Organic Electronics Market Report by Component (Active, Passive), Material (Semiconductor, Conductive, Dielectric and Substrate), Application (Display, Lighting, Battery, Conductive Ink, and Others), and Region 2025-2033

Organic Electronics Market Size:

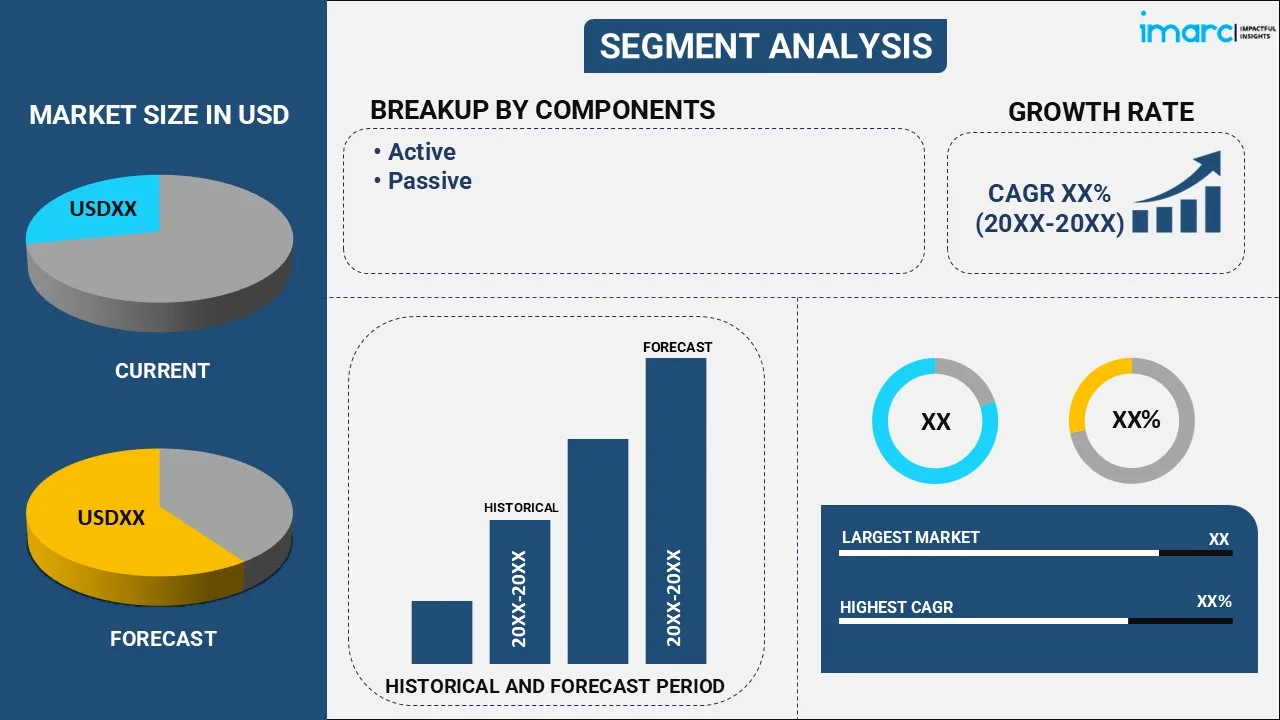

The global organic electronics market size reached USD 98.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 408.8 Billion by 2033, exhibiting a growth rate (CAGR) of 16.3% during 2025-2033. The market is propelled by the increasing demand for energy-efficient solutions, rising consumer electronics adoption, and supportive government policies due to environmental concerns favoring organic and biodegradable materials.

Key Insights:

- In terms of region, Asia Pacific held the leading position in revenue in 2024.

- Based on component, the active segment accounted for the largest market share in 2024.

- Among materials, semiconductor generated the highest revenue in 2024.

- The display segment was the leading application.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 98.3 Billion |

|

Market Forecast in 2033

|

USD 408.8 Billion |

| Market Growth Rate 2025-2033 | 16.3% |

Organic Electronics Market Analysis:

- Major Market Drivers: The increased emphasis on eco-friendly technologies and the various breakthroughs in organic photovoltaics (OPVs) and organic light-emitting diodes (OLEDs) technology are increasing the demand for flexible and lightweight electronics, thus propelling the market.

- Key Market Trends: The development of printable electronics for low-cost manufacturing, the broad use of organic photovoltaics in building-integrated photovoltaics (BIPV), and the integration of organic electronics in wearable technology and smart textiles represent key trends in the market.

- Geographical Trends: Asia Pacific is among the leading markets with nations such as China, Japan, and South Korea, for manufacturing and using organic electronics. Furthermore, a plethora of research projects and new technology developments are driving the market growth in North America and Europe.

