Packaged Wastewater Treatment Market Size, Share, Trends and Forecast by Technology, End Use Sector, and Region, 2025-2033

Packaged Wastewater Treatment Market Size and Share:

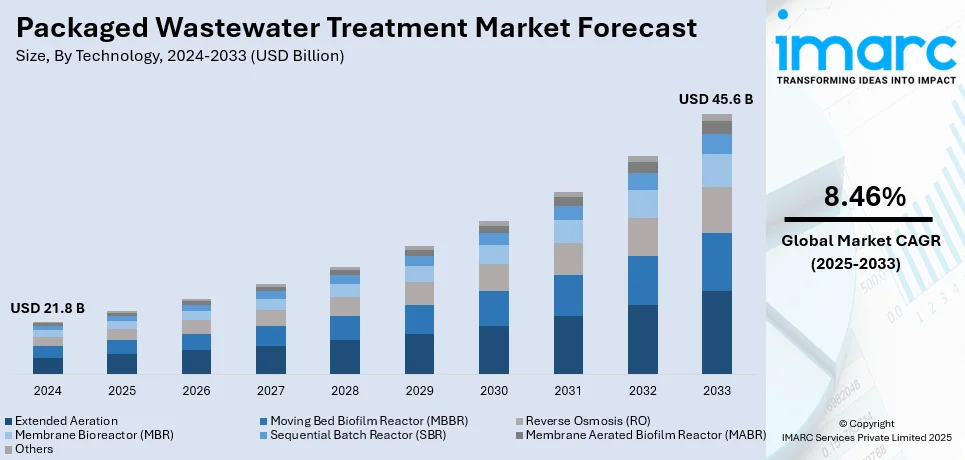

The global packaged wastewater treatment market size was valued at USD 21.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.6 Billion by 2033, exhibiting a CAGR of 8.46% from 2025-2033. North America currently dominates the market, holding a market share of over 40.4% in 2024. The market is experiencing steady growth driven by the rising emphasis on sustainability and water conservation and the integration of smart and automation technologies into packaged wastewater treatment systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 21.8 Billion |

|

Market Forecast in 2033

|

USD 45.6 Billion |

| Market Growth Rate (2025-2033) | 8.46% |

The market segment for packaged wastewater treatment continues to grow because of population increase, urbanization, and tightened environmental regulations. The combination of growing industrial demands and the necessity for decentralized solutions strengthens the market demand, particularly in territories that lack centralized sewage infrastructure. In addition, government regulations related to discharge standards worldwide are forcing industries and municipalities to invest in efficient affordable treatment systems to meet regulatory compliance. Moreover, packaged solutions have gained more attractiveness through improved treatment efficiency which results from technological innovations like membrane bioreactors and moving bed biofilm reactors. The rising need for water reuse strategies due to water scarcity problems has driven industries to choose compact modular treatment systems which provide both quick deployment and operational flexibility.

The packaged wastewater treatment market in the United States continues to grow steadily because of the tightening water quality regulations established by Environmental Protection Agency (EPA) and local state authorities. For instance, in April 2024, the EPA implemented its first nationwide, legally binding drinking water regulation to reduce PFAS exposure, which preserved the wellness of approximately 100 Million individuals and preventing multiple cases of death and critical health issues. Rising industrial wastewater discharge and the need for sustainable treatment solutions encourage the adoption of advanced treatment technologies. In addition, expanding residential developments in remote areas with limited sewer access further contribute to the packaged wastewater treatment market demand. Moreover, the increasing focus on energy-efficient and low-maintenance systems supports investment in packaged treatment plants, helping industries and municipalities meet compliance requirements while managing operational costs effectively.

