Orthopedic Braces and Supports Market Size, Share, Trends and Forecast by Product, Type, Application, End-User, and Region, 2026-2034

Orthopedic Braces and Supports Market Size and Share:

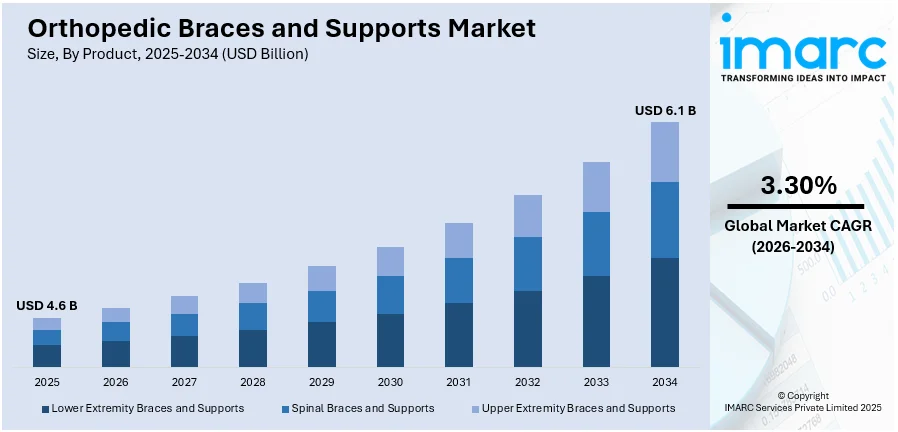

The global orthopedic braces and supports market size was valued at USD 4.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.1 Billion by 2034, exhibiting a CAGR of 3.30% during 2026-2034. North America currently dominates the market in 2025, holding a significant share of around 44.7%. The emerging technological advancements in materials and design, the increasing incidences of musculoskeletal disorders, and the growing awareness about the benefits of orthopedic braces and support for pain management are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.6 Billion |

|

Market Forecast in 2034

|

USD 6.1 Billion |

| Market Growth Rate (2026-2034) | 3.30% |

The market is primarily driven by the growing musculoskeletal disorders and injuries, such as arthritis, osteoporosis, and fractures, that require efficient support and rehabilitation solutions. Moreover, the rising geriatric population worldwide is fuelling demand, which is providing an impetus to the market. Furthermore, continual advancements in material science and product innovations enhance the market appeal. For instance, on August 7, 2024, Aspen Medical Products announced the launch of its first bracing solution specifically designed for patients with proximal junctional kyphosis (PJK), a spinal deformity. This innovative brace provides targeted support for individuals suffering from PJK, which is a common complication after spinal fusion surgery. The increasing adoption of preventive measures through healthcare services combined with greater awareness regarding early treatments in orthopedic conditions significantly fuels the market share.

To get more information on this market Request Sample

The market in the United States is experiencing significant growth due to the increasing participation in sports and recreational activities, which results in a higher incidence of sports-related injuries, driving the demand for braces. It supports to aid in recovery and prevent re-injury. In addition to this, the growing prevalence of obesity in the United States is raising the risk of joint-related disorders, which is providing a boost to orthopedic braces and supports market growth. Besides this, the presence of a robust healthcare infrastructure, coupled with a significant number of specialized orthopedic clinics and rehabilitation centres, ensures greater accessibility and utilization of these products. Furthermore, strategic partnerships between key players are expanding distribution networks, thereby facilitating the growth of the market. For example, on March 27, 2024, Zimmer Biomet, headquartered in the United States, partnered with OSSIS to become the exclusive distributor of personalized 3D-printed titanium hip replacement joints in the Asia-Pacific region. This collaboration aims to enhance patient care by combining Zimmer Biomet's healthcare expertise with OSSIS's advanced 3D printing technology.

Orthopedic Braces and Supports Market Trends:

The emerging technological advancements in materials and design

Emerging technological developments in materials and design are the key drivers for the market. Besides this, various technological advancements in materials results in the creation of lightweight, strong, and hypoallergenic materials for orthopedic braces and supports, thereby fuelling the market growth. Moreover, materials such as advanced composites, memory foam, and breathable fabrics are replacing traditional materials that offer improved comfort and compliance to patients, further driving the market expansion. In addition to this, three-dimensional (3D) printing technology helps in the design and customization options, which provides a precise fit tailored to each patient's unique anatomy, thereby improving patient comfort, optimizing therapeutic benefits, reducing recovery times, and minimizing the risk of complications, which is another major growth-inducing factor.

