Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End Use Industry, and Region, 2025-2033

Paper Packaging Market Overview:

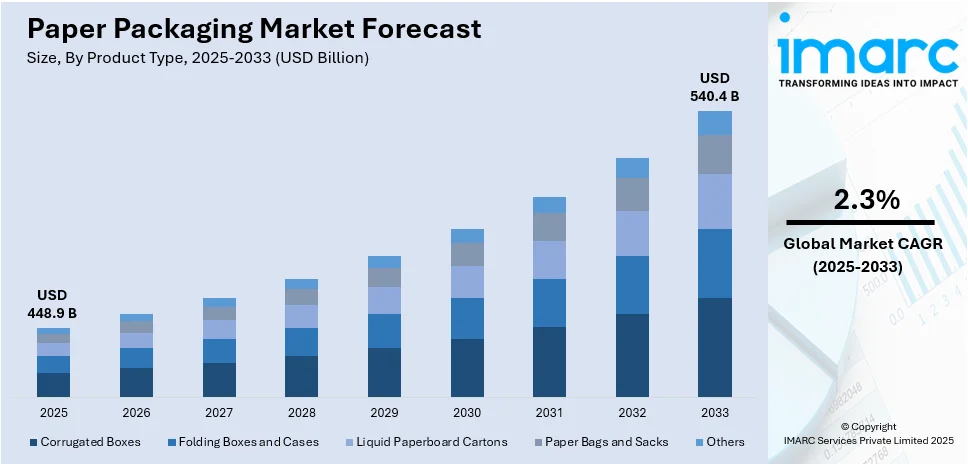

The global paper packaging market size is anticipated to reach USD 448.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 540.4 Billion by 2033, exhibiting a CAGR of 2.3% from 2025-2033. The market is driven by growing environmental awareness and the global shift toward sustainable and biodegradable packaging solutions.

Market Size & Forecasts:

- The paper packaging industry size is anticipated to reach USD 448.9 Billion in 2025.

- The market is projected to reach USD 540.4 Billion by 2033, with a CAGR of 2.3% from 2025-2033.

Dominant Segments:

- Product Type: Folding boxes and cases stand as the largest component in 2024, holding around 45.2% of the market due to the widespread use in packaging across industries like food, electronics, and consumer goods drives this demand. Their cost-effectiveness, versatility, and sustainability further boost their preference among manufacturers and retailers worldwide.

- Grade: Uncoated recycled leads the market with around 38.8% of market share in 2024. The main usage of uncoated recycled board (URB) is based on its environmental benefits and flexibility.

- Packaging Level: Primary packaging leads the market with around 48.3% of market share in 2024. Primary packaging directly encompasses the packaging that comes in immediate contact with the product.

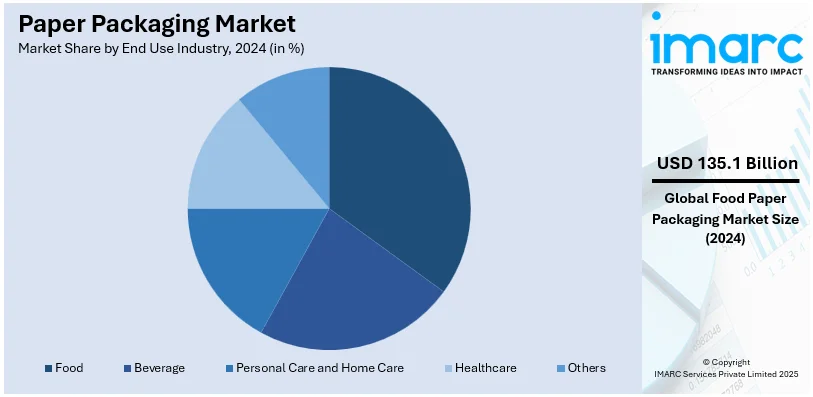

- End Use Industry: Food leads the market with around 30.8% of market share in 2024. The food industry has been influenced by a wider range of packaging needs, from fresh fruits and bakery items to frozen foods and dried goods.

