Outsourced Customer Care Services Market Size, Share, Trends and Forecast by Service, End Use, and Region, 2025-2033

Outsourced Customer Care Services Market Size and Share:

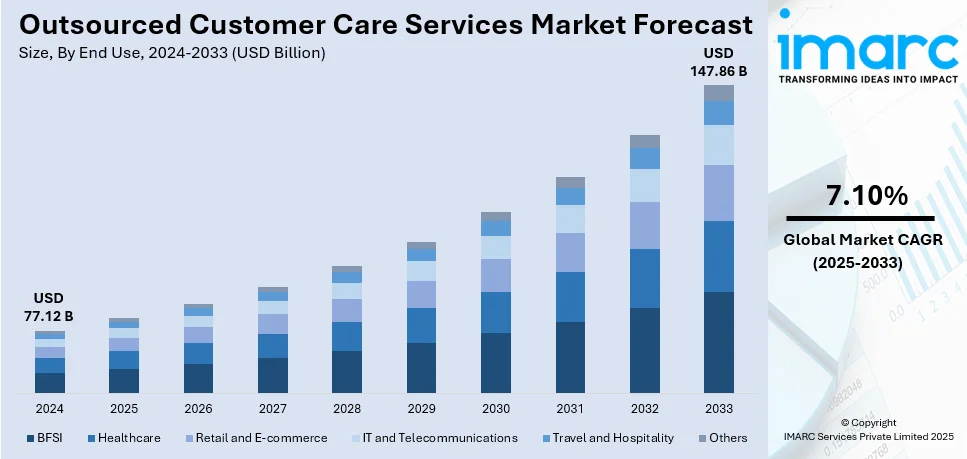

The global outsourced customer care services market size was valued at USD 77.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 147.86 Billion by 2033, exhibiting a CAGR of 7.10% from 2025-2033. North America currently dominates the market, holding a market share of over 43.7% in 2024. The market is expanding mainly driven by demand for cost-effective, efficient and scalable support solutions. Advancements in AI, automation and omnichannel platforms are reshaping the industry enhancing customer experience and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 77.12 Billion |

| Market Forecast in 2033 | USD 147.86 Billion |

| Market Growth Rate (2025-2033) | 7.10% |

Key outsourced customer care services market trends across the globe include cost efficiency, access to advanced technology and the growing demand for multilingual support. Businesses seek to reduce operational expenses while maintaining quality making outsourcing an attractive option. Rapid advancements in AI and automation tools enhance service delivery and efficiency further fueling adoption. The rise in ecommerce and globalization has heightened the need for 24/7 customer support across various channels driving companies to outsource. According to industry reports, in 2024, eCommerce was reported to continue to thrive with 2.71 billion global shoppers contributing to a $6.3 trillion industry projected to reach $8 trillion by 2027. Online retail purchases will account for 20.1% of total retail this year increasing to 22.6% by 2027. Additionally, a focus on personalized customer experiences and the ability to scale operations quickly in response to market demands contribute to the growth of this industry.

Key drivers in the United States outsourced customer care services market include the need for cost reduction, technological innovation, and the demand for seamless customer experiences. Companies are turning to outsourcing to manage rising operational costs while accessing specialized expertise. The integration of AI, analytics, and cloud-based solutions allows providers to offer personalized, efficient and scalable support. The growth of ecommerce, remote work trends, and multi-channel communication preferences have intensified the need for round-the-clock and high-quality customer service. For instance, the Census Bureau reported that U.S. retail ecommerce sales for Q3 2024 reached $300.1 billion up 2.6% from Q2. Ecommerce constituted 16.2% of total retail sales which were $1,849.9 billion reflecting a 1.3% increase. As compared to Q3 2023, e-commerce sales rose by 7.4%. Regulatory compliance and data security standards in the U.S. further push businesses to partner with trusted outsourcing providers ensuring reliability and efficiency.

Outsourced Customer Care Services Market Trends:

Integration of AI and Automation

The incorporation of AI and automation into customer support is transforming the way companies interact with their clients, thereby driving growth in the outsourced customer care services market. Chatbots and virtual assistants that leverage natural language processing can quickly address routine questions providing prompt solutions and minimizing wait times. Automated workflows streamline processes like ticket routing, feedback collection and follow-ups enhancing efficiency and minimizing human intervention for repetitive tasks. These tools not only improve response speed but also ensure consistency in service quality. Advanced AI systems analyze customer data to predict needs and provide personalized solutions. For instance, in August 2024, VXI Global Solutions was honored with Frost & Sullivan's 2024 Asia-Pacific Customer Value Leadership Award for its innovative customer experience (CX) management services. The company utilizes artificial intelligence (AI) and machine learning (ML) technologies to enhance the efficiency of contact centers, streamline operations and improve customer satisfaction demonstrating its commitment to delivering exceptional customer experiences. This technological shift allows companies to scale support operations while focusing human agents on complex issues.

