Perfume Market Size, Share, Trends and Forecast by Perfume Type, Category, and Region, 2026-2034

Perfume Market 2025 Size, Share & Analysis:

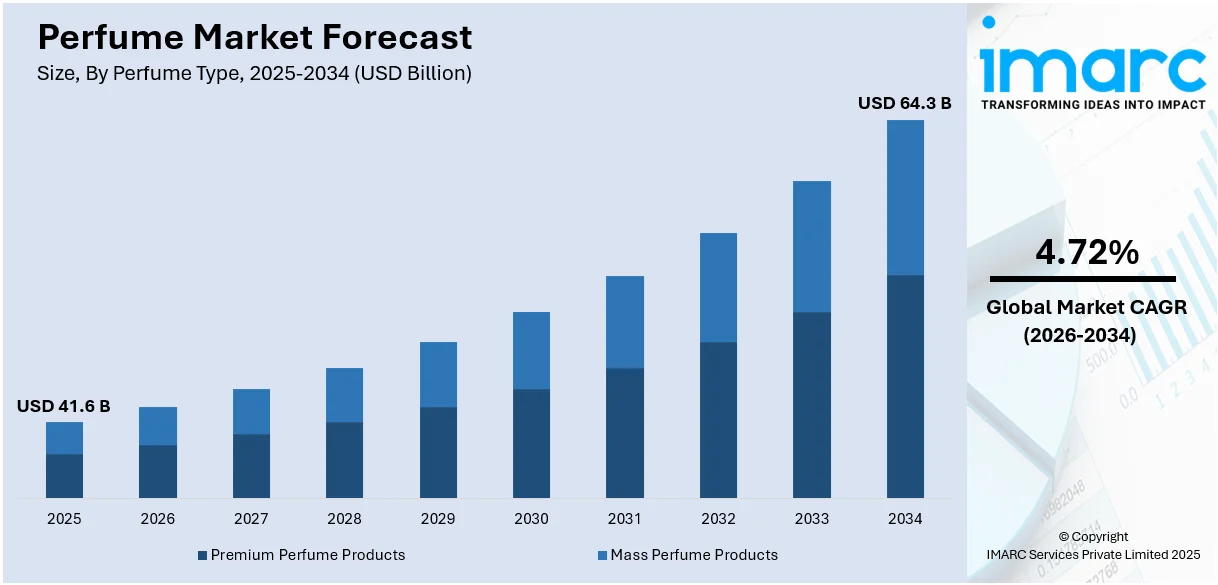

The global perfume market size reached USD 41.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 64.3 Billion by 2034, exhibiting a growth rate CAGR of 4.72% during 2026-2034. Brazil currently holds the largest perfume market share. This is due to changing trends and preferences, growing levels of disposable incomes, rapid e-commerce and online retail, rising innovation in products and marketing, and emerging markets and globalization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 41.6 Billion |

|

Market Forecast in 2034

|

USD 64.3 Billion |

| Market Growth Rate (2026-2034) | 4.72% |

The global perfume market demand is experiencing steady growth driven by rising consumer demand for personal grooming and luxury products. Consumers in emerging economies, particularly, have seen increases in disposable income, and hence are willing to spend more on premium fragrances. Customization and personalization of perfumes also create a high demand in this industry as companies introduce one-off, bespoke products that resonate with individual preferences. The influence of social media and rapid urbanization has increased brand awareness and increased the popularity of celebrity-endorsed fragrances. The expanding e-commerce sector has made luxury perfumes more accessible, which has encouraged impulse purchases and increased the customer base. Increased focus on natural and sustainable ingredients aligns with shifting consumer preferences toward eco-friendly products, which further drives innovation in the market. Seasonal launches, festive collections, and aggressive marketing drives by the key players support the momentum of the perfume market to continue a growth path.

To get more information on this market Request Sample

The United States has emerged as a key region market for perfumes due to changing consumer preferences and strong personal grooming. High disposable incomes and a penchant for premium and luxury products are key factors driving demand. The market benefits from the increasing inclination toward personalized and niche fragrances, as brands offer unique blends to cater to diverse tastes. E-commerce plays an important role in market expansion. It provides easy access to numerous products and facilitates impulse purchases. Social media and influencer marketing influence purchasing decisions mostly among younger generations. Trends in sustainability are also catching up as consumers favor those brands that highlight the importance of using eco-friendly ingredients and ethics. Seasonal launches and celebrity endorsements make fragrances even more alluring. Innovation in formulation and packaging continues unabated. The U.S. market remains a fertile terrain for established players as well as emerging brands.

