Organic Dairy Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Distribution Channel, and Region, 2025-2033

Organic Dairy Market Size and Share:

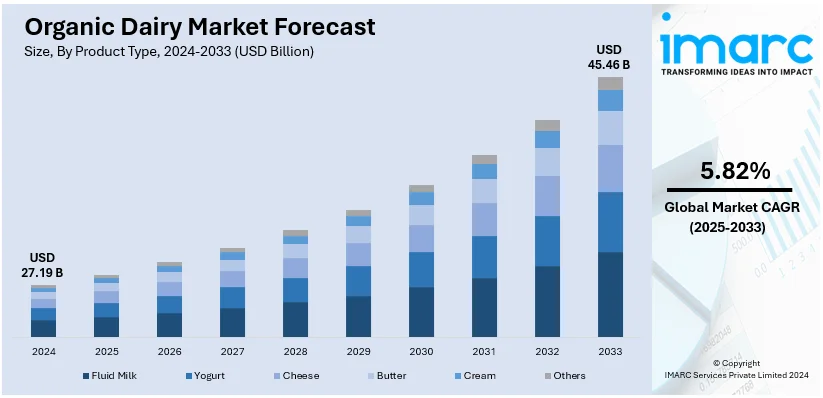

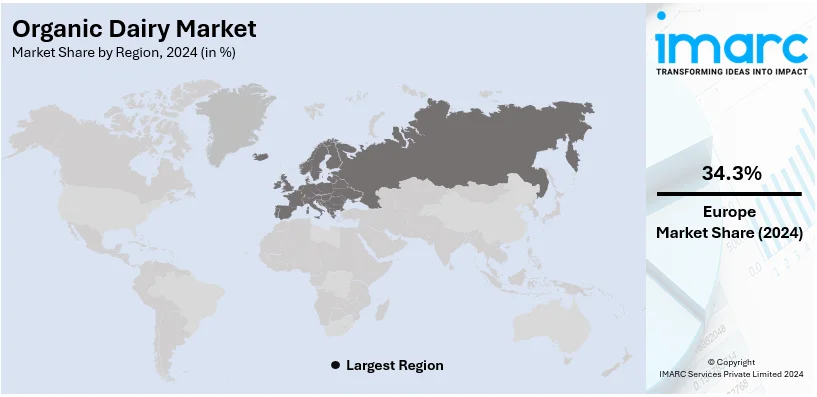

The global organic dairy market size was valued at USD 27.19 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.46 Billion by 2033, exhibiting a CAGR of 5.82% from 2025-2033. Europe currently dominates the market, holding a market share of over 34.3% in 2024. The increasing consumer health consciousness, environmental sustainability, regulatory support, certification, expanding retail availability, and rising disposable income levels, all contributing to the organic dairy market share expansion in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 27.19 Billion |

|

Market Forecast in 2033

|

USD 45.46 Billion |

| Market Growth Rate (2025-2033) | 5.82% |

One of the key drivers in the organic dairy market is the rising consumer preference for natural and chemical-free products. As health awareness grows, many individuals seek food options perceived as safer and more nutritious, leading to increased demand for organic milk, cheese, and yogurt. Organic dairy products are free from synthetic pesticides, antibiotics, and genetically modified organisms (GMOs), aligning with consumer priorities for sustainability and health. Additionally, the expanding availability of organic dairy products in retail stores and e-commerce platforms has improved accessibility and expanded organic dairy market share. This shift is further supported by government initiatives and certifications promoting organic farming and eco-friendly agricultural practices.

The United States is emerging as a leading market, holding a total of 89.80% share. It plays a significant role in the organic dairy market, driven by strong consumer demand for sustainable and health-focused products. Growing awareness of the benefits of organic dairy, such as the absence of synthetic hormones, antibiotics, and GMOs, has augmented organic dairy market growth drivers. For instance, in September 2024, U.S. organic milk sales reached 249 million pounds, up 9.1% from the previous year. Organic whole milk sales rose 15.5% to 131 million pounds, while reduced-fat milk (2%) sales increased by 4.2% to 80 million pounds. The U.S. Department of Agriculture’s (USDA) Organic certification standards ensure product authenticity, fostering consumer trust. Large-scale retailers and specialty organic stores have expanded organic dairy offerings, increasing accessibility. Additionally, innovation in organic dairy products, such as plant-based blends and fortified options, aligns with evolving dietary preferences, further contributing to the U.S. as a key market for organic dairy.

