Passenger Cars Market Report by Type (Hatchback, Sedan, Utility Vehicle), Fuel Type (Gasoline, Diesel, and Others), Engine Capacity (< 1000 cc, < 1000-1500 cc, < 1500-2000 cc, >2000 cc), Propulsion Type (IC Engine, Electric Vehicle), and Region 2025-2033

Passenger Cars Market Size:

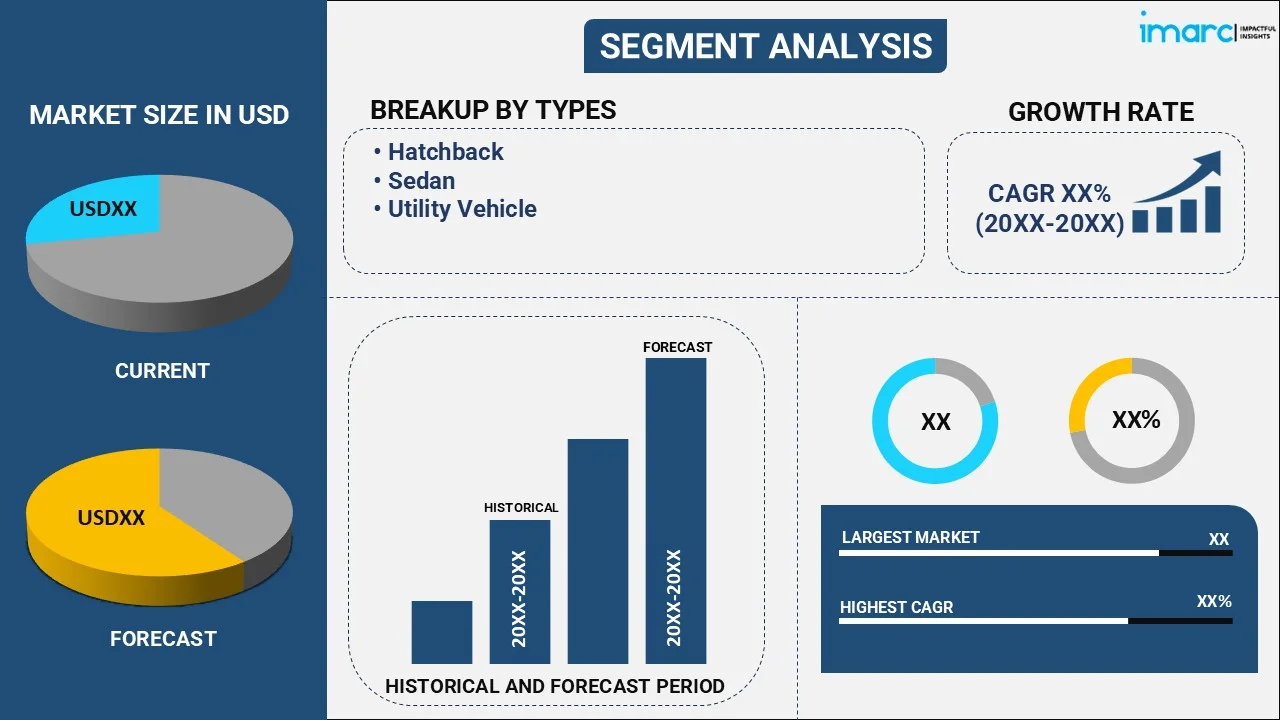

The global passenger cars market size reached USD 1.8 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Trillion by 2033, exhibiting a growth rate (CAGR) of 6.81% during 2025-2033. Rapid urbanization, rising disposable income levels, technological advancements, growing environmental awareness, an increasing demand for fuel-efficient and electric vehicles (EVs), the rise of ride-hailing services, and the increasing need for enhanced safety are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.8 Trillion |

| Market Forecast in 2033 | USD 3.4 Trillion |

| Market Growth Rate (2025-2033) | 6.81% |

Passenger Cars Market Analysis:

- Major Market Drivers: Rapid urbanization and increasing disposable income, allowing more people to afford cars represent major drivers of the market. Government initiatives promoting electric vehicles (EVs) and stricter emission regulations are encouraging the production of fuel-efficient and environmentally friendly cars. Technological advancements in safety, comfort, and connectivity are also boosting the product demand.

