Personal Care Contract Manufacturing Market Size, Share, Trends, and Forecast by Product Types, Formulation, Service, Applications, and Region, 2025-2033

Personal Care Contract Manufacturing Market Size and Share:

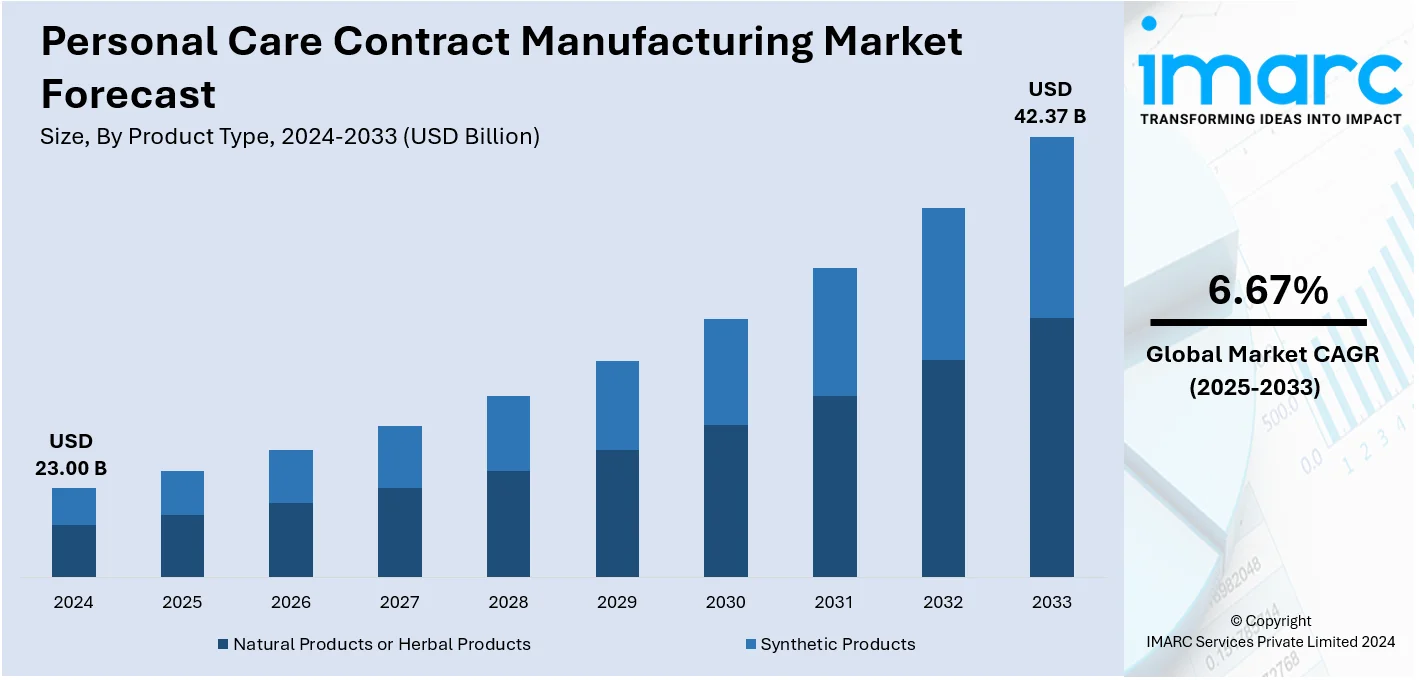

The global personal care contract manufacturing market size was valued at USD 23.00 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 42.37 Billion by 2033, exhibiting a CAGR of 6.67% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 37.5% in 2024. The market is experiencing steady growth driven by the rising consumer demand for innovative and sustainable products. Brands increasingly outsource production to specialized manufacturers for cost efficiency, quality control, and faster time-to-market. Key drivers include technological advancements, customization trends and the growing focus on natural ingredients.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 23.00 Billion |

|

Market Forecast in 2033

|

USD 42.37 Billion |

| Market Growth Rate 2025-2033 | 6.67% |

The personal care contract manufacturing market is primarily driven by the growing demand for innovative and customized products in skincare, haircare, and cosmetics. As brands seek to reduce operational costs and improve efficiency outsourcing manufacturing processes to specialized contractors has become increasingly popular. The rise in consumer preference for natural and organic ingredients also plays a significant role in shaping the market. Advancements in manufacturing technologies such as automation and sustainable practices are enhancing production capabilities. For instance, in January 2024, Future Origins launched to develop sustainable ingredients for personal care and cleaning products including face wash. Founded by Geno, Unilever, Kao, and L'Oréal the venture completed a 63,000-liter pilot and plans to establish a commercial manufacturing plant by 2025 aiming for ecofriendly surfactants with lower carbon footprints

