Orphan Drugs Market Size, Share, Trends and Forecast by Drug Type, Disease Type, Phase, Top Selling Drugs, Distribution Channel, and Region, 2025-2033

Orphan Drugs Market Size, Share & Trends

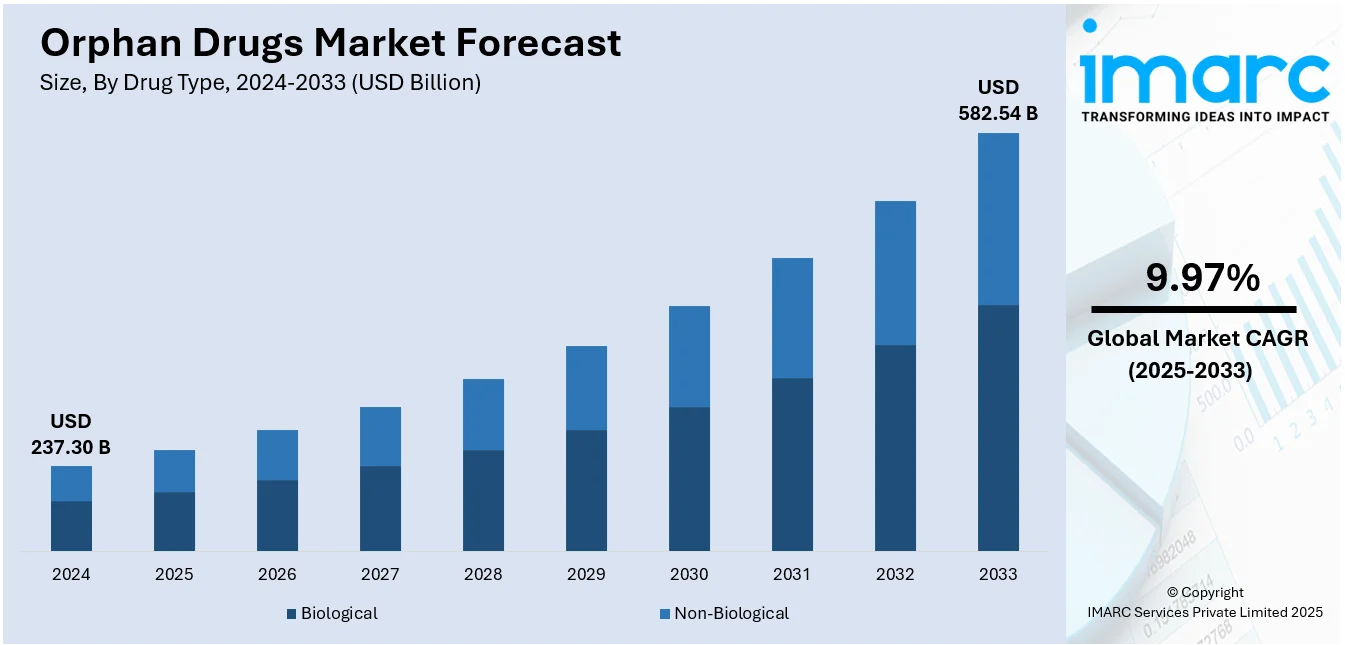

The global orphan drugs market size was valued at USD 237.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 582.54 Billion by 2033, exhibiting a CAGR of 9.97% from 2025-2033. North America currently dominates the market with 35.5% of the market share. The orphan drugs market share is expanding, driven by the increasing knowledge of rare diseases as a major public health issue, technological advancements in genomics, biotech, and precision medicine, and favorable regulatory framework offered by different national and international health authorities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 237.30 Billion |

|

Market Forecast in 2033

|

USD 582.54 Billion |

| Market Growth Rate (2025-2033) | 9.97% |

The market for orphan drugs is largely driven by supportive regulatory environments and government incentives to foster the development of therapies for rare diseases. Regulators offer incentives such as market exclusivity, tax credits, lower fees, and accelerated approval procedures. These incentives greatly lower the cost of financial risk for pharmaceutical firms and stimulate innovation in specialized therapeutic areas. Another key driver is the increasing incidence of rare diseases worldwide, combined with increased awareness and enhanced diagnostic technology. Developments in genomics and personalized medicine are allowing for improved detection and targeting of rare genetic disorders, driving the demand for orphan drugs.