The increasing incidences of musculoskeletal disorders

The market is witnessing a profound impact due to the escalating incidences of musculoskeletal disorders. As per WHO, approximately 1.71 billion people have musculoskeletal conditions worldwide. Musculoskeletal disorders include numerous conditions affecting the muscles, bones, tendons, ligaments, and joints. In addition, individuals are seeking effective non-surgical solutions to manage pain, provide support, and help in the healing process, thus contributing to the market growth. Moreover, rising awareness about early intervention and preventing injuries is motivating people to seek orthopedic bracing and support to minimize the risk of injuries and improve their performance, which is another major growth-inducing factor. Besides this, it offers a non-invasive and cost-effective approach to address these issues, making them an attractive choice for patients and healthcare providers, thus propelling the market growth. Furthermore, the growing geriatric population is susceptible to numerous disorders, such as osteoarthritis, fractures, and sprains, which is also creating a positive orthopedic brace and supports market outlook.

The growing awareness about the benefits of orthopedic braces and support

The increasing awareness among people regarding the benefits of these devices in pain management and better musculoskeletal health propels the orthopedic braces and supports market demand. Moreover, the growing prevalence of musculoskeletal disorders and sport-related injuries is fuelling the growth of the market. According to reports, around 12 million children aged between 5 and 22 years' experience a sport-related injury every year. Individuals suffer from various discomforts, aches, or injuries and thus expedite the adoption rate of the product. These products will ease pain and stabilize joints as well as enable faster recovery. Also, the publication of information by multiple media channels through health professionals, internet services, and experiences from patients helps raise public awareness of the benefits of orthopedic support. The several types of available products, each catered to definite orthopedic conditions or injuries, are creating a positive market outlook for patients as well as for consumers.

Orthopedic Braces and Supports Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global orthopedic braces and supports market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, type, application, and end-user.

Analysis by Product:

- Lower Extremity Braces and Supports

- Spinal Braces and Supports

- Upper Extremity Braces and Supports

Lower extremity braces and supports leads the market with around 52.61% of market share in 2025 due to the importance these serve for enhancing mobility, pain reduction, and rehabilitation. The various products under these are useful in different conditions, including ligament injuries, osteoarthritis, post-surgical recovery, and sports-related injuries, which require constant application both in clinics and homes. Driving forces include an increasing prevalence of musculoskeletal disorders, aging populations, and higher injury rates from sports. Advancements in materials that make braces and supports more lightweight and breathable significantly enhance patient comfort and compliance, thereby increasing usage. With the emphasis on less invasive solutions and preventive care, lower extremity braces, and supports find expanding use in managing chronic conditions and preventing injuries. Their role in quality-of-life enhancement and faster recovery underlines the importance of soft and elastic orthopedic bracing and supporting products in the market.

Analysis by Type:

- Soft and Elastic Braces and Supports

- Hinged Braces and Supports

- Hard and Rigid Braces and Supports

Soft and elastic braces and supports leads the market with around 42.2% of market share in 2025. The versatility, comfort, and universal application of soft and elastic bracing and supporting products make these the most sought-after products globally in the market. Such soft and elastic supports and braces offer mild to moderate support, compression, and stabilization to different musculoskeletal conditions. They are quite effective for treating minor sprains, strains, joint pain, and swelling and are widely used for everyday treatment and preventive purposes. They can be afforded and applied easily to a wide customer base, including athletes who would like to avoid injuries and individuals with chronic diseases such as arthritis. Advances in material technology also improved their breathability and durability, further expanding their use. As the interest in non-invasive, low-cost solutions continues to expand, soft and elastic bracing and supporting devices are seen as integral parts of enhancing mobility and promoting musculoskeletal health overall.

Analysis by Application:

- Ligament Injury

- Preventive Care

- Post-Operative Rehabilitation

- Osteoarthritis

- Others

Ligament Injury leads the market with around 36.5% of market share in 2025 due to the high prevalence of sports injuries, accidents, and musculoskeletal degeneration caused by aging. Ligament injury braces provide stabilization and protection and further support the joints for healing and prevention of damage. They are generally applied in treating injuries to the major ligaments such as ACL, MCL, and PCL of the knee and sprains in the ankle and wrist. Such braces allow the patients to maintain an active lifestyle during recovery, as they help reduce strain due to controlled mobility. Rising awareness regarding sports safety and increasing participation in sports and other physical activities raise demand for ligament injury braces, particularly for athletes. Technological advancements, including adjustable and ergonomic designs, have improved their effectiveness and comfort, making them indispensable for rehabilitation and injury prevention worldwide.

