Organic Substrate Packaging Material Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Organic Substrate Packaging Material Market Size and Share:

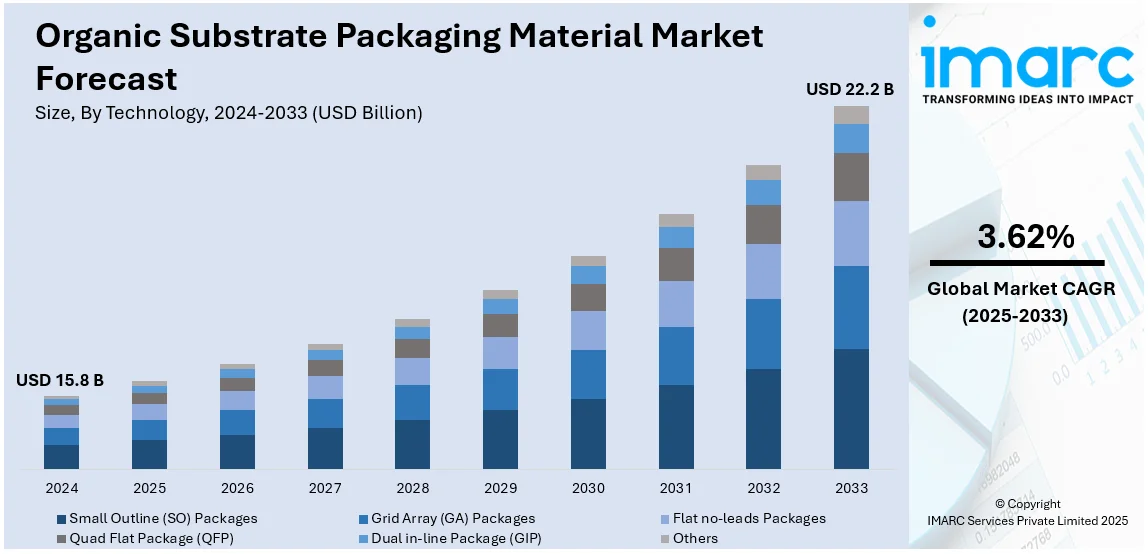

The global organic substrate packaging material market size was valued at USD 15.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.2 Billion by 2033, exhibiting a CAGR of 3.62% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 48.4% in 2024. Increasing adoption of miniaturized electronic devices, advancements in high-density interconnect technology, stringent environmental regulations promoting sustainable packaging, growing demand for 5G and AI-driven semiconductor applications, and the shift toward bio-based, halogen-free materials are driving the organic substrate packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.8 Billion |

|

Market Forecast in 2033

|

USD 22.2 Billion |

| Market Growth Rate (2025-2033) | 3.62% |

The market is significantly influenced by the continual advancements in bio-based materials that are enhancing the structural integrity and thermal stability of organic substrate packaging. Additionally, the rising demand for sustainable packaging solutions in semiconductor applications is facilitating the organic substrate packaging material market growth. On November 5, 2024, Henkel announced advancements in semiconductor packaging materials, focusing on reliability and sustainability. The company has developed high thermal sintering die attach solutions with approximately 200 W/mK thermal conductivity for automotive applications and introduced the Loctite Eccobond UF 9000AE, a large die capillary underfill capable of filling die sizes up to 50x50mm. Henkel is also emphasizing sustainable practices by offering materials with zero intentionally added PFAS and exploring the use of renewable carbon sources. The integration of organic substrates in advanced IC packaging, including system-in-package (SiP) and fan-out wafer-level packaging, is supporting miniaturization trends. Moreover, the expansion of 5G infrastructure is increasing demand for high-frequency, low-loss organic substrates.

The United States stands out as a key regional market, driven by government incentives promoting domestic semiconductor manufacturing under initiatives like the CHIPS and Science Act are strengthening the organic substrate packaging materials market demand. On November 21, 2024, Arizona State University and Deca Technologies will receive up to USD 100 Million from the National Institute of Standards and Technology as part of the SHIELD USA initiative. With a focus on organic materials and substrates, this project seeks to promote innovation in the domestic semiconductor packaging ecosystem. It will be a crucial part of the U.S. Department of Commerce's larger USD 11 Billion CHIPS research and development (R&D) program. Also, increasing defense and aerospace electronics production, requiring advanced, lightweight, and high-reliability substrates, is further driving market expansion. The rapid development of IoT-enabled devices and AI-driven computing applications is fostering the need for organic substrates with enhanced signal integrity and thermal dissipation. Additionally, collaborations between U.S.-based semiconductor foundries and packaging technology providers are accelerating research and development (R&D) activities in high-density interconnect organic substrates, enhancing market competitiveness.