Packaged Wastewater Treatment Market Trends:

Increasing Environmental Regulations

The increasing stringency of environmental regulations worldwide represents one of the primary factors favoring the packaged wastewater treatment market growth. The governing authorities and regulatory bodies are imposing stricter standards for wastewater discharge, which is driving the need for advanced treatment solutions. According to industry reports, 44% of the world’s wastewater is currently discharged into the environment without undergoing any treatment. This includes human waste, household sewage, and, at times, toxic or medical waste, all of which are released directly into natural ecosystems. Along with this, the growing concerns about water pollution and its adverse effects on ecosystems and public health are offering a favorable market outlook. Environmental regulations require industries, municipalities, and other entities to treat their wastewater before their discharge into natural water bodies. In line with this, the escalating demand for packaged wastewater treatment systems across various industries is strengthening the growth of the market. These systems offer a cost-effective and efficient way to meet compliance requirements while minimizing the environmental impact. Additionally, the rising emphasis on sustainability and water conservation is promoting the adoption of packaged wastewater treatment solutions. Apart from this, several organizations are focusing on optimizing water usage and reducing water wastage, making compact and efficient wastewater treatment systems an essential component of their operations.

Rapid Urbanization and Industrialization

The increasing number of people shifting from rural to urban settings and the growing need for effective wastewater management across the globe are influencing the market positively. According to the United Nations, 55% of the global population currently resides in urban areas, a figure projected to rise to 68% by 2050. In addition, the expansion of industries and manufacturing facilities and the continuous rise in industrial wastewater generation are supporting the growth of the market. Along with this, the rising preferences of industries for reliable and scalable wastewater treatment solutions that can accommodate varying volumes and characteristics of wastewater are offering a favorable market outlook. Packaged wastewater treatment systems offer a versatile solution for urban and industrial wastewater treatment needs. Their modular design allows for easy expansion to accommodate increased wastewater volumes, making them ideal for areas experiencing rapid growth and development. In line with this, packaged wastewater treatment systems are easily scalable, allowing for the expansion of treatment capacity to accommodate increased wastewater volumes. This scalability supports urban development as it ensures that wastewater treatment infrastructure can keep pace with population and industrial expansion.

Technological Advancements and Innovation

Continuous technological advancements and innovation in wastewater treatment plants are creating a positive outlook for the market. The global HydroWASTE database encompasses over 58,000 wastewater treatment plants. Additionally, several manufacturers are constantly developing new and improved technologies to enhance the efficiency and effectiveness of wastewater treatment processes. Along with this, the integration of smart and automation technologies into packaged wastewater treatment systems is driving the market. These innovations enable real-time monitoring and control of the treatment process, optimizing energy consumption and resource utilization. Such advancements improve the performance of these systems and reduce operational costs. Moreover, the development of sustainable and energy-efficient treatment methods is attracting a wider consumer base. This includes the utilization of renewable energy sources such as solar and wind power to power wastewater treatment processes. These eco-friendly approaches align with the growing global focus on sustainability and environmental responsibility. Furthermore, incorporating renewable energy sources like solar and wind power into wastewater treatment processes reduces the carbon footprint of treatment facilities.

Packaged Wastewater Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global packaged wastewater treatment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and end use sector.

Analysis by Technology:

- Extended Aeration

- Moving Bed Biofilm Reactor (MBBR)

- Reverse Osmosis (RO)

- Membrane Bioreactor (MBR)

- Sequential Batch Reactor (SBR)

- Membrane Aerated Biofilm Reactor (MABR)

- Others

Extended aeration stands as the largest technology in 2024, holding around 34% of the market. Extended aeration is a biological treatment technology that relies on prolonged contact between microorganisms and wastewater to break down contaminants. It offers energy efficiency and can handle variable flow rates. Extended aeration systems find their primary application in small to medium-sized municipal wastewater treatment plants and decentralized systems because they combine simplicity with high reliability. These systems mainly maintain low operational expenses while needing minimal support activity. Furthermore, the extended aeration process effectively removes organic matter, ensuring compliance with effluent quality standards while promoting sustainable wastewater treatment practices in communities with limited resources.

