Orthopedic Prosthetics Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033

Orthopedic Prosthetics Market Size and Share:

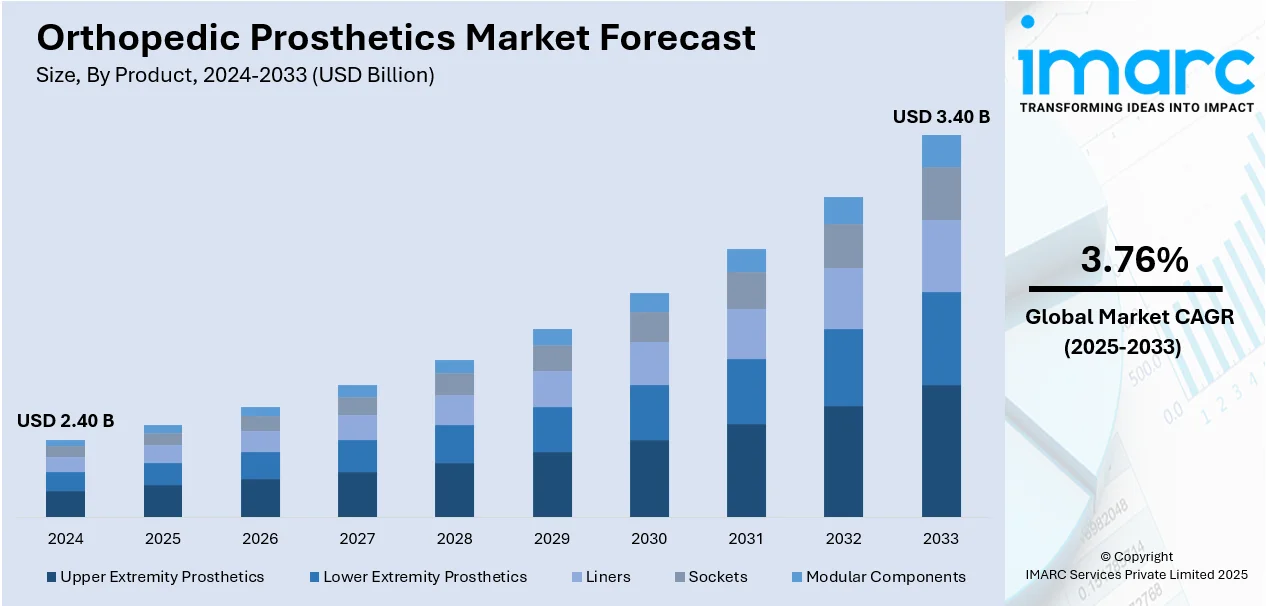

The global orthopedic prosthetics market size was valued at USD 2.40 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.40 Billion by 2033, exhibiting a CAGR of 3.76% from 2025-2033. North America currently dominates the market, holding a market share of over 39.3% in 2024. The market is primarily driven by the considerable rise in the number of aging population, increasing prevalence of orthopedic disorders and injuries, and growing acceptance and awareness regarding prosthetic solutions among the masses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.40 Billion |

| Market Forecast in 2033 | USD 3.40 Billion |

| Market Growth Rate 2025-2033 | 3.76% |

The increasing incidences of diabetes and vascular diseases are major contributors to the market as they raise the demand for prosthetic solutions. Apart from that, continual technological advancements in technologies like bionic or 3D-printed prosthetics, functionality, and comfort are impelling the market. For example, on July 1, 2024, the Orthopaedic Research Lab at Radboudumc, in collaboration with ATRO Medical, began working on the 3D-printed PCU Meniscus Prosthesis, a project focused on creating custom meniscus implants based on AI and 3D printing. This project uses AI to design strong meniscus prostheses in a customized way based on individual patients by scanning the healthy meniscus in one leg to provide a suitable design for an implant for the affected leg. Also, the adoption of advanced prosthetics solutions in the military and defense sectors for injured personnel accelerates the growth of the market. Moreover, the shift towards tailor-made or patient-specific prosthetics enabled by new materials and designs reshapes the market trends, thus ensuring steady growth.

