Peritoneal Dialysis Market Report by Treatment Type (Continuous Ambulatory Peritoneal Dialysis (CAPD), Automated Peritoneal Dialysis (APD)), Product (Peritoneal Dialysis Solution, Peritoneal Dialysis Devices, Peritoneal Dialysis Sets, Peritoneal Dialysis Catheters, and Others), End User (Home-based Dialysis, Dialysis Centers and Hospital-based Dialysis), and Region 2025-2033

Peritoneal Dialysis Market Size:

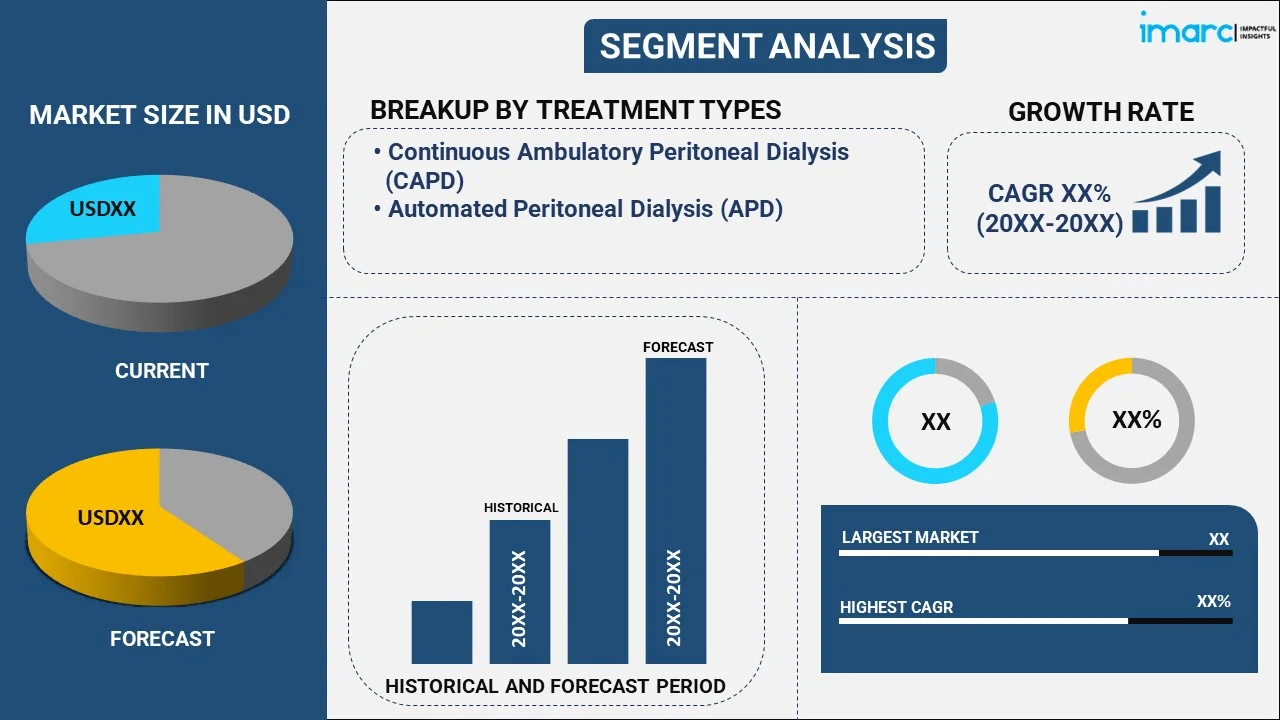

The global peritoneal dialysis market size reached USD 18.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.16% during 2025-2033. North America leads the market attributed to improved healthcare infrastructure, rising cases of chronic kidney diseases, and increasing adoption of home-based dialysis solutions supporting patient-centered care. The market is being driven by the rising number of dialysis centers worldwide, the increasing government initiatives to promote kidney disease management, the growing adoption of continuous ambulatory peritoneal dialysis (CAPD), and the expanding healthcare infrastructure in developing countries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.0 Billion |

|

Market Forecast in 2033

|

USD 26.5 Billion |

| Market Growth Rate 2025-2033 | 4.16% |

Peritoneal dialysis (PD) represents a type of kidney failure treatment procedure wherein a soft plastic tube or catheter is placed in the abdominal lining or belly through surgery. Once it is positioned, a sterile cleansing fluid is transmitted by the duct that helps filter the blood inside an individual’s body by removing waste products. After a period of time, the liquid and filtered unwanted components flow out of the abdomen and are discarded. PD is differentiated into continuous ambulatory peritoneal dialysis and continuous cycling peritoneal dialysis (CCPD). These approaches offer treatment flexibility, reduce the need to visit dialysis centers, and provide better clinical outcomes, resulting in lesser medications and fewer food restrictions. Apart from this, it can be carried out at home and is needle-free; thus, PD is used by hospitals and healthcare centers to treat kidney failures.

