Passive Electronic Components Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2026-2034

Passive Electronic Components Market Size and Share:

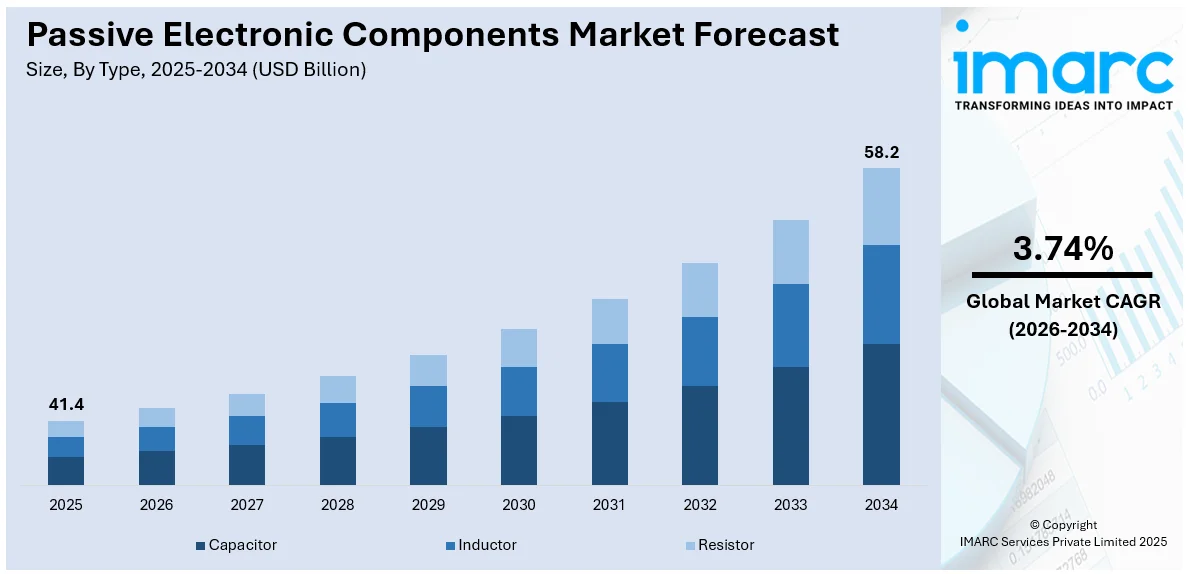

The global passive electronic components market size was valued at USD 41.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 58.2 Billion by 2034, exhibiting a CAGR of 3.74% from 2026-2034. North America currently dominates the market, holding a market share of over 35.8% in 2025. The market is primarily driven by the rising demand in consumer electronics like smartphones and wearables, growing adoption of electric vehicles and advanced automotive systems, and expanding renewable energy infrastructure requiring efficient energy management and reliability in energy-generating and storage systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 41.4 Billion |

|

Market Forecast in 2034

|

USD 58.2 Billion |

| Market Growth Rate (2026-2034) | 3.74% |

The global market is experiencing robust growth, fueled by continual advancements in miniaturization. In line with this, rising demand for high-performance components in automotive, telecommunications, and industrial automation, is impelling the market. Increased adoption of IoT devices, wearables, and smart home technologies amplified the need for capacitors, resistors, and inductors for efficient power management and signal processing. For instance, on March 11, 2024, Knowles Precision Devices introduced new Electric Double Layer Capacitor (EDLC) modules with a three-cell design, offering higher voltages and space efficiency. Ideal for energy storage in EVs, IoT, and renewable energy systems, these supercapacitors provide high energy density, low self-discharge, and a 10-year lifespan. Additionally, the ongoing shift towards renewable energy, electric mobility, 5G, and advanced semiconductors drives growth, supported by expanding manufacturing and supply chains.

