Painting Robots Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Painting Robots Market Size and Share:

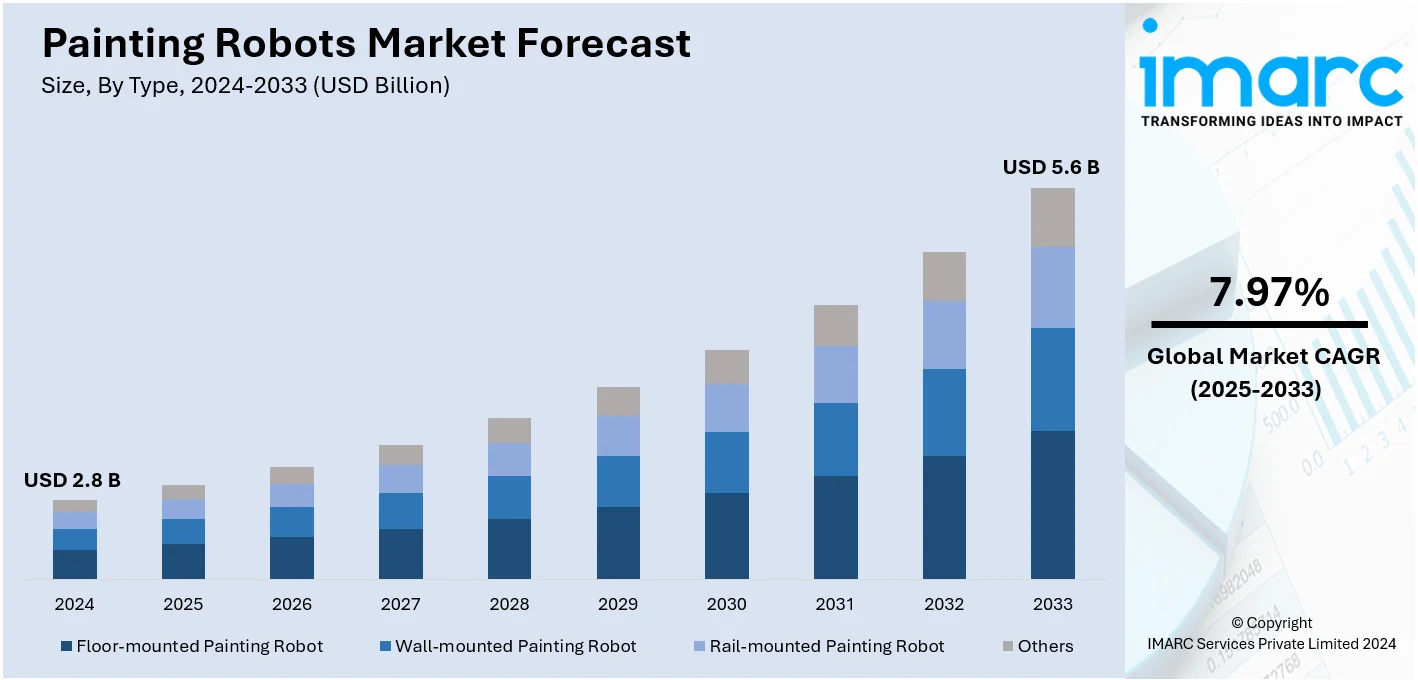

The global painting robots market size was valued at USD 2.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.6 Billion by 2033, exhibiting a CAGR of 7.97% from 2025-2033. Asia Pacific currently dominates the market, driven by rapid industrialization, strong automotive demand, cost-effective automation solutions, government support, and a focus on manufacturing efficiency, quality, and sustainability across key sectors like automotive, electronics, and aerospace.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.8 Billion |

|

Market Forecast in 2033

|

USD 5.6 Billion |

| Market Growth Rate 2025-2033 | 7.97% |

The growth of the global painting robots market is primarily driven by advancements in automation, the increasing demand for high-quality finishes, and the need for improved production efficiency across industries like automotive, aerospace, and manufacturing. Robotics offer consistent, precise application of coatings, reducing human error, enhancing product quality, and ensuring safety by minimizing exposure to hazardous chemicals. Moreover, the trend towards smart manufacturing, supported by Industry 4.0, is boosting the adoption of robotic solutions for painting tasks. Economic factors such as labor cost reduction, the ability to work in hazardous environments, and the growing focus on sustainability are further accelerating market demand. Additionally, the continuous development of AI-driven robots and innovations in robot technology are making robotic painting solutions more cost-effective and accessible.

