Payment Security Market Size, Share, Trends and Forecast by Component, Platform, Enterprise Size, End User, and Region, 2025-2033

Payment Security Market Size and Share:

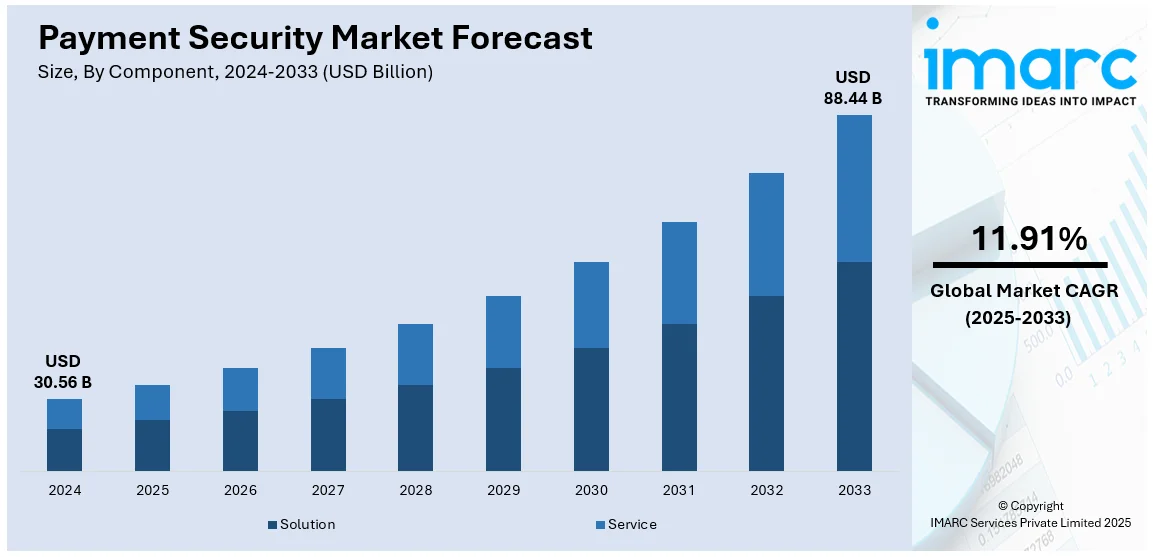

The global payment security market size was valued at USD 30.56 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 88.44 Billion by 2033, exhibiting a CAGR of 11.91% from 2025-2033. North America currently dominates the market, holding a market share of over 35.0% in 2024. The growth of the North American region is driven by increased digital payments, rising cyber threats, stringent regulations, and the adoption of advanced security technologies across industries. These factors are significantly boosting the payment security market share, as businesses prioritize safeguarding transactions to maintain consumer trust and meet compliance requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 30.56 Billion |

|

Market Forecast in 2033

|

USD 88.44 Billion |

| Market Growth Rate (2025-2033) | 11.91% |

The global transition to cashless payment methods is accelerating with the widespread use of e-commerce platforms, digital wallets, and mobile payment applications. This rise in digital transactions necessitates secure payment systems to protect sensitive user data and ensure transaction safety. Moreover, as cybercriminals employ increasingly sophisticated tactics, businesses face mounting risks of payment system breaches. High-profile incidents and the growing prevalence of fraud and phishing attacks are heightening the need for robust security measures, such as tokenization, encryption, and real-time fraud monitoring. Besides this, emerging technologies like artificial intelligence (AI), machine learning (ML), and biometric authentication are improving payment security. These innovations enhance fraud detection, enable real-time risk assessments, and strengthen authentication processes, making them key contributors to market growth.

The United States is a crucial segment in the market, driven by the adoption of wearable payment technologies. These advancements allow users to securely store credentials and access systems or make transactions with enhanced convenience. The increasing use of smartwatches and other wearables highlights the growing demand for secure, user-friendly solutions in payment and access systems. In 2024, Allegion US announced it became the first security solutions provider to support mobile credentials on Wear OS by Google smartwatches. Starting December 9, 2024, users can add Schlage mobile credentials, like student IDs and employee badges, to their Google Wallet on Wear OS smartwatches for enhanced convenience and security. This integration provides seamless access to buildings and systems via a simple tap on Schlage electronic locks.

