Personal Mobility Devices Market Size, Share, Trends and Forecast by Product, End Use, and Region, 2025-2033

Personal Mobility Devices Market Size and Share:

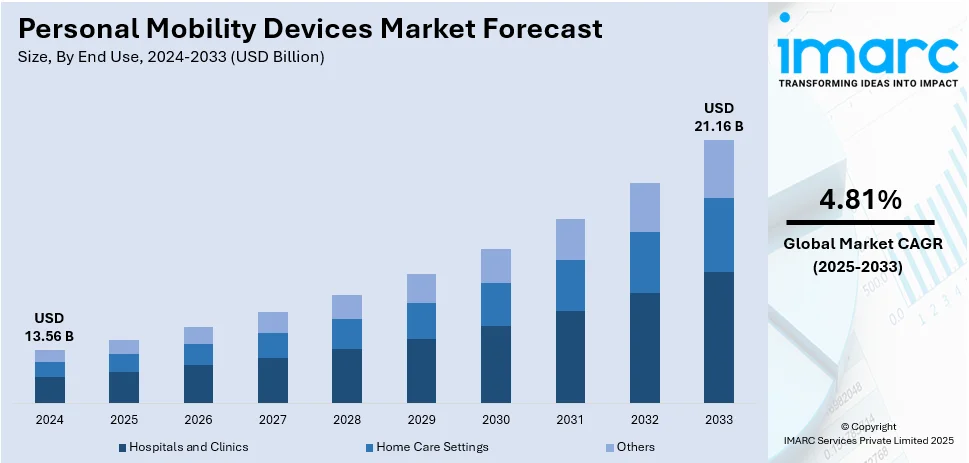

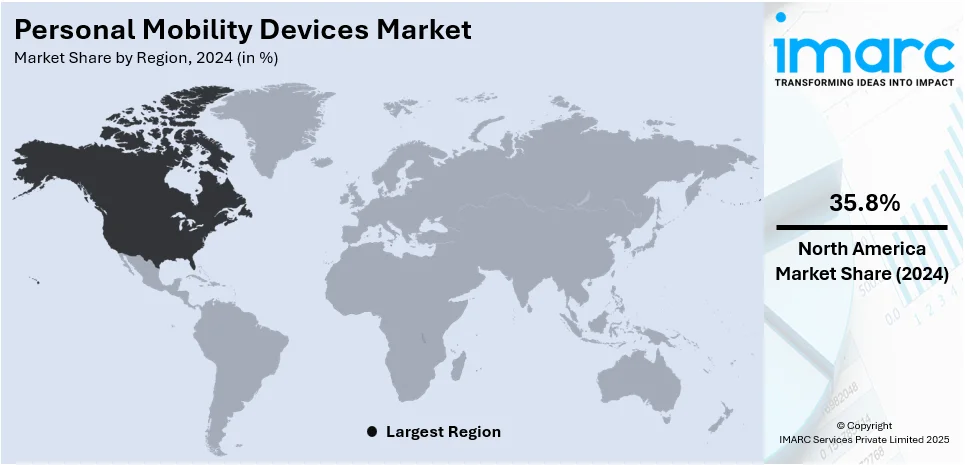

The global personal mobility devices market size was valued at USD 13.56 Billion in 2024. The market is projected to reach USD 21.16 Billion by 2033, exhibiting a CAGR of 4.81% from 2025-2033. North America currently dominates the market, holding a market share of 35.8% in 2024. The market is propelled by the growth in the geriatric population, rising prevalence of mobility disorders, and the surge in demand for independent living solutions. Product design advancements, including smart functions, portability, and ergonomic comfort, are improving product usability.

Market Size & Forecasts:

- Personal mobility devices market was valued at USD 13.56 Billion in 2024.

- The market is projected to reach USD 21.16 Billion by 2033, at a CAGR of 4.81% from 2025-2033.

