Pay TV Market Size, Share, Trends and Forecast by Type, Technology Type, Application, and Region, 2025-2033

Pay TV Market Size and Share:

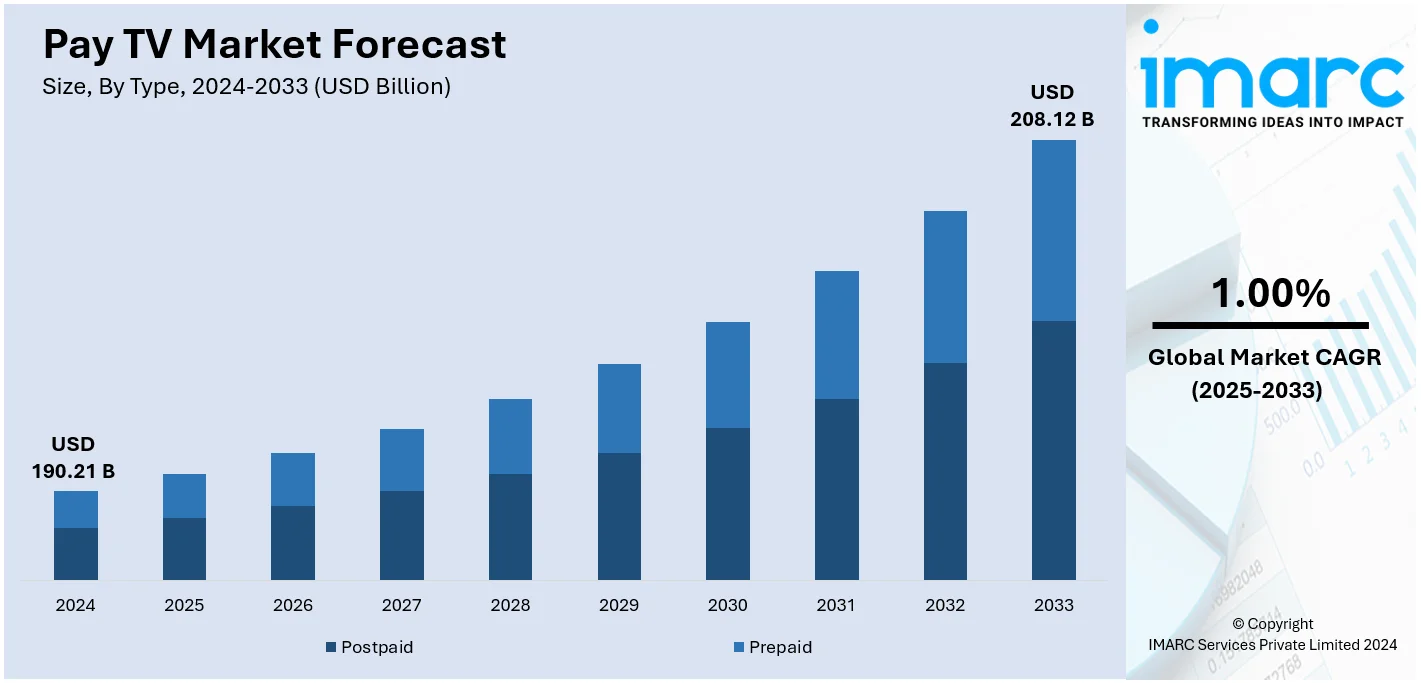

The global pay TV market size was valued at USD 190.21 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 208.12 Billion by 2033, exhibiting a CAGR of 1.00% during 2025-2033. North America currently dominates the market, holding a significant market share of over 32.8% in 2024. The market is driven by the escalating consumer need for quality content, advancements in broadcasting technologies, significant globalization of content, and the rising popularity of bundled service packages. Additionally, inflating disposable incomes, a preference for diverse viewing options, and the rapid emergence of digital platforms contribute to increasing the pay TV market share significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 190.21 Billion |