Organic Substrate Packaging Material Market Trends:

Sustainable and Eco-Friendly Packaging

The awareness about the environment increases the requirement for eco-friendly and sustainable materials, which is enhancing the organic substrate packaging materials market outlook. The traditional packaging made of plastics has come under scrutiny due to its adverse effects on the environment. Packaging manufacturers are now looking at alternatives such as biodegradable plastics, plant-based packaging materials, and recycled products. These alternatives are supposed to reduce waste and minimize the carbon footprint of the packaging process. Apart from the environmental advantages, these materials open avenues for regulatory compliance. Governments worldwide are developing more stringent packaging waste laws and regulations. The rise in consumer demand for sustainable products is evident, with 73% of global consumers willing to pay more for sustainable packaging, according to an industrial report. Many markets, including the organ substrate market, therefore adapt to sustainable packaging as part of their corporate social responsibility.

Technological Advancements in Packaging Materials

The continuous technological innovations in packaging materials are a significant organic substrate packaging material market trend. High-performance polymers, nanomaterials, and intelligent packaging solutions are increasingly being used to enhance the safety, shelf life, and functionality of organ substrate products. For example, intelligent packaging encompasses sensing elements or indicators implanted directly within the package and tracks changes in temperature, humidity, or chemical concentrations for ensuring organic substrates to stay under the right storage and handling conditions during transit and warehousing. Nanotechnology improves strength, increases toughness of the package and delivers a heightened protection level of packaging from external environmental contaminates. These technologies ensure safe transportation and preservation of organic substrates while offering transparency to the consumer by providing real-time data on product quality.

Rise in Biopharmaceutical and Medical Applications

The organizational expansion that is rapidly progressing in the sector of biopharmaceuticals and medicine is creating a demand for the specialized packaging materials used for organic substrates. With the healthcare industry adopting more biotechnology advancements and practices on organ transplants, safe and reliable packaging solutions are becoming critical requirements. Any tissue or other biological product served as an organic substrate needs packaging that keeps them in good condition while maintaining sterility and temperature control. This increases the demand for packaging material that protects the product additionally with tamper-proof seals, anti-microbial, and temperature-sensitive packaging. The Global Observatory on Donation and Transplantation (GODT) reports that there were 157,494 solid organ transplants performed worldwide in 2022. The packaging materials have to be developed strictly adhering to medical and pharmaceutical standards as they are bound by stringent safety and quality requirements. Also, with the emergence of personalized medicine and customized treatment, there is a growing demand for more flexible and versatile packaging solutions adapted to specific medical purposes.

Organic Substrate Packaging Material Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global organic substrate packaging material market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on technology and application.

Analysis by Technology:

- Small Outline (SO) Packages

- Grid Array (GA) Packages

- Flat no-leads Packages

- Quad Flat Package (QFP)

- Dual in-line Package (GIP)

- Others

Flat no-leads packages lead the market with around 31.2% of market share in 2024.It facilitates efficient dissipation of heat as well as good electrical performances in miniaturized electronic appliances. FNL packages will support advanced applications in telecommunications, automotive electronics, and consumer electronics as the need for high-density and high-reliability semiconductor packaging grows. Compatibility with organic substrates such as ajinomoto build-up film (ABT) and bismaleimide triazine (BT) improves signal integrity and minimizes power loss. The organic packaging material transition is a sustainability step away from traditional ceramic or metal-based packaging. With advances in 5G, IoT, and AI-driven devices, FNL packages with organic substrates are increasingly adopted to lead innovations in the field of semiconductor manufacturing and packaging efficiency.

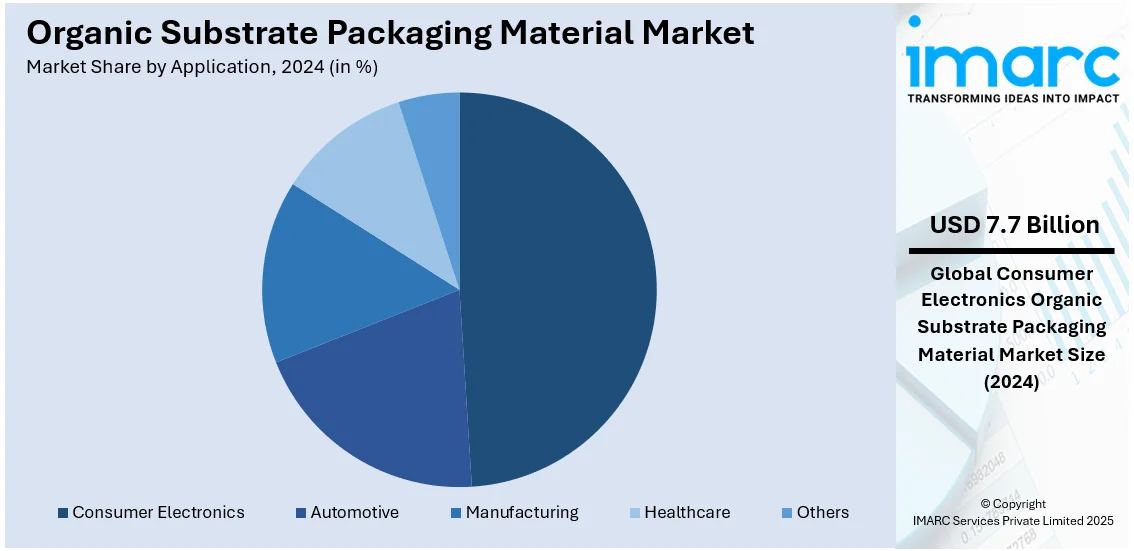

Analysis by Application:

