Pates Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Pates Market Size and Share:

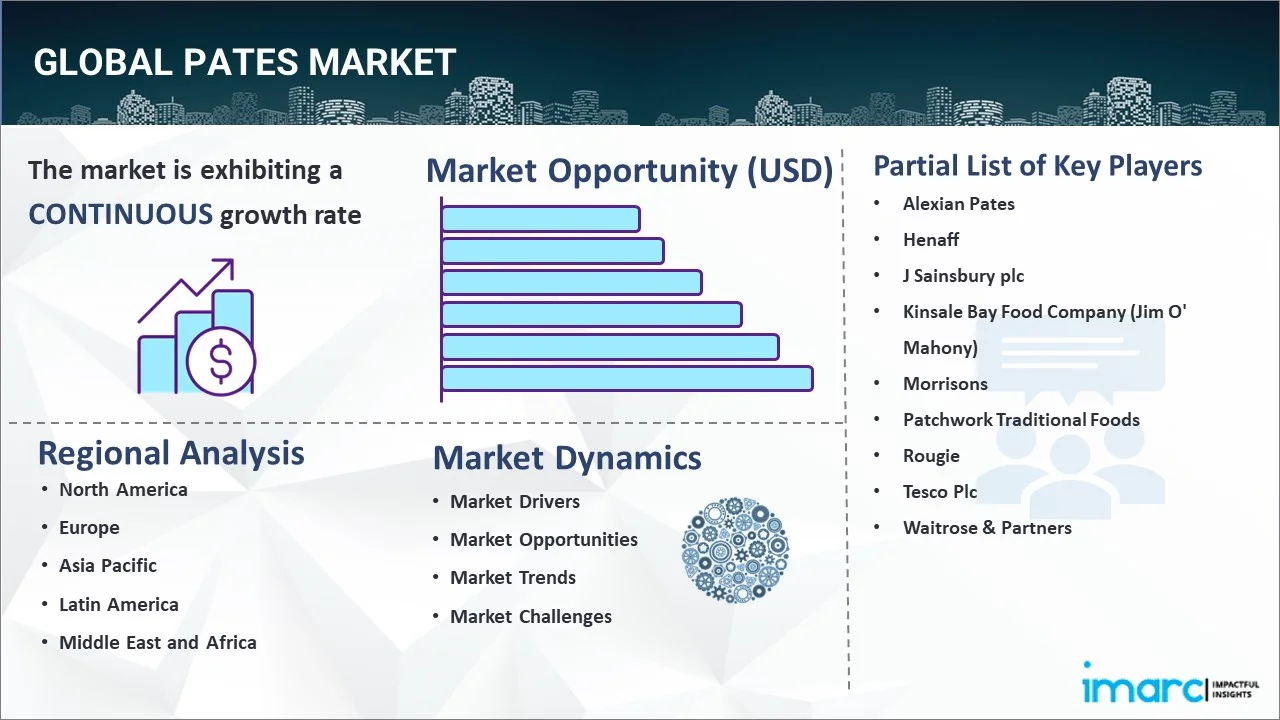

The global pates market size was valued at USD 1.25 Billion in 2024. The market is projected to reach USD 1.42 Billion by 2033, exhibiting a CAGR of 1.40% from 2025-2033. Europe currently dominates the market, holding a market share of 48.4% in 2024. Rising penetration of western cuisines, changing consumer dietary patterns, and escalating demand for processed food items represent some of the key factors driving the market expansion. Moreover, increasing shift towards nutrient-dense diets is propelling the pates market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.42 Billion |

| Market Growth Rate 2025-2033 | 1.40% |

Market Size & Forecasts:

- Pates market was valued at USD 1.25 Billion in 2024.

- The market is projected to reach USD 1.42 Billion by 2033, at a CAGR of 1.40% from 2025-2033.

Dominant Segments:

- Product Type: Chicken represents the largest market share because chicken pate appeals to a wider consumer base due to its familiar taste, affordability, and versatility. It is often perceived as lighter and healthier than red meat options, making it suitable for daily utilization and preferred in both traditional and modern cuisines.

- Distribution Channel: Supermarket/hypermarket dominates the pates market because of the presence of extensive product variety, easy accessibility, and competitive pricing. These stores provide a convenient one-stop shop for people, enabling impulse buying and exposure to premium and gourmet pate brands through dedicated chilled sections.

