Parboiled and White Rice Market Size, Share, Trends and Forecast by End Use, and Country, 2025-2033

Parboiled and White Rice Market Size and Share:

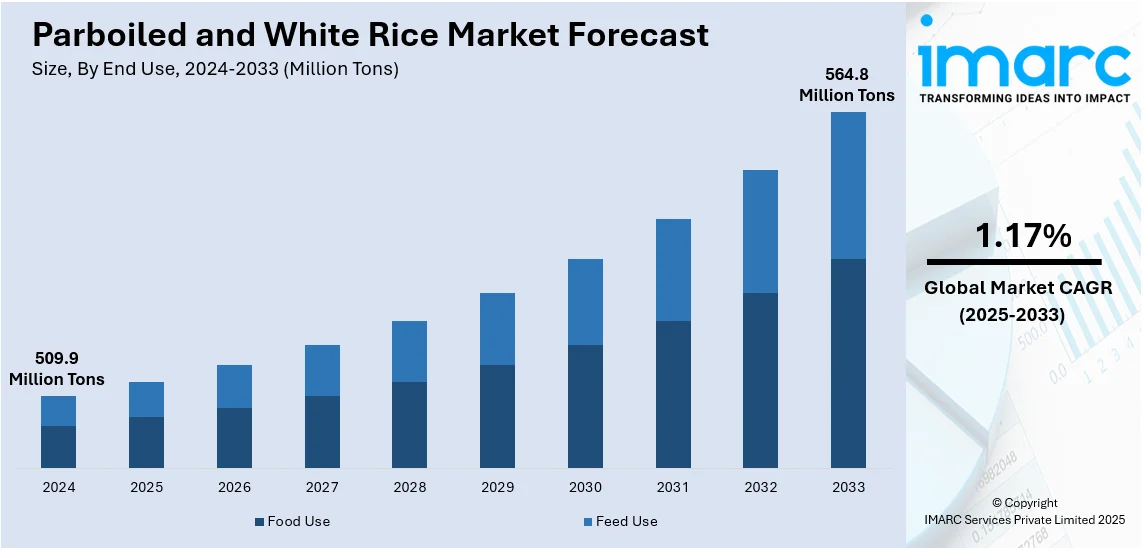

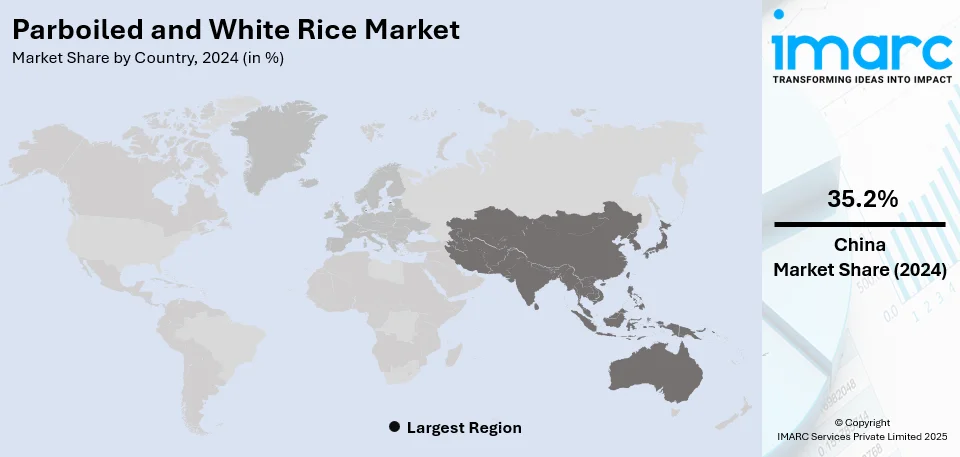

The global parboiled and white rice market size was valued at 509.9 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 564.8 Million Tons by 2033, exhibiting a CAGR of 1.17% from 2025-2033. China currently dominates the market, holding a market share of over 35.2% in 2024. The parboiled and white rice market share is rising due to rising global demand for staple foods, increasing urbanization, and growing consumer preference for convenient and nutrient-rich rice varieties. Expanding trade, improved processing technologies, and higher consumption in Asia, Africa, and the Middle East further contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

