Personal Flotation Devices Market Size, Share, Trends and Forecast by Product, Application, Sales Channel, End User, and Region, 2025-2033

Personal Flotation Devices Market 2024, Size and Outlook:

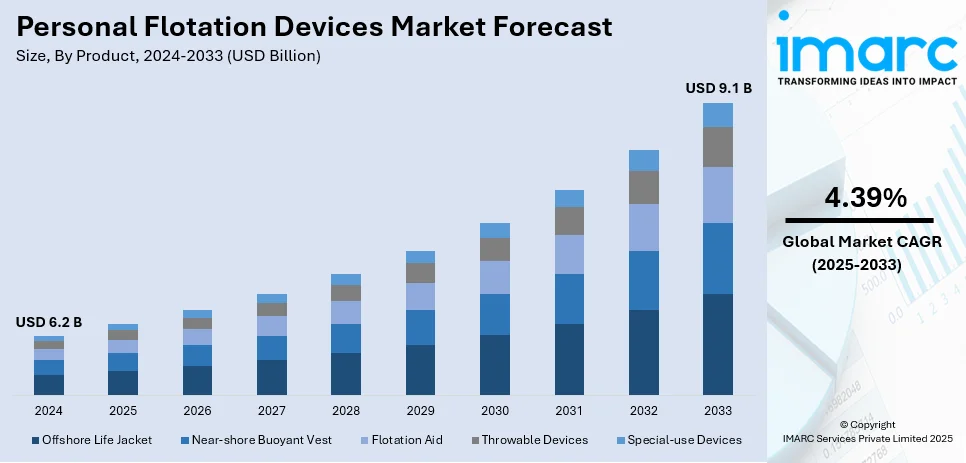

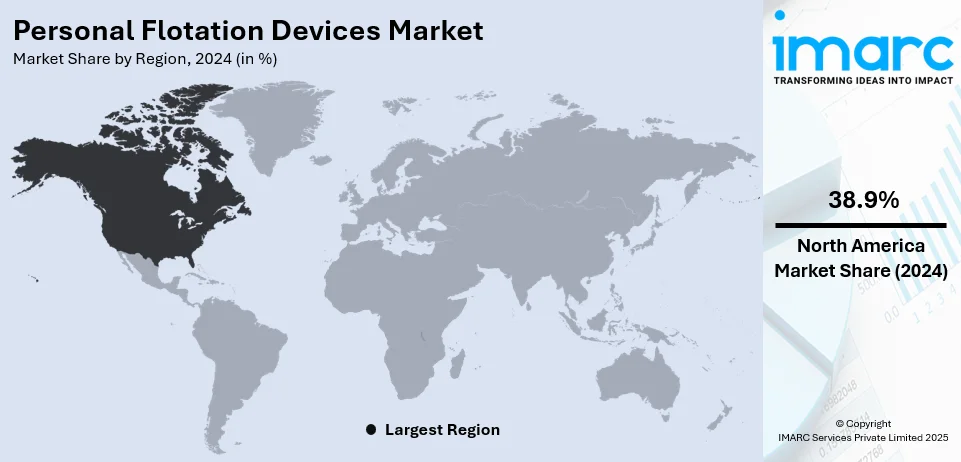

The global personal flotation devices market size was valued at USD 6.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.1 Billion by 2033, exhibiting a CAGR of 4.39% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.9% in 2024. The robust demand for recreational activities, stringent safety regulations, and the strong establishment of leading manufacturers in the region are major factors boosting the expansion of the personal flotation devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.2 Billion |

|

Market Forecast in 2033

|

USD 9.1 Billion |

| Market Growth Rate (2025-2033) | 4.39% |

The growing interest in water-based activities, including boating, kayaking, and paddleboarding, has notably increased the personal flotation devices (PFDs) market demand. For instance, over 2.5 million students have completed The BoatUS Foundation’s online Boating Safety Courses, offering certified safety education in 37 states, including New York. As participation in water-based activities grows, awareness of potential risks has increased, prompting consumers to prioritize safety gear like PFDs. This heightened focus on safety has fueled market growth.

