OTP Hardware Authentication Market Size, Share, Trends and Forecast by Product Type, Type, End User, and Region, 2025-2033

OTP Hardware Authentication Market Size and Share:

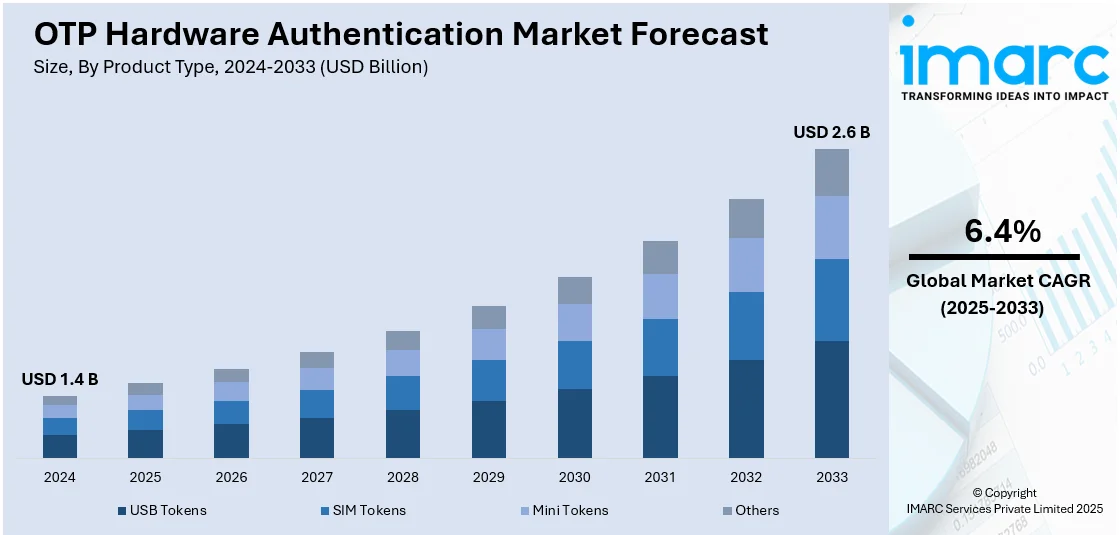

The global OTP hardware authentication market size was valued at USD 1.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.6 Billion by 2033, exhibiting a CAGR of 6.4% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.5% in 2024. The market is propelled by growing cybersecurity threats, strong regulatory frameworks, and rising demand for secure user authentication. The region's advanced digital infrastructure and high enterprise adoption of two-factor authentication contribute significantly to market expansion and technology integration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.4 Billion |

|

Market Forecast in 2033

|

USD 2.6 Billion |

| Market Growth Rate 2025-2033 | 6.4% |

The rising demand for secure, user-controlled authentication solutions is a key factor fueling the growth of the OTP hardware authentication industry. Growing incidents of credential theft, regulatory pressure to strengthen identity verification, and increased adoption of digital services are pushing organizations toward robust authentication mechanisms. Hardware tokens, including OTP generators and FIDO2-compliant devices, offer strong protection as they operate offline and are less vulnerable to remote attacks. In this context, regulatory developments have further accelerated this trend. For instance, in February 2025, the Reserve Bank of India (RBI) introduced a revised authentication framework that mandates two-factor authentication for digital payments. The framework identifies hardware tokens, such as YubiKeys and FIDO2 devices, as reliable alternatives to SMS OTPs. This regulation has prompted banks, fintech platforms, and payment processors to deploy hardware tokens across customer touchpoints to ensure compliance and prevent fraud. Additionally, growing awareness of hybrid authentication devices that combine OTP and certificate-based authentication is also influencing product development and enterprise-level deployment strategies.

The United States stands out as a critical market disruptor due to increasing concerns over legacy authentication vulnerabilities and federal cybersecurity warnings. Following the Salt Typhoon cyberattack in January 2025, federal agencies, including the FBI and CISA, issued advisories against using SMS OTPs due to known flaws in the SS7 protocol. In this context, the industry is witnessing a rapid shift toward secure hardware-based authentication methods. The recommendation to adopt phishing-resistant tools has spurred demand for physical tokens, especially among critical infrastructure providers, government agencies, and financial institutions. Enterprises are now investing in hardware solutions that eliminate dependency on mobile networks and shared credentials. The heightened scrutiny on authentication standards in the U.S. is also prompting vendors to integrate advanced features, such as biometric validation and secure elements, within OTP hardware devices. This broader push toward zero-trust architectures and hardware-enforced security models is expected to influence purchasing decisions and shape market dynamics across the North American region in the coming years.