The orphan drugs market in the United States is driven by several factors. The growing incidence of rare diseases, impacting a huge number of Americans, highlights the expanding need for specialized medicines. Advanced genetic screening and diagnostic technologies are allowing for earlier and more precise identification of rare conditions, driving a larger addressable patient base. Additionally, effective advocacy by rare disease organizations and patient groups is enhancing awareness, funding, and patient access to orphan drugs. High price potential and positive reimbursement practices in the American healthcare infrastructure also favor expansion opportunities. Orphan drugs also tend to bear higher prices given scarce alternatives as well as due to the extremely serious nature of conditions they seek to treat. In 2025, the US Food and Drug Administration (FDA) has awarded orphan drug status to rilzabrutinib, an experimental, new, advanced, oral, reversible Bruton's tyrosine kinase (BTK) inhibitor, for two rare diseases, including warm autoimmune hemolytic anemia (wAIHA) and IgG4-related disease (IgG4-RD).

Orphan Drugs Market Trends:

Increasing Prevalence and Awareness About Rare Diseases

The increasing knowledge of rare diseases as a major public health issue is driving the growth of the market. In 2024, it was estimated that approximately 300 million billion around world lived with rare diseases. Increasing prevalence rates, combined with enhanced epidemiological studies and patient registries, are illuminating the scope of these disorders. Greater awareness through advocate groups, non-profit organizations, and public campaigns has also been important in bringing education to healthcare providers, policymakers, and the general public. Greater awareness not only improves earlier diagnosis and disease management but also improves demand for novel therapies. Governments and private companies are committing more resources to rare disease research, and enhanced data sharing is moving the development pipeline more efficiently.

Advancements in Genomics and Precision Medicine

Technological advancements in genomics, biotech, and precision medicine are transforming the diagnosis and management of rare diseases at a strong pace offering a favorable orphan drugs market outlook. Genomic sequencing, bioinformatics, and personalized medicine methodologies are facilitating more accurate diagnosis and individualized treatment plans, especially for rare and complex genetic disorders. These technologies have compressed the drug discovery process and improved the success rate of targeted therapies by correlating drug mechanisms with individual genetic markers. In addition, the emergence of companion diagnostics enables improved patient selection and monitoring, which improves treatment efficacy and safety. Biopharmaceutical firms are increasingly using these technologies to create new biologics, gene therapies, and ribonucleic acid (RNA)-based treatments for small patient populations with high unmet medical needs. The IMARC Group predicts that the companion diagnostics market is expected to reach USD 22.3 Billion by 2033.

Favorable Regulatory Frameworks and Government Incentives

The favorable regulatory framework offered by different national and international health authorities is impelling the orphan drugs market growth. Various countries around the world provide a wide range of incentives designed to encourage pharmaceutical firms to invest in rare disease treatments. These incentives generally range from market exclusivity, clinical research tax credits, regulatory fees waiver, expedited approvals, and grant dollars. These encourage significantly the reductions of the money hurdles involved with the research and development of these orphan drugs with small target numbers and little commercial value. This regulatory encouragement builds confidence and generates a more stable and secure setting for firms to create and market therapies for unmet and vulnerable patient segments, sustaining long-term market growth. Governments are also allocating budgets for managing rare diseases, which is further driving the need for orphan drugs. For instance, Union of India announced its plan to establish a National Fund for Rare Diseases (NFRD) and provision for ₹974 crore for FYs 2024–25 and 2025–26 as suggested by NRDC awaiting MoHFW clearance. Similarly, or slightly greater, fund amount shall be provisioned for 2026–27 and 2027–28.

Orphan Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global orphan drugs market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on drug type, disease type, phase, top selling drugs, and distribution channel.

