OSS & BSS Market Size, Share, Trends and Forecast by Component, OSS & BSS Solution Type, Deployment Mode, Organization Size, Industry Vertical, and Region 2026-2034

OSS & BSS Market Size and Share:

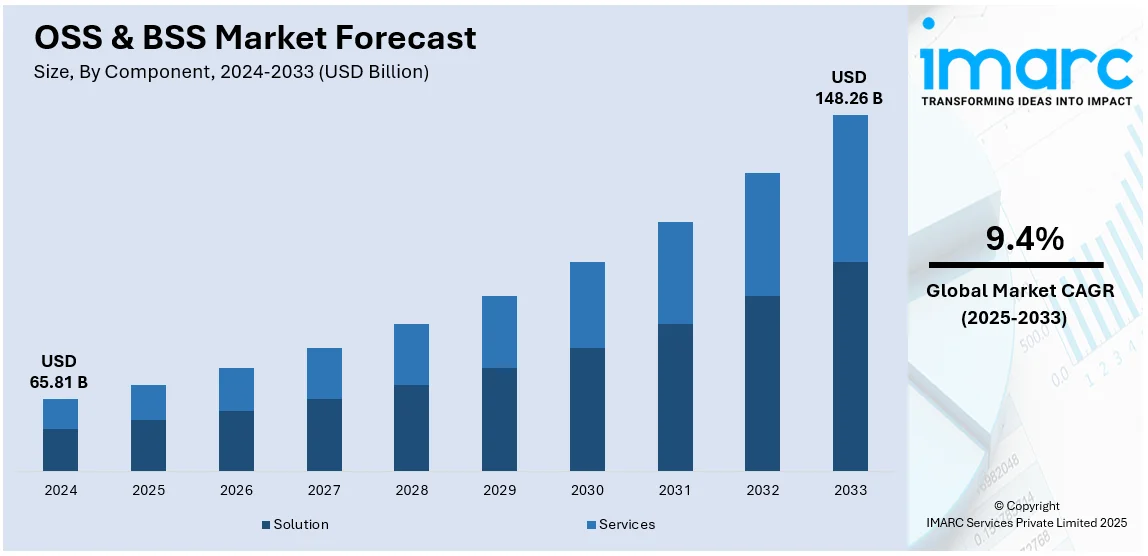

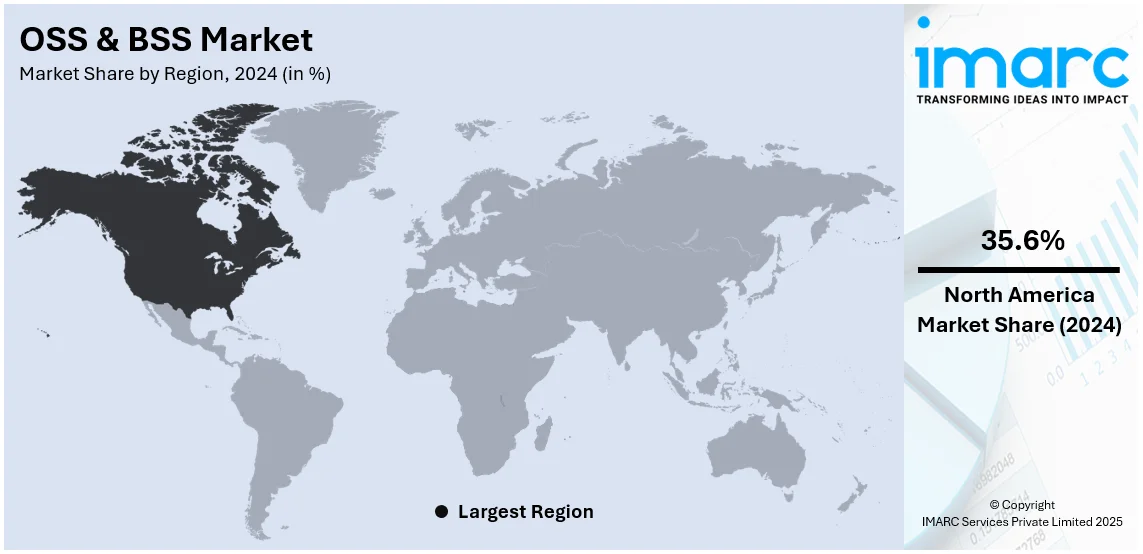

The global OSS & BSS market size was valued at USD 65.81 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 148.26 Billion by 2034, exhibiting a CAGR of 9.4% during 2026-2034. North America currently dominates the market, holding a significant market share of over 35.6% in 2024. The market is driven by the significant expansion of the telecommunication sector, rising consumer expectations, and the emergence of fifth generation technology to improve network speed, capacity, and connectivity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 65.81 Billion |