The United States plays a pivotal role in serving the personal flotation devices (PFD) market through a combination of robust regulatory frameworks, advanced manufacturing capabilities, and widespread consumer awareness. For instance, the U.S. Coast Guard has adopted new ANSI standards for lifejackets and personal flotation devices (PFDs), effective January 2025. The updated rule includes standards for Level 50, 70, and 100 buoyancy aids, improving safety and enabling compliance in both the U.S. and Canada. Manufacturers can seek Coast Guard approval for these updated PFDs under new approval series but cannot receive new approvals for older series. Existing devices remain valid for production and use. Additionally, U.S. manufacturers lead the global market in producing innovative, high-quality PFDs designed for various water activities. Ongoing safety campaigns and education initiatives further promote PFD usage, ensuring that consumers prioritize safety. The country’s well-established distribution networks and retail channels also facilitate widespread accessibility to PFDs.

Personal Flotation Devices Market Trends:

Increasing Awareness of Water Safety

As the global participation in water-based recreational activities and sports continues to rise, there is an increased emphasis on water safety. This growing awareness has significantly contributed to the personal flotation devices (PFDs) market growth, which are crucial in preventing drowning and ensuring safety across various water conditions. According to the WHO 2024 report, there are approximately 300,000 annual drowning deaths worldwide, with children and young people being disproportionately affected. Children under the age of 5 account for nearly 25% of all drowning deaths. This alarming statistic has prompted a heightened focus on protective measures, driving the adoption of PFDs among families, water sports enthusiasts, and professionals. As governments and safety organizations increase their advocacy for water safety, the demand for high-quality, reliable PFDs is expected to surge, further propelling market growth. The growing awareness of water-related risks, particularly for young children, underscores the essential role of PFDs in reducing drowning fatalities globally.

Government Regulations and Safety Standards

Stricter safety requirements and regulations to govern water sports and maritimes related activities have brought about a drastic increase in personal flotation devices requirements. Most nations have implemented directives that require the application of PFDs for specific water recreational activities, promoting the growth further. In May 2023, the Seventy-sixth World Health Assembly adopted a resolution to accelerate global efforts for drowning prevention through 2029. The resolution includes establishing a Global Alliance for Drowning Prevention, partnering with UN organizations, international development partners, and NGOs. Additionally, WHO is set to release a global status report on drowning prevention in 2024, highlighting the urgency of this issue. According to WHO, in flood-related disasters, drowning accounted for 75% of the deaths, thereby underscoring the critical role that PFDs play in water safety. Together with growing awareness of water safety and prevention of drowning, such developments have gone a long way to boost the demand for PFDs globally and drive the expansion of the personal flotation devices market share.

Technological Advancements in PFD Design

Continuous innovation in the design and materials used for personal flotation devices (PFDs) has significantly improved their functionality, comfort, and durability, driving the market's growth. Modern features such as automatic inflation, lightweight materials, and enhanced buoyancy have made PFDs more appealing and practical for consumers. For example, the Mustang Survival Atlas 190 DLX Pro Sensor Life Jacket took a spot on TIME's 2024 Best Inventions list in the Outdoor category. As recognized for excellence in safety and comfort, the new design puts a re-engineered bladder along with 190N of buoyancy. Such developments not only enhance consumer confidence but also highlight the evolving capabilities of PFDs, which makes them more attractive to a broader range of water sport enthusiasts and recreational users. These advancements are instrumental in fostering the ongoing growth of the personal flotation device market.

Personal Flotation Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global personal flotation devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, sales channel, and end user.

Analysis by Product:

- Offshore Life Jacket

- Near-shore Buoyant Vest

- Flotation Aid

- Throwable Devices

- Special-use Devices

As per the personal flotation devices market forecast, near-shore buoyant vest leads the industry with around 24.9% of the market share in 2024. The purpose of these vests is for the use of recreational boating, kayaking, and other shallow-water activities within calm, protected waters near shore. These have gained popularity for their light and comfortable design as well as their user-friendliness, appealing to many consumers such as families, casual boaters, and enthusiasts in water sports. With increased participation in recreational water activities, along with increasing awareness for water safety, demand for near-shore buoyant vests will increase. For this reason, they are also expected to continue enjoying a dominant market share in PFDs, driven by their convenience and affordability and being suitable for everyday water-related activities.