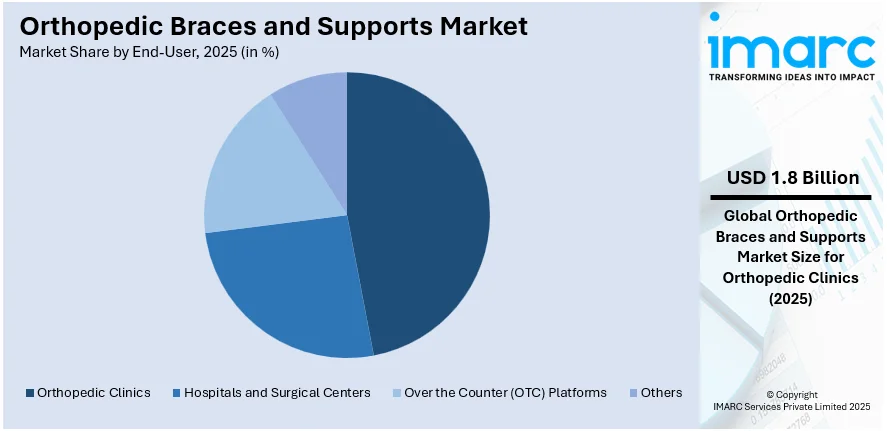

Analysis by End-User:

Access the comprehensive market breakdown Request Sample

- Orthopedic Clinics

- Hospitals and Surgical Centers

- Over the Counter (OTC) Platforms

- Others

Orthopedic clinics leads the market with around 41.5% of market share in 2025 due to their specialized focus on diagnosing and treating musculoskeletal conditions. These clinics are useful for prescribing and dispensing braces and support the treatment of numerous injuries and disorders, such as ligament injuries, osteoarthritis, fractures, and post-operative recovery. Patients in need of a specific approach often seek orthopedic clinics. Therefore, this setting is very important when it comes to recommending excellent, customized braces that precisely reflect medical requirements. Advanced rehabilitation centres are found in orthopedic clinics as well, integrating braces into recovery plans to achieve optimal recovery with minimal risk of further injury. The rapidly increasing global rate of musculoskeletal disorders combined with an increasingly aging population and increased sports-related injuries opens a higher patient base, reflects the importance of orthopedic clinics in the market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2025, North America accounted for the largest market share of over 44.7% due to well-established healthcare infrastructure, a high level of awareness of musculoskeletal disorders, and extensive usage of advanced medical devices. Growing conditions, including arthritis, osteoporosis, and sports injuries, are reported among the aged and active individuals in the region. The United States is the prime contributor in which health expenditure has been substantial, along with preventive care and rehabilitation practices. Additionally, the region hosts market leaders, including innovating on designs and the use of materials to drive market expansion constantly. Also, easy reimbursement facilities, along with exposure to the latest and sophisticated treatments, propel orthopedic brace usage through both clinic and home-based usage channels. North America is, therefore, a key region that is setting the trends and driving the pace of advancement in the global orthopedic braces and supports market.

Key Regional Takeaways:

United States Orthopedic Braces and Supports Market Analysis

The demand for United States orthopedic braces and supports is expected to grow, driven by a growing geriatric population and an increased incidence of musculoskeletal disorders. Also, sports injuries among people have been increasing lately, thereby raising the need for functional braces during recovery and for preventing injury. According to research, over 200,000 people suffer from an ACL injury each year in the United States, and half of the patients undergo some form of reconstruction of the knee. About 70% happen during agility sports, including basketball, soccer, skiing, and football. In addition to this, technological advancements in product design and materials are another major growth driver. The use of lightweight, breathable, and customizable orthopedic braces helps ensure better patient comfort and compliance. In addition to this, the popularity of D2C models and e-commerce platforms is making these products more accessible, thus fueling market growth. Policies for reimbursement by the major insurers also contribute to a big extent to promoting the use of orthopedic support, particularly among older adults. Apart from this, an increase in obesity levels also leads to disorders of joints, such as osteoarthritis, thus augmenting demand for braces and supports. An increased awareness regarding preventive care and the importance of orthopedic support in rehabilitation increases their importance in the U.S. healthcare system.

