Palm Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Palm Oil Price Trend, Index and Forecast

Track real-time and historical palm oil prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Palm Oil Prices January 2026

| Region | Price (USD/Kg) | Latest Movement |

|---|---|---|

| Northeast Asia | 1.33 | 4.7% ↑ Up |

| Southeast Asia | 1.04 | 4.0% ↑ Up |

| North America | 1.6 | -6.4% ↓ Down |

Palm Oil Price Index (USD/KG):

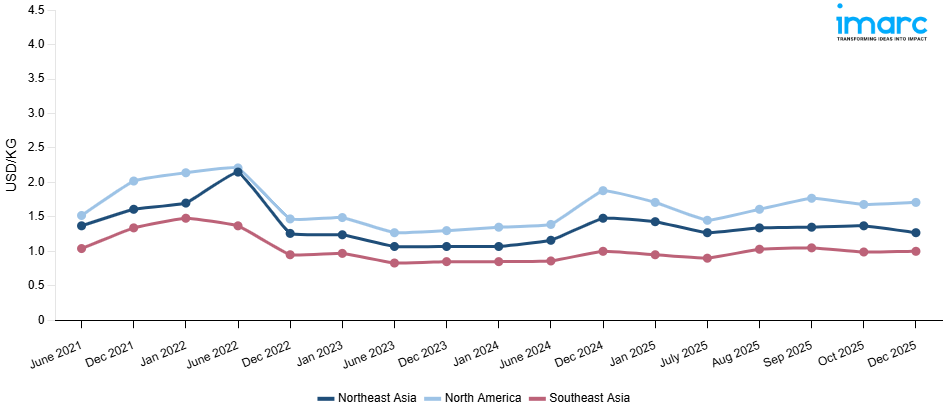

The chart below highlights monthly palm oil prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: Palm oil prices in Northeast Asia rose slightly as demand from food manufacturing and oleochemicals supported steady procurement. The palm oil price index reflected stable trade flows, with refiners increasing purchases to meet seasonal consumption. Imports helped balance supply, while consistent downstream activity in packaged food production contributed to marginal upward momentum in the regional market.

Southeast Asia: In Southeast Asia, palm oil prices increased moderately, driven by firm regional consumption and healthy export activity. The palm oil price index showed strength as domestic processors and biodiesel manufacturers sustained procurement levels. Favorable harvesting conditions ensured adequate availability, but strong demand from international buyers provided upward support to pricing, keeping regional sentiment firm.

North America: Palm oil prices in North America recorded significant growth due to robust demand from food processing and the biofuel sector. The palm oil price index moved sharply higher as buyers increased imports to cover rising industrial consumption. Supply chain reliability and consistent consumer demand in packaged food products reinforced bullish market conditions, sustaining the upward trajectory in prices.

Palm Oil Price Trend, Market Analysis, and News

IMARC's latest publication, “Palm Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the palm oil market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of palm oil at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed palm oil prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting palm oil pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

.webp)

Palm Oil Industry Analysis

The global palm oil industry size reached USD 57.75 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 78.71 Billion, at a projected CAGR of 3.33% during 2026-2034. Market growth is supported by rising demand in food processing, cosmetics, and biofuel industries, along with increasing usage as a cost-effective vegetable oil alternative. Expanding applications in packaged foods, detergents, and industrial lubricants further drive the long-term outlook.

Latest developments in the Palm Oil Industry:

- January 2025: Hindustan Unilever Limited (HUL) approved the acquisition of Vishwatej Oil Industries' palm undertaking in Telangana. This move supports HUL’s palm localisation strategy to reduce import dependence, enhance supply chain resilience, and contribute to India’s National Mission on Edible Oils through sustainable farming practices.

- July 2024: RSPO and IVPA signed an MoU to promote sustainable palm oil cultivation and imports in India. With India importing 9 million tonnes annually, efforts focus on awareness, policy advocacy, and increasing domestic production under NMEO-OP. RSPO membership in India grew 20%, reaching 118 entities.

- May 2024: Leading geospatial intelligence AI technology firm Dabeeo commenced its latest AI monitoring project of palm oil farms in Indonesia. The company inked a deal with Tunas Sawa Erma Group, one of Indonesia's major palm oil producers, for the project, spanning across a total of 765 square kilometers.

- May 2024: India's first integrated Oil Palm Processing Unit by 3F Oil Palm started its commercial operations. This integrated Oil Palm project includes a cutting-edge oil palm factory (Palm Oil Processing and Refinery), a zero-discharge effluent plant, a palm waste-based power plant, and additional structures and go-downs for support purposes. This factory marks the first Oil Palm factory in Arunachal Pradesh and India's first Oil Palm Factory under NMEO-OP.

- January 2024: Karnataka-based MK Agrotech, an edible oil and food company, and M11 Industries announced the launch of an oil palm plantation program in Odisha. The company signed a memorandum of understanding (MoU) with the Government of Odisha under the National Mission on Edible Oils–Oil Palm (NMEO-OP).

Product Description

Palm oil is a versatile vegetable oil derived from the mesocarp of the fruit of the oil palm (Elaeis guineensis). It is semi-solid at room temperature and is characterized by its high content of saturated and monounsaturated fatty acids, along with a natural presence of carotenoids and vitamin E. Palm oil is widely used in the production of edible products such as cooking oil, margarine, and baked goods, as well as in non-food industries including cosmetics, detergents, and biofuels. Its oxidative stability and long shelf life make it a preferred choice in processed foods. Industrially, refined, bleached, and deodorized (RBD) palm oil serves as a feedstock for oleochemicals, which are used in surfactants, lubricants, and personal care products. Due to its versatility and cost efficiency, palm oil plays a critical role in global food security and industrial applications.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Palm Oil |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Palm Oil Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of palm oil pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting palm oil price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The palm oil price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The palm oil prices in January 2026 were 1.33 USD/KG in Northeast Asia, 1.04 USD/KG in Southeast Asia, and 1.6 USD/KG in North America.

The palm oil pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for palm oil prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)