Analysis by Application:

- Passenger and Aircraft Crew

- Commercial Vessels

- Cargo Ships

- Tugboats

- Passenger Ferries

- Others

Based on the personal flotation devices market trends, commercial vessels leads the industry in 2024. Commercial vessels, such as cargo ships, fishing boats, and passenger ships, need specialized safety equipment to meet stringent safety regulations and ensure the safety of crew members and passengers. PFDs are a mandatory safety measure on these vessels to prevent drowning in case of accidents or emergencies at sea. Regulatory requirements to meet maritime safety standards enforced by the U.S. Coast Guard or other maritime authorities will be responsible for increasing commercial sector demand for high-quality, durable, and reliable PFDs. Commercial vessel operations with a growing focus on worker safety, adherence to operational standards, and safety regulation compliance will remain a leader of the PFD market during the course of 2024 and further ahead.

Analysis by Sales Channel:

- Specialty Stores

- Company Owned Outlets

- Online Sales Channels

- Others

Based on the personal flotation devices market outlook, speciality stores leads the market in 2024. These specialty stores, which focus on outdoor recreation and water sports equipment, offer a wide range of high-quality PFDs catering to specific customer needs, including boating, kayaking, paddleboarding, and fishing. Consumers often prefer shopping at specialty stores due to their knowledgeable staff, specialized product offerings, and the opportunity to try on different PFD models to ensure proper fit and comfort. Moreover, specialty stores primarily offer high-quality, performance PFDs targeted to different recreational water activities that tend to draw enthusiast buyers for the same safety and quality consciousness. Given increased recreational water participation and rising knowledge of water safety, PFD demand in 2024 will continue strong and specialty stores should remain key participants in this space.

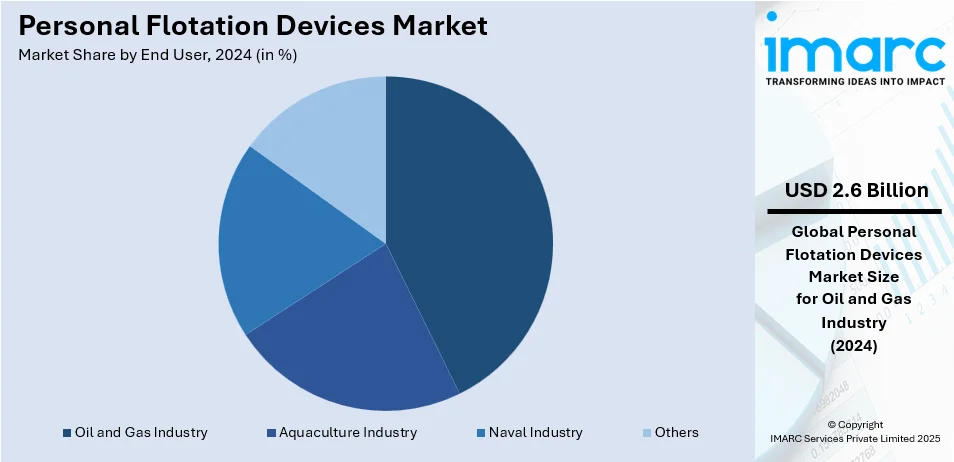

Analysis by End User:

- Aquaculture Industry

- Oil and Gas Industry

- Naval Industry

- Others

Oil and gas industry leads the market with around 42.5% of the market share in 2024. This dominance is driven by the critical need for safety equipment in offshore oil and gas operations, where workers are exposed to high-risk environments such as offshore platforms, drilling rigs, and marine vessels. PFDs are essential for protecting workers in the event of a fall overboard or emergency situations, ensuring their survival in harsh, open-water conditions. The industry’s stringent safety regulations, combined with growing awareness of worker safety, fuel the demand for advanced, durable PFDs that can withstand extreme conditions. As oil and gas companies continue to prioritize safety and compliance, the PFD market in this sector is projected to maintain its leadership position throughout 2024.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.9%. This dominance is attributed to the region’s high participation in recreational water activities, such as boating, kayaking, and fishing, coupled with strong safety regulations that require the use of PFDs. The U.S. and Canada have well-established regulatory frameworks, including mandates from organizations like the U.S. Coast Guard, which ensure widespread adoption of safety equipment across commercial, recreational, and industrial sectors. Furthermore, North America is home to leading PFD manufacturers and distributors, ensuring a steady supply of innovative, high-quality products. The increasing focus on water safety, along with a growing outdoor recreational market, continues to drive significant demand for PFDs in the region.