- Key Market Trends: The growing shift toward electric and hybrid vehicles, driven by environmental concerns and supportive government policies represents the key trend of the market. Autonomous driving technologies are gaining traction, with car manufacturers investing in artificial intelligence (AI) and sensors for self-driving capabilities. Connectivity features like in-car infotainment, smartphone integration, and over-the-air updates are becoming standard in modern vehicles.

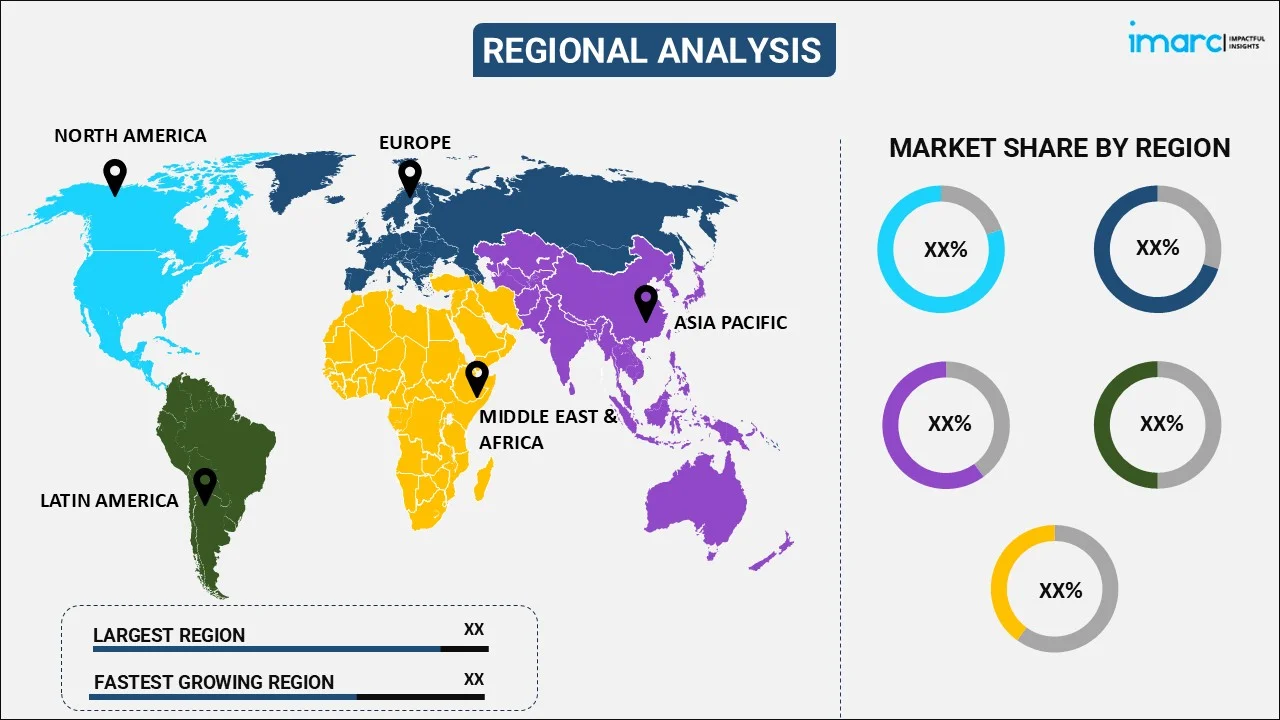

- Geographical Trends: According to the passenger cars market overview, Asia Pacific accounts for the largest region in the market across the globe. The market in the Asia Pacific region is majorly driven by increasing vehicle ownership, rapid urbanization, and rising middle-class population. Government incentives for electric vehicles (EVs), along with the growing demand for fuel-efficient cars, further boost the market growth.

