Packaging Robots Market Size, Share, Trends and Forecast by Gripper Type, Application, End User, and Region, 2025-2033

Packaging Robots Market Size and Share:

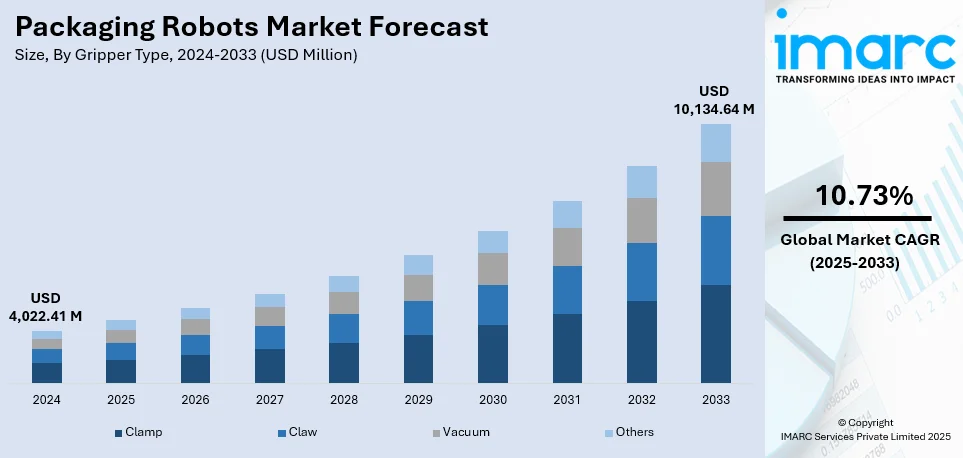

The global packaging robots market size was valued at USD 4,022.41 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,134.64 Million by 2033, exhibiting a CAGR of 10.73% from 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 34.6% in 2024. The growth of the Asia Pacific region is driven by increasing industrial automation, rapid e-commerce expansion, demand for cost-effective packaging solutions, and advancements in robotics technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4,022.41 Million |

|

Market Forecast in 2033

|

USD 10,134.64 Million |

| Market Growth Rate (2025-2033) | 10.73% |

The growing popularity of online shopping is increasing the need for effective packaging solutions. As online retail expands, businesses must efficiently handle, package, and dispatch significant quantities of products. Packaging robots deliver essential automation to meet this demand, guaranteeing quicker order processing and reducing manual mistakes in high-volume settings. Moreover, various sectors are encountering shortages in labor and increasing labor expenses, rendering automation a more appealing choice. Packaging robots decrease dependence on human labor by automating repetitive activities, enabling businesses to sustain productivity while lowering labor costs. This transition to robotic solutions addresses workforce issues and enhances operational efficiency. Moreover, the incorporation of artificial intelligence (AI), machine learning (ML), vision systems, and sophisticated sensors into packaging robots is greatly improving their accuracy, adaptability, and overall capabilities. These technological innovations allow robots to adjust to various product types and packaging requirements, helping businesses optimize their processes and minimize mistakes.

To get more information on this market, Request Sample

The United States plays a crucial role in the market, driven by the increasing demand for flexible, high-efficiency solutions that can handle a wide variety of products. Companies are adopting AI-based robotic systems that enable seamless adjustments for different products, reducing risks and improving operational efficiency. This trend is particularly important in industries with high changeover and throughput demands, such as consumer packaged goods (CPG) export operations, where automation helps maintain consistency and speed across diverse packaging requirements. For instance, in 2024, Y International, a part of LuLu Group International, implemented an AI-based robotic secondary packaging solution at PACK EXPO, designed to handle the high-changeover and throughput demands of their CPG export operations. Partnering with Tutor Intelligence, the company successfully reduced risks associated with robotics, utilizing flexible, usage-based pricing and continuous automation for over 5,000 SKUs. The robots’ AI software ensures seamless adjustments to different products, offering reliable, hands-free packing for improved efficiency in their US warehouse.