OTP Hardware Authentication Market Trends:

Focus on Seamless Token Management

Vendors are increasingly focusing on improving usability and resilience to promote OTP hardware token adoption. One major concern among enterprises using time-based OTP systems is token desynchronization, which often leads to failed authentications and higher helpdesk dependency. To address this, market players are embedding features that simplify token recovery and reduce support load. For instance, in February 2025, RSA introduced a key update in its Cloud Authentication Service by enabling a resynchronization feature for OTP hardware authenticators. This allows users to restore out-of-sync devices by entering the serial number and two valid consecutive OTPs, eliminating the need for backend intervention. This advancement strengthens the appeal of hardware tokens in sectors that prioritize security but struggle with operational disruptions. As user-friendly features become standard, hardware OTP tokens are expected to see broader enterprise uptake, particularly where auditability and offline security are vital. This trend aligns with the growing demand for robust, easy-to-manage solutions that reduce administrative overhead without compromising security, ultimately contributing to a streamlined and scalable authentication infrastructure for large organizations.

Shift Toward Phishing-Resistant Solutions

Enterprises worldwide are steadily moving toward hardware authentication methods that can resist phishing and eliminate password-related risks. As cyberattacks grow targeted and sophisticated, especially those exploiting human error, there is a rising urgency for secure, user-centric login systems. FIDO2 hardware keys offer a high-assurance alternative by enabling passwordless authentication tied to a physical device, making them immune to phishing attempts. In January 2025, T-Mobile rolled out over 200,000 FIDO2 YubiKeys across its employee base, replacing legacy OTP methods. This large-scale shift not only reinforced internal cybersecurity but also demonstrated the scalability and practicality of hardware-backed passwordless authentication in real-world enterprise settings. By removing reliance on shared secrets and streamlining login experiences, the deployment sets a precedent for others operating in critical infrastructure and high-risk sectors. The trend reflects a clear move away from traditional OTP tokens toward advanced, phishing-resistant technologies. It also signals growing enterprise readiness to adopt modern identity verification tools that offer both enhanced protection and operational efficiency at scale.

Rising Adoption of Secure Hardware Tokens

Due to the rising instances of phishing and cyberattacks, several organizations are using OTP hardware devices as they are isolated from the network and cannot be externally accessed. As per an industry report, phishing attacks have surged significantly, with global incidents rising by 58% from 2022 to 2023. In 2023, nine out of ten organizations reported experiencing at least one phishing attack. This represents one of the key factors impelling the market growth. Moreover, as these devices have long battery life and offer maximum security, they are widely utilized to support the operation, maintenance and management of various end use industries. As such, Visa announced its tokenization technology has generated over USD 40 Billion in e-commerce revenue and prevented USD 650 Million in fraud in one year. With 10 Billion tokens issued, 29% of Visa transactions now use tokens, enhancing security and data control. Furthermore, the growing traction of hybrid tokens, which are a combination of OTP and certificate-based authentication within a single device, is stimulating the market growth. Apart from this, the key players are incorporating innovative features, such as liquid crystal display (LCD) screen, keypads for passwords and biometric readers, to enhance the security of their products. JumpCloud’s 2024 IT Trends Report reveals that 83% of organizations still use password-based authentication and require multi factor authentication (MFA), while 66% mandate biometrics. They are also offering wireless product variants, which is expected to positively influence the market growth in the coming years.

OTP Hardware Authentication Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global OTP hardware authentication market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, type, and end user.

Analysis by Product Type:

- USB Tokens

- SIM Tokens

- Mini Tokens

- Others

In 2024, the USB tokens segment led the OTP hardware authentication market, holding 34.8% of the market share, driven by rising demand for compact, user-friendly, and portable authentication solutions that offer secure offline access without relying on internet connectivity. Organizations across sectors preferred USB tokens for their plug-and-play functionality, tamper-resistant design, and minimal setup requirements. Their compatibility with a wide range of enterprise systems and ability to store cryptographic keys securely contributed to their popularity. Additionally, growing concerns over phishing attacks and credential theft pushed enterprises to adopt physical security devices that offer strong two-factor authentication. Regulatory mandates around data security, particularly in finance and healthcare, further boosted the deployment of USB tokens. Their cost-effectiveness and high reliability also made them a preferred choice for small to mid-sized businesses aiming to strengthen digital identity protection.

