Pectin Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Pectin Price Trend, Index and Forecast

Track the latest insights on Pectin price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Pectin Prices Outlook Q3 2025

- USA: USD 11268/MT

- China: USD 9325/MT

- Germany: USD 11382/MT

- Thailand: USD 11222/MT

- Turkey: USD 12973/MT

Pectin Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the pectin prices in the United States reached 11268 USD/MT in September. The price appreciation was attributed to a cautiously positive economic environment characterized by stable consumer spending and increasing industrial production, which fueled demand from key sectors such as food and beverages, pharmaceuticals, and cosmetics. Production volumes remained stable despite transport issues and higher energy and transport costs, whilst rising end-user demand and rebounding economy pushed prices upward.

During the third quarter of 2025, the pectin prices in China reached 9325 USD/MT in September. The price contraction was driven by weakened downstream demand, ample domestic inventories, and aggressive export pricing strategies aimed at clearing excess stock. Despite these challenges, China continued its expansion in the health-foods repertoire. The country's focus on sustainable practices and large-scale citrus processing capacity helped maintain its position as a major pectin producer, although pricing remained under pressure from oversupply conditions.

During the third quarter of 2025, the pectin prices in Germany reached 11382 USD/MT T in September. The quarter witnessed a notable recovery in market sentiment, with prices settling higher following previous declines, highlighting the resilience and demand recovery within the European pectin market. Constrained raw material supply, especially citrus peels due to crop diseases and adverse weather in key sourcing countries, exerted upward pressure on production costs.

During the third quarter of 2025, the pectin prices in Thailand reached 11222 USD/MT in September. The price decline reflected the broader dynamics within Southeast Asia's expanding pectin market, where the young urban population demonstrated growing uptake of fortified beverages and modern fruit-based snacks. However, volatility and seasonality of citrus peel feedstock affected raw material costs, whilst energy and logistics costs materially impacted ingredient economics. Increasing digital and retail reach enabled local and imported pectin brands to reach new consumer segments, although pricing remained competitive due to both indigenous and multinational firms vying for market share.

During the third quarter of 2025, the pectin prices in Turkey reached 12973 USD/MT in September. The price trends were supported by constrained supply conditions and rising production costs throughout the region. Higher production costs, including elevated energy tariffs and labor expenses, added upward pressure to the pricing. Another important factor was the development of the thickeners segment for pectin, which had a significant impact on market dynamics.

Pectin Prices Outlook Q2 2025

- USA: USD 11090/MT

- China: USD 9535/MT

- Germany: USD 11556/MT

- Thailand: USD 11510/MT

- Turkey: USD 12558/MT

During the second quarter of 2025, the pectin prices in the United States reached 11090 USD/MT in June. The price decline was attributed to weakened downstream demand, ample domestic inventories, and aggressive export pricing from Latin America and Europe, alongside improved logistics, reducing urgency in purchases. Congestion at key ports, peak season surcharges, and equipment shortages inflated freight costs in the earlier months, but by June, improved port conditions eased supply pressures, contributing to falling prices. The drop in feedstock citrus fruit prices further weakened production costs, whilst buyers from pharmaceutical and food industries prioritized inventory management due to ongoing trade uncertainties.

During the second quarter of 2025, the pectin prices in China reached 9535 USD/MT in June. The price rebound was primarily driven by a weakened Yuan, boosting export competitiveness and sparking higher international demand, particularly from food and pharmaceutical sectors. Seasonal trends and tariff-driven urgency added momentum to shipments, whilst persistent port congestion in North China, exacerbated by fog and a rush of shipments bound for international markets, tightened short-term availability. This allowed exporters to raise prices despite relatively steady domestic demand.

During the second quarter of 2025, the pectin prices in Germany reached 11556 USD/MT in June. Strong European demand and raw material shortages drove price increases, whilst severe disruptions at major ports, including labor strikes and weather-related delays, exacerbated logistical issues and further tightened supply. Rising production costs, particularly due to citrus peel shortages, added additional upward pressure on prices, whilst demand from the food and beverage industry remained robust.

During the second quarter of 2025, the pectin prices in Thailand reached 11510 USD/MT in June. Regulatory and quality compliance requirements across export markets, combined with the technology intensity required to produce high-purity pectin at scale, presented ongoing challenges. Despite these constraints, increasing digital and retail reach enabled pectin brands to access new consumer segments, supporting gradual market development. Regional policy incentives for waste-to-value projects and prioritization of export-oriented ingredient plants signaled incremental capacity investments.

