Organic Baby Food Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Organic Baby Food Market Size and Share:

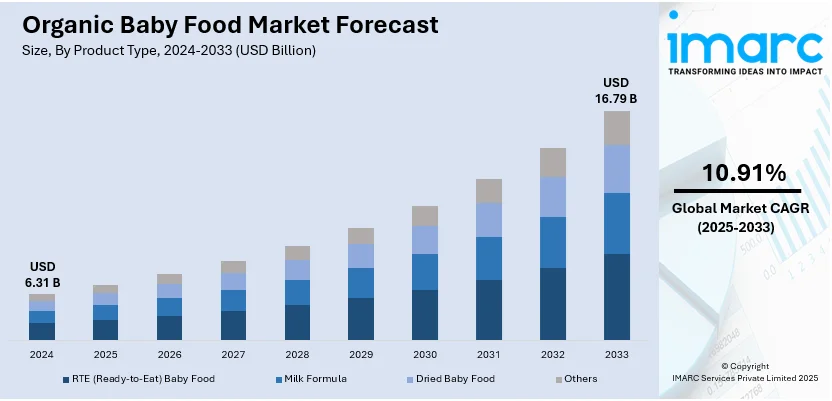

The global organic baby food market size was valued at USD 6.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.79 Billion by 2033, exhibiting a CAGR of 10.91% from 2025-2033. Asia Pacific currently dominates the organic baby food market share by holding over 48.9% in 2024. The market is driven by rising parental awareness of infant nutrition, increasing disposable incomes, rapid urbanization, expanding e-commerce penetration, and growing concerns over food safety and chemical-free ingredients.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.31 Billion |

|

Market Forecast in 2033

|

USD 16.79 Billion |

| Market Growth Rate (2025-2033) | 10.91% |

The global organic baby food market demand is primarily driven by the rising parental awareness of the importance of early childhood nutrition. In line with this, the growing health concerns over preservatives, pesticides, and artificial additives in conventional baby food are pushing consumers toward natural and organic options, which is aiding the market growth. Moreover, the expanding disposable incomes, especially in emerging economies, enable parents to spend more on premium baby food products, driving the market demand. Besides this, rapid urbanization and changing lifestyles are boosting demand for convenient, ready-to-eat (RTE) organic baby food. Also, e-commerce growth and improved retail distribution enhance accessibility, which is contributing to the market expansion. Additionally, the increasing cases of food allergies and intolerances fuel the demand for allergen-free organic baby food, thus impelling the market growth.

The United States holds a significant share of 87.90% in the organic baby food market, driven by several unique factors. Stringent food safety regulations and United States Department of Agriculture (USDA) organic certifications are boosting consumer trust in organic baby products, supporting the market growth. In addition to this, the rising demand for clean-label and non-genetically modified organism (GMO) foods is encouraging parents to choose organic options, strengthening the organic baby food market share. Concurrently, the increasing awareness of childhood obesity and its links to poor nutrition is driving preference for healthier alternatives, fostering the market demand. Moreover, the growing availability of organic baby food in mainstream supermarkets and subscription-based meal services is enhancing accessibility, providing an impetus to the market. Furthermore, government initiatives promoting organic farming and sustainable agriculture are supporting the market expansion. Apart from this, the influence of social media and parenting blogs is shaping purchasing decisions, thereby propelling the market forward.

Organic Baby Food Market Trends:

Rising Health Awareness and Parental Concerns

The rising health awareness and parental concerns are significant market drivers for global organic baby food. Parents have become more aware of child nutrition, early development, and its significance for their baby's health. In addition to this, rising urban development trends and expanding buying capacity of individuals is fueling the organic premium food sales across the globe. According to the United Nations, by 2050, 68% of the world population is projected to live in urban areas. This, coupled with the easy availability of these variants via hypermarkets, supermarkets, specialty stores, and e-commerce retail channels that offer doorstep delivery and multiple payment methods, is enhancing the organic baby food market outlook.

Product Innovation and Flavor Expansion

Product manufacturers are introducing different flavored baby food items, including chocolate and banana, mango and strawberry products, for improved appeal to babies while building their product line. The companies are adopting pouches and reusable containers as packaging alternatives because they aim to provide both convenience and sustainability benefits. This approach enables businesses to mark their products distinct from competition as they adapt their lineup for customers with shifting buying habits. The market also welcomes premium organic-certified baby foods that combine fortification with health-focused ingredients because health-conscious parents are seeking these options. For instance, Little Spoon became the first U.S. baby food brand to adopt European Union-aligned safety standards, addressing parental concerns over contaminants and enhancing product transparency. Additionally, healthy ingredients alongside minimal processing attract parents to purchase food for their infants since they seek nutritious, appropriate alternatives. Besides this, new product innovations enhance both the general appeal along with the accessibility of organic products designed for babies, which is boosting the organic baby food market growth.

