Patient Engagement Solutions Market Report by Therapeutic Area (Chronic Diseases, Fitness, Women's Health, Mental Health, and Others), Application (Social Management, Health Management, Home Healthcare Management, Financial Health Management), End User (Payers, Providers, and Others), Component (Software, Services, Hardware), Delivery Type (Web-based/Cloud-based, On-premises), and Region, 2026-2034

Market Overview 2026-2034:

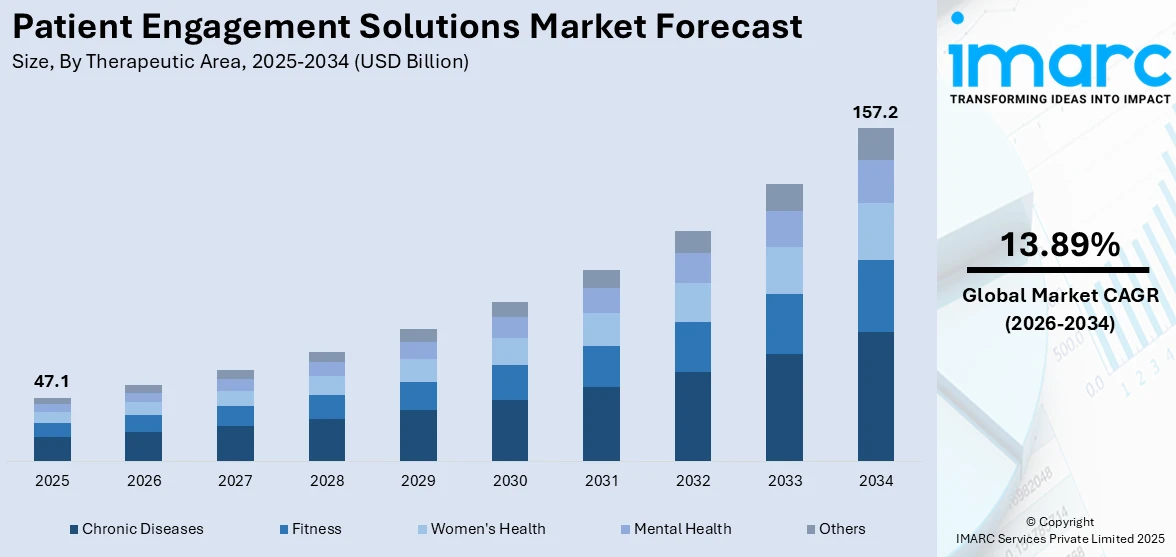

The global patient engagement solutions market size reached USD 47.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 157.2 Billion by 2034, exhibiting a growth rate (CAGR) of 13.89% during 2026-2034. The customer-focused nature of the care, encompassing several programs and rules aimed at the patient empowerment, along with the growing popularity of the ehealth solutions represent some of the key factors propelling the growth of the market.

Key Insights:

- In terms of region, North America held the leading position in revenue in 2025.

- Among therapeutic areas, chronic diseases generated the highest revenue in 2025.

- Health management was the top-performing application segment.

- Providers emerged as the primary end user group in the market.

Market Size and Forecast:

- Market Size in 2025: USD 47.1 Billion

- Projected Market Size in 2034: USD 157.2 Billion

- CAGR (2026-2034): 13.89%

- Largest Market in 2025: North America

Global Patient Engagement Solutions Market Analysis:

- Major Market Drivers: The main force behind patient engagement solutions adoption is the growing trend towards patient-centered care, the increasing acceptance of mobile health (mHealth) apps, and the ever-increasing population of patients with chronic ailments. However, government regulation and financial supports helping promote the patient engagement as a crucial way to enhance healthcare result and lower cost should be of great importance. The use of new technologies including artificial intelligence, machine learning, and data analytics for personalizing and improving the patient experience is an economic driver for the market to grow. Besides this, the Covid-19 pandemic has fast-forwarded telehealth and remote patient monitoring, revealing how all stakeholders should adopt digital platforms in the delivery of healthcare services.