During the second quarter of 2025, the pectin prices in Turkey reached 12558 USD/MT in June. The price appreciation reflected rising production costs and strong domestic demand dynamics. Higher energy tariffs and labor expenses added upward pressure to pectin pricing throughout the region. Flexible regulatory frameworks provided opportunities for manufacturers to produce pectin-based food products across diverse applications, supporting sustained pricing strength. The region continued to benefit from its strategic position serving both European and Middle Eastern markets.

Pectin Prices Outlook Q1 2025

- USA: USD 11225/MT

- China: USD 9325/MT

- Germany: USD 11385/MT

During the first quarter of 2025, the pectin prices in the USA reached 11225 USD/MT in March. The market saw a minor uptick in pricing, following a previous month-over-month fall. Market participants reported that suppliers successfully maintained a firm price position, with regional and international quotations showing a little upward trend. Another primary factor contributing to the moderate price increase was the abundance of inventory available among traders.

During the first quarter of 2025, the pectin prices in China reached 9325 USD/MT in March. As evident by the pectin price chart, the market saw price fluctuations. An important element influencing the supply chain was the national holidays for the Lunar New Year and the Spring Festival in China. These festivities caused brief production halts, resulting in a short-term supply disruption, thus influencing prices.

During the first quarter of 2025, the pectin prices in Germany reached 11385 USD/MT in March. The prices of feedstocks used in the production of pectin-related products were rising, driving up production costs for manufacturers. Besides, the depreciation of the euro increased import costs for raw materials and finished products. Additionally, geopolitical tensions and trade uncertainties contributed to market instability.

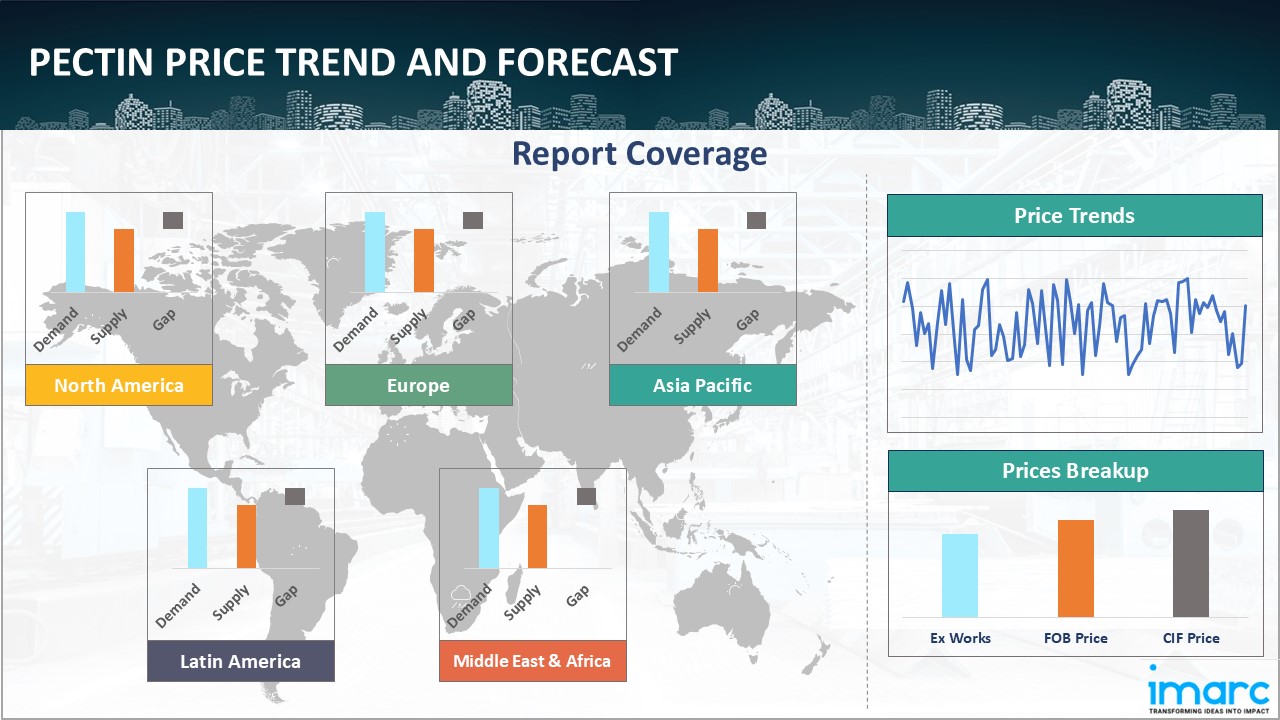

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the pectin prices.