Growing Demand for Specialized Organic Baby Food

Key manufacturers are introducing vegan, no cholesterol, and gluten-free organic baby food that can safely be consumed by babies suffering from lactose intolerance and celiac disease. According to the National Institute of Health, experts estimate that about 68% of the world’s population has lactose malabsorption. Furthermore, the increasing number of metabolic disorders in babies leads parents to choose organic baby food instead of non-organic alternatives. As parents become more informed about dietary restrictions and food allergies, the demand for specialized baby food options is rising. This trend is prompting manufacturers to develop allergen-free, easily digestible, and nutritionally rich alternatives that cater to diverse dietary needs, ensuring optimal infant health and development and influencing the organic baby food market trends.

Organic Baby Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global organic baby food market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- RTE (Ready-to-Eat) Baby Food

- Milk Formula

- Dried Baby Food

- Others

The Ready-to-Eat (RTE) baby food segment holds the largest market share in the global organic baby food market, driven by increasing consumer demand for convenience and nutrition-rich options. Rapid urbanization and working parents together with busy lifestyles drive parents to choose organic baby food that is easily available and ready to use. They are looking for high-quality preservative-free products which combine safety features with convenience benefits. Moreover, the growth of e-commerce offers subscription-based meal services, which deliver increased accessibility of RTE organic baby food. Besides this, manufacturers who create BPA-free pouches with resealable containers to provide extended shelf life and improved portability features are contributing to the market expansion. Additionally, consumer awareness regarding organic and clean-label ingredients leads to purchasing choices in the market, thus driving the market forward. As a result, the RTE organic baby food segment is growing, since companies launch regular flavor updates and fortified product formulations.

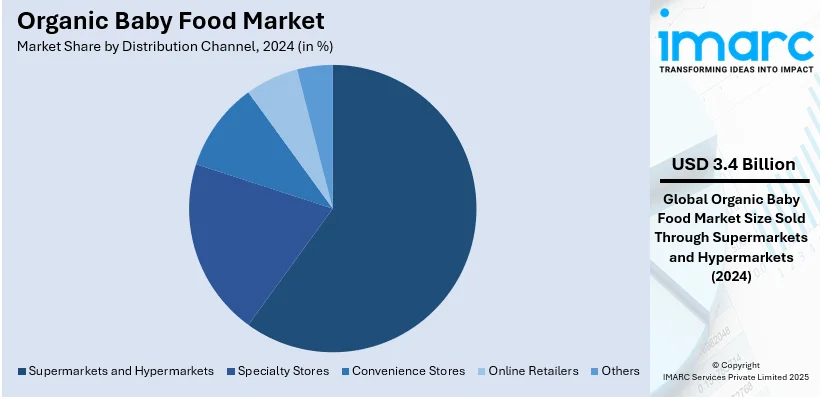

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retailers

- Others

Supermarket and hypermarket lead the market with a significant share of 53.7%. These stores provide suitable storage solutions for their products while offering different package sizes and multiple products for customers. The bigger retail stores also possess sufficient space to enhance brand exposure and messaging, which allows them to implement promotional tactics for particular brands or products. In line with this, the increasing consumer preference for one-stop shopping experiences is driving sales through these channels. Supermarkets and hypermarkets provide discounts, loyalty programs, and in-store promotions, attracting price-sensitive buyers. Additionally, trusted retailer partnerships with organic baby food brands enhance credibility and encourage purchases. Furthermore, the availability of dedicated organic sections and improved product placement strategies are supporting the market growth. With the expansion of retail chains and increased investments in organized retailing, supermarkets and hypermarkets remain the dominant distribution channel for organic baby food.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 48.9%. The demand in this region is driven by the governing agencies of numerous countries that are undertaking initiatives for regulating organic farming and improving product availability. In addition to this, the increasing awareness of chemical-free baby products and the rising number of the working population are impelling the market demand. Besides this, the market receives a positive influence from an increasing willingness of consumers to spend extra money for organic baby food products. Also, the rapid expansion of e-commerce platforms and modern retail chains is improving product accessibility across urban and rural areas. Additionally, rising birth rates in key markets like India and China are boosting the market demand. The presence of domestic organic baby food brands offering region-specific formulations is further contributing to the market expansion. Apart from this, the growing willingness to pay a premium price for high-quality, organic baby food variants is influencing the market positively in the region.

