Payment Monitoring Market Size, Share, Trends and Forecast by Component, Organization Size, Deployment, Application, End User, and Region, 2025-2033

Payment Monitoring Market Size and Share:

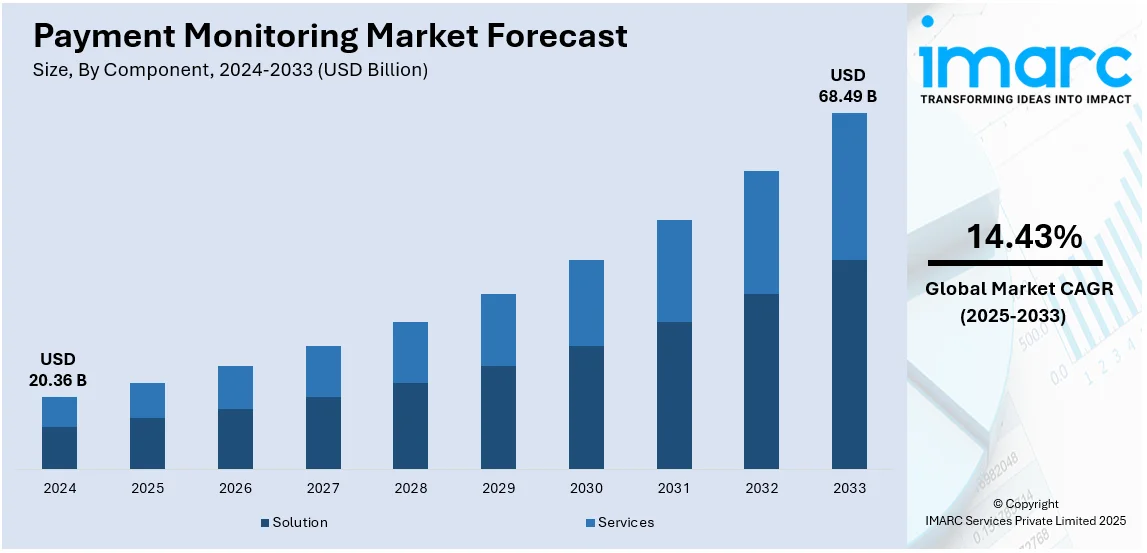

The global payment monitoring market size was valued at USD 20.36 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 68.49 Billion by 2033, exhibiting a CAGR of 14.43% from 2025-2033. North America currently dominates the market, holding a market share of over 34.6% in 2024. The payment monitoring market share is expanding, driven by the rising cases of financial fraud worldwide, increasing implementation of strict compliance regulations, and recent advancements in technologies, including artificial intelligence (AI), big data analytics, and machine learning (ML).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20.36 Billion |

| Market Forecast in 2033 | USD 68.49 Billion |

| Market Growth Rate (2025-2033) | 14.43% |

The rising adoption of digital transactions is fueling the market growth. As online payments expand, businesses face higher risks of cyber threats, encouraging them to adopt advanced monitoring solutions. Besides this, government agencies are implementing anti-money laundering (AML) and fraud prevention laws, requiring financial institutions to invest in real-time transaction tracking. The increasing employment of AI and ML is aiding in improving fraud detection accuracy and reducing false positives. Additionally, the demand for cross-border transactions and real-time payment processing creates the need for continuous monitoring. Moreover, cloud-based solutions gain popularity, as they offer scalability, cost-effectiveness, and easy integration with existing financial systems.

The United States has emerged as a major region in the payment monitoring market owing to many factors. The rising implementation of strict financial regulations due to rising fraud risks, including cyberattacks is offering a favorable payment monitoring market outlook. According to IT Governance USA, from November 2023 to April 2024, a sum of 6,845,908,997 identifiable records were compromised in 2,741 publicly reported events in the US. In response, regulatory bodies are implementing AML and fraud prevention laws, encouraging financial institutions to employ advanced monitoring solutions. Additionally, the expansion of e-commerce and online banking portals catalyzes the demand for real-time transaction tracking to prevent cyber threats. AI and ML also play a key role in enhancing fraud detection accuracy and lowering false positives. Apart from this, the adoption of real-time payments and cross-border transactions requires continuous monitoring for security and compliance.

Payment Monitoring Market Trends:

Rising Incidents of Financial Fraud

Based on the latest payment monitoring market forecast, the growing incidence of financial fraud is positively influencing the market. 1.13 Million cases of financial cybercrime were reported in India in 2023, according to the latest data. The sum of these cases came to INR 7488.6 Crore. In addition, there was a 300% surge in fraud related to banking, according to the Reserve Bank of India (RBI). Businesses must have robust systems in place to detect and prevent fraudulent conduct, as financial crimes become increasingly sophisticated. These companies are heavily investing in advanced payment monitoring solutions that employ cutting-edge technologies, such as AI and ML, which enable real-time analysis of massive amounts of transaction data, identifying patterns and anomalies that may indicate fraudulent activity.