Europe Pectin Price Trend

Q3 2025:

As per the pectin price index, Northern European markets experienced price softening attributed to inventory surplus conditions and competitive import availability from Mediterranean production centres. The region's food and beverage industry demonstrated seasonal demand moderation, particularly within jam and preserve manufacturing, which traditionally peaks during autumn preparation cycles. Raw material availability from Spanish and Italian citrus processors remained adequate, though quality considerations commanded premium pricing for certified organic and clean-label specifications. Sustainability initiatives and single-use plastics directive implementation continued driving innovation in pectin-film composites, creating differentiated demand segments.

Q2 2025:

The pectin price index in Europe during the second quarter of 2025 demonstrated upward momentum across major consumption markets, driven by strengthening demand and supply tightness. Northern European nations experienced robust demand from food processing industries preparing for summer production cycles, particularly within dairy and beverage applications. Mediterranean production regions faced constraints from earlier-than-anticipated citrus harvest conclusions, creating feedstock procurement challenges for regional processors. Germany and France, leveraging proximity to Spanish citrus peel processing infrastructure, maintained relatively stable supply access, though competitive bidding elevated raw material costs. Clean-label product development initiatives accelerated, with manufacturers increasingly prioritising certified organic and natural pectin specifications despite premium pricing implications.

Q1 2025:

As per the pectin price index, prices in Europe experienced fluctuations in Q1 2025 due to a complex interplay of factors, including oversupply, weak demand, and shifts in global trade dynamics. A key driver was the build-up of pectin inventory, forcing suppliers to trade cautiously and offer price reductions to clear excess stock. Additionally, a global decrease in logistics costs also contributed to lower prices, especially for pectin, as import costs were reduced.

This analysis can be extended to include detailed pectin price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Pectin Price Trend

Q3 2025:

The pectin price index in North America during the third quarter of 2025 exhibited modest upward pressure, driven primarily by supply-side constraints and elevated raw material costs. United States market dynamics dominated regional trends, with tight citrus peel availability from Florida and California production regions creating feedstock procurement challenges. Canadian markets followed parallel trajectories, influenced by import dependency and cross-border trade dynamics. The food processing industry maintained steady demand, particularly within breakfast preserves and bakery filling applications, whilst pharmaceutical and nutraceutical sectors demonstrated consistent consumption patterns. Trade policy considerations, including tariff structures and import duty adjustments, influenced sourcing strategies and pricing benchmarks.

Q2 2025:

United States markets experienced subdued consumption patterns across key food processing sectors, with manufacturers demonstrating cautious purchasing behaviour amid economic uncertainty and elevated interest rate environments. Import competition intensified, with competitively priced offerings from Latin American and European suppliers creating pricing pressures on domestic production. Canadian markets followed parallel trends, influenced by cross-border trade dynamics and import dependency for industrial requirements. The pharmaceutical sector maintained consistent demand patterns, providing baseline consumption support despite broader market weakness. Logistics improvements, including normalised freight rates and improved port efficiency, reduced transportation cost components.

Q1 2025:

Following a period of persistent price falls, prices stabilized and rose significantly in March 2025. The market saw a gradual increase in import quotations inside the regional market, with merchants dealing with more than enough inventory. Starting with the market trend, the initial decline in prices across the US market was principally impacted by dampened buying attitude, resulting in the accumulation of excess stocks in both importing and exporting countries, particularly in key suppliers such as China.

Specific pectin historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Pectin Price Trend

Q3 2025:

The market across the Middle East and Africa region during the third quarter of 2025 experienced varied dynamics influenced by diverse economic conditions and infrastructure capabilities. Gulf Cooperation Council nations demonstrated robust demand growth, driven by expanding food processing industries and increasing consumer preferences for convenience foods and premium bakery products. North African markets, particularly Egypt and Morocco, exhibited steady consumption patterns supported by traditional jam and confectionery manufacturing sectors. Import dependency dominated regional supply structures, with pricing heavily influenced by international freight costs and currency exchange rate fluctuations.

Q2 2025:

In Q2 2025, pectin prices in the Middle East and Africa (MEA) were influenced by several factors, including import dependency, with the region relying heavily on imports from Europe and Asia, making prices vulnerable to fluctuations in freight costs and currency exchange rates. A weaker local currency increased the cost of imports, further driving price hikes. Additionally, economic conditions such as inflation and fiscal challenges reduced purchasing power in some regions, prompting manufacturers to adjust prices. Logistics and infrastructure constraints, particularly in Sub-Saharan Africa, led to delays and increased costs for delivery, impacting pricing.