Key Regional Takeaways:

North America Organic Baby Food Market Analysis

The North America organic baby food market is experiencing steady growth, driven by increasing parental awareness of infant nutrition and rising demand for clean-label, non-GMO, and preservative-free products. According to reports, a survey indicated that 93% of U.S. parents are concerned about baby food quality, driving demand for products free from unhealthy additives and heavy metals. This growing concern is pushing manufacturers to enhance product transparency and prioritize stringent quality controls. The United States and Canada are the key markets, supported by strong regulatory frameworks like USDA Organic Certification and growing consumer preference for organic diets. Besides this, the expansion of premium and specialized baby food brands, along with the rise of e-commerce and subscription-based meal services, is fueling the market growth. Additionally, higher disposable incomes and a strong retail presence in supermarkets and specialty stores contribute to the increasing adoption of organic baby food in the region, thereby propelling the market forward.

United States Organic Baby Food Market Analysis

Organic baby food adoption in the United States is expanding due to the growing online e-commerce distribution channel, which offers convenience for busy parents seeking healthier alternatives. For instance, in 2024, US eCommerce sales increased by 2.8% from the previous quarter and a 7.2% increase compared to the same quarter last year. The digital shift has enabled consumers to explore a wide range of organic baby food products with transparency regarding ingredients and sourcing. Subscription models and doorstep delivery services are fuelling this trend, as parents prioritize quality and ease of access. Enhanced digital marketing strategies are increasing awareness, while promotions and discounts drive consumer interest. Retailers are optimizing their platforms for better user experiences, ensuring seamless purchases. The availability of organic baby food through various online marketplaces encourages greater adoption, especially among tech-savvy parents looking for premium nutrition options. Moreover, digital reviews and influencer endorsements play a role in consumer decision-making, enhancing trust in organic baby food brands. With growing concerns about artificial ingredients and preservatives, the online e-commerce distribution channel provides a vital platform for expanding the organic baby food industry in the region.

Europe Organic Baby Food Market Analysis

Organic baby food adoption in Europe is gaining momentum due to the growing packaging innovations catering to the growing babies suffering from lactose-intolerant and celiac disease. According to National Library of Medicine, the frequency of classic celiac disease with malabsorption is approximately 1 in 1000 children. Advancements in eco-friendly and convenient packaging ensure product integrity while aligning with consumer sustainability concerns. Parents are actively seeking specialized formulations designed for the growing babies suffering from lactose-intolerant and celiac disease, encouraging manufacturers to introduce allergen-free variants with clear ingredient labelling. Resealable pouches and portion-controlled containers enhance usability, meeting the evolving needs of modern families. The emphasis on growing packaging innovations reflects a broader industry shift towards safety and transparency, factors that resonate with parents prioritizing health-conscious choices. Enhanced packaging technologies also prolong shelf life, ensuring the availability of fresh organic baby food across different retail channels. The demand for functional and informative packaging solutions continues to grow, reinforcing trust in organic baby food options. With heightened awareness of dietary sensitivities, tailored packaging solutions play a crucial role in shaping consumer adoption trends.

Asia Pacific Organic Baby Food Market Analysis

The organic baby food market in Asia-Pacific is witnessing substantial growth due to the growing supermarkets and hypermarkets, offering a wide selection of organic products tailored to evolving consumer preferences. According to reports, there are 66,225 Supermarkets in India as of January 23, 2025, which is a 3.88% increase from 2023. The expansion of large retail chains enhances accessibility, allowing parents to explore multiple brands and formulations in one place. These retail spaces provide an immersive shopping experience, where promotional campaigns and in-store sampling influence purchasing decisions. The growing supermarkets and hypermarkets serve as trusted sources for premium nutrition, appealing to health-conscious parents seeking reliable organic baby food. Their extensive supply chains ensure product availability, reducing stock shortages and enhancing consumer satisfaction. Competitive pricing and bundled offers further drive demand, making organic baby food more affordable for a larger demographic. With dedicated organic sections and informative labelling, supermarkets and hypermarkets reinforce consumer confidence in these products. The continuous expansion of large-format retail outlets across urban and semi-urban areas solidifies their role in driving organic baby food adoption across the region.

Latin America Organic Baby Food Market Analysis

Organic baby food adoption in Latin America is rising due to growing disposable income, enabling families to allocate more resources to premium nutrition options. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. Parents are becoming increasingly aware of the benefits of chemical-free and additive-free diets, encouraging the transition to organic alternatives. With growing disposable income, affordability concerns are diminishing, making organic baby food a viable choice for a broader consumer base. Retailers are capitalizing on this shift by expanding product offerings and promotional strategies, ensuring accessibility across urban and suburban markets. The demand for high-quality, nutrient-rich baby food is reinforcing the market’s growth, as parents prioritize wholesome options.