- Region: Europe leads the pates market due to its strong culinary tradition of consuming pates, especially in France, Belgium, and Germany. The region values artisanal food items, supports local producers, and has a well-developed cold food supply chain.

Key Players:

- The leading companies in pates market include Alexian Pates, Henaff, J Sainsbury plc, Kinsale Bay Food Company (Jim O' Mahony), Morrisons, Patchwork Traditional Foods, Rougie, Tesco Plc, Waitrose & Partners, etc.

Key Drivers of Market Growth:

- Innovations in Flavor: Producers are introducing new ingredients, spices, and fusion styles that appeal to evolving palates. This variety increases consumer interest and encourages repeat purchases, supporting consistent growth in both retail and foodservice sectors.

- Growing Popularity of Wine and Cheese Pairings: Pates pair well with gourmet food items, making them a preferred choice for upscale gatherings and tastings. This trend is catalyzing the demand for pates in retail, restaurants, and specialty food stores, supporting the market expansion.

- Increased Focus on Sustainability and Ethical Sourcing: Brands are adopting eco-friendly packaging and transparent practices. Ethical sourcing builds trust, attracts conscious buyers, and strengthens brand image, boosting overall market growth and long-term customer loyalty.

- Cultural Curiosity and Food Experimentation: People are seeking unique taste experiences and are more open to trying traditional delicacies like pates. This adventurous palate is catalyzing the demand, especially for regional, artisanal, and fusion varieties, expanding the market's reach and appeal.

- Rising Tourism Activities: Tourists often look for authentic local food items, and pates serve as a gourmet specialty in many cultures. This rising exposure is boosting worldwide demand as travelers are developing a taste for pates and seeking them.

Future Outlook:

- Strong Growth Outlook: The pates market is expected to see sustained expansion, as the demand for gourmet and specialty food items is increasing. Rising interest in premium, ready-to-eat (RTE) products and expanding retail and foodservice channels continue to fuel the market growth.

- Market Evolution: The sector is anticipated to shift from a niche gourmet segment to a more mainstream offering. It is experiencing rising acceptance due to changing consumer tastes, premiumization trends, and wider availability in supermarkets, delis, and online platforms, making it accessible to a broader audience.

Pate is a paste or spread of finely chopped or pureed seasoned meat that usually contains liver. It is a savory filling of meat and fat baked in a terrine, an earthenware vessel. Some common types of meat used to make pate includes chicken, pork, pig scraps, duck, goose, lamb, venison, and fish. It is generally prepared by grinding meat marinated with herbs, spices, vegetables, and wine or liquor. The meat is ground to obtain the desired texture, and the fat is ground separately and then worked into the meat, either manually or in a food processor. The pate mixture is then added with binding agents, such as eggs or panada, which is a paste made using flour, bread, or other starch. Pates can be eaten hot or cold and served with a variety of dishes. Since they are rich in iron, copper, and vitamins A and B-12, pates are gaining immense traction across the globe.

To get more information on this market, Request Sample

The pates market is being driven by evolving user preferences, lifestyle changes, and the growing demand for gourmet and convenient food options. Increasing interest in premium and artisanal food items has positioned pates as a luxury indulgence, appealing to both traditional consumers and younger demographics seeking new culinary experiences. The rise of online retail and food delivery platforms has made pates more accessible, offering a wide variety of flavors and premium offerings directly to people. Additionally, the impact of food bloggers, chefs, and social media campaigns is enhancing consumer awareness, encouraging experimentation and catalyzing overall demand.

The United States has emerged as a major region in the pates market owing to many factors. Increasing demand for gourmet and premium food experiences is fueling the pates market growth. Rising exposure to international cuisines is making pates more appealing to American consumers. Online retail and food delivery services are further fueling the accessibility, allowing people to conveniently explore different flavors. In the United States, approximately two-thirds of consumers utilized a food-ordering app at least once for takeout, delivery, or both, as reported in the September 2024 Consumer Food Insights Report (CFI). More than 50% used an application for a delivery request. Social media platforms, food bloggers, and culinary influencers are playing a key role in shaping consumer choices by promoting recipe ideas, pairing suggestions, and lifestyle-oriented content around pates.