Q1 2025:

The report explores the pectin pricing trends and pectin price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on pectin prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Pectin Price Trend

Q3 2025:

The Asia Pacific region during the third quarter of 2025 presented diverse pectin market conditions across its geographically expansive markets. Chinese market dynamics, characterised by oversupply and competitive pressure, influenced broader regional pricing benchmarks, whilst Southeast Asian nations experienced varied trajectories based on localized demand patterns. Indian markets demonstrated growth momentum, supported by expanding dairy and confectionery industries and increasing consumer adoption of functional foods. Japanese and South Korean markets maintained stable premium pricing structures, reflecting quality specifications and clean-label product requirements within sophisticated consumer markets. Australian markets exhibited steady demand from food processing sectors, though import competition from Asian production centres created pricing pressures.

Q2 2025:

Chinese markets experienced upward price momentum following post-Lunar New Year demand recovery, with food processing activities resuming normal operational intensity. Southeast Asian nations demonstrated varied trends, with Thailand and Indonesia experiencing demand growth supported by expanding food and beverage industries. Indian markets showed robust expansion, driven by dairy sector growth and increasing consumer adoption of functional food products. Japanese and South Korean markets maintained premium pricing structures, reflecting stringent quality specifications and clean-label requirements within sophisticated consumer environments. Australian markets exhibited steady demand from food processing sectors, complemented by growing pharmaceutical and nutraceutical applications.

Q1 2025:

China, a major exporter of H.M. pectin, had been significantly impacted by trade policy changes. Prices rose due to increased production costs, currency exposure, and changing freight rates. The anticipation of persistent trade disruption beyond the Lunar New Year forced importers to rearrange their purchasing plans, subjecting prices to further upward pressure.

This pectin price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Pectin Price Trend

Q3 2025:

Latin America's pectin market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in pectin prices.

Q2 2025:

Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting Latin America’s ability to meet international demand consistently. Moreover, the pectin price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing pectin pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Pectin Price Trend, Market Analysis, and News

IMARC's latest publication, “Pectin Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the pectin market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of pectin at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed pectin prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting pectin pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Pectin Industry Analysis

The global pectin market size reached USD 1,256.27 Million in 2024. By 2033, IMARC Group expects the market to reach USD 2,368.54 Million, at a projected CAGR of 6.94% during 2025-2033. The market is primarily driven by the escalating consumer demand for clean-label and natural food ingredients, expanding applications in pharmaceutical and nutraceutical sectors, increasing prevalence of functional foods and health-conscious dietary preferences, and robust growth in convenience food consumption.

Latest developments in the pectin industry:

- April 2025: DSM-firmenich, innovators in nutrition, health, and beauty, expanded its investment in Yantai DSM Andre Pectin Company Limited (Andre Pectin), increasing its shareholding to 90.5%.

- December 2024: Candy Pros, a manufacturer of candy and gummy bases, launched its newest invention, the Naked Gold Pectin Gummy Base. This novel product is intended to take the place of conventional gelatin-based alternatives and address frequent problems that operators encounter when using pectin or alternative vegan gelling compounds.

- July 2024: The US Department of Agriculture's Agricultural Research Service (USDA ARS) developed a new type of pectin that can gel low-sugar food products. The new pectin allows manufacturers to create low-sugar products with the same texture and mouthfeel as full-sugar versions. This innovation could enable the food industry to produce healthier products with less added sugar while maintaining desirable sensory qualities.

- June 2024: Tate & Lyle has announced an agreement to acquire the entire issued share capital of CP Kelco U.S., CP Kelco China, and CP Kelco ApS, along with their respective subsidiaries (collectively referred to as 'CP Kelco'). CP Kelco is a prominent provider of pectin, specialty gums, and other nature-based ingredients. The acquisition is from J.M. Huber Corporation for a total implied consideration of USD 1.8 billion, on a cash-free, debt-free basis.

- April 2024: CP Kelco completed a USD 60 million expansion of its citrus fiber production capacity in Matão, Brazil, driven by strong customer demand. This expansion increases the total capacity to approximately 5000 metric tons, positioning CP Kelco as a leading supplier of citrus fiber for food, beverage, and consumer products globally.

Product Description

Pectin refers to a naturally occurring polysaccharide found in the cell walls of plants, especially abundant in fruits like citrus peels and apples. It is widely used as a gelling ingredient to help thicken and stabilize mixtures, mainly for making jams and jellies in the food business. It is also utilized as a fat substitute in baked products and in the production of confections and sweets. This soluble fiber can help lower blood sugar levels and improve digestive health. Pectin is also considered to be good for heart health since it can lower cholesterol by blocking the absorption of cholesterol in the gut. It is available in several forms, like liquid or powder, and varies in terms of its gelling properties depending on the pH and the presence of sugar and calcium.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Pectin |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Pectin Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of pectin pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting pectin price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The pectin price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)