Dominant Segments:

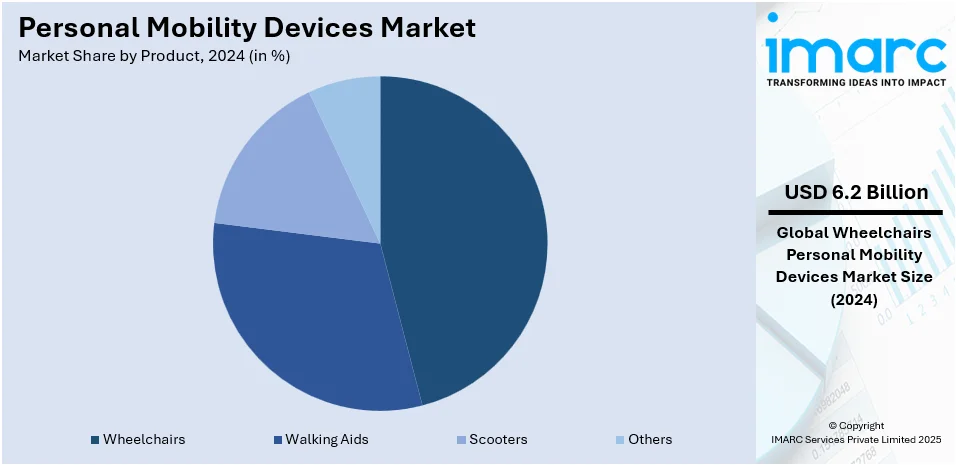

- Product: Wheelchairs, accounting for a share of 45.9%, lead the market because they are essential for individuals with limited or no mobility. Their wide use across hospitals, elderly care centers, and home environments, along with continuous design innovations, is supporting their dominant market presence.

- End Use: Home care settings represent the largest market share as they offer comfort and convenience for patients requiring long-term mobility support. With the rising aging population and chronic illness cases, more individuals continue to prefer at-home recovery.

- Region: North America, holding 35.8% of the market share, is enjoying the leading position, due to a well-established healthcare system, high healthcare spending, increasing elderly population, and widespread insurance coverage for mobility devices. Additionally, early adoption of assistive technologies is fueling the market expansion in the region.

Key Players:

- The leading companies in personal mobility devices market include Arjo, Carex Health Brands Inc. (Compass Health Brands Corp.), Drive Medical Inc, GF Health Products Inc., Invacare Corporation, Kaye Products Inc., Medline Industries Inc., Performance Health Supply Inc. (Patterson Medical), Pride Mobility Products Corp., Rollz International, Stryker Corporation, Sunrise Medical (US) LLC, etc.

Key Drivers of Market Growth:

- Rising Prevalence of Chronic Illnesses: An increase in the number of people suffering from chronic conditions like arthritis and diabetes is catalyzing the demand for personal mobility devices. These health issues often impair movement, making assistive devices essential for daily life.

- Higher Injury Rates: Frequent injuries from accidents and work-related incidents are promoting the use of personal mobility devices. Temporary or permanent mobility losses are creating the need for wheelchairs, crutches, and walkers. With more people needing support during recovery, the market is experiencing consistent growth in both medical and home settings.

- Expansion of E-commerce Platforms: E-commerce platforms make it easier for people to access and purchase mobility devices from home. With product variety, detailed reviews, and doorstep delivery, online channels offer unmatched convenience.

- Technological Advancements: Innovations like foldable frames, electric controls, and smart tracking are making personal mobility devices more efficient and user-friendly. As technology is evolving, people are more willing to invest in modern devices that suit their lifestyle.

- Rising Awareness Campaigns: Health campaigns by non-governmental organizations (NGOs) and government agencies are spreading awareness about the benefits of mobility devices. These efforts reduce stigma, highlight options, and educate users and caregivers.