Key Regional Takeaways:

United States Personal Flotation Devices Market Analysis

The U.S. PFD market is growing rapidly with increasing concerns over water safety, especially with the rise in recreational boating accidents. According to the American Boating Association, in 2020, the U.S. Coast Guard reported 5,265 recreational boating accidents, which resulted in 767 deaths, 3,191 injuries, and an estimated USD 62.5 million in property damage. The fatality rate from these accidents stood at 6.5 deaths per 100,000 registered recreational vessels. This goes to show the necessity of safety measures like PFDs in the reduction of drowning and injuries.

Boating and water sports are ever more popular activities. This surge has created an enormous demand for personal flotation devices. More stringent safety requirements and growing public awareness about water safety have further fueled the increase in the usage of PFDs. Innovation in design and development in comfort, durability, and usability have further fuelled the market in the United States.

Europe Personal Flotation Devices Market Analysis

Increasing participation in water-based recreational activities, coupled with the growing concern over water safety, is resulting in the strong growth of the Europe personal flotation devices (PFD) market. The WHO 2023 report estimates drowning as the cause of around 20,000 deaths every year in the Europe region, calling for the necessity of effective safety measures such as PFDs. In 2021, around 630,000 Germans aged 14 and older practiced water sports such as sailing and surfing multiple times a month for recreational purposes, according to CBI. More people taking part in water sports, therefore, results in increased demand for personal flotation devices in ensuring safety and avoiding drowning.

Moreover, the ever-increasing adoption of water sport activities in all parts of the region and greater regulatory measures associated with water safety are driving demand for PFDs. Innovations in European PFD design continue to gain momentum, enhancing comfort and functionality, which supports greater adoption among users of water sport and leisure products.

Asia Pacific Personal Flotation Devices Market Analysis

The Asia Pacific personal flotation device (PFD) market is growing at a significant rate due to the increasing number of tourists and water-based activities in the region. Thailand, being one of the most visited countries, received around 28 million foreign visitors in 2023, as per the government's public relations department. As many tourists are involved in water sports, the demand for PFDs is increasing because these devices are essential for safety. Other countries, particularly India, observe increased attention regarding water safety issues, with approximately over 70% of those drowning deaths caused by accidental fall incidents in the year 2022, cited by the National Crime Records Bureau. This incident has, therefore compelled more demand of PFD in the prevention process of drowning-related accidents.

With the continuous demand for increased water-based recreations from the local population as well as tourism, the use of reliable, innovative flotation devices is expected to increase. Improving awareness toward water safety as well as imposition of stricter regulation is further facilitating the growth in the Asia-Pacific region for the PFDs market.

Latin America Personal Flotation Devices Market Analysis

Latin America Personal Flotation Devices Market The influx of international tourists is rising day by day, so is the level of participation in water-based activities. According to industry reports, foreign visitors arriving in Brazil reach 690,236 in December 2024, having increased by 11.1 percent in contrast with the same month in 2023. Locations such as Brazil, Mexico, and the Caribbean become water sport hubs for surfing, snorkeling, and diving. Such a scenario does result in an increase in demand for PFDs.

The rising consciousness about water safety and stricter regulation in countries such as Brazil and Mexico are further accelerating market growth. Because tourism is increasingly on the rise and activities involving water keep gaining popularity, the demand for reliable and comfortable personal flotation devices is expected to increase. Improving safety consciousness in water-based recreation is anticipated to fuel growth in the Latin American PFD market in the future.

Middle East and Africa Personal Flotation Devices Market Analysis

Middle East and Africa personal flotation device (PFD) markets are currently enjoying fast growth because of increased tourism as well as more interest in activities that relate to water. In fact, as the World Tourism Organization notes, international arrivals into the Middle East rose 29% in 2024 over 2019, and there was a rise of 6% into Africa during the same period. Popular tourist destinations include Dubai, Egypt, and South Africa, where water sports like yachting, scuba diving, and jet skiing are being done. Thus, the demand for PFDs increases in order to provide safety while participating in these water sports.

In addition to these, safety awareness and legislation further push this market upward. Many countries like UAE and South Africa have put strict legislation for people participating in any form of water sports, as the government obligates everyone who enters water with PFD. Rising fears in relation to flooding over large regions in Africa increases demand for these products. In these scenarios, local as well as international market players target their marketing strategy mainly towards the water safety PFDs market.

