Over The Counter (OTC) Drugs Market Size, Share, Trends and Forecast by Product Type, Route of Administration, Dosage Form, Distribution Channel, and Region, 2025-2033

Over The Counter (OTC) Drugs Market Size and Share:

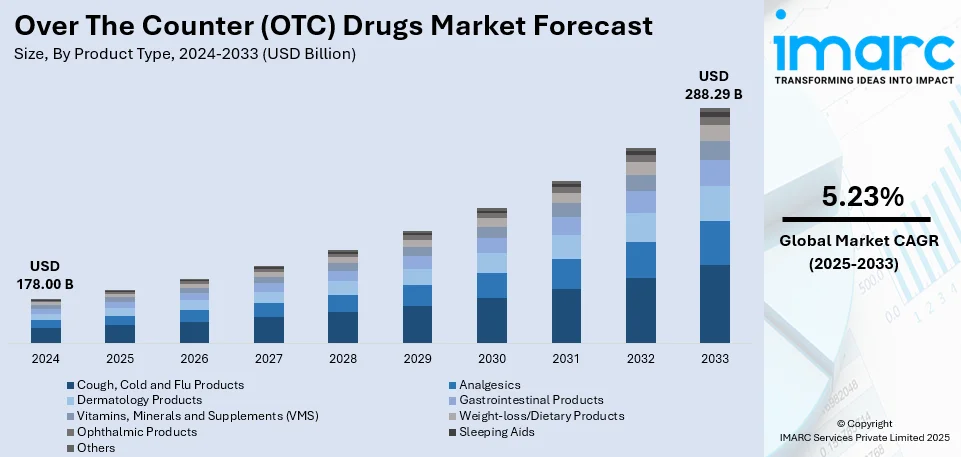

The global over the counter (OTC) drugs market size was valued at USD 178.00 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 288.29 Billion by 2033, exhibiting a CAGR of 5.23% from 2025-2033. North America currently dominates the over the counter (OTC) drugs market share at 42.2% in 2024. The market in the region is driven by strong consumer preference for self-medication, high healthcare expenditures, widespread retail availability, and favorable regulatory support for non-prescription medications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 178.00 Billion |

|

Market Forecast in 2033

|

USD 288.29 Billion |

| Market Growth Rate (2025-2033) | 5.23% |

The global OTC drugs market demand is expanding due to the increasing consumer preference for self-medication, driven by rising healthcare costs and convenience. In addition, the growth in e-commerce and online pharmacies is enhancing accessibility and boosting sales worldwide, which is aiding in the market expansion. Moreover, favorable regulatory frameworks, including prescription-to-OTC switches, are expanding product availability, driving the market demand. Regulatory oversight is influencing the market, with the U.S. Food and Drug Administration (FDA) proposing the removal of oral phenylephrine, a widely used ingredient in over-the-counter cold and cough medications, citing its lack of effectiveness as a nasal decongestant. This move is prompting pharmaceutical companies to reformulate the affected products. Besides this, the rising awareness of preventive healthcare and wellness trends is fueling the demand for vitamins, supplements, and pain relievers, providing an impetus to the market. Also, an aging population with chronic conditions is increasing reliance on OTC treatments for symptom management, supporting the market growth. Furthermore, pharmaceutical innovations, such as improved formulations and combination therapies, are enhancing efficacy and consumer trust, thus impelling the market growth.

The United States holds 89.80% shares, with OTC drugs market growth significantly driven by the high consumer trust in branded medications, supported by aggressive marketing and advertising campaigns. In line with this, the expansion of retail pharmacy chains and convenience stores ensures widespread product availability, fueling the market demand. Studies conducted by the U.S. Department of Health and Human Services (HHS) compare drug availability and pricing in the U.S. with other countries, offering valuable insights into the global OTC market. These findings play a significant role in shaping regulatory decisions and influencing pricing strategies. Concurrently, government initiatives promoting cost-effective healthcare solutions encourage the adoption of OTC drugs, contributing to the market expansion. Additionally, the rise of personalized healthcare apps and digital symptom checkers is empowering consumers to make informed self-medication choices, aiding the market growth. Furthermore, the increasing demand for natural and organic OTC products is driving innovation in herbal and clean-label formulations, boosting the market demand. Apart from this, the rising surge in travel and outdoor activities is driving the sales of OTC allergy, pain relief, and digestive health products, thereby propelling the market growth.