Omnichannel Support

Omnichannel support ensures customers can interact with businesses seamlessly across various communication channels such as phone, email, social media, live chat and messaging apps. This approach allows for consistent service quality enabling customers to switch channels without losing context or repeating information. Advanced platforms integrate these channels into a unified system empowering agent to access a complete history of interactions and provide more efficient resolutions. By catering to customer preferences for diverse communication methods businesses enhance satisfaction and loyalty. For instance, in September 2024, ROI CX Solutions acquired Active TeleSource enhancing its omnichannel customer experience services in the utilities sector. ATI specializes in customer care for electric, gas and water utilities. This acquisition positions ROI for growth by leveraging ATI's expertise in the regulated utility market. Omnichannel strategies also allow companies to analyze interactions across platforms gaining valuable insights to refine processes and improve overall experiences.

Multilingual Support

Multilingual support plays a crucial role in delivering exceptional customer experiences in a globalized market. Businesses offering services in multiple languages can connect with diverse customer bases building trust and loyalty by addressing communication barriers. Culturally aware representatives add value by understanding regional nuances, preferences and behaviors ensuring interactions feel personalized and respectful. This capability is essential for industries like ecommerce, travel, and tech, where customers often span geographies. For instance, in October 2024, Teleperformance expanded its global presence by opening a new multilingual hub in Bali, Indonesia employing 500 Customer Experts to provide support in over 21 languages. This site will enhance service offerings contributing to TP's operations across Asia and Europe while continuing its growth in Indonesia and beyond. By employing advanced technologies like AI-powered translation tools alongside skilled agents, companies can provide consistent and high-quality support across languages enhancing accessibility and inclusivity while maintaining brand consistency on a global scale.

Outsourced Customer Care Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global outsourced customer care services market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service and end use.

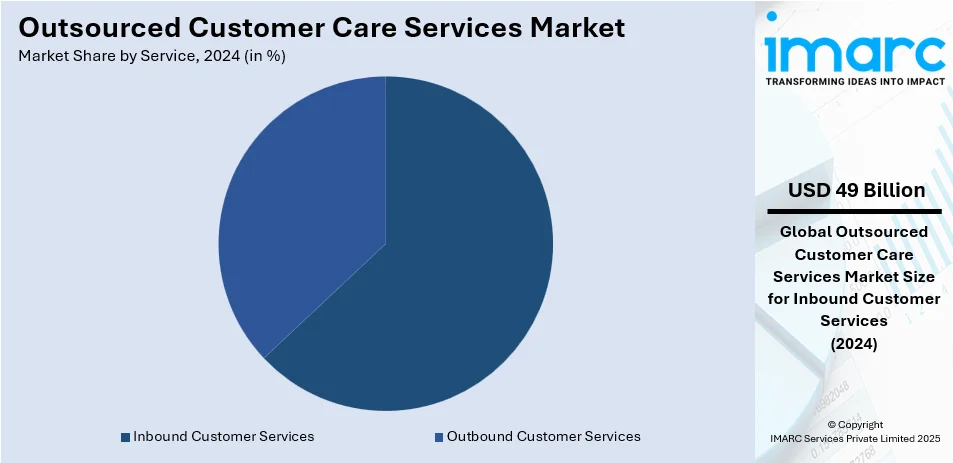

Analysis by Service:

- Inbound Customer Services

- Outbound Customer Services

Inbound customer services lead the market with around 63.5% of the overall outsourced customer care services market share in 2024. Inbound customer services dominate the outsourced customer care services market by providing essential support for customer queries, technical assistance and complaint resolution. These services are critical for businesses aiming to enhance customer satisfaction and loyalty. Companies outsource inbound services to ensure 24/7 availability, multilingual support and cost-effective solutions particularly in industries like retail, telecommunications and banking. The increasing use of AI and automation such as chatbots and IVR systems complements human agents enabling efficient handling of high volumes while maintaining a personal touch. For instance, in November 2024, Syntheia Corp. annouced its plans to enhance its inbound customer calls with AI-powered virtual assistants boosting sales and customer satisfaction. Since its beta launch Syntheia has processed over 750,000 conversations. This demand for seamless and customer-focused interactions makes inbound services a key driver in the outsourced customer care sector.