Competitive Landscape:

The personal flotation device (PFD) market is defined by a competitive mix of established global brands and emerging regional players. Key industry leaders, such as The Coleman Company, Inc., Kent Sporting Goods, and O'Neill, dominate the market by offering a broad range of PFDs designed for various applications, including recreational boating, water sports, and commercial use. These companies compete through continuous product innovation, focusing on enhancing safety features, comfort, and durability. Additionally, progress in environmentally conscious materials and sustainable manufacturing methods is gaining growing significance among consumers. New entrants are leveraging niche marketing strategies, targeting specific customer segments with specialized, high-performance PFDs. This dynamic competition fosters ongoing improvements in quality, accessibility, and pricing, benefiting end-users across diverse markets. For instance, in 2024, Astral introduced the Indus™, the first freestyle-inspired high float life jacket, offering 22 lbs. of buoyancy and enhanced mobility, improving survival chances on high or flooded waters. The dividend announcement reflects the company's continued financial strength and commitment to providing innovative safety solutions for outdoor enthusiasts, reinforcing its presence in the growing PFD market.

The report provides a comprehensive analysis of the competitive landscape in the personal flotation devices market with detailed profiles of all major companies, including:

- Absolute Outdoor Inc.

- Aqua Lung International

- Galvanisers India

- Hutchwilco Limited

- Hydrodynamic Industrial Co. Ltd.

- Johnson Outdoors Inc.

- LALIZAS

- Marine Rescue Technologies (Wescom Group)

Latest News and Developments:

- November 2024: TeamO launches the Hi-Lift lifejacket, an innovative personal flotation device that takes safety and performance to a whole new level.

- October 2024: TIME magazine names Mustang Survival's Atlas 190 DLX Pro Sensor Life Jacket as one of the top innovations of 2024 for its design and functionality.

- July 2024: Typhoon International unveiled the Hudson 50N Buoyancy Aid which further enriched its dinghy and watersports safety gear portfolio.

- May 2024: Wescom Group unveiled the sMRT V300 Class M Man Overboard emergency distress beacon, a commercial-grade device designed to improve man-overboard alerting, locating, and recovery with an extended signaling range.

- April 2024: LALIZAS announced the acquisition of Revere Survival, a US-based manufacturer & distributor of liferafts and other premium survival equipment to expand its foothold in the country.

Personal Flotation Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Offshore Life Jacket, Near-shore Buoyant Vest, Flotation Aid, Throwable Devices, Special-use Devices |

| Applications Covered |

|

| Sales Channels Covered | Specialty Stores, Company Owned Outlets, Online Sales Channels, Others |

| End Users Covered | Aquaculture Industry, Oil and Gas Industry, Naval Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Absolute Outdoor Inc., Aqua Lung International, Galvanisers India, Hutchwilco Limited, Hydrodynamic Industrial Co. Ltd., Johnson Outdoors Inc., LALIZAS, Marine Rescue Technologies (Wescom Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the personal flotation devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global personal flotation devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the personal flotation devices market industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The personal flotation devices market was valued at USD 6.2 Billion in 2024.

IMARC estimates the personal flotation devices market to reach USD 9.1 Billion by 2033, exhibiting a CAGR of 4.39% during 2025-2033.

Key factors driving the personal flotation devices market include the growing popularity of water sports and recreational activities, stringent safety regulations, increasing awareness of water safety, technological advancements in PFD design, and rising participation in commercial sectors such as oil and gas, all of which boost demand for reliable flotation devices.

North America currently dominates the market, holding a significant share of 38.9%. This leadership can be attributed to rising recreational water activities and increasing consumer awareness of safety. The region’s robust manufacturing capabilities, innovative product designs, and high standards for quality have fostered market growth. Additionally, North American consumers prioritize safety in water sports, prompting widespread adoption of PFDs. The presence of major manufacturers and advanced distribution networks further strengthens the region’s market leadership.

Some of the major players in the personal flotation devices market include Absolute Outdoor Inc., Aqua Lung International, Galvanisers India, Hutchwilco Limited, Hydrodynamic Industrial Co. Ltd., Johnson Outdoors Inc., LALIZAS, Marine Rescue Technologies (Wescom Group), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)