Osseointegration Implants Market Size, Share, Trends and Forecast by Product, Material, End User, and Region, 2025-2033

Osseointegration Implants Market Size and Share:

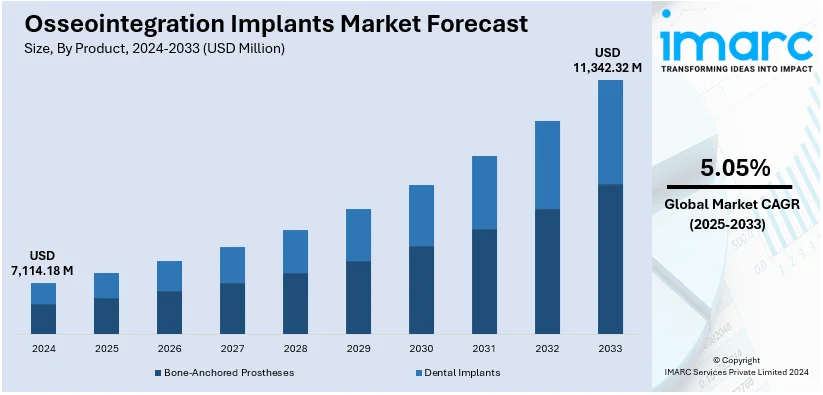

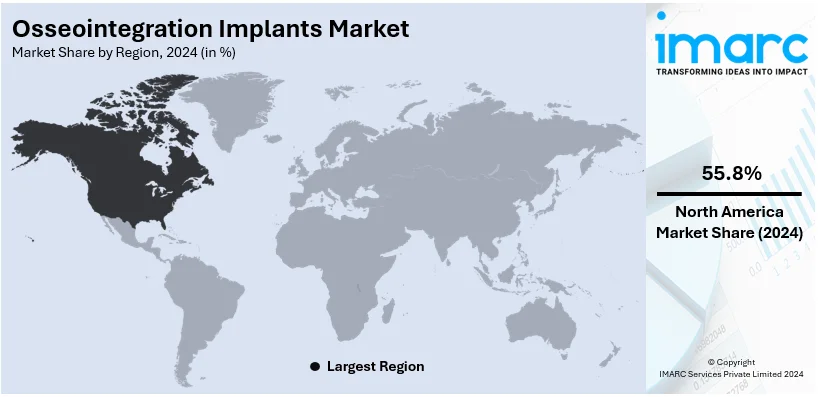

The global osseointegration implants market size was valued at USD 7,114.18 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 11,342.32 Million by 2033, exhibiting a CAGR of 5.05% from 2025-2033. North America currently dominates the market, holding a market share of over 55.8% in 2024. The market is primarily driven by the increasing aging populations, rising demand for dental and orthopedic procedures, advancements in implant technologies, growing awareness about oral health, expanding healthcare infrastructure, and the implementation of favorable reimbursement policies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7,114.18 Million |

|

Market Forecast in 2033

|

USD 11,342.32 Million |

| Market Growth Rate 2025-2033 | 5.05% |

The increasing prevalence of orthopedic and dental disorders, which require advanced implant solutions for effective treatment, is driving the global osseointegration implants market. In addition to this, the increasing number of fatal road traffic accidents and the growing number of individuals suffering from osteoarthritis and rheumatoid arthritis increases the need for joint and knee replacement surgeries. This leads to increasing consumer preferences for minimally invasive surgeries (MIS), which is propelling the growth of the market. Besides this, growth and innovations related to treatments improving durability, biocompatibility, and functionality, are fueling the market development. For instance, on March 28, 2024, Osstem Implant launched its TSIII SOI implant which boasts of the next-generation Super Osseointegration (SOI) surface treatment that improves healing and strengthens initial bone formation. This new surface treatment uses UV and HEPES buffering agents to create a super-hydrophilic coating that enhances biocompatibility and reduces the osseointegration period from up to six months to about two months. Apart from this, it is supported by the increasing healthcare expenditure, supportive government policies, and the growth in the adoption of minimally invasive surgical techniques for promoting the mass penetration of osseointegration implants in the developed and emerging markets.

