Pepperoni Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Pepperoni Market Size and Share:

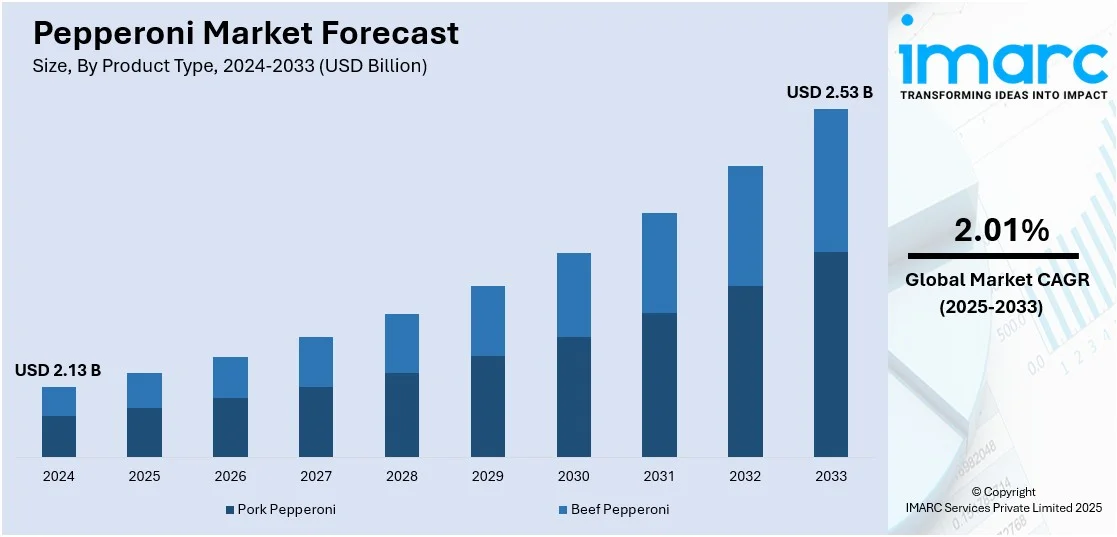

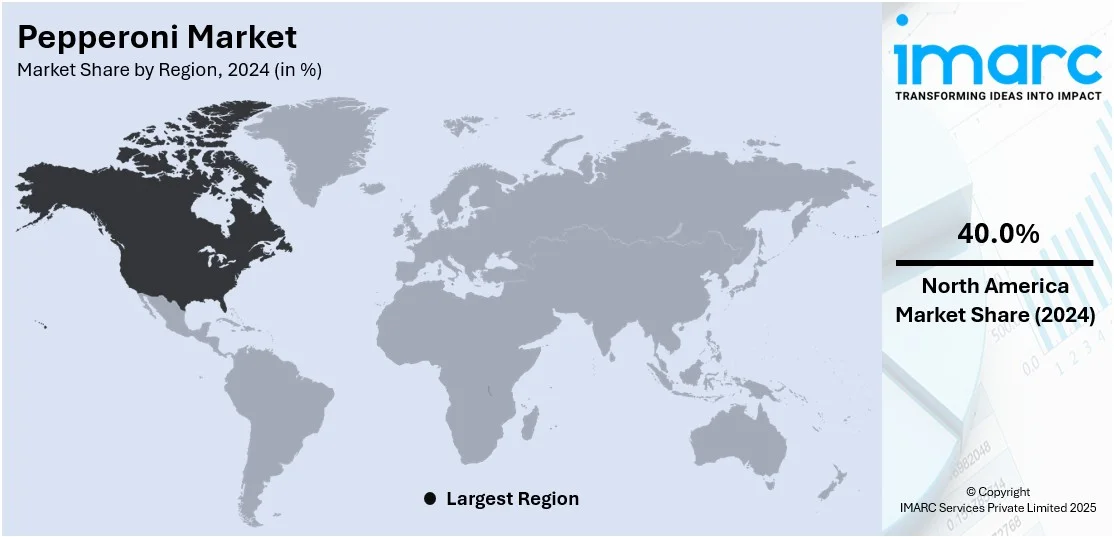

The global pepperoni market size was valued at USD 2.13 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.53 Billion by 2033, exhibiting a CAGR of 2.01% from 2025-2033. North America currently dominates the market, holding a market share of over 40.0% in 2024. The market is growing steadily due to the rising demand in pizzas, snacks, and ready-to-eat meals. Innovations in plant-based options and clean-label products are also expanding consumer reach across the region, contributing to an overall increase in pepperoni market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.13 Billion |

