Gelatin Market Size, Share, Trends and Forecast by Raw Material, End Use, and Region, 2025-2033

Gelatin Market Size, Share, Growth Analysis & Outlook:

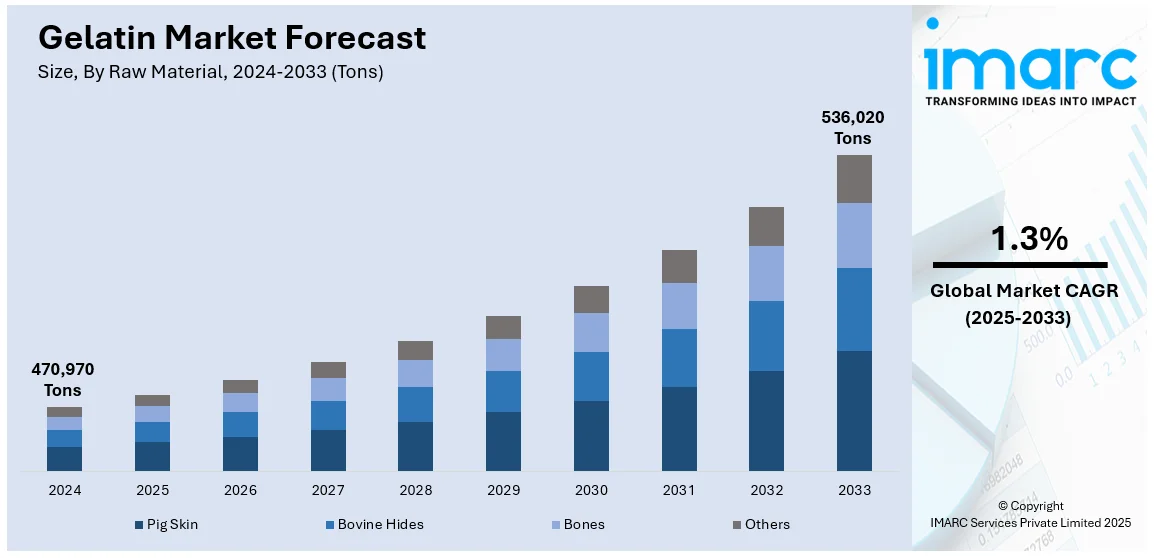

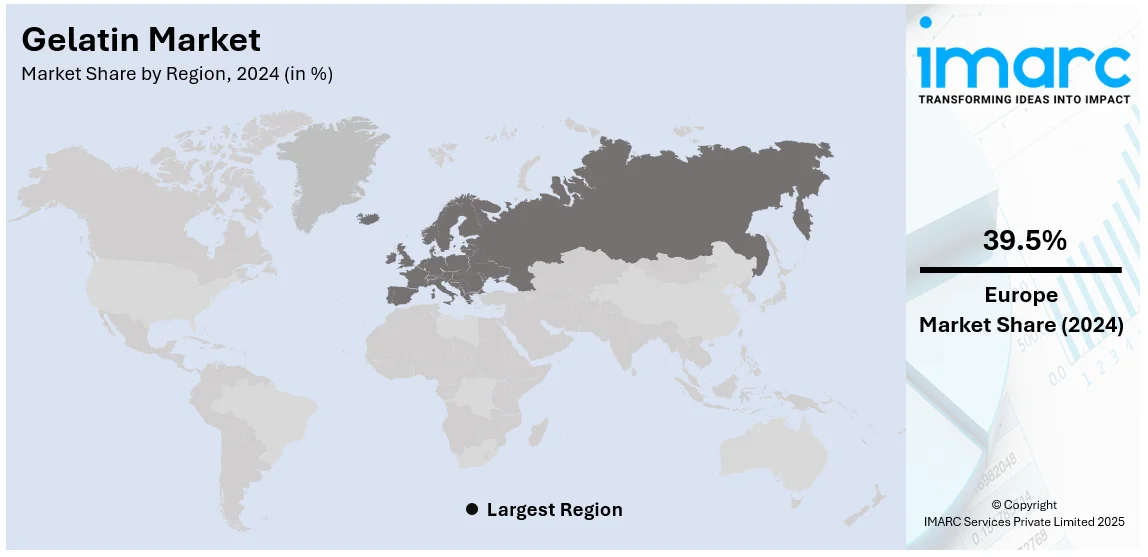

The global gelatin market size was valued at 4,70,970 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 5,36,020 Tons by 2033, exhibiting a CAGR of 1.3% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 39.5% in 2024. The market is experiencing steady growth driven by the growing consumer demand for natural and clean-label ingredients, the pharmaceutical and nutraceutical sectors' expansion due to increased health awareness, and continuous technological advancements in product manufacturing processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

4,70,970 Tons |

|

Market Forecast in 2033

|

5,36,020 Tons |

| Market Growth Rate (2025-2033) |

1.3%

|

The global gelatin market is experiencing significant growth due to increasing demand from the food, pharmaceutical, and cosmetic industries. Along with this, rising health awareness among consumers is fueling the use of gelatin in dietary supplements, protein-rich products, and functional foods. On 5th November 2024, GELITA announced that they will be presenting their latest innovations in gelatin and collagen peptides at Fi Europe 2023. Solutions include OPTIBAR for high-protein bars, SOLUFORM for low-sugar confectionery, and CONFIXX for fortified gummies. The company's experts will speak on protein bar innovations and the optimization of omega-3 supplements. In the pharmaceutical sector, its applications in capsules, drug delivery systems, and wound care are expanding due to its biocompatibility and ease of digestion. Additionally, the growing trend of clean-label and natural ingredients in cosmetics and food products is driving the adoption of gelatin. Moreover, expanding applications in photography, biotechnology, and packaging further contribute to the gelatin market outlook.