| Market Forecast in 2033 | USD 208.12 Billion |

| Market Growth Rate (2025-2033) | 1.00% |

The pay TV market is driven by several factors, including the increasing demand for high-quality content, exclusive programming, and live sports events that attract subscribers. The rise in disposable income, especially in developing economies, has made premium TV services more accessible. Technological advancements, such as 4K resolution, smart TVs, and high-speed internet, have enhanced the viewing experience, encouraging more people to subscribe to pay TV services. Additionally, telecom providers' bundling services with internet and phone packages has made pay TV more appealing. The growth of on-demand streaming platforms, offering diverse content, also complements traditional pay TV. Consumer preferences for convenience, access to a variety of channels, and reliable service quality continue to fuel pay TV market growth, despite the rise of OTT services.

In the United States, the pay TV market is driven by several key factors, including a strong demand for exclusive content like live sports, premium channels, and popular television series. Consumers continue to value traditional TV subscriptions for access to high-quality programming, especially in households with multiple viewers. Bundling pay TV services with internet and phone packages from telecom providers increases affordability and convenience. Additionally, technological advancements such as 4K resolution, smart TV compatibility, and better user interfaces enhance the viewing experience. The demand for live programming, including news and sports, further represents some of the key pay TV market trends. While OTT platforms are growing in popularity, many consumers still prefer pay TV for its reliability, comprehensive channel offerings, and family-friendly viewing options. For instance, in October 2024, a merger between DirecTV and Dish was announced after more than ten years of intermittent discussions. To stop satellite TV's losses due to cord-cutting, the former will buy the latter for $1 and $9.75 billion in debt, making it the largest pay TV operator with about 18 million subscribers, surpassing both Comcast and Charter Communications.

Pay TV Market Trends:

Growing Consumer Demand for UHD and 4K Services

The growing consumer demand for UHD and 4K services significantly drives the pay TV market as viewers seek higher picture quality and enhanced viewing experiences. These advanced services provide sharper, more vibrant images, catering to an audience increasingly focused on superior visual content. Pay TV providers invest in UHD and 4K technologies to meet this demand, attracting new subscribers and retaining existing ones. This trend also encourages the development of premium content, further boosting market growth. For instance, in April 2022, SES announced the results of its annual Satellite Monitor market research, highlighting its leadership in satellite TV content delivery. SES now delivers nearly 8,400 TV channels, including 3,130 in HD or UHD, to 366 million TV homes worldwide, an increase of five million homes from the previous year. SES continues to outperform the industry by reaching the highest number of TV homes and delivering a record-breaking number of channels. Such initiatives are contributing to the creation of a positive pay tv market outlook.

Advent of Subscription-based Payment Models

The advent of subscription-based payment models drives the pay TV market by offering consumers flexible and affordable access to a wide range of content. These models allow users to customize their viewing experience, opting for packages that suit their preferences and budgets. Subscription services often include exclusive content, on-demand viewing, and multi-device access, enhancing user convenience and satisfaction. This approach also provides a steady revenue stream for providers, encouraging investment in high-quality content and advanced broadcasting technologies. For instance, in January 2022, Azam TV introduced a package of 100 DTH channels to Zimbabweans for USD 5 a month. For USD 15 a month, subscribers can access 130 channels, including many premium options. The channel lineup includes sports, movies, cartoons, documentaries, news, drama, music, and religious content. Azam TV's service is also available in Tanzania, Uganda, Malawi, Kenya, and Rwanda. This, in turn, is intensifying the pay tv market demand across the globe.

