Packaged Salad Market Size, Share, Trends and Forecast by Product, Processing, Distribution Channel, and Region, 2026-2034

Packaged Salad Market Size and Share:

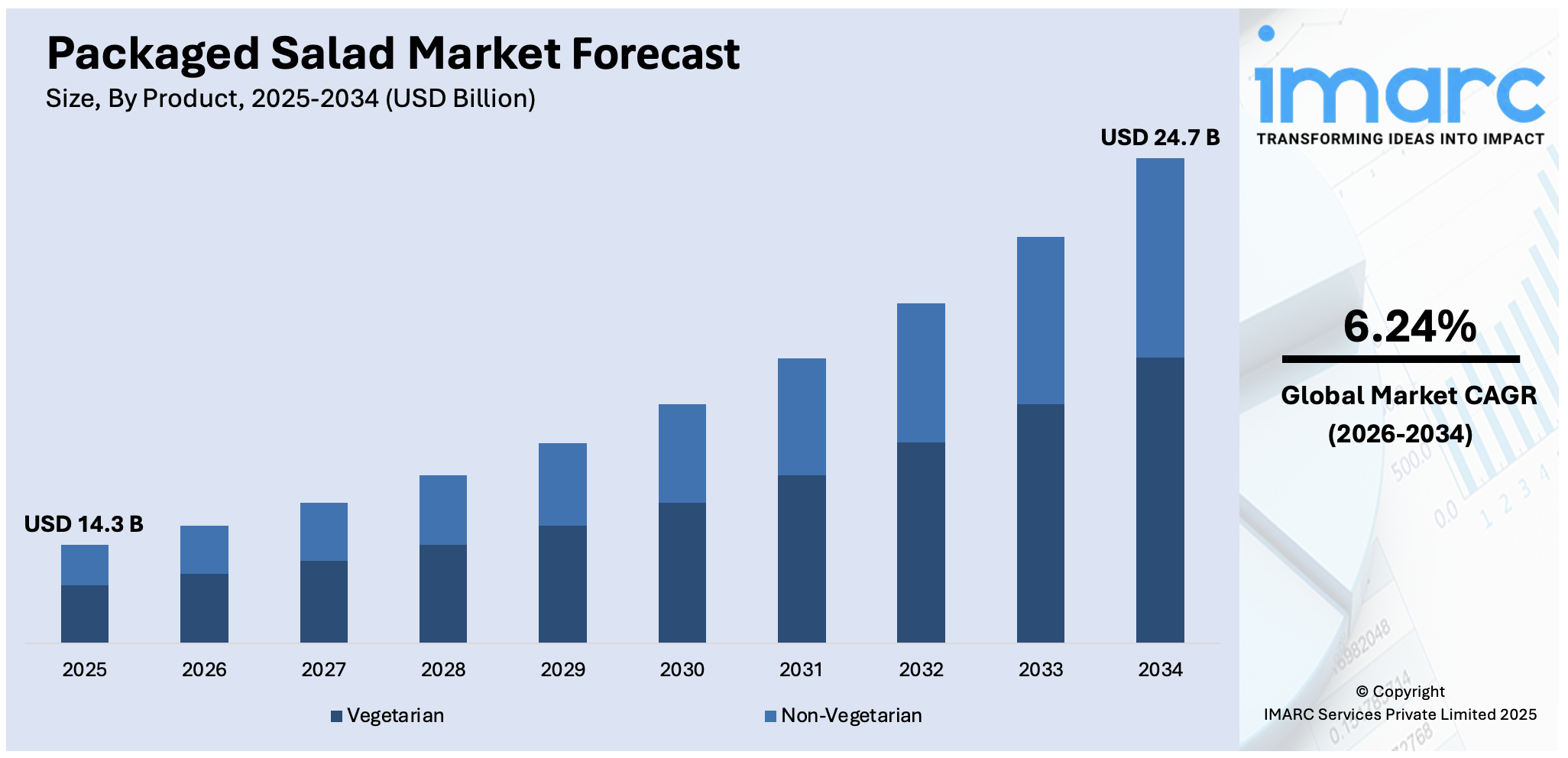

The global packaged salad market size was valued at USD 14.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 24.7 Billion by 2034, exhibiting a CAGR of 6.24% from 2026-2034. North America currently dominates the market, holding a market share of over 39.8% in 2025. The packaged salad market share in the North American region is growing because of high consumer awareness about healthy eating, widespread availability of ready-to-eat (RTE) options, well-established retail infrastructure, and increasing preferences for organic and clean-label products. Busy lifestyles further boost the demand for convenient, nutritious meal solutions across the region.