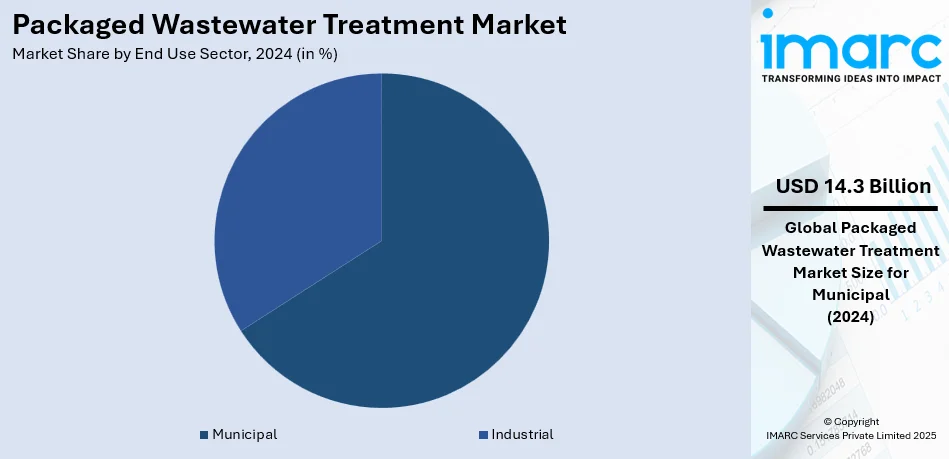

Analysis by End Use Sector:

- Municipal

- Industrial

- Chemical and Pharma

- Oil and Gas

- Food, Pulp and Paper

- Metal and Mining

- Power Generation

- Others

Municipal leads the market with around 65.8% of market share in 2024. Municipal wastewater treatment involves the purification of wastewater from residential and public sources. Packaged systems for municipal use are designed to handle large volumes of sewage and domestic wastewater efficiently. They aid in ensuring the safe discharge of treated water back into the environment or its reuse for non-potable purposes, such as irrigation, industrial applications, or landscape watering. By efficiently managing wastewater, these systems play a critical role in contributing to public health, environmental protection, and overall water conservation efforts.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.4%. This is due to the increasing demand for reliable and eco-friendly water management solutions. The region benefits from stringent environmental regulations, promoting the adoption of advanced wastewater treatment technologies. Moreover, robust industrialization, urbanization, and a growing focus on environmental sustainability further fuel the market growth. Additionally, the demand for packaged systems rises from investments in infrastructure development and municipal sector expansion and industrial growth. The region benefits from both established companies in the market space and ongoing technological improvements that drive its advancement.

Key Regional Takeaways:

United States Packaged Wastewater Treatment Market Analysis

In 2024, United States accounted for 86.80% of the market share in North America. The packaged wastewater treatment market in the United States is driven by a combination of stringent regulatory frameworks, technological advancements, and a growing emphasis on sustainability. The rise in employment within key sectors such as Mining, Logging, and Construction, where according to the USDA, as of February 2023, 8.27 Million people were employed, representing a 3.88% increase from the previous year, has contributed to an increased demand for efficient wastewater management solutions. These industries, with their high water consumption and wastewater production, are adopting packaged systems that offer compact, cost-effective, and decentralized treatment solutions. Additionally, the need to comply with regulations like the Clean Water Act, which enforces wastewater treatment standards, is accelerating the adoption of such systems. Technological advancements, including energy-efficient systems like membrane bioreactors and advanced filtration, are improving performance, reducing operational costs, and making packaged solutions more attractive. The increasing focus on water reuse and resource recovery, particularly in urban and industrial areas, is further boosting market growth. Moreover, the growing need for wastewater treatment systems in rural and remote areas, where traditional infrastructure is often not feasible, is supporting the market’s expansion. With water scarcity becoming a major concern, packaged wastewater treatment systems provide a sustainable solution for businesses and governments aiming to optimize water usage and meet environmental compliance.