- Competitive Landscape: Some of the major market players in the organic electronics industry include AGC Inc., BASF SE, Covestro AG, DuPont de Nemours Inc., FUJIFILM Corporation, Heliatek GmbH, Merck KGaA, Novaled GmbH (Samsung SDI Co. Ltd.), PolyIC GmbH & Co. KG (LEONHARD KURZ Stiftung & Co. KG), Sony Corporation and Universal Display Corporation among many others.

- Challenges and Opportunities: Challenges in the market are the cost of production and performance limitations compared to conventional electronics. As per the organic electronics market overview, opportunities comprise innovations to enhance the durability, efficiency, and scalability of organic electronic devices, with the growing investment in research and development (R&D) for next-generation materials and applications presenting growth prospects.

To get more information on this market, Request Sample

Organic Electronics Market Trends:

Supportive Government Policies

Government policies that are supportive of the organic electronics sector represents major growth-inducing factor. For instance, the DOE Solid-State Lighting Program advances U.S. scientific capabilities, stimulates investment from the business sector, provides internationally recognized insights, and fosters innovation in the development of effective and flexible lighting solutions to improve health, productivity, and well-being. Furthermore, there is still a lot of potential for solid-state lighting (SSL), particularly LED-based technologies, to move toward peak performance. DOE projections indicate that by 2035, modern lighting systems might save 6.9 Trillion kWh of power by accomplishing efficiency, control, and linked lighting goals. Hence, these energy reductions would avert energy-related costs of almost USD 710 Billion and 2.1 Billion Metric Tons of carbon dioxide emissions. These initiatives enable improvements in OLED longevity, cost-effectiveness, and efficiency by offering vital funding and support for research, which in turn affects market expansion.

Increased Adoption in Consumer Electronics

The growing utilization of flexible organic electronics in the consumer electronics industry is propelling market expansion, mainly due to the improved flexibility and lightweight of these materials. As they are thin and flexible, organic electronics are being incorporated into a wide range of products, including flexible TVs and smartphones. This is redefining product designs. For instance, on 4 January 2024, the Consumer Technology Association predicted that retail revenues in the U.S. consumer technology industry would increase by 2.8% in 2024, reaching USD 512 Billion, a USD 14 Billion increase from 2023. Based on CTA's forecast, this suggests that consumer spending on technology-related goods and services is increasing. As manufacturers continue to innovate and invest in organic electronics to meet these consumer demands, the market is expected to expand further, fostering greater technological advancements and wider application scopes within the industry.

Rising Demand for Energy-efficient Solutions

The market for organic electronics is expanding due in large part to the growing need for energy-efficient solutions. According to the Department of Energy, light- emitting diode (LED) technology is the most advanced and energy-efficient lighting option available. Furthermore, the use of LED lighting has the potential to completely change how lighting is provided in the US in the future. Besides, residential LED lighting may last up to 25 times longer than conventional incandescent lights and consume at least 75% less energy, especially those with ENERGY STAR certifications. In addition, the extensive use of LED lighting has the potential to significantly influence energy saving in the US. It is anticipated that most lighting installations will make use of LED technology by 2035. By 2035, the yearly energy savings from LED lighting could surpass 569 terawatt hours, which is the same as the energy output of almost 92 1,000-megawatt power plants. Thus, energy efficiency is driving its use in industries including consumer electronics, architectural lighting, and automotive lighting.

Organic Electronics Gaining Ground in Wearable Technology

The demand for smarter, lighter, and more flexible wearables is pushing manufacturers to adopt organic electronics. These materials offer advantages that traditional rigid components can’t, i.e., comfort, skin conformity, and design flexibility. Whether it’s health monitoring patches, fitness bands, or smart textiles, organic circuits and sensors allow for better user experience by adapting to body movement without causing discomfort. Their compatibility with stretchable substrates also makes them ideal for clothing-integrated electronics. One area gaining attention is organic bioelectronics, which combines biology with organic materials to develop wearable systems capable of monitoring vital signs and health indicators. As the wearable tech market shifts toward more discreet and always-on solutions, organic electronics are helping bridge the gap between utility and comfort. The focus is now on devices that blend seamlessly into everyday life, without adding bulk or stiffness.

Ongoing Progress in Organic Photovoltaic Development

Organic Photovoltaics (OPVs) continue to attract interest as research focuses on improving their stability, durability, and adaptability. Unlike traditional solar cells, OPVs are lightweight, flexible, and can be printed on a wide variety of surfaces. This opens up possibilities for use in non-flat spaces, from windows and backpacks to portable devices and building materials. Scientists are working to enhance the absorption range and electrical performance by refining organic materials and layering techniques. The production process is also less resource-intensive compared to conventional methods, making OPVs more attractive for manufacturers aiming to reduce environmental impact. With innovation advancing the performance of the organic photovoltaic cell, these systems are gradually finding practical use in projects that value flexibility, aesthetic design, and ease of integration.