- Competitive Landscape: Some of the major market players in the passenger cars industry include Bayerische Motoren Werke AG, Ford Motor Company, General Motors Company, Groupe Renault, Honda Motor Co. Ltd., Hyundai Motor Company, Mercedes-Benz Group AG, Tata Motors Limited, Tesla Inc., Toyota Motor Corporation and Volkswagen AG, among many others.

- Challenges and Opportunities: Some of the key passenger cars market recent opportunities include the growing demand for EVs, driven by government incentives and environmental awareness. In line with this, advancements in autonomous driving and connectivity technologies present significant growth potential. The expanding consumer base preferring car-sharing and ride-hailing offers new revenue streams while emerging markets provide untapped growth prospects for manufacturers. However, the market also faces various challenges such as high production costs, especially for electric vehicles (EVs), due to expensive battery technology and limited charging infrastructure. Stringent emission regulations and shifting consumer preferences toward sustainability also pressure manufacturers to innovate rapidly. Supply chain disruptions and fluctuating raw material prices further complicate production.

Passenger Cars Market Trends:

Technological Advancements and Electrification

In August 2024, Ki Mobility’s myTVS announced the launch of an artificial intelligence (AI)-led diagnostics platform that will cater to the aftermarket segment that can help customers monitor their car’s health and aid technicians at service centers with several functions including identifying where the scratches and dents are by merely taking a picture of the vehicle to quote how much it would cost a customer to get their car fixed. Similarly, in September 2024, Volkswagen of America, Inc. (VWGoA) announced the deployment of generative AI within the myVW mobile app through a strategic partnership with Google Cloud. Volkswagen is leveraging Google Cloud's industry-leading AI and machine learning capabilities, as well as expertise from Google Cloud Consulting to power Volkswagen's new myVW Virtual Assistant and provide vehicle owners with intuitive access to critical vehicle information and services. These technological innovations including the adoption of artificial intelligence (AI) for self-driving cars, along with the steadily rising demand for electric vehicles (EVs), hybrid cars, and autonomous driving technology are expected to generate a significant passenger cars market revenue over the coming years.

Government Regulations and Environmental Policies

Governments of various countries worldwide are implementing stricter emission regulations and offering incentives for electric and low-emission vehicles. For instance, in September 2024, the auto industry body Society of Indian Automobile Manufacturers (Siam) welcomed the government's decision to approve two schemes with a total outlay of Rs 14,335 crore to promote electric vehicles, with the aim to make clean and green transportation more accessible to all. The Union Cabinet approved two schemes -- PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme with an outlay of Rs 10,900 crore over two years, and the PM-eBus Sewa-Payment Security Mechanism (PSM) scheme with a budget of Rs 3,435 crore. According to the passenger cars market forecast, this push toward greener transportation solutions is significantly accelerating the transition to cleaner energy in the automotive sector.

Rising Consumer Demand for SUVs

The increasing disposable income, rapid urbanization, and a rising preference for personal mobility, especially in developing regions, are driving passenger car sales. Additionally, trends like SUV popularity and demand for fuel-efficient, high-tech vehicles are shaping market dynamics. According to International Energy Agency, SUVs accounted for 48% of global car sales in 2023, primarily due to the appeal of SUVs as a status symbol and their potential enhancements in comfort, along with the marketing strategies of leading automakers. Furthermore, while only 5% of SUVs currently on the road are electric, they account for a growing share of electric car sales. In 2023, more than 55% of new electric car registrations were SUVs. This rise in SUV sales is expected to create a positive passenger cars market outlook across the globe.

Passenger Cars Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, fuel type, engine capacity, and propulsion type.

Breakup by Type:

- Hatchback

- Sedan

- Utility Vehicle

Hatchback accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes hatchback, sedan, and utility vehicle. According to the report, hatchback represented the largest segment.