Stringent Regulatory Compliance Requirements

The ongoing implementation of strict regulatory compliance requirements is fueling the market growth. Government agencies and financial authorities around the world have executed rigorous regulations to combat money laundering, terrorist financing, and other financial crimes. According to the United Nations, in 2024, the yearly sum of money laundered across the globe was approximately 2-5% of the world’s GDP, equating to USD 800 Billion to USD 2 Trillion. Regulations, such as the USA PATRIOT Act, the European Union’s (EU) 5th Anti-Money Laundering Directive (5AMLD), and the Financial Action Task Force (FATF) recommendations, mandate financial institutions to implement robust payment monitoring systems. These systems must be capable of tracking and analyzing transactions in real time, identifying suspicious activities, and generating reports for regulatory authorities. These systems must be able to track and analyze transactions in real time, detect questionable activity, and generate reports for regulatory agencies. The complexity and volume of these regulations necessitate advanced technologies to ensure compliance. Payment monitoring solutions equipped with AI and ML can automate the compliance process, reducing the risk of human error and ensuring that all transactions are scrutinized according to regulatory standards.

Rapid Technological Advancements

Advancements in technology are impelling the payment monitoring market growth. Developments in AI, ML, and big data analytics are changing how payment monitoring systems operate. According to industry reports, the global AI market is projected to grow at a CAGR of 23.64% from 2025-2033, while the ML market is forecasted to expand at a CAGR of 32.6% during 2025-2033, highlighting the robust innovations and advancements in these sectors. AI and ML algorithms can analyze vast amounts of transactional data in real time, identifying patterns and anomalies that may indicate fraudulent activities. These technologies enable the creation of sophisticated models that can learn from historical data and improve over time, refining their accuracy and effectiveness. Additionally, improvements in blockchain technology are providing new ways to ensure transaction transparency and traceability, further enhancing the capabilities of payment monitoring systems.

Payment Monitoring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global payment monitoring market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, organization size, deployment, application, and end user.

Analysis by Component:

- Solution

- KYC/Customer Onboarding

- Case Management

- Watch List Screening

- Dashboard and Reporting

- Services

Solution (KYC/customer onboarding, case management, watch list screening, and dashboard and reporting) held 68.5% of the market share in 2024. It offers advanced automation, real-time fraud detection, and seamless integration with existing financial systems. Businesses prefer solutions over services since they provide long-term cost savings and efficiency, reducing the need for manual oversight. With AI and ML, these solutions continuously improve by identifying suspicious transactions faster and more accurately. Regulatory compliance is another key factor, as financial institutions rely on robust software to meet strict AML and fraud prevention requirements. Additionally, scalable solutions can handle growing transaction volumes without significant operational costs. Unlike service-based monitoring, which often requires ongoing human intervention and higher maintenance expenses, software solutions offer customizable and automated processes that ensure accuracy and speed. The increasing adoption of digital payments also drives the demand for strong technology-driven monitoring systems. As a result, organizations across industries prioritize solutions to enhance security, efficiency, and compliance in financial transactions.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises account for 65.2% of the market share. They handle high transaction volumes and face greater risks of fraud and regulatory scrutiny. With complex financial operations across multiple locations, they require advanced monitoring systems to identify suspicious activities and verify adherence to AML regulations. These organizations have the resources to invest in sophisticated AI-oriented solutions that automate fraud detection, reduce false positives, and improve transaction security. Additionally, large enterprises operate in highly regulated industries like banking, e-commerce, and healthcare, making compliance a top priority. They also deal with a diverse range of payment methods, ranging from online transactions to cross-border payments, creating the need for robust monitoring tools. Large enterprises prefer scalable and customizable solutions that integrate seamlessly with their existing financial infrastructure. This strong demand for comprehensive security and compliance drives their leadership in the market.

Analysis by Deployment:

- Cloud-based

- On-premises

Cloud-based holds 55.8% of the market share. It offers scalability, cost efficiency, and real-time data processing. Businesses prefer cloud-based solutions since they eliminate the need for expensive infrastructure and reduce maintenance costs. With cloud technology, companies can easily scale their payment monitoring capabilities, as transaction volumes grow, ensuring continuous fraud detection and compliance. Cloud-based systems also facilitate real-time tracking of transaction, enabling businesses to identify and thwart suspicious activities instantly. Additionally, they provide seamless integration with other financial tools and support remote access, which is essential for global operations. Security is another key factor, as cloud providers offer advanced encryption, automated updates, and compliance with industry regulations. Unlike traditional systems, which require manual upgrades and face data storage limitations, cloud solutions provide automatic updates and unlimited storage. As businesses increasingly adopt digital payment methods, cloud-based payment monitoring becomes the preferred choice for its flexibility, reliability, and security.