Analysis by Drug Type:

- Biological

- Non-Biological

Biological holds 65.8% of the market share. It represents the largest segment, chiefly because of their success in treating the underlying pathophysiologic mechanisms of orphan diseases. It is generally developed from living organisms and comprise monoclonal antibodies, gene therapies, recombinant proteins, and cell-based medicines. Its potential to provide targeted, disease-modifying actions renders them very well adapted to intricate and genetically influenced diseases. As biotechnology and genomics advance, biologics are being developed more for an increasingly broad range of rare conditions, such as specific cancers, immunodeficiencies, and metabolic diseases. Their growing presence in the market is facilitated by the robust pipeline of biologic orphan drugs, as well as by favorable regulatory mechanisms like fast-track approval and orphan designation. Moreover, the premium pricing and longer development cycles associated with biologics are often justified by their therapeutic value, especially in cases where treatment alternatives are limited or non-existent.

Analysis by Disease Type:

- Oncology

- Hematology

- Neurology

- Cardiovascular

- Others

Oncology holds 36.6% of the market share. The oncology segment holds a dominant position in the orphan drugs space due to the prevalent incidence of uncommon cancers and the pressing demand for targeted therapy. Uncommon cancers, like particular forms of leukemia, sarcomas, and lymphomas, tend to have fewer or no viable treatments, fueling immense research and development efforts. Pharmaceutical firms are moving more and more towards these orphan oncology indications because of advantages provided under the orphan drug act, such as market protection and lower development expense. Molecular biological advancements and the use of immunotherapy have increasingly pushed the speed of development in personalized cancer care, such as monoclonal antibodies and checkpoint inhibitors. Also, the partnerships among academic institutions and biotech companies have resulted in the discovery of novel biomarkers and pathways for unusual cancer subtypes.

Analysis by Phase:

- Phase I

- Phase II

- Phase III

- Phase IV

Phase I of orphan drug development focuses on evaluating safety, dosage range, and pharmacokinetics in a small group of healthy volunteers or affected patients. This phase plays a critical role in laying the foundation for subsequent clinical trials. Although the patient population is typically small, which aligns with the nature of rare diseases, careful monitoring is required to assess tolerability and identify any adverse reactions.

Phase II trials for orphan drugs are designed to evaluate therapeutic efficacy and further assess safety in a larger cohort of patients who are affected by the rare disease under investigation. This phase is particularly crucial in the orphan drug landscape, as it provides initial evidence of the drug’s clinical benefit, which can guide decision-making for Phase III trials.

Phase III is the most resource-intensive phase of orphan drug development, focused on confirming the drug's efficacy, monitoring side effects, and comparing its performance to existing treatments or placebos.

Phase IV, or post-marketing surveillance, focuses on monitoring the long-term safety, effectiveness, and overall impact of orphan drugs after they receive regulatory approval and enter the market.

Analysis by Top Selling Drugs:

- Revlimid

- Rituxan

- Copaxone

- Opdivo

- Keytruda

- Imbruvica

- Avonex

- Sensipar

- Soliris

- Other

Keytruda holds 15.7% of the market share. Keytruda (pembrolizumab) is one of the best-selling medicines, including in the orphan drugs market. It is a PD-1 inhibitor that has found widespread use in oncology, especially for rare cancers such as Merkel cell carcinoma and primary mediastinal large B-cell lymphoma. Keytruda's success in gaining orphan drug status in several indications reflects its therapeutic utility and effectiveness in the treatment of diseases with high unmet needs. Its extensive clinical value and positive results have made it a pillar of immunotherapy, with uses that tend to go beyond initial approval ranges through continued studies and trials. By providing a notable survival advantage in a number of uncommon oncological disorders, Keytruda has set the standard for precision medicine. Regulatory pressure and ongoing innovation in biomarker-led therapies are assisting it in growing its base in the rare disease environment, solidifying its position as a market leader in the orphan drug space.