The United States stands out as a key regional market, primarily driven by the rising popularity of fortified beverages and functional food products, where gelatin is a key ingredient for texture and stability. Concurrently, increasing consumer preference for natural and organic ingredients is enhancing the demand for gelatin sourced from sustainable raw materials. On 6th July 2024, researchers from China developed biodegradable aerogel made of gelatin and salmon DNA that reflects sunlight, reducing the temperature by up to 16°C at direct sun exposure, and 1.8°C at night. Tested in Chengdu and Kunming, this material reduces energy consumption in buildings by up to 68.7% in its application as cladding and is recyclable or compostable. The gel also has the capability of exhibiting a visible light reflectance exceeding 100%, rendering it one of the most efficient passive cooling materials reported. In the medical field, advancements in regenerative medicine and tissue engineering are creating new applications for gelatin-based biomaterials. In addition, the growing interest in keto and collagen-rich diets has accelerated its use in health-focused products. Furthermore, innovations in packaging and biodegradable materials also contribute to the gelatin market share in the U.S.

Gelatin Market Trends:

Increasing demand in the food and beverage industry

The gelling, stabilizing, and thickening properties of gelatin are leading to its extensive utilization in food and beverages, thereby bolstering the overall market trend. It is widely applied in confectionery, dairy goods, desserts, and meat products. According to industry reports, global meat consumption is projected to reach between 460 Million by 2050. Therefore, this is significantly supporting the gelatin market revenue. Along with this, the expanding number of shoppers settling on items with spotless and natural ingredients has, as such, advanced the utilization of gelatin that is sourced from natural sources including animal bones and connective tissues. Moreover, the popularity of various types of functional foods including protein-rich and low-fat products is contributing towards the use of gelatin, and a more active use of gelatin is observed from gelatin stead extract. In an effort to cater to these demands, manufacturers are integrating gelatin into products to offer better texture, mouthfeel, and enhanced nutritional value, which in turn is driving the growth of the market.