Payment Security Market Trends:

The Significant Expansion of the E-commerce and Online Shopping Industry

The e-commerce and online shopping industries are growing significantly. In addition, the rise in digitization, the growing internet penetration, and the easy availability of online shopping applications are contributing to the market growth. For instance, according to an industrial report, in 2023, global retail e-commerce sales were estimated to reach approximately USD 5.8 trillion, up from USD 5.2 trillion in 2022. It also offers convenience, accessibility, and the availability of several product choices to consumers on these digital platforms requiring secure and seamless payment transactions are influencing the market growth. Moreover, the need for robust payment security solutions due to increasing online shopping activities among customers entrusting their sensitive financial information to e-commerce platforms requires airtight security measures to protect data during every step of the transaction process representing another major growth-inducing factor. Besides this, e-commerce businesses are adopting advanced encryption methods, secure authentication processes, and real-time monitoring to ensure the confidentiality and integrity of payment information, thus accelerating market growth. Furthermore, the expansion of cross-border e-commerce led to the adoption of secure payment processing for international transactions which is essential to encourage global market growth.

The Emerging Technological Advancements

The payment security market growth is driven by rapid technological advancements offering innovative solutions to combat evolving cyber threats. These advancements empower businesses to strengthen their payment security measures and provide customers with enhanced protection. Moreover, the integration of tokenization, a method that substitutes sensitive payment data with unique tokens, ensures that even if a breach occurs, hackers obtain meaningless data, thus mitigating the risk of fraudulent transactions which represents another major growth-inducing factor. Along with this, the incorporation of biometric authentication which employs unique human characteristics such as fingerprints and facial recognition for secure identity verification during payments enhances security and provides seamless and user-friendly experiences thus propelling the market growth. Besides this, the introduction of artificial intelligence (AI) in fraud detection and prevention, and machine learning (ML) algorithms to analyze patterns in transaction data to identify anomalies indicative of fraudulent activity are accelerating the market growth. For instance, Visa's investments in artificial intelligence (AI) and other technologies enabled the payments processor to block 80 million fraudulent transactions worth USD 40 billion in 2023, as per reports.

The growing Number of Cybersecurity Threats and Data Breaches

The digital transformation led to a rising number of cybersecurity threats, including unauthorized access, fraud, and data breaches in payment security. According to Verizon's 2023 Data Breach Investigations Report, which analyzed over 16,000 reported data breach incidents, many attacks were centered on social engineering and hacking, with the financial services sector being a primary target. These rising threats are driving businesses to prioritize payment security solutions. Cybercriminals are becoming sophisticated in exploiting vulnerabilities, making it imperative for businesses to prioritize comprehensive payment security strategies. Moreover, unauthorized access to payment data can lead to severe financial losses and reputational damage leading to widespread adoption of payment security solutions representing another major growth-inducing factor. Along with this, hackers target weak points in payment systems, often gaining access through phishing attacks, malware, or social engineering, thus influencing market growth. Apart from this, fraudulent activities, such as credit card fraud and identity theft are impacting individuals and businesses requiring stringent security measures, thus augmenting the market growth. Furthermore, the theft of sensitive payment information can lead to financial and legal repercussions resulting in the adoption of multi-layered security measures, including real-time transaction monitoring, two-factor authentication, encryption of sensitive data, and employee training to recognize and prevent potential security breaches are creating a positive payment security market outlook.

Payment Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global payment security market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, platform, enterprise size, and end user.

Analysis by Component:

- Solution

- Encryption

- Tokenization

- Fraud Detection and Prevention

- Service

The solution component is driven by fortifying the integrity of financial transactions across various industries. These solutions include sophisticated tools and technologies that address the evolving cybersecurity threats. Moreover, the incorporation of payment security solutions to counter unauthorized access, fraud, and data breaches to protect sensitive payment data during transmission and storage represents another major growth-inducing factor. Additionally, secure authentication processes, such as multi-factor authentication and biometric verification, provide robust identity validation, ensuring that only authorized individuals can initiate transactions, thus contributing to the market growth. Along with this, the real-time monitoring and fraud detection solutions use advanced AI and machine learning algorithms to analyze transaction patterns to identify anomalies indicative of fraudulent activities which allows businesses to block potential attacks in real time, safeguarding customer data and their own financial interests, thus propelling the market growth. Furthermore, tokenization solutions are gaining traction by replacing sensitive payment information with unique tokens, which add an extra layer of security, thus providing a positive thrust to market growth.

