Pen Needles Market Report by Type (Standard Pen Needles, Safety Pen Needles), Needle Length (4mm, 5mm, 6mm, 8mm, 10mm, 12mm), Therapy (Insulin, GLP-1, Growth Hormones), Mode of Purchase (Retail, Non-Retail), End User (Hospitals and Clinics, Home Healthcare, and Others), and Region 2025-2033

Pen Needles Market Size:

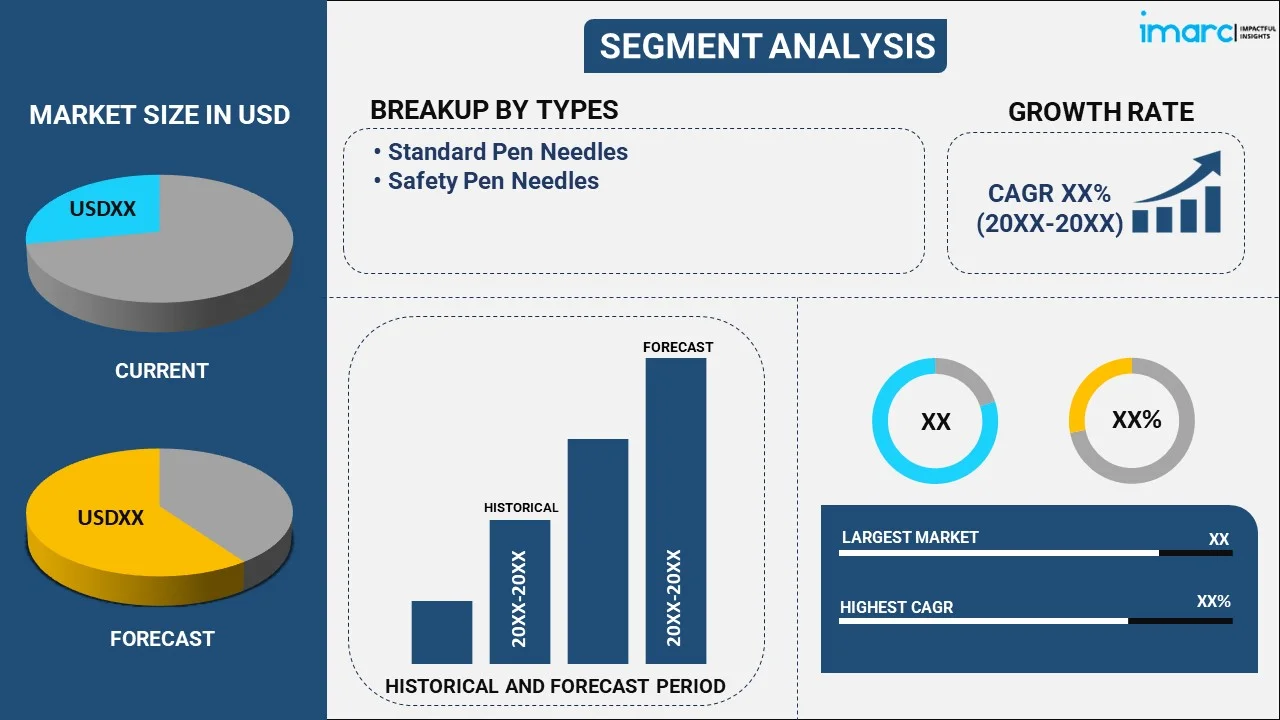

The global pen needles market size reached USD 4.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.8 Billion by 2033, exhibiting a growth rate (CAGR) of 12.2% during 2025-2033. The market is driven by the rising prevalence of diabetes and chronic diseases, expanding geriatric population, increasing investment in the healthcare sector, rapid technological advancements, growing self-administration of insulin, and the imposition of favorable reimbursement policies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.2 Billion |

|

Market Forecast in 2033

|

USD 11.8 Billion |

| Market Growth Rate (2025-2033) | 12.2% |

Pen Needles Market Analysis:

- Major Market Drivers: The increasing prevalence of diabetes and other chronic illnesses that require regular insulin injections has been leading to a higher demand for pen needles. Furthermore, technological advancements in design, such as ultra-fine and shorter needles, in combination with favorable reimbursement policies and government efforts, are contributing to the market growth.