Perfume Market Trends:

Changing consumer trends and preference

Consumer trends and preferences have been the driving force in the global perfume market growth. Every perfume manufacturer is constantly watchful and adaptive to the emerging tastes of consumers. Changing desires for unique and lingering scents, preferences for more natural and sustainable formulations, and celebrity-endorsed fragrances are some of the factors that impact product formulations and marketing strategies. It has become a trend amongst today's consumers to purchase customized and personalized fragrances. This has led to the development of niche and boutique perfume brands offering a wide range of options to individuals looking for a signature fragrance. Moreover, the concept of gender-neutral fragrances is gaining popularity, reaching out to a wider audience, and thus expanding market opportunities. According to an industry survey report, 43% of worldwide consumers are interested in aromas that help in relaxation for home fragrances. They select products that contribute to creating a warm, welcoming feeling in the home and increase their sense of well-being.

Increasing disposable income

The expansion of perfume markets around the world is partly driven by growing disposable incomes, particularly in developing regions. According to industry reports, both family spending and global disposable incomes rose 2.6% in 2022. Additionally, Saudi Arabia is projected to witness the highest real-term growth, with income and spending growing at a rate of around 16% per annum. The more individuals and households have higher incomes, the more they are willing to spend on luxury and premium fragrance products. This is particularly true in the case of countries such as China and India, wherein the growing middle-class populations have increased the demand for premium perfumes. Luxury perfume brands have seized this market segment by marketing exclusive and limited-edition fragrances, which have further enhanced sales. Also, the need to enjoy luxury and sophistication is what propels the purchase of high-end perfumes and enhances the perfume market outlook.

Rapid e-commerce and online retail

E-commerce and online retail have transformed the perfume industry. Online shopping has eased consumer access to a variety of perfumes, as they can view a wide variety of products from the comfort of their homes. Through websites, customers can obtain long descriptions of products, read reviews, and gain recommendations, thus making more informed decisions. Online stores usually offer special deals and discounts, which makes the high-end fragrances reach the masses. The ability to browse and compare different brands and products from the comfort of the home of an individual has significantly expanded the reach and revenue potential of the perfume market. Industry projections anticipate that global retail e-commerce sales will surpass USD 4.1 Trillion in 2024.

Product innovation and marketing

Innovation in fragrance development and marketing strategies is a driving force behind the global perfume market trends. Perfume houses also put in massive amounts of investments for R&D so that unique scents that appeal can be developed. Unilever just recently, in November 2024, issued a press release wherein they were investing Euro 100 Million, equivalent to USD 104.91 Million to develop the skills for fragrance design and creation digitally internally. Advances in fragrance technology, particularly through synthetic aroma chemicals and extractable sustainable methods, have permitted wide and lasting fragrances to be produced. Marketing techniques will also enable the attracting of consumer interest. Brands such as perfume collaborate with stars, designers, and influential personalities for the famous creation of products. Ads appealing to the eyes and compelling fragrances in packaging lead consumers to shop for these items.

New markets and internationalization

The expansion of the global perfume market into emerging markets is another significant driver. Countries in Asia-Pacific, the Middle East, and Latin America have witnessed growing middle class with disposable income, rapid urbanization, and increasing urban populations. According to UN statistics, already 55% of the world's population lives in cities, and by 2050, this figure should increase to 68%. All these factors make up a very favorable ground for perfume and luxury goods.

Globalization has opened wider doors for perfume brands and their access to international markets. Brands adapt their products and marketing strategies to suit the preferences and cultural nuances of different regions, tapping into the vast potential of diverse markets worldwide.

Perfume Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global perfume market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on perfume type and category.

Analysis by Perfume Type:

- Premium Perfume Products

- Mass Perfume Products

Premium perfume products account for the largest segment. Premium perfumes take precedence due to their rich quality, long-lasting formulae, and lifestyle connected with luxury lifestyles. Due to growing disposable incomes, high disposable incomes have brought people to seek and spend more on premium personal grooming products in this way. Expansion into emerging markets and strategic marketing campaigns further facilitated growth by leveraging high-profile celebrity endorsements. With access to e-commerce channels that make it easy for clients to buy premium items with personalized recommendations, more of the client's preference shifts to this category as compared to the other two categories.