- Key Market Trends: The major market trends in patient engagement solutions are the incorporation of artificial intelligence (AI) and machine learning that ultimately lead to personalized care plans and communication. The ever-increasing uptake of telehealth and remote patient monitoring owing to the ongoing COVID-19 global emergence has clearly demonstrated the role of digital platforms as a vital interface for healthcare provision. Mobile health (mHealth) apps are gaining a footing, with more and more users embracing them as a convenient option for getting health information and health services Increasingly, non-intrusive technology for health tracking and data collection via wearable devices is being used. Healthcare providers and patients are strongly supporting seamless and secure access to health history which is creating a positive patient engagement solutions market outlook.

- Competitive Landscape: Some of the major market players in the global patient engagement solutions industry include AdvancedMD (Global Payments Inc.), Allscripts Healthcare Solutions Inc., Athenahealth Inc., Cerner Corporation, EMMI Solutions LLC (Wolters Kluwer N.V.), Epic Systems Corporation, GetWellNetwork Inc., Lincor Solutions Limited, McKesson Corporation, Medecision Inc. (Health Care Service Corporation), Orion Health Ltd., Phytel Inc. (International Business Machines Corporation) etc.

- Geographical Trends: North America is the largest market for patient engagement solutions and the region is fueled by the healthcare infrastructure, high healthcare expenditure, and the influence of leading healthcare IT firms on the market. Such implementation initiatives are also significantly helped by the tough healthcare quality and safety requirements governing patient care, and in particular under the Affordable Care Act (ACA) and Health Information Technology for Economic and Clinical Health Act (HITECH Act) that push the acceptance of EHRs and patient engagement technologies. Furthermore, the high marketing literacy and the growing cases of chronic health conditions that require patients to be routinely engaged during and after treatment have major effects on the market size in this particular region.

- Challenges and Opportunities: Implementing patient engagement solutions will face challenges ranging from ensuring data privacy and security, bridging digital knowledge disparities, as well as integrating several health systems into a single network. The cost of installing and running the equipment is an example of barriers that might stop the providers of the healthcare from being able to do the advanced technologies. In spite of adversities, this implicates room for innovation and expansion of new technology. The prospect of creating more- user friendly and inclusive interface that would attract a more diverse audience ranging from the elderly patients and other individuals who are less tech savvy is clear. The growth in cybersecurity measures can boost the level of trust and impressive use of these innovations.

To get more information on this market Request Sample

Patient Engagement Solutions Market Trends/Drivers:

Growing Trend of Patient-Centered Approach

The implementation of patient-centred care has led to a growth in doctors’ demand of patient engagement. The healthcare providers acknowledge the significance of actively enlisting the patients and make it a part in their health care decision and treatment planning. Engagement tools in healthcare empower patients and assist the healthcare providers to complete the desire of patients to participate in their health care provision. In addition to this, the patient-centered care gives place to effective communication processes between healthcare providers, patients, and those taking care of them. For instance, there is a shift towards a value-based care system in the healthcare industry where providers are reimbursed for the health outcomes of their patients. Empowered patients are satisfied and healthy, which, in turn, result in improved health outcomes at decreased healthcare costs. In 2021, only 85% of the respondents were confident in dealing with their health, if they were provided with the right information and applications such as technology. This is further boosting the patient engagement solutions market share.

Increasing Use of Digital Health Technologies

The digital health technologies, such as smartphone, wearable devices and connected health devices, give the patients a widened platform for healthcare services and their interactions with healthcare professionals. Through these various technologies, patient engagement solutions offer people an easy and comfortable way for patients to communicate with their care teams, stay informed about their health, and monitor their health status. For instance, as stated in an article in The Financial Express, from 01/2022 till 07/2023, 76.1% of patients with Type 2 Diabetes Mellitus (T2DM) used the mySugr app and linked their meter to the app via Bluetooth. These users claimed of monitoring the blood sugars more often, improved medication compliance and greater level of overall awareness of the diabetes management. Digital health technology becomes widespread and there is a subsequent surge in need for patient engagement solutions, which are able to integrate and utilize these technologies. Additionally, such integration gives clinicians an opportunity to remotely monitor patient's health conditions, provide immediate interventions, and better manage chronic illnesses.