- Key Market Trends: The burgeoning popularity of insulin self-administration, coupled with ongoing product advances such as ergonomic designs and safety features, is attracting new customers and positively improving the dynamics of the market. Furthermore, the introduction of e-commerce platforms and online sales channels that make pen needles more accessible is fueling the expansion of this market.

- Geographical Trends: Europe is currently dominating the market, due to increased diabetes prevalence, advanced healthcare infrastructure, and robust reimbursement systems. Other regions are also experiencing growth as a result of heightened product awareness, upgraded healthcare facilities, and the rising disposable incomes.

- Competitive Landscape: Some of the major market players in the pen needles industry include A. Menarini Diagnostics srl, Advancare Pharma, Arkray Inc., B. Braun Melsungen AG, Becton Dickinson and Company, Hindustan Syringes & Medical Devices Ltd., HTL Strefa SA, Novo Nordisk A/S, Owen Mumford Ltd., Simple Diagnostics, Trividia Health Inc. (Sinocare), Ultimed Inc., among many others.

- Challenges and Opportunities: The high cost of improved pen needles, along with limited reimbursement in some jurisdictions, poses an obstacle to market expansion. However, growing knowledge and education about diabetes management have created opportunities to boost the market in emerging countries.

Pen Needles Market Trends:

Increasing Prevalence of Diabetes and Other Chronic Diseases

The rising prevalence of diabetes and other chronic diseases across the globe is a major factor driving the pen needles market growth. According to the International Diabetes Federation's (IDF) Diabetes Atlas, 10.5% of the adult population aged 20 to 79 had diabetes in 2021, with over half unaware of the diagnosis. By 2045, this forecast predicts that one in every eight adults, or nearly 783 million, will have diabetes, which is an approximately 46% rise. In line with this, diabetes management necessitates frequent monitoring and insulin administration, which is accomplished with insulin pens equipped with pen needles. Pen needles are an indispensable tool for diabetes patients who require frequent insulin injections due to their ease and user-friendliness.

Expanding Geriatric Population

The pen needles market forecast highlights that the expanding geriatric population is a significant factor that is resulting in the growth of this market. Geriatric adults are more susceptible to chronic diseases, including diabetes, due to age-related physiological changes and a higher prevalence of comorbidities. According to the World Health Organization (WHO), the proportion of the world's population over 60 years is projected to nearly double from 12% in 2015 to 22% by 2050. This demographic shift has profound implications for healthcare systems and the demand for medical devices. Additionally, pen needles that are designed with features like easy handling, minimal pain, and safety mechanisms are beneficial for this age group. As the geriatric population continues to grow, the demand for products that are tailored to their specific needs is expected to increase, driving the expansion of the market.

Growing Investment in the Healthcare Sector

The increasing funding in the healthcare industry by several countries is strengthening the pen needle market share. For example, in 2022, Europe's overall government spending on health totaled €1221 Billion, or 7.7% of GDP. Similarly, India's public healthcare spending accounted for 2.1% of GDP in FY23 and 2.2% in FY22. This expansion has been allowing for improved diagnosis, monitoring, and management of illnesses such as diabetes, which drives up the demand for pen needles. Furthermore, the availability of cost-effective insurance coverage and reimbursement schemes have been encouraging patients to explore the use of insulin pens and pen needles as a treatment option. For instance, 92.1 percent of people, or 304.0 million in the U.S., had health insurance at some point during 2022, which also increased the pen needles demand.

Pen Needles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, needle length, therapy, mode of purchase, and end user.

Breakup by Type:

- Standard Pen Needles

- Safety Pen Needles

Standard pen needles accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes standard pen needles and safety pen needles. According to the report, standard pen needles represented the largest segment.

As per the pen needles market outlook and analysis, the standard pen needles segment represented the largest share, driven by their widespread usage and acceptance among patients and healthcare providers. These needles are designed to fit most insulin pens and are known for their versatility, ease of use, and availability in various lengths and gauges. Moreover, standard pen needles are preferred due to their cost-effectiveness and the broad range of options that ensure compatibility with various insulin delivery systems. Besides this, the continuous improvements in design and technology, which enhance comfort and reduce pain during injections, are positively impacting the pen needle market value.