Market Size & Forecasts:

- The global packaged salad market was valued at USD 14.3 Billion in 2025.

- The market is expected to reach USD 24.7 Billion by 2034 at a CAGR of 6.24% from 2026-2034.

Dominant Segments:

- Product: The largest is the vegetarian segment, fueled by the rising demand for plant-based eating due to health benefits, environmental concerns, and growing interest in plant-based diet choices. This segment is augmented by increased flexitarian diets and a preference for lighter, plant-based meals.

- Processing: The highest market share belongs to conventional packaged salads because they are cheaper, widely available, and have well-developed supply chains. Organic salads are becoming popular, but their price restricts wider usage.

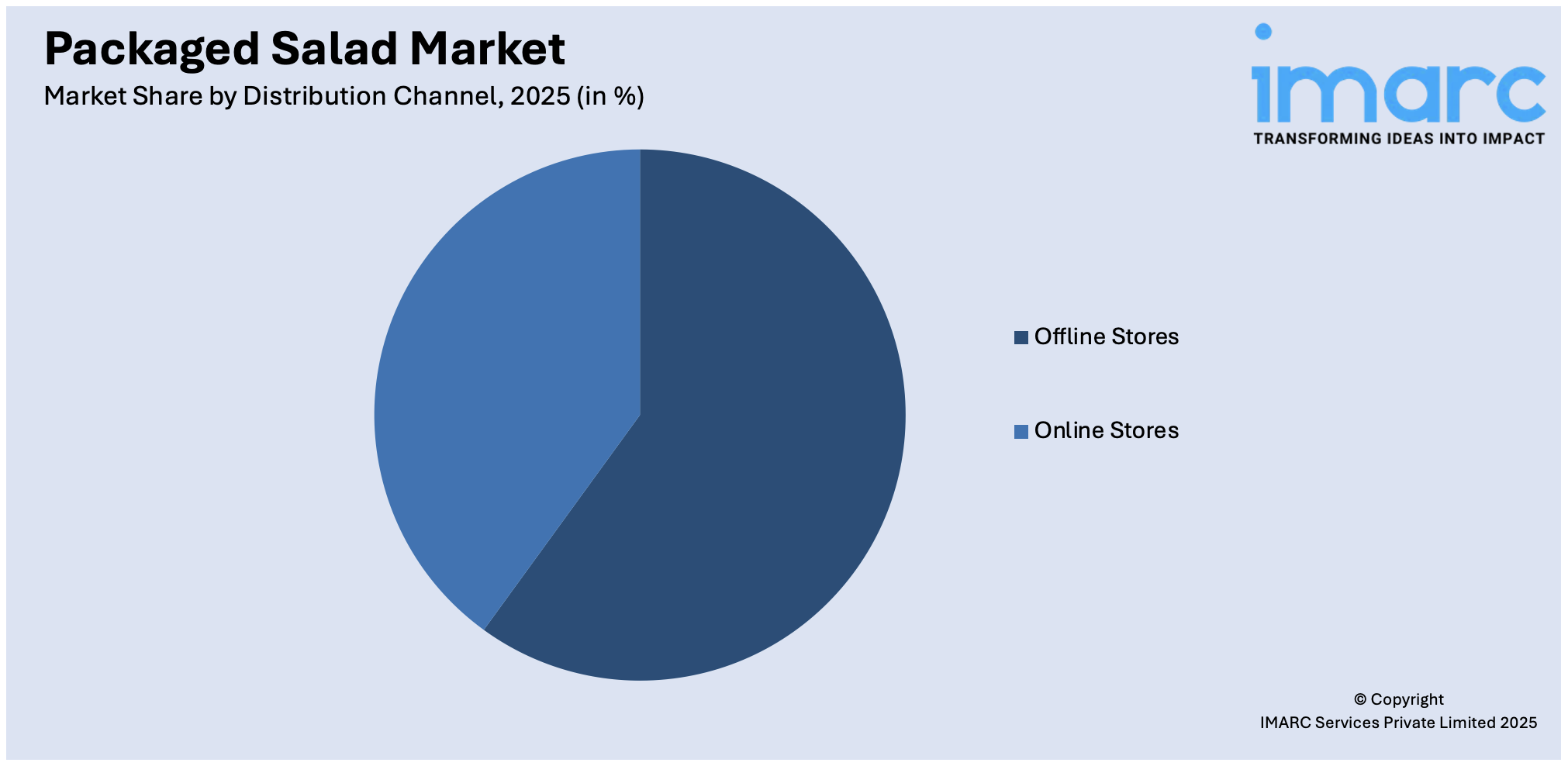

- Distribution Channel: Offline stores lead as the major distribution channel, due to the convenience of brick-and-mortar shopping, direct availability of fresh products, and the ability to touch and check quality and freshness. Online stores are increasing, but offline retail is still the choice for the majority of consumers.

- Region: North America dominates the world market for packaged salads, with more than 39.8% market share in 2025. This is mainly driven by high levels of consumer health and wellness awareness, the broad availability of ready-to-consume products, and the robust retail network of the region. The US and Canada drive most of this demand, where there is growing focus on healthy and convenient meal solutions to suit hectic lifestyles.

Key Players:

Some of the major players in packaged salad companies are Bonduelle, Brightfarms Inc., Dole Food Company Inc., Earthbound Farm (Taylor Fresh Foods Inc.), Eat Smart, Fresh Express (Chiquita Brands International), Gotham Greens, Mann Packing Co. Inc. (Fresh Del Monte Produce Incorporated), Misionero, United Salad Co., Zina's Salads Inc., etc. They are emphasizing product innovation, organic and clean-label, and sustainability in their offerings to address changing consumer trends.

Key Drivers of Market Growth:

- Health and Wellness Trends: Growing consumer recognition of the health benefits of salads, driven by health concerns over chronic diseases, is growing demand for convenient, healthy meal choices.

- Demand for Organic and Plant-Based Products: The shift towards organic, plant-based, and clean-label products is driving market growth as consumers seek natural ingredients.

- Convenience: Increasingly busy lifestyles are driving the demand for ready-to-eat, single-serve, and on-the-go packaging forms for salads, in line with the requirement for convenience in meal options.