Rapid expansion in the pharmaceutical and nutraceutical sectors

Pharmaceutical, nutraceutical, and allied industries are the major consumption areas for gelatin enumerable, fostering the growth of the gelatin market. According to a market research report, the global nutraceuticals market size reached USD 468.5 Billion in 2023. IMARC Group expects the market to reach USD 856.3 Billion by 2032, exhibiting a growth rate (CAGR) of 6.7% during 2024-2032. Thus, this is also propelling the gelatin market growth, in addition, the biocompatibility, non-immunogenicity, and great film-forming properties of gelatin are advantageous for a wide range of pharmaceutical uses such as capsule shells, tablet binders, and wound dressings. Apart from this, the rising incidence of chronic diseases and an aging population are accelerating demand for pharmaceuticals and, accordingly, gelatin-based products. Growing consumer preferences for health and wellness are driving the demand for gelatin in a myriad of food and nutraceutical products, particularly dietary supplements, and applications such as soft gel capsules and other delivery formats in the nutraceutical market. Moreover, increasing inclination towards the adoption of preventive healthcare and the growing consumption of dietary supplements also support the market expansion.

Considerable growth in the cosmetics and personal care industry

According to the gelatin market analysis, another crucial factor supplementing the gelatin market is the cosmetics and personal care industry. In this sector, gelatin is adapted for being film-forming, and able to hold onto moisture, which is why it is also known as a hydrolysate, mainly used as an ingredient in skincare, haircare, and cosmetic products. According to McKinsey, in 2023, global beauty market retail sales grew to USD 446 Billion, up 10 percent from 2022. Along with this, gelatin is considered a natural alternative to synthetic ingredients with increasing consumer inclination toward natural and sustainable beauty products. Furthermore, the wave of the "clean beauty" trend requiring gelatin-free formulations for cosmetics is enhancing the consumption rate of gelatin in personal care. With the safety-efficacy duo, the pharma and cosmetic-textile industry as well as nutraceuticals are providing impetus to the growth prospects of gelatin and thereby accelerating the gelatin market demand.

Gelatin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global gelatin market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on raw material and end use.

Analysis by Raw Material:

- Pig Skin

- Bovine Hides

- Bones

- Others

Pig skin stands as the largest component in 2024. Pig skin gelatin offers the benefits of better gel strength, clearness, and an array of applications such as food, pharmaceuticals, and cosmetics. By the effective extraction process and more affordable production costs most remarkably in comparison to bovine hides or fish, it certainly reigns supreme. It is further in line with the growing demand from consumers for natural, functional ingredients, heightening its attraction in the food and beverage industry. Additionally, the use of pig skin gelatin in confectionery products, meat processing, and dairy products as a gelling agent, emulsifier, and stabilizer is fueling the demand for this segment. Also, advancements in processing technologies have enhanced pig skin gelatin quality and its functional properties which have further fueled the growth of the pig skin gelatin market. According to the gelatin market forecast, the pig skin segment is the most prominent segment under the product category and is retaining its position as the market advances further, driven by additional benefits such as continuous development and the growing inclination of consumers towards natural pig skin.