Future Outlook:

- Strong Growth Outlook: The personal mobility devices market is expected to see sustained expansion, driven by rising aging population, increasing disability rates, and greater demand for independent living solutions. Technological innovations, expanding home care preferences, and improved accessibility in public infrastructure are further supporting the market growth.

- Market Evolution: The sector is anticipated to shift from basic manual aids to advanced motorized solutions with smart features. Innovations like lightweight materials, ergonomic designs, and the Internet of Things (IoT) integration are enhancing user comfort and independence.

The global need for personal mobility devices is largely driven by an increasing geriatric population and escalating cases of mobility-related disorders. With improved healthcare, life expectancy is improving globally, and hence a greater percentage of the population now needs long-term mobility support. The elderly are most at risk of diseases like arthritis, osteoporosis, and other musculoskeletal diseases that compromise movement and daily functioning. This phenomenon is particularly true in the developed and urbanizing parts of North America, Europe, and Asia where extensive healthcare structures and advanced medical awareness have enhanced the utilization of mobility aids. Governments and healthcare organizations are also investing in policies and infrastructure favoring accessibility and inclusion, increasing the availability of mobility devices. In addition, heightening awareness about independent living and quality of life during advanced ages has motivated users as well as caregivers to embrace technologically sophisticated devices, thus driving steady market growth on an international level. For instance, in January 2025, Strutt introduced the Strutt ev¹ with Co-Pilot 3D sensor navigation, intelligent drive modes, and longer battery range, transforming smart personal mobility for complex spaces.

To get more information on this market, Request Sample

The United States has a leading share in the personal mobility devices market outlook, with around 87.90% in 2024. The reason behind this leadership is the nation's well-developed healthcare network, high geriatric population, and extensive insurance cover for assistive medical equipment. U.S. customers also have early adoption tendencies when it comes to cutting-edge technologies, pushing manufacturers to launch products incorporating features like motorized propulsion, foldability, GPS navigation, and remote support. As per the sources, in January 2024, Sunrise Medical introduced the Switch-It Vigo, a wireless head control system that allows for intuitive power wheelchair use via head movements, promoting independence and communication for individuals with complex mobility requirements. Moreover, public health programs and regulatory assistance also reinforce standardization and accessibility in hospitals, eldercare centers, and home care environments. Increased focus on independent living and inclusion policies at state and federal levels have also led to architectural modifications, enhanced public transportations, and financial aid programs for the users of mobility aids. An established distribution network, both physical and digital, is a guarantee of widespread availability of various products that suit the functional and aesthetic needs of large user bases. These elements combined ensure that the country holds the top spot in the international market.

Personal Mobility Devices Market Trends:

Growing prevalence of chronic illnesses

Increasing incidence of chronic illnesses, such as arthritis, diabetes, and multiple sclerosis, is fueling the market growth. According to industry reports, as of March 2024, the impact of osteoarthritis influenced around 7.6% of the worldwide population, with an anticipated rise of 60 to 100% by 2050. Long-term health conditions often result in reduced mobility and fatigue, making devices like wheelchairs, walkers, and scooters essential for daily functioning. Health professionals frequently recommend these aids to manage symptoms and minimize strain. Additionally, patients with progressive illnesses are seeking assistive devices to maintain autonomy in their home environments. The growing burden of chronic diseases, especially among the aging population, is creating a sustained need for personalized and accessible mobility solutions.

Higher injury rates

Rising injury rates, especially from accidents and occupational hazards, are propelling the market growth. As per the data released by the Traffic Police Department, the total number of accidents on national and state highways in Maharashtra, India, increased from 35,243 in 2023 to 36,084 in 2024. Temporary or permanent mobility issues resulting from fractures, surgeries, or spinal cord injuries often require assistive devices during the recovery phase. Young and active individuals recovering from trauma are also contributing to the demand for lightweight and advanced mobility aids. With rising urbanization activities and fast-paced lifestyles in emerging economies, the frequency of traffic accidents and workplace injuries is surging, creating a consistent need for wheelchairs, crutches, and walkers. Rehabilitation centers and hospitals frequently prescribe these devices to aid post-injury mobility, helping individuals regain functionality.

