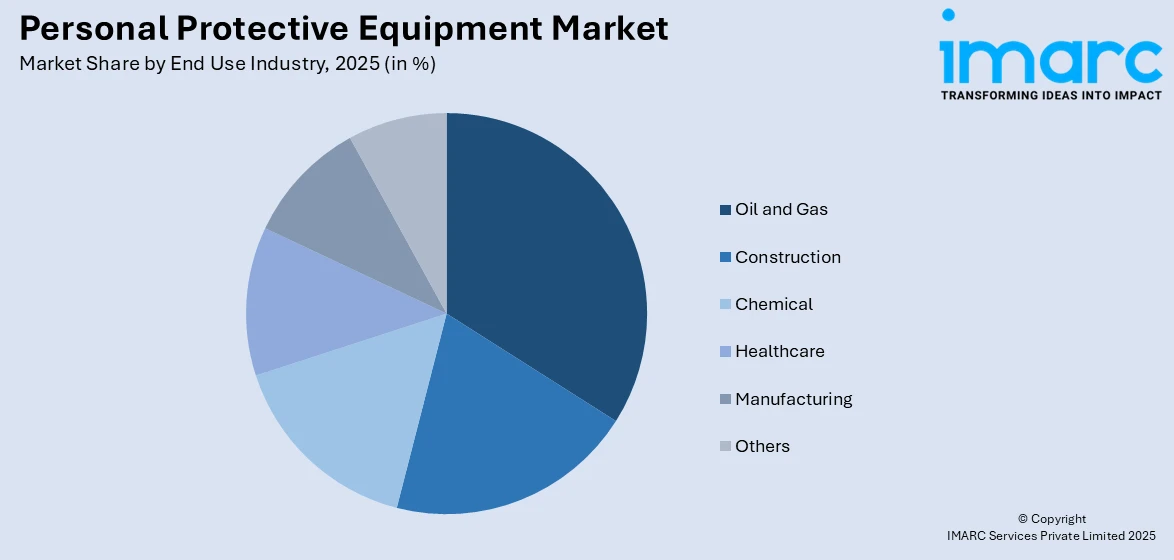

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Market Breakup by Equipment Type

-

-

-

- Head, Eye and Face Protection

- Respiratory Protection

- Protective Clothing

- Hand and Arm Protection

- Protective Footwear

- Fall Protection

- Hearing Protection

- Others

-

-

- Construction

- Market Breakup by Equipment Type

-

-

-

- Head, Eye and Face Protection

- Respiratory Protection

- Protective Clothing

- Hand and Arm Protection

- Protective Footwear

- Fall Protection

- Hearing Protection

- Others

-

-

- Chemical

- Market Breakup by Equipment Type

-

-

-

- Head, Eye and Face Protection

- Respiratory Protection

- Protective Clothing

- Hand and Arm Protection

- Protective Footwear

- Others

-

-

- Healthcare

- Market Breakup by Equipment Type

-

-

-

- Head, Eye and Face Protection

- Respiratory Protection

- Protective Clothing

- Hand and Arm Protection

- Others

- Demand Growth Index of PPEs due to COVID-19

- Specifications of Healthcare Suits/Gowns

-

-

- Manufacturing

- Market Breakup by Equipment Type

-

-

-

- Head, Eye and Face Protection

- Respiratory Protection

- Protective Clothing

- Hand and Arm Protection

- Protective Footwear

- Fall Protection

- Hearing Protection

-

-

- Others

Oil and gas leads the market with a market share of 16.7% in 2025 as it is a key contributor to the world's personal protective equipment (PPE) market due to the nature of the business environment being highly risky. The employees are continually exposed to risk factors like chemical exposure, fire, extreme temperature, and heavy equipment. Due to this, strict safety policies require specialized PPE usage such as flame-proof clothing, helmets, goggles, gloves, and respiratory devices. The demand for adherence to occupational safety standards, including OSHA and ANSI, also drives PPE demand in the industry. Moreover, increased exploration and production activities, particularly in offshore and remote areas, are driving the implementation of sophisticated PPE technologies. Organizations are increasingly spending on rugged and comfortable protective equipment in order to reduce workplace hazards and ensure workforce productivity and safety. With ongoing emphasis on protecting workers, minimizing risks, and optimizing operations, the oil and gas sector will continue to lead in propelling growth and innovation in the PPE market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Europe

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Countries

- Germany

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- United Kingdom

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End-Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- France

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End-Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Netherlands