Analysis by Application:

- Anti-Money Laundering

- Compliance Management

- Customer Identity Management

- Fraud Detection and Prevention

Anti-money laundering accounts for 36.5% of the market share. Financial institutions and firms need to adhere to stringent anti-money laundering regulations to prevent illegal transactions. Government agencies worldwide enforce anti-money laundering laws to combat financial crimes, making advanced monitoring solutions essential. Companies prioritize these systems to detect suspicious transactions, identify money laundering patterns, and report activities to regulatory authorities. With the broadening of digital payments and cross-border transactions, the risk of financial crimes increases, driving the demand for effective anti-money laundering solutions. These systems use AI and ML to analyze transaction data in real time, reducing false positives and improving fraud detection accuracy. They focus on regulatory compliance, helping businesses to avoid heavy fines and reputational damage. As authorities continue tightening financial regulations and criminals develop more sophisticated laundering techniques, businesses increasingly invest in modern monitoring tools.

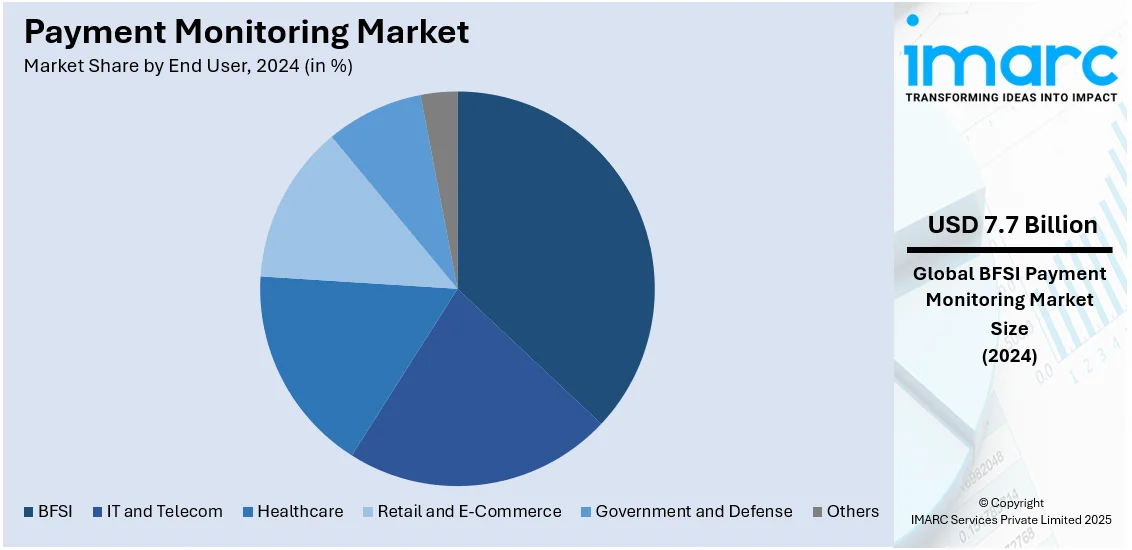

Analysis by End User:

- BFSI

- IT and Telecom

- Healthcare

- Retail and E-Commerce

- Government and Defense

- Others

BFSI accounts for 37.6% of the market share. BFSI companies handle massive transaction volumes daily and face high risks of fraud and financial crimes. Strict regulations require them to implement advanced monitoring systems to identify suspicious activities and fraud and ensure adherence to AML laws. The rise of digital banking, online payments, and cross-border transactions further creates the need for real-time monitoring solutions. BFSI companies wager heavily on AI-based payment monitoring tools to enhance accuracy, reduce false positives, and automate fraud detection. Moreover, BFSI operates under constant regulatory scrutiny, making adherence a top priority. Additionally, financial institutions deal with various payment methods, ranging from card transactions to cryptocurrency, requiring robust security measures. As cyber threats and fraudulent activities become more sophisticated, BFSI organizations continue to lead in adopting advanced payment monitoring systems to protect customer transactions and maintain financial stability.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 34.6%, enjoys the leading position in the market. The region is recognized for its advanced financial infrastructure, strict regulatory environment, and high usage of digital payments. This area hosts a significant number of major banks and fintech companies that require robust monitoring solutions to identify fraud and guarantee adherence to AML laws. Apart from this, the expansion of digital payment platforms in the region is fueling the market growth. In April 2024, Payments Canada teamed up with technology companies IBM and CGI to announce its plans to introduce real-time rail (RTR) system for quick digital payments in Canada by 2026. The RTR system sought to enhance transaction monitoring and security for Canadian citizens and enterprises by enabling real-time payments 24/7, ensuring their clearance and settlement are completed easily. Apart from this, North America has a high adoption rate of AI and ML in financial services, enabling more accurate and efficient transaction monitoring.