Expansion of e-commerce platforms

The rapid broadening of e-commerce platforms is offering a favorable market outlook. As per the IMARC Group, the global e-commerce market size reached USD 26.8 Trillion in 2024. Online platforms enable users, especially those with limited mobility, to compare and purchase products without leaving their homes. A wide range of options, competitive pricing, doorstep delivery, and customer reviews enhance buying convenience and confidence. E-commerce channels also promote niche and specialized items that may not be easily available in physical stores, making it easier for people to find the exact mobility solution they need. Moreover, digital platforms often include detailed product specifications and video demonstrations, supporting informed decision-making. The availability of return policies and online customer support adds to user satisfaction. As online retail continues to expand worldwide, it is significantly improving the market reach.

Key Growth Drivers of Personal Mobility Devices Market:

Technological advancements

New developments are aking devices more lightweight, foldable, and user-friendly, catering to the evolving needs of users. Features, such as motorized controls, smart sensors, and global positioning system (GPS) navigation, are being integrated into modern mobility aids. These advancements improve functionality, safety, and convenience for people, especially those with complex mobility challenges. Battery-powered wheelchairs offer extended mobility with minimal physical effort. Additionally, smart devices can connect to mobile apps for health tracking, route planning, and emergency alerts. As technology is becoming more accessible and cost-effective, manufacturers are focusing on customizable and digitally enabled products. This tech-oriented transformation is not only enhancing user experience but also expanding the market base by appealing to younger demographics and tech-savvy population.

Rising awareness campaigns

Awareness campaigns led by healthcare organizations, NGOs, and government agencies are driving the demand for personal mobility devices. These initiatives educate the public about the benefits of mobility aids, reduce social stigma, and encourage early adoption, especially among aging and disabled populations. Campaigns through television, social media, and community outreach programs promote available solutions and connect individuals to support services. Such efforts are particularly impactful in rural or underserved areas, where access to healthcare knowledge is limited. Awareness drives also inform caregivers and families, ensuring that individuals with limited mobility receive appropriate assistance. By increasing visibility and acceptance, these campaigns aid in fostering a more inclusive attitude towards assistive technologies. As a result, more people are becoming proactive in seeking solutions that improve their independence and quality of life, catalyzing the demand for personal mobility devices.

Increased participation in mobility-focused sports and activities

Rising interest in adaptive sports and mobility-focused recreational activities is contributing to the growth of the market. Individuals with physical limitations are increasingly engaging in sports like wheelchair basketball, para-cycling, and marathons, which require specialized mobility equipment. This participation assists in promoting a culture of inclusion and active living, encouraging individuals to adopt advanced devices that support their lifestyle goals. Manufacturers are responding with sports-specific mobility aids that offer performance, durability, and customization. Additionally, public events and competitions help normalize mobility devices, inspiring others to seek similar tools for fitness and recreation. As more organizations are investing in inclusive sports programs and awareness is growing about physical activity for all abilities, the demand for high-quality, sport-adapted mobility solutions is rising.

Personal Mobility Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global personal mobility devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and end use.

Analysis by Product:

- Walking Aids

- Wheelchairs

- Scooters

- Others

As per personal mobility devices market analysis, wheelchairs held a share of around 45.9% during 2024, making them the top product segment. Their success is propelled by their wide scope of applications, meeting users with both long-term and short-term mobility issues. Wheelchairs exist in various forms, such as manual, electric, transport, and lightweight models, and are thus customizable depending on the needs of users. Advances in technology like powered controls, recline features, and safety sensors have improved user satisfaction and usage, especially among disabled and elderly individuals. The increasing need for comfort, portability, and independence has created demand for foldable and ergonomically structured models that can be used both indoors and outdoors. Furthermore, financial support by the government in the form of subsidies, insurance claims, and assistive technology programs has boosted wheelchair accessibility. As international focus on inclusive mobility increases, ongoing innovation and product differentiation will be required to drive wheelchair demand among hospitals, rehabilitation centers, and homecare settings.