Over The Counter (OTC) Drugs Market Trends:

Expansion of E-Commerce and Digital Pharmacies

The expansion of e-commerce and digital pharmacies are influencing the OTC drug market trends by providing consumers with better access to drugs through enhanced convenience and ease. According to reports, the U.S. OTC drugs retail market shows an online share of 36.7% which will reach 50.8% by 2028. Pharmacy Times also reported in its 2024 article that online retailers will dominate one-third of all U.S. OTC drug sales during this current year. Moreover, the increasing use of artificial intelligence (AI)-powered recommendation systems together with subscription packages and telehealth options continues to boost online sales activity. Several pain relievers with allergy medications and digestive drugs are accessible through online platforms at cost-effective prices. The combination of AI-based recommendations with subscription services delivers improved customer satisfaction by offering tailored recommendations and automated reorder capabilities. Besides this, traditional pharmacies and new market participants have adopted digital platforms which leads to investments in online retail operations. Health regulators have also modified their rules to ensure safe OTC drug purchases online and support the market expansion. Furthermore, companies now use digital marketing methods, telemedicine partnerships, and influencer collaborations to make their brands more visible and sell products more efficiently. As a result, the e-commerce market has become a dominant growth engine for OTC drug makers, reaching consumers directly and growing their presence across the world.

Rising Consumer Preference for Self-Medication

Consumers are embracing self-care and self-medication because of high medical costs, increased health consciousness, and greater availability of medical information. For instance, the Consumer Healthcare Products Association reveals that U.S. adults primarily use OTC medications to treat their minor symptoms since 81% of them employ this approach. OTC medications give people the power to manage simple health conditions including the common cold, allergies, headaches, and gastrointestinal problems without doctor-prescription requirements. The market expansion is further driven by consumers preferring OTC medications together with convenient access to more products through retail stores pharmacies and online delivery networks. In addition to this, the consumer obtains better healthcare decision-making capacity through enhanced packaging and labeling techniques which provide clear dosing information and digital health engagement platforms. Also, the market demands therapy along with multi-symptom relief products because consumers want better ways to control their healthcare needs. Through their responses to consumer calls pharmaceutical businesses are developing innovative OTC formulations while expanding their marketing activities to provide safer use information for OTC medications. As a result, the transformation of customer behavior maintains a steady long-term expansion of the OTC medication sector which continues to prioritize self-administration of medications.

Growing Demand for Natural and Herbal OTC Products

The expanding consumer interest in herbal and natural OTC products with clean labels is transforming the OTC drugs market outlook because people want safer chemical-free alternatives. For example, the Vicks Double Power Cough Drops from P&G in 2024 feature Ayurvedic ingredients including menthol with eucalyptus oil and camphor which are available as soothing honey and warming ginger variants. The product targets patients seeking better throat and cough relief through herbal remedies which are gaining popularity in the market. Concurrent with this, the public shows rising caution about synthetic elements and their associated side effects which drives the demand for natural herbal medicine organic supplements, and homeopathic remedies. The wellness movement together with health prevention practices also promotes consumers to purchase herbal products that build immunity address pain and support digestive health. The accessibility and credibility of herbal medicines have improved because of increased investments in research and development (R&D) alongside regulatory approvals. Furthermore, the growing demand for consumer-preferred products has encouraged businesses to add botanical extracts vitamins, and functional components to their product lines. In confluence with this, the changing market demands cause businesses to adapt their strategic approach through transparent sustainable practices and ethical sourcing methods. As more people become aware of natural remedy advantages the market potential for herbal and plant-based OTC products is expanding, and sustaining the market growth in the coming years.

Over The Counter (OTC) Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global over the counter (OTC) drugs market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on product type, route of administration, dosage form, and distribution channel.

Analysis by Product Type:

- Cough, Cold and Flu Products

- Analgesics

- Dermatology Products

- Gastrointestinal Products

- Vitamins, Minerals and Supplements (VMS)

- Weight-loss/Dietary Products

- Ophthalmic Products

- Sleeping Aids

- Others

Cough, cold, and flu products dominate the OTC drugs market share with 26.5% shares due to high seasonal demand and increasing self-medication practices. In addition, the rising cases of respiratory infections, exacerbated by pollution and climate variations, are driving the market expansion. Consumers prefer multi-symptom relief formulations, prompting pharmaceutical companies to develop innovative combinations. The availability of OTC products across retail pharmacies, supermarkets, and online platforms enhances accessibility, fueling sales growth. Furthermore, the growing awareness of preventive healthcare is increasing the demand for decongestants, antihistamines, and natural remedies. Additionally, the rising preference for sugar-free, herbal, and pediatric-friendly formulations is attracting diverse consumer segments, further strengthening the market share.

