Performance Additives Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2025-2033

Performance Additives Market Size and Share:

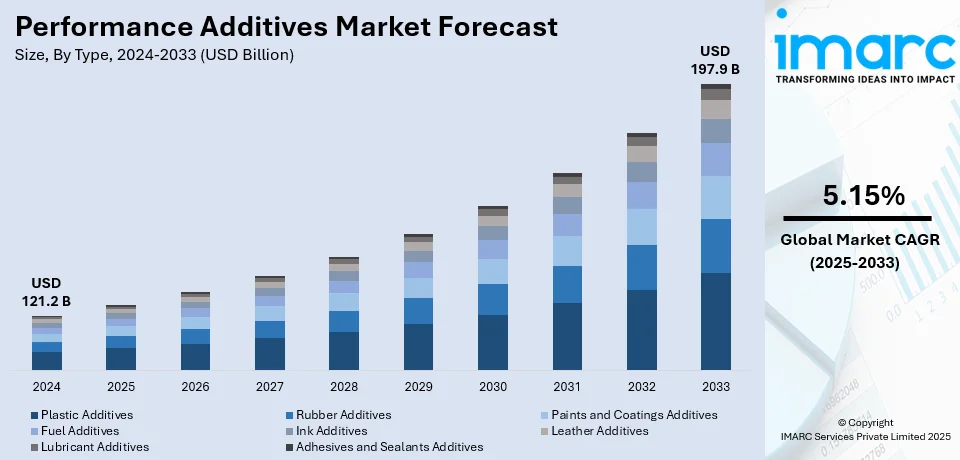

The global performance additives market size was valued at USD 121.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 197.9 Billion by 2033, exhibiting a CAGR of 5.15% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 35.4% in 2024, driven by rapid industrial growth, increased demand across various sectors, and expanding manufacturing capabilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 121.2 Billion |

| Market Forecast in 2033 | USD 197.9 Billion |

| Market Growth Rate (2025-2033) | 5.15% |

One of the most significant factors pushing the performance additives market forward is the high-performance material requirements that have grown extensively in a plethora of sectors including automotive, construction, and electronics. For instance, in August 2024, BASF Performance Materials announced an ambition to get at least 20% of its sales by 2030 from circular economy initiatives that aim at more sustainable solutions through recycling in product lines. With the search for better product durability, efficiency, and sustainability coming at the cost of manufacturers, the need for advanced additives that can enhance the properties of material has grown significantly. Performance additives, mainly used to improve certain attributes like heat resistance, chemical stability, wear resistance, and overall life, are crucial for high-stress applications. Additionally, regulatory pressures for setting and maintaining stricter environmental standards are forcing markets to use more eco-friendly, sustainable additives, further driving growth.

The United States is one of the largest players in serving the global performance additives market by innovation, manufacturing capacity, and research & development. For example, in 2024, Executive Order 14057 requires federal agencies to focus on purchasing sustainable products, such as performance additives, to guide USD 730 billion in procurement. EPA introduced ecolabels for green materials, enhancing sustainability in high-performance industries. The country hosts leading chemical companies that produce a wide range of high-quality performance additives for industries such as automotive, aerospace, construction, and consumer goods. US-based manufacturers are leading the way in developing new, sustainable additives that meet growing regulatory standards and enhance product performance. In addition, the strong presence of advanced research institutions coupled with collaborations between industry players ensures continuous innovation placing the US at the helm of performance additive production and distribution around the globe

Performance Additives Market Trends:

Rapid growth in the electronics and electrical sectors

The rapid growth of the electronics and electrical sectors positively impacts the market. With advancements in technology, the demand for electronic devices increases, and more materials are being sought after for enhancing the performance and reliability of electronic components. These additives form a crucial position in these sectors by providing diverse functionalities, like flame retardancy, thermal conductivity, UV resistance, and electrical insulation. They further strengthen the reliability, safety, and efficiency of electronics equipment and suitability for widespread applications such as consumer electronics, automotive electronics, telecommunication, and industrial electronics. In the area of electronics and electrical, innovation and growth will continue to thrive, and accordingly, demand for high-performance materials and additives is expected to rise further ahead also. According to NITI Aayog, the electronics industry of India has mushroomed, and the value stands at USD 155 Billion in FY23. The growth is near doubling, from USD 48 Billion in FY17 to USD 101 Billion in FY23. Manufacturers and suppliers of these additives continuously develop new formulations and solutions to meet the continuously evolving needs of these industries, which contribute to the overall growth and advancements of the market.