Technological Advancements

The latest tech innovations in artificial intelligence (AI) and machine learning (ML) are transforming the connections between patients and solutions for patient engagement. These technologies allow for the complexity analysis, predictive modeling, and patient data-based interventions. AI powered chatbots and virtual assistants would employ individualized health tips, answer patient questions, and deliver timely guidance to clients. Machine learning systems can examine lot of patient data for the identification of patterns, trends and risky issues, and help with tailored care strategies and early detection. According to an article published in Financial Express, a study conducted by the Boston Consulting Group (BCG) and B Capital which predicts that digital healthcare in India will grow tenfold to a USD 37 billion industry by 2030. This is further expected to fuel the patient engagement solutions market forecast over the coming years.

Patient Engagement Solutions Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global patient engagement solutions market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on therapeutic area, application, component, delivery type and end user.

Breakup by Therapeutic Area:

- Chronic Diseases

- Obesity

- Diabetes

- Cardiovascular

- Others

- Fitness

- Women's Health

- Mental Health

- Others

Chronic diseases represents the leading segment

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes chronic diseases (obesity, diabetes, cardiovascular, and others), fitness, women's health, mental health, and others. According to the report, chronic diseases represented the largest segment.

Chronic conditions including diabetes, cardiovascular diseases, respiratory disorders and cancer are the most spread diseases in the world. In addition to this, these diseases have increased significantly in recent years. These diseases involve long-term management, which entails monitoring and lifestyle changes. Engaging solutions in patients have a great contribution to patients with chronic diseases via therapeutic approaches such as self-management, adherence to drugs, monitoring of symptoms, and remote monitoring. These concerns frequently remain for an extended period of time outside of the common healthcare facility. Patient engagement solutions are well designed to address this need because they can offer remote monitoring capability to patients to monitor their health metrics and even share the data with healthcare providers.