|

Market Forecast in 2034

|

USD 148.26 Billion |

| Market Growth Rate (2026-2034) | 9.4% |

Several organizations are recognizing the importance of harnessing enormous amounts of structured and unstructured information to gain insights, improve customer experiences, and optimize operations. The increasing adoption of big data, advancements in AI and machine learning technologies, and expanding application areas of cloud computing have further bolstered this trend. Furthermore, the growth in demand for data-driven decision-making across diverse industries is stimulating the demand for OSS & BSS solutions. In addition, the rise in digital transformation initiatives and the need for real-time analytics to address competitive pressures and evolving market demands are key factors contributing to the expansion of the market.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by widespread digital transformation initiatives across diverse sectors where analytics is pivotal for operational optimization and strategic planning. The increasing initiatives for implementing advanced technologies in the defense sector are opening new growth avenues for the OSS & BSS market growth. For instance, in July 2024, The United States Department of Defense signed a Statement of Intent (SOI) for data, analytics, and artificial intelligence cooperation with the Singapore Ministry of Defense. The SOI deploys a holistic method for technological collaboration, allowing both defense establishments to examine approaches and discuss the best practices for leveraging data, analytics, and AI capabilities at speed and scale.

OSS & BSS Market Trends:

Telecom Industry Growth

The continuous expansion of telecom networks is driving the telecommunications industry's growth. Business support systems (BSS) and operational support systems (OSS) are essential for handling these complex network activities and improving client relations. Consequently, the leading the OSS & BSS market companies are investing in the telecommunication sector to stay ahead of the competition which is also impacting the OSS and BSS growth. For example, In February 2024, Indosat Ooredoo Hutchison (IOH) and Ericsson (NASDAQ: ERIC) signed a Memorandum of Understanding at the Mobile World Congress (MWC) 2024 in Barcelona and are keeping up their tactical alliance to probe inherent technology partnerships in the future that might strengthen customer satisfaction and support Indonesia's digitalization initiatives. It is a component of Indosat's overarching goal of enabling Indonesians to support the digitalization-related aspects of Golden Indonesia 2045. Also. Indosat and Ericsson will work together to extend the efforts on the Ericsson business support system (BSS) platform, enabling the company to provide faster-to-market, innovative services to Prepaid customers.

Emergence of 5G Networks

The dispersing of 5G networks marks a transformative phase in the telecommunications sector, introducing unprecedented levels of network speed, capacity, and connectivity. 5G technology is set to recast numerous industries by enabling faster data transmission, lower latency, and the connection of a vast number of devices simultaneously. In June 2023, during Ooredoo Qatar’s visit to Ericsson’s headquarters in Kista, Sweden, to strengthen the association on radio access network (RAN) technologies and services, the two (2) companies motioned a five-year (5) extension of their 5G arrangement to work together to outstretch the attempt on the Ericsson business support system (BSS) platform, permitting the company to provide faster-to-market, innovative services to Prepaid customers. These solutions are essential for telecom operators to navigate the complexities of 5G infrastructure, from network slicing to real-time data analytics. They enable the delivery of enhanced customer experiences through improved reliability, service flexibility, and personalized offerings.

Rising Customer Expectations

Customer expectations are at an all-time high, as they seek personalized, seamless experiences across various touchpoints, demanding quick and efficient service delivery. This shift in customer expectations necessitates the adoption of advanced operational support systems (OSS) and business support systems (BSS). These solutions are integral to enabling better customer engagement and service delivery by providing a unified view of the customer across different channels. As a result, numerous key players are investing in the market to expand their OSS & BSS market growth. For example, in September 2021, MDS Global, a prominent supplier of BSS-as-a-Service solutions disclosed that iD Mobile, a major mobile virtual network operator in the UK entered into a direct agreement with the company. It allows iD Mobile to maintain access to MDS Global's adaptable and immediate BSS platform and enhance network performance and customer experience. OSS solutions enhance service quality and reliability, ensuring that customer demands for uninterrupted connectivity are met, while BSS solutions manages customer relationships, supporting personalized billing, and offering tailored services.