To get more information on this market Request Sample

The United States is a key regional market is primarily driven by its strong industrial base and leadership in aerospace, defense, automotive, and telecommunications sectors. Similarly, the rising demand for advanced systems in electric vehicles (EVs) and renewable energy infrastructure is increasing the adoption of capacitors, resistors, and inductors. Notably, on August 26, 2024, Bourns, Inc. expanded its Riedon Industrial Shunt Resistors lineup, offering precision solutions for battery management systems, solar inverters, and power supplies, reinforcing its U.S.-based leadership. Moreover, rapid 5G network development, smart city projects, and IoT adoption further drive the need for high-performance passive components. Apart from this, increasing investments in research and development (R&D) enable miniaturized, energy-efficient components, while strategic government initiatives and robust supply chain networks ensure sustained market expansion and global competitiveness.

Passive Electronic Components Market Trends:

Increasing Demand for Consumer Electronics

The increasing usage of smartphones, laptops, tablets, and wearable devices is leading to a tremendous increase in the demand for passive electronic components. Components like capacitors, resistors, and inductors form the core in ensuring that such devices work efficiently and deliver optimum performance in accordance with technological innovations in consumer electronics. The wearables market, for example, kicked off strong in 2024, as the International Data Corporation (IDC) said shipments of wearable devices grew by 8.8% year over year in 1Q24 to reach 113.1 million units. This increase in wearable technology demand and continued smartphone and laptop growth directly contribute to expanding passive components requirements. As consumer preferences shift and the demand for more advanced, efficient electronic devices increases, the global passive electronic components market is poised for continued expansion, fueled by the escalating electronics industry.

Expansion of Automotive Industry

The automotive sector's growth in electric vehicles and the increasing presence of advanced driver-assistance systems have greatly stimulated the demand for passive electronic components. Capacitors and resistors are some key components for electric vehicle battery management systems, power electronics, and ECUs, playing a critical role in driving the growth of the market. In 2023, nearly 14 million new electric cars were registered globally, pushing the total number of EVs on the roads to 40 million, which is in accordance with the sales forecast from the 2023 edition of the Global EV Outlook (GEVO-2023), as reported by the International Energy Agency (IEA). This rise in the adoption of electric vehicles is intensifying the need for high-performance passive components, further supporting the demand in the global passive electronic components market.

Growing Demand for Renewable Energy Systems

A global drive to mitigate the population's reliance on inadequate energy sources resulted in an increased focus on sustainable energy solutions. Solar power, wind power equipment, and other energy storage systems have been in high demand as they depend on passive electronic components, which allow for efficient energy conversion, storage, and management. The International Energy Agency (IEA) has projected that in 2024, wind and solar photovoltaic (PV) systems will produce more electricity than hydropower for the first time in the world. Modern bioenergy also became the largest source of renewable energy globally in 2022, with over a 50% share of global renewable energy use. This is fueling the increase in the adoption of renewable energy, leading to additional demand for passive electronic components in optimizing performance and reliability in energy-generating and storage systems. As renewable infrastructure continues growing, the demand for these critical components will keep driving growth in the market.

Passive Electronic Components Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global passive electronic components market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type and end use industry.

Analysis by Type:

- Capacitor

- Ceramic Capacitors

- Tantalum Capacitors

- Aluminum Electrolytic Capacitors

- Paper and Plastic Film Capacitors

- Supercapacitors

- Inductor

- Power

- Frequency

- Resistor

- Surface-mounted Chips

- Network

- Wirewound

- Film/Oxide/Foil

- Carbon

Capacitor leads the market with around 54.4% of market share in 2025, due to their critical role in energy storage, regulation, and signal processing across various applications. They are indispensable in power electronics, renewable energy systems, and electric vehicles, ensuring stable power delivery and enhanced circuit efficiency. Their widespread use spans industries such as consumer electronics, automotive, telecommunications, and industrial sectors. Technological advancements, including higher capacitance, miniaturization, and improved heat resistance, have further expanded their applications in high-demand areas like renewable energy and electric mobility. Capacitors are particularly vital in renewable energy systems, such as solar inverters and wind turbines, optimizing performance and reliability. This versatility, coupled with increasing demand in emerging technologies, solidifies their dominance in the market.