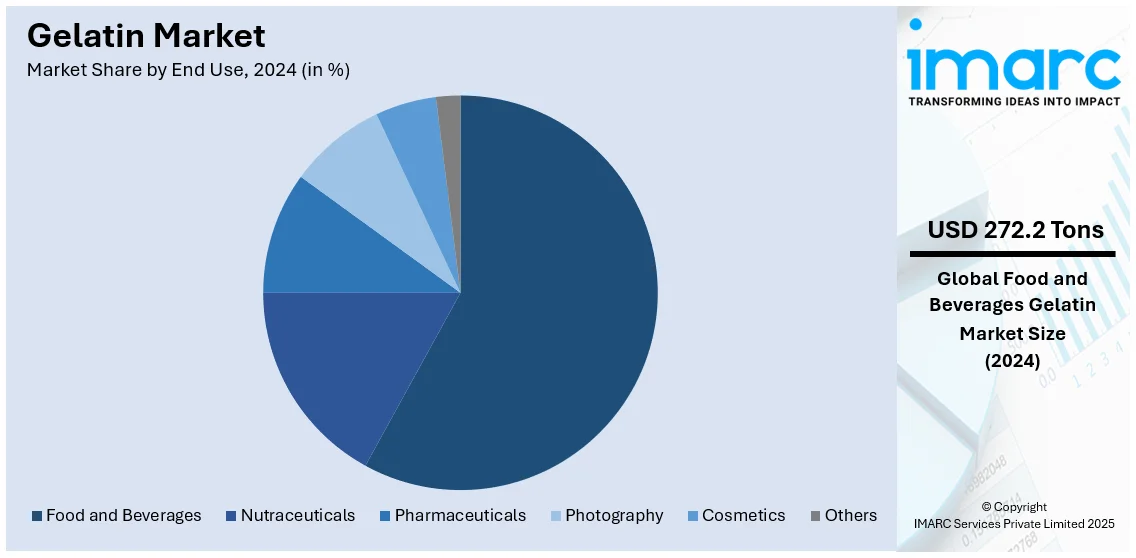

Analysis by End Use:

- Food and Beverages

- Nutraceuticals

- Pharmaceuticals

- Photography

- Cosmetics

- Others

Food and beverages lead the market with around 57.8% of market share in 2024, impelled by the multifunctional properties of gelatin in enhancing texture, stability, and mouthfeel in a plethora of products. Gelatin is used for the preparation of gelled foods in many applications such as confectionery, dairy products, desserts, and meat products to function as a gelling agent, stabilizer, thickener, or emulsifier. Additionally, the escalating requirement for clean-label and natural products makes it much more attractive as it is sourced from naturally occurring pig skin, bovine hides, and fish. In addition, the gelatin market insights that the demand for gelatin is further enhanced due to rising consumer inclination towards the intake of healthy products including functional foods and beverages containing protein content and low-fat products. Advances in food processing and formulation have enabled gelatin to be more widely used in new applications including protein bars, and other healthy snacks. Besides, gelatin helps enhance the sensory properties of food items such as texture and appearance, which is vital for food product producers to stay competitive in the market in terms of meeting consumer requirements. The dominance of food and beverages in the gelatin market is growing as health-conscious consumers continue to look for healthy and natural food alternatives, fostered by continuously changing product development and consumer trends.

Regional Analysis:

- Europe

- North America

- Asia

- South America

- Others

In 2024, Europe accounted for the largest market share of over 39.5%, due to innovation and the rising consumer preference for quality products. Along with this, the European market is equipped with state-of-the-art processing technologies and high quality and safety regulations, assuring that the standard in gelatin production in this market is higher compared to other markets. In addition, a strict regulatory landscape in the region presents the opportunity to use natural and clean-label ingredients, which is in line with the prevailing consumer tendency for health wellness and sustainability. Apart from this, major producers of gelatin operate in Germany, France, and the Netherlands where the increased application grades are in demand. Rapidly increasing consumption of gelatin in confectionery, dairy, and meat processing industries in Europe, due to a greater desire among European consumers for improved texture and functionality in food and beverage products. Furthermore, the pharmaceutical industry is also a lucrative source of revenue for the market, as gelatin is used to produce capsules and other medical gear for its superior biocompatibility and safety.

Gelatin Market Regional Takeaways:

United States Gelatin Market Analysis

In 2024, the US accounted for around 80.00% of the total North America gelatin market. The increasing utilization of gelatin in the healthcare industry is attributed to its wide-ranging applications in drug encapsulation, wound care, and vaccine production. According to U.S. Centers for Medicare & Medicaid Services, U.S. health care spending grew 7.5 percent in 2023, reaching USD 4.9 Trillion. Gelatin’s properties, such as biodegradability and biocompatibility, make it an ideal component for soft and hard capsules, contributing to its increasing demand. The market also benefits from innovations in drug delivery systems, which often leverage gelatin for sustained-release formulations. The growing focus on preventive healthcare and dietary supplements has further augmented its adoption, as gelatin is a critical ingredient in gummy vitamins and nutritional supplements. The versatility of gelatin to meet diverse pharmaceutical requirements ensures its robust incorporation across a spectrum of therapeutic products. The accelerated pace of product launches in the healthcare sector, supported by advancements in gelatin manufacturing processes, sustains its growing adoption, highlighting its indispensable role in meeting industry standards and regulatory compliance.