OSS & BSS Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on component, OSS & BSS solution type, deployment mode, organization size, and industry vertical.

Analysis by Component:

- Solution

- Services

Solution leads the market with around 62.4% of market share in 2024. Solutions such as billing and revenue management systems dominate the market growth. These solutions play a critical role in enabling communication service providers to efficiently manage their billing processes, handle customer accounts, and optimize revenue streams. Additionally, components like service fulfillment, network management, and customer management systems hold significant sway within the OSS and BSS domain. At present, the OSS & BSS market involves key players investing in solution to stay ahead of the competition. Based on a recent analysis of the market for business support systems (BSS) and operations support systems (OSS), Frost & Sullivan awarded Netcracker Technology the 2021 Global OSS/BSS Technology Innovation Award for bridging the gap between consumer demands and the solutions currently on the market. Netcracker's creative solution enables CSPs to prosper as the sector enters the 5G era. It also allows CSPs to maximize client income and return on investment (ROI). The technology, which comes in modular or suite versions, enables ecosystem participants to change goods and services at any time, possibly growing their B2B2X market. Furthermore, the improvements enable customer loyalty programs of CSPs with diverse product and service offerings to be expanded to any listing. As telecommunication technologies continue to evolve, the demand for robust OSS and BSS solutions is expected to persist, driving innovation and competition within the market.

Analysis by OSS & BSS Solution Type:

- Network Planning and Design

- Service Delivery

- Service Fulfillment

- Service Assurance

- Billing and Revenue Management

- Network Performance Management

- Customer and Product Management

- Others

Network planning & design leads the market with around 19.3% of market share in 2024. Network design and planning are the most prevalent categories in this group. It allows providers to effectively plan and design their network infrastructure, which guarantees peak performance and scalability. Additionally, network design concentrates on the actual blueprinting and implementation of these networks, network planning entails thorough analysis and forecasting to create networks that satisfy present and future demands. Recently, in March 2024, Netcracker Technology disclosed its achievement of the top position among 13 vendors in Telco Republic's Disrupter Quintant for Next-Generation Telecom Operations and business support systems (BSS) for the innovative nature of its products and solutions, and proven track record in delivering services and executing digital transformation projects for operators globally. The evaluation conducted by the report encompassed various criteria such as strategy, execution, and the vendor's capability to assist communications service providers (CSPs) in implementing advanced use cases and enhancing IT architecture to the next level.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises segment leads the market with around 62.4% of market share in 2024. On-premises refers to the traditional model where software is installed and operated from the premises of the organization using it, rather than being hosted on cloud servers. It is primarily driven by factors such as data security concerns, regulatory compliance requirements, and the need for greater control over systems and processes. Conseuently, the leading players are investing in the market to stay ahead of the competition. For example, in May 2021, Amdocs, Ltd., a prominent provider of software and services for communications and media companies, disclosed an extension of its global collaboration with Microsoft Corporation. This collaboration expands the availability of Amdocs' portfolio on Microsoft Azure and the Azure for Operators (AFO) initiative. The partnership aims to expedite the communications and media industry's transition to the cloud, empowering service providers to use Amdocs' cloud-native BSS/OSS solutions and services, combined with Azure's cloud capabilities, to develop, manage, and deploy service provider applications efficiently.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises leads the market with 62.4% market share in 2024. Large enterprises typically wield substantial resources and have expansive operational infrastructures, making them significant players in the market. They are dominating the market due to their ability to invest in comprehensive operations support systems (OSS) and business support systems (BSS) solutions that cater to their complex needs. Moreover, large enterprises often prioritize scalability, customization, and integration capabilities in their OSS & BSS solutions to effectively manage their extensive networks and diverse service offerings. As the market continues to evolve, large enterprises are expected to maintain their leading position, driving innovation and setting industry standards in OSS & BSS solutions.