- Sustainability: Consumers who are eco-friendly are leading the way towards adopting sustainable packaging solutions, challenging brands to make the switch to recyclable, biodegradable, or compostable packaging materials.

Future Outlook:

- Strong Growth Outlook: The market for packaged salads is forecast to sustain strong growth, motivated by the trends towards health-conscious eating, convenience, and sustainability. The market will witness a growing emphasis on product innovation, such as organic and plant-based expansion and better packaging to meet environmental objectives.

- Market Evolution: As consumers keep demanding healthier and more convenient foods, the packaged salad market will change, growing in mature and emerging markets across the world.

An increasing number of individuals are becoming aware about their dietary decisions attributed to a growing concern about obesity, diabetes, and heart-related issues. Packaged salads provide a fast and convenient method to incorporate more vegetables, which are high in fiber, vitamins, and antioxidants. This emphasis on preventive health and nutritious eating is prompting consumers to substitute conventional snacks or meals with lighter, healthier choices. In addition, producers are regularly enhancing their products for catering to evolving consumer preferences. This consists of ingredients such as quinoa, kale, chickpeas, tofu, cheese, nuts, and grains, while providing recipes influenced by international cuisines. These advancements maintain the appeal of salads and enable companies to focus on particular dietary preferences such as vegan, keto, or high-protein.

To get more information on this market Request Sample

The United States plays a vital role in the market, propelled by the increasing presence of major grocery chains, convenience stores, and online platforms that have enhanced their cold storage areas, facilitating the stocking and selling of fresh packaged salads. Enhanced cold chain logistics also assist in preserving quality and prolonging shelf life, leading to increased sales. Moreover, the implementation of cutting-edge agricultural technologies and regulated environment farming is aiding brands in enhancing sustainability, minimizing resource usage, and prolonging product freshness, thereby appealing to health-conscious and environmentally aware shoppers looking for premium packaged salad choices. In 2024, Hippo Harvest introduced its USDA-certified organic packaged salad range in the San Francisco Bay region. The lineup featured baby spinach, spring mix, arugula, and additional varieties, cultivated through a controlled environment agriculture system. This creative method decreased the use of water, fertilizer, and land, while providing an extended shelf life for the greens.

