Pediatric Interventional Cardiology Market Size, Share, Trends and Forecast by Device Type, Procedure, End Use, and Region 2025-2033

Pediatric Interventional Cardiology Market Size and Share:

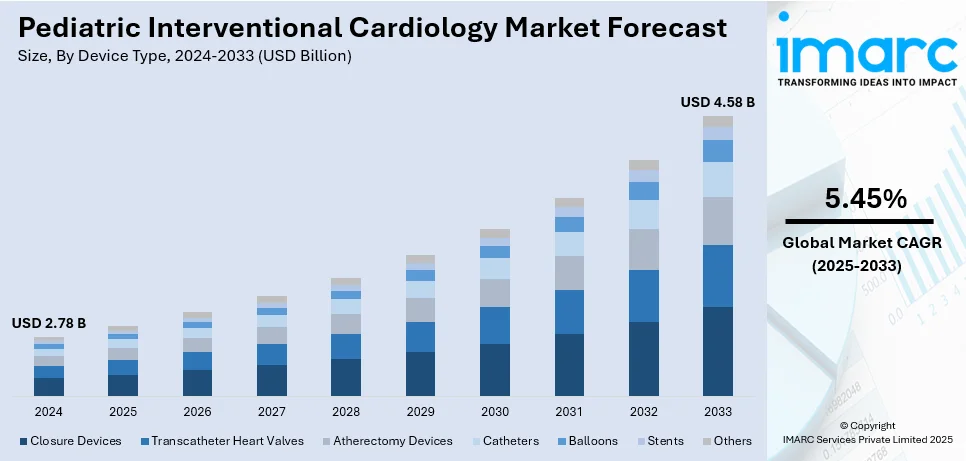

The global pediatric interventional cardiology market size was valued at USD 2.78 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.58 Billion by 2033, exhibiting a CAGR of 5.45% during 2025-2033. North America currently dominates the market, holding a market share of over 35.8% in 2024. The rising congenital heart disease prevalence, rapid technological advancements, increasing preference for minimally invasive (MI) procedures, expanded awareness and early diagnosis initiatives, imposition of supportive government policies, a growing pediatric population, and enhanced healthcare infrastructure, are major factors bolstering the pediatric interventional cardiology market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.78 Billion |

|

Market Forecast in 2033

|

USD 4.58 Billion |

| Market Growth Rate (2025-2033) | 5.45% |

The rising prevalence of congenital heart conditions in children, including atrial septal defect (ASD), atrioventricular canal defect, patent ductus arteriosus (PDA), and ventricular septal defect (VSD), is a significant factor fueling the pediatric interventional cardiology market growth. According to an article published by Cambridge University, approximately 15 million children in low- and middle-income countries die or become disabled each year due to treatable or preventable heart disease. The introduction of novel and more efficient pediatric interventional cardiology devices, including catheters, bio-absorbable stents, guidewires, balloons, stents, vascular closure devices, atherectomy devices is acting as another major growth-inducing factor. In line with this, the shifting inclination of patients toward non-invasive medical treatment procedures, along with the rising awareness regarding the associated benefits, such as lower risk of infection, shorter postoperative recovery times, and avoidance of large scars is also driving the market growth.

The United States exhibits a total share of 89.60% and is a major market disruptor because the country is witnessing an increasing number of cases with congenital heart defects among babies. It has been found that heart defects affect almost 40,000 babies or 1% of births each year in the country. Approximately one in four infants born with a heart defect is diagnosed with a critical congenital heart condition requiring specialized medical intervention. This prevalence underlines the growing necessity for specialized care in pediatric cardiology. Early diagnosis and intervention are now essential; thus, more interventional cardiology procedures have been designed and are specifically developed for children. With growing awareness and enhanced diagnostic capabilities in the United States, a greater number of children are being diagnosed and treated for CHDs, thereby fueling the growth of this medical discipline.