Asia Pacific Gelatin Market Analysis

Gelatin's role in enhancing the texture, stability, and shelf life of dairy products underpins its increasing use in this sector. For instance, India's dairy sector anticipated a 13-14% revenue enhancement for FY 2024-25. The rising consumption of value-added dairy items such as yogurts, puddings, and cheese highlight its functionality as a stabilizing and gelling agent. As dairy producers aim to innovate with fortified and flavored offerings, gelatin’s compatibility with other ingredients supports the development of nutritionally enriched products. Its utility extends to low-fat formulations, where it compensates for fat reduction without compromising taste or texture. The region's dynamic shift toward functional dairy products, including protein-enriched drinks and desserts, drives gelatin’s adoption. With consumer preferences inclining toward premium and convenience-oriented dairy offerings, gelatin’s ability to deliver superior product performance has become instrumental in sustaining this growth trajectory. This expanding market for gelatin in dairy underscores its adaptability to align with changing dietary trends.

Europe Gelatin Market Analysis

The use of gelatin in diverse food and beverage applications continues to grow, driven by its functional attributes as a thickening, gelling, and clarifying agent. According to reports, there are approximately 445k businesses in the food & drink wholesaling industry in Europe. Its incorporation in confectionery products, including marshmallows, gummies, and jellies, underscores its indispensable role in ensuring consistency and appeal. Gelatin’s role in enhancing the mouthfeel and stability of desserts, mousses, and dairy-based drinks also contributes to its widespread application. The shift toward innovative, clean-label, and reduced-sugar products further aligns with gelatin's properties, as it facilitates formulation without compromising on taste or quality. Additionally, gelatin’s use in alcoholic beverages, such as clarifying agents in wines and beers, demonstrates its versatility. As food manufacturers expand their portfolios to cater to emerging trends including plant-based offerings with gelatin-like textures, the demand for specialized gelatin solutions continues to rise, reflecting its integration across the industry.

Latin America Gelatin Market Analysis

Growing disposable income has fuelled the demand for cosmetic and personal care products, leading to increased adoption of gelatin. For instance, total disposable income in Latin America is set to rise by nearly 60% in real terms over 2021-2040. Its application in beauty formulations, such as anti-aging creams, hair conditioners, and masks, highlights its hydrating and strengthening properties. Gelatin’s collagen-rich composition aligns with consumer preferences for skin elasticity and rejuvenation products. Additionally, it enhances the formulation of bioactive ingredients, ensuring stability and efficacy. With the growing focus on natural and effective personal care solutions, gelatin is increasingly valued for its biocompatibility and functional benefits, making it a staple in modern beauty products.

Middle East and Africa Gelatin Market Analysis

The rising focus on health-conscious dining has elevated the adoption of gelatin in wellness meals. In regions where tourism drives culinary innovation, gelatin’s role in crafting health-oriented and sustainable menu options has become prominent. For instance, international visitor spending in the UAE increased nearly 40% in 2023, a 12% increase from 2019 levels, highlighting the country's strong global tourism demand. Its inclusion in high-protein snacks, fortified meals, and specialty desserts caters to travelers seeking wholesome and functional food experiences. This demand for balanced nutrition, paired with sustainability considerations, has positioned gelatin as an essential ingredient in meeting dietary expectations within the wellness-focused hospitality industry.

Leading Gelatin Manufacturers:

The global gelatin market is fiercely competitive, with major companies vying to gain a competitive edge through product innovation, strategic partnerships, and expansion of their production capacities to cater to the rising demand worldwide. Along with this, companies such as Gelita AG, Rousselot, and PB Leiner are also engaged in R&D activities that will improve the functional properties and overall applications of gelatin. They recently announced a new venture to create custom gelatin solutions for the expanding nutraceutical and pharmaceutical industries. In addition, industry constants are entering into mergers & acquisitions to bolster their market presence and benefit from new technology. Apart from this, companies are improving their manufacturing and production to further hold their standing in the market cater to the growing demands of customers from diverse end-use industries and create a positive gelatin market outlook.