Shift towards lightweight materials in automotive and aerospace industries

The new trend emerging in the automotive and aerospace industries is lightweight materials, considering the demand to improve fuel efficiency and lower emissions. Lightweight materials, such as advanced composites, aluminum alloys, and carbon fiber reinforced polymers, can be considered for these objectives. Automotive vehicles with lighter materials reduce vehicle weight, thus allowing better fuel economy and lowering emissions of greenhouse gases. According to industry reports, the Boeing 787 achieved a 10 to 12 percent improvement in fuel efficiency due to 20 percent weight reduction. This is crucial in light of strict emission regulations as well as the demands of consumers who want environmentally friendly and fuel-efficient automobiles. A prominent aspect in aerospace for reducing the weight of an aircraft is in lightweight materials that contribute to consuming fuel directly while increasing the load capacity. As the cost to operate light airplanes is relatively cheap, airlines have started taking greater interest, whereas manufacturers have the responsibility to save costs through fuel-efficient airplanes with increased use of lightweight materials and environmental sustainability factors.

Increasing use of these additives in personal care and cosmetics products

Use of performance additives in personal care and cosmetics is growing. These additives help provide quite a high list of benefits to the formulation, enhancing its performance as well as its aesthetic properties. In skincare lines, performance additives provide enhancements in moisturization and texture; they can also improve the stability and provide a sensory experience through a luxurious feel when applied. A survey found that 82% of women and 62% of men follow a daily skincare routine. More than that, additives such as UV filters and antioxidants act to provide environmental protection to the skin. For hair care, additive elements result in better conditioning, shine, and managability. They help restore damaged hair to its original state, reduce frizz, and keep color from fading off. With the evolution of consumer demands, the market for high-performance additives in personal care and cosmetics is expected to increase. Formulators and manufacturers constantly find innovative additives to cater to the different needs of consumers, thus opening the window for expansion and diversification in this market sector.

Performance Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global performance additives market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end use industry.

Analysis by Type:

- Plastic Additives

- Rubber Additives

- Paints and Coatings Additives

- Fuel Additives

- Ink Additives

- Leather Additives

- Lubricant Additives

- Adhesives and Sealants Additives

Plastic additives stand as the largest type in 2024, as this product is widely used for enhancing plastics properties in many different industries. It enhances the performance of plastic materials by improving characteristics such as durability, heat resistance, UV stability, and fire retardancy. The demand continues to grow with increased reliance on high-performance plastics in industries such as automotive, construction, packaging, and electronics. Additionally, the growing focus on sustainability is fueling the development of eco-friendly plastic additives, including those derived from renewable sources. This trend further accelerates the adoption of plastic additives, making them a dominant and essential component in the performance additives market.

Analysis by End Use Industry:

- Packaging

- Household Goods

- Construction

- Automotive

- Industrial

- Wood and Furniture

- Others

Packaging leads the market in 2024, driven by the growing need for materials that offer improved durability, barrier properties, and sustainability. Performance additives in packaging materials enhance features such as strength, flexibility, moisture resistance, and UV protection, ensuring that products remain intact and protected throughout their lifecycle. As demand for eco-friendly, sustainable consumer packaging becomes more pronounced, the demand for additives that support recyclability, biodegradability, and renewable material usage is on the upswing. Additionally, the growth in the e-commerce and international trade sectors has fuelled the packaging requirement. Overall, such trends continue to cement packaging as the largest application area in the performance additives market, with much growth potential in the near term.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 35.4%. This dominance can be attributed to the rapid industrialization of the region, the increasing manufacturing base, and the high demand for high-performance materials in various sectors. Key industries like automotive, construction, electronics, and packaging drive the need for specialized additives to enhance the performance, durability, and sustainability of products. Additionally, the region's large-scale production capabilities and significant focus on infrastructure development and technological advancements further contribute to its market leadership. With increased interest in green and bio-based additives, the region is gaining a strong hold with many countries of Asia-Pacific adopting sustainability as part of their production processes. In the years ahead, this factor is also going to sustain growth in the region.

Key Regional Takeaways:

United States Performance Additives Market Analysis

The performance additives market in the United States is significantly influenced by several key trends across industries such as automotive, construction, and consumer goods. According to an article published in Autoinsurance.com, in 2022, nearly 279 Million private and commercial vehicles were registered in the U.S., reflecting a 47% increase since 1990. This growth in vehicle registrations creates a steady demand for fuel additives and lubricant additives to enhance engine performance, fuel efficiency, and reduce emissions. In addition, plastic additives that enhance the toughness and strength of building materials are now highly in demand for construction purposes, including improvements in rubber additives in terms of durability and strength, especially in the automotive and industrial sectors. The paints and coatings market benefits from rising demand for advanced coatings that offer protection against corrosion, UV degradation, and environmental wear, while ink additives are crucial in high-quality printing applications. Furthermore, adhesives and sealants additives are in high demand in construction, automotive, and manufacturing sectors as industries seek solutions that enhance product performance, reliability, and sustainability.