The United States stands out as a key regional market, driven by the easy availability of powerful healthcare infrastructure with advanced technologies like microprocessor-controlled and bionic prosthetic devices. Also, increasing healthcare expenditure coupled with beneficial insurance coverage policies lowering the financial burden on patients is also encouraging the uptake of advanced prostheses. In line with this, strategic collaborations and acquisitions between key market players are further strengthening the market presence. For example, on January 8, 2024, OrthoPediatrics Corp. announced that it had acquired Boston Orthotics & Prosthetics, a company that has been one of the leading pediatric orthotic management companies for 50+ years. This strategic acquisition expands OrthoPediatrics' Specialty Bracing Division and enhances its portfolio with advanced non-surgical treatment options for conditions such as scoliosis and neuromuscular disorders. Furthermore, the increasing awareness campaigns and advocacy by organizations dedicated to limb loss and recovery are fostering greater acceptance and utilization of advanced prosthetic devices across the country.

Orthopedic Prosthetics Market Trends:

Rising Road Accident Rates

Increasing numbers of road accidents lead to growth in the global orthopedic prosthetics market share. According to WHO, 1.19 million deaths occur annually, and the same number of 20-50 million people around the world are injured or disabled through such road traffic crashes. In India alone, the Ministry of Road Transport and Highways reported 461,312 road accidents in 2022. The alarming numbers show that the time has arrived for the advancement of prosthetic solutions in rehabilitation as well as quality life for victims of accidents. Therefore, the demand for orthopedic prosthetics will be at a tremendous rise because of the urgent need for proper post-trauma care.

Rising Incidence of Diabetes-Related Amputations

Increased occurrence of diabetes, which poses risks for diabetic complications, strongly promotes the expansion of the orthopedic prosthetics market size. A diabetic can be quite susceptible to having a condition where chronic ulcers could form due to the damaged nerves that would further deteriorate into an amputated limb. Industry reports state that the risk of amputation is up to 25 times higher for people with diabetes compared to those without disease. For example, from the American Diabetes Association, annually, about 154,000 people with diabetes in the US receive amputations, and 80% of all non-traumatic lower limb amputations are diabetes-related complications. This increased incidence marks the demand for higher grade prosthetic devices in order to restore the rehabilitation and process of mobility.

Advancements in Technology

Innovative technologies in prosthetic devices are significantly reshaping the orthopedic prosthetics market trends. In February 2022, for instance, Össur introduced the Power Knee, which is an advanced microprocessor-controlled prosthetic knee system. It is a motorized "smart" prosthesis using complex algorithms to track the user's gait and adjust pace and cadence in real time. Such innovations improve mobility, comfort, and user functionality while catering to the increasing demand for technologically advanced solutions in prosthetic care. An example of how the industry is working toward improving quality of life for individuals suffering from limb loss is represented by the integration of real-time learning capabilities and motorized support in devices such as the Power Knee.

Orthopedic Prosthetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global orthopedic prosthetics market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on the product, technology, and end user.

Analysis by Product:

- Upper Extremity Prosthetics

- Lower Extremity Prosthetics

- Liners

- Sockets

- Modular Components

Upper extremity prosthetics leads the market with around 38.6% of market share in 2024. Upper extremity prosthetics are an important segment of the orthopedic prosthetic market as they address not only the functional needs of patients with upper limb loss or congenital anomalies but also psychological needs. The devices restore critical hand and arm functions, enabling greater ease and independence in performing daily activities. Significant advancements in myoelectric control systems and light materials, especially for prosthetic devices, have greatly made them user-friendly and more comfortable. An increase in the number of traumatic injuries, diabetes-induced amputations, and congenital disabilities further demands an increased level of upper extremity prosthetics. Growing awareness about this technology, improved healthcare access, and other policy measure supports market growth. This product exemplifies a commitment to facilitating movement and a quality lifestyle by merging technology with a user-centered design.

Analysis by Technology:

- Conventional

- Electric Powered

- Hybrid Orthopedic Prosthetics

Electric powered leads the market with around 37.2% of market share in 2024. Electric-powered prosthetics provide improved accuracy, functionality, and user experience. It comes with the latest technologies that include myoelectric sensors and advanced microprocessors that detect muscle signals for natural and intuitive movements. Technology allows healthcare providers to meet the increasing need for high-performance solutions, particularly for upper and lower-limb replacement patients. Also, the rise in diabetes, vascular diseases, and traumatic injuries necessitates these high-tech products. Technological advancements in battery life, lightweight materials, and ergonomic designs further make these products user-friendly and comfortable. This technology represents a giant leap in the restoration of mobility and independence, which makes it vital in the orthopedic prosthetics market.