Organic Dairy Market Trends:

Consumer health consciousness

In recent years, there has been a notable shift in consumer preferences toward healthier and more natural food choices. According to L.E.K. Consulting’s 2018 food and beverage survey of nearly 1,600 consumers, 93% of people want to eat healthy at least occasionally, with 63% striving to do so most or all of the time. This change in dietary habits is one of the primary drivers of the organic dairy market. Consumers are becoming increasingly health-conscious and are seeking products that are free from synthetic hormones, antibiotics, and pesticides. Organic dairy products are perceived as a healthier option as they are produced without the use of these harmful substances, contributing to the positive organic dairy market forecast. This has led to a growing demand for organic milk, yogurt, cheese, and butter. The global cheese market size reached USD 93.3 billion in 2024. Organic dairy products are rich in essential nutrients, including vitamins, minerals, and antioxidants. They are also known to have higher levels of beneficial fatty acids, such as omega-3, which contribute to overall well-being. As consumers become more informed about the nutritional benefits of organic dairy, they are willing to pay a premium for these products.

Environmental sustainability

Concerns about the environmental impact of conventional dairy farming practices have prompted consumers to seek more sustainable alternatives. According to the FAO, more than 150 Million farmers, or more than one in four of the 570 Million farm holdings worldwide, are engaged in dairy farming with at least one milk-producing animal such as cows, buffaloes, goats, or sheep. Organic dairy farming is characterized by practices that prioritize environmental conservation. Organic farms typically use organic feed for livestock, employ rotational grazing techniques, and minimize the use of synthetic chemicals and antibiotics. These practices reduce soil and water pollution, enhance biodiversity, and promote animal welfare. The growing awareness about climate change and the need to reduce carbon footprints have also played a role in driving the organic dairy market revenue. Organic dairy farming tends to have lower greenhouse gas emissions per unit of milk produced compared to conventional methods. This aligns with the preferences of environmentally conscious consumers who are increasingly choosing organic dairy products as a more sustainable option.

Regulatory support and certification

Many countries have strict regulatory bodies and governments, regulating organic farming and dairy productions, to have high standards in terms of certification. All this is to ensure organic authenticity and quality. Since there are these regulations and certification, consumers can trust that the organic label is authentic. The certification process is rigorous in terms of inspections, testing, and compliance with specific criteria, such as the use of organic feed, absence of synthetic chemicals, and adherence to animal welfare standards. APEDA reports that there are 29 accredited certification bodies authorized to grant organic certification, and producers can choose any one of them to certify their farms. This regulatory support and certification have enhanced consumer confidence and encouraged more dairy farmers to switch to organic farming, increasing the availability of organic dairy products in the market, as highlighted in organic dairy industry insights.

Increasing retail availability

Organic dairy products are now more accessible to consumers than ever before. They are no longer confined to specialty health food stores but are widely available in mainstream supermarkets and grocery chains. As of 2023, there are 62,383 Supermarkets and Grocery Stores businesses in the US, according to IBIS World. This increased retail availability has significantly contributed to the growth of the organic dairy market. Supermarkets and grocery stores have recognized the rising demand for organic products and have expanded their organic dairy product offerings. This increased visibility and availability make it easier for consumers to incorporate organic dairy into their daily diets, further fueling market growth.

Rising disposable incomes

Economic factors also play a crucial role in driving the organic dairy market. As expenditure capacities increases in many regions, consumers are more willing to spend on premium products, including organic dairy. Organic dairy products are often priced higher than their conventional counterparts due to the costs associated with organic farming practices. However, consumers with higher incomes are more willing to pay the price premium for perceived health benefits and environmental sustainability. This demographic shift in purchasing power has expanded the consumer base for organic dairy products and contributed to their increasing market demand.

Organic Dairy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global organic dairy market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, packaging type, and distribution channel.