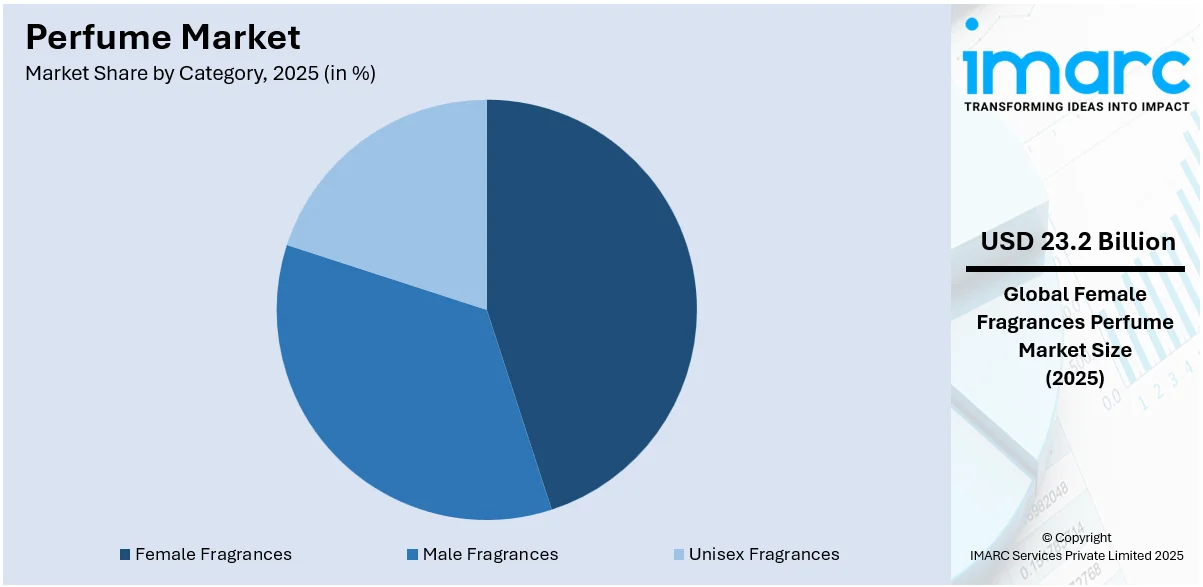

Analysis by Category:

Access the comprehensive market breakdown Request Sample

- Female Fragrances

- Male Fragrances

- Unisex Fragrances

Female fragrances dominate the market. This segment leads due to the wide range of scents available for women, ranging from floral to fruity and oriental and woody notes. Women's fragrances are usually sold based on the highest emotional and aspirational appeals that create a closer association with the consumers. Seasonal collections and gift sets increase demand substantially, especially during festivals and special events. The overall popularity of female celebrity-endorsing products is also a large contributor to this segment through brand loyalty and repeat orders. Advancements in pack design and customization options tailored to women's tastes maintain growth in this segment.

Regional Analysis:

- Brazil

- United States

- Germany

- France

- Russia

Brazil leads the market, accounting for the largest perfume market share. In Brazil, the market for perfumes has grown consecutively over the last few years. The country boasts a huge and varied population with an increasingly booming middle class, which gives reason for fragrance demand to skyrocket. There is also an increased culture of grooming and beauty in the country that has made it an attractive market for perfumes. Also, the weather is warm, and social activities create the need for perfume application. To be in line with the growing base of consumers, domestic as well as international perfume companies have made strategic investments in Brazil. E-commerce as well as direct selling distribution channels are popular, whereby consumers can easily access fragrance products.

The United States is one of the largest perfume markets globally. The diverse consumer preferences of the nation drive a wide variety of fragrance offerings, from light and floral scents to musky and bold fragrances. The U.S. market is highly competitive, with numerous domestic and international perfume brands vying for market share. Department stores, specialty fragrance shops, and online retailers are the primary distribution channels. Moreover, celebrity endorsements and marketing campaigns play a significant role in promoting perfumes. Sustainability and natural ingredients are hot trends among American consumers, thereby pushing the industry to adapt their product development.

The German perfume market is strong, with consumers always opting for high-quality fragrances. The country likes both traditional and niche fragrances, focusing more on craftsmanship and quality. Strong perfume houses from France, Italy, and even Germany itself are present in this market. The strong economy and high purchasing power of the country ensure steady sales. Perfumes are a way for Germans to express themselves and complement their daily routine of grooming. Environment-friendly and eco-friendly perfumes have gained popularity among consumers who are conscious of the environment. The retail channel in Germany consists of perfumeries, departmental stores, and online channels.

France has a unique position in the international perfume market as it is known as the perfume capital of the world. Perfume is a significant part of French culture, and this country hosts many great fragrance houses. France produces some of the world's best and most expensive perfumes. Perfume boutiques and perfume museums can be found all over Paris. French perfumes usually focus on elegance, sophistication, and quality craftsmanship. Exports of French perfumes are substantial to foreign markets with a focus on heritage and tradition. French perfumers have also come forward in embracing sustainability and natural ingredients, which match the trends in the rest of the world.