Key Regional Takeaways:

United States Payment Monitoring Market Analysis

The United States holds 88.70% of the market share in the United States. The market is expanding rapidly due to a combination of regulatory, technological, and user-driven factors. A key driver is the increasing volume of digital payments, supported by the broadening of e-commerce portals, mobile wallets, and contactless transactions, which needs businesses to implement robust monitoring solutions to secure financial data and prevent fraud. The US has also been at the forefront of strict regulatory standards like the Bank Secrecy Act (BSA), AML laws, and Know Your Customer (KYC) requirements, which are encouraging financial institutions to employ advanced payment monitoring systems to ensure compliance and avoid penalties. Additionally, the rise in cyber threats, such as data breaches and online payment fraud, has made payment monitoring an essential component of security infrastructure for financial service providers. According to recent industry reports, in 2023, attacks or attempts at payment fraud affected 80% of enterprises, recording a rise of 15% in comparison to the prior year. As a result, user demand for seamless, secure, and instantaneous transactions is enabling further innovations in payment monitoring solutions, motivating companies to adopt real-time fraud detection technologies.

Europe Payment Monitoring Market Analysis

The market is growing rapidly, driven by the region’s increasing reliance on mobile wallets, digital payments, and e-commerce platforms. According to industry reports, the Europe e-commerce market is growing at a CAGR of 8.30% during 2025-2033 and is set to attain USD 8.46 Trillion by 2033. With the rise of online transactions, financial institutions and businesses are adopting advanced payment monitoring solutions to combat the rising incidences of fraud and ensure compliance with stringent regulatory frameworks, such as the EU’s General Data Protection Regulation (GDPR) and AML directives. The high volume of cross-border transactions within the area and beyond also requires sophisticated systems to track multi-currency payments and prevent financial crimes. Additionally, as user demand for seamless and secure payment experiences rises, there is greater emphasis on real-time fraud detection and prevention. Apart from this, the increasing utilization of new technologies like ML and AI is enhancing payment monitoring capabilities, enabling better predictive analytics and risk management.

Asia-Pacific Payment Monitoring Market Analysis

The APAC market is experiencing significant growth on account of the region's rapid adoption of digital payments. For instance, in India, the total volume of digital payments surged from 2,071 Crore in the financial year of 2017–18 to 18,737 Crore in the financial year of 2023–24, expanding at a CAGR of 44%. As digital payment volumes soar, financial institutions and businesses are increasingly investing in advanced payment monitoring solutions to detect fraud, ensure compliance with AML and KYC regulations, and mitigate cybersecurity risks. The rise in cross-border transactions, driven by broadening trade activities and remittances, further emphasizes the need for robust monitoring tools that can handle complex multi-currency payments. Additionally, technological advancements in ML and AI are also refining the effectiveness of payment monitoring, enabling real-time fraud detection and predictive risk management.

Latin America Payment Monitoring Market Analysis

In Latin America, the market is witnessing growth due to the region’s increasing access to the Internet and mobile connectivity, especially in countries, such as Brazil and Mexico. As per recent reports, 92.5% of households in Brazil had Internet access in 2023. Similarly, toward the end of 2022, 96.8 Million individuals in Mexico were able to use the Internet, equating to 9.3% growth annually. As a result of this enhanced internet availability and mobile network infrastructure, there is a widespread adoption of digital payment systems. This is enabling the employment of payment monitoring solutions to manage the increased volume of transactions, improving security and preventing fraud.

Middle East and Africa Payment Monitoring Market Analysis

The market in the Middle East and Africa is experiencing growth as a result of the rapid expansion of e-commerce portals. According to the IMARC Group, the Middle East e-commerce market is anticipated to attain USD 10,957 Billion by 2033, growing at a CAGR of 21.58% from 2025-2033. This is creating the need for more efficient payment monitoring systems to handle increased transaction volumes and prevent fraud. In addition, the rapid shift towards digital payments, combined with the high popularity of mobile banking and fintech innovations, is bolstering the market growth. This trend is driving the demand for advanced payment monitoring systems to ensure the security of digital transactions and overall regulatory compliance.