Packaged Salad Market Trends:

Growing Popularity of Organic and Plant-Based Salads

A vast number of individuals are recognizing the advantages of natural products, like being free from pesticides and artificial fertilizers, as they prioritize health and environmental effects. As a result, many people are choosing salads as a healthier and convenient method to incorporate more vegetables. As reported by the USDA, sales of organic food in the U.S. exceeded USD 63 Billion from 2020 to 2021. This demand is evident in the growing availability of organic and plant-based salads, serving health-conscious, eco-aware consumers that favorably impact the packaged salad market value. Retailers are increasing their organic selections and allocating additional shelf space to these products in response to rising consumer interest. Furthermore, food manufacturers are putting resources into cleaner ingredient procurement, clear labeling, and sustainable packaging to correspond with this trend, making organic and plant-based salads more popular than ever.

Shifting Towards Convenience and On-the-Go Packaging

With individuals living increasingly hectic lives, the demand for convenient meal options is growing, which makes pre-packaged salads a popular selection. Single-serving and portable packaging formats are particularly favored, offering fast and healthy meals for individuals with busy lifestyles. In response, businesses are creating packaging that guarantees freshness, convenience, and portability, including resealable bags and compartmentalized containers that maintain ingredient freshness until they are consumed. These formats are also appropriate for office lunches, traveling, and health-conscious lifestyles. Along with convenience, there is an increase in consumer interest in eco-friendly packaging options that reduce environmental effects. Numerous brands are transitioning to recyclable, compostable, or reusable materials in their salad packaging to reflect eco-conscious consumer principles. For example, Burger King’s outlets in Germany are utilizing reusable and recyclable polypropylene cups for drinks and ice cream items via the RECUP deposit return system to preserve important packaging resources and decrease the waste produced by single-use cup options. These initiatives not only aid in minimizing plastic waste but also enhance brand reputation.

Rising Adoption of Sustainability in Packaging

Sustainability is becoming essential in the packaged salad industry, as consumers of these products and major stakeholders aim to reduce their environmental footprint. To draw in eco-conscious consumers, numerous companies are opting for sustainable packaging options, which include biodegradable and recyclable types. The U.S. Environmental Protection Agency (EPA) revealed that in 2018, containers and packaging constituted 28.1% of the overall municipal solid waste (MSW) produced, totaling 82.2 million tons. The significant waste produced by the packaged salad industry highlights the necessity for sustainable packaging solutions. Businesses are progressively concentrating on minimizing their ecological impact and addressing consumer demand for sustainable alternatives. This emphasis on sustainability aligns with wider consumer principles, aiding in the development of brand loyalty and distinguishing itself in a competitive marketplace.

Packaged Salad Market Growth Drivers:

Growth of Online Shopping and E-commerce

The expansion of online shopping and e-commerce channels is exerting a revolutionary effect on the packaged salad industry. With the growth of online grocery stores and food order apps, customers now have convenient access to a variety of packaged salads from their homes. This transition to online shopping is making it more convenient for customers to browse and buy fresh, pre-packaged salads without physically having to go to stores. The convenience of ordering, together with the growing effectiveness of cold chain logistics, guarantees the quality and freshness of the products at the point of delivery. With e-commerce becoming increasingly popular, it is likely to increase the demand for packaged salads further, helping brands capture a larger base and propel market growth. The IMARC Group predicts that the global e-commerce market is anticipated to attain USD 214.5 Trillion by 2033.

Product Innovation and Variety

Product innovation is a key driver for the development of the packaged salad market. Manufacturers are adding new combinations of greens, vegetables, fruits, proteins, grains, and dressings every time in a bid to cater to different consumer tastes. This trend is most evident in the addition of gourmet and ethnic flavors, as consumers seek more variety and international tastes. The use of healthier ingredients such as quinoa, chickpeas, and tofu also attracts health-conscious consumers. With these changing and dynamic product lines, packaged salads are becoming more viewed as flexible meal solutions adaptable to most dietary requirements, such as vegan, keto, and high-protein diets. The power to continuously revamp and update product lines keeps the market fresh and competitive, thus fueling the market growth. In 2024, Mann Packaging unveiled its Newman’s Own Salad Kits. The salad kits were available from January 2025 and present 4 culinary-inspired flavor options comprising exquisite quality lettuve from Mann Packaging.