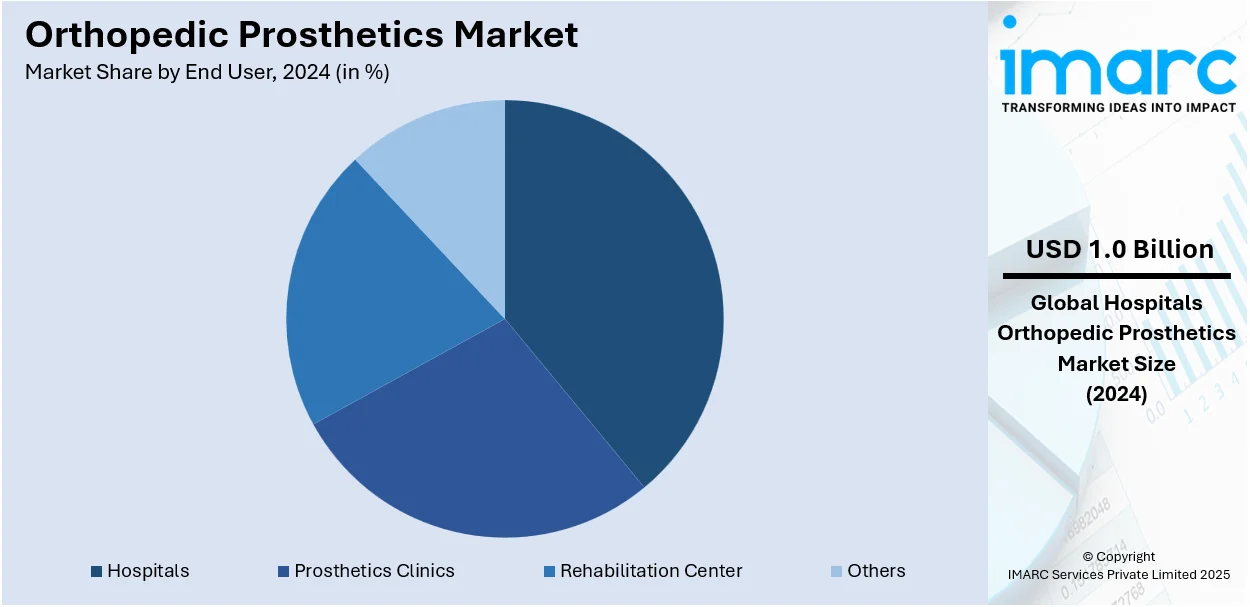

Analysis by End User:

- Hospitals

- Prosthetics Clinics

- Rehabilitation Center

- Others

Hospitals lead the market with around 33.7% of market share in 2024. Hospitals serve as the first contact place for orthopedic prosthetic care for patients. They are the first and only care centers where the necessary limb replacement and rehabilitation treatments take place. The treatment involves the entire range of activities including prosthetic fitting, post-operative care, and physical therapy for an excellent result. The availability of superior technology and expert medical personnel providing specialized prosthetic care in hospitals facilitates market growth. The increase in patient visits to hospitals for prosthetic care is considerably rising with the growing diseases. Hospitals also collaborate with manufacturers to introduce and evaluate innovative prosthetic devices. In addition, insurance coverage and government healthcare programs are readily available in hospital settings. As centers of excellence, hospitals play a major role in the adoption and development of orthopedic prosthetic technologies.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.3%. North America is an important region in the market due to its robust healthcare infrastructure and high adoption of advanced prosthetic technologies. North America is the hub of innovation with significant research and development (R&D) activities to enhance prosthetic functionality and user comfort. The widespread availability of myoelectric and electric-powered prosthetics in the region promotes further growth in the market. North America has a well-established network of experienced healthcare providers with specialized prosthetic clinics, as well as solid reimbursement rules, which provides an impetus to the market. The commitment of the region to technological advances as well as patient care puts it forward as one of the driving forces behind the global orthopedic prosthetics market.

Key Regional Takeaways:

United States Orthopedic Prosthetics Market Analysis

The United States is a significant region in the North America orthopedic prosthetics market with a market share of 88.20%, due to continual technological advancements, implementation of favorable government initiatives, and innovative product launches. In February 2022, Össur introduced the Power Knee, a microprocessor-controlled prosthetic knee system featuring advanced algorithms that detect human movement patterns, adjust to the wearer's speed, and adapt cadence in real time. LIMB-art Prosthetic Leg Covers are a new lower limb prosthetics portfolio that the Steeper Group launched in January 2023. Available in four models - Vent, Core, Wave, and Ultralight- with weights of less than 250 grams, the Steeper Group manufactures the prosthetic leg covers with high-grade nylon for extra strength and flexibility, to increase patient confidence and versatility.