Organic Electronics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, material, and application.

Breakup by Component:

- Active

- Passive

Active accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes active and passive. According to the report, active represented the largest segment.

Active components include organic light-emitting diodes (OLEDs), organic field-effect transistors (OFETs), and organic photovoltaic (OPV) cells. These active parts facilitate light emission, charge transfer, and energy conversion, all of which are essential to the operation of organic electronic devices. Additionally, the widespread use of flexible displays, solar panels, and lighting solutions is influencing the market growth. Furthermore, the growing need for electronics that are flexible, lightweight, and energy-efficient, underscores its crucial role in the development of organic electronics. Hence key players are introducing advanced product variants to meet these needs. For instance, on 29 January 2024, FlexEnable, a company well-known for developing flexible organic electronics in active optics and displays, introduced optical assessment kits designed specifically for AR and VR systems. These kits make use of FlexEnable's flexible liquid crystal (LC) technology with modules like ambient dimming and adjustable lens film. These incredibly light and thin active optics provide AR/VR revolutionary optical capabilities, allowing for far smaller, lighter, and curved devices.

Breakup by Material:

- Semiconductor

- Conductive

- Dielectric and Substrate

Semiconductor holds the largest share of the industry

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes semiconductors, conductive, dielectric and substrate. According to the report, semiconductors accounted for the largest market share.

Semiconductors are essential for developing organic light-emitting diodes (OLEDs), solar cells, and transistors all essential components of consumer electronics, car displays, and renewable energy applications. These materials are essential as they make it easier for electricity to conduct efficiently in a variety of organic electronic devices. Transistors, solar cells, and organic light-emitting diodes (OLEDs) are among the main uses for organic semiconductors. The broad acceptance of these semiconductors is fueled by their special qualities, which include flexibility, reduced weight, and the possibility of cheaper production costs as compared to their inorganic counterparts. Furthermore, the growing need for wearable and flexible electronics that push the limits of conventional electronic solutions is supporting the growth of this market.

Breakup by Application:

- Display

- Lighting

- Battery

- Conductive Ink

- Others

Display represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes display, lighting, battery, conductive ink, and others. According to the report, display represented the largest segment.

Displays are driven by the increasing adoption of organic light-emitting diode (OLED) technology in smartphones, televisions, and wearable devices, which are prized for their superior color quality and energy efficiency. Some application areas include organic photovoltaics, which is gaining traction in the renewable energy sector, and organic sensors, which are becoming integral in healthcare for biometric and environmental monitoring. This diversification showcases the expanding influence of organic materials in modern electronic devices, supporting a broad spectrum of industries with flexible, lightweight, and cost-effective solutions. Hence key players are introducing advanced product variants to meet these needs. For instance, in May 2023, Merck, a prominent science and technology company, launched advanced silicon dielectrics through low-temperature Plasma Enhanced Atomic Layer Deposition (ALD) technology enabling the creation of flexible OLEDs for advanced display devices. These new materials offer significantly enhanced barrier properties, being 100 times more effective and 20 times thinner than current solutions.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest organic electronics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest regional market for organic electronics.

According to the organic electronics market forecast, Asia Pacific emerging as the dominant segment due to the robust electronics manufacturing sector, significant investments in technology and infrastructure, and the presence of key market players. Countries like China, Japan, and South Korea are pivotal, driving innovation and adoption due to their strong focus on consumer electronics and renewable technologies. Additionally, government initiatives supporting technological advancements and the increasing demand for eco-friendly and flexible electronics further propel the market's growth in this region, establishing Asia Pacific as a critical area for organic electronics development. Besides, the launch of advanced product variants in the region is also propelling the market growth. For instance, on 17th March 2023, Panasonic Holdings Corporation introduced advanced color reproduction technology designed to minimize color crosstalk. This innovation involves thinning the photoelectric conversion layer using the high light absorption capabilities of Organic Photoconductive Film (OPF) and employing electrical pixel separation techniques. In this technology, the OPF section responsible for photoelectric conversion and the circuit section for charge storage and readout operate independently within a unique layered structure. This design significantly reduces pixel sensitivity across green, red, and blue wavelengths outside the intended spectrum, leading to decreased color crosstalk and achieving precise color reproduction under various lighting conditions.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the organic electronics companies include AGC Inc., BASF SE, Covestro AG, DuPont de Nemours Inc., FUJIFILM Corporation, Heliatek GmbH, Merck KGaA, Novaled GmbH (Samsung SDI Co. Ltd.), PolyIC GmbH & Co. KG (LEONHARD KURZ Stiftung & Co. KG), Sony Corporation and Universal Display Corporation.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the organic electronics market are strengthening their position through several strategic initiatives. These include ramping up research and development efforts to introduce innovative and more efficient materials, such as advanced conductive polymers and organic light-emitting diodes (OLEDs). They are also forming partnerships and collaborations with technology companies and academic institutions to enhance their technological capabilities and expand their market reach. Additionally, companies are investing in scaling up production facilities to meet the growing demand for organic electronics in applications ranging from flexible displays to solar cells, further strengthening their position in the market. For instance, on 14th April 2023, LAPP, a leading provider of integrated cable and connection technology solutions, collaborated with BASF to integrate a new bio-based plastic into its product lineup. This innovative plastic, named Organic ETHERLINE and developed by BASF, provides a sustainable alternative for various cable applications.