- Consumer Electronics

- Automotive

- Manufacturing

- Healthcare

- Others

Consumer electronics leads the market with around 48.7% of market share in 2024, due to the need for miniaturization, high-performance integration, and cost-effective manufacturing. Devices such as smartphones, laptops, tablets, wearables, and smart home products employ advanced packaging to enhance functionality while keeping their designs compact. Organic substrates provide very high insulation properties along with excellent thermal stability and integrity in the signal for application in high-density interconnects. 5G-enabled devices, IoT applications, and AI-driven consumer gadgets have added complexities to the semiconductor components that would lead to advanced organic substrates' use. Also, sustainability issues are forcing manufacturers to switch from traditional ceramic or metal-based substrates to organic ones to reduce environmental damage.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 48.4% due to the strong presence of the major manufacturing hubs in China, Taiwan, South Korea, and Japan. The region also benefits from a robust supply chain for materials and strong government support as well as large-scale production facilities. Top players in the packaging industry are heavily investing in advanced organic substrates for miniaturization, signal integrity, and thermal management. Rapid growth in consumer electronics, automotive electronics, and telecommunications, particularly with the expansion of 5G and IoT applications, fuels demand for high-performance organic substrates. Asia Pacific is also the most preferred region due to its cost advantages in labor and materials. The region continues to lead innovation and capacity expansion in organic substrate packaging materials as demand for AI-driven devices and high-speed computing grows.

Key Regional Takeaways:

United States Organic Substrate Packaging Material Market Analysis

In 2024, the US accounted for around 80.00% of the total North America organic substrate packaging material market. Growth in the U.S. organic substrate packaging material market is essentially due to increasing consumer demand for eco-friendly products. The Organic Trade Association reports that in 2023, sales of certified organic items were close to USD 70 Billion, while sales of organic food reached USD 63.8 Billion. According to a recent analysis by the IMARC Group, the size of the U.S. organic food market is projected to reach USD 82.7 Billion in 2023. This high demand for organic food is contributing to sustainable packaging solutions growth. Sustainable substrate packaging leaders in the field include EcoEnclose and Earthpack. It also benefits through innovation in the field of compostable materials and biodegradable polymers. Besides, growth is also expected from government regulations promoting sustainable practices. Domestic producers are increasing their operation scale to meet the demand, assuring the U.S. remains the largest in the organic packaging industry around the globe.

Europe Organic Substrate Packaging Material Market Analysis

Demand for organic and eco-friendly products is leading to growing supremacy in the market. The European organic substrate packaging material market, under strict sustainability regulations, exceeds the EUR 50 Billion (USD 53.22 Billion) mark of 2023, and reached USD 57.5 Billion in 2024, as per the IMARC Group analysis. Countries like Germany and France are now experiencing high demand for organic packaging solutions, since retailers and brands are now being encouraged to promote eco-friendly practices. The market is also driven by the Green Deal of the EU, pushing for a change in sustainable materials for packaging. Companies such as BASF and UPM-Kymmene lead the development of biodegradable and compostable packaging materials. As consumers increasingly favor more sustainable, eco-friendly packaging, the demand for plant-based packaging is rising, with high-end organic product manufacturers leading the way in embracing these solutions. Significant advancements are also emerging due to innovations in barrier technologies.

Asia Pacific Organic Substrate Packaging Material Market Analysis

Asia Pacific has already experienced massive growth in consumer interest in the application of organic and sustainable products. China Briefing stated that in 2023, China's organic product industry grew to USD 14 Billion, which stands as the third largest organic product consumption in the world. Demand for organic or eco-friendly packaging material is high with this fact. Increasing organic food demand also stimulates the rise in packaging material, especially where countries like Japan and South Korea are involved, hence a trend in sustainable materials. With an increasingly environmentally friendly mindset, regions will see growth in the kind of packaging the manufacturer comes up with, plant-based and biodegradable for example. Rising demand for organic products, combined with increasing environmental concerns, will boost the market of organic packaging in the Asia Pacific region further.