|

Market Forecast in 2033

|

USD 2.53 Billion |

| Market Growth Rate 2025-2033 | 2.01% |

The pepperoni market is experiencing strong growth driven by rising demand for ready-to-eat and frozen foods, especially in urban areas. Increasing consumption of Western-style fast food, particularly pizza, is boosting pepperoni usage in both retail and foodservice channels. For instance, in September 2024, Marco’s Pizza announced the launch of its new Triple Pepperoni Magnifico Pizza, featuring three varieties of pepperoni just in time for National Pepperoni Pizza Day. This limited time offering combines crispy shredded pepperoni, cupped Old World Pepperoni®, and classic pepperoni atop handmade dough and signature cheeses. rowing meat consumption, expanding QSR chains, and the influence of global food trends are also fueling market expansion. Additionally, innovations in plant-based and low-fat pepperoni variants are attracting health-conscious consumers, thereby creating a positive pepperoni market outlook across the world.

The United States pepperoni market is driven by the continued popularity of pizza, with pepperoni remaining the most preferred topping nationwide. Growth in frozen and ready-to-eat meal segments, along with expanded delivery and takeout options, is sustaining high demand. For instance, in March 2024, Hormel Foods Corp. announced its plans to introduce its new Hormel Ribbon Pepperoni at the International Pizza Expo in Las Vegas. This ready-to-use product aims to enhance operational efficiency for foodservice operators by simplifying pepperoni application, addressing challenges with traditional round formats. The innovation follows Hormel's recent sliced chorizo launch. The rise of high-protein snacking has also boosted the appeal of pepperoni as a convenient, flavorful option. Additionally, product innovation including turkey, beef, and plant-based alternatives—is widening the consumer base and catering to shifting dietary preferences across mainstream and niche markets.

Pepperoni Market Trends:

Clean Label and Nitrate-Free Options

Consumers are increasingly seeking transparency in food ingredients, leading to higher demand for clean-label pepperoni products. Brands are responding by removing artificial preservatives, nitrates, and nitrites, and highlighting natural curing processes using ingredients like celery powder or sea salt. For instance, in March 2023, Volpi Foods introduced its new Uncured Pepperoni & Chorizo Crumbles, combining savory flavors with sweet paprika and fennel. These versatile crumbles, ideal for pizzas, pastas, and more, are non-GMO and gluten-free. This shift aligns with broader health-conscious eating trends, especially among younger demographics and families. As a result, nitrate-free pepperoni options are gaining shelf space in both mainstream grocery and premium food stores, reshaping product development strategies in the category.

Rising Demand from QSRs and Pizza Chains

Quick-service restaurants and pizza chains remain key drivers of pepperoni consumption worldwide. With pizza holding a top spot in global fast-food preferences, pepperoni continues to be the most popular topping. Chains are constantly innovating with stuffed crusts, pepperoni-loaded variations, and combo deals, further boosting usage. For instance, in February 2024, KFC announced plans to launch Chizza, a fusion of fried chicken and pizza, in U.S. restaurants. This dish features two fried chicken filets topped with marinara, mozzarella, and pepperoni. The rise of food delivery apps has expanded access and convenience, increasing off-premise consumption. Pepperoni’s flavor, familiarity, and versatility make it a staple ingredient in QSR menus across markets.

E-commerce and Direct-to-Consumer Growth

The shift toward online grocery shopping and direct-to-consumer models has significantly impacted pepperoni distribution. Post-pandemic habits have accelerated digital adoption, with consumers increasingly purchasing deli meats and ready-to-eat items online. Brands are launching dedicated D2C websites, subscription boxes, and partnering with e-commerce platforms to expand reach. Smaller, artisanal pepperoni producers are also leveraging online channels to connect with niche audiences. Convenient ordering, wider selection, and targeted promotions are making e-commerce a vital growth channel for the pepperoni market.