The growing preference for hatchbacks significantly facilitates the passenger cars demand, primarily due to affordability, compact design, and fuel efficiency associated with the usage of hatchbacks, which make them ideal for urban driving. Their versatility and practical design, which offers flexible cargo space through foldable rear seats, appeal to a broad range of consumers, especially in densely populated areas. In addition to this, hatchbacks provide lower maintenance costs and better maneuverability, making them popular in emerging markets where economic vehicles are in high demand for everyday use.

Breakup by Fuel Type:

- Gasoline

- Diesel

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes gasoline, diesel, and others.

Gasoline-powered cars hold the major share of the market due to their widespread availability, affordability, and familiarity among consumers. They offer lower upfront costs and a well-established refueling infrastructure which is further facilitating the passenger cars market growth. Additionally, gasoline engines provide smoother performance for city driving, making them popular among drivers in both developed and emerging markets, especially where electric vehicle adoption remains limited.

On the other side, diesel cars dominate segments like commercial and long-distance travel due to their superior fuel efficiency and torque, which enhances performance for heavy loads and longer trips. Despite stricter emission regulations, diesel engines remain popular for their durability and cost-effectiveness in certain regions. They are particularly preferred in countries with favorable diesel fuel pricing and tax incentives.

Breakup by Engine Capacity:

- < 1000 cc

- < 1000-1500 cc

- < 1500-2000 cc

- >2000 cc

The report has provided a detailed breakup and analysis of the market based on the engine capacity. This includes < 1000 cc, < 1000-1500 cc, < 1500-2000 cc, and >2000 cc.

Cars with engines under 1000 cc dominate a major market share due to their fuel efficiency, affordability, and compact size, ideal for city driving. These small engines appeal to budget-conscious consumers and are popular in regions with high urban density. They also benefit from lower taxes and insurance costs in many countries, making them accessible to a wide range of buyers.

The 1000-1500 cc segment holds a significant share due to its balance between power and fuel efficiency. These cars offer better performance for everyday driving while still being economical. They cater to middle-class buyers, especially in emerging markets, where moderate engine power and cost-effectiveness are essential. This engine size is common in sedans and compact SUVs, further boosting its demand.

Cars in the 1500-2000 cc range attract consumers seeking more power and performance for highway driving and longer distances. These vehicles, often sedans and SUVs, provide a balance between comfort, power, and efficiency. They are popular among families and professionals who prioritize space and versatility, appealing to buyers in both developed and developing markets.

Engines over 2000 cc dominate the luxury and performance car segments, offering superior power, speed, and performance. These vehicles, typically large SUVs, sports cars, and premium sedans, cater to affluent consumers who prioritize comfort, advanced features, and high-performance capabilities. Although they represent a smaller volume, they contribute significantly to revenue in markets where premium vehicles are in demand.

Breakup by Propulsion Type:

- IC Engine

- Electric Vehicle

IC engine exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes IC engine and electric vehicle. According to the passenger cars market report, IC engine accounted for the largest market share.

Internal combustion (IC) engines hold the largest share of the market primarily due to their long-standing presence and familiarity among consumers. They offer lower initial purchase prices compared to electric vehicles, making them more accessible. A robust refueling infrastructure supports IC engines, facilitating easy access to fuel. Technological advancements have improved their fuel efficiency and reduced emissions, addressing environmental concerns. Additionally, IC engines provide a wide range of vehicle options, from compact cars to SUVs, catering to diverse consumer preferences and driving needs.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest passenger cars market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for passenger cars.