Analysis by Route of Administration:

- Oral

- Parenteral

- Topical

- Others

The oral route leads the OTC drugs market at 37.6% shares due to its convenience, ease of administration, and widespread consumer preference. Tablets, capsules, syrups, and chewable formulations offer accessible solutions for common ailments, including pain relief, digestive issues, and cold symptoms. The segment is growing as pharmaceutical companies develop fast-dissolving tablets and liquid-filled capsules to improve efficacy and patient compliance. Besides this, the expanding retail and e-commerce distribution channels support accessibility, fostering the market demand. Also, the increased demand for herbal and sugar-free oral OTC drugs is shaping product innovation, catering to health-conscious consumers. Additionally, continuous advancements in extended-release formulations are enhancing long-lasting relief and boosting consumer trust. In addition, strong branding, aggressive marketing strategies, and an increasing preference for self-medication are driving the market's growth.

Analysis by Dosage Form:

- Tablets and Capsules

- Liquids

- Ointments

- Others

Tablets and capsules lead the OTC drugs market with 38.8% shares due to their stability, extended potency, and ability to accommodate various active ingredients. The growing consumer preference for single-dose efficiency and precise formulation is driving the demand for these dosage forms. Pharmaceutical advancements, such as enteric-coated and dual-layer tablets, enhance absorption and effectiveness. Moreover, the rising demand for combination therapies in a single tablet or capsule is fueling the market growth. The increasing popularity of plant-based and gelatin-free capsules is attracting vegan and vegetarian consumers. In line with this, efforts to reduce artificial additives and enhance ingredient transparency are strengthening consumer trust. Additionally, ongoing advancements in mini-tablet technology are catering to pediatric and geriatric populations, expanding the market size.

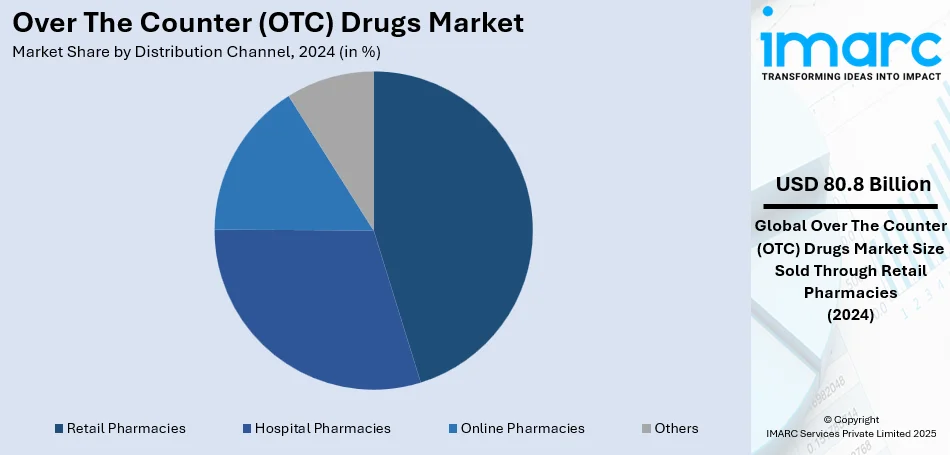

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Retail pharmacies account for the largest share of the OTC drugs market at 45.4% due to their widespread presence, consumer trust, and immediate product availability. The segment is driven by in-store pharmacist consultations, which influence purchasing decisions and encourage self-medication. The expanding pharmacy chains and independent drugstores are enhancing accessibility, particularly in urban and semi-urban areas. Besides this, the growing adoption of loyalty programs and promotional discounts is driving the repetitive adoption of these drugs. Moreover, retail pharmacies are integrating digital solutions, such as prescription scanning and automated refills, to improve convenience. Also, the rise of 24/7 pharmacies and in-store health clinics is supporting the market growth. Additionally, partnerships between pharmaceutical companies and retail chains are ensuring prominent shelf placement and targeted marketing, impelling the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the OTC drugs market with 42.2% shares, driven by high consumer spending, strong brand loyalty, and an expanding range of private-label offerings by major retail chains. The rise of personalized OTC solutions, such as age-specific and symptom-targeted formulations, is attracting diverse consumer segments. Besides this, multilingual packaging and culturally tailored marketing are increasing accessibility across different demographics. Moreover, the growing demand for natural and organic OTC products is fueling innovation in herbal and clean-label formulations. Additionally, regulatory agencies are streamlining approvals for new OTC drugs, fostering product launches. Regulatory agencies are streamlining approvals for new OTC drugs, fostering product launches. As of 2024, the U.S. Food and Drug Administration (FDA) has approved 50 novel drugs, broadening treatment options and fostering continued innovation in OTC formulations. Apart from this, major retailers and pharmacies are enhancing customer engagement through AI-driven recommendations and digital health tools, thus strengthening market growth and accessibility.