Middle East and Africa Organic Baby Food Market Analysis

Organic baby food adoption in the Middle East and Africa is increasing due to the growing rising preference for healthy snacks and drinks, fueled by the growing rapid urbanization. According to UN Habitat, the proportion of people in the Arab region living in cities is 60% and expected to reach 70% by 2050. As families move to urban centers, dietary preferences are shifting toward convenient yet nutritious food choices. The growing rising preference for healthy snacks and drinks reflects changing lifestyles, with parents actively selecting organic baby food for its perceived health benefits. The expansion of retail networks and awareness campaigns is strengthening this trend, making organic baby food more widely available and appealing across diverse consumer groups.

Competitive Landscape:

Market players in the global organic baby food market are actively engaging in product innovation, strategic partnerships, and expansion initiatives to strengthen their presence. Companies are launching new formulations with fortified nutrients, probiotics, and plant-based ingredients to cater to evolving consumer preferences. Sustainable and eco-friendly packaging solutions, such as biodegradable pouches and reusable containers, are gaining traction. Major brands are expanding their distribution channels through e-commerce platforms, subscription services, and partnerships with supermarkets. Additionally, mergers and acquisitions are increasing as companies seek to enhance their product portfolios and market reach. Furthermore, investments in organic farming and supply chain transparency are rising to ensure product quality and consumer trust.

The report provides a comprehensive analysis of the competitive landscape in the organic baby food market with detailed profiles of all major companies, including:

- Abbott Nutrition

- Danone

- Nestle

- Hero Group

- Kraft Heinz

Latest News and Developments:

- October 2024: Babylife Organics has launched the first Regenerative Organic Certified® baby food, emphasizing soil regeneration and sustainable farming. The brand, created by the team behind Made in Nature, ensures high-quality organic nutrition for infants. This initiative supports organic agriculture while promoting healthier food choices for families.

- October 2024: Nestlé India announced the launch of "no refined sugar" variants of its infant food Cerelac after facing criticism over added sugar. CMD Suresh Narayanan stated that this initiative began three years ago and has now resulted in 14 refined sugar-free variants. The expanded Cerelac range in India will now include 21 variants, with a focus on organic content.

- September 2024: Happy Family Organics has launched the first USDA and EU-certified organic infant formulas made in Europe, featuring a patented probiotic and prebiotic blend. Designed to support gut health, these formulas are modelled after breast milk and backed by over 50 years of research. As the largest organic baby food brand in the U.S., the company continues its commitment to high-quality, organic infant nutrition.

- September 2024: Bobbie, a mom-founded pediatric nutrition company, expands its retail presence by launching its USDA Organic-certified infant formulas at Whole Foods Market nationwide. Bobbie Organic and Bobbie Organic Gentle, inspired by European standards, offer high-quality, American-made options for parents seeking organic nutrition. This expansion reinforces Bobbie’s commitment to the belief that "Formula is Food" while meeting the growing demand for organic baby formula.

- August 2024: Happa Foods becomes the first Indian baby food brand to export organic baby purees globally, entering six countries, including Kuwait and the UAE. The start-up aims to challenge Western dominance by providing high-quality, organic fruit and vegetable-based meals. This milestone highlights India’s growing capability in producing premium organic baby food for international markets.

- July 2024: Else Nutrition, a leader in organic, plant-based nutrition for children, is expanding its partnership with a major global retailer. In August, Else’s full range of organic products will be available on the retailer’s Canadian e-store. This move strengthens Else’s commitment to providing clean-label, organic alternatives for families.

Organic Baby Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | RTE (Ready-to-Eat) Baby Food, Milk Formula, Dried Baby Food, and Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retailers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Abbott Nutrition, Danone, Nestle, Hero Group, Kraft Heinz, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the organic baby food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global organic baby food market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the organic baby food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic baby food market was valued at USD 6.31 Billion in 2024.

IMARC estimates the organic baby food market to exhibit a CAGR of 10.91% during 2025-2033, expecting to reach USD 16.79 Billion by 2033.

The organic baby food market is driven by rising parental awareness, increasing demand for clean-label and allergen-free products, growing disposable incomes, expanding e-commerce accessibility, strong regulatory support, and innovations in sustainable packaging.

Asia Pacific currently dominates the market, accounting for a share exceeding 48.9% in 2024. This dominance is fueled by the rising demand for chemical-free baby food, increasing working parents, expanding e-commerce, rising government support for organic farming, higher birth rates, and growing consumer willingness to pay for premium products.

Some of the major players in the organic baby food market include Abbott Nutrition, Danone, Nestle, Hero Group and Kraft Heinz.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)