The United States personal care contract manufacturing market is driven by several factors including the increasing demand for personalized and high-quality personal care products. As consumer preferences shift toward natural, organic, and ecofriendly ingredients brands are outsourcing production to meet these trends while ensuring regulatory compliance. The growing emphasis on cost efficiency and reduced production time also fuels the market as companies seek specialized manufacturers for faster time-to-market. Advancements in manufacturing technologies such as automation and sustainable practices are enhancing production capacity and minimizing costs. The United States market also benefits from its strong retail and e-commerce sectors, which support demand for innovative personal care solutions. According to a report published by the Census Bureau, U.S. retail e-commerce sales for the third quarter of 2024 reached $300.1 billion, marking a 2.6% rise from the second quarter of 2024. The total retail sales amounted to $1,849.9 billion, representing a 1.3% rise. E-commerce accounted for 16.2% of total sales, which is a 7.4% increase as compared to the third quarter of 2023. Adjusted e-commerce sales were $288.8 billion.

Personal Care Contract Manufacturing Market Trends

Rising Demand for Personal Care Products

Rising disposable incomes, evolving beauty standards, and increased self-care awareness have created a growing focus on skincare, haircare, and hygiene, leading to increased demand for personal care products. In order not to overstretch resources, most brands are choosing outsourced manufacturing. In May 2024, Olay launched Cleansing Melts, water-activated dissolving cleansing squares offered in vitamin C, hyaluronic acid, and retinol editions to help fix key consumer pain points in cleansing. L'Oréal was granted approval to expand its Commerce Drive facility to add 158,000 square feet to build on production and improve its supply chain. These developments go on to depict the fact that innovation and infrastructure expansion play a vital role in personal care industry growth. This will further help the brand scale production for the rising demand from consumers.

Expansion of E-commerce Platforms

The rise of e-commerce has played a significant role in the growth of small and medium-sized personal care brands, most of which rely on contract manufacturers for production. E-commerce platforms allow such brands to reach global audiences but require consistent and scalable supply chains to meet consumer demand. This has increased dependency on contract manufacturing services, with an emphasis on not making high-scale investments in the building of manufacturing units for retaining productivity levels. As of 2023, e-commerce already made up 19.4% of all retail sales in the world and is projected to rise further to 22.6% in 2027, based on reports by Industry. Growth in the internet sector shows increasing requirements for personal care contract manufacturing.

Increased Demand for Natural and Organic Products

Brands are looking to collaborate with contract manufacturers who can develop high-quality, plant-based, and chemical-free formulations to meet the increasing consumer demand for natural, organic, and clean-label personal care products. This trend is driven by a demand for safer, more environmentally friendly options in the beauty and personal care market. For instance, G&M Cosmetics, in February 2021, added baby care and vegan beauty products to its product line. The company further consolidated its position in the vegan beauty space with the acquisition of P'URE Papayacare skincare. Such partnerships allow brands to leverage the growing demand for vegan and natural beauty products, and it is reflective of the growing importance of contract manufacturing expertise in meeting consumer expectations for clean and sustainable formulations.

Personal Care Contract Manufacturing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global personal care contract manufacturing market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on product types, formulation, service and applications.

Analysis by Product Types:

- Natural Products or Herbal Products

- Synthetic Products

In the personal care contract manufacturing market natural or herbal products are growing rapidly due to rising consumer demand for clean, organic and ecofriendly beauty solutions. These products are made from plant-based ingredients and free from harmful chemicals appeal to health-conscious consumers. Manufacturers are focusing on sourcing high-quality natural ingredients and meeting stringent certifications. The trend toward sustainability and environmental awareness has further amplified the demand for natural personal care products contributing to their market dominance.

Synthetic products continue to hold a significant share in the personal care contract manufacturing market due to their cost-effectiveness, stability and longer shelf life. These products made with laboratory-created ingredients offer consistency in performance and are often used in mass-market beauty solutions. Consumers appreciate their affordability and effectiveness in addressing various skin and hair concerns. Manufacturers focus on developing innovative synthetic formulations that meet safety standards ensuring high demand for synthetic personal care products especially in mainstream and budget-conscious segments.