Analysis by Type:

- Connected

- Disconnected

- Contactless

In 2024, the disconnected segment led the OTP hardware authentication market, holding 48.7% of the market share, driven by increased demand for authentication devices that function independently of network connectivity, reducing susceptibility to cyberattacks. These solutions appealed to organizations operating in remote or secure environments where online access is restricted or unreliable. Disconnected tokens, which generate one-time passwords without relying on a live connection, offered enhanced privacy and reduced attack vectors, aligning well with regulatory standards for secure authentication. The segment gained traction in industries requiring high security and minimal external communication risks, including government agencies, defense, and critical infrastructure. Rising enterprise awareness of air-gapped security solutions and growing investment in compliance-driven authentication systems also supported market dominance. Their simple deployment, maintenance-free architecture, and robust security features made them a trusted option for mission-critical environments.

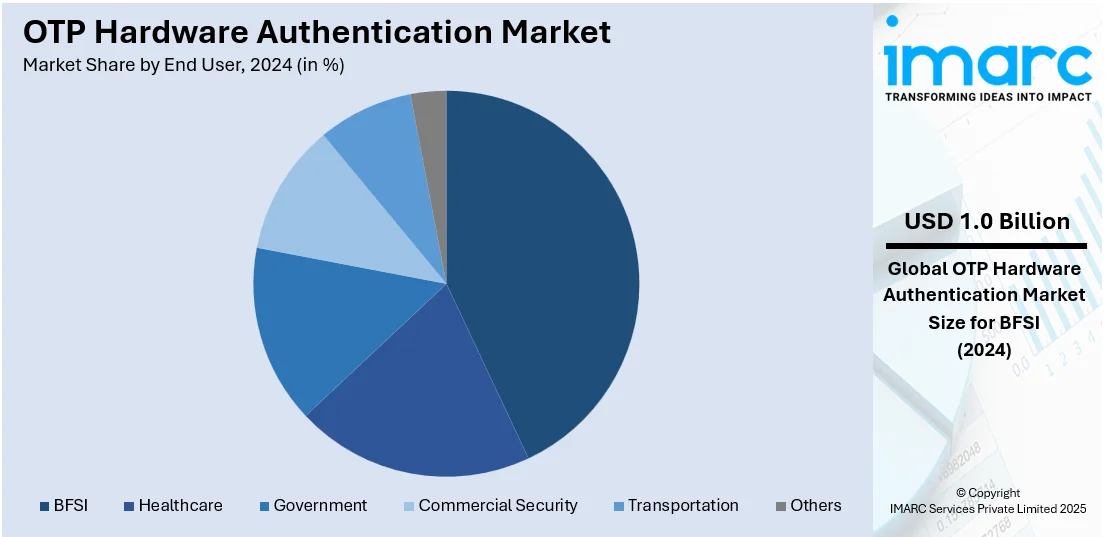

Analysis by End User:

- BFSI

- Healthcare

- Government

- Commercial Security

- Transportation

- Others

In 2024, the BFSI led the OTP hardware authentication market, holding 42.9% of the market share, driven by the sector’s heightened focus on fraud prevention, regulatory compliance, and secure customer transactions. Banks and financial institutions increasingly implemented hardware-based two-factor authentication to protect user identities and secure sensitive financial data amid a surge in digital banking and online payment services. The regulatory pressure to comply with data protection mandates such as PCI DSS and FFIEC further accelerated adoption. OTP hardware tokens offered a dependable method to reduce account breaches and limit access to authorized users only. With rising incidents of phishing, credential stuffing, and data theft, the BFSI sector prioritized robust authentication systems to safeguard user accounts, reduce operational risks, and maintain customer trust in digital banking platforms.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the North America led the OTP hardware authentication market, holding 36.5% of the market share, driven by its advanced cybersecurity ecosystem, widespread digital transformation, and strict regulatory landscape. The region experienced rapid adoption of strong authentication mechanisms across sectors like finance, healthcare, and government, where protecting sensitive data is paramount. Federal mandates, including HIPAA and NIST guidelines, compelled organizations to implement secure identity verification methods, giving a boost to hardware-based OTP systems. The rising volume of cyber threats and high-profile data breaches further emphasized the need for secure access control. Enterprises in the region invested heavily in two-factor and multi-factor authentication tools to reinforce user identity protection. In addition, high awareness levels, strong vendor presence, and investments in secure IT infrastructure sustained the region's leadership in OTP hardware authentication deployment.