Significant Innovations to Provide Reliable Services

Significant innovations in technology enhance the reliability and quality of pay TV services, driving market growth. Advancements such as cloud-based DVRs, AI-driven content recommendations, 4K and HDR broadcasting, and hybrid set-top boxes offer improved user experiences and greater service reliability. These innovations ensure seamless streaming, minimal downtime, and personalized viewing options, attracting and retaining subscribers. As consumers demand higher-quality and more dependable services, these technological improvements become critical drivers for the pay TV market. For instance, in February 2022, Eclat Media Group launched two new channels, SPOTV and SPOTV2, in Southeast Asia and select East Asia territories including Indonesia, Thailand, Singapore, Malaysia, Macau, Mongolia, and the Philippines. These channels feature a variety of sports content, including tennis Grand Slam tournaments Wimbledon and US Open, motorsport championships MotoGP and WorldSBK, World Table Tennis, Badminton World Federation events, and popular Asian sports such as the Korean Baseball Organization (KBO) League, Korean Basketball League (KBL), V-League (volleyball), and Japan's V.League.

Pay TV Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, technology type, and application.

Analysis by Type:

- Postpaid

- Prepaid

Prepaid accounts dominate the pay TV market share due to their flexibility and affordability, allowing consumers to manage expenses without long-term commitments. This model appeals to cost-conscious customers who prefer paying only for the content they want to watch. Prepaid options also attract transient and younger demographics, who prioritize convenience and control over their viewing habits, contributing to their popularity and significant market share. For instance, in March 2024, the Nigerian government launched Silver Lake Television (SLTV) to provide more competitive pricing and disrupt the monopoly in the country's pay TV market. SLTV offers a variety of 55 channels, with pricing starting at N2,500 for the basic plan and N5,000 for the gold plan.

Analysis by Technology Type:

- Cable TV

- DTT and Satellite TV

- Internet Protocol Television (IPTV)

Cable TV leads the market with around 36.7% of market share in 2024. Cable TV holds most of the pay TV market share due to its extensive infrastructure, widespread availability, and established customer base. It offers a reliable and consistent service, providing a vast array of channels and bundled services, including internet and phone packages, which add value for consumers. Additionally, cable TV providers have longstanding relationships with major content producers, ensuring access to exclusive and premium programming. The familiarity and trust built over decades, combined with comprehensive service offerings, make cable TV a dominant force in the pay TV market despite the rise of alternative digital and streaming platforms.