Pediatric Interventional Cardiology Market Trends:

Growing Awareness and Screening Programs

As per the pediatric interventional cardiology market trends, public and private organizations are ramping up efforts to promote early screening for congenital heart diseases. Educational initiatives and complimentary health screenings are motivating parents to pursue prompt medical care. Early diagnosis enhances the chances of effective treatment, thereby broadening the potential of pediatric interventional cardiology. For instance, mandated critical CHD screening using pulse oximetry is known to reduce early infant deaths from critical CHD by 33% in the United States, or 120 early infant deaths averted per year. Improved accessibility to healthcare in developing nations is further amplifying this trend. Increasing awareness is also boosting the demand for advanced healthcare facilities and trained professionals, thereby propelling market growth.

Increasing Pediatric Population and Birth Rates

An increased birth rate with an increase in the population of pediatrics across the world directly forces the demand for healthcare services, of which pediatric cardiology is part. The fertility rate in certain areas of Asia and parts of Africa has increased, and this increases the number of individuals requiring treatment for congenital heart disease. For example, the birth rate for India in 2025 is 16.551 births per 1000 people and it was recorded at 16.750 births per 1000 people in 2024. As such, this trend in population increase will be correlated with the growth in the number of cases requiring interventional cardiology. This population trend will be instrumental in the drive for specialized equipment and expertise in pediatric cardiac care.

Rising Healthcare Infrastructure in Developing Regions

Emerging economies are investing heavily in healthcare infrastructure to meet the growing demand for sophisticated medical care. In 2023, China allocated 7.2% of its economic output to healthcare. Additionally, the country's "Healthy China 2030" plan, which focuses on developing the healthcare industry, aims for the industry to reach a value of around. US$2.4 trillion by 2030. Consequently, specialized pediatric cardiology centers are coming up, well-equipped with the latest technologies. These centers are making interventional cardiology accessible to larger populations. Better infrastructure also supports training programs, which enables more healthcare professionals to offer expert care. The expansion of these services in underserved regions significantly drives pediatric interventional cardiology market demand.

Pediatric Interventional Cardiology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pediatric interventional cardiology market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on device type, procedure, and end use.

Analysis by Device Type:

- Closure Devices

- Transcatheter Heart Valves

- Atherectomy Devices

- Catheters

- Balloons

- Stents

- Others

According to the pediatric interventional cardiology market outlook, closure devices will be the largest device type in 2024, accounting for about 30.8% of the market. Closure devices have become the leading device type because they are the most efficacious approach in the treatment of congenital heart disease, especially ASDs and PDA. They have become an economic minimally invasive model by improving recovery time and patients' outcomes, opening up their chest instead of making huge incisions. Technological advances, like bioresorbable materials and increased precision, also add to the popularity of their use and make closure devices an essential tool in pediatric cardiac interventions. The incidence of congenital heart defects is increasing, and higher awareness about early diagnosis has enhanced the demand for closure devices. Additionally, positive government policies and healthcare funding are boosting their availability in emerging markets.

Analysis by Procedure:

- Catheter-Based Valve Implantation

- Congenital Heart Defect Correction

- Angioplasty

- Coronary Thrombectomy

- Others

Catheter-based valve implantation is gaining popularity because it is minimally invasive, especially in the treatment of valve-related abnormalities such as pulmonary or aortic valve stenosis. Catheter-based techniques enable the placement of replacement valves precisely without open-heart surgery, thereby reducing risks and increasing recovery time. The growing adoption of TPVI and TAVI procedures among pediatric patients is driving the growth of this segment.

Another rapidly expanding segment is the correction of congenital heart defects, including the closure of atrial septal defects and ventricular septal defects. These procedures integrate sophisticated closure devices with catheter-based techniques to correct heart abnormalities with high precision. It continues to gain importance in pediatric interventional cardiology due to awareness and improvements in early diagnostic advancements combined with improvement in technology used in devices.

Pediatric angioplasty is an important intervention in the management of narrowed or obstructed blood vessels caused by congenital or acquired conditions. Balloon angioplasty, which is commonly linked to stenting, remains a relatively minimally invasive intervention that promotes wider blood flow. This is fast-growing with improved imaging technologies and a focus on this minimally invasive procedure in general to reduce trauma in young patients.