509.9 Million Tons |

|

Market Forecast in 2033

|

564.8 Million Tons |

| Market Growth Rate (2025-2033) | 1.17% |

The global parboiled and white rice market demand is driven by factors similar as adding population, rising consumer demand for staple foods, and growing mindfulness of rice’s nutritive benefits. Urbanization and changing salutary habits have fueled demand for accessible and protean food options, making white and parboiled rice essential in homes, eateries, and food processing industries. Health benefits associated with parboiled rice, similar as bettered nutrient retention and lower glycemic index, have boosted its favor among health-conscious consumers. Also, technological advancements in rice processing have enhanced milling effectiveness, perfecting rice quality and shelf life. Government initiatives and trade programs in major rice- producing countries, similar as India, Thailand, and the U.S., support large- scale rice production and exports, further driving market expansion. The growing demand for rice- based processed foods, expanding retail distribution channels, and adding consumer preference for packaged rice products also contribute to the steady growth of the global demand.

The U.S. has emerged as a key regional market for parboiled and white rice driven by factors similar as rising consumer demand for accessible and nutritional food options, adding ethnical diversity, and expanding foodservice operations. Parboiled rice, known for its enhanced nutritive value and bettered cooking properties, appeals to health-conscious consumers and those seeking quick meal solutions. White rice remains a staple in American homes and is extensively used in eateries, especially within Asian, Hispanic, and Middle Eastern cuisines. The growing popularity of global cuisines and the rising number of immigrants have significantly increased rice consumption. Also, expanding retail distribution channels, including e-commerce and private- label brands, have made rice more accessible to consumers. The food industry’s demand for rice in processed foods, ready-to eat meals, and frozen dishes farther powers market growth. With adding mindfulness of rice’s health benefits and the expansion of organic and specialty rice kinds, the U.S. rice market continues to witness steady parboiled and white rice market growth.

Parboiled and White Rice Market Trends:

Growing consumer preference for nutrient-rich rice

Consumers are shifting towards parboiled rice since it contains enhanced nutritional content than white rice. The process of parboiling helps preserve some nutrients such as B vitamins, iron, and magnesium. Such rice is widely consumed among the health-conscious customers. According to IMARC Group, the global parboiled and white rice market reached 509.9 million tons in 2024 and is projected to reach 564.8 million tons by 2033, exhibiting a CAGR of 1.17% during 2025-2033. This growth is driven by increasing health awareness and a rising preference for nutrient-rich alternatives. It has become one of the highest market shares in the developed markets like North America and Europe where customers are very concerned about having healthy carbohydrate. In fact, there are nutrition-rich parboiled rice to combat malnutrition and boost its demand. Urbanization and increased concerns about well-balanced diets due to new awareness among the more economically competitive emerging economies drive the purchasing decision. Food manufacturers are responding through the introduction of parboiled rice in packaged meals, ready-to-eat foods, and fortified rice products. As consumers get to know more about the benefits of parboiled rice, it is going to gain significantly more market share in different regions, challenging the supremacy of white rice.

Expanding global trade and supply chain optimization

The global parboiled and white rice market is witnessing a change with improved supply chain management and strategic trade policies. Over 70% of the world's rice exports come from Thailand, Vietnam, and India, making them the top three exporting countries, according to industry reports. 21.5 million metric tons of rice were shipped by India in 2022, accounting for 36.8% of all rice exports by value. With 13.5% and 8.6% of the world's rice exports by value in the same year, respectively, Thailand and Vietnam are also major exporters. Trade agreements between these countries and the main importers like Middle East, Africa, and Europe are streamlining export processes, ensuring consistent supply, and reducing price volatility. There is also an investment in modern rice mills and automation, improving the efficiency of processing, waste reduction, and enhancing the overall quality of rice exports. Sustainable and traceable supply chains are gaining traction as buyers require certifications to ensure food safety and ethical sourcing. Furthermore, government policies to support rice exports through subsidies and incentives have strengthened the trade landscape. Together, these lead to an even more resilient and competitive rice marketplace, which should ensure stable supplies regardless of such potential disruptions in production due to climate change or geopolitical events.