To get more information on this market, Request Sample

Peritoneal Dialysis Market Trends:

Expanding Patient Awareness and Education Initiatives

Increasing awareness about treatment choices for chronic kidney disease is driving the peritoneal dialysis market demand by promoting patient preference for accessible and home-based care. Historically, a lack of patient awareness regarding alternatives to hemodialysis restricted adoption rates. Nonetheless, enhanced educational efforts by healthcare professionals, advocacy organizations, and industry stakeholders are assisting patients in making more informed choices. Awareness initiatives emphasize the therapeutic benefits, lifestyle adaptability, and financial savings linked to peritoneal dialysis, enabling patients to engage actively in their care decisions. Improved training modules and accessible instructional materials enable patients and caregivers to effectively handle the therapy at home, further boosting their confidence in the treatment method. As knowledge about the long-term safety and benefits of peritoneal dialysis grows, an increasing number of people are opting for this treatment instead of traditional alternatives. This movement toward knowledge-based choices is enhancing overall acceptance, improving patient satisfaction, and establishing peritoneal dialysis as a favored treatment option in kidney care.

Growing Preference for Home-Based Dialysis Therapies

Peritoneal dialysis provides patients the ease of performing treatment at home, lowering reliance on hospital appointments and decreasing exposure to medical environments. This independence boosts patient comfort, increases compliance with treatment plans, and leads to an improved overall quality of life. Healthcare professionals and policymakers are promoting home-based options to alleviate strain on dialysis facilities and enhance healthcare resource utilization. The adaptability of peritoneal dialysis enables patients to incorporate treatment into their everyday lives, fostering autonomy while ensuring clinical efficacy. Moreover, improvements in training and patient assistance initiatives are facilitating safer self-management of treatments for individuals. The increasing acceptance of home-based care models corresponds with wider trends in healthcare delivery, encouraging further adoption of peritoneal dialysis as a favored treatment choice.

Supportive Government Policies and Reimbursement Frameworks

Policymakers worldwide are recognizing the growing occurrence of kidney diseases and the need for sustainable treatment solutions, resulting in efforts to enhance dialysis access. Reimbursement programs for peritoneal dialysis, either partial or complete, alleviate financial pressures on patients, making treatment more cost-effective and promoting wider acceptance. As part of these initiatives, in 2025, the Delhi government unveiled plans to introduce 150 new dialysis machines across six government hospitals through the PMNDP and PPP Dialysis Project, offering complimentary dialysis for low-income groups and subsidized treatment for others. Such initiatives enhance current infrastructure and are vital for guaranteeing equitable access to treatment. Additionally, authorities are promoting awareness initiatives and training activities to enhance the confidence of patients and caregivers in home-based treatments. Through the establishment of supportive structures and the provision of incentives, policymakers are enhancing the availability of peritoneal dialysis, promoting its adoption, and serving as a driving force for lasting market expansion.

Peritoneal Dialysis Market Growth Drivers:

Increasing Prevalence of Diabetes and Hypertension

The rising incidence of chronic diseases like diabetes and hypertension continues to be a significant factor in the peritoneal dialysis market, as these conditions are primary contributors to chronic kidney disease and end-stage renal failure. As more people face kidney issues, the need for efficient and easily accessible kidney replacement treatments keeps growing. As per the International Diabetes Federation (IDF) Diabetes Atlas (2025), 11.1% of adults between 20 and 79—about 1 in 9—are affected by diabetes, with over 40% unaware of their status, highlighting the critical issue of undiagnosed and unaddressed risks. This growing demand underscores the significance of scalable treatment options like peritoneal dialysis, which offers ongoing therapy and can be administered at home. Its capacity to accommodate personalized schedules and lifestyle adaptability is particularly beneficial for patients with comorbid conditions. With a global emphasis on early intervention and managing chronic diseases, the growing prevalence of diabetes and hypertension are leading to higher adoption of peritoneal dialysis.