- Region: Asia-Pacific accounted for the largest market share of over 39.3%. The e-commerce boom has sparked a transformation in packaging preferences, emphasizing paper-based solutions for shipping and product protection.

Key Players:

- Major players in the paper packaging market include Amcor plc, DS Smith Plc, Georgia-Pacific LLC, Holmen Group, Hood Packaging Corporation, Huhtamäki Oyj, International Paper Group, Mondi Group Plc, Napco National, Nippon Paper Industries, Sappi Ltd, Smurfit Kappa Group, Sonoco Products Company, Stora Enso Oyj, WestRock Company, etc.

Key Drivers of Market Growth:

- Sustainability Focus: Growing environmental concerns and demand for eco-friendly materials encourage industries to adopt paper packaging as a sustainable alternative to plastic, supporting circular economy and responsible consumption.

- E-commerce Expansion: Rising online shopping increases the need for durable, lightweight, and protective paper packaging solutions that ensure product safety, enhance customer experience, and allow customization and branding possibilities.

- Regulatory Support: Government regulations and bans on single-use plastics are pushing industries to switch to paper-based alternatives, driving widespread adoption across food, retail, and consumer goods sectors globally.

- Technological Advancements: Innovations in printing, coatings, and smart packaging technologies improve paper packaging performance, allowing better aesthetics, information sharing, product tracking, and overall customer engagement opportunities.

- Food & Pharmaceutical Demand: Rising consumption of packaged food, beverages, and pharmaceuticals boosts demand for safe, hygienic, and efficient paper-based packaging tailored to preserve product quality and shelf life.

Future Outlook:

- Strong Growth Outlook: The market will continue expanding as industries increasingly prioritize sustainable, biodegradable, and recyclable packaging solutions to meet consumer preferences and corporate social responsibility goals.

- Market Evolution: Technological integration, smart packaging, and innovative designs will reshape the market, offering enhanced functionality, branding potential, and eco-friendly solutions to satisfy evolving customer and industry demands.

To get more information on this market, Request Sample

The paper packaging market demand is increasing due to factors such as the growing consumer concern over the environment and the gradual rise in bans on plastic usage. This is further complemented by the enhancement of customer awareness of biodegradable and recyclable materials that facilitate its use. The increasing services in e-commerce and food delivery have fueled the demand for packaging products like boxes, cartons, paper bags, etc. as they are durable and lightweight. Due to sustainability and emerging customer awareness relating to the environment, paper-based packaging, primarily in the areas of food and beverages, healthcare, and personal care, is gaining immense traction. For instance, in May 2024, Mondi launched "TrayWrap," a new form of secondary paper packaging. In addition to this, the new environment-friendly packaging solution created with Mondi's Advantage StretchWrap line to shrink-wrap multiple packages together is gaining immense preference in the food service sector for packaging purposes, which, in turn, is contributing to the paper packaging market size.

The paper packaging market growth in the United States is driven by higher consumer demand for eco-friendly and sustainable packaging due to rising consciousness toward environmental concerns and legal ban on single-use plastics across the region. Prominent factors include ease of recycling and lightweight nature, the growing e-commerce and food delivery services have propelled paper-based packaging including corrugated boxes, paper bags & cartons. The widespread usage of pulp and paper-based food and beverage packaging, particularly in the healthcare and personal care industries, represents one of the key paper packaging market trends, as industries continue to embrace sustainable packaging to meet consumers' expectations. Technological advancements in packaging innovation and printing enhance functionality and branding, further fueling demand. For example, in September 2024, Nestlé launched paperboard canisters for its Vital Proteins brand in the US. Compared with traditional packaging, this design and material improvement reduces the use of plastic by 90%. The research and development team at Nestlé Health Science's R&D center in Bridgewater, New Jersey, collaborated with external partners to innovate the new canister, which incorporates a stiff, tight patented coverlid.