Key Regional Takeaways:

United States OTP Hardware Authentication Market Analysis

In 2024, United States accounted for 84.30% of the market share in North America. The United States OTP hardware authentication market is primarily driven by the increasing incidents of phishing and credential-based cyberattacks. In accordance with this, regulatory mandates such as HIPAA, PCI-DSS, and NIST guidelines driving compliance-driven adoption across healthcare, finance, and government sectors, are propelling market growth. Similarly, the rise in remote workforces, prompting enterprises to secure endpoint access with portable, tamper-resistant authentication devices, is fostering market expansion. According to an industry report, more than 22 Million remote workers were registered in 2023, marking a threefold increase over the past decade. In 2021, the share of remote workers rose significantly to 17.9%. Furthermore, growing enterprise investment in zero-trust security frameworks supporting the integration of hardware tokens, is influencing market demand. The escalating demand from the defense and critical infrastructure sectors for air-gapped and offline authentication is further bolstering market development. Additionally, continual advancements in USB-C and mobile-compatible tokens are broadening device compatibility and market reach. The rising popularity of password less login environments aligning with OTP hardware as a transitional security layer, is also impelling the market. Besides this, increased cybersecurity funding under federal and state-level initiatives continues to support expansion and technological innovation in the market.

Europe OTP Hardware Authentication Market Analysis

The OTP hardware authentication market in Europe is progressing due to strict data protection regulations under the General Data Protection Regulation (GDPR), compelling organizations to adopt stronger authentication practices. In addition to this, increasing incidents of online fraud and identity theft driving demand for secure, offline verification methods, is impelling the market. An industry report indicates that digital fraud cases average over 249,000 annually. In the third quarter of 2022, Russia recorded the highest number of breached internet accounts, with 22.3 Million users affected. The expansion of digital banking and fintech services across the region requiring robust customer authentication protocols is augmenting product sales. Furthermore, favorable government-led eID and cybersecurity initiatives in countries like Germany and France promoting hardware-based security tools, are supporting market growth. The escalating adoption of electronic signatures for legal and administrative transactions is also encouraging higher use of certified OTP devices. Similarly, growth in cross-border business operations, necessitating standardized authentication mechanisms across diverse digital infrastructures, is expanding market scope. Moreover, rising awareness of supply chain vulnerabilities pushing enterprises to implement hardware-based identity verification is creating lucrative market opportunities.

Asia Pacific OTP Hardware Authentication Market Analysis

The market in Asia-Pacific is being propelled by the rise in mobile and internet penetration, increasing the need for secure user authentication in financial and e-commerce platforms. In line with this, favorable government initiatives promoting digital identity systems in countries, such as India and Singapore, accelerating hardware token deployment, is fostering market expansion. Similarly, heightened awareness of cybersecurity threats in sectors, like banking, telecom, and healthcare, encouraging investment in strong authentication tools, is bolstering market reach. According to the Reserve Bank of India (RBI), Indian banks experienced 13.2 Million cyber-attacks between January and October 2023, highlighting growing cybersecurity challenges in the country’s financial sector. Furthermore, cross-border trade expansion in Southeast Asia leading to increased demand for standardized, secure access protocols, is propelling growth in the market. Apart from this, ongoing technological advancements in lightweight and cost-effective token devices are enhancing product adoption among small and medium-sized enterprises.

Latin America OTP Hardware Authentication Market Analysis

In Latin America, the OTP hardware authentication market is propelled by the increasing cybersecurity breaches across financial institutions. Additionally, regulatory bodies in countries like Brazil and Mexico are reinforcing data protection compliance, driving heightened adoption of hardware tokens. Furthermore, growth in online government services, encouraging secure citizen access systems, is expanding market share. Moreover, rising investment in digital banking and fintech platforms creating demand for robust identity verification tools that offer offline functionality and tamper resistance, particularly in regions with limited internet infrastructure or high exposure to online fraud, is providing an impetus to the market. According to Distrito's Fintech Report 2024, Latin America attracted USD 15.6 Billion in fintech investments over the past decade, with Brazilian firms accounting for 66.7% of the total funding.

Middle East and Africa OTP Hardware Authentication Market Analysis

The market in the Middle East and Africa is growing, as a result of the increasing cyber threats targeting financial and government institutions. Similarly, various national digital transformation strategies, particularly in Gulf countries, encouraging stronger identity verification systems, are accelerating market growth. Furthermore, the expansion of mobile banking and digital wallets, generating demand for reliable, offline-compatible security tools, is supporting market demand. The Saudi Arabian Monetary Authority has actively advanced digital payments, resulting in a 62% increase in 2022. That year, the country recorded 8 Billion digital transactions, amounting to more than USD 426 Billion. Moreover, the rapid integration of OTP tokens in public service portals and e-governance platforms is enhancing citizen data protection and fostering trust in digital infrastructure across both emerging and developed markets in the region.