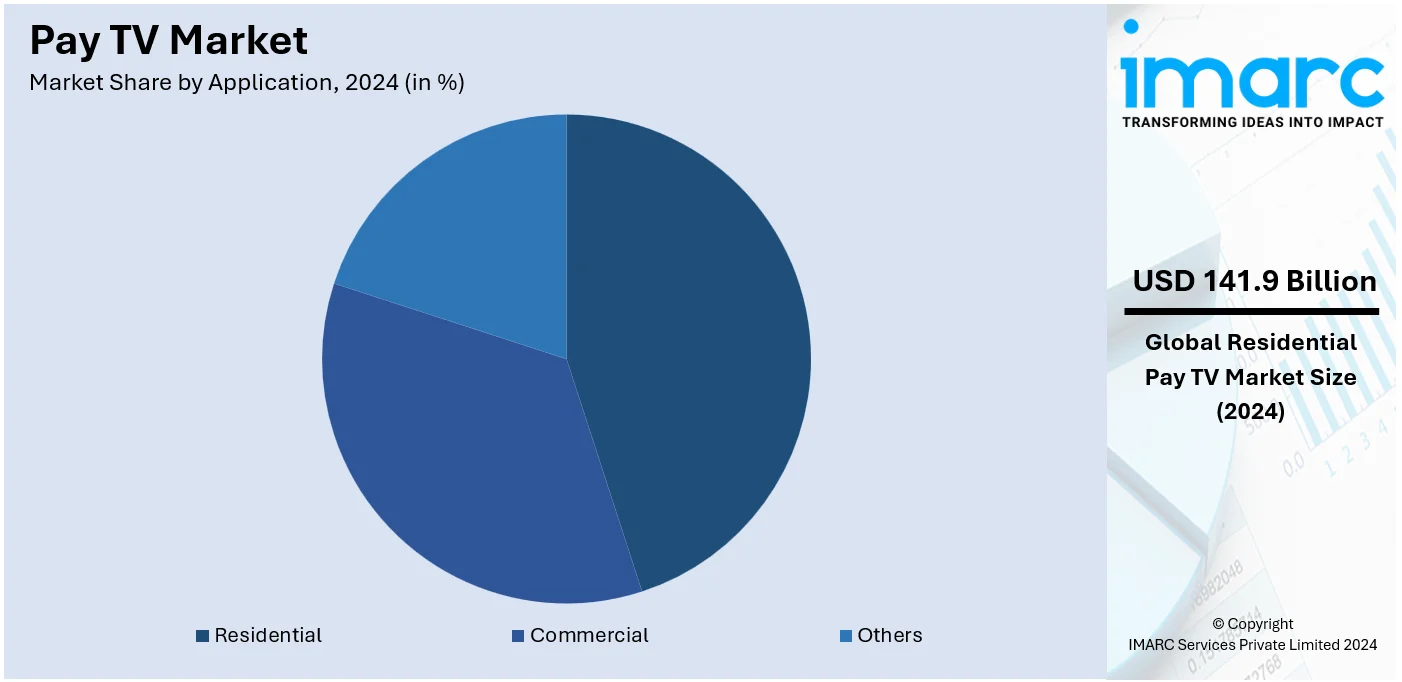

Analysis by Application:

- Commercial

- Residential

- Others

Residential leads the market with around 74.6% of market share in 2024. Residential accounts for the majority of the pay TV market share due to high consumer demand for diverse entertainment options at home. Households seek access to a wide range of channels, including movies, sports, and specialty programming, driving subscriptions. The convenience of bundled services, on-demand content, and the growing trend of home entertainment systems further bolster this demand. Additionally, attractive subscription packages and technological advancements in digital broadcasting enhance the appeal of pay TV services for residential customers. For example, a survey by Media Partners Asia predicts that by 2025, over 96% of India's pay-TV households will be digitalized, and the number of pay-TV subscribers will increase to 134 million.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 32.8%. North America leads the pay TV market due to its advanced digital infrastructure, high consumer spending power, and strong premium and on-demand content demand. The region benefits from an established broadcasting industry, widespread adoption of cutting-edge technologies like 4K and HDR, and significant investments in high-quality content production. Additionally, strategic partnerships and competitive offerings among providers enhance service reliability and innovation, further solidifying North America's dominant position in the pay TV market. For example, according to The National Academy of Television Arts and Sciences, in the United States, 99% of households have at least one television set, and the number of TV sets in the average household is 2.24. 56% of households pay for cable television.

Key Regional Takeaways:

United States Pay TV Market Analysis

In 2024, the United States accounted for the market share of over 74.90%. The U.S. pay TV market is highly transformed, with a penetration rate of 64% in 2023, an industrial report stated. While traditional pay TV services remain the primary option for many households, the sector faces ongoing challenges from the growing trend of cord-cutting, as more consumers switch to alternative content delivery models like streaming. The SVOD services that have emerged with Netflix, Hulu, and Disney+ are increasing competition in the field, and a large number of viewers are getting diverted from cable and satellite packages. By 2023, nearly 58 million households are still subscribing to pay TV, and leading players like Comcast, Charter, and DirecTV hold the ground, as per an industry report. However, the subscriber loss for these service providers is increasing, showing the trend of consumers shifting toward cheaper and more flexible choices. This shift in the market has forced pay TV firms to be innovative, either through adding online streaming services to their platform or launching their very own OTT platforms, mirroring the changes in the U.S. landscape of content consumption.