Organic Electronics Market News:

- March 2025: Researchers at the University of Vienna developed a faster method, i.e., Catalyst-Transfer Macrocyclization, for producing azaparacyclophanes, ring-shaped molecules vital to organic electronics. This new approach simplifies production, making these building blocks more accessible for use in displays, flexible solar cells, and transistors. Published in JACS Au, the breakthrough supports scalable innovation in optoelectronic and supramolecular device manufacturing.

- April 2024: LAPP introduces the ETHERLINE FD bioP Cat.5e, marking its debut bio-cable in series production. This sustainable version features a bio-based outer sheath comprising 43% renewable raw materials (verified by ASTM D6866). The data cable utilizes a sheath material that is partially bio-based. Despite incorporating bio-based elements, the product maintains identical properties to the standard variant made entirely from fossil raw materials. This advancement results in a 24% reduction in carbon footprint compared to cables with fossil-based TPU sheaths.

- 14 May 2024: Deutsche Telekom utilizes Makrolon RE from Biowaste and Residues in Premium TV Box. It features Makrolon RE, an infrared-transparent polycarbonate derived from ISCC PLUS-certified renewable raw materials via a mass-balanced approach. This marks the debut of Makrolon RE in a telecommunications device, emphasizing sustainability using alternative materials sourced from biological waste.

- 17 June 2024: FlexEnable, a pioneer in flexible organic electronics for active optics and displays, has revealed that the world's inaugural mass-produced consumer product featuring organic transistor technology has commenced shipment. The device, named Ledger Stax, is a secure crypto wallet created by the leading French company Ledger. FlexEnable collaborated with display manufacturers DKE (Shanghai) and Giantplus (Taiwan) to bring Ledger's design to life a credit card-sized product with an E Ink display seamlessly curved around a 180-degree bend.

Organic Electronics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Active, Passive |

| Materials Covered | Semiconductor, Conductive, Dielectric and Substrate |

| Applications Covered | Display, Lighting, Battery, Conductive Ink, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGC Inc., BASF SE, Covestro AG, DuPont de Nemours Inc., FUJIFILM Corporation, Heliatek GmbH, Merck KGaA, Novaled GmbH (Samsung SDI Co. Ltd.), PolyIC GmbH & Co. KG (LEONHARD KURZ Stiftung & Co. KG), Sony Corporation, Universal Display Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the organic electronics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global organic electronics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the organic electronics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global organic electronics market was valued at USD 98.3 Billion in 2024.

We expect the global organic electronics market to exhibit a CAGR of 16.3% during 2025-2033.

The increasing product utilization in the manufacturing of electronic displays, lighting solutions, solar panels, conductive inks, etc., is primarily driving the global organic electronics market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous manufacturing units for organic electronics.

Based on the component, the global organic electronics market can be categorized into active and passive. Currently, active component exhibits clear dominance in the market.

Based on the material, the global organic electronics market has been segmented into

semiconductor, conductive, and dielectric and substrate. Among these, semiconductor represents the largest market share.

Based on the application, the global organic electronics market can be bifurcated into display,

lighting, battery, conductive ink, and others. Currently, display accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where Asia-Pacific currently dominates the global market.

Some of the major players in the global organic electronics market include AGC Inc., BASF SE, Covestro AG, DuPont de Nemours Inc., FUJIFILM Corporation, Heliatek GmbH, Merck KGaA, Novaled GmbH (Samsung SDI Co. Ltd.), PolyIC GmbH & Co. KG (LEONHARD KURZ Stiftung & Co. KG), Sony Corporation, and Universal Display Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)