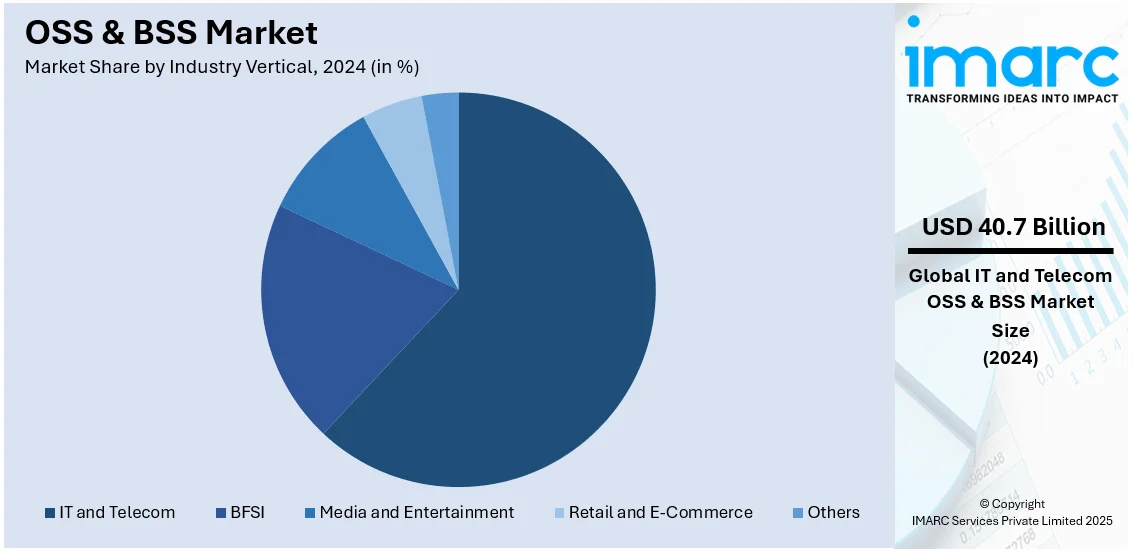

Analysis by Industry Vertical:

- IT and Telecom

- BFSI

- Media and Entertainment

- Retail and E-Commerce

- Others

IT & telecom leads the market with around 61.8% of market share in 2024. The IT and telecom sector is driven by extensive reliance on OSS & BSS solutions to manage and streamline operations effectively. Within the IT sector, businesses use OSS & BSS tools to enhance network performance, automate processes, and ensure seamless customer experiences. Moreover, OSS & BSS solutions managie billing, customer service, network provisioning, and service assurance. As a result, the market is witnessing significant contribution from the IT sector. For example, in July 2021, Netcracker Technology disclosed that Vivo, a subsidiary of the Telefónica Group based in Brazil, has progressed in automating its B2B digital transformation initiative to enhance customer experience and streamline the order processing system. Moreover, Vivo effectively implemented NetCracker's OSS BSS System and Platform/OSS solution to enable the management of product pricing, promotion, and delivery strategies within its enterprise business operations.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.6%. North America operations support systems (OSS) & business support systems (BSS) market is dominating dominant the market due to advanced technological infrastructure, and the growing telecommunications and IT services sector. Additionally, with a strong emphasis on innovation and digital transformation, North American companies are adopting OSS & BSS solutions to streamline operations, enhance customer experiences, and drive business growth. Presently, the OSS and BSS industry forecast involves key players investing in the market to strengthen their position in the market. For example, in March 2024, Etiya revealed its significant contribution to the expansion of the Fizz brand throughout Canada. Etiya's advanced BSS stack serves as the cornerstone of Fizz's upcoming nationwide service launch, solidifying their continued success together and building upon their fruitful partnership.

Key Regional Takeaways:

United States OSS & BSS market Analysis

In 2024, the United States held a market share of 90.7% in North America. The OSS & BSS market in the United States is growing robustly because of a huge increase in mobile cellular subscriptions and the continued evolution of digital services. According to industrial reports, in 2023, the United States had 386 million mobile cellular subscribers, that is, an increase of 3.6 percent from the previous year, which has 112 mobile subscriptions per 100 people. This growth represents a high penetration rate and a thriving mobile ecosystem, with a resultant growing complexity in subscriber data that poses an imperative need for more advanced OSS & BSS solutions. In order to gain greater operational efficiency, enhance network performance, and create a seamless customer experience, the use of these systems is increasing among telecom operators such as Verizon and AT&T. The demand for 5G services, IoT applications, and other digital innovations will further fuel the adoption of cutting-edge OSS/BSS technologies. In the face of stiffening competition, U.S. telecom providers are investing in next-gen solutions to maintain their lead in this fast-evolving market.