The market in the Asia Pacific region is driven by rapid urbanization, which increases the demand for personal vehicles. Some of the key passenger cars market recent developments in the region include the rising disposable and favorable government initiatives. In line with this, the growing income levels of the expanding middle class population base enable more consumers to afford cars. Government initiatives promoting electric vehicles (EVs) and favorable financing options further stimulate market growth. The expanding infrastructure, including road networks and charging stations, enhances accessibility. Moreover, shifting consumer preferences towards fuel-efficient and environmentally friendly vehicles, coupled with a youthful population, contribute significantly to the region's automotive market expansion. For instance, in September 2024, Vidyut, a Bengaluru-based startup specializing in a full-stack electric vehicle (EV) ecosystem, partnered with JSW MG Motor India to launch an innovative financing model for passenger cars. This collaboration introduces a battery-as-a-service (BaaS) program for popular EV models such as the MG Comet EV, MG Windsor EV, and MG ZS EV, to make electric vehicles more accessible and affordable for consumers. Technological advancements in vehicle features attract buyers and support the growth of the market further across the region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the passenger cars industry include Bayerische Motoren Werke AG, Ford Motor Company, General Motors Company, Groupe Renault, Honda Motor Co. Ltd., Hyundai Motor Company, Mercedes-Benz Group AG, Tata Motors Limited, Tesla Inc., Toyota Motor Corporation and Volkswagen AG.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The competitive landscape of the market is characterized by several major players, including Toyota, Volkswagen, and Ford. These passenger cars companies offer diverse models to cater to varying consumer preferences and strong brand recognition. Emerging electric vehicle manufacturers like Tesla and local Asian companies are reshaping the market dynamics, focusing on sustainability and innovation. Intense competition drives technological advancements, particularly in electric and hybrid models. Additionally, alliances and partnerships between automakers and tech companies are increasingly common, fostering collaboration to enhance vehicle features and expand market reach. For instance, in April 2024, Auto parts maker ASK Automotive announced that it has entered a joint venture pact with Japanese auto components supplier AISIN Group Companies in the passenger vehicle space. As part of the collaboration, the two partners will market and sell the auto components in 'independent after markets for passenger car production.

Passenger Cars Market News:

- In September 2024, BorgWarner, a global product leader in delivering innovative and sustainable mobility solutions, solidified an agreement to deliver its turbochargers for use on the General Motors Corvette ZR1 sports car platform, marking the largest passenger car twin turbochargers in the market to be released to date. Paired with the automaker’s 5.5-liter flat-plane crankshaft V8 engine, this “unthinkable” Corvette is capable of 1,064 horsepower and 828 pound-feet of torque.

- In May 2024, Volkswagen Passenger Cars India announced a strategic partnership with the Government e-Marketplace (GeM), broadening the availability of its GNCAP 5-star safety-rated vehicles to government departments across India. The Government e-Marketplace is an innovative online platform established by the Government of India to streamline the procurement processes of goods and services by various government departments, PSUs, autonomous bodies, and local bodies.

Passenger Cars Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hatchback, Sedan, Utility Vehicle |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Engine Capacities Covered | < 1000 cc, < 1000-1500 cc, < 1500-2000 cc, >2000 cc |

| Propulsion Types Covered | IC Engine, Electric Vehicle |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bayerische Motoren Werke AG, Ford Motor Company, General Motors Company, Groupe Renault, Honda Motor Co. Ltd., Hyundai Motor Company, Mercedes-Benz Group AG, Tata Motors Limited, Tesla Inc., Toyota Motor Corporation, Volkswagen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global passenger cars market performed so far, and how will it perform in the coming years ?

- What are the drivers, restraints, and opportunities in the global passenger cars market ?

- What is the impact of each driver, restraint, and opportunity on the global passenger cars market ?

- What are the key regional markets ?

- Which countries represent the most attractive passenger cars market ?

- What is the breakup of the market based on the type ?

- Which is the most attractive type in the passenger cars market ?

- What is the breakup of the market based on the fuel type ?

- Which is the most attractive fuel type in the passenger cars market ?

- What is the breakup of the market based on the engine capacity ?

- Which is the most attractive engine capacity in the passenger cars market ?

- What is the breakup of the market based on the propulsion type ?

- Which is the most attractive propulsion type in the passenger cars market ?

- What is the competitive structure of the market ?

- Who are the key players/companies in the global passenger cars market ?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the passenger cars market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global passenger cars market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the passenger cars industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)