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Social Management

- Health Management

- Home Healthcare Management

- Financial Health Management

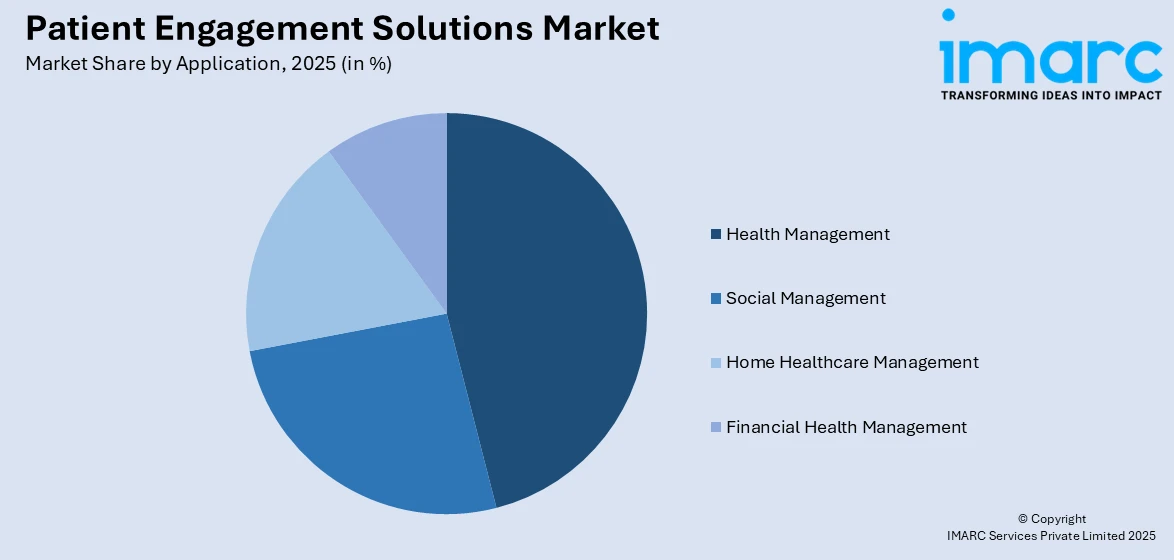

Health management represents the leading segment

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes social management, health management, home healthcare management, and financial health management. According to the report, health management exhibits a clear dominance in the market.

Health management, a vital part of patient engagement solutions, also involves chronic disease management. Patient engagement solutions consist of a diverse functionalities which support different aspects of health management, including use of preventive care, wellness programs, medication management, lifestyle modifications, and even general health monitoring. In addition to that providing the patient engagement solutions for health management individuals can access educational resources, set health goals, track progress, receive personalized recommendations and communicate with health providers for advice and support. These interventions allow patients to have an upper hand in caring for their illnesses, preventing future illnesses, and promoting their overall wellness which is also driving the patient engagement solutions market scope.

Breakup by End User:

- Payers

- Providers

- Others

Providers exhibit a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes payers, providers, and others. According to the report, providers hold the leading position in the market.

Healthcare providers are immediately connected with patients as they are the ones responsible of administering care and diseases management. They are crucial for the engagement of their patients, and to enable the better informed participation of these patients in their healthcare journey. Providers will be able to utilize patient engagement technology to support communication, provide guidance, and put patients in control of their care management. Besides healthcare providers have to follow a number of regulations and standards, for example, the HIPAA(Health Insurance Portability and Accountability Act)regulation in the United States, concerning patient privacy and security of the data. Providers must make sure they meet the standards set by these regulations upon application of patient engagement tools. Regulatory requirements expertise makes them capable of grounding the solutions they offer on these limits.

Breakup by Component:

- Software

- Services

- Hardware

Software accounts for the majority of market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes software, services, and hardware. According to the report, software represented the largest segment.

Software-based patient engagement solutions offer versatility and flexibility in terms of functionality, customization, and integration capabilities. They can be tailored to specific healthcare settings, patient populations, and care requirements. Software solutions can be adapted and scaled to meet the evolving needs of healthcare organizations, making them a preferred choice for addressing diverse patient engagement challenges. Moreover, software solutions provide a wide range of features and functionalities that cater to various aspects of patient engagement. These features include patient portals, secure messaging, appointment scheduling, health education resources, remote monitoring, personalized interventions, data analytics, and more. Software solutions can encompass multiple features within a single platform, offering comprehensive patient engagement capabilities.

Breakup by Delivery Type:

- Web-based/Cloud-based

- On-premises

Web-based/cloud-based method represented the largest segment

A detailed breakup and analysis of the market based on the delivery type have also been provided in the report. This includes web-based/cloud-based and on-premises. According to the report, web-based/cloud-based represented the largest segment.

The web/cloud-based patient involvement tools have a great advantage of the convenient and easy-to-reach properties for both the patients and the health-care workers. The solutions to online networking can be accessed via web browsers or mobile applications that which has an internet connection are enabled to connect and interact. Clinical practitioners can obtain and administer patient data with ease while patients, they can effortlessly interact with their healthcare providers or get any health information they need. Besides, these solutions are capable of the expansion and adjustment according to the needs of healthcare organizations. These give solutions can be quickly scaled to serve effective the needs of the various healthcare practices, small clinics, and big hospital systems. Moreover, they offer great flexibility for making that platform more tailored to the needs of the healthcare providers and assist in adjusting as their patient engagement needs change. This is further influencing the patient engagement solutions market demand across the globe.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America accounts for the majority of market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (United States, Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others); Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others); Latin America (Brazil, Mexico, Others); and the Middle East and Africa.