Key Regional Takeaways:

United States Over the Counter (OTC) Drugs Market Analysis

The U.S. OTC drugs market is expanding due to increasing self-medication trends and soaring healthcare costs. According to reports, the CHPA conducted its 2022 OTC Value Study and reported that OTC medicines save the U.S. healthcare system USD 167.1 billion annually. The high importance of OTC drugs emerges from their ability to reduce healthcare spending and provide better access to medical products. The market keeps growing because consumers can easily find OTC medications through pharmacies as well as supermarkets and online retailers. Moreover, the market holds dominance because major companies such as Johnson & Johnson along with Bayer and Procter & Gamble release numerous inventions. Furthermore, through regulatory oversight, the FDA maintains product safety standards as it introduces new medication formulations along with combination therapy options. Apart from this, the transition toward digital health and e-commerce technology has resulted in substantial growth of online OTC drug sales while Amazon and Walgreens continue to expand their digital OTC drug platforms. This is further boosting the adoption of OTC drugs in the region and catalyzing the market growth.

Europe Over the Counter (OTC) Drugs Market Analysis

The Europe OTC drugs market is growing because citizens demonstrate rising independence in healthcare decisions coupled with government policies that endorse self-treatment practices. For example, in 2023 German residents purchased OTC medicines worth 6 billion euros every year with half of this total dedicated to drugs or self-medications. Thus, millions of Germans regularly acquire these OTC drugs monthly from retail outlets. Germany leads the market alongside France and the United Kingdom because its expanding elderly population chooses natural and herbal remedies. The European regulations for drug safety and marketing standards force pharmaceutical producers to focus on developing high-quality pharmaceuticals. Besides this, the growth of digital pharmacies persists while DocMorris and Boots among other companies enhance their OTC product offerings through their online platforms. Furthermore, preventive healthcare initiatives in the region drive up sales of vitamins as well as dietary supplements and immune-boosting products. Also, the international pharmaceutical firms Sanofi and GlaxoSmithKline are supporting in expansion of the market competition across the region.

Asia Pacific Over the Counter (OTC) Drugs Market Analysis

The Asia Pacific OTC drugs market is expanding swiftly because people are becoming more aware of healthcare and their income increases while they prefer to handle their own medical needs. Research data shows vitamins/minerals and NSAIDs stand as the most commonly purchased OTC drugs by Chinese consumers when they medicate themselves since 58-52% of respondents selected these categories. This data demonstrates strong market demand for these OTC categories in China. Moreover, the consumption of pain relievers cold medicines, and digestive aids shows increasing popularity for over-the-counter medications throughout India, Japan, and Australia. Furthermore, people depend more on OTC treatments for their minor health problems as the region is experiencing rapid urbanization. As a result, local manufacturers together with international companies develop new OTC product lines that cater to a variety of population needs.

Latin America Over the Counter (OTC) Drugs Market Analysis

The OTC drugs market in Latin America is expanding as a result of increased awareness about self-care and the growing middle class. The data from industrial reports shows that self-medication with OTC drugs affects more than 30 million Mexican people who use these drugs at least once annually in 2023. The extensive drug usage within the population becomes evident through the findings of the Mexican Health and Aging Study (MHAS) which reports this number. This market also expands because consumers alter their preferences while influencing the direction of this trend. Natural and herbal remedies have become increasingly popular among citizens throughout Brazil and Argentina. People now have easier access to OTC drugs through updated regulations. Furthermore, the growth of the OTC drug market is powered by the growing number of prevalent chronic diseases that pharmacies and supermarkets offer throughout the market. As a result, local companies collaborate with foreign pharmaceutical corporations to make more products accessible throughout their distribution networks.

Middle East and Africa Over the Counter (OTC) Drugs Market Analysis

The OTC drugs market in the Middle East and Africa is experiencing expansion because people become more interested in self-care and developing better healthcare knowledge. A detailed industrial report shows that the United Arab Emirates OTC drugs market reached a USD 2.79 billion estimated value for 2023 because numerous UAE residents purchase these drugs. Consumers now have an increased disposable income that allows them to adopt preventive health practices, showing a rising interest in natural and homeopathic products. Furthermore, the OTC drug consumption rate increases in Saudi Arabia and South Africa as these countries implement government-provided healthcare programs. Customers can easily access OTC medications through digital health tools and electronic platforms. In line with this, the territory attracts international and local pharmaceutical businesses that use its expanding OTC medicine demands to enter and maximize their presence.