Analysis by Product Type:

- Fluid Milk

- Yogurt

- Cheese

- Butter

- Cream

- Others

Organic fluid milk stands as the largest component in 2024, reflecting its integral role in consumer diets and growing health consciousness. Sales data from USDA indicate consistent growth in organic milk demand, with whole milk leading the segment. For instance, U.S. organic milk sales in September 2024 reached 249 million pounds, with whole milk accounting for over half at 131 million pounds, marking a 15.5% year-over-year increase. This dominance is attributed to the product's versatility, widespread use in households, and alignment with preferences for non-GMO and hormone-free options. The segment benefits from expanded retail availability, innovations like lactose-free variants, and robust marketing emphasizing environmental sustainability and health benefits.

Analysis by Packaging Type:

- Pouches

- Tetra-packs

- Bottles

- Cans

- Others

Pouches leads the market with around 38.7% of market share in 2024 due to their convenience, sustainability, and cost-effectiveness. These flexible packaging options allow for the evolving consumer desire for portability and reduced environmental impact. Lightweight and resealable, pouches improve product freshness and work better than traditional packaging such as cartons or bottles. Pouches also are more environmentally friendly because of the reduced amount of material and energy used in production and transportation, keeping in line with both consumer and producer sustainability goals. Thus, they are appealing across demographics, especially younger consumers and families, who prefer convenience on-the-go. The rise of innovative designs, such as spout pouches, further boosts their market adoption, making them a preferred choice for organic dairy brands.

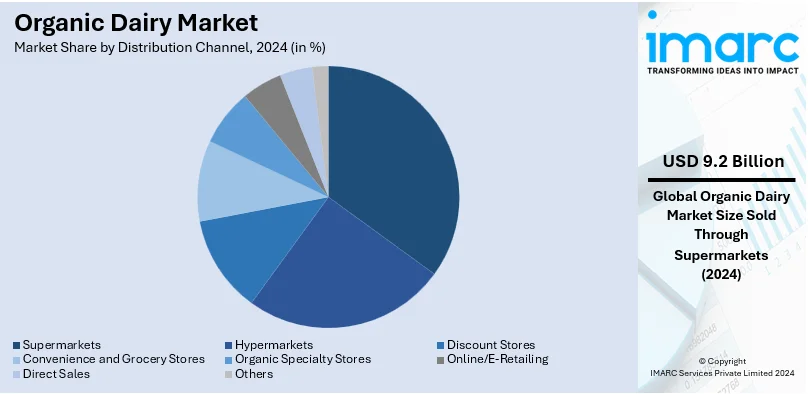

Analysis by Distribution Channel:

- Supermarkets

- Hypermarkets

- Discount Stores

- Convenience and Grocery Stores

- Organic Specialty Stores

- Online/E-Retailing

- Direct Sales

- Others

In 2024, Supermarkets account for the majority of the market at around 33.8%, due to their extensive reach, convenience, and wide product availability. These retail chains cater to diverse consumer needs by offering a range of organic dairy options, including milk, cheese, and yogurt, often under private-label brands at competitive prices. Enhanced shelf visibility and promotions have made organic products more accessible to mainstream shoppers, further driving sales. Supermarkets also benefit from established distribution networks and economies of scale, enabling them to stock fresh organic dairy products consistently. The growth of in-store organic sections and partnerships with certified organic suppliers reinforces their position as the primary channel for organic dairy sales.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 34.3%, driven by strong consumer demand for sustainably produced, high-quality food. Established organic certification systems and government incentives for organic farming have strengthened market growth in the region. Production and consumption leaders are countries such as Germany, France, and the Netherlands. Organic milk, cheese, and yogurt have a high demand in health-conscious consumer populations, and the retail chains and specialty organic stores in Europe offer rich portfolios of organic dairy products that are easily accessible. There's further disposable incomes increase due to cultural demand on sustainable, green, and natural products which, in turn, strengthens market dominance. Eco-friendly innovation in packaging, as well as product diversification, help support market expansion.