Analysis by Platform:

- Web-based

- POS-based

POS-based leads the market with 57.6% of market share in 2024. Point-of-Sale (POS)-based platforms ensure secure payment transactions across several industries. In addition, the point-of-sale system facilitates payment processing at the moment of purchase and offers a seamless and familiar experience to merchants and customers which enhances user confidence and encourages the adoption of secure payment practices, thus contributing to the market growth. Moreover, the integration of advanced security features within POS systems including encryption techniques, secure card readers, and tokenization processes that collectively fortify payment security and protect against potential breaches and fraudulent activities represents another major growth-inducing factor. Furthermore, the easy adaptability of POS-based platforms catering to numerous businesses, from retail stores to restaurants, enables secure payment transactions in various settings which is contributing to their widespread adoption, further solidifying their position at the forefront of the payment security market.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises represent the largest segment, accounting 67.8% of market share in 2024. Large enterprises possess distinct advantages in terms of resources, financial and human, which enable them to invest substantially in robust payment security solutions with their expansive budgets. It allows for the implementation of advanced technologies, sophisticated encryption methods, and dedicated teams focused on monitoring and mitigating security risks which safeguards their own operations while positioning them as industry leaders in promoting secure payment practices. Moreover, the scale of operations and customer base associated with large enterprises amplifies the need for stringent payment security measures to engage these companies in a high volume of transactions and manage vast amounts of customer data, resulting in the adoption of comprehensive security strategies to uphold customer trust and protect their brand reputation. Furthermore, large enterprises often have a global presence, engaging in cross-border transactions that demand secure payment processing across numerous markets and regulatory landscapes which requires the implementation of adaptable security measures to comply with various regional requirements and to ensure consistent protection for the company and its customers, thus propelling the market growth.

Analysis by End User:

- BFSI

- Government and Utilities

- IT and Telecom

- Healthcare

- Retail and E-Commerce

- Media and Entertainment

- Travel and Hospitality

- Others

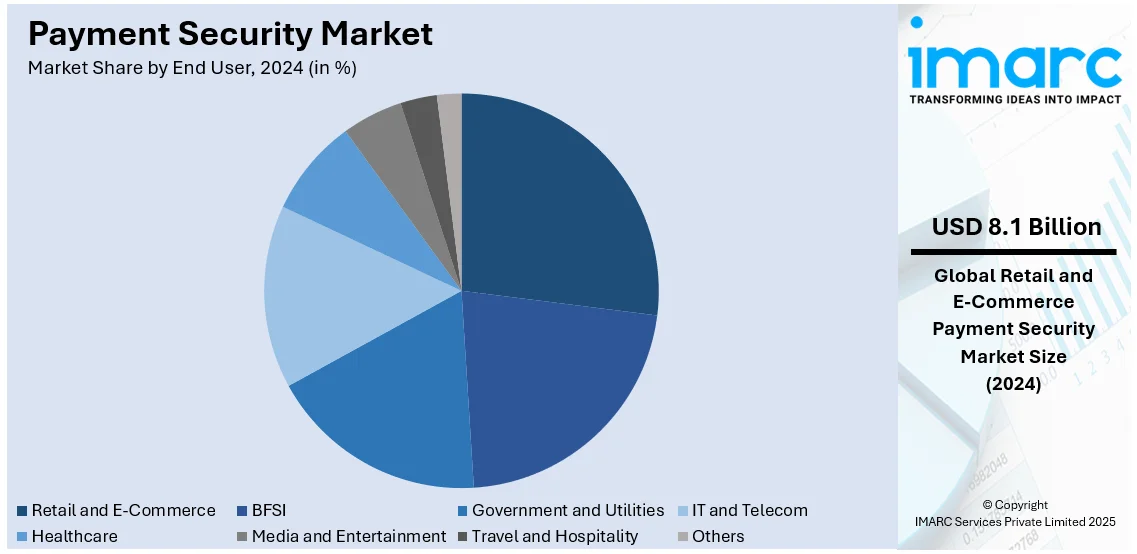

Retail and e-commerce lead the market with 26.5% of market share in 2024. Retail and e-commerce businesses are transforming significantly, transitioning from traditional brick-and-mortar models to dynamic online platforms. In addition, the changing consumer preferences and the convenience of online shopping are escalating the demand for payment security solutions to ensure secure payment processing. Moreover, user entrust their sensitive financial information, including credit card details and personal data, to online retail and e-commerce platforms resulting in stringent payment security measures such as tokenization, biometric authentication, and AI-driven fraud detection to protect client information and enhance the shopping experience represents another major growth-inducing factor. Furthermore, the growing number of cyber threats, data breaches, and fraudulent activities targeting the retail and e-commerce sectors underscores the critical importance of payment security, thus augmenting the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 35.0%. North America is driven by the robust technological infrastructure and a growing digital ecosystem. Moreover, the North America region is home to numerous large-scale corporations, financial institutions, and technology giants that handle extensive volumes of financial transactions which requires rigorous payment security protocols to mitigate risks and maintain consumer trust representing another major growth-inducing factor. In addition, the rising digitalization, the widespread adoption of online payment methods, and the escalating demand for advanced security solutions are augmenting the market growth. Also, businesses and individuals place a premium on protecting financial transactions, driving the need for advanced security measures. In 2024, Payments Canada announced the launch of its Real-Time Rail (RTR) system, set for 2026, to modernize the country's payment infrastructure. The system will allow 24/7, instant payments with enhanced security and interoperability using the global ISO 20022 messaging standard. This initiative aims to boost Canada's competitiveness in the global digital payments market.