Europe Pay TV Market Analysis

The European Pay TV market is steady as a result of consumer preference for varied content and premium services. According to an industrial report, Eastern Europe sees a great deal of growth in OTT services; revenues for TV episodes and movies will increase by 82% from 2023 to 2029, with the market reaching USD 6.96 Billion. Russia and Poland will account for most, at USD 1 Billion and USD 0.7 Billion respectively, together taking two-thirds of regional revenues. SVOD revenues are expected to advance from USD 2.4 Billion in 2023 to USD 4.3 Billion by 2029, with Russia and Poland surpassing USD 1 billion each. Pay TV benefits from bundling with broadband and mobile services in Western Europe. Continued investment in localized productions and partnerships with OTT platforms ensures Europe will remain prominent in the shifting media terrain.

Asia Pacific Pay TV Market Analysis

The Asia Pacific Pay TV market is undergoing major transitions as subscriber bases decline in several regions. Media Partners Asia reports that Pay TV reached 201 million homes excluding China in 2023, a market that continues to focus on high ARPU customers and broadband bundles alongside linear and VOD aggregation. China's Pay TV growth is driven by low-cost IPTV services bundled with broadband, led by providers such as China Telecom and China Mobile. The country added 17 million IPTV subscribers in 2023, offsetting losses in cable TV. In India, the Pay TV market contracted by 6.5 million subscribers in 2023, attributed to cheaper alternatives like Freedish and UGC platforms. Yet, television continues to lead the market, generating 70% of video industry revenue, and TV advertising seems to be still robust. The Australian Pay TV landscape has been transformed with the launch of Foxtel's Hubbl, providing a unified subscription for paid and free streaming. Indonesia and Korea also have flat or declining subscriber bases as a result of competition from SVOD and disruptive OTT platforms. Taiwan's Pay TV revenue continues steady at USD 1.8 billion, of which IPTV is responsible for USD 322 million. Region-wide, broadband access, digital innovation, and localized strategies are reshaping the Pay TV market and responding to shifting consumer demands.

Latin America Pay TV Market Analysis

The Latin American Pay TV market is changing in accordance with shifting consumer preferences, as indicated by a sharp rise in SVOD subscriptions. SVOD subscribers in the region will rise from 110 million in 2023 to 165 million by 2029, led by rising adoption in Brazil and Mexico that will account for 59 million and 43 million subscribers respectively, reports Digital TV Research. U.S.-based platforms like Netflix, Prime Video, and Disney+ will lead the pack, accounting for 83% of paid subscriptions by 2029. Netflix alone is expected to add 9 million subscribers, while Max will contribute 10 million and Disney+ another 8 million during the same period. Local platforms such as Brazil's Globoplay and Televisa's Vix are also carving out significant market shares, with Globoplay accounting for 8% of the total. With growing demands for flexible, premium content, the expansion of SVOD services indicates the growing region. The Pay TV now faces competition from cheaper OTT alternatives. For the future growth to be sustained, it will require partnerships from local and global players together with investments in localized content. A digital evolution is seen reflecting this transition, which is the whole direction of media consumption in Latin America: emphasizing the relevance of tailor-made offerings meeting diverse consumer needs across regions.

Middle East and Africa Pay TV Market Analysis

The Pay TV market in this region is undergoing significant challenges with a projected decline of revenues by USD 1.6 billion between 2016 and 2029, Digital TV Research has shown. This is mainly driven by the growth of OTT platforms and widespread piracy. Though there will be a rise in 3 million pay TV subscribers with the number increasing to 18 Million by 2029, average revenue per user will decline and will fall 43%, from USD 3.8 Billion by 2016 to USD 2.2 Billion in 2029. According to the latest estimates of pay TV revenue by region and country, the main contributors are going to be Turkey and Israel, together accounting for almost half of the revenues by 2029. But for the Arab countries in this region, their pay TV revenue is predicted to decline by a landslide: from USD 1.57 Billion by 2016 to USD 802 Million in 2029. It will decline dramatically from USD 1.14 Billion in 2016 to USD 376 Million by 2029, as is going to happen in Israel's pay TV revenue. With this shift, and the emergence of pirate technologies, OTT (Over-the-Top), traditional Pay TV services find themselves challenged by the altering dynamics of this market.