Paper Packaging Market Trends:

Changing sustainability Initiatives

Governments and corporations worldwide are increasingly adopting policies and practices that ensure environmental responsibility, which is influencing the paper packaging market trends. This is largely due to increased consumer awareness and demand for environmentally friendly packaging solutions, thus reducing the use of plastic and other non-biodegradable materials by a considerable amount. For example, 82% of the respondents are ready to pay extra for the environment-friendly options, as was reported in one survey. Packaging, being recyclable, biodegradable, and often manufactured from renewable resources, stands as a prime beneficiary of this shift. However, the market growth of paper packaging faces limitations because manufacturers select polymer packaging products over paper as it cannot adequately handle heavy products. The material tears easily when subjected to rigorous handling under challenging environments that diminish its strength and durability relative to alternative materials like metal and plastic. The industry will innovate with discoveries in stronger yet more durable packing solutions that can compete as functional alternatives, without sacrificing its environmental values against traditional packaging products. This pattern of sustainability benefits the preservation of natural resources and provides markets for packaging commodities, which enhances the paper packaging market outlook.

Expanding e-commerce sector

Online shopping has become a new cornerstone of the international retail market requiring powerful, agile, and economically efficient packaging products. International Trade Administration states that B2C e-commerce global revenue will surge to USD 5.5 Trillion in 2027 with a firm 14.4% CAGR. In this context, paper-based packaging is an especially attractive option; it is light for shipping, often saving on heavy shipping costs while being easily modified to accommodate differing product sizes or shapes. Packaging, besides giving opportunities for full customization and branding, has now also become an integral part of customer satisfaction and brand perception in the era of digital shopping. Poor structural integrity marks many forms of paper packaging because it fails to deliver the same protective support system found in alternatives. The strength of paper packaging prevents it from adequately protecting heavy bulky items which need strong protective measures. The need to innovate within this area propels the packaging industry forward, motivated by designing new concepts that not only beautify but also make their respective packages strong enough to protect the contents, serving the varied needs of both e-commerce enterprises and consumers.

Increasing regulatory pressure

As regulations have come to reduce single-use plastics, require recycling, and promote the use of materials that carry lower carbon footprints, businesses have had to look for sustainable packaging options. The market faces growth challenges because of strict environmental regulations that target paper production forest extraction methods and the release of harmful chemicals in papermaking. Packaging has been the preferable option because it offers the benefits of recyclability and the use of renewable resources and stands out as a leader among companies trying to comply with the regulations while preserving the integrity and appeal of the packaging. This regulatory environment not only motivates the adaptation of packaging but also stimulates investments in research and development to increase the quality, durability, and sustainability of a packaging solution.

Paper Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global paper packaging market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, grade, packaging level, and end use industry.

Analysis by Product Type:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

Folding boxes and cases stand as the largest component in 2024, holding around 45.2% of the market. Folding boxes and cases are versatile and lightweight, along with being quite easy to use, and are used widely across many sectors such as food and beverages, pharmaceuticals, cosmetics, and small consumer goods for exceptional printability and aesthetic appeal. Folding boxes and cases are especially ideal for retail packaging applications, where appearance and brand distinctiveness are of prime importance. Apart from these, their ability to be manufactured in many different shapes and sizes, along with the option of high-quality graphic designs, has made them an attractive choice for companies looking to improve the aesthetic appeal of product packaging while meeting sustainability and convenience requirements for the consumer.

Analysis by Grade:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

Uncoated recycled leads the market with around 38.8% of market share in 2024. The main usage of uncoated recycled board (URB) is based on its environmental benefits and flexibility. URB is completely made of recycled material, so it reduces demand for virgin fibers and minimizes the environmental footprint of the product. This grade is used in applications where the visibility of the packaging is not a key requirement but must be structural rather than aesthetic; examples include shipping containers, industrial packaging, and base material for laminating. Its cost-effectiveness and high recyclability make URB a sustainable option for businesses wishing to improve environmental stewardship without sacrificing packaging performance.

Analysis by Packaging Level:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

Primary packaging leads the market with around 48.3% of market share in 2024. Primary packaging directly encompasses the packaging that comes in immediate contact with the product. This level of packaging is critical for protecting and preserving the product, ensuring its safety and integrity until it reaches the consumer. Primary packaging is designed for protection, aesthetic appeal, and brand communication, serving as a key marketing tool at the point of sale. It includes various packaging types, such as bottles, cans, wrappers, and boxes for various industries, including food and beverage, pharmaceuticals, cosmetics, and consumer electronics.