To get more information on this market, Request Sample

The USA growth of the painting robots market is driven by increased demand for automation, especially in automotive, aerospace, and industrial segments. As manufacturers strive for higher productivity, superior quality, and cost reduction, robotic painting solutions offer significant advantages, including precision, consistency, and the ability to operate in hazardous environments. The automotive industry, a major adopter, benefits from robots' ability to deliver flawless finishes and optimize paint usage. Additionally, the USA's push for advanced manufacturing technologies, along with the rise of smart factories and AI-driven solutions, is accelerating adoption. Economic factors, such as labor shortages and high operational costs, further drive manufacturers to adopt robotic systems for enhanced efficiency and safety.

Painting Robots Market Trends:

Increased Adoption of Robotic Painting Systems

Robotic painting has rapidly growing markets especially in the automobile and aerospace sectors. The IFR reported in 2021 that the global automotive industry represents 23% of industrial robot installations, where the number reaches nearly 119,000 units. Major automobile makers, such as Toyota and Volkswagen, are on the forefront with respect to automation using robotic painting systems to increase their efficiency as previously labor-based operations. For example, a prominent automobile company has reported that the robotic systems increased the quality of painting by 30% and reduced errors and paint defects. The efficiency of the robotic systems also reduces labor, material usage, and production time costs. This growth is expected to continue as robots provide precise, consistent, and environmentally friendly painting solutions.

Integration of AI and Machine Learning

The use of artificial intelligence and machine learning in robotic systems for painting continues to advance, and Dürr is among the companies leading that advancement. Dürr has even broadened its applications of AI for helping automotive paint shops add robots to existing operations, particularly where quality and plant availability were concerned. Dürr's AI-based Advanced Analytics detects the sources of defects early during the application of paint and high-viscosity material processes to help improve painting accuracy and reduce waste. As stated, Dürr said that their system is the first market-ready AI application dedicated specifically to the automotive paint shop. The program analyzes machine data, such as axis positions and temperatures, while monitoring real-time program times. This system reveals previously unknown causes of defects as well as when maintenance is planned. This also increases overall equipment effectiveness (OEE) while lengthening robotic systems' useful life. For instance, BMW has already validated algorithms that predict optimal maintenance schedules, reducing downtime and increasing production efficiency. This AI integration improves both operational efficiency and paint quality while minimizing waste. As per industry reports, the AI Robotics market is anticipated to grow to USD 22.52 billion by 2025.

Cost Efficiency and Sustainability

Robotic painting systems are known for their ability to save cost and make the manufacture more sustainable. According to industrial reports, robotic painting systems help in avoiding paint waste that may amount up to 40% since their application is a precise control in paint application. Robots can also ensure material consumption decrease by up to 30%. This is because the robots can be programmed with specific accuracy to apply paint, with minimized overspray and the application of paint only on the intended areas. Also, these robots often use low-VOC (volatile organic compounds) and water-based paints, resulting in significantly reduced harmful emissions compared to traditional solvent-based systems. Ford Motor Company has reported that its robotic painting systems resulted in the reduction of waste from paint by 25%, and energy cost was also reduced by 20%. This is in line with the global sustainability goals as manufacturers increasingly seek methods to lower their carbon footprint and minimize waste while improving operational efficiency.

Painting Robots Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global painting robots market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application and end user.