Competitive Landscape:

Key players work on developing new and reliable solutions to meet the high payment monitoring market demand. Big companies are investing in advanced fraud detection technologies, enhancing regulatory compliance, and expanding digital payment security. They wager on ML and AI to improve real-time transaction monitoring, reducing false positives and identifying suspicious activities more accurately. These firms team up with financial institutions to integrate monitoring solutions seamlessly into existing payment systems. Additionally, they focus on innovations, launching cloud-based and scalable platforms that cater to businesses of all sizes. They also play a crucial role in meeting global regulatory requirements by continuously updating their solutions to align with evolving AML and fraud prevention laws. Through strategic partnerships, mergers, and acquisitions, they broaden their market presence and refine their offerings. For instance, in April 2024, Bottomline and Coupa revealed a strategic alliance aimed at streamlining digital payment procedures for companies. Through this collaboration, Coupa could link to Paymode-X, Bottomline's business payments network that provides Premium ACH, enabling the automation of payments from buyers to suppliers.

The report provides a comprehensive analysis of the competitive landscape in the payment monitoring market with detailed profiles of all major companies, including:

- ACI Worldwide Inc.

- Bottomline Technologies Inc.

- FICO

- FIS

- Fiserv Inc.

- International Business Machines Corporation

- NICE Ltd.

- Oracle Corporation

- Refinitiv (London Stock Exchange Group plc)

- SAS Institute Inc.

Latest News and Developments:

- February 2025: Orum, a prominent payments solutions provider, unveiled ‘Monitor,’ an innovative payments portal aimed at optimizing and managing payment processes for businesses. Offering a one-click feature for managing payments, verifying accounts, and generating customized insights, it could monitor transactions and banking account authentication and validation instantaneously.

- January 2025: Fiserv Inc., a global frontrunner in payments and fintech services, formed a collaboration with Spanish bank Unicaja to develop advanced payment and e-commerce solutions. The partnership included omnichannel elements with unmatched standards of security, ease, and rapidity.

- December 2024: SAS Institute Inc. teamed up with Neterium, a premier supplier of regulatory technologies, to unveil the SAS Real-Time Watchlist Screening. This cloud-based system combined batch processing and real-time observation, offering scalable solutions for overseeing payments and organizations.

- December 2024: Creand Crèdit Andorrà chose NICE Actimize, a NICE company, to upgrade and improve its AML solutions. This was set to be achieved by integrating a complete range of NICE Actimize's financial fraud solutions into its operational procedures.

- July 2024: ACI Worldwide, a worldwide frontrunner in essential real-time payment solutions, revealed an extension of its collaboration with Worldpay. This alliance aimed to enable Worldpay to provide top-tier stability and payment acceptance for its international merchants.

Payment Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Deployments Covered | Cloud-based, On-premises |

| Applications Covered | Anti-Money Laundering, Compliance Management, Customer Identity Management, Fraud Detection and Prevention |

| End Users Covered | BFSI, IT and Telecom, Healthcare, Retail and E-Commerce, Government and Defense, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACI Worldwide Inc., Bottomline Technologies Inc., FICO, FIS, Fiserv Inc., International Business Machines Corporation, NICE Ltd., Oracle Corporation, Refinitiv (London Stock Exchange Group plc), SAS Institute Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the payment monitoring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global payment monitoring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the payment monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The payment monitoring market was valued at USD 20.36 Billion in 2024.

The payment monitoring market is projected to exhibit a CAGR of 14.43% during 2025-2033, reaching a value of USD 68.49 Billion by 2033.

As more businesses and people are shifting to online transactions, the risk of fraudulent activities like money laundering and cybercrime grows, driving the demand for advanced monitoring solutions. Besides this, government agencies and regulatory bodies are implementing stringent compliance laws, encouraging financial institutions to implement robust monitoring systems. Moreover, the increasing adoption of AI is enhancing fraud detection by improving accuracy and reducing false positives.

North America currently dominates the payment monitoring market, accounting for a share of 34.6% in 2024, owing to its strong financial infrastructure, strict regulations, and high digital payment adoption. Advanced fraud detection technologies, regulatory compliance requirements, and widespread AI integration strengthen the region’s dominance in ensuring secure and efficient transactions.

Some of the major players in the payment monitoring market include ACI Worldwide Inc., Bottomline Technologies Inc., FICO, FIS, Fiserv Inc., International Business Machines Corporation, NICE Ltd., Oracle Corporation, Refinitiv (London Stock Exchange Group plc), SAS Institute Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)