Increased demand for premium and specialty rice varieties

Consumers are moving towards better varieties of rice such as aged white rice, long-grain parboiled rice, and specialty aromatic rice. Premium rice demand is on the rise with increasing urbanization, disposable incomes, and changes in culinary habits across emerging markets. The United States exported USD 1,393.81 million worth of semi-milled or fully milled rice in 2023, according to World Integrated Trade Solutions (WITS), underscoring the rising demand for premium rice products abroad. In regions such as the Middle East, there is high demand for premium basmati and jasmine rice for their rich aroma and texture. The demand for organic and fortified rice, in fact, is on the increase in western markets. This is also led by the hospitality and food service industries, which are opting for specialty rice for better presentation and flavor of meals. Online sales and direct-to-consumer channels also have various premium varieties of rice available to consumers around the world. As a consequence, rice producers and exporters target a differentiation strategy with branding and sustainable farming as a trend towards fulfilling increasing demand for high-quality rice products.

Parboiled and White Rice Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global parboiled and white rice market report, along with forecasts at the global and regional level from 2025-2033. Our report has categorized the market based on end use.

Analysis by End Use:

- Food Use

- Feed Use

Food use leads the market with 84.6% of market share in 2024 due to its wide consumption across homes, eateries, and foodservice industries. Rice is a chief component in numerous global cuisines, including Asian, Hispanic, and Middle Eastern dishes, driving harmonious demand. Parboiled rice is preferred for its enhanced nutritive profile, firmer texture, and quick- cooking properties, making it ideal for home cuisine and marketable food preparation. White rice, known for its versatility and mild flavor, is extensively used in packaged foods, frozen meals, and ready- to- eat dishes. Also, the growing popularity of accessible and healthy meal options has further increased rice consumption.

Country Analysis:

- China

- India

- Indonesia

- Bangladesh

- Vietnam

- Others

In 2024, China accounted for the largest market share of over 35.2% due to its massive production capacity, high domestic consumption, and strong export capabilities. As the world’s largest rice patron, China benefits from vast agrarian land, farming techniques, and government assist for rice cultivation. The country’s high population drives harmonious domestic demand, with rice being a staple food in Chinese homes and traditional cuisine. also, China has invested in ultramodern rice processing technologies, assuring high- quality parboiled and white rice product. Strong global trade relations and competitive pricing enable China to export large amounts of rice to crucial markets, backing its leadership position.

Key Regional Takeaways:

China Parboiled and White Rice Market Analysis

China parboiled and white rice market experienced growth by a tremendous amount, thanks to its large population and a status of being the largest producer of rice in the world. According to China's National Bureau of Statistics, the country produced approximately 145 million metric tons of rice in 2023, which was more than enough to satisfy both domestic consumption and export quantities. The demand for healthier products is now shifting towards parboiled rice due to nutrition content. This rice variety has more vitamins and minerals than ordinary white rice. It is the reason for higher demand. On the other hand, the more modern and efficient methods of processing rice are supporting the consistent supply and quality improvement of both white and parboiled rice. The growing middle class in China, coupled with a higher standard of living and changing dietary preferences, is expected to further drive the demand for parboiled rice in both urban and rural markets. With export potential also growing, China's rice market remains robust and competitive.

India Parboiled and White Rice Market Analysis

India is one of the world's largest producers and consumers of rice, holding a vast agricultural base. Given the growing popularity of parboiled rice, the Indian Ministry of Agriculture anticipated that the country produced 137.82 million metric tons of rice in 2023, of which a significant portion was parboiled rice. Parboiled rice enjoys preferred consumption particularly in southern as well as eastern India for better texture, durability, and nutritional benefits. With the emergence of changing consumer preferences towards more healthy food varieties, such as nutrient-rich varieties of rice, parboiling is becoming the choice of time. Moreover, the strong exports of rice to other countries by India, majorly parboiled rice, is further enlarging the market. The initiative taken by the government through some of its plans like food security and export of rice is assisting in the enlargement of the rice industry. Modern processing technologies in local rice mills have been adopted because of efficiency, improved product quality, and support for the surging demand of both domestic and export markets.