Perfume sales in Russia have been stable and increasing in recent times, mainly due to the improving economic conditions within the nation and the emergence of the middle-class population. The Russian market prefers stronger long-lasting perfumes, as there is always a tough time for most people during such seasons. The French and Italian brands are the dominant international brands. E-commerce, of course, represents another method by which this niche could be reached or bought from. The promotional tactics will usually be driven home more in terms of perfumes' emotional and sensory sensations. The large geography and varied climate zones in Brazil provide a basis for a variety of fragrances to meet the different preferences of each region.

Key Regional Takeaways:

United States Perfume Market Analysis

This is a booming U.S. perfume business, and the cause is multifaceted, relating to shifting consumer preferences, shifting fashion, and increased levels of disposable income. Niche and luxury fragrance sales are witnessing rapid growth due to consumers with a need for high levels of exclusivity and something unique. Industrial reports said that people in the age group of 35-54 purchase more perfumes since they are relatively more prosperous and spend more, using high-end anti-aging products as they are most likely to be employed more regularly and have higher disposable incomes. As celebrities start their fragrance lines, the market expands along with celebrity-promoted perfumes. In addition, with the growth of online stores like Amazon and Sephora, customers can easily get numerous perfume brands. According to market data, 18,784 firms are operating in the United States online market for perfume and cosmetics sales. Influencer marketing and social media trends are driving demand for new fragrances. The increasing need for natural and sustainable components in perfumes has led to more consumers choosing eco-friendly items that align with their values. Societal change and the growing role of fragrance in self-expression are also leading to increased demand, most particularly among younger consumers.

France Perfume Market Analysis

France is one of the major perfumes markets aside from being a significant exporter of perfumes. In the year 2022, France will be the world's largest perfumer, with USD 7.24 Billion in exports according to an industry report. Perfumes ranked 16th in the list of products exported by France during the same year. Between 2021 and 2022, the US recorded the highest growth rate at USD 208 Million. Other markets that exhibited this rapid growth in exports of Perfumes from France included Spain at USD 151 Million and the United Kingdom at USD 120 Million. Creativity and artistry are at the heart of the business that owns some of the world's most renowned labels: Chanel, Dior, and Guerlain. As customers have increasingly demanded niche and bespoke fragrances, the niche and artisanal brands increased exponentially at the local level. Product development is taking cues from sustainability trends, 40% of new launches feature natural ingredients and recyclable packaging. High-quality standards and gifting culture ensure steady growth in the domestic market.

German Perfume Market Analysis

German consumers seek luxury, high-end products. According to the Observatory of Economic Complexity, Germany has emerged as the third-largest perfume exporter in the world in 2022. Germany exported USD 1.67 Billion worth of perfumes last year. More than 65% of German consumers say they like vegan or natural formulations and prefer companies that offer cruelty-free, sustainable solutions. The demand for niche perfumes has gone multiple folds and domestic as well as foreign premium labels are in great demand. High-end products have become affordable due to the rising e-commerce industry. In Germany, 40 percent of the perfume sales every year are due to the gifting culture prevalent in the country, especially during festive seasons. Urbanization and the growth of the middle class are also driving demand for affordable and luxury products. As an expression of the nation's progressive consumer, bespoke and unisex fragrances are gaining popularity.

Brazil Perfume Market Analysis

Brazil has one of the largest perfume markets in the world, primarily as the country attaches high importance to personal hygiene and uses fragrances regularly. It is a large consumer market, especially in the mass-market categories. As per industry reports, Brazilian adults are keen on in-shower perfumes in 33% of cases, fragrance sticks in 14%, and other solid fragrances in 13% of cases. While multinational companies are making their presence increasingly felt in urban areas, local businesses tend to dominate and mostly manufacture floral and tropical smells that suit local tastes. As reported by industry, domestic brands dominate Brazil, with Malbec from Grupo Boticário, Natura Ekos from Natura & Co., Hinode from Larru´s Industria e Comércio de Cosméticos Ltda, Floratta from Grupo Boticário, and Natura Humour from Natura & Co. Disposable money of the middle class increases the demand for high-end and specialty fragrances. In addition, younger consumers can now purchase perfumes as the e-commerce infrastructure in Brazil grows by 20% every year. Social marketing in social media coupled with promotions during holidays enhances offers further, especially among millennials.