Pepperoni Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pepperoni market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Pork Pepperoni

- Beef Pepperoni

Pork pepperoni stands as the largest product type in 2024, holding around 45.0% of the market. Pork pepperoni remains the dominant product type in the global pepperoni market due to its strong association with traditional pizza and deli products. Its distinct flavor, achieved through a blend of cured pork, spices, and aging, makes it the preferred choice for consumers and foodservice providers alike. Widely used by QSR chains, frozen pizza brands, and restaurants, pork pepperoni consistently leads in volume and value. Despite the emergence of turkey and plant-based alternatives, pork-based variants continue to drive mainstream demand and market share.

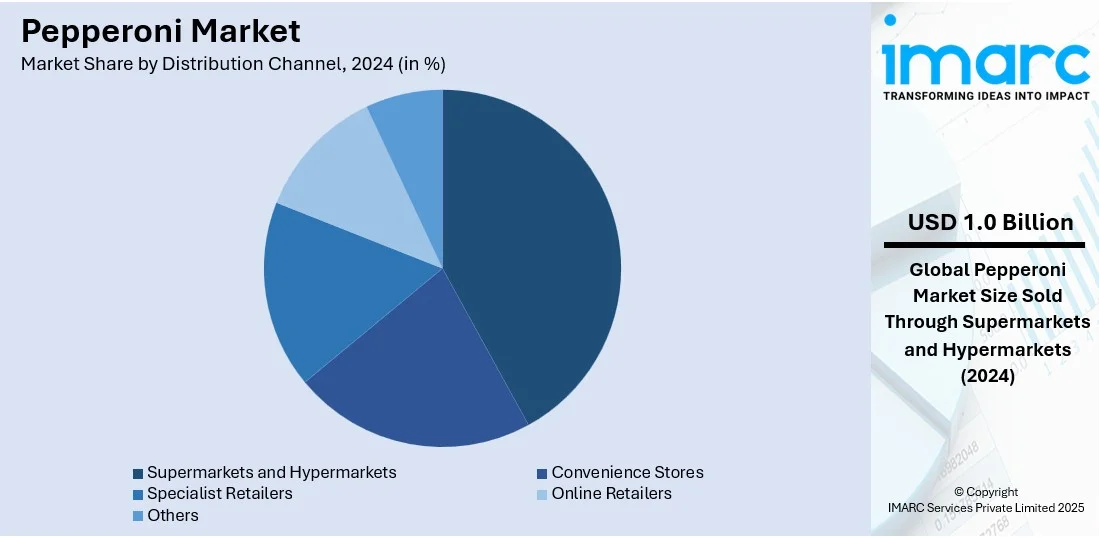

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Retailers

- Others

Supermarkets and hypermarkets leads the market with around 41.7% of market share in 2024. Supermarkets and hypermarkets lead the pepperoni market as the primary distribution channels due to their broad product range, competitive pricing, and high foot traffic. These retail formats offer convenient access to various pepperoni types, including sliced, sticks, and ready-to-cook options. Their ability to stock both mass-market and premium brands makes them attractive to a wide consumer base. In-store promotions, sampling, and prominent shelf placement also help drive sales, reinforcing supermarkets and hypermarkets as the dominant sales point in the pepperoni category.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 40.0%. North America holds the largest share of the global pepperoni market, driven by the region’s strong consumption of pizza and processed meats. The United States, in particular, accounts for a significant portion, with pepperoni being the most popular pizza topping nationwide. A well-established foodservice sector, widespread presence of QSR chains, and high demand for convenience foods further fuel growth. Additionally, product innovation, including nitrate-free and turkey-based variants, supports continued consumer interest, keeping North America at the forefront of pepperoni consumption and production.