Asia Pacific Orthopedic Braces and Supports Market Analysis

Chronic diseases and lifestyle disorders are major market drivers of the Asia Pacific orthopedic braces and support market. The increase in old-age groups within countries like Japan and China increases chronic conditions such as osteoarthritis, rheumatoid arthritis (RA), and degenerative disc diseases. According to reports, in India, the prevalence of RA is about 0.7%, higher than the world's 0.46%, so this condition of chronic musculoskeletal disease leads to joint pain, reduces mobility, and creates deformity; thus, orthotics or braces are necessary to handle the pain and stabilize the affected region and further improve the quality of life. Apart from that, rapid urbanization and a growing sedentary lifestyle are causes of obesity along with many orthopedic issues like back pain or knee disorders. In addition, governments and private sectors are actively investing in public health awareness campaigns that encourage early diagnosis and treatment, and hence, the use of braces and supports is increasing. The growing healthcare infrastructure and increasing healthcare expenditure in the region are also driving the growth of the market. Increasing access to healthcare services in emerging economies such as India and Southeast Asian countries is promoting the adoption of advanced orthopedic products. Additionally, the presence of leading manufacturers and the emergence of local players offering cost-effective solutions ensure a competitive and growing market landscape.

Europe Orthopedic Braces and Supports Market Analysis

The orthopedic braces and support market in Europe is driven by the region's sophisticated healthcare system and a high incidence of orthopedic conditions. The increasing geriatric population in Germany, Italy, and the UK generates a consistent demand for braces and supports. A high incidence of sports injuries and MSDs also fuels the usage of supportive devices in the region. According to reports, sports injuries account for around 6.2 million people annually needing hospital treatment, and about 7% (402,000 cases) gets admitted for further treatment. Moreover, the European Agency for Safety and Health at Work reports that MSDs are among the most common work-related ailments, emphasizing the importance of preventive and therapeutic solutions like braces and supports. In line with this, the development of advanced materials, 3D printing, and smart orthotics braced with sensors that track patient improvement is improving product effectiveness and conformity among patients. European companies also focus on sustainability, including the development of environment-friendly orthodontic devices and items, considering the region's strict environmental regulations and consumers' inclinations. Public health awareness campaigns, along with the growing importance of preventive care, also support the growth of the market. In addition to this, rehabilitation and post-surgical care are growing since there has been an increase in joint replacement surgeries, especially for knees and hips. With healthcare systems offering strong reimbursement policies and the government trying to make healthcare accessible, the market in the region is poised for sustained growth.

Latin America Orthopedic Braces and Supports Market Analysis

Latin America has some of the highest rates of road traffic accidents globally, often resulting in orthopedic injuries that require supportive devices. According to reports, with respect to traffic accidents, the results have been highly negative as there are about 28, 000 fatalities a year, with more than 340, 000 injured people. In addition, the growing popularity of sports like football in Brazil and Argentina also contributes to the demand for braces and supports, particularly among young athletes. Besides this, the rising awareness about healthcare and the availability of affordable orthopedic devices are contributing to the market growth. The expanding healthcare infrastructure in countries like Mexico and Chile and increasing access to insurance coverage further support the adoption of these products. Despite challenges like economic disparity, growing investments in healthcare are expected to drive sustained growth in the region.

Middle East and Africa Orthopedic Braces and Supports Market Analysis

Orthopedic braces and supports in the Middle East and Africa market are driven by the increasing prevalence of orthopedic disorders and road traffic accidents. Increasing awareness regarding these devices and their benefits in post-surgical recovery and injury prevention also supports the growth of the market. Another significant factor driving orthopedic braces and support markets is the gradual degeneration of bones, joints, and muscles with increasing age. Reportedly, older people aged 60 years or more in 2023 across the GCC reached 2.6 million, which constitutes 4.5% of the total population. These elderly patients have an increased risk for diseases like arthritis, osteoporosis, and degenerative joint disorders that then lead to chronic pain, restriction of movements, and susceptibility to more injuries. It has orthopedic braces and supports as a necessary part of management, bringing about stability with a decrease in pain so that the patient can proceed toward rehabilitation. Besides this, initiatives that focus on upgrading the healthcare infrastructure of the countries of the GCC region, such as UAE and Saudi Arabia, further support the market expansion. Also, investments in new medical technologies and their increased adoption as innovative orthopedic products lead to the further growth of the market.

Competitive Landscape:

The orthopedic braces and supports market is highly competitive, driven by strategic initiatives by major key players which is helpful in uplifting the market space along with providing sustainability in that space. Investments in research and development (R&D) activities also allow companies to develop lines of products offering new and diverse portfolios, like braces or supports for different conditions and product enhancements to support the continuous evolution of the consumer. Additionally, companies are embracing digital technologies and investing in telehealth solutions, online sales platforms, and mobile apps to interact with consumers and provide personalized solutions and guidance directly. Apart from this, strategic partnerships with healthcare providers, hospitals, and rehabilitation centers help in expanding distribution networks and provide valuable insights into market trends and consumer preferences.