Russia Perfume Market Analysis

Steady growth in perfume in Russia is observed due to rising disposable incomes with demand for luxury products. Russia has also been the highest exporter of perfumes. The Observatory of Economic Complexity reports the value of perfume exports to USD 30.9 Million to Russia for 2022. Kazakhstan (USD 12.9 Million), Uzbekistan (USD 5.34 Million), Azerbaijan (USD 2.47 Million), Georgia (USD 2.44 Million), and Hong Kong (USD 1.51 Million) were Russia's top export destinations for perfumes. Demand for high-end foreign brands like Dior and Gucci is driven by the fact that nearly more than 50% of Russian customers see perfumes as a status symbol. Local producers are gaining popularity with reasonably priced goods that are catered to the tastes of the Russians, such as potent and long-lasting fragrances for colder areas. Gift culture during New Year and Women's Day contributes to a huge part of annual sales. Rich young customers who seek unique products also buy limited-edition and custom fragrances.

Competitive Landscape:

The key players in the market are highly involved in research and development (R&D) to develop new fragrances that are unique and attractive, as well as embracing sustainability and eco-friendliness to resonate with changing consumer values. Engagement with celebrities, designers, and influencers is another prevalent approach to increasing brand awareness and penetration in the marketplace. Additionally, these leaders have a strong international footprint, covering both mature and emerging markets. Their marketing activities focus much on the emotional and sensory character of perfumes. They generally launch exclusive collections and series in limited numbers to various consumer segments. In other words, all these main players are developing the perfumery market through innovative activities, brand building, and global operations.

The report provides a comprehensive analysis of the competitive landscape in the perfume market with detailed profiles of all major companies, including:

- Avon Products Inc.

- Natura Cosmeticos SA

- Chanel SA

- Coty Inc.

- LVMH

- L’Oreal SA

Latest News and Developments:

- November 2024: Unilever is going to launch a new fragrance brand focusing on offering a large portfolio of fragrances catering to diverse customer needs. The brand will consist of an assortment of premium fragrances that will appeal both to personal care and home care products. This step shows how Unilever aims to expand in the fragrance market by offering consumers differentiated and customized experiences, in response to the growing demand for innovative fragrance-based products.

- October 2024 - L'Oréal is reportedly pondering buying a minor percentage of Amouage, which is a luxury perfume house specializing in unique and high-quality fragrances. This buyout is part of the L'Oréal strategic plan to expand its shares in the luxury fragrance industry. The Oman-based house Amouage has long been a player in the luxury fragrance market. With L'Oréal's involvement, it shall be better positioned in this luxury market.

- June 2024: Introducing the Tricoloured Amphora, a new Dior fragrance bottle that evokes style and artistry. The limited-edition release exudes French elegance and legacy with its flashy color combination and elegant gradient. This Amphora bottle highlights the commitment of Dior to sustainability and artistry in painstaking attention to detail. This design is uniquely different from Dior scents as it incorporates contemporary themes with old techniques.

Perfume Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Perfume Types Covered | Premium Perfume Products, Mass Perfume Products |

| Categories Covered | Female Fragrances, Male Fragrances, Unisex Fragrances |

| Regions Covered | Brazil, United States, Germany, France, Russia |

| Companies Covered | Avon Products Inc., Natura Cosméticos SA, Chanel SA, Coty Inc., LVMH, L'Oréal SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the perfume market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global perfume market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the perfume industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Perfume is a fragrant liquid made from a mixture of aromatic compounds, essential oils, and solvents that create a nice smell. It is used to enhance personal appeal, evoke emotions, or signify luxury. Perfumes come in various types, so they suit different tastes and are part of the staple in personal grooming.

The perfume market was valued at USD 41.6 Billion in 2025.

IMARC estimates the global perfume market to exhibit a CAGR of 4.72% during 2026-2034.

The market is driven by changing trends and preferences, growing levels of disposable incomes, rapid e-commerce and online retail, rising innovation in products and marketing, and emerging markets and globalization.

In 2025, premium perfumes represented the largest segment due to their rich quality, long-lasting formulae, and lifestyle connected with luxury lifestyles.

Female fragrance leads the market due to the wide range of scents available for women, ranging from floral to fruity and oriental and woody notes.

Brazil currently dominates the market, driven by its strong cultural affinity for fragrance, increasing disposable income, growing middle-class population, and the rising demand for both luxury and affordable perfume options among consumers.

Some of the major players in the global perfume market include Avon Products Inc., Natura Cosméticos SA, Chanel SA, Coty Inc., LVMH, L'Oréal SA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)