North America was the largest market for patient engagement solutions due to widespread adoption of digital health technologies, high healthcare IT spending, and favorable government initiatives like the HITECH Act. The region’s mature infrastructure supports advanced patient portals, remote monitoring, and telehealth platforms. Additionally, rising chronic disease prevalence and strong payer-provider networks have pushed healthcare organizations to improve communication and care coordination. Major players headquartered in the U.S. have also driven market innovation. Stringent regulatory standards have further encouraged providers to adopt compliant and integrated engagement tools, making North America a frontrunner in implementing such solutions at scale. For instance, in 2023, built upon high levels of experience in developing artificial intelligence (AI) solutions, Ardent Health and SwitchPoint sustained a successful two-year collaboration to create a healthcare innovation studio that aimed to transform healthcare delivery. Based in Nashville, SwitchPoint Ventures is an AI-focused studio that works alongside business leaders to promote technological innovation. Ardent Health Services dedicates investments to people, technology, and communities, operating through 30 hospitals and nearly 200 sites of care in six states, along with over 24,000 employees and more than 1,200 providers.

Key Regional Takeaways:

Europe Patient Engagement Solutions Market Analysis

In Europe, the market is driven by its structured healthcare systems, strong regulatory support for digital health, and rising demand for remote care tools. Governments across the region are funding eHealth initiatives, and there's a high adoption rate of patient portals, mobile health apps, and telehealth services. Aging populations and chronic disease prevalence have made healthcare providers prioritize patient-centric models, encouraging investments in engagement technologies. These factors make Europe a leading region pushing the demand for advanced digital solutions in patient communication and care coordination. For example, at EULAR 2025 in Barcelona, the Global Healthy Living Foundation presented two abstracts on digital patient engagement solutions. These tools focus on improving communication between patients and doctors, especially for those with rheumatic and musculoskeletal diseases. By addressing poor treatment adherence and supporting disease management, the solutions aim to strengthen care through accessible, patient-centered technology, marking another move toward smarter engagement in healthcare.

Asia Pacific Patient Engagement Solutions Market Analysis

The Asia Pacific region is driving the market due to rising healthcare IT investments, growing smartphone usage, and a rapidly expanding patient base. Countries like China, India, and Japan are prioritizing digital health initiatives and expanding insurance coverage, which fuels demand for mobile health apps, remote monitoring, and virtual care platforms. AI-driven tools are increasingly being integrated into patient engagement platforms to improve care coordination and communication. India is emerging as a key provider of such digital health solutions, supporting global healthcare systems. This shift reflects a broader move toward tech-enabled, patient-centric care models across both developed and emerging healthcare markets. For instance, in April 2025, IKS Health, with a strong operational presence in India, expanded its partnership with OrthoNY to launch an AI-powered patient engagement hub. Alongside revenue cycle management, this addition aims to enhance care coordination and communication. The move underscores India’s growing role in delivering advanced tech solutions to support the patient engagement solutions market.

Competitive Landscape:

The competitive landscape of the market is dynamic and characterized by the presence of several key players, including established healthcare IT vendors, technology companies, and emerging startups. Nowadays, key players are investing in continuous product innovation and development to stay ahead in the market. They are focusing on enhancing existing features, introducing new functionalities, and leveraging emerging technologies such as AI, machine learning, and IoT. They are also forming strategic partnerships and collaborations with other healthcare organizations, technology companies, and industry stakeholders. These partnerships help expand their market reach, access new customer segments, and leverage complementary technologies or expertise. Moreover, various players are engaging in acquisitions and mergers to strengthen their market position and expand their product portfolio.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AdvancedMD (Global Payments Inc.)

- Allscripts Healthcare Solutions Inc.

- Athenahealth Inc.

- Cerner Corporation

- EMMI Solutions LLC (Wolters Kluwer N.V.)

- Epic Systems Corporation

- GetWellNetwork Inc.

- Lincor Solutions Limited

- McKesson Corporation

- Medecision Inc. (Health Care Service Corporation)

- Orion Health Ltd.