The emergency pediatric care market has a very important segment represented by coronary thrombectomy procedures, or removal of blood clots from the coronary arteries. Although this procedure is less common among children as compared to adults, the market is growing with increased awareness and technological development in clot extraction devices. High-definition diagnostic facilities and better training in pediatric cardiologists are driving the adoption of these life-saving interventions.

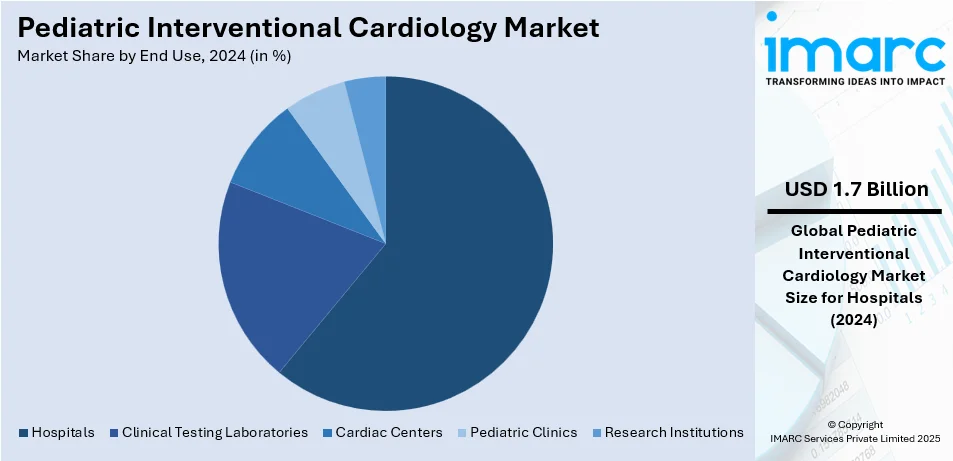

Analysis by End Use:

- Clinical Testing Laboratories

- Hospitals

- Cardiac Centers

- Pediatric Clinics

- Research Institutions

One of the largest end-use sectors in the market are hospitals with a share of 61.6% with all-inclusive facilities and an available multidisciplinary care that deals with complex cases of pediatric heart. Hospitals provide a comprehensive suite of advanced surgical and interventional technologies. The continued rise in cases of congenital heart diseases as well as demand for minimally invasive procedures cements the relevance of hospitals at the center of this end-use segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest pediatric interventional cardiology market share of over 35.8%. This dominance is attributed to advanced healthcare infrastructure, a high incidence of congenital heart diseases, and extensive adoption of minimally invasive procedures. Additionally, significant R&D investments and robust collaborations between medical institutions and device manufacturers further strengthen the region's position. Favorable government policies, robust insurance coverage, and the presence of leading market players further boost accessibility and innovation in pediatric cardiac care, ensuring North America's leadership in the market. Additionally, the rising awareness of early diagnosis and advanced treatment options among parents has significantly increased demand in the region. The strong network of specialized pediatric cardiac centers further supports its market dominance.

Key Regional Takeaways:

United States Pediatric Interventional Cardiology Market Analysis

A major driver of the pediatric interventional cardiology market in the United States is the increasing prevalence of congenital heart defects. According to the CDC, heart defects affect nearly 1% of births, about 40,000 births each year in the U.S. Ventricular septal defects account for the highest percentage of them. With improved diagnostic technologies, mild heart defects are being increasingly detected, further increasing the demand for minimally invasive cardiac procedures. Technological advances such as bioresorbable stents and catheter-based interventions are also increasing the success rate of treatment and reducing the recovery time. This makes it more attractive to healthcare providers and patients. Strong health care infrastructure, extensive insurance coverage, and favorable reimbursement policies in the country are also responsible for the widespread adoption of advanced interventional cardiology procedures. Ongoing investments in research and development by industry leaders drive innovation, enabling safer and more effective treatment options. Government funding and initiatives in pediatric healthcare research further support early diagnosis and timely intervention for congenital heart defects (CHDs). Health care institutions collaborating with medical device manufacturers further accelerate the introduction of advanced technologies. In addition, growing emphasis on personalized healthcare solutions improves the accuracy and safety of pediatric cardiac care, thus driving the market growth.