Packaging Robots Market Trends:

Significant Technological Advancements

Advancements in Artificial Intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are propelling the development of robotics, improving their accuracy, adaptability, and capacity to handle more intricate tasks. A significant instance is the introduction of OmniCore by ABB Robotics in June 2024, an advanced automation platform designed for tasks like gluing, laser cutting, and other precision-oriented activities. OmniCore is claimed to be as much as 25% quicker and 20% more energy-efficient than its prior version, delivering notable enhancements in performance. The platform has received more than USD 170 million in funding, emphasizing advanced robotics that incorporate modular, future-ready control systems. OmniCore effortlessly combines AI, sensors, cloud technology, and edge computing to facilitate sophisticated and self-operating robotic applications. These developments fuel a swiftly growing robotics market, especially in packaging, where rising needs for automation and efficiency are enhancing the global demand for packaging robots, resulting in a positive market forecast.

Increasing Labor Costs and Shortages

Increasing labor expenses and a lack of skilled labor are driving industries to implement robotic solutions to stay competitive and efficient. As reported by the U.S. Bureau of Labor Statistics, compensation expenses for civilian employees rose by 1.2%, adjusted for seasonal variations, for the three months concluding in March 2024. Wages and salaries rose by 1.1%, while benefit costs also climbed by 1.1 percent since December 2023. Compensation expenses for civilian employees surged by over 4.2% in FY2023-24 and by 4.8% in FY2022-23. Wages and salaries increased by 4.4% in FY2023-24 and by 5.0% in FY2022-23. Furthermore, the labor force participation rate is projected to decrease from 62.2% in 2022 to 60.4% in 2032. According to the Bureau of Labor Statistics, it stood at 63.3% prior to the COVID-19 pandemic and had been declining from a peak of 67.4% in 2000. The declining labor force participation rate is anticipated to promote the use of robots, which is likely to positively influence the forecast for the packaging robots market.

Growing Popularity of E-commerce and Consumer Goods

The rise of e-commerce and the increasing demand for packaged consumer products are fueling the necessity for advanced, rapid, and adaptable packaging solutions. U.S. Census statistics show that e-commerce sales represented 15.6% of overall retail sales by the close of 2023, a number expected to rise to 16.6% in 2024 and 20.6% by 2027. In 2023, e-commerce sales in the U.S. totaled USD 1,118.7 billion, highlighting the growth of online retail. As online shopping expands, businesses are adopting sophisticated automation to satisfy the need for quicker and more effective processes. For instance, in February 2024, OSARO, a frontrunner in robotics driven by machine learning, unveiled the Robotic Depalletization System. This AI-powered solution intends to improve efficiency and increase safety in e-commerce fulfillment and warehousing, optimizing operations through the automation of intricate tasks. These innovations are essential for managing the rising number of online orders, driving the need for packaging automation in logistics.

Packaging Robots Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global packaging robots market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on gripper type, application, and end user.

Analysis by Gripper Type:

- Clamp

- Claw

- Vacuum

- Others

Clamp is primarily utilized for managing rigid items with specific forms, like boxes, cartons, and plastic containers. It is highly reliable and can manage heavy payloads. Industries like food and beverages, pharmaceuticals, and consumer goods often prefer clamp gripper due to its ability to securely hold objects without causing damage, thereby ensuring the integrity of packaged products.

Claw gripper, also known as finger gripper, is a versatile and capable of handling a variety of object shapes and sizes. It is particularly useful in industries requiring delicate handling, such as electronics or cosmetics. The multi-fingered design of claw gripper allows for more nuanced control over the items being packaged, making them ideal for tasks requiring greater precision.

Vacuum is widely used for handling objects with flat surfaces or those that require gentle handling, such as glass panels, papers, and plastic films. It relies on suction to hold items and are highly preferred in industries, including automotive, electronics, and food packaging. This gripper us especially useful for high-speed applications and for handling fragile or sensitive items, as it reduces the chance of damaging the product during the packaging process.