Key Regional Takeaways:

United States Payment Security Market Analysis

In North America, the market share for the United States was 83.50% of the total. The US payment security market is booming with companies focusing on the protection of consumers' transactions against the increased cyber threats. The Federal Reserve's 2022 Payments Study states that GP card payments stood at USD 9.76 trillion in value for the year 2022, and this number represents the growing demand for safe payments. A report by Visa said that in 2023, contactless payments accounted for more than 50% of all in-store transactions in the US, more than double the share in the pre-pandemic period. Digital wallets and mobile payment systems, including Apple Pay and Google Pay, are further fueling the payment security market demand. Other prominent innovators are companies like Visa, Mastercard, and PayPal, which lead in providing security in payment gateways and fraud prevention tools. Further, stringent regulations, such as PCI-DSS, have further increased the emphasis on payment security compliance. Even government-driven efforts to enhance cybersecurity, such as the Cybersecurity and Infrastructure Security Agency, add strength to the robust market growth and make the US the global leader in payment security technology.

Europe Payment Security Market Analysis

The European payment security market is growing fast, driven by the increasing demand for secure payment solutions amid the growth of digital payments. According to the 2023 Payments Statistics of the European Central Bank, the number of non-cash payments in the euro area grew by 6.6% to 71.2 billion in the second half of 2023 from the same period in 2022, while the total value of those payments fell by 7.2% to about USD 120.31 trillion. The report from the European Court of Auditors reveals the amount of value from digital payment to retail sale increased by over USD 1.08 trillion yearly between the period of 2017-2023 within the EU borders. The stricter regulation on controlling consumers' information from the European General Data Protection Regulation further forces such firms to find and invest more secure ways in receiving payments. This regulatory framework, along with the increasing usage of mobile payments, is further accelerating demand for advanced payment security solutions across the region.

Asia Pacific Payment Security Market Analysis

The Asia Pacific market for payment security is growing at a huge rate, fueled by rapid digital payment technologies and fast-increasing demand for secure transaction systems. In China, the mobile payment platforms have been led by Alipay and WeChat Pay. The dual platforms are still attracting users in combination to the tune of nearly 2.5 billion users by 2025. For instance, as of 2023, Alipay had more than 640 million monthly active users, compared with approximately 935 million monthly active users at WeChat Pay. The cashless economy has really seen a massive leap forward in digital transactions. India has also experienced tremendous growth in its digital payments industry, as more than 133 billion digital payment transactions were recorded from April 2022 to May 2023, as per reports. This indicates rapid digitalization of the country. This growth can be largely attributed to government initiatives, such as the "Digital India" campaign. With digital transactions increasing day by day, there will be an increased demand for advanced payment security solutions in the region, thus encouraging market growth.

Latin America Payment Security Market Analysis

The Latin American payment security market is growing dramatically, and Brazil is significantly leading the adoption curve for digital payments. According to Bank for International Settlement, Pix, an instant payment system launched by the Brazilian Central Bank in 2020 has bolstered significantly digital payment volume. As of July 2023, to July 2024, more than 90% of Brazilian adults have used or begun a Pix transaction, showing how quickly the system is being adopted and the trend towards digital payments in Brazil. With increased digital payment activity, companies are strengthening their payment security services. The service is also expanding into other Latin American countries, thereby boosting the growth of digital payments in the region. This reflects the increasing need for secure and efficient payment solutions in the region, making it a key player in the global payment security market.