North America Performance Additives Market Analysis

North America is a prominent region in the performance additives market, driven by the presence of leading chemical manufacturers, a robust industrial base, and strong demand across sectors such as automotive, aerospace, construction, and electronics. The United States, in particular, serves as a hub for innovation, with major players such as BASF, Dow Chemical, and Albemarle leading in the development of advanced additives. The market is also influenced by stringent environmental regulations, prompting manufacturers to develop sustainable and eco-friendly additives. For instance, in 2025, BASF Coatings transitioned to 100% renewable electricity at its Greenville, Ohio, and Blackman Township, Michigan sites, reducing CO2 emissions by over 11,000 tons annually, benefiting operations and customers.

The growing focus on high-performance materials that offer enhanced durability, efficiency, and regulatory compliance is further driving market expansion. Additionally, North America’s strong manufacturing and technological capabilities position it as a key player in both production and consumption of performance additives.

Asia Pacific Performance Additives Market Analysis

Performance additives market in the Asia-Pacific region is witnessing significant growth supported by robust industrial expansion that is seen in the automotive, construction, and electronics industries. Asian Automotive Analysis indicates that automobile ownership in Asia, consisting of 2 East Asian countries, 10 ASEAN countries, and 6 South Asian countries, had reached 183 Million Units at the end of 2022. The motorcycle ownership stands at 580 Million Units. This is adding to the demand for fuel additives, lubricant additives, and rubber additives that would improve the performance and fuel efficiency of vehicles as well as the durability of motorcycles. Meanwhile, the construction industry is booming in APAC, which is also demanding plastic and coatings additives to be incorporated into the building materials for strength and longer service life. Ink additives are also seeing an increase in demand, especially in fast-growing packaging. Manufacturing standards in the area continue to show improvement, with a rising demand for automotive and construction sectors for adhesives and sealants additives, both of which require reliability and product life.

Europe Performance Additives Market Analysis

Europe’s performance additives market is largely driven by stringent environmental regulations, technological advancements, and growing demand for high-performance materials across various industries. The automotive sector in Europe is undergoing a significant transformation, with a strong focus on fuel efficiency and sustainability, creating strong demand for fuel additives that improve engine performance and reduce emissions. Additionally, lubricant additives are essential in enhancing engine efficiency and longevity. The need for rubber additives, particularly in the tire and automotive components industry, is growing as manufacturers prioritize performance and durability. In the construction sector, the market for performance additives is also expanding, fueled by increasing infrastructure development. In 2023, the European construction market reached a size of USD 3.38 Billion, which is driving the demand for plastic and coatings additives that enhance the strength, durability, and weather resistance of building materials. Paints and coatings additives are particularly in demand for their ability to provide corrosion protection, UV stability, and superior aesthetic properties. Furthermore, the growing need for high-quality printing solutions in the packaging sector is pushing the demand for ink additives. Lastly, adhesives and sealants additives are becoming increasingly vital in construction, automotive, and manufacturing sectors, where durability, reliability, and product performance are key concerns.

Latin America Performance Additives Market Analysis

The performance additives market in Latin America is growing, driven by expanding industries such as automotive, construction, and manufacturing. In the construction sector, the market for performance additives is boosted by increasing infrastructure projects. In 2023, the Latin American construction chemicals market reached USD 3.6 Billion, spurring demand for plastic and coatings additives that enhance the durability and performance of building materials. Additionally, the automotive industry’s shift toward energy-efficient vehicles is increasing the need for fuel and lubricant additives to improve engine performance. Rubber additives are also in demand for tire production, while adhesives and ink additives are crucial in various industrial applications.

Middle East and Africa Performance Additives Market Analysis

The performance additives market in the Middle East and Africa is driven by rapid infrastructure development, especially in the UAE. In 2024, the UAE construction market size is expected to reach USD 69.5 Billion, fueling demand for performance additives that enhance the durability and strength of building materials. The automotive sector is also expanding, leading to increased demand for fuel and lubricant additives that improve engine performance and fuel efficiency. Rubber additives are essential for producing high-performance tires, while adhesives and sealants additives are crucial for construction and industrial applications, ensuring product reliability and longevity.