Analysis by End Use:

- BFSI

- Healthcare

- Retail and E-commerce

- IT and Telecommunications

- Travel and Hospitality

- Others

BFSI leads the market with around 27.1% of market share in 2024. The BFSI (Banking, Financial Services and Insurance) sector leads the outsourced customer care services market by end use due to its high demand for efficient and reliable customer support. This industry requires handling a large volume of customer interactions including inquiries, account management, loan processing and fraud detection. Outsourcing helps BFSI companies maintain 24/7 service availability, multilingual support and compliance with strict regulatory requirements. For instance, in March 2024, Indian Bank launched Indbank Global Support Services Ltd. (IGSS) to enhance its operational efficiency through outsourcing. Initially focusing on sourcing and collections IGSS plans to expand into processing, contact center services and technology functions. This move aims to streamline operations and support the bank's growth and innovation. The integration of advanced technologies such as AI-powered chatbots and data analytics enhances personalized interactions and operational efficiency. As digital banking and fintech adoption grow the BFSI sector's reliance on outsourcing continues to expand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 43.7%. North America emerged as the largest market for outsourced customer care services due to its well-established industries and high adoption of advanced technologies. Businesses in the region increasingly leveraged outsourcing to reduce costs, enhance efficiency and maintain quality in customer interactions. The demand for omnichannel support, personalized experiences and multilingual capabilities further drove growth particularly in sectors like BFSI, healthcare, ecommerce and technology. North America’s strong infrastructure for integrating AI and automation tools in customer service operations coupled with a skilled outsourcing workforce contributed to its leadership position in the global market while facilitating the outsourced customer care services market demand. For instance, in October 2024, RCC BPO and Fusion CX announced their plans to open new facility in designed to accommodate 1500 employees. This move solidifies their status as the largest employer in the country bolstering the outsourcing sector and creating numerous job opportunities in IT and business services.

Key Regional Takeaways:

United States Outsourced customer care services Market Analysis

In 2024, United States accounted for a share of 86.50% of the North America market. The United States outsourced customer care services market is driven by a focus on cost efficiency, quality enhancement and technological integration. Industries such as BFSI, healthcare, ecommerce and telecommunications rely heavily on outsourcing to meet the growing demand for personalized and multilingual customer support. The adoption of AI and automation tools including chatbots and analytics platforms enables seamless omnichannel experiences. Regulatory compliance and data security standards in the U.S. ensure robust service delivery. With increasing reliance on remote support models and the scaling of operations the U.S. remains a leader in the global outsourced customer care services market.

Europe Outsourced customer care services Market Analysis

The market for outsourced customer care services in Europe is witnessing substantial growth fueled by the rising need for efficient and cost-effective customer support solutions. Companies across various industries are outsourcing services like call center operations, technical support and customer inquiries to third-party providers enabling them to focus on core business functions. Key factors fueling this growth include advancements in technology such as AI-driven chatbots and omnichannel support alongside the need for 24/7 customer service. Businesses are seeking scalability and multilingual capabilities particularly in diverse markets like the UK, Germany and France. The rise of ecommerce and the growing emphasis on customer experience are expected to further boost the demand for outsourced customer care services in Europe. According to industry reports, Europe's retail eCommerce market valued at $631.9 billion is projected to grow at 9.31% annually reaching $902.3 billion by 2027. The UK leads with 9.3% of GDP from eCommerce while Germany, France and Italy show varying online shopping frequencies: 45%, 32% and 34% respectively.

Asia Pacific Outsourced customer care services Market Analysis

The Asia Pacific outsourced customer care services market is rapidly expanding driven by the region’s cost advantages, large talent pool and growing demand for enhanced customer experiences. Countries like India, the Philippines and China have become key hubs for outsourcing offering businesses affordable and high-quality customer support across various industries including ecommerce, banking and telecom. The increasing adoption of digital technologies such as AI, chatbots and cloud-based platforms is reshaping customer care models enabling companies to provide seamless omnichannel support. The rise of ecommerce and mobile-first consumer behavior in the region is further fueling the demand for 24/7 customer service. As businesses seek scalability and multilingual capabilities the Asia Pacific market is expected to maintain strong growth in the coming years.