To get more information on this market, Request Sample

The market in the United States is majorly influenced by the growing prevalence of sports-related injuries and trauma cases, which demand advanced implant solutions for rehabilitation and recovery. The rising incidence of chronic conditions like diabetes and vascular diseases, often leading to limb amputations, drives the demand for osseointegrated prosthetic systems. Moreover, a well-established healthcare infrastructure and strong reimbursement policies promote the adoption of these advanced implants among healthcare providers and patients. Additionally, the rising demand for cosmetic and reconstructive surgeries, particularly among individuals seeking functional and aesthetic enhancements, contributes to market growth. Besides this, the extensive research and development (R&D) activities undertaken by U.S.-based medical device manufacturers and the innovation of osseointegration implant technologies in the country. For example, on September 9, 2024, SINTX Technologies received a notice of allowance for a USPTO patent covering methods to bond bioactive silicon nitride to zirconia-toughened alumina (ZTA) surfaces. The company continues to grow its intellectual property portfolio, now holding 16 U.S. patents.

Osseointegration Implants Market Trends:

Growing Prevalence of Bone-related Disorders

Increasing incidences of bone conditions such as osteoarthritis, osteoporosis, and congenital anomalies are contributing factors to the use of osseointegration implants. An ever-growing elderly global population increases the desire for surgical operations using osseointegration processes, especially on dental and orthopedic prosthetics. There is an intensified demand for developed markets that account for older populations in their demographic groups. The World Health Organization estimates that around 528 million people across the globe were living with osteoarthritis in 2019, a 113% increase from 1990. In addition, 73% of individuals with osteoarthritis are aged 55 years and above. Moreover, 60% of these individuals are women. As a result, this increased prevalence of osteoarthritis among the elderly population is driving up the need for osseointegration implants since most of these patients require procedures like joint replacements. Thus, the osseointegration implants market is growing considerably due to an ageing population and a growing number of bone disorders.

Technological Advancements

Innovations in the materials, coatings, and techniques of implant surface are revolutionizing the efficacy and efficiency of osseointegration implants. Growth in the market is further fueled by the development of biocompatible materials, including titanium and its alloys, that ensure higher success rates for such implants, with patients experiencing durability and comfort. Also, the new 3D printing technologies are offering the possibility to create customized implants, thus bettering outcomes and patient satisfaction. These innovations increase osseointegration implant uptake by healthcare service providers and ease accessibility as well as their cost. Keystone Dental Holdings rolled out the GENESIS ACTIVE Implant System during November 2023. An example of such innovation is seen with the advancement of the new GENESIS ACTIVE Implant System, with Keystone Dental Holdings announcing it in November 2023. This dental implant surgical solution advances placement and restoration for the sector. Continued technological advancements are improving patient outcomes while making the overall process of implant procedures more efficient, and it is driving growth in the osseointegration implants market.

Rising Demand for Aesthetic and Functional Implants

The growing demand for implants that integrate functional advantages with aesthetic enhancement, especially in dental application, acts as a significant growth driver for the osseointegration market. Osseo integration implants provide a permanent and natural replacement of missing teeth that provides both functional and aesthetic advantages. This makes them highly in need among patients looking forward to improving the quality of their life, mainly driven by improving access and awareness in healthcare across the regions. In 2024, the World Health Organization report on oral health continues to reflect that oral health issues persist in the global scene. Estimated to have reached several about 2 billion, people suffering from caries in permanent teeth, and approximately 514 million children with caries in primary teeth, continue to present such immense demands for better dental solutions such as osseointegration implants. This growing demand for advanced dental care is a significant driving force behind the expansion of the osseointegration implants market across the world.

Osseointegration Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global osseointegration implants market report, along with forecasts at the global, regional, and country level from 2025-2033. Our report has categorized the market based on product, material, and end user.