Pates Market Trends:

Increasing demand for gourmet and premium food products

The growing demand for gourmet and premium food products is offering a favorable pates market outlook. Pate, being a rich and flavorful delicacy, appeals to food enthusiasts who value artisanal and refined offerings. This trend is especially strong among urban consumers and younger demographics who are willing to explore international cuisines and upscale food items. Premium pates made from duck liver, truffle, and other fine ingredients cater to this segment and help elevate the product's market appeal. As gifting culture around gourmet hampers and fine dining at home is rising, pate is gaining popularity as a sophisticated option. Foodservice providers are responding by expanding their premium selections. This growing appreciation for luxury and gourmet food items continues to strengthen the demand and innovations in the pates market. As per industry reports, the global gourmet food market is set to increase from USD 29.92 Billion in 2024 to USD 51.83 Billion by 2032, expanding at a CAGR of 7.11% throughout the forecast period (2025-2032).

Broadening of retail outlets

The expansion of retail outlets is among the major pates market trends. According to the IMARC Group, the global retail market size reached USD 30,092.3 Billion in 2024. As modern retail formats, such as supermarkets, hypermarkets, gourmet stores, and online grocery platforms, are broadening, they are creating more shelf space and promotional opportunities for specialty products like pates. People are gaining easier access to various pate options, including different flavors, packaging, and price points, which is encouraging trial and repeat purchases. Retailers often promote pates as part of premium or festive food categories, increasing their appeal among quality-conscious buyers. With better refrigeration and storage facilities, pates can be sold in more locations, including remote and semi-urban areas. The rise of online retail is also supporting the home delivery of chilled products, making pates more accessible.

Rising impact of social media

Increasing impact of social media is positively influencing the market. On social media platforms, food influencers, bloggers, and chefs frequently share recipes, tasting experiences, and serving ideas featuring pate, making it more appealing to a wider audience. Digital platforms showcase pate as part of elegant meals and charcuterie boards, attracting interest from food lovers and home cooks. Visual presentation and storytelling around premium food create aspiration among viewers, encouraging them to try new products like pates. Social media trends are also fueling curiosity for international cuisines, where pates hold cultural significance. Additionally, brands are utilizing targeted ads and influencer partnerships to promote their pate offerings directly to potential buyers. With more people employing social media, the market is set to expand. As per the DataReportal, as of early April 2025, there were 5.31 Billion users of social media globally, which accounted for 64.7% of the overall population.

Pates Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pates market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Chicken

- Fish

- Duck

- Others

Chicken held 35.2% of the market share in 2024. It offers a balance of taste, affordability, and broad consumer appeal compared to other meat-based varieties. Chicken pate is perceived as lighter, healthier, and more versatile, aligning well with the preferences of health-conscious people who seek protein-rich yet lower-fat options. Its milder flavor profile also makes it more adaptable in different recipes and pairings, appealing to both traditional and experimental eaters. Additionally, chicken is one of the most widely consumed meats globally, ensuring consistent raw material availability and cost-effectiveness in production, which strengthens its dominance in the pate category. The popularity of chicken in Western and Asian cuisines is further driving its acceptance across diverse consumer segments. Moreover, the introduction of organic, free-range, and clean-label chicken pate variants enhances its premium positioning, catering to evolving lifestyle and dietary trends. As per the pates market forecast, with evolving user preferences, chicken will continue to hold dominance in the industry.

Analysis by Distribution Channel:

- Supermarket/Hypermarket

- Convenience Store

- Specialty Store

- Online Retailers

- Others

Supermarket/hypermarket accounts for 57.9% of the market share. These retail formats provide unmatched convenience, wide product selection, and consistent quality that appeal to diverse consumer segments. They stock a variety of pate types, including traditional, premium, organic, and plant-based options, allowing shoppers to compare flavors, ingredients, and brands in a single location. Their strategic locations, high foot traffic, and promotional campaigns, such as discounts, loyalty programs, and bundle offers, drive both trial and repeat purchases. In addition, in-store marketing initiatives like eye-catching displays, tasting events, and product demonstrations encourage impulse buying and increase consumer engagement. Cold chain management and advanced storage facilities in these outlets ensure that perishable products like pates remain fresh and safe, enhancing consumer trust. The combination of accessibility, variety, convenience, and effective marketing makes supermarket/hypermarket the dominant distribution channel for pates, supporting steady market growth and broader product adoption.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe, accounting for a share of 48.4%, enjoys the leading position in the market. The region is benefiting from a well-established tradition of artisanal production, premium ingredients, and culinary expertise, which is driving both domestic consumption and export demand. Consumers in Europe increasingly prioritize quality, authenticity, and variety, encouraging manufacturers to innovate with traditional, organic, and flavored pates to meet evolving tastes. High disposable incomes and the growing interest in premium and ready-to-eat (RTE) food items are further strengthening the market expansion. As per the Eurostat, during the second quarter of 2024, per capita household disposable income in the euro area rose by 0.1%, following a 0.4% increase during Q1. Additionally, Europe has well-developed retail channels, including supermarkets, hypermarkets, and specialty gourmet stores, which ensure wide accessibility of pates. Strong food safety standards and regulatory frameworks are also enhancing consumer trust, encouraging repeated purchases.