Competitive Landscape:

The performance additives market features a range of major players, comprising both global chemical corporations and niche additive producers. Industry leaders like BASF, Dow Chemical, Evonik Industries, and Arkema hold a significant share, utilizing broad product offerings and worldwide distribution channels. For instance, in 2024, Evonik launched TEGO® Powder Aid F05, a hydrophobic dry flow additive for powder coatings, enhancing flowability, anti-caking, and stability, particularly for high heat and humidity environments in Asia Pacific. These companies focus on innovation, investing in research and development to introduce advanced, sustainable additives that meet the growing demand for enhanced performance across industries like automotive, electronics, and construction. Additionally, emerging players are gaining traction by offering niche, eco-friendly alternatives, intensifying competition and driving the overall market towards more specialized and sustainable solutions.

The report provides a comprehensive analysis of the competitive landscape in the performance additives market with detailed profiles of all major companies, including:

- ADEKA Corporation

- Arkema S.A.

- Ashland Inc.

- Baerlocher GmbH

- BASF SE

- Clariant AG

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Honeywell International Inc.

- Lanxess AG

- Lubrizol Corporation

- Performance Additives Sdn. Bhd.

- Solvay

Latest News and Developments:

- December 2024: Advancion Corporation launched a next-generation portfolio of multifunctional additives based on its aminoamyl alcohol technology. Designed for industries like personal care, coatings, metalworking fluids, and electronics, these additives delivered high performance while meeting strict safety and regulatory standards.

- November 2024: EnerG Lubricants, in collaboration with GAT GmbH, introduced the GAT X EnerG product line, including additives like the ENERG G1 Xtreme PLUS 5W30 Fully Synthetic Engine Oil. This Mercedes-Benz-approved additive, the first in India to meet MB 229.51 and MB 229.52 standards, enhances fuel efficiency, emissions control, and engine longevity.

- June 2024: Scientists at Mahidol University in Thailand have developed a sustainable pineapple-based leather alternative using fibers extracted from waste pineapple leaves. The fibers are treated with sodium hydroxide or left untreated, then formed into non-woven sheets and coated with natural rubber latex. The material, which can be dyed with natural colorants, offers strong sustainability properties.

- May 2024: Braskem has launched Octane Plus, a fuel additive that boosts gasoline’s octane rating for better high-performance engine efficiency. Developed in Brazil, it will primarily serve export markets in Central and North America, expanding Braskem's premium fuels portfolio.

- May 2024: Clariant introduced its PFAS-free AddWorks PPA additive range for polyolefin film extrusion at NPE2024 in Orlando. The additives improved process stability and film quality by preventing sharkskin and dye build-up while maintaining mechanical and sealing properties. They also offered high thermal stability, low migration, and cost efficiency with low let-down ratios.

Performance Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Plastic Additives, Rubber Additives, Paints and Coatings Additives, Fuel Additives, Ink Additives, Leather Additives, Lubricant Additives, Adhesives and Sealants Additives |

| End Use Industries Covered | Packaging, Household Goods, Construction, Automotive, Industrial, Wood and Furniture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ADEKA Corporation, Arkema S.A., Ashland Inc., Baerlocher GmbH, BASF SE, Clariant AG, Dow Inc., Eastman Chemical Company, Evonik Industries AG, Exxon Mobil Corporation, Honeywell International Inc., Lanxess AG, Lubrizol Corporation, Performance Additives Sdn. Bhd., Solvay, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the performance additives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global performance additives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the performance additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The performance additives market was valued at USD 121.2 Billion in 2024.

IMARC estimates the performance additives market to reach USD 197.9 Billion by 2033, exhibiting a CAGR of 5.15% during 2025-2033.

Key factors driving the performance additives market include growing demand for high-performance materials across industries, stringent environmental regulations, the need for sustainability, technological advancements, and the increasing focus on energy efficiency and durability. Additionally, the rise of renewable and bio-based materials is further boosting market growth.

Asia Pacific currently dominates the market with 35.4% share, driven by rapid industrialization, growing manufacturing sectors, and increasing demand for high-performance materials in industries such as automotive, construction, and electronics. The region’s strong manufacturing capabilities and expanding infrastructure contribute significantly to its market dominance.

Some of the major players in the performance additives market include ADEKA Corporation, Arkema S.A., Ashland Inc., Baerlocher GmbH, BASF SE, Clariant AG, Dow Inc., Eastman Chemical Company, Evonik Industries AG, Exxon Mobil Corporation, Honeywell International Inc., Lanxess AG, Lubrizol Corporation, Performance Additives Sdn. Bhd., Solvay, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)