Analysis by Type:

- Floor-mounted Painting Robot

- Wall-mounted Painting Robot

- Rail-mounted Painting Robot

- Others

In 2024, floor-mounted painting robots are expected to dominate the market, emerging as the largest segment due to their versatility and adaptability across a range of industries. These robots are designed to operate directly on the factory floor, providing flexibility for high-volume production environments, particularly in automotive and manufacturing sectors. Their ability to reach large areas, combined with precision and speed, makes them ideal for tasks requiring consistent quality and efficiency. Floor-mounted robots also offer the advantage of better stability during complex painting operations, ensuring uniform application and reducing paint wastage. As industries continue to focus on automation for increased productivity and cost savings, the sales of floor mounted painting robots are expected to be hardy and indicate the robustness of the former as a significant market growth driver.

Analysis by Application:

- Interior Painting

- Exterior Painting

In 2024, interior painting is anticipated to dominate the painting robots market, propelled by the growing demand for high-quality, uniform finishes across various sectors, especially in automotive and commercial manufacturing. Interior painting applications require precise control over paint application to achieve flawless results, and robotic systems excel in delivering uniform coverage with minimal waste. Robots can also operate in environments that may pose risks to human workers, such as enclosed spaces or areas with hazardous fumes. As manufacturers focus on improving product aesthetics and durability, robotic interior painting ensures a high level of precision and efficiency, contributing to reduced production time and costs. Additionally, the growing adoption of automated solutions in industries like automotive, aerospace, and furniture manufacturing further supports the dominance of interior painting applications in the robotics market.