Analysis by Formulation:

- Liquids

- Creams

- Lotions

- Oils

- Gels

- Others

Liquid formulations lead the personal care contract manufacturing market due to their versatility, ease of use and wide range of applications in products like shampoos, lotions, cleansers and serums. Consumers prefer liquid products for their smooth application and quick absorption particularly in skincare and haircare segments. Liquid formulations also allow for precise ingredient control ensuring uniformity and consistency in the final product. They offer the flexibility to incorporate active ingredients catering to the growing demand for specialized treatments. As consumers increasingly seek effective and user-friendly personal care solutions liquid formulations continue to dominate the market.

Analysis by Service:

- Manufacturing

- Custom Formulation and R & D

- Packaging

- Others

Manufacturing leads the market with around 86.8% of market share in 2024. Manufacturing leads the personal care contract manufacturing market by service due to its core role in producing personal care products at scale. This service encompasses the entire production process from sourcing raw materials to formulation, testing and packaging. Manufacturers offer expertise in developing customized products that align with client specifications, ensuring quality control and compliance with industry regulations. With rising demand for new and innovative personal care items companies increasingly outsource production to specialized manufacturers who can deliver cost effective solutions and speed to market. The focus on efficiency, quality and flexibility makes manufacturing the leading service in this market.

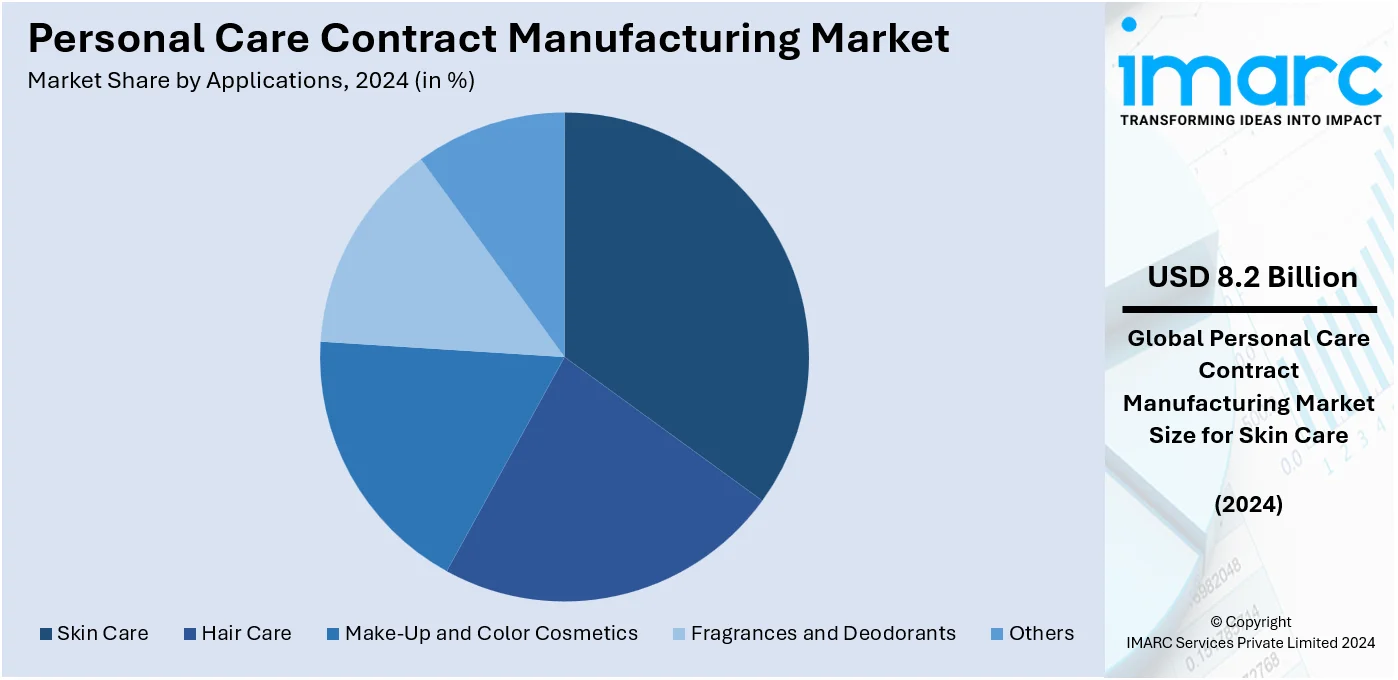

Analysis by Applications:

- Skin Care

- Hair Care

- Make-Up and Color Cosmetics

- Fragrances and Deodorants

- Others

Skin care leads the market with around 35.5% of market share in 2024. Skin care leads the personal care contract manufacturing market by application driven by the growing demand for products that promote healthy and youthful skin. Consumers are increasingly seeking personalized skincare solutions including moisturizers, cleansers, anti-aging creams and sunscreens which has led to a rise in manufacturing contracts for these products. With the focus on natural and organic ingredients manufacturers are responding by developing innovative, safe and effective formulations. The increasing awareness of skin health and the growing influence of beauty trends on social media continue to drive the demand for diverse, high-quality skincare products reinforcing its market leadership.