Rising Geriatric Population

The growing global elderly population significantly influences the adoption of peritoneal dialysis, as older adults are at greater risk for chronic kidney disease and end-stage renal failure. Elderly individuals frequently gain from home treatments as a result of limited mobility and the ease of self-delivered care. Peritoneal dialysis meets these demands by providing ongoing and adaptable care outside of hospital environments, thus reducing reliance on healthcare facilities. The World Health Organization (WHO) states that by 2030, one in every six individuals globally will be 60 years old or more, and this number is anticipated to hit 2.1 billion by 2050, with those over 80 expected to increase threefold to 426 million. This population change increases the need for accessible, minimally invasive, and patient-focused solutions designed for elderly requirements. With global life expectancy increasing, peritoneal dialysis is set to become essential for providing effective kidney care, fostering long-term market growth and greater acceptance.

Advancements in Dialysis Solution Formulations

Advancements in peritoneal dialysis solution formulations are contributing to the market growth by improving patient safety, comfort, and treatment effectiveness. Contemporary solutions aim to enhance biocompatibility, minimizing irritation and maintaining peritoneal membrane function during extended use. Enhanced formulations also reduce issues like infection or inflammation, boosting patient compliance with treatment. Furthermore, advancements in glucose-derived, amino acid, and icodextrin solutions provide enhanced ultrafiltration effectiveness and superior metabolic results for patients. These developments enable customized therapy, permitting treatment plans to be adjusted to specific patient requirements while ensuring steady effectiveness. As a result, the creation of sophisticated, user-friendly dialysis options promotes greater acceptance of peritoneal dialysis, improves treatment results, and boosts long-term patient contentment. Ongoing advancements in solution chemistry and delivery mechanisms are thus a vital factor bolstering the market growth.

Peritoneal Dialysis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on treatment type, product, and end user.

Breakup by Treatment Type:

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

Breakup by Product:

- Peritoneal Dialysis Solution

- Peritoneal Dialysis Devices

- Peritoneal Dialysis Sets

- Peritoneal Dialysis Catheters

- Others

Breakup by End User:

- Home-based Dialysis

- Dialysis Centers and Hospital-based Dialysis

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global peritoneal dialysis market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Amecath

- Baxter International Inc.

- Fresenius Medical Care AG & Co. KGaA

- Medical Components Inc.

- Medionics International Inc.

- Medtronic plc

- Merit Medical Systems Inc.

- Mitra Industries Pvt. Ltd.

- Newsol Technologies Inc.

- Nipro Canada (Nipro Medical Corporation)

- Poly Medicure Limited

- Terumo Corporation

- Utah Medical Products Inc.

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Peritoneal Dialysis Market News:

- September 2025: The Karnataka government announced it will provide free peritoneal dialysis services at home. The initiative will begin with 350 patients, identified by district-level nephrologists. This move aims to make kidney care more accessible across the state.

- June 2025: A team at Yenepoya Medical College Hospital in Mangaluru successfully performed Continuous Ambulatory Peritoneal Dialysis (CAPD) on a 3-year-old boy suffering from acute renal failure. The child was critically ill with no urine output for 10 days. After a month of treatment, he fully recovered and was discharged with normal kidney function.

- October 10, 2024: Fresenius Medical Care announced that it is increasing its supply of IV fluids and peritoneal dialysis products in response to Hurricane Helene and is prioritizing the safety of patients and employees as Hurricane Milton approaches. The company has implemented a strategy to monitor and manage its supply chain, adjust prescriptions as necessary, and collaborate with alternative suppliers to mitigate any potential shortages resulting from Hurricane Helene’s disruption of Baxter International's manufacturing facility in western North Carolina.

- April 1, 2023: Medtronic plc and DaVita Inc. announced the launch of Mozarc Medical, a newly formed independent company focused on transforming kidney health through innovative, patient-centered technology solutions. The new entity aims to advance care in the renal health sector by leveraging both companies' expertise to address the changing needs of kidney patients.

Peritoneal Dialysis Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Treatment Type, Product, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amecath, Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, Medical Components Inc., Medionics International Inc., Medtronic plc, Merit Medical Systems Inc., Mitra Industries Pvt. Ltd., Newsol Technologies Inc., Nipro Canada (Nipro Medical Corporation), Poly Medicure Limited, Terumo Corporation, Utah Medical Products Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global peritoneal dialysis market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global peritoneal dialysis market?

- What are the key regional markets?

- What is the breakup of the market based on the treatment type?

- What is the breakup of the market based on the product?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global peritoneal dialysis market and who are the key players?

- What is the degree of competition in the industry?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the peritoneal dialysis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global peritoneal dialysis market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the peritoneal dialysis industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)