Analysis by Product:

- Bone-Anchored Prostheses

- Dental Implants

Bone-anchored prostheses lead the market in 2024. Bone-anchored prostheses are considered a revolutionary solution for those individuals requiring limb replacement or rehabilitation. The advanced nature of these prosthetic products makes use of osseointegration technology, which involves the direct integration of an implant with bone tissue, thereby offering stability, functionality, and comfort more than socket-based prosthetics. Their growing adoption is due to the increasing prevalence of amputations due to trauma, diabetes, and vascular diseases, coupled with rising awareness about advanced prosthetic options. Users in developed as well as developing markets witness high demand as bone-anchored prostheses can enhance their movement, diminish their pain and even improve the quality of their lives. Besides, the continuous development of implant materials and surgical procedures further enhances their market potential, which makes bone-anchored prostheses a significant product in the osseointegration implant market.

Analysis by Material:

- Metallic

- Ceramic

- Polymeric

- Biomaterials

Metallic leads the market with around 63.5% of market share in 2024. Metallic materials are the mainstay of growth in the global osseointegration implants market, as they have excellent biocompatibility, durability, and mechanical strength. The most widely used metals, such as titanium and its alloys, are preferred for their osseointegration capability, especially for establishing a stable bonding with the bone tissue. These materials are resistant to corrosion and wear, which ensures the long-term functionality and reliability of implants used in dental, orthopedic, and maxillofacial applications. The growing need for durable, high-performance implants, especially for the aging population and for patients with trauma or degenerative conditions, gives vital significance to metallic materials in this market. Moreover, novel techniques in metal fabrication, for example, 3D printing and surface coating technologies, positively impact implant customization while further enhancing patient benefits.

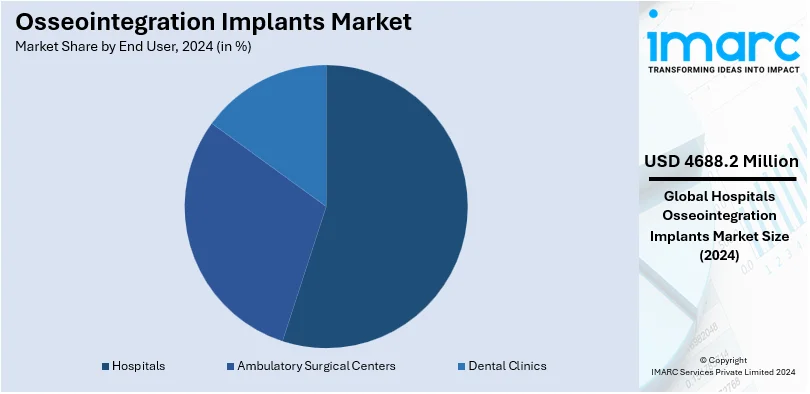

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Dental Clinics

Hospitals lead the market with around 65.9% of market share in 2024 due to the extensive provision of different types of medical services and surgical procedures that are provided for patients seeking proper care. Hospitals have an enormous client base with various types of patients in need of osseointegration implants. Patients may suffer from orthopedic, dental, or maxillofacial disorders and could be survivors of trauma and cancer requiring reconstruction solutions. A growth in surgeries combined with hospital admission due to the prevalence of conditions requiring implantation augments the demand for osseointegration implants. In addition to this, government and private investments in hospital facilities, especially in emerging economies, increase access to quality care, which in turn propels the growth of the market. Hospitals' ability to provide complete post-operative care and rehabilitation ensures optimal patient outcomes, which further strengthens their role in the expansion of the osseointegration implant market.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 55.8% due to advanced healthcare infrastructure, high adoption rates of innovative medical technologies, and a well-established regulatory framework. The increasing elderly population in the region and rising cases of trauma, osteoporosis, and dental conditions significantly fuel the demand for osseointegration implants. Countries like the United States and Canada have huge healthcare spending, strong reimbursement policies, and a strong presence of leading industry players, which fosters rapid adoption of advanced implants. Additionally, research and development (R&D) activities are further supported by funding from the government as well as the private sector to enhance product innovation and patient outcomes. With an increase in awareness regarding the advantages of osseointegration and a large percentage of the population suffering from chronic conditions requiring implants, North America is an essential contributor to the growth of the market. Its proactive attitude toward the adoption of cutting-edge medical solutions ensures sustained importance in the global market.