Asia Pacific Pediatric Interventional Cardiology Market Analysis

The Asia-Pacific region has a high prevalence of congenital heart defects (CHDs) and improving healthcare infrastructure, which is driving the pediatric interventional cardiology market. According to India Pediatrics, with a birth prevalence of congenital heart disease at 9 per 1,000 live births, over 200,000 children are born with CHDs in India each year. The large patient population significantly increases the demand for advanced and minimally invasive cardiac procedures. Rapid urbanization, growing healthcare costs, and government policies that aim at strengthening pediatric healthcare further fuel the market growth. Technological advancements and cost-effective treatment facilities push to adopt interventional cardiology procedures in emerging economies like China and India. Moreover, collaboration with global medical device companies facilitates the transfer of innovative technologies and makes the same treatment available. Growing public awareness of early diagnosis and emergence of private health facilities are further contributing to the demand for pediatric cardiac care solutions in the region.

Europe Pediatric Interventional Cardiology Market Analysis

Factors propelling the European pediatric interventional cardiology market include the high prevalence of congenital heart defects and advancing medical technology. According to the industry reports, it is estimated that 36,000 children with congenital heart defects are born annually within the European Union, and up to 3,000 deaths may occur due to conditions such as TOFPA or late fetal and early neonatal death. This significant disease burden calls for prompt diagnosis and the right treatment at the earliest, providing a strong need for minimally invasive interventional procedures. Moreover, the existence of an advanced healthcare infrastructure in the region, further supported by public initiatives for healthcare for children, enables the embracement of these innovations. Continuous investments of the leading manufacturing companies in developing research and product development further create safer and efficient interventional equipment. In addition, favorable reimbursement policies and strict regulatory standards ensure the availability of high-quality treatment options. Collaboration among academic institutions, research organizations, and healthcare providers further accelerates innovation in pediatric cardiac care. Public awareness campaigns and advocacy by nonprofit organizations also play a vital role in promoting early diagnosis and timely intervention. The increased emphasis on patient-centric and sustainable healthcare models is additionally accelerating the adoption of advanced pediatric interventional cardiology solutions across the region.

Latin America Pediatric Interventional Cardiology Market Analysis

The increasing prevalence of congenital heart defects in Latin America is supporting the growth prospects of the pediatric interventional cardiology market. Various reports indicate that health spending in Brazil was at 9.7% of the gross domestic product (GDP) in 2021, majorly asserting the nation's endeavors to improve healthcare network. Economic growth in the region is also resulting in increased expenditures on high-tech medical equipment. Consequently, the pediatric cardiology market is benefitting from growth in the use of interventional cardiological techniques. Government funding is strategic to the pediatric healthcare infrastructure, and thus presents opportunities for some new treatments and techniques to evolve in association with big multinational medical device companies. Also increased awareness about congenital heart diseases, is expanding the market.

Middle East and Africa Pediatric Interventional Cardiology Market Analysis

The demand for increasing healthcare services and the escalating rate of congenital heart anomaly are boosting the pediatric interventional cardiology market further in the Middle East and Africa. Reports state that Saudi Arabia's economy has been greatly influenced by the country's large healthcare spending as part of its Vision 2030. Its government has been introducing tremendous spending for health and social development since 2018, with an increment from USD 46.6 billion in the year 2018 to reach USD 68.2 billion by 2023. This enhances the Saudi government's continuous focus on improving healthcare services, specifically in pediatric cardiac care. Better infrastructure, huge awareness, and strategic partnerships with medical device international corporations are also driving marked growth in this region's market.

Competitive Landscape:

Key players in the market are innovating, partnering strategically, and expanding geographically to enhance their positions. Companies are investing heavily in R&D for introducing advanced devices, such as bioabsorbable stents, improved catheter systems, and AI-integrated imaging technologies, to improve procedural precision and patient outcomes. Many are joining hands with hospitals, research centers, and government agencies to make clinical trials successful and ensure approval from the regulatory authority for new products. Market leaders are also entering emerging markets through local manufacturing units, distribution networks, and healthcare professional training to increase access to their products. Key players are additionally using merger and acquisition deals to enhance product portfolios and build competitive advantage. Furthermore, digital platforms are being adopted in remote monitoring and post-procedure care, in line with an increasing trend of individualized and technology-oriented healthcare.