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Aerospace and Defense

- Consumer Electronics

- Information Technology

- Automotive

- Industrial

- Others

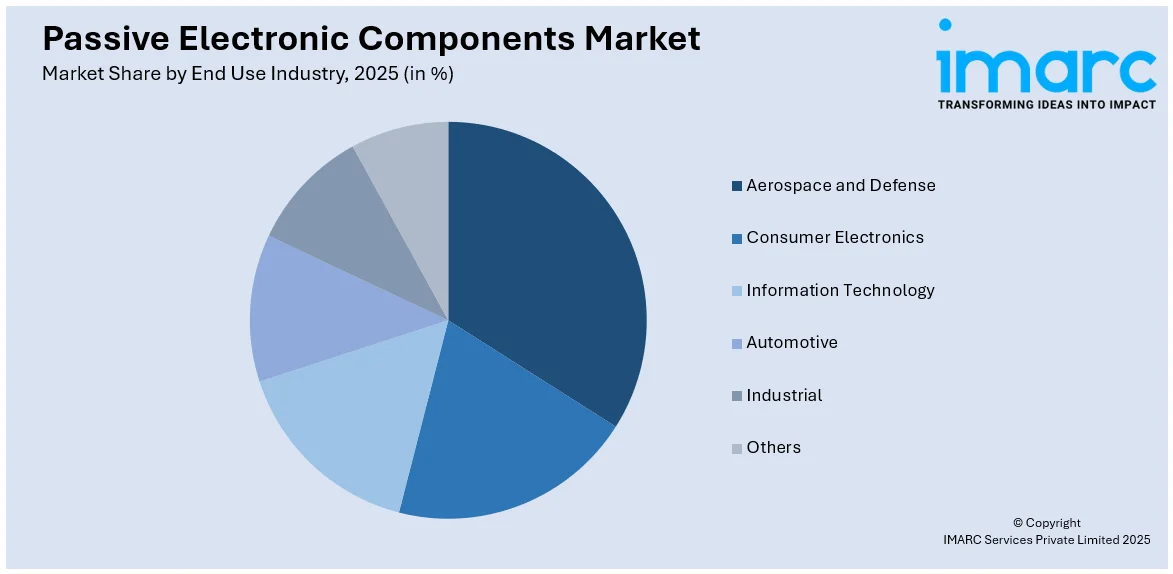

Consumer electronics leads the market with around 25.9% of market share in 2025, due to the widespread use of devices like smartphones, laptops, tablets, and smart home appliances. These devices require a variety of passive components, such as capacitors, resistors, and inductors, to ensure proper functionality, signal processing, and energy efficiency. The rapid advancements in technology, including miniaturization and enhanced performance, have increased the demand for smaller, more reliable components. Additionally, the growing adoption of Internet of Things (IoT) devices, wearables, and gaming systems further amplified the need for passive components in the consumer electronics sector. Their essential role in enabling seamless operation and meeting high production volumes makes consumer electronics the largest contributor to the passive electronic components market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 35.8%, driven by a strong industrial base, an advanced technology infrastructure, and considerable investments in R&D. The region is home to leading industries like aerospace, defense, telecommunications, and automotive, all of which use capacitors, resistors, and inductors extensively for critical applications. The fast-growing electric vehicle and renewable energy markets are further propelling demand for these components in energy storage and power management. Most notably, Quantic Electronics, an American inventor, entered a deal with Richardson Electronics on September 18, 2024, to render the most advanced capacitor technologies accessible to all markets, further expanding mission-critical solutions in defense, aerospace, and 5G. Additionally, robust supply chains and supportive government policies cement North America's top spot, sustaining demand and innovation.

Key Regional Takeaways:

United States Passive Electronic Components Market Analysis

In 2025, the United States represented 86.50% of the North America passive electronic components market, driven by the increasing demand for electric vehicles in the region. New electric car registrations reached 1.4 million in 2023, a remarkable 40% increase compared to 2022, according to the International Energy Agency (IEA). Although the relative annual growth slowed slightly in 2023 compared to previous years, the overall demand for EVs remains strong, ensuring continued growth in the sector. The application of capacitors, resistors, and inductors in passive components is an indispensable element of any EV battery management system, power electronics, or electronic control unit. In relation to improving efficiency, performance, and safety in the adoption of ADAS in electric vehicles, they play a crucial role. With the renewed efforts of the U.S. to employ more sustainable and environmentally friendly technologies, the increased demand for EVs as well as the inclusion of advanced electronics in automotive systems is fostering growth of the passive electronic components in the country.