Middle East and Africa Payment Security Market Analysis

Payment security in the Middle East and Africa is expanding fast, mainly driven by increasing use of digital payment solutions. Mastercard recently released a report, which said around 85% of people in the MENA region have used at least one emerging digital payment method, hence showing an increasingly significant shift towards digital transactions. This acceptance is pushing the demand for high-end payment security systems to safeguard consumers and businesses. The UAE has major growth in digital payment solutions, with aid from the government for paving the way for a cashless economy. With this, the region adopting mobile wallets, contactless payments, and other digital modes has triggered more investment in advanced payment security technologies for safe and secure transactions. The growing reliance of the Middle East and Africa on digital payments is likely to add to the overall growth of the global payment security market.

Competitive Landscape:

At present, key players in the payment security market are taking strategic initiatives to solidify and enhance their positions in an increasingly competitive landscape. They are strategically acquiring or merging with smaller firms that possess specialized expertise in payment solutions which enables them to quickly expand their capabilities, access new markets, and stay ahead of the competition. Besides this, they are forming strategic partnerships and collaborations with other technology companies, financial institutions, and cybersecurity experts to facilitate knowledge sharing, access to complementary technologies, and the creation of comprehensive security solutions that address several threats. Moreover, companies are investing in research and development (R&D) to innovate and develop security solutions, including advancements in encryption technologies, fraud detection algorithms, and biometric authentication methods which contribute to strengthening their product portfolios. In 2024, Evervault launched a modular payments security platform that provides fintechs, banks, and merchants full control over their payment stack while maintaining security and compliance. This platform uses advanced encryption and offers tools like Network Tokens and Card Insights, empowering businesses to optimize payment costs and authorization rates.

The report provides a comprehensive analysis of the competitive landscape in the payment security market with detailed profiles of all major companies, including:

- Bluefin Payment Systems LLC

- Broadcom Inc.

- Cybersource (Visa Inc.)

- Elavon Inc. (U.S. Bancorp)

- Ingenico (Worldline)

- PayPal Holdings Inc.

- SecurionPay

- Shift4 Payments

- Signifyd

- SISA Information Security

- TokenEx

- VeriFone Inc.

Latest News and Developments:

- January 2025: Bluefin announced that it has integrated its PCI-validated P2PE gateway with Visa Platform Connect, which enables global multi-currency payment processing and security. The integration also includes Cybersource for fraud management, thereby reducing risks and improving transaction efficiency.

- November 2024: Ingenico and Crypto.com have partnered to launch a seamless crypto payment solution for Ingenico merchants worldwide. The "plug-and-play" solution will enable merchants to securely accept crypto payments, serving over 680 million consumers globally.

- October 2024: Shift4 announced Pay with Crypto on Oct 28, 2024, allowing businesses globally to accept cryptocurrency payments for both e-commerce and POS merchants. This makes Shift4 the first major payments company to offer seamless global crypto payment capabilities.

- June 2024: Elavon launched the Cloud Payments Interface on June 25, 2024, a new API for the hospitality industry. The system simplifies digital and in-person payments, enhancing client experiences and streamlining operations. It offers real-time, secure data synchronization and supports payments for meals and services, ensuring PCI compliance and scalability.

- January 2024: Ingenico partnered with Cybersource to deliver a secure, unified commerce solution, initially targeting Asia Pacific. This collaboration leverages Visa's global payment and fraud management platform, aiming for worldwide deployment.

Payment Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Platforms Covered | Web-Based, POS-Based |

| Enterprise Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| End Users Covered | BFSI, Government and Utilities, IT and Telecom, Healthcare, Retail and E-Commerce, Media and Entertainment, Travel and Hospitality, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bluefin Payment Systems LLC, Broadcom Inc., Cybersource (Visa Inc.), Elavon Inc. (U.S. Bancorp), Ingenico (Worldline), PayPal Holdings Inc., SecurionPay, Shift4 Payments, Signifyd, SISA Information Security, TokenEx, VeriFone Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the payment security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global payment security market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the payment security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The payment security market was valued at USD 30.56 Billion in 2024.

IMARC estimates the payment security market to exhibit a CAGR of 11.91% during 2025-2033, reaching a value of USD 88.44 Billion by 2033.

The payment security market is driven by the growing cases of cyber threats, regulatory compliance mandates, rise of e-commerce transactions, and the demand for seamless, secure payment experiences. Advancements in encryption technologies, biometrics, and multi-factor authentication also play a crucial role in strengthening security frameworks. These factors collectively push businesses to adopt robust payment security solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the payment security market include Bluefin Payment Systems LLC, Broadcom Inc., Cybersource (Visa Inc.), Elavon Inc. (U.S. Bancorp), Ingenico (Worldline), PayPal Holdings Inc., SecurionPay, Shift4 Payments, Signifyd, SISA Information Security, TokenEx, VeriFone Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)