Competitive Landscape:

Companies in the OTC drugs sector are concentrating on strategic mergers, acquisitions, and partnerships to enhance their product portfolios and expand their global presence. Leading pharmaceutical companies are actively investing in prescription-to-OTC switches to capitalize on consumer demand for self-medication. Digitalization is shaping the industry, with brands leveraging e-commerce and direct-to-consumer sales channels to enhance accessibility. Companies are also emphasizing natural and herbal formulations to cater to the growing preference for clean-label and organic products. Furthermore, R&D efforts are directed toward innovative dosage forms, such as dissolvable strips and chewable tablets, for improved consumer convenience. Additionally, aggressive marketing campaigns and influencer collaborations are strengthening the brand presence and consumer engagement in an increasingly competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the over the counter (OTC) drugs market with detailed profiles of all major companies, including:

- Alkem Laboratories Limited

- Bayer AG

- Daiichi Sankyo Company Limited

- Dr. Reddy’s Laboratories Ltd.

- GlaxoSmithKline plc

- Johnson & Johnson

- Novartis AG

- Perrigo Company plc

- Pfizer Inc.

- Piramal Enterprises Ltd.

- Reckitt Benckiser Group PLC

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

Latest News and Developments:

- January 2024: Sanofi S.A. initiated a demerger of its OTC segment, aiming to streamline operations and focus on core pharmaceutical activities.

- January 2024: Dr. Reddy's Laboratories Ltd. acquired Haleon's nicotine replacement therapy business outside the U.S. for approximately USD 632 million, enhancing its OTC portfolio.

- September 2024: Indian Pharmaceutical Alliance (IPA) responded to CDSCO reports indicating that over 50 medicines, including OTC products, failed quality tests, emphasizing the need for clear distinctions between substandard and counterfeit drugs

- August 2024: Daiichi Sankyo and Merck have extended their global agreement to co-develop and co-commercialize MK-6070, a T-cell engager targeting delta-like ligand 3 (DLL3) for cancer treatment. The partnership excludes Japan, where Merck holds exclusive rights. Merck will manage manufacturing and supply for MK-6070.

Over The Counter (OTC) Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cough, Cold and Flu Products, Analgesics, Dermatology Products, Gastrointestinal Products, Vitamins, Minerals and Supplements (VMS), Weight-loss/Dietary Products, Ophthalmic Products, Sleeping Aids, Others |

| Routes of Administrations Covered | Oral, Parenteral, Topical, Others |

| Dosage Forms Covered | Tablets and Capsules, Liquids, Ointments, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alkem Laboratories Limited, Bayer AG, Daiichi Sankyo Company Limited, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc, Johnson & Johnson, Novartis AG, Perrigo Company plc, Pfizer Inc., Piramal Enterprises Ltd., Reckitt Benckiser Group PLC, Sanofi S.A., Sun Pharmaceutical Industries Ltd. and Teva Pharmaceutical Industries Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the over the counter (OTC) drugs market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global over the counter (OTC) drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the over the counter (OTC) drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The over the counter (OTC) drugs market was valued at USD 178.00 Billion in 2024.

IMARC estimates the over the counter (OTC) drugs market to exhibit a CAGR of 5.23% during 2025-2033, expecting to reach USD 288.29 Billion by 2033.

The OTC drugs market is driven by increasing self-medication trends, expanding retail and e-commerce channels, prescription-to-OTC switches, rising demand for natural and clean-label products, growing aging population with chronic conditions, and pharmaceutical innovations in fast-dissolving, extended-release, and combination formulations enhancing convenience, efficacy, and consumer trust.

North America currently dominates the market, driven by high consumer preference for self-medication, strong retail and e-commerce presence, regulatory support for prescription-to-OTC switches, widespread pharmacy networks, increasing demand for personalized and natural formulations, and continuous pharmaceutical innovations enhancing product accessibility and effectiveness.

Some of the major players in the over the counter (OTC) drugs market include Alkem Laboratories Limited, Bayer AG, Daiichi Sankyo Company Limited, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc, Johnson & Johnson, Novartis AG, Perrigo Company plc, Pfizer Inc., Piramal Enterprises Ltd., Reckitt Benckiser Group PLC, Sanofi S.A., Sun Pharmaceutical Industries Ltd. and Teva Pharmaceutical Industries Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)