Latin America Organic Substrate Packaging Material Market Analysis

The increasing requirement for sustainable and eco-friendly products from consumers is one of the significant growth-inducing factors for the organic solutions packaging material market in Latin America. Brazil is the largest market in Latin America, and its organic food industry is expanding rapidly. According to IMARC Group, the Brazil organic food market size reached USD 3.7 Billion in 2024, reflecting the rising popularity of organic food products in the region. Organic packaging demand is driven by environmentally conscious solutions offered to consumers. The encouragement given by governments in the organic way of farming and sustainability leads the manufacturers towards adopting biodegradable and recyclable materials. Rising e-commerce sites and higher awareness among the people regarding sustainability is also enhancing demand for organic substrate packaging material across Latin America.

Middle East and Africa Organic Substrate Packaging Material Market Analysis

The Middle East and Africa organic substrate packaging material market are witnessing rising attention as there is an increasing requirement for eco-friendly and organic products. The GCC organic food market size was USD 4.4 Billion in 2024 and is expected to continue to increase to USD 11.7 Billion by 2033, according to the IMARC Group. This increase is causing organic and sustainable solutions to be more in demand for packaging in this region. The growth states include the UAE, Saudi Arabia, and Qatar, where consumers are increasingly concerned with sustainability in food and packaging. The high growth in organic food availability with rising disposable incomes and increasing environmental awareness continues to fuel the growth in the market. Government actions to promote sustainability and reduce footprints on the environment have also uplifted the growth in the adoption of organic packaging material in the region.

Competitive Landscape:

The market is highly competitive, driven by advancements in sustainable materials and by increasing demand for biodegradable and compostable packaging. The competition revolves around innovations through plant-based polymers, fiber-based materials, and mycelium-based alternatives by companies differentiating through material strength, barrier capabilities, and competitiveness. Manufacturers primarily focus on optimizing moisture resistance as well as strength while maintaining environmental friendliness. Regulatory policies supporting sustainable packaging are increasing competition and forcing market players to invest in research and development. Strategic partnerships with raw material suppliers and packaging converters enhance market positioning. Product customization, lifecycle assessments, and end-of-life disposal solutions are used to satisfy changing consumer and regulatory expectations as a competitive strategy.

The report provides a comprehensive analysis of the competitive landscape in the organic substrate packaging material market with detailed profiles of all major companies, including:

- Ajinomoto Fine-Techno Co., Inc.

- Amkor Technology, Inc.

- ASE Technology Holding

- KYOCERA Corporation

- PCB Technologies Ltd.

- Shinko Electric Industries Co Ltd

- TOPPAN Inc.

Recent Developments:

- November 2024: Kyocera Corporation faces challenges in its semiconductor organic packaging materials business as demand falls short of forecasts. The downturn affects its entry into the AI chip supply chain, with recovery expected to be slow.

- September 2024: Amkor Technology’s S-SWIFT™ (Substrate Silicon Wafer Integrated Fan-out Technology) revolutionizes IC packaging with high-density organic dielectrics, improving die-to-die interconnects. The dual damascene process embeds RDL in organic materials, enhancing fine-pitch features and addressing silicon technology limitations for AI, HPC, and data centers.

Organic Substrate Packaging Material Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Small Outline (SO) Packages, Grid Array (GA) Packages, Flat no-leads Packages, Quad Flat Package (QFP), Dual in-line Package (GIP), Others |

| Applications Covered | Consumer Electronics, Automotive, Manufacturing, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ajinomoto Fine-Techno Co., Inc., Amkor Technology, Inc., ASE Technology Holding, KYOCERA Corporation, PCB Technologies Ltd., Shinko Electric Industries Co Ltd, TOPPAN Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the organic substrate packaging material market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global organic substrate packaging material market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the organic substrate packaging material industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic substrate packaging material market was valued at USD 15.8 Billion in 2024.

The organic substrate packaging material market is projected to exhibit a CAGR of 3.62% during 2025-2033, reaching a value of USD 22.2 Billion by 2033.

The market is driven by increasing demand for miniaturized and high-performance electronics, advancements in IC packaging technologies such as system-in-package (SiP) and fan-out wafer-level packaging, and the rising adoption of 5G and AI-powered devices. Stringent environmental regulations promoting halogen-free and bio-based materials, alongside expanding semiconductor manufacturing investments, are further fueling growth.

Asia Pacific currently dominates the organic substrate packaging material market, accounting for a share of 48.4% in 2024. The dominance is fueled by strong semiconductor manufacturing hubs in China, Taiwan, South Korea, and Japan, increasing government support for domestic chip production, and the rapid expansion of 5G, IoT, and AI-driven consumer electronics.

Some of the major players in the organic substrate packaging material market Ajinomoto Fine-Techno Co., Inc., Amkor Technology, Inc., ASE Technology Holding, KYOCERA Corporation, PCB Technologies Ltd., Shinko Electric Industries Co Ltd and TOPPAN Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)