Analysis by End Use:

- Hospitals and Clinics

- Home Care Settings

- Others

Homecare settings in the personal mobility devices market were the dominant end-use segment. This is a clear indication of the worldwide shift toward individualized, home-based healthcare for the disabled with mobility issues, especially amongst the elderly. Home-based mobility solutions are more preferred by patients and caregivers, allowing them to maintain independence and stay within the comforts of home. Equipment designed for home use tends to be lightweight, simple to use, and suitable for small indoor areas, and they are perfect for daily transit and support. Remote consultation healthcare services and home rehabilitation services also increase the demand for personal mobility devices in homes. Insurance coverage, reimbursement policies, and government initiatives supporting independent living are also compelling factors driving amplified demand. Moreover, consumer demand for convenience, safety, and dignity in daily activities has led to the introduction of features by manufacturers for domestic use, further entrenching this segment's growth within the general market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America accounted for a 35.8% share in the personal mobility devices market in 2024, which is its largest regional contribution. This leadership role is underpinned by sophisticated healthcare infrastructure, high prevalence of mobility disorders, and a fast-growing geriatric population. The area has good infrastructure that provides access to medical devices as well as government regulations and insurance schemes that promote the use of mobility devices. Regulatory requirements like the Americans with Disabilities Act (ADA) have implemented accessibility requirements for public and private environments, further propelling the need for personal mobility products. Additionally, North American consumers are highly inclined toward technologically sophisticated products that integrate function, style, and digital connectivity. The availability of prominent companies, strong e-commerce infrastructure, and widespread knowledge about independent living and rehabilitation are also factors supporting regional market expansion. With healthcare delivery moving towards home and patient-centric models, the need for mobility aids in North America is likely to continue to be high.

Key Regional Takeaways:

United States Personal Mobility Devices Market Analysis

The United States personal mobility devices market growth is driven by increasing investments in assistive technology and the expansion of advanced home healthcare infrastructure. Rising awareness about preventive care is encouraging early adoption of self‑operated mobility aids that promote independence in daily living. According to the Centers for Disease Control and Prevention (CDC), 12.2 percent of U.S. adults report a mobility disability involving serious difficulty walking or climbing stairs, underscoring a sizeable addressable population for device makers. Product design is increasingly guided by evidence‑based ergonomics, while strong consumer purchasing power supports the demand for customizable, digitally connected solutions that track usage and generate telemetry for clinicians. Favorable reimbursement policies within value‑based care frameworks incentivize providers to prescribe high‑function aids for both chronic and post‑acute needs. Growing smart‑city initiatives integrating accessible transport hubs with IoT‑linked wheelchairs and scooters, further normalizing their daily use. Continuous R&D collaborations between hospital systems, engineering schools, and veteran rehabilitation centers accelerate the commercialization of lightweight materials and battery technologies. Combined, these factors point to a resilient, innovation‑centric outlook for U.S. market expansion over the next decade.

Europe Personal Mobility Devices Market Analysis

Europe’s personal mobility devices market benefits from comprehensive social welfare programs and robust universal healthcare coverage that lower personal out‑of‑pocket costs. Policymakers are actively promoting aging‑in‑place models, and population data bear this out. Furthermore, a large numbe of aging population in the region is further driving the market. The Center for Aging Better notes that almost one in five people in England are aged 65 and over, while nearly two in five are 50 and over, reflecting a sizable base seeking long‑term mobility support. Mid‑market growth is being catalyzed by the widespread adoption of lightweight, foldable frames that fit compact urban housing and public transport designs. Sustainability imperatives encourage manufacturers to prioritize recyclable composites and low‑energy propulsion systems, aligning with the region’s circular economy goals. Public procurement rules now weigh eco‑labels alongside cost and functionality, guiding hospitals and municipal care services toward greener options. Meanwhile, cross‑border R&D consortia funded by Horizon programs are trialing sensor‑rich exoskeletal aids for stroke rehabilitation, reinforcing Europe’s reputation for clinical‑grade innovation. These developments collectively underpin a stable, regulation‑led growth trajectory.