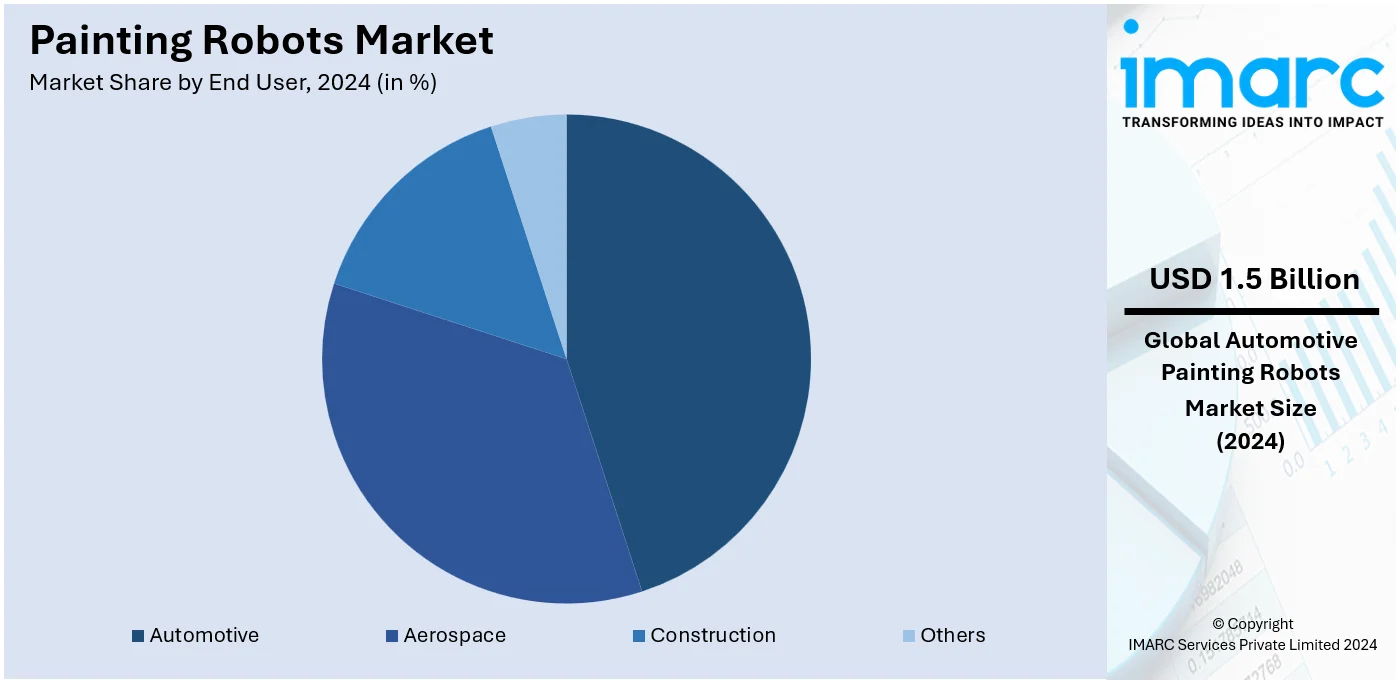

Analysis by End User:

- Automotive

- Aerospace

- Construction

- Others

In 2024, Automotive will be the main market for painting robots, because the industry has a huge need for precision, speed, and cost efficiency in vehicle manufacturing. Automakers are increasingly adopting robotic systems to achieve consistent, high-quality paint finishes while reducing human labor costs and minimizing waste. Robots are particularly advantageous in automotive painting due to their ability to apply even layers of paint across large surfaces, ensuring uniformity and reducing the risk of defects. Additionally, with the rise of electric vehicles and the need for efficient, scalable production, automotive manufacturers are prioritizing automation to streamline operations and meet growing production demands. This sector's focus on safety, quality control, and sustainability further boosts the widespread adoption of robotic painting solutions in the automotive production process.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific is expected to account for the largest share of the painting robots market, driven by rapid industrialization and the strong presence of key manufacturing sectors, particularly in countries like China, Japan, and South Korea. The region is home to some of the world’s largest automotive manufacturers, which heavily invest in robotic automation to enhance production efficiency, quality, and safety. Additionally, Asia Pacific’s competitive labor costs, coupled with the growing demand for advanced manufacturing technologies, further boost the adoption of robotic painting systems. Governments in the region are also supporting automation through favorable policies and initiatives aimed at improving manufacturing capabilities. The region’s expansive electronics, consumer goods, and aerospace sectors are also contributing to the rising demand for robotic painting solutions, cementing Asia Pacific’s dominance in the global market.

Key Regional Takeaways:

North America Painting Robots Market Analysis

The growth of the painting robots market in North America is driven by several factors, including a strong focus on manufacturing automation, labor cost reduction, and the need for improved product quality and consistency. The automotive sector, in particular, has been a major adopter of robotic painting systems, as robots ensure precise, uniform application of coatings, reducing waste and enhancing finish quality. According to a report by Statista, the robotics market in North America is expected to grow from $16.5 billion in 2023 to $25.2 billion by 2028, with significant contributions from industrial automation. Additionally, the push for sustainability and green manufacturing practices is accelerating the adoption of robotic systems, which can optimize paint usage and reduce harmful emissions. The need for enhanced worker safety and the rise of smart factory technologies further drive the adoption of painting robots in industries like aerospace and electronics.

United States Painting Robots Market Analysis

The U.S. painting robots market is growing sharply along with an increasing industrial robot market. For instance, according to an industrial report, industrial robot installations recorded an increase by 10 percent as 39,576 installations in 2022 were experienced with the region registering 71% installations in the whole of America. This growth also increases in related markets such as auto manufacturing wherein automated painting system robotic applications gain precedence. Manufacturers are using robotic solutions to improve production standards and reduce defects in the process of application as demand for efficiency, precision, and consistency in paint application increases. In addition, these systems also enhance the sustainability aspects by reducing paint waste and complying with environmental regulations. With the U.S. holding a 7% share of global installations, growth in industrial robotics is directly proportional to the growing demand for robotic painting solutions, especially in high-quality finish and high-volume production sectors. This trend is likely to grow as automation becomes an integral part of manufacturing processes.