Analysis by End Use Industry:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

Food leads the market with around 30.8% of market share in 2024. The food industry has been influenced by a wider range of packaging needs, from fresh fruits and bakery items to frozen foods and dried goods. Packaging solutions that ensure food safety and optimum shelf life while complying with strict regulatory standards are crucial. All forms of packaging, from corrugated boxes to folding cartons, including paper-based flexible packaging, will be tailored to the specific requirement. Innovations in barrier technologies and sustainable packaging solutions will further solidify demand for packaging in the industry, in consonance with evolving paper packaging market trends.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 39.3%. The e-commerce boom has sparked a transformation in packaging preferences, emphasizing paper-based solutions for shipping and product protection. According to the India Brand Equity Foundation, India's e-commerce market has added 125 Million online shoppers in the past three years, with an additional 80 Million expected to join by 2025, reflecting rapid growth in the sector. With online sales surging across fashion, electronics, and personal care industries, businesses are increasingly opting for corrugated boxes and protective paper wraps to replace plastic alternatives. These packaging options cater to the dual needs of sustainability and product integrity during transit. Lightweight and customizable, paper packaging ensures efficient shipping while aligning with consumer demand for environmentally friendly practices. Additionally, packaging innovations like reinforced paperboard for bulk orders and compostable filler materials further address industry-specific needs. The rise of subscription-based services in industries like cosmetics and health supplements has also contributed to the adoption of paper packaging for aesthetically pleasing and sustainable unboxing experiences. Such eco-driven initiatives are reshaping packaging strategies, meeting the growing expectations of e-commerce-savvy consumers.

Paper Packaging Regional Takeaways:

North America Paper Packaging Market Analysis

Several factors are driving the growth of the paper packaging market in North America. Increased environmental awareness among consumers and businesses has led to a shift from plastic to paper-based packaging due to its sustainability and recyclability. Stringent regulations against plastic use, such as bans on single-use plastics, have further fueled demand for eco-friendly packaging solutions. Additionally, the rise of e-commerce and home delivery services has created a greater need for protective and lightweight packaging materials, with paper being a popular choice. Consumer preference for convenience and environmentally conscious products also supports the market's growth. Moreover, innovations in paper packaging, such as enhanced strength and barrier properties, are increasing its application in diverse industries, including food, beverages, and personal care.

United States Paper Packaging Market Analysis

In 2024, the United States accounted for the largest market share of over 88.0% in North America. The rising emphasis on sustainable solutions has driven a surge in the demand for paper packaging. Increasing awareness about environmental impact is propelling the transition to alternatives such as paper bags in retail, personal care, and hospitality industries. According to McKinsey, eco-friendly packaging is gaining traction, with nearly 50% of US consumers willing to pay 1-3% more for sustainable options. This trend spans various end-use areas, highlighting a growing demand for greener packaging solutions. These eco-conscious materials are gaining traction in various sectors that aim to align with consumer expectations for sustainability. Retailers and brands are adopting paper packaging for its biodegradability and lower carbon footprint, resonating with green consumerism trends. These changes are reflected in the growing preference for paper-based solutions in fashion outlets, grocery stores, and event promotions. With shifting policies favoring recyclable materials, industries are also exploring innovations like reusable and water-resistant paper packaging, which are tailored for heavy-duty applications. Such developments enhance market adoption while mitigating concerns related to plastic waste, ensuring paper packaging's dominance in the packaging landscape.

Europe Paper Packaging Market Analysis

The expansion of the food and beverages sector has catalysed the adoption of paper-based solutions tailored to industry requirements. According to reports, the food & drink wholesaling industry in Europe, comprising approximately 445k businesses, is witnessing robust growth, driven by increasing demand for food and beverage products across the region. Packaging innovations include grease-resistant paper wraps for fast food, moisture-proof paperboard for frozen items, and aesthetic paper sleeves for gourmet products. With an increasing focus on sustainability, cafes and restaurants are replacing traditional packaging with paper-based alternatives for takeaways and deliveries. The trend aligns with consumer preference for eco-conscious dining experiences, driving demand for items like compostable straws, paper cups, and biodegradable cutlery sleeves. Advances in functional paper coatings ensure compatibility with a wide range of food types, supporting versatility. Regulations discouraging single-use plastics have further encouraged industry players to invest in paper packaging innovations that meet safety and hygiene standards, while enhancing branding opportunities. These factors collectively underline the pivotal role of paper packaging in redefining practices within the food and beverages sector.