- Phytel Inc. (International Business Machines Corporation)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- April 2025: Health Union acquired Adfire Health, a data-driven digital engagement firm specializing in HCP targeting. This move boosts its ability to deliver direct-to-consumer and HCP marketing solutions for pharma and life sciences. The combined strength of both companies creates a powerful, first-party dataset for integrated, omnichannel campaigns reaching patients and healthcare teams across specialties and platforms.

- Cerner partnered with Well Health, a patient communication platform, to enhance patient engagement and communication capabilities within its Cerner EHR system. The collaboration aimed to provide seamless and convenient communication between healthcare providers and patients through secure messaging and other digital channels.

- Epic Systems Corporation introduced the Share Everywhere feature in its patient engagement platform, allowing patients to securely share their medical information with any healthcare provider, even if they don't use Epic's EHR system. This development aimed to promote interoperability and improve care coordination across different healthcare settings.

- Allscripts Healthcare Solutions, Inc. launched the Allscripts Virtual Triage, a telehealth solution designed to enable remote triage and patient engagement. The platform integrated virtual care capabilities, appointment scheduling, and patient communication tools to enhance access to care and improve patient engagement.

Patient Engagement Solutions Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Therapeutic Areas Covered |

|

| Applications Covered | Social Management, Health Management, Home Healthcare Management, Financial Health Management |

| End Users Covered | Payers, Providers, Others |

| Components Covered | Software, Services, Hardware |

| Delivery Types Covered | Web-based/Cloud-based, On-premises |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AdvancedMD (Global Payments Inc.), Allscripts Healthcare Solutions Inc., Athenahealth Inc., Cerner Corporation, EMMI Solutions LLC (Wolters Kluwer N.V.), Epic Systems Corporation, GetWellNetwork Inc., Lincor Solutions Limited, McKesson Corporation, Medecision Inc. (Health Care Service Corporation), Orion Health Ltd., Phytel Inc. (International Business Machines Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the patient engagement solutions market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global patient engagement solutions market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the patient engagement solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global patient engagement solutions market size was valued at USD 47.1 Billion in 2025 and is projected to reach USD 157.2 Billion by 2034, exhibiting a CAGR of 13.89% during the forecast period.

We expect the global patient engagement solutions market to exhibit a CAGR of 13.89% during 2026-2034.

The high prevalence of several chronic disorders, along with the increasing awareness towards mobile healthcare facilities among the masses, is primarily driving the global patient engagement solutions market.

The sudden outbreak of the COVID-19 pandemic has led to the rising adoption of numerous patient engagement solutions as they minimize hospitalization visits and remotely provide available treatment options for the coronavirus-infected patients.

Based on the therapeutic area, the global patient engagement solutions market can be segmented into chronic diseases, fitness, women's health, mental health, and others. Currently, chronic diseases hold the majority of the total market share.

Based on the application, the global patient engagement solutions market has been divided into social management, health management, home healthcare management, and financial health management. Among these, health management currently exhibits a clear dominance in the market.

Based on the component, the global patient engagement solutions market can be bifurcated into

software, services, and hardware. Currently, software holds the largest market share.

Based on the delivery type, the global patient engagement solutions market has been categorized into web-based/cloud-based and on-premises, where web-based/cloud-based currently accounts for the majority of the global market share.

Based on the end user, the global patient engagement solutions market can be segregated into payers, providers, and others. Currently, providers exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global patient engagement solutions market include AdvancedMD (Global Payments Inc.), Allscripts Healthcare Solutions Inc., Athenahealth Inc., Cerner Corporation, EMMI Solutions LLC (Wolters Kluwer N.V.), Epic Systems Corporation, GetWellNetwork Inc., Lincor Solutions Limited, McKesson Corporation, Medecision Inc. (Health Care Service Corporation), Orion Health Ltd., and Phytel Inc. (International Business Machines Corporation).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)