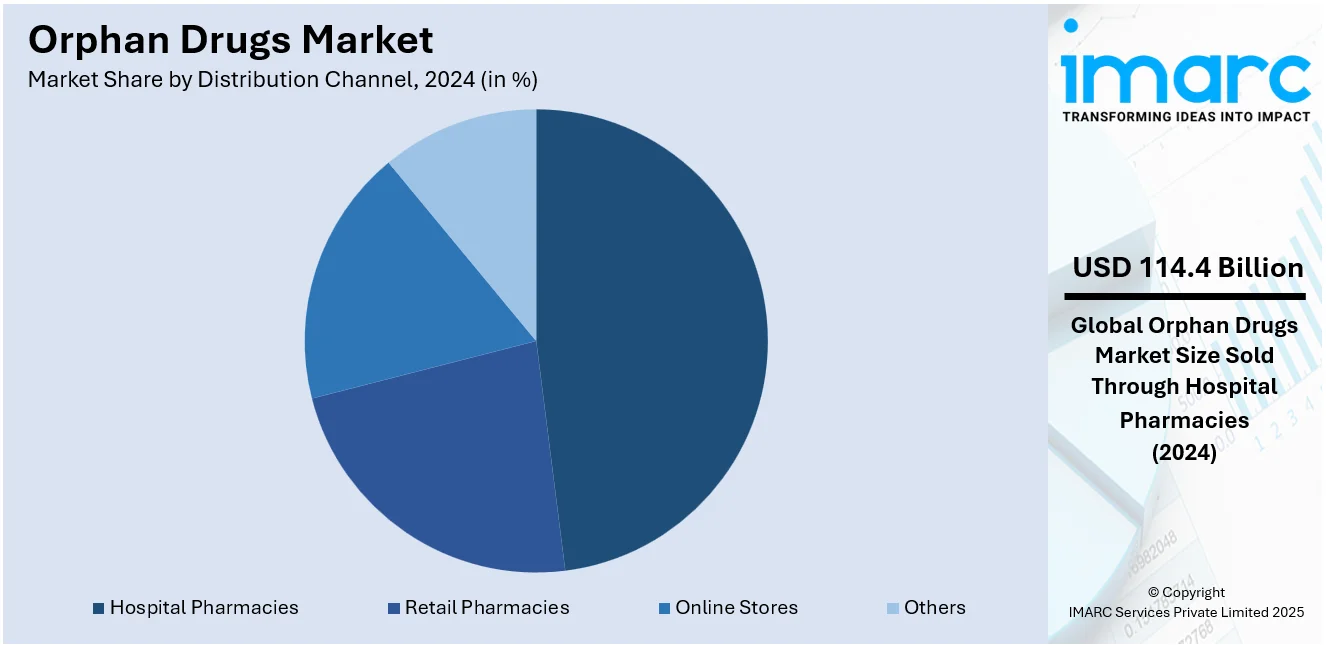

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Stores

- Others

Hospital pharmacies hold 48.2% of the market share. Hospital pharmacies hold the biggest market share. Hospital pharmacies are also essential in the dispensing of orphan drugs, especially because of the specialized nature and administration needs of these treatments. Most orphan drugs are applied in the treatment of complicated, life-threatening, or uncommon diseases that need close medical monitoring, hence the most suitable place for them to be dispensed is the hospital. These medications usually entail complex dosing regimens, intravenous delivery, or patient monitoring for side effects, all of which are best conducted in a hospital setting. Furthermore, hospitals commonly engage in post-marketing research and clinical trials, providing them with direct access to recently approved orphan therapies. Due to the limited availability and high price of orphan drugs, hospital pharmacies also collaborate closely with healthcare payers and drug manufacturers in ensuring proper inventory management as well as reimbursement coordination.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 35.5%. North America represents the largest segment, driven by strong regulatory support, technological advancements, and a rising focus on rare disease treatment. The United States, in particular, leads the region due to the well-established framework under the Orphan Drug Act, which provides incentives such as tax credits, market exclusivity, and expedited review processes. These provisions have encouraged pharmaceutical companies to invest in niche areas that previously lacked commercial viability. The increasing prevalence of rare diseases, estimated to affect over 30 million people in the US, is also contributing to growing demand for targeted therapies. Another leading trend is the convergence of precision medicine and genomic technologies in orphan drug development. With better diagnostic capabilities, more patients are being correctly diagnosed, resulting in improved treatment target and personalized treatments. Also, partnerships among biotech companies, academic institutions, and government agencies are driving innovation and accelerating research pipelines.