Asia Pacific Personal Mobility Devices Market Analysis

In Asia Pacific, rapid urbanization and shrinking household sizes are driving demand for personal mobility devices that help older adults stay active in crowded cities. The World Health Organization reports that about 16 percent of the Southeast Asia Region’s population lives with significant disability, underscoring the need for scalable assistive solutions. Local manufacturing hubs produce cost‑efficient wheelchairs and power scooters, while telehealth and private insurance make prescriptions easier in peri‑urban areas. Modular designs with swappable batteries and adjustable frames to suit varied apartment layouts. Governments are weaving accessibility norms into metro and bus upgrades, and rising disposable incomes are broadening demand beyond hospital discharges. These influences are creating a fast‑moving, price‑diverse market in which domestic brands scale regionally and multinational firms compete on smart features.

Latin America Personal Mobility Devices Market Analysis

Latin America’s personal mobility devices market is gaining momentum as health coverage widens, and disability inclusion climbs the policy agenda. Novo Plano Viver Sem states that the New Living Without Limits Plan earmarks USD 446 Million for accessibility and assistive technology, signaling sustained public funding. Simultaneous urban renewal works add curb ramps and tactile paving, normalizing daily wheelchair use. Growing e‑commerce shortens supply chains, letting consumers in smaller cities access basic and smart devices. Local start‑ups employ 3-D printing to cut costs, while academic‑clinic partnerships refine ergonomic prototypes. Expanding micro‑credit programs also help low‑income users acquire essential mobility aids on installment terms. These factors underpin a community-centered, diversified growth trajectory.

Middle East and Africa Personal Mobility Devices Market Analysis

In the Middle East and Africa, investment in inclusive infrastructure and rehabilitative care is boosting the personal mobility devices market. A report states that a social‑care project in Saudi Arabia’s Qassim Region worth USD 22.1 Million aims to transform support services for people with disabilities through a trilateral partnership, highlighting public‑sector commitment. Concurrent housing schemes specify universal design features that raise demand for compact indoor wheelchairs, while humanitarian agencies procure rugged aids for rural terrain. The rise of digital health platforms enables remote fitting and follow‑up, laying the groundwork for steady, policy‑driven growth.

Competitive Landscape:

The competitive dynamics of the personal mobility devices market are changing fast, fueled by innovation, product diversification, and expansion strategies globally. According to the personal mobility devices market forecast, producers are increasingly targeting advanced features like smart navigation, remote control ability, foldability, and light weight to improve user experience and address increasing demand. Customization and ergonomic design are becoming major differentiators, as users want solutions that accommodate specific mobility requirements and lifestyles. Players in the market are also broadening their portfolios to cater to a wider range of physical conditions, age groups, and usage settings. Strategic alliances with healthcare facilities and insurance companies are enabling strengthened distribution channels and enhanced product availability. Digital sales channels also are empowering direct consumer connections and expanding reach to urban and rural markets. With local demand catapulting in both advanced and emerging economies, competitive advantage now depends more on technological flexibility, regulatory adaptation, and local product tuning.

The report provides a comprehensive analysis of the competitive landscape in the personal mobility devices market with detailed profiles of all major companies, including:

- Arjo

- Carex Health Brands Inc. (Compass Health Brands Corp.)

- Drive Medical Inc

- GF Health Products Inc.

- Invacare Corporation

- Kaye Products Inc.

- Medline Industries Inc.

- Performance Health Supply Inc. (Patterson Medical)

- Pride Mobility Products Corp.