Europe Painting Robots Market Analysis

The Europe painting robots market is growing rapidly. This is mainly due to advances in automation, as well as the growing need for precision and efficiency in the production of automotive and electronics industries. As industrial robot installations in Europe increase, so does the demand for robotic painting solutions. According to an industrial report, in 2022, Europe had increased its total robot installations by 3%, with a total of 84,226 units. Germany was the largest market, accounting for 25,636 units. The main driver remains to be the automotive industry, which only uses robotic painting for the production of vehicles. Italy and France each added 8% and 13% to the list, with further expansion of demand for painting robots at modernization of manufacturing processes in automotive and consumer goods sectors. The European Union represents 84% of robot installations within the region's leading players: Germany, Italy, and France. Again, as the sector changes, so does the approach and thrust for business to shift towards automation by paving an automation way through production speed, quality, and sustainability with the help of painting robots. Focusing on digitalization and green manufacturing technologies, the expansion of robotic painting systems in Europe will help in maintaining its dominant position in the global robotic automation market.

Asia Pacific Painting Robots Market Analysis

Asia Pacific remained the largest of the world markets with this region accounting for 73% of all installations of new industrial robots in 2022, an industrial report stated. China had installed 290,258 units, 52% of global installations, while both Japan and South Korea saw growth of installations of painting robots at +9% to 50,413 units and +1% to 31,716 units, respectively. In this regard, industries such as electronics, automotive, and manufacturing, which are precision and efficiency oriented, require painting robots. The painting robot market in Europe is also expanding. Total installations reached 84,226 units in 2022. Countries such as Germany and Italy exhibit robust growth in terms of the adoption of robots. The adoption rate is significant, especially in automotive, where painting robots have become more vital. Parallel growth in both Asia Pacific and Europe is a pointer to the rising demand for robotic automation in painting applications, thereby supporting industrial efficiency across these regions.

Latin America Painting Robots Market Analysis

Latin America's painting robots market is growing, influenced by industrial automation growth in the region, particularly in Mexico and Brazil. Both countries have advanced manufacturing processes, which push demand for automation. According to an industrial report, Mexico recorded 13% growth in robot installations, while deploying 6,000 units in 2022. Brazil remains the largest economy in the region and focuses on upgrading industries. The economies of both countries are modernizing their sectors, mainly automotive and electronics, which are boosting the demand for painting robots. The advantages of these robots include increased accuracy, less labor, and higher production. Another factor that increases the adoption of painting robots as well as other types of industrial robots is the growth of the middle class and investment in advanced technologies to satisfy the demand for high-quality outputs of manufacture and efficient production processes.

Middle East and Africa Painting Robots Market Analysis

The Middle East and Africa region is witnessing growing demand for painting robots, which is being driven by industrial modernization and investments in the defense sector, especially in Saudi Arabia and South Africa. According to an industrial report, Saudi Arabia's defense budget was estimated at USD 75.01 billion in 2022, which has furthered technological development, including automation in the defense and manufacturing sectors. In contrast, South Africa has a solid manufacturing sector with companies such as Denel, which produce robots for local and export markets. These open up potential paths for incorporating painting robots, especially in automotive and aerospace industries. The development, with the government's initiatives to upgrade infrastructure and industry, puts the region as an emerging market for painting robots.

Competitive Landscape:

The global painting robots market is highly competitive, with numerous players across the robotics, automation, and manufacturing industries. Key companies dominate the market, leveraging their strong technological expertise, global reach, and comprehensive product offerings. These players focus on developing advanced robotic systems with improved precision, speed, and adaptability to cater to diverse industries, including automotive, aerospace, and industrial manufacturing. Competition is also driven by continuous innovation in AI-driven robotics, smart manufacturing, and Industry 4.0 integration. Many companies are also creating strategic partnerships and collaborations to expand their technological capability and increase market presence. Other regional players in Asia-Pacific provide cost-effective solutions and tap local manufacturing demands in the market dynamics. The increasing emphasis on sustainability, labor safety, and customization is pushing companies to differentiate themselves through tailored solutions and improved operational efficiency.