Asia Pacific Paper Packaging Market Analysis

The Asia Pacific paper packaging market exhibits swift growth because consumers prefer eco-friendly solutions for packaging their food products and other consumer goods through retail channels. The market growth becomes stronger due to environmental consciousness among consumers who choose sustainable packaging solutions. Alongside their expanding populations and increasing urbanization China leads the market with India and Japan as major contributors because of their strong manufacturing businesses. The regional progress benefits from specific government programs that target sustainability while decreasing plastic waste amounts. Paper packaging solutions experience continued advancement because of improvements in materials and design engineering of paperboard components. Online shopping growth drives additional demand for paper packaging because e-commerce companies search for sustainable shipping solutions.

Latin America Paper Packaging Market Analysis

Increasing disposable incomes have led to heightened consumer spending, boosting demand for products presented in sustainable paper-based packaging. For instance, total disposable income in Latin America is projected to increase by nearly 60% in real terms from 2021 to 2040, driven by narrowing regional disparities, technological advancements, and a shift towards higher value-added sectors. This trend is particularly evident in the growing use of attractive and functional packaging for premium and everyday consumer goods. From luxury personal care products to locally crafted artisanal goods, the emphasis on visually appealing, eco-friendly paper packaging reflects shifting preferences toward environmentally responsible consumption. Paper packaging offers versatility in designs, enabling brands to create unique and high-impact packaging solutions that appeal to diverse demographics. The preference for such sustainable options not only enhances consumer engagement but also reinforces environmentally conscious values, making it a preferred choice across various consumer-focused industries.

Middle East and Africa Paper Packaging Market Analysis

The increasing scale of healthcare operations has driven demand for specialized paper packaging solutions designed to meet stringent industry requirements. According to Dubai Healthcare City Authority report, by 2022, Dubai saw a significant rise in healthcare infrastructure, with 4,482 private medical facilities, including 56 hospitals, reflecting a growing demand for medical services that require packaging. Applications include sterile wraps for medical devices, protective paper layers for pharmaceutical shipping, and eco-friendly blister packs for over-the-counter medications. Paper packaging offers a sustainable alternative to traditional materials, aligning with the healthcare sector's emphasis on minimizing environmental impact while maintaining safety standards. Advances in moisture-resistant and tamper-proof paper coatings have expanded its suitability for various medical applications. The shift to recyclable and biodegradable materials highlights the sector's efforts to integrate sustainability without compromising functionality or regulatory compliance, marking a significant evolution in packaging practices.

Leading Paper Packaging Companies:

The paper packaging market is highly competitive, with key players focusing on sustainability, innovation, and product diversification. Major companies like International Paper Group, WestRock Company, and Smurfit Kappa Group the market, leveraging extensive manufacturing capabilities and advanced technologies. Smaller firms compete by offering specialized, eco-friendly packaging solutions tailored to niche markets. Increasing demand for recyclable and biodegradable materials has intensified competition, prompting investments in research and development. E-commerce growth has further driven demand for corrugated packaging, pushing companies to expand production capacities. Strategic mergers, acquisitions, and collaborations are common as players aim to strengthen market presence and address evolving consumer and regulatory demands for sustainable packaging solutions.