Europe Packaged Wastewater Treatment Market Analysis

In Europe, the packaged wastewater treatment market is driven by a combination of stringent environmental regulations, sustainability initiatives, and technological innovations. According to reports, agricultural labour input in the EU was the equivalent of 7.6 Million full-time workers in 2023, highlighting the significant role agriculture plays in water consumption and wastewater production. This sector’s increasing demand for efficient, decentralized treatment solutions is accelerating the adoption of packaged systems. European Union regulations, such as the Urban Waste Water Treatment Directive, are further propelling the market, as municipalities and industries strive to meet wastewater treatment standards. The European Green Deal, which emphasizes reducing carbon footprints and promoting sustainable water management, is pushing the adoption of energy-efficient, low-maintenance packaged systems. Additionally, concerns over water scarcity and quality in several regions are heightening the need for compact treatment solutions that allow for water reuse and resource recovery. Technological advancements such as membrane filtration, biofiltration, and ultraviolet disinfection are making packaged systems more efficient and versatile. Furthermore, the rise of the circular economy model, which encourages resource recovery, is encouraging industries to adopt systems that optimize water use. As such, the market for packaged wastewater treatment systems in Europe continues to expand in response to regulatory pressures and sustainability goals.

Asia Pacific Packaged Wastewater Treatment Market Analysis

In the Asia-Pacific (APAC) region, rapid urbanization, industrial growth, and significant water access challenges are driving the packaged wastewater treatment market. According to the WHO/UNICEF, an estimated 500 Million people in Asia and the Pacific lack access to a basic water supply, and 1.14 Billion people are without access to sanitation. These statistics highlight the critical need for decentralized wastewater treatment solutions, as traditional infrastructure often fails to meet the growing demands of urban and rural areas. Governments are increasingly prioritizing water quality improvements, pushing for innovative, scalable packaged systems to address both water scarcity and pollution concerns. Technological advancements in energy-efficient and compact systems are meeting the demand for affordable, sustainable solutions. Furthermore, the growing emphasis on water reuse in agriculture and industry is creating new opportunities for packaged wastewater treatment. As water management becomes more crucial in the region, these systems are expected to see sustained demand.

Latin America Packaged Wastewater Treatment Market Analysis

In Latin America, the packaged wastewater treatment market is driven by rapid urbanization, industrial growth, and increasing environmental concerns. Between 2000 and 2023, 505 hydrological disasters were reported in the region, resulting in 10,694 fatalities, highlighting the vulnerability of water infrastructure. As a result, governments are focusing on improving water management systems, leading to higher demand for decentralized, cost-effective packaged wastewater treatment solutions. These systems are seen as an effective way to address localized water treatment challenges, ensure environmental compliance, and reduce the risk of contamination. Technological advancements and a focus on water reuse are further driving market growth.

Middle East and Africa Packaged Wastewater Treatment Market Analysis

The Middle East and Africa (MEA) market for packaged wastewater treatment is driven by rapid urbanization, water scarcity, and industrial expansion. The UAE oil and gas market, projected to exhibit a CAGR of 6.30% during 2025-2033, is contributing to the increased demand for efficient wastewater management systems. As industries in the region expand, there is a growing need for decentralized treatment solutions that can effectively manage wastewater while meeting stringent environmental regulations. Technological advancements in energy-efficient and compact systems, along with a focus on water conservation, are further boosting the demand for packaged wastewater treatment systems in MEA.

Competitive Landscape:

The packaged wastewater treatment market exhibits strong competition which results from ongoing technological innovation. Businesses center their efforts on delivering modular, energy-efficient, and customizable solutions which comply with various regulatory needs and environmental standards. Moreover, the market witness research investments that develop beneficial strategies to optimize treatment results and minimize operational expenses throughout the market. For instance, in December 2024, the European Bank for Reconstruction and Development (EBRD) announced a USD 30 million financing package for the Water Authority of Jordan to support the construction of a new wastewater treatment plant in Irbid, benefiting up to 200,000 people by 2045. Strategic collaborations and acquisitions serve as common business strategies for players who want to extend their product ranges and enter emerging markets that need sustainable wastewater treatment solutions. Furthermore, this dynamic landscape fosters an environment of constant improvement and adaptation to evolving market needs.