Competitive Landscape:

The market is shaped by rising innovation in authentication technologies, a focus on enhancing user convenience and increasing integration with enterprise security systems. Market players compete on product reliability, compact designs, and compliance with global security standards while expanding their presence through strategic partnerships, regional diversification, and tailored solutions for industry-specific security needs.

The report provides a comprehensive analysis of the competitive landscape in the OTP hardware authentication market with detailed profiles of all major companies, including:

- Authenex Inc.

- Deepnet Security

- Dell EMC

- Entrust Datacard Corporation

- Feitian Technologies Co. Ltd.

- Fortinet Inc.

- HID Global Corporation (Assa Abloy AB)

- Microcosm Ltd.

- One Identity LLC (Quest Software)

- OneSpan Inc.

- RSA Security LLC (Symphony Technology Group)

- SafeNet, Inc.

- Securemetric Berhad

- Symantec Corporation (Broadcom Inc.)

- Thales Group

- Yubico Inc.

Latest News and Developments:

- January 2025: SEALSQ and WISeKey announced a collaboration with NIST to develop a Quantum-Resistant USB Token. Their QUASARS project integrates CRYSTALS-Kyber and Dilithium algorithms into low-power semiconductors, targeting secure IoT applications across sectors, such as healthcare, automotive, and smart cities.

- August 2024: Mastercard launched its Payment Passkey Service globally. The service replaces OTPs with biometric authentication, enhancing security and streamlining online checkout. Partners include Axis Bank, Razorpay, PayU, and Juspay, aiming to reduce fraud and improve user experience through tokenized, password-less transactions.

- June 2024: Thales launched the SafeNet eToken FIDO Token USB-C globally. Available in single and 10-pack options, the token features a compact USB-C design compatible with major devices. Co-branded versions with Microsoft and FIDO Alliance are MISA-approved, enhancing secure authentication across Windows, Mac, Android, and iPad platforms.

- May 2024: Oracle introduced the Oracle Universal Authenticator, a security solution offering SSO with multifactor and password-less authentication. It supports adaptive risk-based protection for sensitive applications, centralized administration, and a user self-service portal.

- May 2024: Vodafone-linked PairPoint advanced its blockchain SIM technology to support tokenized deposits, including JP Morgan’s Onyx network. Through its Digital Asset Broker (DAB) middleware, PairPoint enables cross-chain interoperability for IoT financial transactions, with applications in automotive, cargo tracking, digital wallets, and collaborations involving Mastercard, Chainlink, and Deloitte.

OTP Hardware Authentication Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | USB Tokens, SIM Tokens, Mini Tokens, Others |

| Types Covered | Connected, Disconnected, Contactless |

| End Users Covered | BFSI, Healthcare, Government, Commercial Security, Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Authenex Inc., Deepnet Security, Dell EMC, Entrust Datacard Corporation, Feitian Technologies Co. Ltd., Fortinet Inc., HID Global Corporation (Assa Abloy AB), Microcosm Ltd., One Identity LLC (Quest Software), OneSpan Inc., RSA Security LLC (Symphony Technology Group), SafeNet, Inc., Securemetric Berhad, Symantec Corporation (Broadcom Inc.), Thales Group and Yubico Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the OTP hardware authentication market from 2019-2033.

- The OTP hardware authentication market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the OTP hardware authentication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The OTP hardware authentication market was valued at USD 1.4 Billion in 2024.

The OTP hardware authentication market is projected to exhibit a CAGR of 6.4% during 2025-2033, reaching a value of USD 2.6 Billion by 2033.

The market is driven by increasing cyber threats, data privacy regulations, demand for secure access control, and growing adoption of two-factor authentication. Expansion of digital services and remote work trends also fuel demand for reliable authentication solutions.

North America currently dominates the OTP hardware authentication market accounting for the largest market share of 36.5% in 2024. The growth is driven by widespread digitization, rising cybersecurity investments, strict regulatory compliance, and increased adoption of secure authentication solutions across banking, healthcare, government, and enterprise sectors.

Some of the major players in the OTP hardware authentication market include Authenex Inc., Deepnet Security, Dell EMC, Entrust Datacard Corporation, Feitian Technologies Co. Ltd., Fortinet Inc., HID Global Corporation (Assa Abloy AB), Microcosm Ltd., One Identity LLC (Quest Software), OneSpan Inc., RSA Security LLC (Symphony Technology Group), SafeNet, Inc., Securemetric Berhad, Symantec Corporation (Broadcom Inc.), and Thales Group and Yubico Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)