Key Regional Takeaways:

North America Pates Market Analysis

The North America pates market is witnessing steady growth driven by the rising demand for premium and gourmet food products, as consumers are seeking unique culinary experiences that combine taste with sophistication, making pates a popular choice for fine dining and home consumption. Increasing exposure to global cuisines, especially European and French-inspired delicacies, is fueling interest in pates as consumers in North America are showing a greater willingness to explore international flavors and textures. Online retail platforms and food delivery services are playing a crucial role by expanding the availability of both traditional and innovative pate options, making them more accessible to urban and suburban households. The strong impact of social media, food bloggers, and digital campaigns is also shaping consumer awareness, encouraging experimentation through recipe inspiration, pairing ideas, and lifestyle-driven food trends. As of September 2025, in the United States, 73% of individuals (approximately 253 Million) engaged with social media. Furthermore, rising health consciousness has opened opportunities for new product development, such as organic, low-fat, or plant-based pates, catering to diverse dietary preferences. Increasing disposable incomes, premiumization trends in the packaged food sector, and the emphasis on convenience through RTE gourmet offerings are collectively driving the market forward.

United States Pates Market Analysis

The United States holds 82% of the market share in North America. The United States is witnessing rising demand for pates due to the expansion of e-commerce portals. Online retail has made it easier for consumers to access a variety of flavors and premium offerings at their convenience. Increasing digital platforms and delivery services are broadening the availability, while rising influence of social media is driving awareness, taste exploration, and lifestyle-driven consumption. For instance, the number of online shoppers in the United States is anticipated to have reached 288.45 Million by 2025. People are influenced by food bloggers, influencers, and online reviews, which are encouraging trials and repeat purchases. Social media campaigns showcasing recipe ideas and pairing options are further boosting consumer engagement. Additionally, rising preferences for gourmet food experiences and curiosity towards global cuisines are creating opportunities for pate producers to innovate with exotic flavors, healthier formulations, and plant-based alternatives. Retailers and online platforms are also highlighting pates as versatile meal components, appealing to both casual consumers and premium buyers. Seasonal promotions, bundled offers, and creative packaging are further attracting attention, ensuring that pates are positioned not only as specialty products but as mainstream food choices.

Europe Pates Market Analysis

Europe is witnessing significant market expansion driven by the thriving food processing sector, which has facilitated improved production capabilities and diversification of product lines. For instance, in 2024, the food processing sector in Europe comprised 294,000 companies, which accounted for 15.2% of the entire European industry. The food processing sector’s broadening allows manufacturers to integrate advanced techniques, ensuring better texture, flavor, and extended shelf life for pates. This technological growth is promoting greater consumer trust and boosting wider availability of innovative options, including both traditional and contemporary variations. As the sector is prioritizing efficiency, scalability, and innovations, the growing adoption of pates reflects shifting preferences toward RTE delicacies. The food processing sector is focusing on premiumization and sustainable sourcing, aligning with evolving consumer expectations.

Asia-Pacific Pates Market Analysis

The Asia-Pacific region is experiencing market growth due to expanding grocery retail stores, which are enhancing accessibility across both metropolitan and semi-urban centers. For instance, in 2024, India had approximately 13 Million grocery retail outlets. Increased store penetration has made pates more visible to consumers, supported by product diversification within modern trade outlets. This retail expansion is encouraging trial purchases, as people are increasingly exposed to RTE and gourmet products. The rise of organized grocery retail stores has also improved product placement and marketing strategies that position pates as an aspirational choice. Shoppers are drawn towards premium offerings while seeking convenience and variety within their daily diets. This shift in buying patterns is enhancing long-term adoption, as grocery retail stores are actively driving awareness and availability.

Latin America Pates Market Analysis

Latin America is observing strong growth in pates consumption due to the growing urbanization rates and disposable incomes. For instance, by 2025, 315 Million individuals will reside in major cities of Latin America, where the per-capita GDP is projected to attain USD 23,000. Expanding cities and modern lifestyles are encouraging people to experiment with gourmet products like pates, while higher disposable incomes are supporting the affordability of premium food options. Urban centers are driving stronger demand for RTE items, and pates align well with these evolving food habits.