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Belgium

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Norway

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Sweden

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Finland

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Denmark

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Southern Europe

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Eastern Europe

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Germany

- Market Breakup by Equipment Type

- North America

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Countries

- United States

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Canada

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- United States

- Market Breakup by Equipment Type

- Asia Pacific

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Countries

- China

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Australia

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- India

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Japan

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- South Korea

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Indonesia

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Malaysia

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- New Zealand

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- China

- Market Breakup by Equipment Type

- Latin America

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Countries

- Brazil

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Mexico

- Market Breakup by Equipment Type

- Head, Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Fall Protection

- Hearing Protection

- Protective Footwear

- Others

- Market Breakup by End Use

- Manufacturing

- Oil and Gas

- Healthcare

- Chemicals

- Construction

- Others

- Market Breakup by Equipment Type

- Brazil

- Market Breakup by Equipment Type

- Middle East and Africa

In 2025, Europe held the highest share of 30.2% in the market. The region's demand is growing, thanks to its strict safety regulations and laws. Moreover, the increased popularity of advanced industrial environments, such as manufacturing, and healthcare industries, is driving the use of specialized personal protective gear, which is also supporting the growth of this market in the region. For example, EU Members signed off on a commission proposal to invest more than EUR 1 Billion in infrastructure projects under the Connecting Europe Facility. Additionally, Protective Industrial Products Inc. announced that it would acquire Industrial Starter. The business is well known in Europe as a quality supplier of PPE, workwear, footwear, and fall protection. Through the acquisition, Protective Industrial Products Inc. would expand its presence in southern and eastern Europe.

Key Regional Takeaways:

North America Personal Protective Equipment Market Analysis

The North America PPE market is experiencing steady growth, driven by strict regulatory enforcement and a strong culture of workplace safety. Regulatory bodies such as OSHA play a critical role in mandating the use of PPE across industries, including construction, healthcare, manufacturing, and oil and gas. Moreover, the region’s advanced industrial infrastructure and emphasis on employee welfare further support consistent demand for high-quality protective gear. To strengthen domestic capabilities and reduce reliance on imports, governments are also supporting localized manufacturing. For instance, in October 2024, the Biden administration allocated up to $510 million to six companies to enhance domestic production of PPE, aiming to replenish the Strategic National Stockpile for future health emergencies. Additionally, increasing investment in infrastructure development and energy projects fuels the need for specialized PPE. The market is also benefiting from a rising focus on innovation, with manufacturers introducing ergonomic, durable, and technologically advanced equipment tailored to the needs of various sectors. Apart from this, supply chain localization efforts further enhance resilience, which is boosting the market demand.

United States Personal Protective Equipment Market Analysis

The United States is witnessing increasing personal protective equipment adoption due to growing construction activities driven by rising investment in infrastructure. Expanding urbanization, large-scale commercial and residential developments, and highway expansion projects are fueling the demand for protective gear in construction sites. Strict workplace safety regulations and enforcement are ensuring higher compliance, contributing to the widespread use of helmets, gloves, respiratory masks, and high-visibility clothing. The emphasis on worker safety, coupled with rapid technological advancements in protective materials, is further boosting adoption. Growing construction activities across industrial, institutional, and civil engineering projects are enhancing personal protective equipment demand. The shift toward smart protective solutions, including sensor-embedded safety gear, is gaining traction. Workforce expansion in skilled trades and increased awareness regarding occupational hazards are reinforcing the necessity for reliable protective gear across multiple construction-related operations.

Asia Pacific Personal Protective Equipment Market Analysis

Asia-Pacific is experiencing increased personal protective equipment adoption due to growing chemical sector developments. According to the India Brand Equity Foundation, the Indian chemical industry is currently valued at US$ 220 billion and is expected to reach US$ 300 billion by 2030 and US$ 1 trillion by 2040. Expanding industrialization, the establishment of large-scale chemical plants, and increased production of hazardous materials are accelerating the demand for protective suits, respirators, and chemical-resistant gloves. The strict enforcement of occupational safety standards and rising awareness of workplace hazards are further driving market growth. Technological advancements in protective fabrics and materials are enhancing safety levels, promoting higher adoption across chemical handling and manufacturing processes. Growing chemical sector expansions are leading to increased investments in advanced safety solutions, ensuring improved worker protection against toxic exposures.

Europe Personal Protective Equipment Market Analysis

Europe is seeing a rise in personal protective equipment adoption due to the growing manufacturing sector expansion driven by increasing production activities. Rapid automation, evolving industrial safety standards, and greater workforce engagement in high-risk environments are propelling demand for protective clothing, gloves, eye protection, and respiratory equipment. Manufacturing sector advancements, particularly in heavy machinery, automotive, and electronics production, are emphasizing worker safety, leading to increased compliance with stringent safety regulations. The integration of cutting-edge materials into protective gear is enhancing durability and comfort, encouraging broader usage across industrial sites. Growing production volumes and complex manufacturing processes are creating an urgent need for advanced protective solutions, reinforcing occupational hazard prevention measures. Rising industrial automation and workforce skill diversification are further promoting the adoption of innovative personal protective equipment across diverse manufacturing environments.

Latin America Personal Protective Equipment Market Analysis

Latin America is witnessing growing personal protective equipment adoption due to expanding healthcare operations and rising disposable incomes. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), of Brazil’s 7,191 hospitals, 62% are private. The increasing number of medical facilities, hospitals, and diagnostic centers is fueling demand for protective clothing, gloves, masks, and eyewear. Enhanced infection control measures, stricter healthcare regulations, and the growing use of disposable protective gear are further supporting market expansion. Expanding healthcare infrastructure and the need for effective contamination prevention are driving higher compliance with protective standards.