Growing Acceptance of Plant-Based and Vegan Diets

Rising demand for plant-based and vegan diets is a key growth driver in the packaged salad market. In January 2025, a joint study by YouGov and Veganuary estimated that around 25.8 million individuals worldwide attempted veganism. As people become more health-oriented and ever more aware about the ethical and environmental advantages of cutting down on meat, more are embracing plant-based alternatives such as packaged salads. Salads are inherently versatile and can be easily adapted to vegan diets by including a wide range of vegetables, grains, legumes, and plant-based proteins. This aligns with the increasing demand for convenient, meat-free meal options that do not compromise on taste or nutrition. The shift towards plant-based diets, driven by health, environmental responsibility, and moral reasons, is turning packaged salads into a popular choice among a large portion of the population.

Packaged Salad Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global packaged salad market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, processing, and distribution channel.

Analysis by Product:

- Vegetarian

- Non-Vegetarian

According to the packaged salad market research report, the vegetarian segment is the most significant in the market, propelled by an increasing inclination towards plant-based diets among consumers. This change is driven by the growing knowledge about the health advantages linked to vegetarian diets, such as reduced chances of chronic illnesses and improved overall well-being. Increasing worries regarding animal welfare and environmental sustainability are also supporting this trend, motivating more individuals to embrace vegetarian diets. The rise in flexitarian diets, where people cut back on meat without completely removing it, is further catalyzing the demand for vegetarian packaged salads. Producers are reacting by providing a variety of flavor profiles, nutrient-dense ingredients, and global recipes that address changing taste preferences. Moreover, vegetarian salads are viewed as lighter, more digestible, and accommodating to various dietary needs, rendering them a convenient and attractive option for everyday meals and quick snacks.

Analysis by Processing:

- Organic

- Conventional

Conventional holds the biggest packaged salad marker share because of its low prices and broad availability. Conventional agricultural methods enable extensive production, resulting in these salads being more widely accessible and affordable for a larger variety of consumers. These products are easier to find in popular retail outlets such as supermarkets, hypermarkets, and convenience stores, which enhances their market share. In contrast to organic choices, conventional salads are free from certification standards or higher costs, which makes them a favored option for budget-conscious consumers. The steady demand from households, institutional purchasers, and foodservice chains further bolsters the expansion of this segment. Additionally, traditional salads are frequently supported by well-established supply chains and effective distribution networks that guarantee availability throughout the year. The cost-effectiveness and trustworthiness of traditionally processed salads maintain its supremacy in the industry.

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online Stores

- Offline Stores

As per the packaged salad market overview, offline stores remain the largest distribution channel in the market, mainly because they provide instant access to new items and the ease of in-person shopping. Shoppers often choose to purchase quickly consumable products such as packaged salads from brick-and-mortar locations to guarantee they are selecting the freshest and best-quality options accessible. In-store promotions, appealing displays, and the chance to examine packaging and freshness directly further affect buying choices. Supermarkets, hypermarkets, and local grocery stores frequently have specific areas for pre-prepared meals, allowing busy shoppers to choose swiftly. Besides this, the trust associated with well-known local shops is crucial for repeat buying. Additionally, seasonal promotions and loyalty initiatives aid brick-and-mortar shops in keeping buyers and sustaining their status as the favored option for packaged salads.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

As per the packaged salad market outlook, North America is the leading region in the packaged salad market, hugely attributed to high consumer consciousness of health and wellness, along with a great retail infrastructure. In the US and Canada, there is a significant demand for convenient and nutritious meal choices such as packaged salads. The U.S. Department of Agriculture (USDA) states that in 2020, the typical American ate about 1.6 cups of vegetables daily, falling short of the advised 2.5 cups. Additionally, the widespread availability of these products in supermarkets and convenience stores across North America further boosts their market dominance in the region and positively affects packaged salad market revenue. This regional demand is further bolstered by the growing number of dual-income families and busy individuals, promoting dependence on fast, healthy meal options. Increasing awareness regarding calorie consumption, portion sizes, and clean-label ingredients is further supporting the market dominance of North America.