Europe OSS & BSS market Analysis

The OSS & BSS market in Europe is expanding rapidly with the growth in 5G infrastructure and major investments in telecom networks. According to the European Commission, 5G coverage reached 80% of the European population in 2023, against the backdrop of 73% in 2022. The Commission's 5G Action Plan launched back in 2016 was able to play a catalysing role in expediting this deployment by harmonizing roadmaps, providing assurance of spectrum bands, and emphasizing early deployment in the urban and transport corridors. In response to this endeavor, the European Commission has devoted over Euro 700 Million, which amounts to roughly USD 728 Million in public funding towards 5G research through Horizon 2020 and, subsequently, an extra Euro 865 million, about USD 900 million that is put toward the development of 5G and fiber networks over the next couple of years. This infrastructure development is further pushing the demand for sophisticated OSS & BSS solutions that would manage increased data traffic, optimize network performance and enhance customer experiences. The key players in the region, such as Deutsche Telekom and Vodafone, are heavily investing in the next-gen OSS/BSS systems to support 5G services, machine-to-machine (M2M) applications, and IoT connectivity.

Asia Pacific OSS & BSS market Analysis

The Asia Pacific OSS & BSS market is growing significantly due to the increasing mobile users, penetration of internet, and rising demand for smart city infrastructure. The GSMA said that the region had approximately 1.73 billion unique mobile subscribers in 2022, and the projection was to reach 2.1 billion by 2030, which further emphasizes the need for scalable and adaptable OSS & BSS systems to support vast user bases. China, India, and Japan are at the front of this change, as telecommunication operators are investing in significant amounts of AI and automation that optimize network management and improve customer service. Local companies like Tata Consultancy Services (TCS) and Bharti Airtel are also developing the region, along with IBM. Increased adoption of 5G and smart devices in the region drives the demand for advanced telecom solutions.

Latin America OSS & BSS market Analysis

The Latin America OSS & BSS market is growing due to increased mobile subscriptions and the usage of mobile internet within the region. According to industrial reports, in 2023, Latin America had 832.6 million mobile subscriptions, which indicated a penetration rate of 125%. Among these, 570 million were smartphone subscriptions, while 418 million people or 65% of the population used mobile internet. This rise in mobile connectivity is giving a boost to the demand for more advanced OSS & BSS solutions that will help manage subscriber data and optimize the delivery of services as mobile operators expand their footprints. With smartphone and mobile internet penetration increasing, telecom operators in this region are more and more adopting next-gen OSS/BSS technologies to ensure improved customer experience, greater network efficiency, and innovation in new services. Main investors include América Móvil and Telefónica who invest in these solutions so that the increasing demands from mobile users in Latin America are met.

Middle East and Africa OSS & BSS market Analysis

The OSS & BSS market in the Middle East and Africa is growing, driven by increased mobile network penetration, digital infrastructure investments, and smart city projects. Telecom services revenue in the EMEA region, which includes the Middle East, and Africa, stood at USD 461 billion in 2023, with a growth of 3.1% over 2022, according to IDC's Worldwide Semiannual Telecom Services Tracker. The telecom sector in the region is experiencing a higher-than-average forecast revision, with inflation being the major driver, especially in countries like Egypt and Turkey, where hyperinflation has resulted in a tremendous rise in ARPU, more than 50% per annum, as per an industry report. For instance, Saudi Arabia and the UAE are investing huge in 5G. These require more advanced OSS and BSS systems to manage massive user traffic and operational complexity. Besides, the accelerated growth in mobile data usage as well as machine-to-machine applications is driving demand for more sophisticated OSS solutions to support these technologies. Competitive nature of telecom markets as well as increasing price in some areas has increased telecom services prices and pushed operators to get more advanced solutions to maintain good service delivery and retention for customers. Companies such as Etisalat and STC are investing in AI and automation to improve the network management, which raises OSS & BSS technology demands in next-generation ones.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the OSS and BSS industry include:

- Amdocs

- Comarch SA

- Comviva

- CSG Systems, Inc.

- Infosys Limited

- Mavenir

- Netcracker

- Nokia Corporation

- Optiva, Inc.

- Suntech S.A

- Telefonaktiebolaget LM Ericsson

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

At present, key players in the market are actively engaged in various strategies to maintain and expand their market presence. These strategies often include product innovation, strategic partnerships, mergers and acquisitions, and geographic expansion. Moreover, strategic collaborations with telecommunications operators, software vendors, and system integrators help key players broaden their product offerings and reach new customer segments. The OSS & BSS market scope also includes leading players entering into collaborations. For example, MTN and Microsoft initiated a collaborative effort aimed at implementing cutting-edge technologies to enhance the experience of MTN's customers in South Africa and Nigeria. The central focus of this initiative is to transition operational support systems (OSS) and business support systems (BSS) and applications to the Microsoft Azure cloud platform, to achieve operational efficiencies and cost savings. The project entails the strategic migration of selected business applications to Azure, and Accenture has been engaged to provide technology implementation, integration, and support services, working closely with MTN and Microsoft to facilitate the seamless migration and ongoing operations of the targeted environments.