Competitive Landscape:

The pay TV market's competitive landscape is characterized by a diverse array of service providers offering extensive channel lineups, premium on-demand content, and advanced features like cloud DVRs and 4K resolution. Innovation and technological advancements drive competition, with companies continually enhancing their offerings to attract and retain subscribers. Strategic partnerships with content creators and exclusive broadcasting rights for popular events further differentiate services. Packages with competitive prices and bundled services also increase market attractiveness and consumer value. For instance, in May 2023, Comcast introduced Now TV, a streaming service with 60 plus channels. The platform will be available to Xfinity Internet customers for an everyday monthly price of USD 20, no equipment required, and the ability to sign up and cancel anytime.

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the pay TV industry include:

- Bharti Airtel Limited

- DIRECTV (AT&T Communications)

- Dish Network Corporation

- DishTV India

- Fetch TV Pty Limited (Astro All Asia Networks)

- Foxtel (News Corp. Australia)

- Rostelecom PJSC

- Tata Sky Limited

- Tricolor TV

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- December 2024: News Corp sold Foxtel to DAZN for USD 2 Billion, a signal of a shift from television to publishing. DAZN is a broadcasting partner for Serie A, LaLiga, Bundesliga, and Ligue 1 and competes with traditional TV and satellite channels by providing sports content on its streaming platform.

- December 2024: Curiosity Inc, announced its continual expansion into Free Ad-Supported Streaming Television with the launch of channels on Fubo, DirecTV, Xumo, Sky UK, STARZ ON, and Fawsome TV, particularly catering to the steady demand for ad-supported factual content and providing diversified revenue streams.

- October 2024: DirecTV announced that it will acquire Dish at USD 1, and it creates the largest pay-TV distributor with 20 million subscribers. The deal includes Sling TV and USD 10 billion of debt, with Dish having sought a debt reduction amounting to USD 1.57 billion. AT&T is selling off its 70% holding to TPG for the sum of USD 7.6 billion.

- August 2024: Fetch TV announced the launch of numerous new applications using the AndApps™ solution, built by Consult Red. AndApps™ simplifies the deployment of applications, enriching its app offerings with minimal effort in development and disruption to the device. Its modular architecture allows for easy integration, deployment, and updates of the device without rebooting.

- June 2023: Frndly TV introduced its new app specifically designed for Samsung Smart TVs in the United States. This move further exemplifies the brand’s dedication to its rapidly growing customer base and innovative service enhancement approach.

Pay TV Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Postpaid, Prepaid |

| Technology Types Covered | Cable TV, DTT and Satellite TV, Internet Protocol Television (IPTV) |

| Applications Covered | Commercial, Residential, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bharti Airtel Limited, DIRECTV (AT&T Communications), Dish Network Corporation, DishTV India, Fetch TV Pty Limited (Astro All Asia Networks), Foxtel (News Corp. Australia), Rostelecom PJSC, Tata Sky Limited, Tricolor TV, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pay TV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pay TV market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the pay TV industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pay TV market was valued at USD 190.21 Billion in 2024.

IMARC estimates the pay TV market to reach USD 208.12 Billion by 2033 exhibiting a CAGR of 1.00% during 2025-2033.

Factors driving the pay TV market include demand for exclusive content like live sports and premium channels, technological advancements (e.g., 4K resolution, smart TVs), bundling services with internet and phone packages, and a preference for high-quality programming. Despite the rise of streaming, many still value traditional TV’s comprehensive offerings.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the pay TV market include Bharti Airtel Limited, DIRECTV (AT&T Communications), Dish Network Corporation, DishTV India, Fetch TV Pty Limited (Astro All Asia Networks), Foxtel (News Corp. Australia), Rostelecom PJSC, Tata Sky Limited, Tricolor TV, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)