The report provides a comprehensive analysis of the competitive landscape in the pediatric interventional cardiology market with detailed profiles of all major companies, including:

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Cardinal Health Inc.

- Edwards Lifesciences Corporation

- General Electric Company

- Koninklijke Philips N.V.

- Lepu Medical Technology (Beijing) Co. Ltd.

- Medtronic plc

- NuMED Inc.

- Siemens Healthineers AG

- Terumo Corporation

- W. L. Gore & Associates Inc.

Latest News and Developments:

- December 2024: DPU Super Speciality Hospital in Pimpri, Pune, has launched a 10-bed Pediatric Cardiac ICU, offering specialized care for children with cardiac conditions. The unit, equipped with advanced medical technology and staffed by skilled personnel, ensures comprehensive care and optimal outcomes. This initiative was made possible through a CSR contribution from Bajaj Finserv.

- October 2024: Six innovators in pediatric cardiology received USD 50,000 each in the “Make Your Medical Device Pitch for Kids!™” competition in Toronto. The funding aims to advance the development and market readiness of devices improving care for children with heart conditions.

- July 2023: Apollo Hospitals has launched Apollo Children’s, India’s largest pediatric care network, with 40+ hospitals, 900+ beds, and 400+ specialists across 25+ specialties. It offers advanced treatment for complex conditions like congenital disorders, cardiac issues, oncology, and organ transplants. Dr. Prathap C. Reddy highlighted its goal to set new benchmarks in comprehensive pediatric care.

- May 2023: Niloufer Hospital in Hyderabad has launched a pediatric cardiology unit, with Dr. Ramesh Reddy, Director of Medical Education, in attendance. Developed in collaboration with the Sri Sathya Sai Health and Educational Trust, the unit will provide comprehensive pediatric cardiac screening, treatment, and minor surgical procedures.

Pediatric Interventional Cardiology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Coverage | Closure Devices, Transcatheter Heart Valves, Atherectomy Devices, Catheters, Balloons, Stents, Others |

| Procedures Covered | Catheter-Based Valve Implantation, Congenital Heart Defect Correction, Angioplasty, Coronary Thrombectomy, Others |

| End Uses Covered | Clinical Testing Laboratories, Hospitals, Cardiac Centers, Pediatric Clinics, Research Institutions |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Biotronik SE & Co. KG, Boston Scientific Corporation, Cardinal Health Inc., Edwards Lifesciences Corporation, General Electric Company, Koninklijke Philips N.V., Lepu Medical Technology (Beijing) Co. Ltd., Medtronic plc, NuMED Inc., Siemens Healthineers AG, Terumo Corporation and W. L. Gore & Associates Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pediatric interventional cardiology market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pediatric interventional cardiology market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pediatric interventional cardiology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pediatric interventional cardiology market was valued at USD 2.78 Billion in 2024.

IMARC Group estimates the market to reach USD 4.58 Billion by 2033, exhibiting a CAGR of 5.45% during 2025-2033.

The pediatric interventional cardiology market is driven by the increasing prevalence of congenital heart defects, rapid advancements in minimally invasive technologies, rising awareness of early diagnosis, growing healthcare infrastructure in emerging economies, supportive government policies, and an expanding pediatric population demanding advanced cardiac care solutions.

North America currently dominates the market, due to advanced healthcare infrastructure, high adoption of innovative technologies, and a strong network of specialized pediatric cardiac care.

Some of the major players in the pediatric interventional cardiology market include Broadcom Inc., Infineon Technologies AG, Murata Manufacturing Co. Ltd., NXP Semiconductors N.V., Qorvo Inc., Skyworks Solutions Inc., STMicroelectronics N.V., Taiyo Yuden Co. Ltd., TDK Corporation, Teradyne Inc., Texas Instruments Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)