Recent Developments:

- April 2025: Cerillion launched Cerillion 25.1, an updated BSS/OSS suite featuring a next-generation Promotions Engine that enables telecom providers to create, manage, and scale personalized offers with unprecedented agility. Integrated with Cerillion’s Convergent Charging System, it allows real-time, dynamic campaigns based on customer behavior without coding. The release also introduces AI-powered assistants: Bill Intelligence for clear bill comparisons, Sales Assistant for natural language product selection, and Promotions Assistant for rapid promotion creation. These innovations simplify operations, enhance customer experience, and boost revenue by enabling timely, personalized engagement.

- March 2025: Tune Talk partnered with Mavenir to deploy a cloud-native Digital OSS/BSS platform. This platform enables self-healing, automatic scaling, zero-touch operations, and AI-driven hyper-personalized customer services, enhancing operational efficiency by 60-70% and network reliability. The collaboration accelerates Tune Talk’s digital transformation, optimizing network management and customer experience while reducing costs.

- February 2025: Infovista and CSG formed a strategic partnership to deliver integrated, pre-tested OSS and BSS solutions aimed at Communication Service Providers (CSPs). Combining Infovista’s Ativa automated assurance suite with CSG’s Converged Mediation & Activation platform, the collaboration enables unified policy management, charging, and customer data with network operations. This integration supports real-time marketing, advanced 5G monetization, and streamlined telecom orchestration, enhancing operational efficiency, accelerating digital transformation, and improving customer experiences while ensuring compliance and scalability.

- February 2025: Constellation SaaS LLC launched an end-to-end, cloud-native BSS/OSS ecosystem for broadband providers. Powered by CSG, it automates the entire lead-to-cash process, including sales, inventory, order management, provisioning, billing, payments, and customer care. The solution integrates with top industry platforms, streamlining operations, reducing costs, and enabling providers to scale efficiently.

- February 2025: Amdocs unveiled CES25, its next-generation, cloud-native Customer Experience Suite infused with generative AI. CES25 integrates the amAIz telco intelligence suite, offering AI, ML, and GenAI platforms and agents that automate workflows, optimize operations, and enhance customer and employee experiences. It supports B2C, B2B, and B2B2X growth with modular, scalable solutions spanning marketing, sales, billing, network management, and digital service monetization. Key components include AI-driven CRM, flexible billing, intelligent networking, eSIM cloud, and a digital subscription platform, enabling service providers to innovate, reduce costs, and unlock new revenue streams.

OSS & BSS Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| OSS & BSS Solution Types Covered | Network Planning and Design, Service Delivery, Service Fulfillment, Service Assurance, Billing and Revenue Management, Network Performance Management, Customer and Product Management, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | IT and Telecom, BFSI, Media and Entertainment, Retail and E-Commerce, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amdocs, Comarch SA, Comviva, CSG Systems, Inc., Infosys Limited, Mavenir, Netcracker, Nokia Corporation, Optiva, Inc., Suntech S.A, Telefonaktiebolaget LM Ericsson, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the OSS & BSS market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global OSS & BSS market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the OSS & BSS industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global OSS & BSS market was valued at USD 65.81 Billion in 2024.

The market is estimated to reach USD 148.26 Billion by 2033, exhibiting a CAGR of 9.4% during 2025-2033.

The rising integration of Artificial Intelligence (AI) and Machine Learning (ML) with OSS & BSS to achieve diverse business goals, gather information, and analyze unstructured and structured data, is primarily driving the global OSS & BSS market.

North America currently dominates the global OSS & BSS market. The dominance is driven by its advanced telecom infrastructure, rapid adoption of 5G, IoT, and cloud technologies, as well as the presence of leading providers like Amdocs and Oracle.

Some of the major players in the global OSS & BSS market include Amdocs, Comarch SA, Comviva, CSG Systems, Inc., Infosys Limited, Mavenir, Netcracker, Nokia Corporation, Optiva, Inc., Suntech S.A, Telefonaktiebolaget LM Ericsson, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)