The report provides a comprehensive analysis of the competitive landscape in the gelatin market with detailed profiles of all major companies, including:

- Gelita AG (Formerly DGF Stoess)

- Rousselot SAS

- PB Gelatin (Tessenderlo Group)

- Sterling Biotech Ltd

- Weishardt Group

- Nitta Gelatin

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- December 2024: BIO INX has launched BIORES INX, a gelatin-based resin for 3D bioprinting, enhancing its DLP platform compatibility. Developed from GelMA at Ghent University, the resin mimics the natural extracellular matrix. It offers biocompatibility, meets ISO 10993-5 standards, and eliminates challenges such as water evaporation during printing. BIORES INX expands BIO INX's bioresin portfolio to nine products.

- December 2024: Lapi Gelatine showcased its advanced gelatin and collagen peptide solutions at FiE 2024, emphasizing European production and high safety standards. The company highlighted its Lapigel, Peptolap, and Protesol brands, catering to diverse sectors including pharmaceuticals, food, cosmetics, and nutraceuticals. Fabio Da Lozzo, general manager, detailed their comprehensive portfolio of bovine, fish, and porcine-origin products. These innovations underscore Lapi Gelatine's commitment to quality, functionality, and meeting diverse client needs.

- August 2024: Aenova is set to launch a new gummy production line in Cornu, Romania, by late 2024, capable of producing 1 Billion gummies annually. This €8 Million investment supports starchless manufacturing of gelatin and pectin formulations, catering to food and pharmaceutical-grade needs. Gummies' rising global demand, valued at USD 9 Billion in 2023, highlights their convenience and efficacy. The facility offers halal, kosher, and vegan options, aligning with diverse dietary requirements.

- May 2024: Nitta Gelatin India Ltd (NGIL), a joint venture between Nitta Gelatin Inc., Japan, and Kerala State Industrial Development Corporation Ltd (KSIDC) commenced work on a Rs 60 crore expansion project in Kerala. The bhumi pooja for NGIL Collagen Peptide expansion project was conducted at the NGIL factory at Kakkanad, Kochi.

- February 2024: Caldic and Nitta Gelatin have formed a strategic partnership to enhance their offerings in the Food, Pharma, and Personal Care markets across Europe. The collaboration focuses on innovative collagen and specialty gelatin solutions, targeting regions such as Benelux, France, and Germany. Starting January 2024, the partnership aims to leverage Caldic's advanced facilities and market insights. This initiative supports the growing demand for gelatin and collagen peptide-based products.

Gelatin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | ‘000 Tons, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Pig Skin, Bovine Hides, Bones, Others |

| End Uses Covered | Food and Beverages, Nutraceuticals, Pharmaceuticals, Photography, Cosmetics, Others |

| Regions Covered | Europe, North America, Asia, South America, Others |

| Companies Covered | Gelita AG (Formerly DGF Stoess), Rousselot SAS, PB Gelatin (Tessenderlo Group), Sterling Biotech Ltd, Weishardt Group, Nitta Gelatin, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the gelatin market from 2019-2033.

- The gelatin market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the gelatin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gelatin market was valued at 4,70,970 Tons in 2024.

IMARC estimates the gelatin market to exhibit a CAGR of 1.3% during 2025-2033, reaching 5,36,020 Tons by 2033.

Some of the key factors that are driving the gelatin market include the growing consumer demand for clean-label and natural ingredients, rapidly expanding product applications in the food, pharmaceutical, and nutraceutical industries, continual technological advancements in manufacturing, and increased health awareness.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the gelatin market, accounting for a share exceeding 39.5% in 2024. This dominance is fueled by innovation, high safety standards, and strong consumer preference for natural and sustainable products

Some of the major players in the gelatin market include Gelita AG (Formerly DGF Stoess), Rousselot SAS, PB Gelatin (Tessenderlo Group), Sterling Biotech Ltd, Weishardt Group, and Nitta Gelatin, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)