Europe Passive Electronic Components Market Analysis

The European passive electronic components market will continue to grow robustly, with the development of the automotive and consumer electronics industries being considered key drives for this growth. In 2023, the EU car market showed a spectacular increase of 13.9 % compared to 2022 with 10.5 million units sold, according to the European Automobile Manufacturers Association (ACEA). As the automotive sector continues to trend towards electric vehicles, the demand for passive components such as capacitors, resistors, and inductors is picking up, especially for EV power management systems and electronic control units. Moreover, the European online consumer electronics market reached EUR 90 Billion (USD 93 Billion) in 2023, and is likely to grow further to EUR 107 Billion (USD 111 Billion) by 2025, based on the projections of Cross-Border Commerce Europe. Advancements in consumer electronics drive the necessity for an effective electronic component portfolio spanning devices such as smartphones, laptops, and a rapidly expanding range of wearables. This growth fuels increased demand for passive electronic components across diverse markets within the continent, ensuring functionality, reliability, and performance in modern electronic systems.

Asia Pacific Passive Electronic Components Market Analysis

The Asia Pacific market is growing highly due to the increased demand for electronics and renewable energy solutions. The Electronics System Design and Manufacturing (ESDM) sector has a crucial role in supporting the Indian government's ambition of generating USD 1 Trillion in economic value from the digital economy by 2025, as mentioned by IBEF. According to the India Cellular and Electronics Association, the mobile phone manufacturing industry expanded with a whopping CAGR of 40.76% between 2015 and 2024, thereby fueling growth in passive electronic components. Renewables too witnessed growth across the region, as China is expected to add nearly 60% of new renewable capacity installations between now and 2030, as stated by IEA. Rising demand for electronics in mobile devices and renewable energy systems will consume passive electronic components such as capacitors, resistors, and inductors, which are likely to fuel market growth in the Asia Pacific.

Latin America Passive Electronic Components Market Analysis

The Latin America passive electronic components market is poised to grow with increased demand for electronic devices in the different sectors of the region. In 2023, the Brazilian devices market is forecasted to amount to USD 21.5 Billion, registering a 1.1% growth from the previous year 2022, as mentioned by IDC. This growth represents the increased consumer demand for mobile phones, laptops, and other electronic products that require passive components such as capacitors, resistors, and inductors. Also, the Latin American automotive sector is experiencing significant expansion, with a strong emphasis on electric vehicles. This shift is driving an increased demand for components used in battery management systems and power electronics, which are essential for efficient and reliable EV operations. Additionally, the Latin America region also experiences growth within the renewable energy sector with consistent rise in the regions' solar and wind energy capacities. Such trends continue to bring escalation to passive electronic components in all parts of the Latin American continent.

Middle East and Africa Passive Electronic Components Market Analysis

The Middle East and Africa market is growing quite robustly in various consumer electronics, automotive, as well as in the renewable energy industry. Countries in the region have huge amounts invested in renewable energy, as claimed by the International Energy Agency. The vision is to achieve clean energy in the region by 2030. The need for passive electronic components is going to rise in solar, wind energy, and energy storage systems. The automotive sector is changing in the MEA region with electric vehicles. New registrations of electric vehicles grew by 15% in the region, in 2023 and the demand for passive components including capacitors, resistors, and inductors for the battery management as well as for power electronics are growing at tremendous rates. Consumer electronics are expanding, especially in Saudi Arabia and the UAE. More acceptance of smartphones, laptops, and smart home appliances are leading to higher demand for such passive components.