Key Regional Takeaways:

North America Organic Dairy Market Analysis

The North American organic dairy market has experienced steady growth, driven by this consumer demand for healthier and sustainably produced food. Organically produced milk in the United States remains a dominant feature of the dairy sector in general, with producers increasingly attending to these demands through certification under organic practices. The USDA reports that although organic dairy products still constitute a small share of the total dairy market, the organic sector is going to grow as consumers demand organic products free from antibiotics and synthetic hormones.

The challenges faced by organic dairy farmers have also affected the market. Higher production costs and premium pricing for organic dairy products are often the outcomes in such scenarios. Moreover, the dynamic of the market is now changing due to more consumers turning toward plant-based alternatives. Despite this, organic dairy enjoys a niche with its set of loyal customers. It is expected that milk production will stand at 226 billion pounds in 2024, with organic dairy products being one of the key segments of the market.

United States Organic Dairy Market Analysis

The U.S. organic dairy market is experiencing robust growth as consumers are increasingly favoring healthy, sustainable, and natural food options. As awareness grows on the advantages of organic farming—such as no antibiotics and synthetic pesticides, demand for organic dairy has seen a surge. The consumers also are shifting to these products because of health issues related to chemicals in the conventional dairy. Lactose intolerance and milk allergies have increased; organic dairy products are gentler on the digestive system. Ethical farming methods and concerns for animal welfare are other important drivers of consumer preference. Organic dairy sales also benefited from the increasing prevalence of e-commerce, which was used to make 22.0% of all U.S. retail sales in 2023. Expanded organic certification standards offer ongoing market transparency and premium quality, thereby establishing customer trust. All of these elements contribute to growing the U.S. organic dairy market.

Europe Organic Dairy Market Analysis

The European organic dairy market is driven by increasing consumer demand for high-quality, sustainably sourced products. Growing health concerns from pesticides, antibiotics, and additives in their conventional dairy products are nudging consumers to prefer organic instead. A recent IRI International survey found that 70% of Europeans now want healthier food choices with less salt, sugar, fat, or calories. Furthermore, ethical concerns related to animal welfare and environmental sustainability add to the attraction of organic dairy. The European Union supports this shift through strong regulations and subsidies for organic farming. Supermarkets and specialized organic retailers have expanded access to organic dairy, with certified organic labels further boosting consumer confidence in markets like Germany, France, and the UK. These factors collectively position Europe as a significant player in the global organic dairy market.

Asia Pacific Organic Dairy Market Analysis

The organic dairy market in the Asia-Pacific (APAC) region is experiencing growth driven by increasing health consciousness and changing dietary preferences. Rising concerns over the health implications of conventional dairy products, such as the use of antibiotics and growth hormones, are fueling demand for organic alternatives. The growing middle class, which reached 2 Billion in 2020 and is expected to grow to 3.5 Billion by 2030, according to the World Economic Forum, is enabling consumers to prioritize premium, organic food options. Additionally, the expansion of organic farming practices is gaining momentum as consumers seek transparency in sourcing and environmental sustainability. The adoption of organic dairy is further supported by the rise of lactose intolerance and the growing popularity of plant-based diets. Increasing product availability in urban centers through modern retail channels is promoting market growth, with government support for organic agriculture also playing a key role in driving the sector forward.

Latin America Organic Dairy Market Analysis

Organic dairy products in Latin America are mainly driven by increasing health consciousness and the increasing demand for natural products without additives. Increased awareness of the benefits of organic products, especially the nonuse of pesticides and hormones, has caused a demand for organic dairy. Additionally, household per capita income in Brazil grew 11.5% in 2023, according to the Brazilian Institute of Geography and Statistics (IBGE). This growth in disposable income, along with expanding retail infrastructure, is enabling consumers to opt for organic food. The trend, which is supported by government through organic farming, is enabling the development of the market.

Middle East and Africa Organic Dairy Market Analysis

The organic dairy market in the Middle East is driven by increased health awareness and the increasing demand for natural, hormone-free dairy products. Concerns regarding food safety and environmental impact have pushed consumers toward organic alternatives. Lactose intolerance in this region is also common, where in the world, it was said that 70% of the population is affected; based on PMC, it gives strength to the demand for organic dairy which is perceived as gentler for a digestive system. The increase of the middle class along with the growth of retail infrastructures is also boosting market size, supported by the fact of premium organic offerings.