Regional Analysis

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 37.5%. Asia Pacific accounted for the largest market share in the personal care contract manufacturing market due to rapid economic growth increasing disposable incomes and a growing focus on personal grooming and beauty. The region is home to a large consumer base that is highly receptive to new skincare, haircare and cosmetic products. The presence of established manufacturing hubs in countries like China, India and South Korea has facilitated cost-effective production and innovation. The rising demand for natural and organic personal care products coupled with the region's strong manufacturing capabilities further strengthens its dominance in the market.

Key Regional Takeaways:

North America Personal Care Contract Manufacturing Market Analysis

The North American personal care contract manufacturing market is experiencing robust growth driven by the increasing demand for innovative and high-quality beauty products. Consumers are becoming more conscious of product ingredients with a strong preference for natural, organic, and cruelty-free options. The rise of ecommerce and social media influencers is further propelling product demand particularly among millennials and Gen Z who seek premium, sustainable, and personalized offerings. The region’s focus on sustainability and regulatory compliance pushes brands to rely on contract manufacturers for scalable cost-efficient production. This trend is positioning contract manufacturing as a crucial growth driver in North America's personal care sector.

United States Personal Care Contract Manufacturing Market Analysis

In 2024, United States accounted for a share of 89.00% of the North American market. A major growth driver for the US personal care contract manufacturing market is the growing demand for beauty and personal care products from the American consumer. A 2023 LendingTree survey showed that 75% of Americans say that beauty products are necessary; on average consumers spend around USD 1,754 yearly on such products. Social media has largely been responsible for this trend; 46% of Americans agree that they have spent more money on beauty products because of influences from social media and more so among the millennials at 67% and Gen Z at 64%. The desirability for high-end luxury beauty products can also be indicated as 67% of the millennials and 57% of the Gen Zers are willing to spend extra on them. This increasing affinity for high-value and fashion-follower beauty brands motivates those companies to contract and outsource for manufacturing to higher production levels hence, more demand for this contract manufacturing business in the US personal care markets.

Europe Personal Care Contract Manufacturing Market Analysis

According to an industry report, Europe is one of the leading markets for personal care products with a value of Euro 96 billion (USD 99 billion) in 2023, making it one of the important growth drivers for the contract manufacturing sector. Cosmetics Europe, the personal care association, report that the sector supports over 3.5 million jobs from direct employees totalling 259,244 and 2.68 million indirect workers along the entire value chain within major markets that include Germany, France, Italy, the UK, Spain, and Poland. The increasing demand for high-quality, innovative, and sustainable personal care products is forcing brands to rely on contract manufacturers to scale production efficiently and meet market demand while staying competitive. This trend is further driven by Europe's strong focus on sustainability, regulatory standards, and product innovation. Its contract manufacturing continues gaining momentum due to the region having an established presence in the marketplace and the resultant ability to achieve diverse consumer demands and preferences.

Latin America Personal Care Contract Manufacturing Market Analysis

Growth in personal care in the Latin American market will be driven mainly by rising awareness among consumers especially about the importance of vegan, organic and natural cosmetics coupled with a growing concern for sustainability. Consumers are ever more seeking value-alignment and manufacturers must innovate and present new offerings for this purpose. For instance, in October 2022, L'Oreal's Brazilian subsidiary broadened its portfolio of sun protection products to cater to the various skin types and requirements of Brazil's diverse population. This is part of the larger trend in Latin America where companies are focusing on clean and environmentally friendly formulations. As a result, personal care companies are increasingly seeking contract manufacturers to increase their production while upholding quality standards and responding to the market's expectations for sustainability and natural ingredients. This shift towards more sustainable, personalized, and high-performance products positions contract manufacturing as a key growth driver in the Latin American personal care market. In recent times, Brazil has experienced notable expansion in personal care positioning itself as one of the biggest worldwide markets. As reported by ABIHPEC (Brazilian Association of the Personal Hygiene, Perfume, and Cosmetics Industry), Brazil's international trade in these items hit an impressive USD 1.74 billion in 2023, with exports constituting over fifty percent of this total.