Key Regional Takeaways:

United States Orphan Drugs Market Analysis

The United States hold 93.00% of the market share in North America. The United States experiences increasing orphan drug adoption due to growing investment in THE pharmaceutical sector, driving research into rare diseases. According to reports, in the US pharmaceutical industry, there were 25 private equity deals announced in Q3 2024, worth a total value of USD 2.3 Billion. Pharmaceutical companies allocate substantial resources to develop therapies targeting conditions with limited treatment options. Regulatory incentives, including expedited approvals and market exclusivity, encourage innovation. Growing collaborations between biotechnology firms and research institutions further accelerate drug development. Rising healthcare expenditures support the availability of orphan drugs, improving accessibility for patients. Expanding clinical trials enhance treatment options, addressing unmet medical needs. Public and private funding initiatives boost research efforts, fostering drug innovation. Advancements in drug formulation improve efficacy and patient outcomes. Increased awareness among healthcare providers leads to early diagnosis and intervention, optimizing treatment success, and thereby driving the market for orphan drugs.

Asia Pacific Orphan Drugs Market Analysis

Asia-Pacific witnesses expanding orphan drug adoption due to the increasing prevalence of cancer, prompting pharmaceutical companies to develop specialized treatments. According to the National Cancer Registry Programme, the estimated number of incident cases of cancer in India for the year 2022 was found to be 14,61,427. Rising incidence of rare malignancies creates demand for novel therapies addressing unmet medical needs. Advancements in medical technology enhance drug discovery, leading to more effective treatment options. Favorable regulatory policies streamline approval processes, accelerating drug availability. Growing investments in oncology research foster innovation, promoting targeted therapies. Expanding healthcare infrastructure improves access to specialized treatments, supporting patient outcomes. Expanding clinical research collaborations facilitate new drug development, enhancing treatment efficacy. Increasing healthcare spending strengthens access to high-cost orphan drugs, ensuring affordability. Personalized medicine advancements align with the development of precision therapies, benefiting patients with rare cancers and augmenting the need for orphan drugs.

Europe Orphan Drugs Market Analysis

Europe is experiencing increasing orphan drug adoption due to growing research and development activities, propelling advancements in rare disease treatment. According to Eurostat, in 2023, the EU spent €381 Billion on research and development; R&D expenditure as a percentage of GDP stood at 2.22% in 2023, compared with 2.08% in 2013. Rising investment in drug discovery is facilitating novel therapeutic innovations. Expanding partnerships between biotech firms and academic institutions are accelerating clinical trials for orphan drugs. Enhanced funding in genetic research is enabling personalized medicine breakthroughs. Adoption of advanced biopharmaceutical technologies is improving drug efficacy and patient outcomes. Streamlined regulatory frameworks support faster orphan drug approvals. Moreover, the development of specialized research centers is expediting orphan drug discovery. Expanding healthcare innovation hubs are fostering new treatment methodologies. Support for translational research is enabling swift transition from laboratory discoveries to clinical applications.

Latin America Orphan Drugs Market Analysis

Latin America observes expanding orphan drugs adoption due to growing online stores, offering greater accessibility to specialized treatments. The shift toward digital healthcare platforms enhances drug availability, allowing patients to access medications conveniently. Rising internet penetration supports e-commerce growth, driving online pharmaceutical sales. Streamlined distribution channels reduce barriers to obtaining orphan drugs, improving affordability. Digital pharmacies facilitate direct patient engagement, enhancing treatment adherence. Expanding telemedicine services complement online sales, promoting seamless healthcare access. Increasing digital literacy strengthens consumer confidence in online healthcare solutions.

Middle East and Africa Orphan Drugs Market Analysis

Middle East and Africa witness increasing orphan drugs adoption due to growing healthcare infrastructure, enhancing treatment accessibility for rare diseases. According to the Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022, projected to expand further by 3-6% in facilities and 10-15% in professionals in 2023. Expanding medical facilities improve diagnosis and patient care, strengthening market penetration. Government investments in specialized healthcare services facilitate orphan drug availability. Advancements in hospital networks ensure efficient drug distribution, supporting patient needs. Regulatory developments streamline drug approvals, accelerating market entry. Rising medical research initiatives foster innovation, contributing to orphan drug development.