Others include magnetic, which uses magnets to handle ferrous materials, and soft gripper, designed for delicate or irregular objects using flexible materials. Adaptive gripper is also gaining traction, as it can adjust to different shapes and sizes, improving versatility. These innovative gripper types enhance robotic systems' ability to handle a broader range of materials and tasks.

Analysis by Application:

- Picking and Placing

- Packing

- Tray Packing

- Case Packing

- Filling

- Others

- Palletizing

- Case Palletizing

- Bag Palletizing

- De-Palletizing

Picking and placing exhibits a clear dominance in the market, supported by the growing demand for automation across numerous sectors, especially e-commerce, food and beverage, and consumer products. With the rise of online shopping, the demand for effective and accurate management of products during packaging has become essential. Picking and placing robots streamline the monotonous job of choosing and positioning items in packaging or on conveyors, greatly lowering labor costs, mistakes, and production duration. Their capacity to manage a diverse variety of products, from oddly shaped items to delicate goods, boosts their appeal even more. Furthermore, progress in robotic technology, such as AI and machine learning, allows these robots to enhance their precision and adjust to different packaging needs. These robots are also created to function alongside human operators in cooperative settings, increasing flexibility. The rise of online shopping and the drive for operational effectiveness is driving the need for picking and placing robots.

Analysis by End User:

- Food and Beverage

- Pharmaceutical

- Consumer Products

- Logistics

- Others

The food and beverage industry relies on packaging robots to improve packaging speed, accuracy, and hygiene. These robots handle tasks such as sorting, labeling, and filling, ensuring high standards of safety and consistency in packaging while reducing human contact with products.

In the pharmaceutical sector, packaging robots are used to ensure the precise packaging of drugs and medical devices. With high regulations surrounding product safety, these robots ensure accuracy in labeling, filling, and sealing, reducing contamination risks and improving efficiency in the packaging process.

Packaging robots in the consumer products industry are used to automate tasks such as sorting, filling, and palletizing. These robots improve production rates, consistency, and packaging flexibility, which is especially important for industries with varied product types, like electronics, cosmetics, and household goods.

The logistics sector uses packaging robots for tasks like sorting, packaging, and palletizing goods for shipment. These robots improve warehouse efficiency by speeding up the packaging process and allowing for better space optimization, reducing operational costs in fulfillment centers.

Others include various industries like automotive, chemicals, and textiles, where packaging robots are used for specialized applications. These robots handle tasks that require precise, high-volume packaging, ensuring faster turnaround times and consistency in production across a range of sectors.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, holding a significant market share of over 34.6% in 2024. This is driven by the rapid expansion of manufacturing sectors in countries like China, India, and Japan. The increasing demand for efficient and automated packaging solutions is a direct result of the region's growing need for streamlined production processes. In February 2024, OMRON Automation launched the TM S Series Collaborative Robots in India, expanding its robotics offerings. These robots, designed with faster joints and expanded safety features, cater to factories operating in shared workspaces, boosting efficiency in manufacturing environments. The availability of a skilled workforce in automation technologies and the continued advancement in robotics are vital drivers of this market. Furthermore, the region's competitive advantage lies in the continuous research and development in robotics, allowing companies to provide innovative solutions tailored to the evolving packaging needs of various industries.

Key Regional Takeaways:

United States Packaging Robots Market Analysis

The adoption of packaging robots is accelerating as the pharmaceutical sector experiences rapid growth. According to reports, the US pharmaceutical sector is growing, with 2,325 brand-name manufacturers in 2023, marking a 7.8% rise from 2022. With stringent requirements for precision and hygiene, packaging robots offer unparalleled benefits in tasks such as labeling, blister packing, and carton formation. The expanding focus on drug safety and packaging customization necessitates robotic solutions that ensure accuracy while maintaining speed. Automation enables compliance with regulatory standards while reducing human error, making robots indispensable in high-volume operations. Additionally, advancements in robotic arms and sensors allow efficient handling of delicate items like vials and syringes, ensuring product integrity. The surge in demand for innovative medicines and vaccine distribution has further fueled the need for automated solutions, enabling manufacturers to meet market demands promptly. These systems integrate seamlessly with other automation technologies, ensuring streamlined workflows and optimizing productivity in pharmaceutical packaging lines.