Breakup by Needle Length:

- 4mm

- 5mm

- 6mm

- 8mm

- 10mm

- 12mm

8mm holds the largest share of the industry

A detailed breakup and analysis of the market based on the needle length have also been provided in the report. This includes 4mm, 5mm, 6mm, 8mm, 10mm, and 12mm. According to the report, 8mm accounted for the largest market share.

Based on the pen needles market report and trends, the 8mm needle length segment holds the largest share in the market, attributed to its balanced efficacy and comfort for a wide range of patients. This length is considered optimal for subcutaneous insulin delivery, ensuring adequate penetration to the subcutaneous tissue while minimizing the risk of intramuscular injection. Moreover, the 8mm needles are widely recommended by healthcare providers due to their versatility, making them suitable for adults and children. Along with this, the extensive use of 8mm needles in clinical practice, coupled with patient familiarity and acceptance, is enhancing the pen needles market size.

Breakup by Therapy:

- Insulin

- GLP-1

- Growth Hormones

Insulin represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the therapy. This includes insulin, GLP-1, and growth hormones. According to the report, insulin represented the largest segment.

According to the pen needles market overview and segmentation, insulin therapy constituted the largest share, driven by the growing prevalence of diabetes and the necessity of insulin administration for effective disease management. In line with this, insulin therapy requires frequent and precise injections, making pen needles an essential tool for diabetic patients. Moreover, the rising convenience, accuracy, and reduced pain associated with pen needles that enhance patient compliance and quality of life are contributing to the market growth. Additionally, the development of advanced insulin pens and continuous innovations in product technology are supporting the pen needle market price trends.

Breakup by Mode of Purchase:

- Retail

- Non-Retail

Retail exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the mode of purchase have also been provided in the report. This includes retail and non-retail. According to the report, retail accounted for the largest market share.

As per the pen needles market research report, the retail segment represented the largest share, driven by the convenience and accessibility it offers to consumers. Retail pharmacies and online stores provide an easy and immediate access point for patients as they offer quick supplies without the need for a medical facility visit. Besides this, the broad distribution networks of retail channels ensure widespread availability, catering to urban and rural populations. Additionally, retail outlets offer a variety of brands and products, allowing patients to choose pen needles that best meet their needs and preferences.

Breakup by End User:

- Hospitals and Clinics

- Home Healthcare

- Others

Hospitals and clinics dominate the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, home healthcare, and others. According to the report, hospitals and clinics represented the largest segment.

Hospitals and clinics constituted the largest segment, driven by the high volume of medical procedures and chronic disease management performed in these settings. They are primary healthcare providers where a significant number of diabetes patients receive their diagnosis, treatment plans, and ongoing management, necessitating a steady supply of pen needles for insulin administration and other injectable therapies. Moreover, these healthcare facilities prioritize patient safety and efficacy, opting for high-quality needles to ensure precise and comfortable medication delivery. Additionally, hospitals and clinics serve as the first point of education for patients on the correct use of these needles, boosting the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest pen needles market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represents the largest regional market for pen needles.

Europe holds the largest segment in the pen needles industry, driven by a combination of high diabetes prevalence, advanced healthcare infrastructure, and supportive government policies. In line with this, the robust healthcare systems that provide extensive access to diabetes management tools, coupled with increased support from strong reimbursement frameworks that reduce the financial burden on patients, are boosting the market growth. Along with this, the high awareness of diabetes care, with proactive public health campaigns and educational programs that promote the use of these pens, is favoring the market growth. Additionally, the presence of several leading medical device manufacturers that foster innovation and boost the availability of advanced needle technologies is stimulating the pen needle market revenue.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the pen needles industry include:

- A. Menarini Diagnostics srl

- Advancare Pharma

- Arkray Inc.

- B. Braun Melsungen AG

- Becton Dickinson and Company

- Hindustan Syringes & Medical Devices Ltd.

- HTL Strefa SA

- Novo Nordisk A/S

- Owen Mumford Ltd.