Key Regional Takeaways:

United States Osseointegration Implants Market Analysis

The United States is a significant region in the osseointegration implants market with the market share of 89.30%, due to the rise in the number of people with arthritis and mobility problems. According to the CDC, a report in 2024 stated that about 58.5 million adults aged 18 years and older are living with arthritis in the United States, with 25.7 million experiencing activity limitations due to arthritis. The projections indicate that, by 2040, this number will surge to 78 million adults, and this population is surely aged, attributed also to lifestyle, in musculoskeletal conditions. Arthritis is a primary cause of disability and surely does require surgical intervention like joint replacements, where osseointegration implants improve mobility and quality of life. Growing demand for advanced implants made from biocompatible materials, along with the increasing awareness of healthcare, is driving the growth of the market. In addition, efforts to increase access to orthopedic care are expected to boost the demand for osseointegration solutions in the United States.

Europe Osseointegration Implants Market Analysis

The Europe osseointegration market is expected to rise significantly due to the aging population in the region and the rise in osteoporosis. On January 1, 2023, the European Union population was 448.8 million, with one-fifth, or 21.3%, aged 65 years or above, according to the European Commission. This indicates the growing needs for medical interventions, such as osseointegration implants, to treat the bone-related condition associated with advancing age. Additionally, osteoporosis remains a serious health issue in Europe, where over 23 million people are at high risk of osteoporotic fractures, as NIH data in 2021 indicates. The majority of such fractures require surgery and implantation, which means the demand for more advanced osseointegration technologies is increased. Moreover, solid healthcare infrastructure combined with innovations happening in implantable materials and surgical techniques increase the success ratio of treatments for osseointegration, giving Europe a large market for its solutions.

Asia Pacific Osseointegration Implants Market Analysis

The Asia Pacific osseointegration implants market has high growth potential, as the region has a rapidly aging population and is witnessing rising osteomyelitis, among other bone-related disorders. According to NIH, the population aged 65 or older in China will grow more than double from 172 million or 12.0% of total population in 2020 to 366 million or 26.0% by 2050. This demographic change gives rise to increasing demand for state-of-the-art healthcare services. This encompasses conditions such as osteoporosis, arthritis, and joint degeneration, in addition to osseointegration implants. Also, the healthcare infrastructure is becoming more advanced within the region. There are enhanced investments in the medical technology space, thus paving the way for growth. It includes Japan-one of the most geriatric countries and India- one of the increasing healthcare conscious ones. Advances in implant materials, including personalized 3D printing of implants, improve success rates. Therefore, osseointegration implants are witnessing significant growth as the leading market area in the Asia Pacific region.

Latin America Osseointegration Implants Market Analysis

The Latin American osseointegration implants market is growing due to the increasing orthopedic disorder prevalence, primarily in Brazil. In this region, the growing demand for hip replacement surgeries supports the market expansion. According to estimates from the Brazilian Hip Society, there are about 70,000 hip arthroplasties performed annually. Only 17,000 of them are publicly funded, according to an NCBI report in 2020. Thus, this situation presents a sizeable opportunity for private healthcare service providers to help bridge the ever-growing demand gap for hip replacement and osseointegration implants. The aging population in Latin America and the rising awareness of advanced medical technologies are also contributing to the need for high-quality orthopedic implants. As more patients seek personalized and long-lasting solutions for conditions like osteoarthritis and osteoporosis, the market for osseointegration implants in Latin America is expected to continue its growth. The region is heading for tremendous gains in implant technology and patient care, thus offering some great opportunities that are expected in the coming years.

Middle East and Africa Osseointegration Implants Market Analysis

The Middle East and Africa (MEA) osseointegration implants market is witnessing significant growth with the increasing incidence of bone-related disorders like osteoarthritis (OA) and rising investments in healthcare. According to the NIH, the standardized prevalence of OA in the MENA region was 5,342.8 cases per 100,000 in 2019. This number rose by 9.3% from 1990. The growing case of OA, which is greatly promoted through the aging population, fuels the need for joint replacement surgeries, a scenario where osseointegration implants are fundamental. Additional strength to the increased demand for superior medical technologies that include osseointegration implants is provided with the increasing regional healthcare spending-estimated to stand at USD 135.5 Billion by the year 2027 in GCC, as per reports. Moreover, the rising preference and adoption of innovative and highly biocompatible materials in solutions from implant technology, which is currently enhancing the whole market growth through the MEA region.