Competitive Landscape:

Market players in the orphan drugs space are increasingly making strategic partnerships and mergers and acquisitions (M&A) to improve their research pipelines and broaden their product offerings. Pharmaceutical and biotech firms are prioritizing novel drug development, especially in fields like gene therapy, immunotherapy, and rare oncology. A key trend is the increase in alliances between specialty biotech companies and large pharma companies that have more commercialization capabilities. Firms are also using regulatory incentives to speed up development and obtain market exclusivity. Many players are investing in new, high-tech innovation such as AI-powered drug discovery and precision medicine to make clinical trials more efficient, thereby driving the orphan drugs market demand. These activities demonstrate an innovation and competition-oriented environment towards fulfilling unmet medical requirements for rare diseases.

The report provides a comprehensive analysis of the competitive landscape in the orphan drugs market with detailed profiles of all major companies, including:

- Alexion Pharmaceuticals Inc.

- Amgen Inc.

- AstraZeneca

- Bayer AG

- Daiichi Sankyo Company Limited

- Genentech USA, Inc (F. Hoffmann-La Roche AG)

- GSK plc

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis Pharmaceuticals Corporation

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceuticals U.S.A., Inc

Latest News and Developments:

- November 2024: CervoMed announced that the FDA granted orphan drug designation to neflamapimod for treating frontotemporal dementia. The designation highlighted the unmet need in FTD and the drug’s potential in neurologic disorders.

- September 2024: Agios Pharmaceuticals announced that the FDA granted orphan drug designation to tebapivat (AG-946) for treating myelodysplastic syndromes (MDS). The designation highlighted the need for new oral treatments for anemia in lower-risk MDS patients. Agios aimed to develop the first oral therapy targeting ineffective erythropoiesis in MDS.

- March 2024: Terns Pharmaceuticals announced that the FDA granted Orphan Drug Designation to TERN-701 for treating chronic myeloid leukemia. TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor, was in Phase 1 clinical development.

- February 2024: Rapid Commercialization Partners (RCP) collaborated with Orphan Now to support companies in expediting orphan drug development. The partnership aims to streamline market entry, ensuring faster access to critical treatments for patients worldwide. This initiative enhances commercialization efficiency, benefiting rare disease drug developers.

- February 2024: Cabaletta Bio announced that the FDA granted Orphan Drug Designation to CABA-201 for treating myositis. The investigational CD19-CAR T cell therapy is being developed for B cell-driven autoimmune diseases. The company is advancing Phase 1/2 RESET trials to evaluate CABA-201 across multiple conditions.

Orphan Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Biological, Non-Biological |

| Disease Types Covered | Oncology, Hematology, Neurology, Cardiovascular, Others |

| Phases Covered | Phase I, Phase II, Phase III, Phase IV |

| Top Selling Drugs Covered | Revlimid, Rituxan, Copaxone, Opdivo, Keytruda, Imbruvica, Avonex, Sensipar, Soliris, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alexion Pharmaceuticals Inc., Amgen Inc., AstraZeneca, Bayer AG, Daiichi Sankyo Company Limited, Genentech USA, Inc (F. Hoffmann-La Roche AG), GSK plc, Johnson & Johnson, Merck & Co., Inc., Novartis Pharmaceuticals Corporation, Pfizer Inc., Sanofi S.A., Takeda Pharmaceuticals U.S.A., Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the orphan drugs market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global orphan drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the orphan drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The orphan drugs market was valued at USD 237.30 Billion in 2024.

The orphan drugs market is projected to exhibit a CAGR of 9.97% during 2025-2033, reaching a value of USD 582.54 Billion by 2033.

The market is driven by supportive regulatory incentives, rising prevalence of rare diseases, increasing awareness, and advancements in genomics, biotechnology, and precision medicine.

North America currently dominates the orphan drugs market, accounting for the largest share, supported by strong regulatory frameworks, advanced diagnostics, and increased R&D investment.

Some of the major players in the orphan drugs market include Alexion Pharmaceuticals Inc., Amgen Inc., AstraZeneca, Bayer AG, Daiichi Sankyo Company Limited, Genentech USA, Inc (F. Hoffmann-La Roche AG), GSK plc, Johnson & Johnson, Merck & Co., Inc., Novartis Pharmaceuticals Corporation, Pfizer Inc., Sanofi S.A., Takeda Pharmaceuticals U.S.A., Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)