- Rollz International

- Stryker Corporation

- Sunrise Medical (US) LLC

Latest News and Developments:

- July 2025: IIT Madras introduced a new 8.5-kg wheelchair that promoted independence. It consisted of a singular structure crafted from aerospace-quality material and featured a minimalist design. It was completely customizable and came in sizes ranging from 13 inches to 18 inches.

- June 2025: Kalogon launched Bondar, a 3D-printed custom wheelchair back support designed to integrate with its Orbiter Med smart cushion. Covered by Medicare, Bondar improved posture and comfort through clinician-guided design and simplified installation. The system addressed pressure management, aiding in spinal alignment and reducing risks of pressure-related complications for users.

- June 2025: HopSkipDrive expanded its services by launching wheelchair-accessible vehicle rides, Rider Assistants, and a car seat program to support diverse student transportation needs. The initiative enhanced accessibility, safety, and care, using technology like Safe Ride InSight™ and RideIQ to streamline ride management for schools and ensure compliance with high safety standards.

- April 2025: Japanese startup Lifehub Inc. unveiled plans to launch its Avest electric wheelchair in 2026, featuring caterpillar tracks for stair-climbing and slopes. Priced at ¥1.5 Million, it traveled 40 KM per charge and adjusted seat angles on 40-degree inclines. A model for escalator use was also under development.

- March 2025: Arcatron Mobility’s Frido brand debuted the Electric Prime Wheelchair, featuring a 24‑V lithium battery with a 15‑KM range, ambidextrous joystick, voice‑guided SOS, and manual‑electric dual modes. Foldable to 100 kg capacity, the smart model followed global exports and 20 chair donations to Aaji Care homes.

- March 2025: Precision Rehab released the iBOT duo electric balance wheelchair by Mobius Mobility. Featuring gyroscopic tech, 16 kph top speed, terrain versatility, tiller steering, and customizable options, the iBOT duo catered to both full-time wheelchair users and those needing support for long distances, enhancing independence and comfort.

Personal Mobility Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Walking Aids, Wheelchairs, Scooters, Others |

| End Uses Covered | Hospitals and Clinics, Home Care Settings, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arjo, Carex Health Brands Inc. (Compass Health Brands Corp.), Drive Medical Inc, GF Health Products Inc., Invacare Corporation, Kaye Products Inc., Medline Industries Inc., Performance Health Supply Inc. (Patterson Medical), Pride Mobility Products Corp., Rollz International, Stryker Corporation and Sunrise Medical (US) LLC |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the personal mobility devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global personal mobility devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the personal mobility devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The personal mobility devices market was valued at USD 13.56 Billion in 2024.

The personal mobility devices market is projected to exhibit a CAGR of 4.81% during 2025-2033, reaching a value of USD 21.16 Billion by 2033.

The market is propelled by the growing geriatric population, rising prevalence of mobility disorders, and surging demand for independent living aids. Smart wheelchairs and foldable, lightweight designs are improving user convenience through cutting-edge technologies. Favorable healthcare policies, insurance reimbursements, and increased availability of home-based care services are also driving the demand for personal mobility devices globally.

North America currently dominates the personal mobility devices market, accounting for a share of 35.8%. The region is characterized by a large geriatric population, well-established medical facilities, and wide-ranging insurance coverage for mobility equipment. Strict accessibility laws, high consciousness levels, and ongoing product innovation foster growth in the market. Additionally, increased demand for aging-in-place and homecare environments further supports the region's leadership in the international market.

Some of the major players in the personal mobility devices market include Arjo, Carex Health Brands Inc. (Compass Health Brands Corp.), Drive Medical Inc, GF Health Products Inc., Invacare Corporation, Kaye Products Inc., Medline Industries Inc., Performance Health Supply Inc. (Patterson Medical), Pride Mobility Products Corp., Rollz International, Stryker Corporation and Sunrise Medical (US) LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)