Competitive Landscape:

The osseointegration implants market at the global level is highly competitive, with key manufacturers focusing on innovation, technology, and differentiation in products. The key companies majorly emphasize the research and development (R&D) activities of implant design, biocompatibility, and long-term durability. Companies have been investing significantly in minimally invasive solutions and personalized implants in order to bring better patient results. Market players are trying to increase their geographies through partnerships, collaboration, and distribution agreements. Rising consumption of advanced materials such as titanium and ceramic help in further innovation. Manufacturers target emerging markets by providing cost-effective solutions, which impact the market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the osseointegration implants market with detailed profiles of all major companies, including:

- Bicon

- CAMLOG Biotechnologies GmbH

- CONMED Corporation

- Dentsply Sirona

- Envista Holdings Corporation

- Henry Schein, Inc.

- Institut Straumann AG

- Integrum

- Osstem Implant Co. Ltd.

- Smith & Nephew

- Stryker Corporation

- Zimmer Biomet

Recent Developments:

- February 2024: ZimVie Inc., a leading life sciences company focused on dental and spine markets, today announced the launch of the TSX Implant in Japan, significantly expanding its product offerings in the region.

- March 2023: Dentsply Sirona introduced the DS OmniTaper Implant System, designed for a wide range of clinical applications. This system features an efficient drilling protocol and includes a pre-mounted TempBase component for immediate restoration, enhancing procedural workflows.

- May 2023: Zimmer Biomet Holdings Inc. completed its acquisition of Ossis, the company that makes customized 3D-printed hip replacement implants. This acquisition reinforces Zimmer Biomet's portfolio and further develops an earlier collaboration that Zimmer Biomet has had with Ossis, its partner in hip and pelvic replacement solutions across the Asia Pacific region.

Osseointegration Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bone-Anchored Prostheses, Dental Implants |

| Materials Covered | Metallic, Ceramic, Polymeric, Biomaterials |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Dental Clinics |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Bicon, CAMLOG Biotechnologies GmbH, CONMED Corporation, Dentsply Sirona, Envista Holdings Corporation, Henry Schein, Inc., Institut Straumann AG, Integrum, Osstem Implant Co. Ltd., Smith & Nephew, Stryker Corporation, Zimmer Biomet, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the osseointegration implants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global osseointegration implants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the osseointegration implants industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Osseointegration implants are medical devices designed to establish a direct interface between bone and an implant, allowing for improved stability and integration. These implants are commonly used in dental, orthopedic, and prosthetic applications to enhance functionality and patient outcomes by providing a seamless connection between bone and the implant material.

The osseointegration implants market was valued at USD 7,114.18 Million in 2024.

IMARC estimates the global osseointegration implants market to exhibit a CAGR of 5.05% during 2025-2033.

The global osseointegration implants market is driven by increasing demand for dental and orthopedic implants, advancements in implant technology, a growing aging population prone to bone-related conditions, and rising awareness of prosthetic solutions. Improved healthcare infrastructure further boosts market growth.

According to the report, bone-anchored prostheses represented the largest segment by product, driven by increasing cases of limb amputation, advancements in prosthetic designs, and growing acceptance of high-performance prosthetics for improved mobility and quality of life.

According to the report, metallic represented the largest segment by material, driven by its superior strength, biocompatibility, corrosion resistance, and ability to support long-term osseointegration, making it ideal for dental and orthopedic applications.

According to the report, hospitals represented the largest segment by end users, driven by their advanced surgical infrastructure, skilled professionals, and the rising number of implant procedures performed in these settings.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global osseointegration implants market include Bicon, CAMLOG Biotechnologies GmbH, CONMED Corporation, Dentsply Sirona, Envista Holdings Corporation, Henry Schein, Inc., Institut Straumann AG, Integrum, Osstem Implant Co. Ltd., Smith & Nephew, Stryker Corporation, Zimmer Biomet, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)