Key Regional Takeaways:

United States Packaged Salad Market Analysis

The United States is witnessing increased packaged salad adoption, reaching 86.70% of the market share in North America, due to the growing focus on healthy lifestyles. A survey shows that almost 7 out of 10 (68%) American participants view healthy eating habits as a key element in enhancing an individual's likelihood of living a long and healthy life. Consumers are becoming more conscious about their nutritional intake, driving the demand for convenient and nutritious meal options. Packaged salad offers a quick and fresh alternative for individuals seeking balanced eating habits without compromising on convenience. Health trends, including organic and low-calorie meals, are further boosting interest in pre-washed and ready-to-eat leafy greens. The rising awareness of diet-related health concerns is encouraging people to integrate packaged salad into daily routines. Food service providers and supermarkets are expanding product availability to cater to evolving consumer preferences. Marketing campaigns emphasizing the benefits of maintaining a healthy diet through convenient meal solutions are strengthening the shift towards packaged salad consumption across different demographic groups.

Europe Packaged Salad Market Analysis

Europe is witnessing growing packaged salad adoption due to increasing ready-to-eat product demand driven by busy lifestyles. The shift towards convenient and time-saving meal solutions is prompting consumers to choose pre-packaged, fresh, and nutritious options. Packaged salad serves as an ideal choice for those looking for healthy alternatives without extensive meal preparation. The fast-paced work culture is contributing to the demand for quick meals that align with dietary needs. The expansion of supermarket offerings and improved packaging technologies are making these products more appealing. Increased health awareness, along with changing consumption habits, is further fueling the demand. Rising promotions by food manufacturers emphasizing the benefits of ready-to-eat food products are playing a crucial role in influencing consumer choices, thereby strengthening packaged salad market expansion.

Asia Pacific Packaged Salad Market Analysis

Asia-Pacific is experiencing an upsurge in packaged salad adoption due to a growing vegan population. According to reports, approximately 24% of the Indian population was strictly vegetarian and 9% were vegan as of 2022. The growing adoption of plant-based diets is encouraging consumers to explore convenient and fresh food options. Packaged salad is gaining traction as an accessible and nutritious choice, supporting the shift toward plant-based lifestyles. Changing dietary habits, influenced by health-conscious individuals and ethical considerations, are accelerating demand. The expansion of plant-based food alternatives across retail and food service outlets is making it easier for individuals to incorporate fresh vegetables into their meals. Growing urbanization and increasing disposable incomes are further supporting market growth. Rising promotional efforts highlighting the nutritional value of plant-based meals are reinforcing consumer interest, leading to higher packaged salad consumption in response to evolving dietary preferences.

Latin America Packaged Salad Market Analysis

Latin America is witnessing increased packaged salad adoption due to the rising number of e-commerce channels. Digital transformation in the food industry is making it easier for consumers to access fresh and pre-packaged salad options through various online channels. The convenience of ordering ready-to-eat products from online food delivery platforms is catering to busy urban consumers. Improved cold chain logistics and doorstep delivery services are enhancing accessibility. Digital marketing strategies highlighting freshness and convenience are influencing purchasing patterns, further driving packaged salad demand.

Middle East and Africa Packaged Salad Market Analysis

The Middle East and Africa region is seeing increased packaged salad adoption due to the expansion of the tourism sector. The rising influx of international visitors is boosting the need for healthy and convenient food options in hotels, restaurants, and quick-service outlets. Packaged salad is becoming a preferred choice among travelers looking for fresh and nutritious meals. Hospitality providers are expanding their menu offerings to cater to evolving preferences. The growing tourism sector is fostering investments in food service and retail channels, supporting packaged salad consumption.

Competitive Landscape:

Major participants in the market are concentrating on product development, increasing their organic and clean-label options to align with evolving consumer tastes. For example, in 2023, Fresh Express introduced four new salad products, which consist of three chopped salad kits, including Twisted Caesar Lemon Caesar, Twisted Caesar Pesto Caesar, and Mexican Style and one crunchy mix (Butter Supreme). These kits showcased popular flavors and high-quality ingredients. The initiative sought to address the rising need for easy, plant-based, and global tastes in salads. Additionally, top firms are investing in innovative packaging solutions to prolong shelf life and preserve freshness, while also using environment-friendly materials to meet sustainability objectives. Strategic partnerships with retailers and foodservice operators enhance distribution channels and bolster market visibility. Businesses are also improving supply chain effectiveness and utilizing automation to optimize production. Marketing initiatives are placing greater focus on health advantages and clarity in sourcing.