Key Regional Takeaways:

United States Pepperoni Market Analysis

In 2024, the United States accounted for over 87.90% of the dehumidifier market in North America. United States experiences rising pepperoni demand because of the growing focus on a healthy diet, influencing product formulations with leaner meat blends and reduced sodium options. According to surveys, nearly 7 in 10 (68%) American respondents recognize healthy eating habits as an important factor in improving a person’s chance for a long and healthy life. Consumers seeking high-protein snacks contribute to expanding pepperoni-based product lines across delis and meal kits. The growing focus on healthy diet encourages manufacturers to introduce nitrate-free and organic variants, gaining traction in premium food categories. Expanding awareness about protein-rich diets further positions pepperoni as a favored ingredient in salads and sandwiches. The growing focus on healthy diet also fuels innovation in portion-controlled packs, catering to calorie-conscious consumers. Foodservice chains incorporate pepperoni into diverse menus, reflecting its versatility beyond traditional pizzas. The rising influence of health-conscious consumer choices drives market players to highlight nutritional benefits, reinforcing pepperoni's presence across retail and foodservice sectors. Growing demand for functional ingredients further aligns pepperoni with evolving dietary preferences in the country.

Asia Pacific Pepperoni Market Analysis

Asia-Pacific witnesses expanding pepperoni consumption, largely driven by growing supermarkets and hypermarkets facilitating broader product accessibility. According to reports, there are 66,225 supermarkets in India as of January 23, 2025, which is a 3.88% increase from 2023. Increased store expansions enhance visibility, allowing pepperoni to penetrate new consumer segments. The growing supermarkets and hypermarkets trend supports diverse product placements, from frozen pizzas to sandwich fillings, accelerating retail sales. Rising disposable incomes further encourage trial purchases, strengthening the pepperoni market demand across urban and semi-urban areas. The growing supermarkets and hypermarkets landscape enables competitive pricing strategies, making pepperoni more affordable for wider demographics. Retailers emphasize dedicated sections for international processed meats, boosting brand recognition and consumer awareness. The expanding footprint of modern trade channels ensures consistent product availability, reinforcing repeat purchases. The growing supermarkets and hypermarkets development also enhances promotional campaigns, driving seasonal discounts and in-store tastings, leading to increased consumer engagement.

Europe Pepperoni Market Analysis

Europe sees sustained pepperoni expansion, influenced by growing food processing industries integrating it into diverse convenience food offerings. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. Increased automation and technological advancements within growing food processing industries enable efficient large-scale production, supporting competitive pricing. Rising consumer preference for processed meat snacks bolsters pepperoni inclusion in ready-to-cook and frozen meal segments. The growing food processing industries streamline product innovation, driving demand for artisanal and premium pepperonis. Strong distribution networks ensure a steady supply to retailers and food service providers, further stimulating consumption. Growing food processing industries also foster strategic partnerships between meat suppliers and manufacturers, resulting in innovative product launches. Enhanced quality control mechanisms elevate food safety standards, reinforcing consumer confidence in packaged pepperoni products.

Latin America Pepperoni Market Analysis

Latin America exhibits increasing pepperoni adoption, supported by growing online retailers expanding accessibility to a broader customer base. According to reports, the Latin America market currently boasts over 300 Million digital buyers. Digital grocery platforms integrate processed meats into curated selections, enhancing product visibility. The growing online retailers trend promotes convenient doorstep delivery, appealing to urban consumers with fast-paced lifestyles. Subscription-based meat delivery services capitalize on changing consumer habits, ensuring frequent purchases of pepperoni. Increased mobile commerce and app-based shopping drive impulse buys, strengthening market growth. The growing online retailers ecosystem enables personalized promotions and targeted advertising, further influencing purchasing decisions.

Middle East and Africa Pepperoni Market Analysis

Middle East and Africa observe rising pepperoni demand due to growing demand for ready-to-eat food items, driven by growing tourism. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. Expanding hospitality sectors incorporate pepperoni into diverse fast-food offerings, catering to international visitors. The growing demand for ready-to-eat food items strengthens quick-service restaurant menus, increasing consumer exposure. Hotels and resorts introduce pepperoni used in dishes, reflecting global culinary preferences. The growing tourism influx elevates demand for processed meat snacks, leading to expanded retail availability. Convenience stores enhance pepperoni accessibility for on-the-go consumption, aligning with evolving travel trends.