Middle East and Africa Pates Market Analysis

In the Middle East and Africa region, the market is expanding due to the growing demand for meat and poultry products. For instance, the Middle East processed meat products market reached an impressive USD 15.20 Billion valuation in Q2 2025. Shifting consumption patterns, influenced by dietary preferences, are increasing awareness of pates as an appealing value-added product. Rising demand for meat and poultry products is directly enhancing opportunities for pates integration into everyday meals.

Competitive Landscape:

Key players are focusing on innovations, product diversification, and strategic marketing to meet evolving consumer preferences. They are continuously introducing new flavors, premium variants, and healthier alternatives, such as organic, low-fat, and plant-based pates, catering to health-conscious people. Strong branding and promotional activities, including collaborations with chefs, food influencers, and digital campaigns, help in increasing consumer awareness and trial. Key players are also leveraging advanced packaging solutions to enhance shelf life, maintain freshness, and improve convenience, which appeals to modern lifestyles. Their robust distribution networks, both offline and online, ensure greater market penetration and accessibility across regions. Additionally, investments in sustainability and clean-label ingredients are further resonating with the growing consumer demand, making key players instrumental in shaping the expansion of the pates market globally. For instance, in February 2025, Purina's Fancy Feast revealed the nationwide introduction of Gems, a chef-designed product showcasing pyramid-shaped pates with flowing gravy in beef, chicken, tuna, or salmon varieties, aimed at elevating cats' dining experience through inventive design and practical packaging.

The report provides a comprehensive analysis of the competitive landscape in the pates market with detailed profiles of all major companies, including:

- Alexian Pates

- Henaff

- J Sainsbury plc

- Kinsale Bay Food Company (Jim O' Mahony)

- Morrisons

- Patchwork Traditional Foods

- Rougie

- Tesco Plc

- Waitrose & Partners

Latest News and Developments:

- June 2025: Food Standards Australia New Zealand authorized the Australian food technology startup Vow Foods to sell products made from cultured quail cells. Vow's crafted whipped pâté, foie gras, and a candle made from edible tallow, derived from cultured Japanese quail cells, would be showcased at high-end Australian eateries, such as Bottarga in Melbourne and Nel in Sydney.

- March 2025: Nayi Le Achaar Pâté, created by Local to Global Foods, debuted as a distinctive fusion of traditional Indian achaar and French sophistication, presenting pâté as a cultural connector that reinterpreted African tastes for worldwide audiences.

- March 2025: Italian truffle company La Rustichella introduced a new range of 100% certified organic items, featuring black and white truffle paté, oils, and carpaccio, demonstrating its dedication to sustainability and addressing the increasing worldwide demand for organic luxury food.

Pates Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chicken, Fish, Duck, Others |

| Distribution Channels Covered | Supermarket/Hypermarket, Convenience Store, Specialty Store, Online Retailers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alexian Pates, Henaff, J Sainsbury plc, Kinsale Bay Food Company (Jim O' Mahony), Morrisons, Patchwork Traditional Foods, Rougie, Tesco Plc, Waitrose & Partners, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pates market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pates market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pates market was valued at USD 1.25 Billion in 2024.

The pates market is projected to exhibit a CAGR of 1.40% during 2025-2033, reaching a value of USD 1.42 Billion by 2033.

The growing interest in gourmet and premium food experiences is driving the demand for pates, which are often associated with luxury dining and refined tastes. The expansion of online retail and food delivery services has made it easier for people to access a wider range of pate varieties, including artisanal and international options, from the comfort of their homes. Additionally, social media, food bloggers, and influencer-driven campaigns are promoting recipes and pairing ideas, driving trial and repeat purchases.

Europe currently dominates the pates market, accounting for a share of 48.4% in 2024, due to its rich culinary heritage, strong tradition of gourmet and artisanal food items, and rising consumer preferences for premium and authentic products. Besides this, widespread appreciation for quality, flavor, and variety in delicatessen offerings is fueling the market expansion.

Some of the major players in the pates market include Alexian Pates, Henaff, J Sainsbury plc, Kinsale Bay Food Company (Jim O' Mahony), Morrisons, Patchwork Traditional Foods, Rougie, Tesco Plc, Waitrose & Partners, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)