The report provides a comprehensive analysis of the competitive landscape in the global paper packaging market with detailed profiles of all major companies, including:

- Amcor plc

- DS Smith Plc

- Georgia-Pacific LLC

- Holmen Group

- Hood Packaging Corporation

- Huhtamäki Oyj

- International Paper Group

- Mondi Group Plc

- Napco National

- Nippon Paper Industries

- Sappi Ltd

- Smurfit Kappa Group

- Sonoco Products Company

- Stora Enso Oyj

- WestRock Company

Latest News and Developments:

- November 2024: MasterFoods™ has introduced Australia's first paper-recyclable single-serve Squeeze-On Tomato Sauce packs, reducing plastic use by 58%. This innovative packaging aligns with the brand’s sustainability goals. The packs can be recycled through curbside programs, making them eco-friendly. MasterFoods™ continues to lead sustainable packaging solutions in the food industry. The trial represents a significant step in reducing environmental impact.

- October 2024: UPM Specialty Papers and Eastman have unveiled an innovative paper packaging solution for food applications, featuring a biobased, compostable coating. Utilizing Eastman’s Solus™ performance additives and BioPBS™ polymer, the coating ensures grease and oxygen barriers while remaining ultra-thin for compatibility with fiber recycling streams. This eco-friendly design allows brands to embrace recyclable and sustainable packaging solutions.

- September 2024: Mondi has introduced a fully paper-based mailer, developed in collaboration with Amazon, to enhance eCommerce packaging sustainability. Made from renewable resources and recyclable in the paper waste stream, the mailer eliminates plastic bubble inlays. Its innovative design prevents goods from shifting, ensuring safe delivery. This introduction demonstrates Mondi's dedication to eco-friendly packaging options. The Protective Mailers add to Mondi's extensive portfolio for a greener eCommerce industry.

- June 2024: Mondelez and Saica Group introduced recyclable paper-based multipack packaging for the chocolate, biscuit, and confectionery industries. The packs support heat-sealing and offer coated or uncoated finishes. Designed for Vertical Form Fill Seal (VFFS) processes, the solution ensures high print quality, efficient machine compatibility, and strong sealing performance. This innovation enhances functionality while maintaining product integrity. The eco-friendly approach targets sustainability in the packaging industry.

- April 2024: Parkside has introduced Recoflex, a recyclable paper-based flexible packaging line emphasizing durability, barrier performance, and heat sealability. Available in single-ply or laminate forms, it caters to diverse market needs. A phased rollout starting in April will expand the range, building on the success of Parkside’s freezer-proof paper material. This innovation aims to transform paper-based flexible packaging solutions.

Paper Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor plc, DS Smith Plc, Georgia-Pacific LLC, Holmen Group, Hood Packaging Corporation, Huhtamäki Oyj, International Paper Group, Mondi Group Plc, Napco National, Nippon Paper Industries, Sappi Ltd, Smurfit Kappa Group, Sonoco Products Company, Stora Enso Oyj, WestRock Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the paper packaging market from 2019-2033.

- The paper packaging market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global paper packaging market size is anticipated to reach USD 448.9 Billion in 2025.

IMARC estimates the paper packaging industry is forecasted to reach USD 540.4 Billion by 2033, growing at a compound annual growth rate (CAGR) of 2.3% from 2025-2033.

The key factors driving the global paper packaging market include rising demand for sustainable and eco-friendly packaging, growing e-commerce and food delivery services, and stricter regulations against plastic usage. Increasing consumer preference for recyclable materials, advancements in packaging technology, and the widespread adoption of paper packaging in food, healthcare, and personal care sectors also contribute.

The food industry leads the paper packaging market based on end use industry, driven by the rising demand for sustainable, eco-friendly solutions and increasing consumer preference for environmentally conscious products, along with regulatory pressure to reduce plastic waste.

Asia Pacific currently dominates the keyword market, accounting for a share of 39.3%. This dominance is fueled by packaging innovations like reinforced paperboard for bulk orders and compostable filler materials, along with the rise of subscription-based services in industries like cosmetics and health supplements, which are creating a positive paper packaging market outlook in the region.

Some of the major players in the global paper packaging market include Amcor plc, DS Smith Plc, Georgia-Pacific LLC, Holmen Group, Hood Packaging Corporation, Huhtamäki Oyj, International Paper Group, Mondi Group Plc, Napco National, Nippon Paper Industries, Sappi Ltd, Smurfit Kappa Group, Sonoco Products Company, Stora Enso Oyj, WestRock Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)