Competitive Landscape:

The pepperoni market is moderately consolidated, with a mix of established meat processing companies and emerging specialty brands competing across retail and foodservice segments. Key players focus on product differentiation through flavor innovation, clean-label formulations, and alternative meat options to cater to evolving consumer preferences. Private label offerings are also expanding, especially in large retail chains. Market competition is further intensified by the rise of e-commerce and direct-to-consumer channels, enabling smaller producers to reach niche audiences. Consistent demand from QSRs and frozen food manufacturers keeps the market dynamic, with pricing, quality, and distribution reach being critical competitive factors.

The report provides a comprehensive analysis of the competitive landscape in the pepperoni market with detailed profiles of all major companies, including:

- Battistoni Italian Specialty Meats

- Bridgford Foods Corporation

- Danish Crown Toppings (Dk Foods)

- Hormel Foods Corporation

- Johnsonville

- Liguria Foods

- Pallas Foods

- Smithfield Foods

Latest News and Developments:

- October 2024: HORMEL® Pepperoni Confetti was introduced as a bold new twist on the classic favorite, featuring a unique ribbon shape for even distribution. Designed to enhance pizzas, snacks, and appetizers, it offered an irresistible flavor experience. The limited-time product delighted consumers, redefining how pepperoni could be enjoyed. Available at select retailers, it brought a fun and innovative touch to every bite.

- October 2024: Goodfella’s refreshed its frozen pizza lineup with a new logo, packaging, and improved recipes, including its Stonebaked Thin Pepperoni pizza. A study revealed demand for bolder flavors and crispier bases, leading to a revamped sauce and texture. The Pepperoni pizza featured an enhanced base and richer taste to meet consumer preferences.

- September 2024: Pizza Nova launched its Cup & Char Pepperoni and Doppio Pepperoni Signature Pizza on September 20 to celebrate National Pepperoni Pizza Day. The Cup & Char Pepperoni crisped up into crunchy cups, while the Doppio featured a double serving of pepperoni with mozzarella and signature sauce. President Domenic Primucci highlighted the unique texture and taste of the new topping.

- June 2024: Applegate® introduced its first organic pepperoni, expanding its natural meat line with pork & beef and turkey options. The brand teamed up with Coyote Outdoor Living and Bob’s Red Mill for the Ultimate Pizza Giveaway to celebrate. The organic pepperoni, now available at Sprouts and Whole Foods, met Applegate’s high standards. Fans enjoyed the same great flavors in pizzas, subs, and snacks with a commitment to humane and antibiotic-free meat.

- April 2024: Papa Johns introduced the Crispy Cuppy ‘Roni platform, offering three new menu items featuring premium cupping pepperoni. The pepperoni had been showcased in the NY Style Crispy Cuppy ‘Roni Pizza, Papadia, and Papa Bites. This launch followed past successes like the Epic Pepperoni Stuffed Crust and Shaq-a-Roni. The brand had aimed to elevate pepperoni lovers’ experience with bold, flavorful innovations.

Pepperoni Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pork Pepperoni, Beef Pepperoni |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialist Retailers, Online Retailers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Battistoni Italian Specialty Meats, Bridgford Foods Corporation, Danish Crown Toppings (Dk Foods), Hormel Foods Corporation, Johnsonville, Liguria Foods, Pallas Foods, Smithfield Foods |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pepperoni market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pepperoni market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pepperoni industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pepperoni market was valued at USD 2.13 Billion in 2024.

IMARC estimates the pepperoni market to reach USD 2.53 Billion by 2033, exhibiting a CAGR of 2.01% from 2025-2033

Key drivers of the pepperoni market include rising global pizza consumption, increased demand for high-protein snacks, and growth in quick-service restaurants. Expanding retail availability, innovations in healthier variants, and the popularity of ready-to-eat and frozen meals also contribute to sustained market growth.

North America currently holds the largest pepperoni market share, driven by strong demand in the U.S. foodservice sector, especially in pizza chains and frozen meals. High consumer preference for processed meats and widespread retail availability further support the region’s leading position.

Some of the major players in the pepperoni market include Battistoni Italian Specialty Meats, Bridgford Foods Corporation, Danish Crown Toppings (Dk Foods), Hormel Foods Corporation, Johnsonville, Liguria Foods, Pallas Foods and Smithfield Foods, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)