The report provides a comprehensive analysis of the competitive landscape in the painting robots market with detailed profiles of all major companies, including:

- ABB Ltd.

- CMA Robotics Spa

- Borunte Robot Co., Ltd.

- Dürr Group

- Epistolio Srl

- FANUC America Corporation

- Gaiotto Automation (Gruppo Sacmi)

- Kawasaki Heavy Industries, Ltd.

- Krautzbergerger GmbH

- KUKA AG

- Lesta

Latest News and Developments:

- November 2024: Dürr initiated the RoX research project with 30 companies and institutes focusing on developing AI-based robotics solutions in collaboration. The German Ministry for Economic Affairs is funding the project, which includes the development of a digital ecosystem to improve the efficiency of manufacturing processes and increase data sovereignty. Dürr will focus on process development for painting.

- July 2024: ABB Robotics's PixelPaint technology has been chosen by Mahindra & Mahindra (M&M) to offer high-end personalization options in its electric vehicle range. M&M would be the first Indian OEM to offer PixelPaint, and serialization will begin in 2025.

- May 2024: FANUC America launched CRX-10iA/L Paint, being the world's first global explosion-proof collaborative paint robot. As an innovation suitable for industrial applications in painting, coating, or fiberglass, these robots ensure their safety compliance based on U.S. explosion-proof standards while empowering higher-mix-low-volume operations toward automation.

- May 2024: Dürr announced that they produced its 18,000th painting robot, which was an EcoRP L033i for the topcoat line of Audi's electric vehicle. The robot featured EcoBell4 atomizer technology, which guarantees quick color change and less paint waste, aligning with the environmentally friendly features of Audi's Q6 e-tron series.

- November 2023: Yaskawa has introduced the MOTOMAN NEXT series, the first adaptive robot in the industry.This open-platform automation solution aims to enhance flexibility and efficiency, offering a versatile approach to automation across various industries, setting new standards in robotic technology and performance.

Painting Robots Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floor-mounted Painting Robot, Wall-mounted Painting Robot, Rail-mounted, Painting Robot, Others |

| Applications Covered | Interior Painting, Exterior Painting |

| End Users Covered | Automotive, Aerospace, Construction, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., CMA Robotics Spa, Borunte Robot Co., Ltd., Dürr Group, Epistolio Srl, FANUC America Corporation, Gaiotto Automation (Gruppo Sacmi), Kawasaki Heavy Industries, Ltd., Krautzbergerger GmbH, KUKA AG, Lesta, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the painting robots market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global painting robots market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the painting robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Painting robots are automated systems used in various industries to apply coatings or paints to products with high precision and efficiency. These robots are designed to deliver consistent finishes, reduce human error, and optimize paint usage, often improving safety and productivity in industrial processes.

The painting robots market was valued at USD 2.8 Billion in 2024.

IMARC estimates the global painting robots market to exhibit a CAGR of 7.97% during 2025-2033.

Key factors driving the market include increasing demand for automation, cost-effective production, high-quality finishes, improved manufacturing efficiency, labor cost reduction, and safety concerns, especially in industries like automotive, aerospace, and electronics.

In 2024, floor-mounted painting robots represented the largest segment by type, driven by their stability, flexibility, and capability to handle large-scale applications efficiently in industries like automotive and manufacturing.

Interior painting leads the market by application, owing to its demand for precise, uniform coatings, especially in industries like automotive and commercial manufacturing.

The automotive sector is the leading segment by end user, driven by the high demand for automated, precise, and cost-efficient painting solutions to enhance vehicle production and finish quality.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global painting robots market include ABB Ltd., CMA Robotics Spa, Borunte Robot Co., Ltd., Dürr Group, Epistolio Srl, FANUC America Corporation, Gaiotto Automation (Gruppo Sacmi), Kawasaki Heavy Industries, Ltd., Krautzbergerger GmbH, KUKA AG, Lesta, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)