Middle East and Africa Personal Protective Equipment Market Analysis

The Middle East and Africa are experiencing increasing personal protective equipment adoption due to growing oil and gas projects. According to reports, during the period 2024-2028, a total of 668 oil and gas projects are expected to commence operations in the Middle East. Expanding exploration, refining, and extraction activities are driving demand for flame-resistant clothing, chemical-resistant gloves, helmets, and respiratory protection. Stringent safety protocols and the high-risk nature of operations in drilling and refining sites are ensuring widespread usage of protective gear. Rising investment in large-scale oil and gas infrastructure developments is further reinforcing safety standards, leading to increased procurement of advanced protective solutions. Worker safety initiatives, combined with growing awareness of occupational hazards, are strengthening market demand for high-performance protective clothing and accessories.

Competitive Landscape:

The personal protective equipment (PPE) market is characterized by intense competition, with numerous players striving to strengthen their market position through innovation and strategic initiatives. Companies are focusing on developing advanced, ergonomic, and application-specific PPE to meet evolving industry needs. Product differentiation through features such as enhanced comfort, durability, and compliance with international safety standards is a key competitive strategy. Market participants are also investing in automation and digital technologies to improve manufacturing efficiency and reduce lead times. Additionally, strategic collaborations, licensing agreements, and geographic expansion are common moves to access new markets and customer segments. Pricing strategies and consistent quality control remain critical in building brand reputation and securing long-term contracts.

The report provides a comprehensive analysis of the competitive landscape in the personal protective equipment market with detailed profiles of all major companies, including:

- Honeywell International Inc.

- E I Dupont De Nemours and Co.

- Kimberly-Clark Professional

- Ansell Limited

- MSA Safety Inc.

- Lakeland Industries Inc.

- Alpha Pro Tech Ltd.

- Sioen Industries NV

- Radians Inc.

- COFRA Holding AG

- Avon Rubber P.L.C.

- National Safety Apparel

Latest News and Developments:

- March 2025: Airgas launched the RADNOR™ women’s PPE line, offering safety gear tailored for women in the welding industry. The collection includes gloves and welding jackets designed for fit, function, and comfort. Airgas collaborated with top manufacturers to ensure high-quality materials and safety standards. This initiative underscores Airgas’s commitment to workplace safety, comfort, and inclusivity.

- March 2025: Stryker introduced the Steri-Shield 8 personal protection system, featuring a customizable helmet and three toga options. Designed through extensive research and user collaboration, it enhances safety and comfort for medical professionals. The system includes a lighted helmet, battery, and pullover toga for improved protection. Stryker continues to innovate PPE solutions, reinforcing its leadership in medical technologies.

- February 2025: Dentec Safety Specialists launched Guide Gloves in Canada, introducing European innovation and Scandinavian craftsmanship to the market. Known for advanced materials and ergonomic design, Guide Gloves set new standards in safety, comfort, and sustainability. This expansion strengthens Dentec’s PPE offerings, catering to industrial and professional needs. The launch underscores a commitment to quality and environmental responsibility in hand protection.

- September 2024: Centurion Safety Products introduced two new industrial safety helmets, Nexus E: Protect T2 and Nexus HeightMaster, featuring Twiceme HTH technology for enhanced safety. The Nexus E: Protect T2 is an eco-friendly ANSI Type II helmet, while the Nexus HeightMaster is designed for working at heights. Both models offer optional integrated eyewear and advanced protective features.

Personal Protective Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| End Use Industries Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Honeywell International Inc., E I Dupont De Nemours and Co., Kimberly-Clark Professional, Ansell Limited, MSA Safety Inc., Lakeland Industries Inc., Alpha Pro Tech Ltd., Sioen Industries NV, Radians Inc., COFRA Holding AG, Avon Rubber P.L.C., National Safety Apparel |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the personal protective equipment market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global personal protective equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the personal protective equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The personal protective equipment market was valued at USD 87.4 Billion in 2025.

IMARC estimates the personal protective equipment market to exhibit a CAGR of 7.45% during 2026-2034, expecting to reach USD 170.0 Billion by 2034.

Key factors driving the personal protective equipment (PPE) market include stringent safety regulations, increasing workplace safety awareness, industrial expansion, technological advancements in protective gear, rising demand in healthcare and construction sectors, and the growing emphasis on sustainable and ergonomic PPE solutions across diverse end-use industries.

Europe currently dominates the market, accounting for a share exceeding 30.2%. This dominance is fueled by strict occupational safety regulations, a strong manufacturing and construction base, high awareness of worker protection standards, and continuous innovation in PPE technologies.

Some of the major players in the personal protective equipment market include Honeywell International Inc., E I Dupont De Nemours and Co., Kimberly-Clark Professional, Ansell Limited, MSA Safety Inc., Lakeland Industries, Inc., Alpha Pro Tech, Ltd., Sioen Industries NV, Radians, Inc., COFRA Holding AG, Avon Rubber P.L.C., National Safety Apparel, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)