Latin America Outsourced customer care services Market Analysis

The Latin American outsourced customer care services market is witnessing notable growth driven by cost efficiency, high-quality service offerings and the region’s proximity to North America. Countries like Mexico, Brazil and Argentina have become popular outsourcing destinations due to their large multilingual workforce and competitive labor costs. The growing demand for 24/7 customer support particularly in sectors like ecommerce, finance and telecom is propelling market expansion. Additionally, advancements in automation, AI-driven chatbots and omnichannel service platforms are enhancing customer experience and operational efficiency. As businesses in North America and Europe increasingly seek nearshore outsourcing solutions Latin America’s strategic geographic location and skilled labor force position it as a key player in the global outsourced customer care market.

Middle East and Africa Outsourced customer care services Market Analysis

The Middle East and Africa (MEA) outsourced customer care services market is growing as businesses in the region seek cost-effective and efficient solutions to manage customer interactions. Countries like South Africa, Egypt and the UAE are emerging as key outsourcing hubs, offering skilled labor, multilingual support and competitive pricing. The market is driven by the increasing demand for customer service in sectors such as telecom, retail and banking alongside the growing adoption of digital technologies like AI, chatbots and cloud-based platforms. As regional companies expand their customer base and demand for 24/7 support rises outsourcing customer care is becoming a strategic solution. The region’s focus on improving customer experience and operational efficiency is expected to sustain market growth in the coming years.

Competitive Landscape:

The outsourced customer care services market is highly competitive with numerous global and regional players offering a range of solutions across industries such as telecom, retail, finance and ecommerce. Key service providers differentiate themselves through factors like technological innovation, service scalability, multilingual capabilities and cost efficiency. With the increasing adoption of AI, automation and omnichannel platforms companies are striving to integrate advanced technologies into their offerings to enhance customer experience and operational efficiency. Additionally, the rise of nearshore outsourcing and a focus on 24/7 support are shaping competition prompting providers to continuously improve service quality and expand their geographical reach. For instance, in November 2024, Accenture invested in Cresta a company specializing in AI powered contact center solutions to enhance efficiency and productivity. The collaboration will integrate Cresta’s technology with Accenture’s AI Refinery™️ driving personalized customer interactions and operational excellence. This partnership aims to transform customer service across various industries boosting satisfaction and reducing costs.

The report provides a comprehensive analysis of the competitive landscape in the outsourced customer care services market with detailed profiles of all major companies, including:

- Accenture plc

- Amdocs

- Concentrix Corporation

- Foundever

- Startek

- TD SYNNEX Corporation

- Teleperformance SE

- Transcom

Latest News and Developments:

- In June 2024, Microsoft announced its plans to launch Dynamics 365 Contact Center a cloud solution that prioritizes Copilot features. This innovative platform enhances customer service by leveraging generative AI to improve self-service options, intelligent routing and agent support. It integrates seamlessly with existing CRM systems and aims to boost service efficiency and customer satisfaction across all engagement channels.

- In January 2024, Brown Gibbons Lang & Company (BGL) announced the sale of VOXDATA Solutions to Qualfon Group. Located in Montreal, VOXDATA will enhance Qualfon's global reach by providing multilingual customer service capabilities. This acquisition aims to strengthen service offerings in North America, drive growth, and create new employment opportunities for both companies.

Outsourced Customer Care Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Inbound Customer Services, Outbound Customer Services |

| End Uses Covered | BFSI, Healthcare, Retail and E-commerce, IT and Telecommunications, Travel and Hospitality, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Amdocs, Concentrix Corporation, Foundever, Startek, TD SYNNEX Corporation, Teleperformance SE, Transcom, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the outsourced customer care services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global outsourced customer care services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the outsourced customer care services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The outsourced customer care services market was valued at USD 77.12 Billion in 2024.

IMARC estimates the outsourced customer care services market to reach USD 147.86 Billion by 2033, exhibiting a CAGR of 7.10% during 2025-2033.

The growth of the global outsourced customer care services market is driven by cost efficiency, the need for 24/7 support, advancements in AI and automation, increasing demand for personalized customer experiences, and the shift towards digital customer service channels like chatbots and social media platforms.

North America holds the largest share of the outsourced customer care services market, accounting for over 43.7% in 2024. This leadership is driven by high demand for omnichannel support, advanced AI-driven customer service solutions, and the strong presence of major outsourcing providers catering to industries like telecom, BFSI, and healthcare. These factors, collectively, are creating a positive outsourced customer care services market outlook across the region.

Some of the major players in the outsourced customer care services market include Accenture plc, Amdocs, Concentrix Corporation, Foundever, Startek, TD SYNNEX Corporation, Teleperformance SE, Transcom, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)