Europe Packaging Robots Market Analysis

The increasing proliferation of food and beverage businesses has significantly driven the adoption of packaging robots. According to reports, there are approximately 445k businesses in the food & drink wholesaling industry in Europe. Automation offers enhanced speed and reliability in processes like filling, capping, and sealing, catering to high-volume demands. Robotics ensures product consistency and adherence to safety standards critical for perishable goods. Customizable robotic systems enable rapid changes in packaging designs, aligning with evolving user trends. Moreover, automation reduces waste and optimizes resource utilization, addressing sustainability goals. With robotic systems ensuring airtight sealing and precise labeling, manufacturers can guarantee product freshness and traceability. These features are particularly valuable in meeting diverse packaging needs for beverages, processed foods, and dairy products. Integration with conveyors and automated storage solutions further enhances production line efficiency, minimizing downtime and ensuring faster delivery cycles for the food and beverage sector.

Asia Pacific Packaging Robots Market Analysis

The rising demand for consumer products has spurred the increased utilization of packaging robots in production facilities. According to the India Brand Equity Foundation, the appliance and consumer electronics (ACE) industry in India reached over USD 48.37 Billion in 2022. These robots excel at performing repetitive and high-precision tasks, such as wrapping, palletizing, and sorting, enhancing production efficiency. Automated systems help manufacturers respond to fluctuating individual preferences by enabling flexible packaging designs and reducing lead times. The ability to scale operations quickly without compromising quality is essential in meeting seasonal surges and promotional campaigns. The integration of robotics with vision systems allows the precise handling of diverse product sizes and shapes, accommodating varied packaging requirements. Robotics also addresses labor shortages and reduces workplace injuries, making it an attractive investment for manufacturers seeking sustainable and efficient operations. The growing emphasis on environmentally friendly packaging further highlights the role of robots in handling recyclable materials and reducing waste.

Latin America Packaging Robots Market Analysis

In Latin America, the expansion of e-commerce is encouraging the adoption of packaging robots. For instance, the Latin America e-commerce market, with over 300 Million digital buyers, is projected to grow by over 20% by 2027, highlighting a significant expansion in online shopping. As online shopping continues to expand, businesses are under pressure to fulfill orders more quickly and efficiently. Packaging robots offer an automated solution to handle the high volume of orders and varying package sizes that e-commerce platforms deal with. These systems help streamline the packaging process, reduce human labor, and increase speed, enabling companies to meet the demands of a rapidly growing online market. Automated packaging solutions also improve accuracy and help ensure timely delivery, which is critical in maintaining customer satisfaction in the competitive e-commerce landscape.

Middle East and Africa Packaging Robots Market Analysis

The logistics industry has progressively adopted packaging robots due to their capability to manage intricate tasks with efficiency and accuracy. Reports indicate that logistics in the Middle East is thriving as GCC nations capitalize on their strategic positioning, with 30% of worldwide trade transiting through the Red Sea and Gulf of Aden, prompting additional growth and diversification in the industry. Robots enhance processes such as picking, packing, and labeling, which are essential for effective order fulfillment. The flexibility of robotic systems to manage different packaging materials and dimensions enables companies to meet changing demands effortlessly. By decreasing manual interventions, these systems lower errors, enhance workflow efficiency, and facilitate continuous operations. Automation in logistics tackles issues such as workforce shortages, maintaining steady productivity, and achieving faster delivery times.

Competitive Landscape:

Major participants in the market are concentrating on improving their product range via innovations in AI, ML, and sophisticated sensors to boost efficiency, accuracy, and adaptability. Numerous entities are putting resources into creating modular and flexible systems capable of managing various packaging functions across multiple sectors. There is a focus on minimizing energy consumption and enhancing sustainability through the creation of robots that need less energy and utilize environmentally friendly materials. Moreover, these firms are establishing strategic alliances to enhance their technological abilities and international presence. In July 2024, Coesia, a global leader in packaging and industrial solutions, acquired a minority stake in PWR (Packaging with Robots). This strategic decision seeks to enhance Coesia’s abilities in comprehensive automated packaging solutions. The collaboration aims to improve efficiency and accuracy in packaging operations by utilizing robotics and vision systems. The partnership highlights Coesia's dedication to innovation and the enhancement of its advanced packaging technology range.