- Simple Diagnostics

- Trividia Health Inc. (Sinocare)

- Ultimed Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The major pen needle companies are focusing on innovation, strategic partnerships, and expanding their global footprint to maintain and enhance their market positions. They are focusing on innovating with ultra-fine and shorter needles to improve patient comfort and compliance. Moreover, some players are leveraging their strong presence in the insulin delivery market to integrate advanced pen needles with their insulin pens to ensure seamless and effective diabetes management. Besides this, they are working on expanding their product portfolio with technologically advanced solutions and enhancing distribution networks to reach a broader audience. Moreover, these companies are actively involved in strategic collaborations and acquisitions to strengthen their market presence and capabilities.

Pen Needles Market News:

- In February 2023, Montmed Inc. announced that the United States Patent and Trademark Office (USPTO) has issued a second U.S. Patent for Sitesmart Pen Needles. This pen needle system is designed to favor teaching and adherence to a healthy injection site rotation regimen. Each package of Sitesmart contains 100 insulin pen needles distinctively marked with 4 colors, along with educational messages and an association tool labeled directly on the packaging. This allows the user to simply and easily create a personalized, structured injection site rotation plan, in which each of the four colors of the pen needle is associated with a distinct injection area, seamlessly instructing the insulin user where to inject at each injection.

- In March 2024, Medical Technology and Devices (MTD) entered into a deal to acquire Ypsomed's pen needle and blood glucose monitoring (BGM) businesses. MTD claims to be the second-largest manufacturer of pen needles globally. The company said it will incorporate Ypsomed's pen needle and BGMs portfolio to ensure long-term availability of an exclusively European manufactured, innovative pen needle offering.

Pen Needles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Standard Pen Needles, Safety Pen Needles |

| Needle Lengths Covered | 4mm, 5mm, 6mm, 8mm, 10mm, 12mm |

| Therapies Covered | Insulin, GLP-1, Growth Hormones |

| Mode of Purchases Covered | Retail, Non-Retail |

| End Users Covered | Hospitals and Clinics, Home Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A. Menarini Diagnostics srl, Advancare Pharma, Arkray Inc., B. Braun Melsungen AG, Becton Dickinson and Company, Hindustan Syringes & Medical Devices Ltd., HTL Strefa SA, Novo Nordisk A/S, Owen Mumford Ltd., Simple Diagnostics, Trividia Health Inc. (Sinocare), Ultimed Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pen needles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pen needles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pen needles industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global pen needles market was valued at USD 4.2 Billion in 2024.

We expect the global pen needles market to exhibit a CAGR of 12.2% during 2025-2033.

The rising prevalence of chronic disorders, such as Diabetes Mellitus (DM), that require daily or weekly administration of medicinal drugs, is primarily driving the global pen needles market.

The sudden outbreak of the COVID-19 pandemic has led to rising utilization of pen needles for self- administration of drugs, particularly among patients suffering from medical ailments, to avoid coronavirus infection upon hospital or clinic visits.

Based on the type, the global pen needles market can be segregated into standard pen needles and safety pen needles. Currently, standard pen needles account for the largest market share.

Based on the needle length, the global pen needles market has been divided into 4mm, 5mm, 6mm, 8mm, 10mm, and 12mm. Among these, 8mm long needles currently exhibit a clear dominance in the market.

Based on the therapy, the global pen needles market can be bifurcated into insulin, GLP-1, and growth hormones, where insulin therapy holds the majority of the total market share.

Based on the mode of purchase, the global pen needles market has been categorized into retail and non-retail. Currently, retail purchase exhibits a clear dominance in the market.

Based on the end user, the global pen needles market can be segmented into hospitals and clinics, home healthcare, and others. Among these, hospitals and clinics currently represent the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global pen needles market include A. Menarini Diagnostics srl, Advancare Pharma, Arkray Inc., B. Braun Melsungen AG, Becton Dickinson and Company, Hindustan Syringes & Medical Devices Ltd., HTL Strefa SA, Novo Nordisk A/S, Owen Mumford Ltd., Simple Diagnostics, Trividia Health Inc. (Sinocare), and Ultimed Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)