The report provides a comprehensive analysis of the competitive landscape in the packaged wastewater treatment market with detailed profiles of all major companies, including:

- Bio-Microbics, Inc.

- Clearford Water Systems Inc.

- Corix Group of Companies

- CST Wastewater Solution

- Fluence Corporation Limited

- Global Treat, Inc.

- Organica Water, Inc.

- Pollution Control Systems, Inc.

- Smith & Loveless, Inc.

- Veolia Environment SA

- Westech Engineering, Inc.

Latest News and Developments:

- November 2024: Oxyle has installed its first PFAS destruction system in Switzerland, providing a permanent solution for groundwater contamination caused by PFAS. This advanced technology breaks down "forever chemicals" into harmless minerals without harmful byproducts, offering a cost-effective alternative to traditional methods like activated carbon. The system ensures regulatory compliance and reduces operational costs for industries dealing with PFAS contamination.

- November 2024: Hubert Enviro Care Systems Pvt. Ltd. (HECS) has launched the ‘MediClear’ Packaged Effluent Treatment Plant (PETP) for hospitals, offering a sustainable solution for managing medical effluent. The units, available in capacities from 2KLD to 100KLD, provide flexible installation options and efficiently treat effluent from hospital sources like labs and operation theatres. HECS aims to support healthcare facilities in maintaining high hygiene and environmental standards with this eco-friendly solution.

- November 2023: Smith & Loveless Inc. announced the release of its latest informational brochures for the S&L FAST® and S&L Modular FAST® packaged wastewater treatment systems. These new brochures help assist consulting engineers, private developers, and commercial end-users with wastewater treatment applications that experience variable and seasonal flow changes like schools, campsites and retreat centers, and hotels and motels.

- May 2022: Veolia Environment SA and Séché Environment entered into a unilateral put agreement, which led Séché Environment to buy a French section of Veolia's industrial water treatment services business. This forms the final part of the antitrust remedies mandated by the European Commission in relation to the merger between Veolia and Suez.

- July 2020: Westech Engineering, Inc. launched the LAZERFLO® low-profile stainless-steel underdrain system, which provides a replacement to higher-profile plastic-block underdrains and stainless-steel teepee-design underdrains.

Packaged Wastewater Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Extended Aeration, Moving Bed Biofilm Reactor (MBBR), Reverse Osmosis (RO), Membrane Bioreactor (MBR), Sequential Batch Reactor (SBR), Membrane Aerates Biofilm Reactor (MABR), Others |

| End Use Sectors Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bio-Microbics, Inc., Clearford Water Systems Inc., Corix Group of Companies, CST Wastewater Solution, Fluence Corporation Limited, Global Treat, Inc., Organica Water, Inc., Pollution Control Systems, Inc., Smith & Loveless, Inc., Veolia Environment SA, Westech Engineering, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the packaged wastewater treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global packaged wastewater treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the packaged wastewater treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The packaged wastewater treatment market was valued at USD 21.8 Billion in 2024.

IMARC estimates the global packaged wastewater treatment market to reach USD 45.6 Billion in 2033, exhibiting a CAGR of 8.46% during 2025-2033.

The market is driven by stricter environmental regulations, urbanization, and the need for efficient solutions in remote areas. Additionally, technological advancements in energy-efficient, modular systems and rising concerns about water scarcity and pollution further fuel market growth.

North America currently dominates the market, holding a market share of over 40.4% in 2024. This leadership is driven by stringent environmental regulations, robust infrastructure, and increasing demand for sustainable water management solutions. The region's advanced technological adoption and focus on energy-efficient systems further drive market growth.

Some of the major players in the packaged wastewater treatment market include Bio-Microbics, Inc., Clearford Water Systems Inc., Corix Group of Companies, CST Wastewater Solution, Fluence Corporation Limited, Global Treat, Inc., Organica Water, Inc., Pollution Control Systems, Inc., Smith & Loveless, Inc., Veolia Environment SA, Westech Engineering, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)