Competitive Landscape:

The market of passive electronic components is very competitive with numerous key players in focus, mainly with regard to innovation and more advanced products, including miniaturized capacitors, resistors, and inductors. As such, there is also the tendency towards strategic partnerships, mergers, and acquisitions with companies trying to increase their global presence and expand production capacities. For instance, on January 6, 2025, Globe Capacitors collaborated with PolyCharge to combine NanoLam technology into its capacitors to increase energy density, reliability, and compactness. This collaboration will deliver advanced solutions for electric vehicles, renewable energy, and industrial power supplies, thus strengthening the innovation leadership of both companies around the world. The increasing demand for electric vehicles, renewable energy, and IoT devices increased competition in the market, and regional manufacturers have played a crucial role in fulfilling localized needs and driving market growth.

The report provides a comprehensive analysis of the competitive landscape in the passive electronic components market with detailed profiles of all major companies, including:

- Eaton Corporation PLC

- KOA Corporation

- Kyocera Corporation

- Murata Manufacturing Co. Ltd.

- Panasonic Corporation

- Samsung Electro-Mechanics Co. Ltd.

- Taiyo Yuden Co. Ltd.

- TDK Corporation

- TE Connectivity

- TT Electronics Plc

- Vishay Intertechnology Inc.

- Yageo Corporation

Latest News and Developments:

- March 2024: KEMET, a business unit of the YAGEO Group, announced the T581 capacitors that meet the Military Performance Specification MIL-PRF-32700/2. The capacitors are rated at 35V and are optimized for military applications where high-performance requirements are the norm. The capacitors utilize polymer tantalum technology, offering superior volumetric efficiency, which makes them an excellent choice for use in fast-switching DC/DC converters requiring high efficiency.

- February 2024: Samtec increased its Edge Rate connector family offering with the new ERM6 & ERF6 Series, which provide an even denser mating configuration than the existing connectors, a smaller width, and 5 mm of height. Those connectors support all applications from embedded vision, industrial automation, instrumentation, and robotics up to the highest high-speed applications of up to 56 Gbps PAM4.

- January 2024: Murata Manufacturing Co., Ltd. released the DFE2MCPH_JL series of automotive-grade power inductors, with two options available in 0.33µH and 0.47µH. Designed for automotive powertrain and safety applications, these inductors tap into Murata's know-how in materials and manufacturing technology to provide exceptional performance for systems like ADAS and In-Vehicle Infotainment (IVI), both growth areas.

Passive Electronic Components Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Use Industries Covered | Aerospace and Defense, Consumer Electronics, Information Technology, Automotive, Industrial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Eaton Corporation PLC, KOA Corporation, Kyocera Corporation, Murata Manufacturing Co. Ltd., Panasonic Corporation, Samsung Electro-Mechanics Co. Ltd., Taiyo Yuden Co. Ltd., TDK Corporation, TE Connectivity, TT Electronics Plc, Vishay Intertechnology Inc. and Yageo Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the passive electronic components market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global passive electronic components market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the passive electronic components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Passive electronic components refer to essential circuit elements that do not require external power to operate. They regulate or store energy in electrical systems and include components like capacitors, resistors, and inductors. These components perform critical functions such as filtering, energy storage, and signal processing, ensuring stability and efficiency in electronic devices.

The passive electronic components market was valued at USD 41.4 Billion in 2025.

IMARC estimates the global passive electronic components market to exhibit a CAGR of 3.74% during 2026-2034.

The global market is majorly driven by rising demand in consumer electronics, electric vehicles, renewable energy systems, IoT devices, and 5G networks, alongside advancements in miniaturization, energy-efficient technologies, and increasing investments in research and development.

In 2025, capacitator represented the largest segment by type, driven by their critical role in energy storage, signal regulation, and power management across various applications.

Consumer electronics leads the market by end use industry attributed to the widespread use of smartphones, laptops, wearables, and IoT devices requiring passive components.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global passive electronic components market include Eaton Corporation PLC, KOA Corporation, Kyocera Corporation, Murata Manufacturing Co. Ltd., Panasonic Corporation, Samsung Electro-Mechanics Co. Ltd., Taiyo Yuden Co. Ltd., TDK Corporation, TE Connectivity, TT Electronics Plc, Vishay Intertechnology Inc., and Yageo Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)