Competitive Landscape:

The organic dairy market is highly competitive, where a few key players are seeking to gain market share. Key global players are using the existing distribution networks, huge brand recognition, and product portfolios. These companies present a wide range of organic dairy products, from milk, cheese, and yogurt. Regional players are also big in Europe, focusing on organic farming practices and obtaining the necessary certifications. Private label brands are also rising in supermarkets, offering lower prices to consumers and allowing more consumers access to organic offerings. In addition, direct-to-consumer platforms are further making the market intensify through e-commerce with online retailers offering organic dairy products. Companies are thus investing more in sustainability, innovation, and packaging for differentiation.

The report provides a comprehensive analysis of the competitive landscape in the organic dairy market with detailed profiles of all major companies, including:

- Arla Foods A.M.B.A.

- Aurora Organic Dairy

- Organic Valley

- Horizon Organic

- Whole Foods Market

- Kroger

Latest News and Developments:

- In November 2024, Rumiano Cheese Co. launched its Farm to School Organic Cheese Program, aimed at providing K-12 schools in California with healthy, organic cheese. The program is already operational, serving 10 school districts and reaching over 50,000 students daily.

- In March 2024, Kaneka Corporation launched JAS-certified organic milk under its Pur Natur™ brand. Initially sold at LIFE Corporation supermarkets, it was later made available at organic stores. Sourced from Betsukai Wellness Farm in Hokkaido, the milk was produced using organic circular dairy farming and A2 milk, offering a rich flavor and clean aftertaste. The product reflects the growing interest in A2 milk in Japan.

- In January 2024, Straus Family Creamery launched organic lowfat kefir in Plain and Blueberry flavors, packaged in reusable glass bottles. Kefir, a cultured fermented milk beverage, has a tangy taste and drinkable consistency.

- In January 2024, Akshayakalpa Organic opened a new production facility at Pooriyampakkam farm near Chennai, Tamil Nadu, spanning two acres. The facility processes 40,000 liters of organic dairy daily, including 34,000 liters of milk and 6,000 liters of curd. With advanced technology, the plant ensures dairy products are free from antibiotics, additives, and pesticides, reflecting the company’s commitment to sustainable farming and high-quality organic production.

- In March 2022, Organic Valley introduced its latest offerings, premium organic Creamers in delectable French Vanilla and Sweet Cream variants. These creamers cater to at-home baristas seeking a healthier choice, boasting a 40% reduction in sugar compared to the leading flavored creamer brand. What sets them apart is the absence of artificial ingredients and their lactose-free formulation, making them an excellent addition for those who prioritize quality and health in their coffee rituals.

Organic Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fluids Milk, Yogurt, Cheese, Butter, Cream, Others |

| Packaging Types Covered | Pouches, Tetra-Packs, Bottles, Cans, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, Discount Stores, Convenience and Grocery Stores, Organic Specialty Stores, Online/E-Retailing, Direct Sales, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Arla Foods A.M.B.A., Aurora Organic Dairy, Organic Valley, Horizon Organic, Whole Foods Market, Kroger, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the organic dairy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global organic dairy market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the organic dairy industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic dairy market was valued at USD 27.19 Billion in 2024.

IMARC estimates the organic dairy market to exhibit a CAGR of 5.82% during 2025-2033, reaching a value of USD 45.46 Billion by 2033.

The organic dairy market is driven by increasing consumer health consciousness, and rising demand for natural and chemical-free products among the masses. In addition to this, growing retail availability, environmental sustainability concerns, regulatory support, and rising disposable incomes are also propelling the market growth.

Europe currently dominates the organic dairy market, accounting for a share exceeding 34.3% in 2024. This dominance is fueled by strong consumer demand for sustainably produced food, government incentives, and advanced organic certification systems.

Some of the major players in the organic dairy market include Arla Foods A.M.B.A., Aurora Organic Dairy, Organic Valley, Horizon Organic, Whole Foods Market, and Kroger, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)