Educational programs aid the growth of the market. For example, in June 2024, East Tennessee State University initiated an orthotics and prosthetics program to fill the increasing national demand for certified prosthetists and orthotics.

Several diabetes-related amputations, sports injuries, and road accidents, and the prevalence of osteosarcoma lead to a higher need for orthopedic prosthetics. Stanford University's news article has reported that over 3.5 million children in the U.S. suffer from sports injuries every year, which reflects the increased need for prosthetics and orthotics solutions. With these factors and technological advancement along with government support, the market is likely to grow significantly during the forecast period.

Europe Orthopedic Prosthetics Market Analysis

Europe is expected to witness growth in the market size over the forecast period. The increased car accident rate, improved research and development (R&D) activities, and implementation of innovative technologies facilitate market growth. Road traffic-related accidents in Germany are also on the rise, which is increasing the need for orthotics and prosthetics. According to Destatis or Statistisches Bundesamt, about 21,600 people were injured in Germany in road traffic accidents solely in February 2023, which requires advanced prosthetic solutions to improve mobility and quality of life of victims.

Similarly, in the UK, research and development focus on growing the market. A technologically advanced prosthetic leg was developed by the University of the West of England (UWE) Bristol in October 2024 designed for use by people with above-knee amputations. This innovation highlights the commitment of the region towards upgrading prosthetic technology and allowing users to function more efficiently and comfortably. These factors, combined with higher awareness and availability of prosthetic solutions, are expected to fuel the growth of orthopedic prosthetics within Europe.

Asia Pacific Orthopedic Prosthetics Market Analysis

The Asia-Pacific orthopedic prosthetics market is poised for rapid growth, driven by a rising number of diabetes-related amputations, increasing road accidents, and supportive government initiatives. In Australia, government reforms and funding are bolstering the prosthetics market. For example, the 2021-2022 Federal Budget allocated AUD 22 Million (USD 13.8 Million) for reforms to the Prostheses List, aiming to align benefits with public prosthetic device prices and ensure patient access and clinician choice.

Additionally, road accidents are a significant contributor to market growth in the region. According to data from India’s Ministry of Road Transport and Highways, in the first six months of 2022, approximately 2,300 road accidents were reported. These incidents often lead to severe injuries requiring prosthetic solutions. Electric prostheses, which utilize existing nerves for functional use and provide a natural appearance, are increasingly being adopted in such cases. The convergence of government support, rising healthcare needs, and advancements in prosthetic technology is anticipated to propel the Asia-Pacific orthopedic prosthetics market during the forecast period.

Latin America Orthopedic Prosthetics Market Analysis

A major growth driver for the Latin America orthopedic prosthetics market is the increasing prevalence of diabetes-related orthopedic conditions and an aging population. The International Diabetes Federation reports that more than 32 million adults in Latin America had diabetes in 2023, a disease that greatly increases the risk for amputations due to complications such as diabetic foot ulcers. The increasingly elderly population further increases demand. In 2022, the age group over 60 constitutes 13.4% of the population in Latin America and the Caribbean and stood at approximately 88.6 million people, as per industry report. This number will go up to 16.5% by 2030, resulting in greater rates of osteoarthritis, fractures, and amputations. Together, these health issues will bring greater demand for orthopedic prosthetics, therefore fueling market growth. As the health care facility improves and awareness increases, access to prosthetic solutions is becoming widespread across this region.

Middle East and Africa Orthopedic Prosthetics Market Analysis

A key growth driver for the Middle East and Africa (MEA) orthopedic prosthetics market is the increasing incidence of diabetes and the health transformation taking place in the region. Saudi Arabia's Vision 2030 will overhaul the healthcare sector through improved access, quality, and disease prevention. The Health Sector Transformation Program, a key element of this vision, is upgrading infrastructure and improving workforce capabilities, and adopting new technologies, all of which expand access to orthopedic prosthetics.