The report provides a comprehensive analysis of the competitive landscape in the orthopedic braces and supports market with detailed profiles of all major companies, including:

- 3M Company

- Bauerfeind AG

- Becker Orthopedic

- Bird & Cronin (Dynatronics Corporation)

- Breg Inc.

- Deroyal Industries Inc.

- Enovis

- Fillauer LLC

- Frank Stubbs Company Inc.

- Medi GmbH & Co. KG

- Ossur hf.

- Ottobock SE & Co. KGaA

- Remington Medical Equipment

- Thuasne Group

- Zimmer Biomet Holdings Inc.

Latest News and Developments:

- January 2024: OrthoPediatrics Corp., a company focused exclusively on advancing the field of pediatric orthopedics, acquired Boston Orthotics & Prosthetics, a leader in pediatric orthotic management for over 50 years. Boston Orthotics & Prosthetics is a successful business that provides cutting-edge bracing, orthotic, and prosthetic technology for the non-operative treatment of children with neuromuscular problems, plagiocephaly, and scoliosis.

- January 2024: EnovisTM Corporation announced the debut of its new DonJoy® ROAMTM OA knee brace, which is intended for patients with osteoarthritis or other knee discomfort and instability, through its DJO, LLC subsidiary. The newest advancement in unloader technology, ROAM OA, dynamically relieves pain, enhances stability, and aids in improving mobility by releasing the pressure of noncompartmental osteoarthritis and redistributing weight away from the injured knee.

- October 2023: OrthoPediatrics Corp. announced the DF2® Brace's limited distribution as part of its growth in the non-surgical treatment of musculoskeletal ailments in children. In place of a spica cast, the DF2® Brace is designed to immobilize the femur, knee, and hip in pediatric patients aged 6 months to 5 years to treat femur fractures.

- September 2023: Enovis Corporation announced that it has agreed to acquire LimaCorporate S.p.A. Enovis is a medical device company specializing in orthopedics that offers a wide variety of orthopedic medical devices, such as bone growth stimulators, diabetic footwear, surgical instruments, braces, and various pain and rehabilitation supplies. The deal has an enterprise value of USD 844 Million.

Orthopedic Braces and Supports Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Lower Extremity Braces and Supports, Spinal Braces and Supports, Upper Extremity Braces and Supports |

| Types Covered | Soft and Elastic Braces and Supports, Hinged Braces and Supports, Hard and Rigid Braces and Supports |

| Applications Covered | Ligament Injury, Preventive Care, Post-Operative Rehabilitation, Osteoarthritis, Others |

| End Users Covered | Orthopedic Clinics, Hospitals and Surgical Centers, Over-The-Counter (OTC) Platforms, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | 3M Company, Bauerfeind AG, Becker Orthopedic, Bird & Cronin, LLC (Dynatronics Corporation), Breg Inc., Deroyal Industries Inc., Enovis, Fillauer LLC, Frank Stubbs Company Inc., Medi GmbH & Co. KG, Ossur hf., Ottobock SE & Co. KGaA, Remington Medical Equipment, Thuasne Group, Zimmer Biomet Holdings Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the orthopedic braces and supports market from 2020-2034.

- The orthopedic braces and supports market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the orthopedic braces and supports industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The orthopedic braces and supports market was valued at USD 4.6 Billion in 2025.

The orthopedic braces and supports market is projected to exhibit a CAGR of 3.30% during 2026-2034, reaching a value of USD 6.1 Billion by 2034.

The orthopedic braces and supports market is driven by rising prevalence of orthopedic disorders, advancements in product design, growing awareness of preventive care, rising incidents of road and athletic accidents, and high demand for non-invasive healthcare treatments.

North America currently dominates the orthopedic braces and supports market, accounting for a share of 44.7% in 2025. The dominance is fueled by advanced healthcare infrastructure, high adoption rates of innovative products, and a growing aging population.

Some of the major players in the orthopedic braces and supports market include 3M Company, Bauerfeind AG, Becker Orthopedic, Bird & Cronin, LLC (Dynatronics Corporation), Breg Inc., Deroyal Industries Inc., Enovis, Fillauer LLC, Frank Stubbs Company Inc., Medi GmbH & Co. KG, Ossur hf., Ottobock SE & Co. KGaA, Remington Medical Equipment, Thuasne Group, and Zimmer Biomet Holdings Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)