Indonesia Parboiled and White Rice Market Analysis

Indonesia's rice market continues to be an essential part of its food security and agricultural economy. Rice production in Indonesia increased up to 54 million metric tons in 2023, says the Ministry of Agriculture. As such, parboiled rice is slowly and steadily gaining preference due to better cooking properties, nutritional profile, and longer shelf life. This variety of rice is especially attractive for a health-conscious consumer and this growing demand for better rice quality in the market. Rising middle-class household incomes and their resultant household disposable incomes are driving steady demand for parboiled rice. In addition, government investment in the modernization of rice cultivation and milling infrastructure are likely to improve further the country's rice output. Indonesia also experiences a rising trend in rice export volume, especially for parboiled rice into markets in Africa and the Middle East. The modernization of rice farming and processing technology will continue to facilitate the growth of both domestic and export markets.

Bangladesh Parboiled and White Rice Market Analysis

Bangladesh has always preserved the culture of rice growth, and the rice market is an important part in the context of Bangladesh's food security. In 2023, Bangladesh produced approximately 39.1 million metric tons of rice, according to an industrial report. Due to its long shelf life and nutritional benefits, parboiling rice is becoming more and more popular in both domestic and foreign markets. It is investing modern milling technology in its country's rice mills, many of which are focused in rural areas, in order to produce better-quality rice, increasing Bangladesh's capacity to manage internal consumption and expand its export reach. Increasing incomes, changes in dietary patterns, and growing urbanization raise internal consumption levels of rice, including parboiled varieties. Initiatives launched by the government of Bangladesh also include supporting agro-innovations and other infrastructure improvement actions, which could further boost its productivity and overall quality of production. Another related factor to account for in growing the market's size is that Bangladesh's parboiled rice exports to several markets in Africa and the Middle East have kept growing.

Vietnam Parboiled and White Rice Market Analysis

Vietnam is a major player in the global rice market, with a strong production base that supports both domestic consumption and export markets. In 2023, rice production in Vietnam reached approximately 43.5 million metric tons, according to an industrial report. Parboiled rice is gaining popularity both in the domestic and international markets because of its superior cooking characteristics, higher nutritional value, and longer shelf life. The government has put in enough resources into rice farm and processing equipment modernization that have lifted the quality of and competitiveness for Vietnamese rice products, especially for parboiled. The volume of Vietnam rice exported has still seen a hike while its destinations spread to include more countries within Africa, Middle East, as well as many in Asia, largely because parboiled Vietnam rice has more customers seeking the better option regarding nutrition. As rice processing continues to advance and the market grows, this is likely to help Vietnam remain competitive in the global rice industry.

Competitive Landscape:

Key players are adopting modern milling, parboiling, and packaging technologies to improve rice quality, shelf life, and production efficiency. Innovations such as fortified rice and low-GI variants cater to health-conscious consumers. Companies are strengthening their supply chains and forming strategic partnerships to increase exports. By entering new markets and expanding retail distribution, they ensure broader consumer reach. Moreover, with rising demand for organic and premium rice, brands are launching non-GMO, organic, and specialty rice options. Sustainable farming practices and environmental-friendly packaging also appeal to environmentally aware shoppers. These efforts are creating a favorable parboiled and white rice market outlook.

The report provides a comprehensive analysis of the competitive landscape in the parboiled and white rice market with detailed profiles of all major companies:

Latest News and Developments:

- September 2024: India has revoked the export tax on parboiled rice, effective October 22, 2024, aiming to boost rice exports. With surging inventories and a bumper crop due to favorable monsoon rains, the move is expected to increase global supplies and help soften international rice prices.

Parboiled and White Rice Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Food Use, Feed Use |

| Countries Covered | China, India, Indonesia, Bangladesh, Vietnam, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the parboiled and white rice market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global parboiled and white rice market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the parboiled and white rice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The parboiled and white rice market was valued at 509.9 Million Tons in 2024.

The parboiled and white rice market is estimated to exhibit a CAGR of 1.17% during 2025-2033.

The parboiled and white rice market share is rising due to rising global demand for staple foods, increasing urbanization, and growing consumer preference for convenient and nutrient-rich rice varieties. Expanding trade, improved processing technologies, and higher consumption in Asia, Africa, and the Middle East further contribute to market growth.

China currently dominates the market due to its massive production capacity, high domestic consumption, and strong export capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)