Middle East and Africa Personal Care Contract Manufacturing Market Analysis

The personal care contract manufacturing market in the MEA is showing significant growth in the wake of an increasing demand by consumers for different types of personal care products. According to ITA, the cosmetic and personal care market in the UAE is valued at around approximately USD 1.16 Billion with excellent market potential and rapid growth. Key segments such as skincare, cosmetics, fragrances and personal care are booming, and the emerging "Beauty Tech" segment further enhances market dynamics. As consumers increasingly seek innovative, personalized and high-performance products brands are turning to contract manufacturers to scale production while ensuring quality. This shift also aligns with the growing demand for clean, organic and sustainable formulations. Contract manufacturing has emerged as a vital enabler for brands to efficiently meet market needs especially in light of the changing consumer preferences in MEA and the strong emphasis on sustainability positioning it as a key growth driver in the region's personal care sector.

Competitive Landscape:

The personal care contract manufacturing market is highly competitive with numerous players offering a wide range of services to cater to the growing demand for personalized and innovative beauty products. Companies compete on factors such as product quality, manufacturing efficiency, flexibility and adherence to sustainability and regulatory standards. The rise of consumer preferences for organic, vegan, and ecofriendly products has prompted manufacturers to adapt their processes to meet these demands. Advancements in manufacturing technologies such as automation and product customization further intensify competition. Firms also focus on building long-term relationships with brands by providing cost-effective scalable solutions and maintaining high-quality production standards.

The report provides a comprehensive analysis of the competitive landscape in the personal care contract manufacturing market with detailed profiles of all major companies, including:

- A.I.G. Technologies Inc.

- ApolloCorp Inc.

- Beautech Industries Limited

- CoValence Laboratories

- Formula Corporation

- McBride plc

- Nutrix International LLC

- PLZ Corp.

- Sarvotham Care Limited

- Skinlys

- Tropical Products Inc

- VVF Limited

Latest News and Developments:

- July 2024: Debut, a leading name in biotech beauty, launched BiotechXBeautyLabs, an initiative focused on formulation development and contract manufacturing. The venture emphasizes cutting-edge, sustainable biotech products, collaborating with global beauty brands to deliver custom formulations and clinically-supported white-label solutions. This partnership allows brands to harness biotechnology for superior performance, distinctive claims, and formulations that are 95% bio-based, all while minimizing research expenses.

- April 2024: Lubrizol, a US leader in personal care ingredients, announced that it had signed a memorandum of understanding with China's Proya Cosmetics. The joint venture is focused on accelerating beauty product development with an eye to the market. In a partnership now over 20 years old, Lubrizol and Proya intend to combine their expertise to develop and market products that meet the preferences of the local market as well as satisfy regulatory requirements.

- August 2023: With Eco Lips introducing its first OTC-certified organic medicated lip balm to the market, the company increased its organic line of lip care products. Specifically, this is a product line that was engineered for the alleviation and protection from fever blisters and cold sores. To date, Eco Lips' retail placement in the drugstore chain is largest in the US, which also marks CVS achievement.

Personal Care Contract Manufacturing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Natural Products or Herbal Products, Synthetic Products |

| Formulations Covered | Liquids, Creams, Lotions, Oils, Gels, Others |

| Services Covered | Manufacturing, Custom Formulation and R & D, Packaging, Others |

| Applications Covered | Skin Care, Hair Care, Make-Up and Color Cosmetics, Fragrances and Deodorants, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A.I.G. Technologies Inc., ApolloCorp Inc., Beautech Industries Limited, CoValence Laboratories, Formula Corporation, McBride plc, Nutrix International LLC, PLZ Corp., Sarvotham Care Limited, Skinlys, Tropical Products Inc. and VVF Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the personal care contract manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global personal care contract manufacturing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the personal care contract manufacturing industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global personal care contract manufacturing market was valued at USD 23.00 Billion in 2024.

The market is estimated to reach USD 42.37 Billion by 2033, exhibiting a CAGR of 6.67% during 2025-2033.

Key factors driving the global personal care contract manufacturing market include increasing consumer demand for innovative, natural, and sustainable products, cost-efficiency, and faster time-to-market. Additionally, rising awareness of product safety and quality, along with the growing trend of outsourcing manufacturing to meet regulatory standards, further fuel market growth.

Asia Pacific currently dominates the personal care contract manufacturing market, accounting for a share of 37.5% in 2024. This dominance is fueled by the region's expanding middle-class population, rising disposable incomes, and increasing consumer awareness about personal care and beauty products.

Some of the major players in the global personal care contract manufacturing market include A.I.G. Technologies Inc., ApolloCorp Inc., Beautech Industries Limited, CoValence Laboratories, Formula Corporation, McBride plc, Nutrix International LLC, PLZ Corp., Sarvotham Care Limited, Skinlys, Tropical Products Inc. and VVF Limited etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)