The report provides a comprehensive analysis of the competitive landscape in the packaged salad market with detailed profiles of all major companies, including:

- Bonduelle

- Brightfarms Inc.

- Dole Food Company Inc.

- Earthbound Farm (Taylor Fresh Foods Inc.)

- Eat Smart

- Fresh Express (Chiquita Brands International)

- Gotham Greens

- Mann Packing Co. Inc. (Fresh Del Monte Produce Incorporated)

- Misionero

- United Salad Co.

- Zina's Salads Inc.

Latest News and Developments:

- June 2025: London salad chain Atis has opened its first stand-alone catering division, Catering Feasts, to meet growing demand for group ordering. Food-to-go operator Atis will now provide ordering for five or more and cater to central London offices and events. The service is being made available from the group's Borough Yards, Eccleston Yards, Regent Street and Eastcheap sites.

- May 2025: Fresh Express®, the salad manufacturing leader, is improving mealtimes with three irresistible new Chopped Salad Kits based on the boldest international flavors. From rich Mexican-inspired to hearty farmhouse classic to zesty orange sesame, these new kits provide a convenient way to transform everyday meals into desirable culinary escapades – without leaving home.

- May 2025: Salad Life launched in its operations in Delhi NCR to provide exquisite and fresh salads. Started as a cloud kitchen, Salad Life is built for speed, scale, and storytelling delivery through urban hubs across the country through major aggregators. Every order is carefully designed to be visually plated even in a box, Instagrammable and highly gratifying. Compostable packaging and changing season menu updates are planned too.

- May 2025: Taylor Farms introduced two chopped salad kits to bring consumers bold flavors and convenience including Creamy Italian and Jalapeño Popper.

- April 2025: Little Leaf Farms, the leading packaged lettuce brand produced sustainably with controlled environment agriculture (CEA), is launching a Sesame Ginger variety to its speedy-growing Salad Kits line.

- April 2025: Two ready-to-eat salad factories in Germany owned by Bonduelle were sold to Taylor Farms and Foodiverse, which will collaborate to spur growth for the combined businesses in Europe. The factories include Bonduelle's packaged salads business within the country in a release from Bonduelle. The transaction grows Foodiverse's worldwide staff to 2,650 employees and its production facility base to nine.

- February 2025: Dole Fresh Vegetables launched four new, trend-setting DOLE Salad Kit varieties, including Chopped Smash Burger and three Premium Kits in apple harvest, cool melon, and strawberry poppyseed flavors. This rollout is a testament to research into today's taste trends and a move to boost vegetable eating. With the rollout, Dole solidifies its market leadership, having recently been named most-trusted brand in Salad Kits, and looks toward substantial retail growth by April 2025.

Packaged Salad Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Vegetarian, Non-Vegetarian |

| Processings Covered | Organic, Conventional |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bonduelle, Brightfarms Inc., Dole Food Company Inc., Earthbound Farm (Taylor Fresh Foods Inc.), Eat Smart, Fresh Express (Chiquita Brands International), Gotham Greens, Mann Packing Co. Inc. (Fresh Del Monte Produce Incorporated), Misionero, United Salad Co., Zina's Salads Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the packaged salad market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global packaged salad market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the packaged salad industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The packaged salad market was valued at USD 14.3 Billion in 2025.

The packaged salad market is projected to exhibit a CAGR of 6.24% during 2026-2034, reaching a value of USD 24.7 Billion by 2034.

The packaged salad market is growing because of rising health consciousness, busy lifestyles demanding convenient meal options, increasing demand for ready-to-eat foods, and better availability across retail channels. Innovative blends, clean-label ingredients, and eco-friendly packaging are also contributing to expanding consumer interest and market growth.

North America currently dominates the packaged salad market, accounting for a share of 39.8%. The dominance of the region because of high consumer awareness regarding healthy eating, widespread availability of ready-to-eat options, strong retail infrastructure, and increasing preference for organic and clean-label products. Busy lifestyles further boost demand for convenient, nutritious meal solutions across the region.

Some of the major players in the packaged salad market include Bonduelle, Brightfarms Inc., Dole Food Company Inc., Earthbound Farm (Taylor Fresh Foods Inc.), Eat Smart, Fresh Express (Chiquita Brands International), Gotham Greens, Mann Packing Co. Inc. (Fresh Del Monte Produce Incorporated), Misionero, United Salad Co., Zina's Salads Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)