According to an industry report, the MEA region has the highest regional prevalence of 16.2% for diabetes and the second-highest expected increase of 86% in the number of diabetic individuals, which is projected to reach 136 million by 2045. With 24.5% of diabetes-related deaths occurring in people of working age, the demand for prosthetics, especially among diabetic patients requiring amputations, is on the rise. Despite spending USD 32.6 Billion on diabetes care in the region, which accounts for 3.4% of global expenditure, the region's need for advanced prosthetic solutions remains significant, further driving market growth.

Competitive Landscape:

The market is highly competitive, with key players constantly innovating in the area of materials and technology. Leading companies are focusing on developing lightweight, strong, and customized prosthetics that enhance the mobility and comfort of patients. Also, the considerable rise in the uptake of advanced prosthetic solutions among the masses has resulted in massive investments in research and development (R&D) activities by the key players. Competition in the market also relates to affordability and accessibility, with major players focusing on providing more value-for money solutions. Regulatory compliance and clinical outcomes also impact the dynamics of the market.

The report provides a comprehensive analysis of the competitive landscape in the orthopedic prosthetics market with detailed profiles of all major companies, including:

- Blatchford Limited

- Fillauer LLC

- Hanger Inc.

- Johnson & Johnson

- Ossur hf.

- Ottobock SE & Co. KGaA

- Protunix

- Smith & Nephew Plc

- Steeper Inc.

- Stryker Corporation

- WillowWood Global LLC

- Zimmer Biomet

Recent Developments:

- May 2024: Medical technology giant Ottobock has unveiled the Evanto foot, an advanced mechanical prosthetic that promises a dynamic, flexible, and stable performance unlike any other. It is an advance that represents a huge step forward in prosthetic technology, creating a new benchmark for the industry.

- March 2024: NIPPON EXPRESS HOLDINGS, INC. invested in Instalimb, Inc., the company that is growing its worldwide business in the 3D-printed prosthetics industry. The investment came through the NX Global Innovation Fund in February 2024 and helps in sustaining the growth of the business, including the operations in the Philippines and India.

- June 2023: Fillauer released the Myo/One Electrode system, developed in collaboration with Coapt. This innovative system is compact and waterproof, with a preamplifier that supports two EMG signal channels for myoelectric devices. It eliminates the need for extra components such as sealing rings and cables, streamlining the design and enhancing overall functionality.

- May 2023: WillowWood launched Alpha Control Liner System, an internally- electronics embedded prosthetic liner. Such a product has come along with Coapt and helps people using myoelectric prosthetics to better understand through more consistent and comfortable contact between the electrode and their skin, hence making this easier to control. Control of the prosthesis's movement is done through Complete Control developed by Coapt through understanding what the user intends using machine learning.

Orthopedic Prosthetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Upper Extremity Prosthetics, Lower Extremity Prosthetics, Liners, Sockets, Modular Components |

| Technologies Covered | Conventional, Electric Powered, Hybrid Orthopedic Prosthetics |

| End Users Covered | Hospitals, Prosthetics Clinics, Rehabilitation Center, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blatchford Limited, Fillauer LLC, Hanger Inc., Johnson & Johnson, Ossur hf., Ottobock SE & Co. KGaA, Protunix, Smith & Nephew Plc, Steeper Inc., Stryker Corporation, WillowWood Global LLC, Zimmer Biomet, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the orthopedic prosthetics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global orthopedic prosthetics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the orthopedic prosthetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Orthopedic prosthetics are custom-made devices designed to replace or support a missing or impaired limb, enhancing mobility and quality of life for individuals with limb loss.

The global orthopedic prosthetics market was valued at USD 2.40 Billion in 2024.

IMARC estimates the global orthopedic prosthetics market to exhibit a CAGR of 3.76% during 2025-2033.

The market is driven by advancements in prosthetic technologies, increasing cases of limb amputation due to accidents or diseases, and growing awareness about rehabilitation options.

According to the report, upper extremity prosthetics represented the largest segment by products, driven by rising demand for advanced prosthetic solutions and increasing limb loss cases.

According to the report, electric powered represented the largest segment by technology, driven by their enhanced functionality and growing adoption due to technological innovations.

According to the report, hospitals represented the largest segment by end user, driven by their access to advanced prosthetic devices and skilled professionals for effective rehabilitation.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global orthopedic prosthetics market include Blatchford Limited, Fillauer LLC, Hanger Inc., Johnson & Johnson, Ossur hf., Ottobock SE & Co. KGaA, Protunix, Smith & Nephew Plc, Steeper Inc., Stryker Corporation, WillowWood Global LLC, and Zimmer Biomet, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)