The report provides a comprehensive analysis of the competitive landscape in the packaging robots market with detailed profiles of all major companies, including:

- ABB Ltd.

- Comau S.p.A.

- Denso Wave Incorporated

- Doosan Robotics Inc.

- FANUC America Corporation

- Krones AG

- Kuka AG

- Mitsubishi Electric Corporation

- Omron Robotics

- ProMach Inc.

- Remtec Automation, LLC

- Schneider Electric

- Syntegon Technology GmbH

- Yaskawa America, Inc.

Latest News and Developments:

- December 2024: Circus and Vytal have partnered to integrate a sustainable packaging system into the AI-powered CA-1 robot, set for global rollout in 2025. Vytal, active in 22 countries, supports this initiative with reusable packaging solutions, tackling 170 Million tons of annual packaging waste. The collaboration aligns with UN sustainability goals, promoting waste reduction and circular economy practices. This partnership aims to revolutionize the global food-service industry's move toward zero waste operations.

- November 2024: Doosan Robotics is exhibiting its high-capacity collaborative robots (cobots) at PACK EXPO 2024 in McCormick Place, Chicago. Spanning eight partner booths, the cobots demonstrate versatility and innovative applications in the packaging sector. The exhibition highlights their transformative potential for streamlining packaging operations. PACK EXPO 2024 runs from November 3-6.

- September 2024: Premier Tech has unveiled the Toma cobot, a collaborative robot system for packaging and palletizing. It features the Fanuc CRX-30iA arm and Movn software for seamless configuration, simulation, and HMI monitoring. Users can streamline operations by simply entering case dimensions and selecting pallet patterns. This innovation highlights Premier Tech’s century-long expertise in smart manufacturing and packaging solutions.

- March 2024: ABB recently opened its refurbished US robotics headquarters and manufacturing facility in Auburn Hills, Michigan. The facility will support ABB Robotics' global leadership in developing and manufacturing leading-edge robotic solutions in the US.

Packaging Robots Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gripper Types Covered | Clamp, Claw, Vacuum, Others |

| Applications Covered |

|

| End Users Covered | Food and Beverage, Pharmaceutical, Consumer Products, Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Comau S.p.A., Denso Wave Incorporated, Doosan Robotics Inc., FANUC America Corporation, Krones AG, Kuka AG, Mitsubishi Electric Corporation, Omron Robotics, ProMach Inc., Remtec Automation, LLC, Schneider Electric, Syntegon Technology GmbH, Yaskawa America, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the packaging robots market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global packaging robots market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the packaging robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global packaging robots market was valued at USD 4,022.41 Million in 2024.

The global packaging robots market is estimated to reach USD 10,134.64 Million by 2033, exhibiting a CAGR of 10.73% from 2025-2033.

The global packaging robots market is driven by the growing demand for automation to improve efficiency and reduce labor costs, the rise of e-commerce and online retailing, and the need for high-speed, precise packaging solutions. Additionally, advancements in AI, ML, and robotics technology, along with increasing user expectations for fast and reliable packaging, are bolstering the market growth.

Asia Pacific currently dominates the market, holding a significant market share of 34.6% in 2024. The growth of the Asia Pacific region is driven by increasing industrial automation, rapid e-commerce expansion, demand for cost-effective packaging solutions, and advancements in robotics technology.

Some of the major players in the global packaging robots market include ABB Ltd., Comau S.p.A., Denso Wave Incorporated, Doosan Robotics Inc., FANUC America Corporation, Krones AG, Kuka AG, Mitsubishi Electric Corporation, Omron Robotics, ProMach Inc., Remtec Automation, LLC, Schneider Electric, Syntegon Technology GmbH, Yaskawa America, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)